Altice USA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altice USA Bundle

Altice USA operates within a dynamic landscape shaped by evolving political regulations, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for anticipating challenges and capitalizing on opportunities in the telecommunications sector. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights for strategic planning.

Gain a competitive edge by exploring how societal shifts and environmental concerns also influence Altice USA's operations and market positioning. This ready-made analysis provides expert-level intelligence, perfect for investors and business strategists. Purchase the full version now to unlock a complete breakdown and make informed decisions.

Political factors

Altice USA operates within a telecommunications sector heavily shaped by the Federal Communications Commission (FCC). Shifts in FCC leadership and policy, like potential deregulation or alterations to net neutrality, directly affect Altice's operational agility and investment plans. For instance, the FCC's ongoing review of submarine cable licensing rules in 2024 highlights the dynamic nature of this regulatory landscape.

Government programs like the Broadband Equity, Access, and Deployment (BEAD) program, funded by the Infrastructure Investment and Jobs Act (IIJA), are designed to bring broadband to areas lacking adequate service. This initiative, with an allocation of $42.45 billion, aims to bridge the digital divide, primarily favoring fiber deployment.

While these initiatives present opportunities for network expansion, they also introduce competitive dynamics for established providers such as Altice USA. Altice USA could potentially benefit from these funding streams for infrastructure upgrades or face increased competition from entities receiving these grants.

Altice USA has been a vocal participant in discussions with the Federal Communications Commission (FCC) concerning pole attachment regulations, recognizing their critical role in accelerating broadband infrastructure development. These regulations govern how companies like Altice can access utility poles to install their network equipment.

Significant obstacles arise when utility companies fail to maintain up-to-date lists of authorized contractors or implement arbitrary caps on the number of pole applications they process. These administrative roadblocks directly impede Altice's ability to expand its high-speed internet services to new areas, as seen in the ongoing challenges faced by many broadband providers in securing timely pole access across various states.

To counter these delays, Altice USA actively pushes for more robust FCC oversight and enforcement mechanisms. The company believes that streamlined processes and clearer guidelines are essential for fostering competition and ensuring that more communities gain access to reliable broadband, a sentiment echoed by industry reports highlighting the substantial impact of pole access delays on deployment timelines.

Consumer Protection Regulations

Consumer protection regulations significantly shape Altice USA's operational landscape. These rules, including broadband labeling mandates and prohibitions against digital discrimination, directly influence how the company advertises, sets prices, and structures its service agreements. For instance, the Federal Communications Commission (FCC) has been active in this space, with ongoing discussions and potential rulemakings around transparency in internet service.

The legal scrutiny faced by Altice USA underscores the importance of these consumer-focused laws. A notable example is the lawsuit initiated by Connecticut concerning a 'Network Enhancement Fee.' This legal action demonstrates the real-world consequences of non-compliance and the potential financial and reputational risks involved.

- Broadband Labeling: Regulations require clear and accurate disclosure of internet speeds, pricing, and fees to consumers.

- Digital Discrimination: Prohibitions aim to prevent unfair or discriminatory practices in the provision of broadband internet access.

- Legal Challenges: Lawsuits, such as the one in Connecticut regarding fees, highlight ongoing enforcement and compliance issues.

Lobbying and Political Contributions

Altice USA actively participates in the political arena through lobbying and campaign contributions, aiming to shape telecommunications policy. In 2023, the company reported significant lobbying expenditures, reflecting its commitment to influencing regulatory outcomes. This engagement is crucial for advocating for favorable legislation and maintaining a competitive edge in the dynamic broadband and media sectors.

The company's political activities are designed to support its strategic objectives, including infrastructure investment and market access. For instance, Altice USA has been vocal on issues related to net neutrality and broadband deployment funding. Their political engagement underscores the importance of government relations in the telecommunications industry, where policy decisions can directly impact business operations and profitability.

- Lobbying Expenditures: Altice USA's reported lobbying outlays for 2023 indicate a substantial investment in influencing policy.

- Political Contributions: The company's contributions to political campaigns demonstrate its active role in supporting candidates and parties aligned with its interests.

- Policy Advocacy: Efforts are focused on advocating for policies that promote broadband expansion and fair competition.

