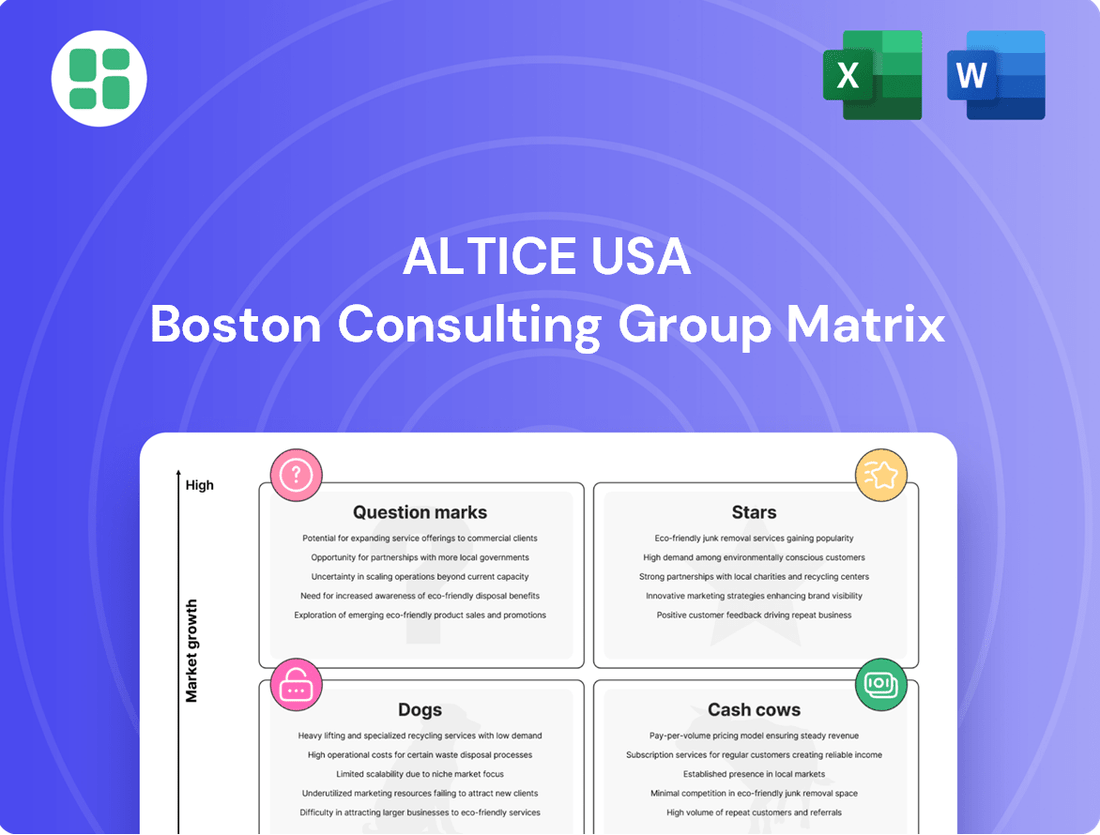

Altice USA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altice USA Bundle

Altice USA's strategic positioning is illuminated by its BCG Matrix, revealing a dynamic portfolio of services. Understanding which segments are generating substantial cash flow versus those requiring significant investment is crucial for any stakeholder. This preview offers a glimpse into this vital analysis.

Dive deeper into Altice USA's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Altice USA's fiber internet expansion is a clear Star in its BCG Matrix. The company is aggressively deploying fiber, targeting 6.5 million fiber passings by the end of 2025. This strategic move is designed to capture significant market share in a high-growth sector.

The company reported a substantial acceleration in fiber net additions, adding 56,000 new fiber customers in Q2 2025 alone. This brought its total fiber customer base to 663,000, marking a remarkable 53% year-over-year increase. This rapid growth underscores the strong market demand and Altice USA's successful execution of its fiber strategy.

Altice USA is strategically expanding its multi-gig broadband offerings, aiming to reach 65% of its service footprint by 2028. This aggressive rollout signifies a commitment to the premium segment of the internet market, anticipating robust demand for higher speeds.

By focusing on these advanced tiers, Altice USA is positioning itself to attract and retain high-value customers, thereby increasing its market share in a competitive landscape. This move is expected to drive significant top-line growth and strengthen the Optimum brand's standing.

