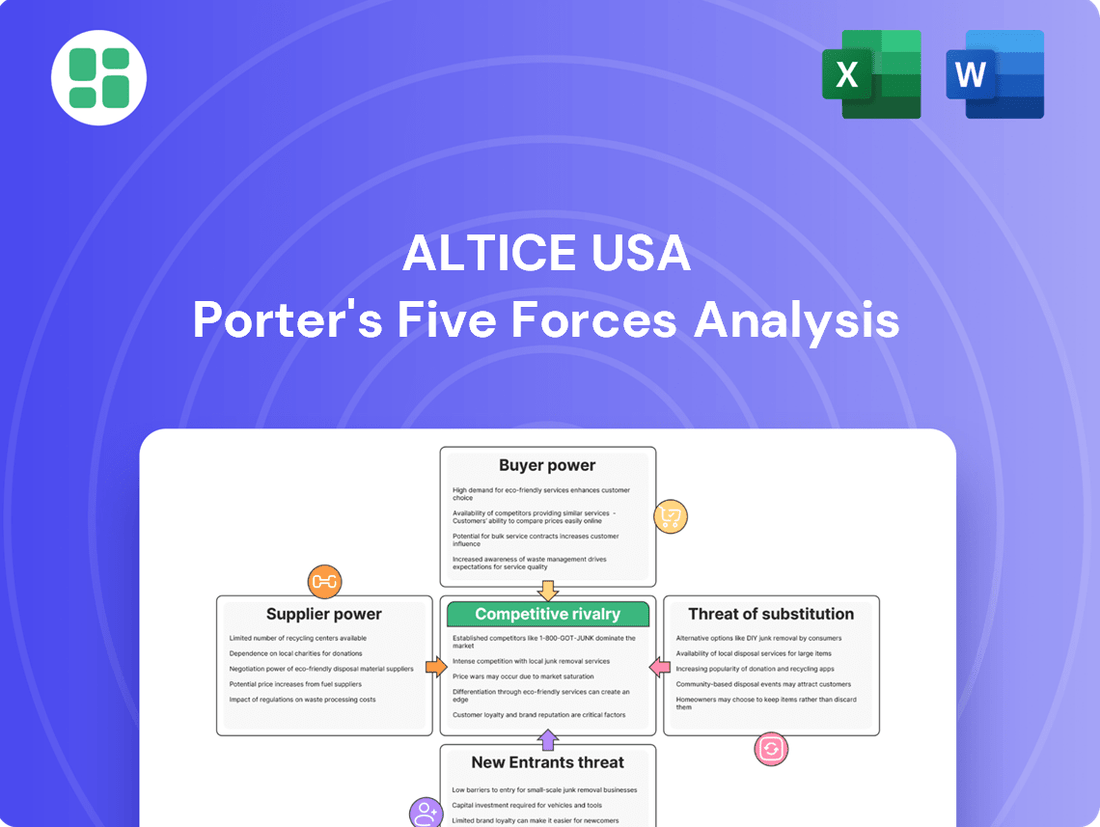

Altice USA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altice USA Bundle

Altice USA faces significant competitive pressures, particularly from the intense rivalry among existing cable and broadband providers, and the growing threat of new entrants like 5G home internet. Buyer power is substantial, as consumers have multiple choices for internet and TV services, leading to price sensitivity and a demand for value. The full Porter's Five Forces Analysis delves into the nuanced impact of these forces, revealing strategic vulnerabilities and opportunities for Altice USA.

Ready to move beyond the basics? Get a full strategic breakdown of Altice USA’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Altice USA, a major player in video services, faces a significant challenge from concentrated content providers. These few, powerful media companies control the popular programming that consumers want, giving them considerable sway over pricing. This concentration means Altice USA has limited options when negotiating for content, often leading to escalating programming expenses.

The bargaining power of these concentrated content providers is a key factor impacting Altice USA's profitability. In fiscal year 2024, Altice USA managed to bring down video programming cost inflation to around 4%, a notable decrease from the 6-8% seen in previous years. However, these costs still represent a substantial portion of the company's operating budget, underscoring the ongoing influence of these content suppliers.