- Regulatory Landscape: Engagement aims to navigate and influence the complex regulatory environment affecting the telecommunications sector.

Government initiatives like the Broadband Equity, Access, and Deployment (BEAD) program, with $42.45 billion allocated, aim to expand broadband access, potentially benefiting Altice USA through infrastructure upgrades but also introducing new competitive pressures. The company's active lobbying efforts in 2023, evidenced by significant expenditures, underscore its commitment to influencing telecommunications policy and ensuring a favorable regulatory environment for growth.

What is included in the product

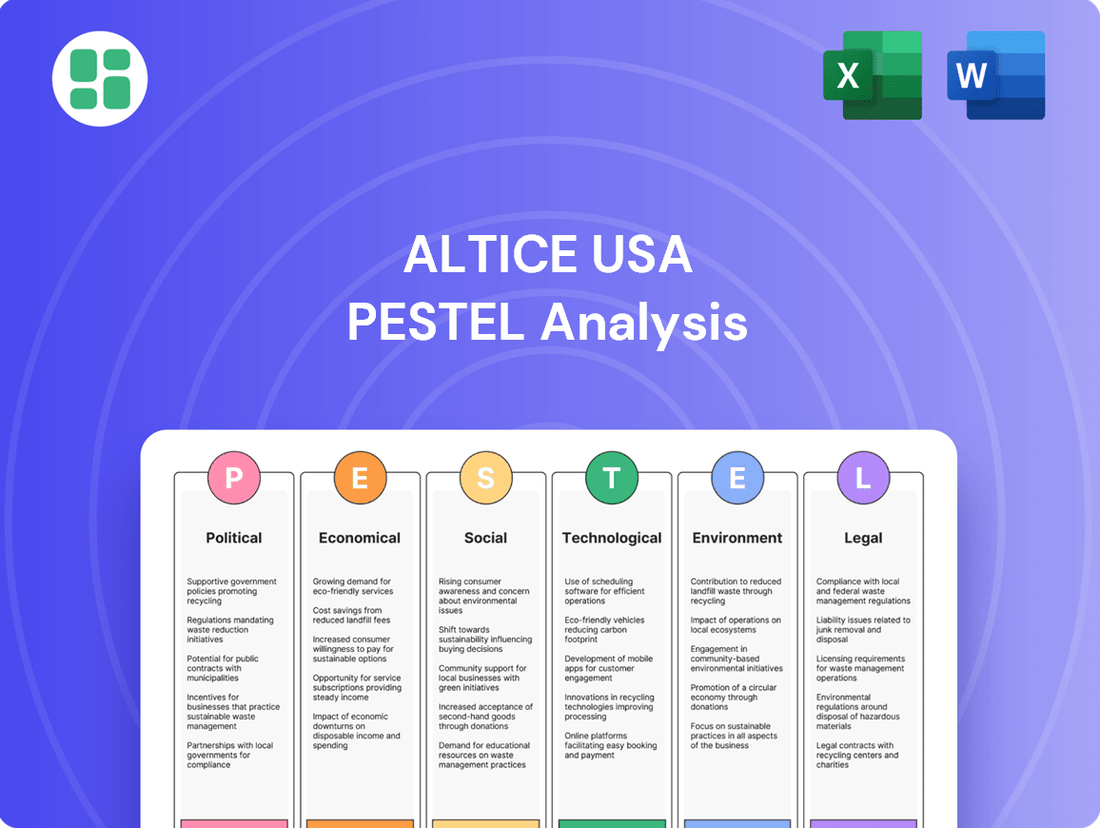

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Altice USA across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within the telecommunications and media landscape.

A concise Altice USA PESTLE analysis that highlights key external factors impacting the business, offering clarity and actionable insights for strategic decision-making.

This PESTLE analysis for Altice USA provides a structured overview of the external environment, simplifying complex market dynamics to help teams identify and address potential challenges.

Economic factors

Altice USA faced significant revenue headwinds in early 2025, with a notable decline in its residential services and advertising segments. This mirrors a wider industry trend where traditional video and telephony services are seeing reduced demand. For instance, in Q1 2025, the company reported a drop in total revenue, underscoring the economic pressures on its core offerings.