Altice Mobile is positioned as a Star within the Altice USA BCG Matrix, showcasing impressive growth. In the second quarter of 2025, the company added 38,000 new mobile lines, a substantial 42% increase compared to the previous year, bringing its total to 546,000 lines. This rapid expansion in a growing mobile market, coupled with Altice's strategy to boost penetration among its existing broadband customers, highlights its potential to become a major player.

Business Services (Lightpath)

Altice USA's Lightpath subsidiary, a key player in business services, is positioned as a strong contender in the BCG matrix. Its focus on enterprise and hyperscaler clients has driven consistent revenue, reaching $414 million in fiscal year 2024.

Lightpath's substantial sales pipeline, particularly for AI infrastructure connectivity, and secured contracts with major hyperscalers underscore its high-growth potential. This segment is a strategic asset for Altice USA, further bolstered by acquisitions like United Fiber and Data, which expand its reach and capabilities.

- Revenue Growth: Lightpath generated $414 million in FY 2024, demonstrating robust financial performance.

- High-Growth Market: Significant sales pipeline in AI infrastructure connectivity and hyperscaler contracts indicate strong market traction.

- Strategic Expansion: Acquisitions like United Fiber and Data enhance Lightpath's capabilities and market position.

- Future Potential: The segment represents a critical component for Altice USA's future growth trajectory.

New Fiber Build-outs in Competitive Markets

Altice USA's strategic focus on deploying new fiber networks in highly competitive markets, such as those already served by Verizon Fios and Frontier Communications, positions these build-outs as Stars within its BCG Matrix. This aggressive approach aims to leverage superior fiber technology to gain a significant foothold and market share.

The company anticipates that by offering a more advanced and differentiated broadband service, it can effectively drive higher gross customer additions and simultaneously reduce customer churn. This strategy is particularly relevant as broadband demand continues to grow, making these competitive areas attractive for investment.

- Market Share Capture: Altice USA is actively targeting competitive areas to increase its subscriber base.

- Technological Differentiation: The emphasis is on fiber technology as a key differentiator.

- Growth Potential: These markets represent high-growth opportunities for broadband services.

- Customer Acquisition & Retention: The strategy aims to boost new customer sign-ups and lower churn rates.

Altice USA's fiber expansion initiatives, particularly in competitive markets, are clear Stars. The company is aggressively pushing fiber passings, aiming for 6.5 million by the end of 2025, demonstrating a commitment to high-growth segments. This strategy is designed to capture market share through technological superiority, with a focus on increasing gross customer additions and reducing churn in areas already served by competitors like Verizon Fios and Frontier Communications.

| Initiative | BCG Category | Key Data Point | Strategic Rationale |

|---|---|---|---|

| Fiber Network Expansion | Star | Targeting 6.5 million fiber passings by end of 2025 | Capture market share in high-growth broadband sector, leverage superior technology. |

| Multi-Gig Broadband Rollout | Star | Aiming for 65% service footprint by 2028 | Attract and retain high-value customers, drive top-line growth. |

| Altice Mobile Growth | Star | Added 38,000 new lines in Q2 2025 (42% YoY increase) | Boost penetration among broadband customers, capitalize on growing mobile market. |

| Lightpath Business Services | Star | FY 2024 Revenue: $414 million | Leverage AI infrastructure demand and hyperscaler contracts for consistent revenue. |

What is included in the product

This BCG Matrix overview analyzes Altice USA's business units, identifying which to invest in, hold, or divest for optimal growth.

The Altice USA BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, relieving the pain of complex data interpretation.

Cash Cows

Altice USA's existing Hybrid Fiber-Coaxial (HFC) broadband base, serving around 4.3 million subscribers as of Q2 2025, is a prime example of a cash cow. This extensive network, though mature, continues to generate substantial and reliable cash flow for the company.

Despite a slight decline in overall broadband subscribers, the rate of this loss decelerated, and crucially, average revenue per user (ARPU) saw an increase. This suggests a strong hold on its existing customer base in established markets and an ability to extract more value from them, reinforcing its cash cow status.

Altice USA's traditional video services, despite experiencing a decline of 56,000 subscribers in the second quarter of 2025, still represent a significant cash cow. The segment holds a substantial customer base of roughly 1.7 million residential subscribers, which continues to generate considerable revenue for the company.

The company is actively working to optimize this mature business by migrating customers to new video tiers and enhancing gross margins. This strategic approach aims to maximize profitability from the existing subscriber base, ensuring it remains a consistent cash generator even without significant growth.