Suppliers of specialized network equipment, like fiber optic cables and HFC components, hold considerable bargaining power. Altice USA's significant investment in expanding its fiber network, a key initiative in 2024, directly increases its reliance on these niche vendors.

The global submarine cable systems market, a critical segment for fiber optic infrastructure, was valued at approximately $15 billion in 2023 and is expected to see robust growth, underscoring the sustained demand for advanced network hardware and the leverage it gives suppliers.

Technology and software providers hold significant bargaining power over Altice USA, particularly as the company invests heavily in AI and automation. For instance, Altice USA's 2024 strategic initiatives include deploying AI Virtual Assistants and Access Network Automation, which necessitates reliance on specialized software vendors for these advanced capabilities. This dependence can allow suppliers of AI platforms, data analytics tools, and network management software to command higher prices or dictate terms, given the critical nature of these technologies to Altice's operational efficiency and customer experience improvements.

Limited Alternatives for Core Infrastructure

For essential network infrastructure, such as the fiber optic cables and the sophisticated equipment needed for Fiber-to-the-Home (FTTH) deployment, Altice USA faces a constrained supplier market. The specialized nature of these components means that only a select few companies possess the capability to provide them at the scale and quality required. This limited availability directly translates to increased negotiation power for these suppliers, potentially driving up procurement costs for Altice USA and reducing its flexibility in sourcing these critical materials.

The complexity inherent in building and maintaining large-scale telecommunications networks further narrows the field of viable suppliers. Companies like Altice USA rely on a handful of manufacturers and service providers who can meet stringent technical specifications and delivery timelines. For instance, in 2024, the global market for optical network hardware, a key component for FTTH, was dominated by a few major players, indicating a concentrated supply chain.

- Limited Supplier Pool: The specialized nature of core telecom infrastructure components restricts the number of qualified providers.

- Increased Procurement Costs: A lack of alternatives empowers suppliers to command higher prices for essential network hardware.

- Reduced Negotiation Flexibility: Altice USA has less leverage when negotiating terms due to the limited availability of alternative suppliers.

- Dependency on Key Providers: The complex requirements for network build-outs create a reliance on a small group of established infrastructure vendors.

Rising Costs of Content Production

The escalating cost of creating compelling video content presents a significant challenge for distributors like Altice USA. This upward trend in production expenses directly influences the fees content providers demand, squeezing margins for those who package and deliver this content to consumers.

Competition among streaming platforms and established networks for exclusive or high-demand shows and live events fuels this cost inflation. As more players vie for eyeballs, the price of licensing or producing desirable content inevitably climbs. For Altice's video division, this translates to higher operational expenditures, even as they work to streamline their offerings.

- Content Production Costs: The overall expense of producing high-quality video content continues to increase, impacting fees charged to distributors.

- Competition for Content: Streaming services and traditional broadcasters compete for premium content, driving up licensing and production costs.

- Impact on Distributors: This trend leads to higher input costs for companies like Altice USA's video segment.

- Cost Optimization Efforts: Altice USA faces the challenge of managing these rising costs despite efforts to optimize video packages.

Altice USA navigates a landscape where suppliers of specialized network equipment and technology hold considerable sway. This is particularly evident as the company invests heavily in fiber expansion and AI-driven automation, increasing its reliance on a limited pool of vendors capable of providing advanced components and software solutions. For instance, in 2024, Altice USA's focus on Access Network Automation highlighted its dependence on specialized software providers.

The bargaining power of content providers also remains a significant factor. While Altice USA managed to curb video programming cost inflation to approximately 4% in fiscal year 2024, these costs still represent a substantial operational expense, demonstrating the continued leverage of major media companies in dictating programming fees.

| Supplier Type | Key Dependence for Altice USA | Supplier Bargaining Power Factor | 2024/Recent Data Point |

|---|---|---|---|

| Content Providers | Popular programming for video services | Concentration of media companies | Video programming cost inflation ~4% in FY24 |

| Network Equipment Vendors | Fiber optic cables, HFC components | Specialized nature of components, limited suppliers | Increased reliance due to fiber network expansion |

| Technology/Software Providers | AI Virtual Assistants, network automation software | Criticality of advanced technology for operations | Investment in AI and automation initiatives |

What is included in the product

This analysis examines the competitive landscape for Altice USA by evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications and media sector.