Despite strategic investments to bolster its fiber and mobile businesses, these growth areas haven't yet offset the erosion in legacy revenue streams. The company posted net losses in both the first and second quarters of 2025, a clear indicator of the challenging economic climate impacting overall profitability and the ability to convert revenue into earnings.

Altice USA grapples with a substantial debt burden, reporting consolidated net debt around $25 billion and a high net leverage ratio. This significant financial obligation directly affects its operational flexibility and available cash flow for strategic initiatives or shareholder returns.

A considerable portion of Altice USA's debt is scheduled for maturity in 2027, presenting a critical economic hurdle. The company must actively manage and potentially refinance this upcoming debt, a process that will be influenced by prevailing interest rates and overall market conditions.

Altice USA navigates a fiercely competitive telecommunications landscape. Rivalry comes from established broadband providers, emerging fiber overbuilders, and the growing adoption of fixed wireless access (FWA) solutions. This competitive pressure directly impacts subscriber numbers in their core broadband and video services.

The intense competition has been a significant factor in Altice USA's subscriber trends. For instance, in the first quarter of 2024, the company reported a net loss of broadband subscribers, a trend influenced by the aggressive pricing and service offerings from competitors. This necessitates substantial capital expenditure on network upgrades, particularly in fiber optic expansion and mobile service development, to stay competitive and secure future growth.

Capital Expenditures and Network Investment

Altice USA is heavily investing in its fiber network and mobile services, with capital expenditures (CapEx) remaining a key focus. For the full year 2024, Altice USA projected CapEx to be in the range of $1.2 billion to $1.3 billion, underscoring their commitment to network expansion and upgrades.

These significant investments are vital for staying competitive and enabling future growth, particularly in expanding their fiber footprint and supporting their burgeoning mobile business. However, this substantial financial commitment directly impacts the company's free cash flow generation.

The company's strategy involves a careful balancing act: pushing forward with these essential network investments while simultaneously driving operational efficiencies. The goal is to ensure these expenditures contribute to achieving their target Adjusted EBITDA growth.

- Network Expansion: Continued investment in fiber optic technology to increase broadband speeds and coverage.

- Mobile Growth Support: Allocating capital to enhance the mobile network infrastructure and services.

- Financial Impact: CapEx represents a significant cash outflow, affecting free cash flow in the short to medium term.

- Efficiency Focus: Management aims to offset investment costs through operational improvements and cost management to meet EBITDA targets.

ARPU and Subscriber Trends

Despite facing overall revenue declines and a loss of broadband subscribers, Altice USA has demonstrated resilience in its average revenue per user (ARPU) for broadband, which saw an increase. This suggests customers are either upgrading services or the company is effectively monetizing its existing base. The company's strategic focus on fiber and mobile is paying off, with strong customer additions in these segments, indicating a move towards higher-margin revenue streams.

For the first quarter of 2024, Altice USA reported a slight increase in its residential broadband ARPU, reaching $83.75, up from $82.96 in the prior year. This growth is crucial as the company works to stabilize its broadband subscriber base, which saw a net loss of 17,000 subscribers in Q1 2024. The expansion of its fiber network and the continued uptake of its mobile services are key components of this strategy to offset traditional broadband pressures.

- Broadband ARPU Growth: Residential broadband ARPU increased to $83.75 in Q1 2024.

- Fiber and Mobile Expansion: Altice USA is prioritizing growth in fiber and mobile services to drive higher margins.

- Subscriber Stabilization Efforts: The company is implementing strategies to counter broadband subscriber losses, which stood at 17,000 in Q1 2024.

The economic landscape for Altice USA in 2024 and early 2025 presented a mixed bag, with declining revenues in legacy segments offset by growth in newer services. The company's substantial debt, approximately $25 billion, and upcoming maturities in 2027, pose significant financial management challenges, especially in a high-interest-rate environment.

Despite a net loss of 17,000 broadband subscribers in Q1 2024, Altice USA saw its residential broadband average revenue per user (ARPU) tick up to $83.75. This indicates a growing reliance on higher-value services and a need to maintain ARPU to counteract subscriber attrition, a trend exacerbated by intense market competition.