Altice USA's Optimum Media is a strong advertising solutions business. It offers multiscreen advertising and saw revenue growth of 12.8% in News & Advertising for Q2 2025. This business leverages existing video platforms and customer reach.

Optimum Media functions as a cash cow for Altice USA. It generates stable revenue with minimal extra investment. Its mature service and high market share contribute significantly to overall profitability.

Basic & Mid-Tier Internet Packages

Altice USA's basic and mid-tier internet packages function as significant cash cows within its product portfolio. These offerings serve a wide customer base, providing dependable internet access at competitive price points across Altice's operational areas.

Although these segments are not experiencing rapid expansion, they are crucial for generating substantial and consistent revenue. They maintain a high market share in their respective categories, underscoring their stability.

- High Market Share: These packages command a strong position in the market, reflecting customer loyalty and competitive pricing.

- Stable Revenue Stream: They contribute significantly to Altice USA's consistent revenue generation, acting as a reliable income source.

- Customer Base: They represent a large and stable customer base, essential for predictable financial performance.

- Focus on Efficiency: Efforts to manage these established services and improve network quality are key to sustaining their cash-generating ability.

Legacy Fixed-Line Telephone Services

Altice USA's legacy fixed-line telephone services, while in a declining market, represent a classic cash cow. These services generate a stable and predictable revenue stream from a loyal, albeit shrinking, customer base. In 2023, the U.S. landline market continued its downward trend, with a significant portion of households opting for mobile-only or VoIP solutions. For Altice USA, this segment requires very little in terms of new investment for marketing or expansion, allowing it to generate substantial cash flow with minimal effort.

The strategic advantage of these legacy services lies in their high market share within a low-growth environment. This maturity means that operational costs are well-understood and often optimized.

- Stable Revenue: Despite market decline, these services provide a consistent income stream.

- Low Investment Needs: Minimal capital is required for maintenance or promotion.

- Mature Market Position: Altice USA holds a significant share of this established, albeit shrinking, segment.

- Cash Generation: The services are a reliable source of cash that can be reinvested in other business areas.

Altice USA's broadband services, particularly its established Hybrid Fiber-Coaxial (HFC) network serving approximately 4.3 million subscribers as of Q2 2025, are a significant cash cow. Despite a slight subscriber decline, ARPU growth indicates strong value extraction from its mature customer base.

The company's traditional video services, while seeing subscriber losses, still maintain a substantial base of around 1.7 million residential subscribers, generating considerable revenue. Altice USA is optimizing this segment by migrating customers to new tiers and improving margins, ensuring continued cash generation.

Optimum Media, Altice USA's advertising solutions business, is another key cash cow. It demonstrated robust revenue growth of 12.8% in News & Advertising for Q2 2025, leveraging existing video platforms and customer reach with minimal additional investment.

Basic and mid-tier internet packages also function as dependable cash cows, holding high market share and providing stable revenue. These segments are crucial for consistent income, with efforts focused on efficiency and quality to maintain their cash-generating ability.

| Business Segment | Subscriber Base (Approx.) | Q2 2025 Revenue Growth (Segment Specific) | Cash Cow Characteristics |

|---|---|---|---|

| Broadband (HFC) | 4.3 million | ARPU Increase | High Market Share, Stable Cash Flow |

| Traditional Video | 1.7 million | Declining Subscribers, Margin Improvement Focus | Stable Revenue Stream, Low Investment Needs |

| Optimum Media (Advertising) | N/A | +12.8% (News & Advertising) | High Profitability, Minimal Investment |

| Basic/Mid-Tier Internet | N/A | N/A | High Market Share, Stable Revenue |

Full Transparency, Always

Altice USA BCG Matrix

The Altice USA BCG Matrix preview you're viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, will be delivered in its final, ready-to-use format, enabling you to instantly leverage its insights for business planning and competitive analysis.

Dogs

Obsolete video packages and tiers, those seeing a significant decline in subscriber numbers and minimal new revenue, are firmly positioned in the Dogs quadrant of the BCG Matrix. As consumers increasingly favor streaming services and Altice's own newer, streamlined video options, these legacy offerings are becoming increasingly unprofitable, essentially acting as cash traps.

Altice USA's strategic initiative to introduce simplified video packages directly reflects a deliberate effort to divest from these less lucrative and rapidly shrinking legacy tiers. This move is designed to reallocate resources towards more promising and future-proof segments of their business.