Effortlessly identify and address the most pressing competitive threats in the broadband and cable market, allowing Altice USA to strategically mitigate risks and capitalize on opportunities.

Customers Bargaining Power

Altice USA's residential video subscriber base has been on a steady downward trend, a clear indicator of the powerful bargaining position of its customers. In the first quarter of 2024, the company reported a net loss of 65,000 video subscribers, continuing a pattern seen throughout 2023 where they shed over 200,000 video customers. This significant decline is fueled by the widespread availability of streaming services, allowing consumers to bypass traditional cable packages and negotiate better deals for broadband-only services, thereby diminishing Altice's pricing power.

The broadband market is experiencing a significant surge in competition, largely driven by the aggressive expansion of fiber overbuilders and the emergence of 5G Fixed Wireless Access (FWA) providers. This influx of new players and technologies means customers now have a wider array of choices than ever before, fundamentally shifting the power dynamic.

This increased competition directly translates to a stronger bargaining power for customers. With more providers vying for their business, consumers can more readily switch to competitors offering better pricing or superior service. This puts considerable pressure on incumbent providers like Altice USA to remain competitive on both fronts.

The impact of this intensified rivalry is already evident. For instance, in the first quarter of 2024, Altice USA reported broadband net losses, a direct consequence of these competitive pressures. This highlights the tangible financial implications of a market where customer loyalty is increasingly challenged by readily available alternatives.

Customers are becoming more aware of the costs associated with cable and internet services, leading to increased price sensitivity. Altice USA's residential average revenue per user (ARPU) saw a decline in 2024, signaling that customers are pushing back against higher prices, even as broadband ARPU experienced modest growth.

This pressure on ARPU is a direct result of customers actively seeking more affordable options. Altice USA has acknowledged this trend by developing targeted marketing campaigns and introducing new, more budget-friendly service packages to retain its customer base.

Lowering Switching Costs

Customers possess greater bargaining power when switching between providers becomes simpler and less expensive. The increasing availability of alternative broadband technologies, such as fiber optic and Fixed Wireless Access (FWA), directly contributes to this. These advancements mean customers have more choices beyond traditional cable, making it easier to find competitive offerings. For instance, in 2024, the expansion of fiber networks by competitors continued to put pressure on incumbent providers like Altice USA.

Furthermore, the ease of porting phone numbers and a decreased reliance on bundled services significantly lower the barriers to switching. Customers are no longer as tied to a single provider for all their communication needs. This flexibility allows them to shop around and select the best individual services, amplifying their ability to negotiate or switch. Altice USA itself has acknowledged this dynamic, with efforts to reduce customer churn being a key strategic focus, underscoring the reality of customer mobility in the current market.

- Reduced Switching Costs: Proliferation of fiber and FWA technologies offers more alternatives.

- Ease of Portability: Simpler phone number porting reduces customer lock-in.

- Unbundling Trend: Less reliance on bundled services empowers customers to pick and choose.

- Increased Competition: Altice USA's focus on churn reduction highlights customer choice.

Availability of Bundled Alternatives

The availability of bundled alternatives significantly impacts Altice USA's customer bargaining power. Competitors frequently offer attractive bundles, often including mobile services, or provide standalone options that precisely match individual customer needs. This fragmentation of the market, where customers can opt for mobile-only internet or combine streaming services with basic broadband, grants them greater control over their service selections and overall expenditure.

For instance, in 2024, major telecommunications providers continued to emphasize bundled packages to retain subscribers. Altice USA itself promotes its own bundles, often featuring broadband, TV, and mobile. However, the competitive landscape means customers can often find compelling deals from rivals like Verizon Fios or Xfinity, which may offer more flexible or cost-effective combinations, thereby increasing customer leverage.

- Bundled Offerings: Competitors provide diverse bundles, including mobile, TV, and internet packages.

- Standalone Services: Customers can choose individual services like broadband or streaming, bypassing comprehensive bundles.

- Market Fragmentation: The availability of varied options fragments the market, empowering customers with choice.