Capital expenditures, projected between $1.2 billion and $1.3 billion for 2024, are critical for expanding fiber networks and supporting mobile growth, but they also strain free cash flow. The company's ability to meet its Adjusted EBITDA growth targets hinges on balancing these investments with operational efficiencies.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Residential Broadband ARPU | $83.75 | $82.96 | +0.95% |

| Broadband Subscribers Net Change | -17,000 | -12,000 | Worsened |

| Projected 2024 CapEx | $1.2 - $1.3 billion | N/A | N/A |

What You See Is What You Get

Altice USA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Altice USA PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, offering valuable insights for strategic planning.

Sociological factors

Consumer behavior is rapidly evolving, with a significant move away from traditional cable TV and landline phone services. This shift, often called cord-cutting, favors streaming platforms and mobile-centric communication. For Altice USA, this means their established revenue sources from video are directly affected, pushing the company to prioritize high-speed internet and mobile services.

The societal trend of cord-cutting is evident in subscriber numbers. In the first quarter of 2024, Altice USA reported a decrease in its video subscribers, a direct reflection of consumers opting for more flexible and on-demand entertainment options. This necessitates a strategic pivot towards broadband and mobile as primary growth drivers.

The persistent digital divide, marked by unequal access to reliable and affordable internet, continues to shape the market for broadband providers like Altice USA. As of early 2024, reports indicate that millions of American households, particularly in rural and low-income urban areas, still lack adequate broadband. This presents both a challenge and an opportunity for Altice USA to expand its reach and customer base.

Altice USA's engagement in initiatives aimed at bridging this gap, such as participating in the Affordable Connectivity Program (ACP) or developing localized community broadband solutions, will be crucial. The ACP, for instance, has provided discounts on internet service to eligible households, demonstrating a tangible government effort to address affordability. However, the program's future funding remains a point of discussion, impacting the long-term sustainability of such affordability measures.

Societal expectations are increasingly leaning towards universal broadband access as a fundamental utility, akin to electricity or water. This growing sentiment places pressure on major providers like Altice USA to invest in infrastructure upgrades and offer more accessible service tiers, especially in underserved territories. Failure to address these expectations could lead to reputational damage and potential regulatory scrutiny.

The shift towards remote work and online learning, accelerated by recent global events, has solidified the demand for dependable, high-speed internet. This sustained trend directly benefits broadband providers like Altice USA, as more households require robust connectivity for productivity and education. For instance, in late 2024, reports indicated that over 60% of the US workforce had experienced some form of remote work, highlighting the enduring nature of this shift.

Altice USA is well-positioned to leverage this demand, particularly with its ongoing fiber optic network expansion. The company's investment in fiber infrastructure, aiming to reach millions of homes by 2025, directly addresses the need for faster and more reliable internet essential for video conferencing, online classes, and remote collaboration. Network quality and consistent performance are now paramount for customer retention in this environment.

Customer Experience and Satisfaction

In today's fiercely competitive telecommunications landscape, customer experience and satisfaction are paramount for Altice USA's sustained success. The company recognizes that happy customers are more likely to stay, directly impacting retention rates and overall revenue. Altice USA is actively investing in initiatives designed to elevate its service quality and streamline customer interactions.

These efforts are geared towards reducing churn, a key performance indicator in the industry. For instance, by focusing on improved sales execution and more tailored marketing, Altice USA aims to align its offerings more closely with what customers truly want and need. This customer-centric approach is vital for differentiating itself from rivals and fostering loyalty.

Altice USA's commitment to enhancing customer experience is reflected in its ongoing operational improvements. The company is implementing strategies to simplify processes and boost service reliability. These actions are crucial for building trust and ensuring that customers feel valued. For example, in Q1 2024, Altice USA reported a slight improvement in its residential customer churn rate, a positive sign that these initiatives are beginning to resonate.

Key areas of focus for improving customer satisfaction include:

- Streamlining onboarding processes for new subscribers.

- Enhancing the responsiveness and effectiveness of customer support channels.

- Developing more personalized service plans and communication strategies.

- Investing in network upgrades to ensure consistent and high-quality service delivery.