Altice USA's HFC infrastructure shows stagnation in certain geographic areas, particularly those with limited fiber investment. These regions often experience intense competition and significant subscriber churn, as customers migrate to providers with more advanced network capabilities.

In these markets, the existing HFC network struggles to keep pace, leading to low market share and dim growth prospects. This situation results in ongoing financial losses and minimal returns on investment for Altice USA.

Altice USA's outdated equipment rentals represent a classic Dogs category. This segment involves renting older modems and set-top boxes that are becoming less competitive as customers increasingly prefer to buy their own or upgrade to newer technology. For instance, as of Q1 2024, Altice USA reported a slight decrease in its rental revenue per user, a trend likely exacerbated by the aging equipment in this segment.

This part of the business likely sees declining demand and contributes minimally to Altice USA's overall growth or market share. The capital tied up in these depreciating assets, such as older modem inventory, represents an inefficient use of resources, further solidifying its position as a Dog within the BCG matrix.

Underperforming Niche Content Offerings

Altice USA's niche content offerings, outside of its flagship News 12, i24NEWS, and Cheddar, represent potential 'Dogs' in the BCG matrix. These might include smaller, specialized news channels or digital platforms that struggle to gain traction with audiences and advertisers alike. For instance, if a particular niche news vertical launched in 2023 or early 2024 is consuming significant operational costs but has yet to demonstrate a clear path to profitability or substantial audience growth, it would fit this category.

These underperforming assets can drain resources that could be better allocated to more promising ventures. The company's strategic emphasis remains on bolstering its established news brands, which have a proven track record. Any niche content that doesn't align with this core strategy and fails to capture a meaningful market share or revenue stream is a candidate for re-evaluation.

- Low Viewership: Niche content failing to reach critical mass in terms of audience engagement.

- Limited Advertising Revenue: Inability to attract significant advertising dollars due to small or unsegmented audiences.

- Resource Drain: Continued investment in content that does not yield proportionate returns.

- Strategic Misalignment: Offerings that do not complement the company's focus on established news brands.

Certain Legacy Voice/Data Solutions for Small Businesses

Certain legacy voice and data solutions for small businesses represent Altice USA's potential Dogs in the BCG Matrix. These are services like traditional landline phone systems or basic internet packages that are becoming obsolete.

These offerings are being rapidly outpaced by cloud-based communication platforms and high-speed fiber internet, which provide greater flexibility and cost-efficiency. For example, while small businesses increasingly adopt VoIP (Voice over Internet Protocol) services, which saw a global market size of approximately $117.1 billion in 2023, the demand for traditional PBX systems is diminishing.

- Declining Revenue Streams: Altice USA likely experiences a downward trend in revenue from these older services as customers migrate to newer technologies.

- Low Market Share Growth: With limited innovation and competition from advanced alternatives, these legacy solutions struggle to attract new customers or retain existing ones, resulting in minimal market share expansion.

- High Maintenance Costs: Maintaining outdated infrastructure for these services can incur significant operational costs without corresponding revenue growth, further impacting profitability.

- Customer Attrition: Small businesses are actively seeking more robust and scalable solutions, leading to a gradual but steady loss of customers from these legacy product lines.

Altice USA's legacy video packages and outdated equipment rentals are prime examples of 'Dogs' in the BCG Matrix. These segments, characterized by declining subscriber numbers and minimal new revenue, are becoming unprofitable cash traps as consumers shift to newer technologies. For instance, the company's rental revenue per user saw a slight decrease in Q1 2024, likely influenced by aging equipment.

Furthermore, certain niche content offerings and legacy voice/data solutions for small businesses also fall into this category. These underperforming assets, such as traditional landlines or specialized news verticals with low viewership, drain resources that could be better invested in more promising areas. The global market for VoIP services, valued around $117.1 billion in 2023, highlights the migration away from older communication technologies.

| Segment | BCG Category | Key Characteristics | Financial Implication |

| Legacy Video Packages | Dogs | Declining subscribers, low new revenue, unprofitable | Cash trap, resource drain |

| Outdated Equipment Rentals | Dogs | Aging modems/set-top boxes, decreasing rental revenue | Inefficient use of capital, minimal returns |

| Niche Content Offerings (excluding core brands) | Dogs | Low viewership, limited advertising, resource intensive | Potential strategic misalignment, drains resources |

| Legacy Small Business Services (e.g., traditional landlines) | Dogs | Obsolete technology, customer attrition, high maintenance costs | Declining revenue, low market share growth |

Question Marks

Altice USA's strategic expansion into greenfield areas, focusing on new fiber build-outs, positions these ventures as potential Stars within its business portfolio. These initiatives target previously unserved or underserved markets, offering substantial growth prospects despite initial low market penetration.