- Cost Control: Customers gain more control over their spending by selecting services that best fit their budget and needs.

Customers wield significant power due to the proliferation of alternative broadband providers and technologies. In Q1 2024, Altice USA lost 65,000 video subscribers, a trend that saw over 200,000 video customers depart in 2023. This is largely because consumers can now opt for streaming services and broadband-only plans, forcing providers to compete on price and service quality.

| Metric | Q1 2024 | 2023 |

|---|---|---|

| Altice USA Residential Video Net Losses | -65,000 | > -200,000 |

| Average Revenue Per User (ARPU) - Residential | Declined | Declined |

Preview the Actual Deliverable

Altice USA Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Altice USA details the intense competitive rivalry within the broadband and cable industry, highlighting the significant threat of new entrants due to high capital requirements and regulatory hurdles. It also thoroughly examines the bargaining power of buyers, influenced by the availability of alternative communication services and the potential for customer churn, alongside the moderate threat of substitutes from emerging technologies like 5G wireless. Furthermore, the analysis delves into the bargaining power of suppliers, particularly concerning content providers and network equipment manufacturers, to provide a complete understanding of Altice USA's strategic landscape.

Rivalry Among Competitors

Altice USA is grappling with intense competition from fiber overbuilders, companies aggressively installing their own fiber-to-the-home (FTTH) networks directly into areas already served by Altice's hybrid-fiber coaxial (HFC) infrastructure. These new fiber networks often boast superior speeds and reliability, directly challenging Altice's existing customer base and contributing to broadband subscriber losses.

This overbuilding trend is a significant factor in the competitive landscape. For instance, by the end of 2023, numerous smaller, regional fiber providers had made substantial inroads into previously dominated cable markets. Altice USA is actively responding by accelerating its own fiber network expansion, aiming to upgrade its HFC footprint to FTTH to remain competitive and retain its subscribers.

Mobile carriers, including giants like Verizon and T-Mobile, are aggressively rolling out their 5G Fixed Wireless Access (FWA) services. This technology presents a compelling, and frequently more affordable, substitute for conventional wired broadband connections. For instance, T-Mobile reported over 2.7 million 5G Home Internet customers by the end of Q1 2024, showcasing the rapid adoption of this alternative.

The impact of FWA on the broadband market is significant; it has captured all net broadband subscriber growth in the United States since the middle of 2022. This trend directly challenges incumbent providers like Altice USA, as customers increasingly opt for wireless solutions. This shift underscores the intensifying competitive landscape for traditional cable and fiber providers.

Fixed Wireless Access proves particularly advantageous in areas where laying fiber optic cable is difficult or excessively expensive. This includes both less densely populated, underserved regions and dense urban settings where infrastructure deployment faces logistical hurdles. The ability of 5G FWA to bypass these physical limitations makes it a potent competitive force across diverse geographic markets.

The traditional pay-TV market is facing a significant downturn as more consumers cut the cord, leading to fierce competition among the remaining providers for a dwindling customer base. This trend directly impacts companies like Altice USA, which has seen its video subscriber numbers decline.

To counter this, Altice USA is actively innovating with new video service tiers and strategically prioritizing its robust broadband and mobile segments to ensure continued revenue generation. For instance, by the end of Q1 2024, Altice USA reported a decrease in total video subscribers, underscoring the urgency of this strategic shift.

Market Share Pressure and Subscriber Losses

Altice USA faces intense competition, evident in its consistent broadband subscriber losses. In the first quarter of 2024, the company reported a net loss of 16,000 broadband customers, a trend that continued from the previous year. This ongoing decline underscores significant pressure on market share as rivals aggressively vie for customers.

Despite strategic initiatives aimed at reducing customer churn and boosting additions in fiber and mobile services, Altice USA's residential segment experienced a net loss of 22,000 total residential customers in Q1 2024. This persistent decline highlights the challenging landscape and the fierce battle for market dominance within its service areas.

- Broadband Subscriber Losses: Altice USA reported a net loss of 16,000 broadband subscribers in Q1 2024.

- Overall Residential Decline: The company saw a net loss of 22,000 total residential customers in Q1 2024.

- Competitive Pressure: These figures reflect a challenging market where rivals are effectively capturing market share.