Community Engagement and Social Responsibility

Altice USA actively engages with communities through programs focused on education and digital inclusion. For instance, in 2023, the company expanded its Altice Connects initiative, which aims to bridge the digital divide by offering free internet and digital literacy training. This focus on social responsibility can strengthen public perception and build goodwill.

The company's commitment extends to supporting local non-profits and educational institutions. These partnerships not only address specific community needs but also contribute to Altice USA's reputation as a corporate citizen, potentially influencing customer loyalty and employee morale. By investing in the well-being of the areas it serves, Altice USA can foster stronger, more positive relationships.

- Community Investment: Altice USA's philanthropic efforts in 2023 supported over 100 community organizations nationwide.

- Digital Literacy: The company provided digital skills training to more than 50,000 individuals through its various programs in the past year.

- Educational Partnerships: Altice USA collaborated with 25 school districts to enhance STEM education and provide resources for students.

Societal shifts towards digital-first communication and entertainment continue to reshape Altice USA's market. The ongoing trend of cord-cutting, where consumers abandon traditional cable for streaming services, directly impacts video revenue streams, reinforcing the need for a strong focus on broadband and mobile offerings. This is evident in subscriber data, with Altice USA experiencing a decline in video customers in early 2024 as flexible, on-demand options gain prominence.

The persistent digital divide remains a significant factor, with millions of American households still lacking adequate broadband access as of early 2024. Altice USA's participation in programs like the Affordable Connectivity Program (ACP) addresses this gap, though the program's future funding creates uncertainty for long-term affordability initiatives.

There's a growing societal expectation for universal broadband access, pushing companies like Altice USA to invest in infrastructure and offer more accessible service tiers, particularly in underserved areas. The sustained demand for reliable, high-speed internet, fueled by remote work and online learning trends observed throughout 2024, presents a clear opportunity for broadband providers like Altice USA, especially with their ongoing fiber optic network expansion targeting millions of homes by 2025.

Customer experience is paramount in the competitive telecom sector, with Altice USA actively investing in service quality and customer interaction improvements to reduce churn. Initiatives like streamlining onboarding and enhancing customer support are key. For instance, Q1 2024 saw a slight improvement in residential customer churn rates, indicating early success in these customer-centric strategies.

| Societal Factor | Impact on Altice USA | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Cord-Cutting | Decreased video revenue, increased focus on broadband/mobile | Video subscriber decline reported in Q1 2024 |

| Digital Divide | Opportunity for expansion, challenge in affordability | Millions of US households lacked adequate broadband in early 2024 |

| Demand for Remote Work/Learning | Increased demand for high-speed internet | Over 60% of US workforce experienced remote work in late 2024 |

| Customer Experience Expectations | Focus on retention and loyalty | Slight improvement in residential churn rate in Q1 2024 |

Technological factors

Altice USA is making substantial investments in expanding its fiber-to-the-home (FTTH) network, a clear signal of its commitment to future-proofing its broadband infrastructure. This strategic focus on fiber is designed to offer customers multi-gigabit speeds, a significant upgrade in reliability and overall service quality.

By prioritizing fiber, Altice USA aims to sharpen its competitive edge against other providers also investing in this advanced technology. The company has set ambitious targets for fiber passings, with a significant portion of its expansion planned for completion by 2025 and continuing into subsequent years.

Altice USA's mobile segment is showing robust growth, with a notable increase in net additions for mobile lines. This upward trend is closely tied to a rising convergence rate, meaning more broadband customers are also opting for Altice's mobile services. This highlights the success of their strategy to bundle mobile solutions, effectively leveraging their position as a Mobile Virtual Network Operator (MVNO).

The ongoing integration of 5G technology is a critical factor in this expansion. By enhancing its mobile network capabilities, Altice USA is better positioned to compete in the rapidly evolving telecommunications landscape. This technological advancement not only improves the customer experience but also opens up new revenue streams and strengthens its overall market offering.

Altice USA is actively enhancing its hybrid-fiber coaxial (HFC) network, moving beyond fiber-only strategies. The company is implementing DOCSIS 3.1 and preparing for DOCSIS 4.0, which are crucial for delivering multi-gigabit internet speeds. This technological advancement allows Altice USA to offer competitive high-speed internet across its service areas, even in locations where full fiber deployment is still in progress.