These significant capital investments in fiber infrastructure are crucial for future revenue streams. By 2025, new fiber builds are projected to be the primary driver of Altice USA's fiber net growth, underscoring the importance of these greenfield projects.

Altice USA's advanced digital advertising platforms, potentially including highly targeted or programmatic offerings beyond Optimum Media, represent a strategic move into a high-growth sector. The digital advertising market is projected to reach $1.1 trillion globally by 2024, underscoring its significant potential.

While this area offers substantial growth, Altice USA would likely enter with a relatively low market share, necessitating significant investment in technology development and aggressive market penetration strategies to compete effectively.

Altice USA's foray into smart home and IoT services positions it as a potential question mark in the BCG matrix. While the overall IoT market is experiencing robust growth, projected to reach $1.5 trillion globally by 2025, Altice USA is a newer player with a comparatively small market share in this burgeoning sector.

Significant investment in marketing and the development of robust infrastructure will be crucial for Altice USA to establish a strong foothold and capture a larger portion of this expanding market. The company's ability to differentiate its offerings and build brand awareness will be key to its success in this competitive landscape.

Strategic Partnerships for Content Bundling

Altice USA's strategic partnerships for content bundling, like its recent integration with Disney+ and Hulu, aim to boost customer acquisition and retention in a crowded streaming market. These collaborations are a move to offer more value, potentially attracting subscribers who seek bundled entertainment options.

While the streaming sector is undeniably a high-growth area, Altice's position within these bundles is still developing. The company's capacity to transform these partnerships into substantial market share gains for its primary services remains uncertain, classifying this as a 'Question Mark' within the BCG matrix. This necessitates careful investment and sharp strategic execution to capitalize on these opportunities.

- Customer Acquisition & Retention: Bundling with services like Disney+ and Hulu is a tactic to draw in new subscribers and keep existing ones by offering a more comprehensive entertainment package.

- Market Position: Altice's role in these content bundles is relatively new, making its ability to significantly influence market share for its core offerings a key area of uncertainty.

- Investment & Strategy: This 'Question Mark' status indicates that further investment and refined strategic planning are essential for Altice to effectively leverage these partnerships and achieve desired growth.

- Competitive Landscape: In 2024, the intense competition in the media and entertainment sector underscores the importance of such strategic alliances for differentiation and subscriber engagement.

AI-Driven Operational Enhancements

Altice USA is actively integrating AI to streamline operations, aiming to automate decision-making processes and drive down expenses. This strategic push into AI-driven enhancements positions the company to potentially offer new technological services to its customer base.

While these AI initiatives focus on internal efficiency, any expansion into new AI-powered customer offerings would represent a move into a high-growth, albeit nascent, market segment for Altice USA. Such ventures typically demand substantial upfront capital for research, development, and system integration.

- AI Investment: Altice USA's commitment to AI for operational efficiency is a key differentiator.

- Cost Reduction: Automation through AI is projected to yield significant cost savings.

- Market Potential: New AI-driven customer services could tap into a rapidly expanding technological market.

- Investment Needs: The development and integration of these advanced AI capabilities require considerable initial financial outlay.

Altice USA's expansion into smart home and IoT services is a prime example of a Question Mark. While the global IoT market is expected to reach $1.5 trillion by 2025, Altice USA is a relatively new entrant with a small market share in this rapidly growing sector.

Significant investment in marketing and robust infrastructure development will be crucial for Altice USA to gain traction and capture a larger portion of this expanding market. The company's success hinges on its ability to differentiate its offerings and build strong brand recognition in a competitive space.

Similarly, Altice USA's strategic content bundling, such as with Disney+ and Hulu, places it in a Question Mark category. While these partnerships aim to boost customer acquisition and retention in the competitive streaming market, Altice's influence on market share for its core services remains uncertain.

The company's ability to translate these alliances into substantial gains requires careful investment and sharp strategic execution. In 2024, the intense competition in media and entertainment highlights the critical need for such alliances to stand out and engage subscribers.

BCG Matrix Data Sources

Our Altice USA BCG Matrix is built on verified market intelligence, combining financial data from company filings, industry research from leading analysts, and official reports to ensure reliable, high-impact insights.