Cybersecurity and Data Security

As a significant player in the internet and mobile sectors, Altice USA is increasingly exposed to sophisticated cybersecurity threats and the potential for data breaches. Protecting sensitive customer information is paramount, especially with the growing volume of data handled. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the substantial financial and reputational risks involved.

Maintaining stringent data security protocols and adapting to a dynamic regulatory environment, such as GDPR and CCPA, are essential for Altice USA. These regulations impose strict requirements on how customer data is collected, stored, and used, with significant penalties for non-compliance. The expansion of the Internet of Things (IoT) introduces new vulnerabilities, as more connected devices create a larger attack surface that requires continuous monitoring and security updates.

- Increased Threat Landscape: Cyberattacks are becoming more frequent and complex, targeting telecommunications infrastructure.

- Regulatory Compliance: Adhering to evolving data privacy laws like CCPA and GDPR is critical to avoid substantial fines.

- IoT Security Challenges: Securing a growing ecosystem of connected devices presents new and complex cybersecurity hurdles.

Artificial Intelligence (AI) Integration

Altice USA is actively integrating Artificial Intelligence (AI) to refine its network operations and customer interactions. This strategic move aims to boost efficiency and cut expenses, aligning with a wider industry shift towards AI-driven solutions.

The company is leveraging AI for tasks such as optimizing network performance, automating customer service responses, and streamlining internal processes. For instance, AI-powered analytics can predict network issues before they impact customers, reducing downtime and improving service quality. This focus on efficiency is crucial for maintaining a competitive edge in the telecommunications sector.

- Network Optimization: AI algorithms are being deployed to analyze vast amounts of network data, identifying patterns and anomalies to proactively address potential disruptions and enhance overall service reliability.

- Customer Service Enhancement: Altice USA is exploring AI-driven chatbots and virtual assistants to handle customer inquiries more efficiently, aiming for faster resolution times and improved customer satisfaction.

- Operational Efficiencies: Automation of routine tasks through AI is expected to reduce operational costs, allowing for greater investment in service improvement and innovation.

- Data-Driven Decision Making: AI provides advanced analytical capabilities, enabling more informed strategic decisions across various business functions, from marketing to infrastructure development.

Altice USA's technological strategy centers on expanding its fiber-to-the-home (FTTH) network and enhancing its existing hybrid-fiber coaxial (HFC) infrastructure with DOCSIS 3.1 and 4.0 technologies to deliver multi-gigabit speeds.

The company is also leveraging Artificial Intelligence (AI) for network optimization, customer service automation, and operational efficiencies, aiming to improve service quality and reduce costs.

Furthermore, Altice USA is integrating 5G technology into its mobile offerings, boosting network capabilities and customer experience as a Mobile Virtual Network Operator (MVNO).

However, these advancements also expose Altice USA to increased cybersecurity threats and the need for strict data privacy compliance, with the global average cost of a data breach reaching $4.45 million in 2024.

Legal factors

The ongoing debate and Federal Communications Commission (FCC) decisions on net neutrality, particularly the potential reclassification of broadband as a Title II telecommunications service, present a significant legal consideration for Altice USA. This reclassification, if fully implemented without forbearance, could subject the company to stricter regulations akin to traditional common carriers, impacting how it manages its network traffic and potentially its pricing strategies.

While the FCC has historically exercised forbearance, meaning it has chosen not to enforce certain common carrier obligations, the legal landscape surrounding these decisions remains fluid. For instance, the FCC's 2023 decision to reinstate net neutrality rules and reclassify broadband under Title II faced legal challenges, creating an environment of regulatory uncertainty. This uncertainty directly affects Altice USA's long-term operational planning and investment decisions in its network infrastructure.

Altice USA navigates a complex landscape of data privacy and consumer protection laws, including federal statutes like the Electronic Communications Privacy Act and a growing number of state-specific regulations. These laws govern how the company collects, uses, and protects customer data, a critical aspect of its broadband and media services.

The evolving nature of these regulations presents ongoing compliance challenges. For instance, new privacy legislation set to take effect in January 2025 will necessitate continuous updates to Altice USA's systems and operational processes. Such adaptations can lead to significant costs and may influence the development of new business opportunities or the modification of existing ones.

Antitrust and market consolidation remain key legal factors for Altice USA. The telecommunications sector is constantly abuzz with discussions about mergers and acquisitions, which could reshape the competitive environment. While Altice USA has prioritized internal improvements, shifts in antitrust enforcement or significant industry consolidation could present both challenges and opportunities for its strategic direction. For instance, the Federal Communications Commission's (FCC) increased oversight on foreign ownership in the sector adds another layer of legal consideration for any company operating within it.

Copyright Infringement Litigation

Altice USA has encountered significant legal hurdles, notably copyright infringement litigation. A prominent example is the dispute with Warner Bros. Discovery, often referred to as the 'Warner Matter,' which involved carriage disputes and content access. These legal battles can impose substantial financial penalties and negatively impact the company's public image.

Such litigation underscores the critical need for Altice USA to implement rigorous risk management protocols and ensure strict adherence to intellectual property regulations. This is especially true given the company's core business involves the distribution of video and digital content services.

- Warner Bros. Discovery Dispute: In early 2023, Altice USA and Warner Bros. Discovery engaged in a carriage dispute that temporarily removed WBD channels from Altice USA's Optimum and Suddenlink systems, impacting millions of subscribers.

- Financial Ramifications: While specific settlement figures are often not fully disclosed, similar copyright infringement cases can result in multi-million dollar judgments or settlements, alongside legal defense costs.

- Reputational Impact: Prolonged carriage disputes and legal challenges can erode customer trust and brand loyalty, potentially leading to subscriber churn.

Local and State Regulatory Compliance

Altice USA navigates a complex web of local and state regulations beyond federal oversight. These include varying franchise agreements, service quality mandates, and specific local ordinances across the 21 states where it operates. For instance, a lawsuit filed by Connecticut concerning a 'Network Enhancement Fee' highlights the direct legal scrutiny from state-level consumer protection efforts.

The company's compliance burden is significant, as each jurisdiction may impose unique requirements. These local and state-level rules can impact everything from pricing structures to network build-out obligations. Failure to adhere to these diverse regulations can result in penalties and legal challenges, as seen in the Connecticut case.

- Franchise Agreements: Local governments grant franchises, often with specific service and investment commitments.

- Service Quality Standards: States and municipalities may set performance benchmarks for network reliability and customer service.

- Local Ordinances: These can cover a range of issues, from pole attachments to construction permits.

- Consumer Protection Enforcement: State attorneys general actively pursue cases related to billing practices and service fees.

Legal factors significantly shape Altice USA's operations, from federal regulations like net neutrality debates and data privacy laws to state-specific franchise agreements and consumer protection mandates. The company faces ongoing compliance challenges due to evolving legislation, such as new privacy laws impacting data handling. Furthermore, copyright infringement litigation, exemplified by the Warner Bros. Discovery dispute, highlights substantial financial and reputational risks, underscoring the need for robust legal and risk management strategies.

Environmental factors

Altice USA has publicly committed to reducing its environmental footprint, integrating sustainability into its core operations and corporate ethos. The company's 2023 Sustainability & Impact Report details initiatives aimed at transforming its value chain and enhancing environmental performance, underscoring a strategic prioritization of ecological responsibility.

Altice USA is committed to improving its environmental footprint by focusing on energy efficiency and reducing greenhouse gas (GHG) emissions. This includes strategic investments in smart building technologies and upgrading to more energy-efficient lighting and HVAC systems across its facilities.

The company is also proactively assessing climate-related risks to bolster the resilience of its network infrastructure. For instance, in 2023, Altice USA reported progress in its energy management initiatives, aiming to decrease its overall energy consumption and associated emissions, aligning with broader industry trends towards sustainability.

Altice USA is actively enhancing its waste management, aiming to minimize the environmental impact of its products and packaging. This involves implementing strategies for product reuse and recycling, directly addressing growing concerns around electronic waste and promoting circular economy principles within the telecommunications industry.

In 2023, the company reported a significant reduction in landfill waste, diverting 75% of its operational waste through recycling and reuse programs. This initiative supports the broader telecommunications sector's push towards sustainability, as companies increasingly focus on extending product lifecycles and reducing their carbon footprint.

Climate-Related Risk Assessment

Altice USA is actively assessing its climate-related risks and opportunities to strengthen its network and business operations. This proactive approach is crucial as environmental concerns gain prominence among investors and customers, driving the company to integrate sustainability into its core strategy. By managing environmental priorities effectively, Altice USA aims to improve its overall performance across its entire value chain.

The company's commitment to climate resilience is underscored by its participation in initiatives like the CDP (formerly the Carbon Disclosure Project). In its 2023 disclosure, Altice USA reported that approximately 98% of its operational greenhouse gas emissions are Scope 1 and Scope 2, primarily related to energy consumption and fleet operations. This focus allows them to target key areas for reduction and efficiency improvements.

- Network Resilience: Implementing measures to protect infrastructure from extreme weather events, such as flooding and high winds, which are becoming more frequent due to climate change.

- Operational Efficiency: Reducing energy consumption in data centers and offices, and optimizing fleet management to lower fuel usage and emissions.

- Stakeholder Expectations: Responding to increasing demands from investors and customers for transparent reporting on environmental performance and climate risk mitigation strategies.

- Regulatory Landscape: Preparing for potential future regulations related to carbon emissions and environmental impact, ensuring compliance and maintaining a competitive edge.

Sustainable Infrastructure and Fiber Deployment

Altice USA's commitment to sustainable infrastructure is prominently displayed in its long-term vision for fiber-to-the-home (FTTH) network deployment. This strategic focus on fiber is crucial for its environmental impact, as fiber optic technology is inherently more energy-efficient per bit transmitted compared to legacy copper or hybrid fiber-coaxial (HFC) networks. As of early 2024, Altice USA continues to invest heavily in expanding its fiber footprint, aiming to reach millions of additional homes with its advanced broadband solutions, directly contributing to a reduced carbon footprint for its operations.

The environmental advantages of fiber are significant. For instance, studies indicate that fiber optic networks can consume up to 80% less energy than copper networks for the same data throughput. This efficiency translates into lower operational costs and a smaller environmental impact as Altice USA scales its high-speed internet services. The company's ongoing buildout plans, which prioritize fiber, align with broader environmental goals and increasing consumer demand for greener technology solutions.

- Fiber's Energy Efficiency: Fiber optic networks use significantly less energy per gigabit of data compared to older technologies.

- Reduced Carbon Footprint: By prioritizing FTTH, Altice USA is actively working to lower its carbon emissions as its network expands.

- Investment in Sustainability: The company's capital expenditures in 2024 and 2025 are heavily weighted towards fiber deployment, reflecting a commitment to environmentally sound infrastructure.

- Market Demand: Growing consumer and business preference for sustainable and high-performance connectivity solutions supports Altice USA's fiber strategy.

Altice USA is actively addressing environmental concerns by focusing on energy efficiency and reducing greenhouse gas (GHG) emissions across its operations. The company's 2023 Sustainability & Impact Report highlights investments in smart building technologies and upgrades to energy-efficient systems, aiming to decrease overall energy consumption.

The company is also prioritizing network resilience against climate change impacts, such as extreme weather. In 2023, Altice USA reported that 98% of its operational GHG emissions were Scope 1 and 2, primarily from energy use and fleet operations, allowing for targeted reduction efforts.

Altice USA is further committed to sustainable infrastructure through its extensive fiber-to-the-home (FTTH) network deployment. This fiber strategy, with significant investment planned for 2024 and 2025, is inherently more energy-efficient than older technologies, contributing to a reduced carbon footprint per data transmitted.

| Environmental Focus | 2023 Data/Initiatives | Outlook (2024-2025) |

| GHG Emissions | 98% Scope 1 & 2 emissions | Continued focus on reduction via energy efficiency |

| Waste Management | 75% waste diverted from landfill | Enhancing product reuse and recycling programs |

| Network Infrastructure | Prioritizing energy-efficient FTTH deployment | Continued heavy investment in fiber expansion |

| Energy Efficiency | Smart building tech, efficient lighting/HVAC | Further integration of energy-saving measures |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Altice USA is built upon a comprehensive review of official government data, reputable market research firms, and industry-specific publications. This ensures that all political, economic, social, technological, legal, and environmental factors are grounded in current and credible insights.