Strategic Responses and Innovation

Altice USA is actively investing in strategic responses to combat intense competition. A key initiative is the acceleration of its fiber deployment, aiming to reach 2 million homes by the end of 2025, a significant upgrade from its existing cable network. This push for faster, more reliable internet is designed to attract and retain customers in a market where speed and quality are paramount.

Furthermore, Altice USA is expanding its mobile virtual network operator (MVNO) service, Lightpath Fiber, to offer bundled internet and mobile solutions. This strategy leverages its broadband infrastructure to capture a share of the growing mobile market. The company also focuses on enhancing operational efficiencies, notably through the integration of artificial intelligence (AI) to streamline customer service and network management.

- Fiber Deployment: Altice USA plans to pass 2 million homes with fiber by the end of 2025, a substantial increase in its high-speed network footprint.

- MVNO Expansion: The company is growing its mobile service, Lightpath Fiber, to offer combined broadband and mobile packages, enhancing its competitive offering.

- Operational Efficiency: AI implementation is a core strategy to improve customer experience and reduce operational costs, directly impacting financial performance.

- Subscriber Stabilization: These strategic moves are critical for stabilizing Altice USA's subscriber base and improving its financial health in a challenging telecom landscape.

Competitive rivalry is a major force impacting Altice USA, driven by aggressive fiber overbuilders and the rise of 5G Fixed Wireless Access (FWA). These alternatives directly challenge Altice's traditional broadband services, leading to subscriber losses, with the company reporting a net loss of 16,000 broadband subscribers in Q1 2024. The declining pay-TV market further intensifies this rivalry, forcing Altice to focus on its broadband and mobile segments to maintain its position.

| Metric | Q1 2024 | Year-over-Year Change |

|---|---|---|

| Broadband Subscribers | Net Loss of 16,000 | Continued Decline |

| Total Residential Customers | Net Loss of 22,000 | Persistent Pressure |

| Video Subscribers | Declining Trend | Market Shift |

SSubstitutes Threaten

Fiber-to-the-home (FTTH) internet is a strong substitute for Altice USA's current cable offerings. FTTH provides much faster speeds, lower latency, and better reliability compared to traditional cable broadband.

With an estimated 80% of U.S. households expected to have access to fiber by 2028, this growing availability poses a significant threat to Altice USA's existing customer base, who are using hybrid fiber-coaxial (HFC) technology.

To counter this, Altice USA is investing heavily in its own fiber network expansion. This strategic move aims to retain customers and compete directly with the superior capabilities of pure fiber services.

5G Fixed Wireless Access (FWA) presents a significant threat to Altice USA. Major mobile carriers such as Verizon and T-Mobile are actively expanding their 5G FWA offerings, delivering high-speed internet wirelessly, often at competitive price points. This technology is particularly attractive in regions where laying fiber optic cable is difficult or expensive.

The impact of 5G FWA is already evident in the market. Since mid-2022, 5G FWA has been responsible for all the growth in U.S. broadband subscribers, indicating a clear shift in consumer preference and a direct challenge to traditional cable providers like Altice USA.

Direct-to-consumer streaming services like Netflix and Disney+ present a significant threat to Altice USA's traditional cable TV business. These platforms offer vast content libraries directly to consumers, often at a lower price point than bundled cable packages. This has fueled a trend known as cord-cutting, where consumers cancel their cable subscriptions in favor of streaming alternatives.

The financial impact of this shift is substantial. For example, in 2023, the pay-TV sector, which includes cable, saw a continued decline in subscribers. While specific figures for Altice USA's video subscriber losses in 2024 are still emerging, the broader industry trend indicates ongoing pressure. This increasing adoption of OTT services directly erodes Altice's customer base for its core video product.

Mobile-Only Internet Solutions

The threat of substitutes for Altice USA's fixed-line internet services is moderate, primarily stemming from mobile-only internet solutions. For some consumers, especially those with limited incomes or in areas with strong cellular signals, using mobile hotspots or dedicated mobile data plans can be a viable alternative to traditional broadband. This is particularly relevant as the Affordable Connectivity Program (ACP) winds down, potentially pushing more price-sensitive households towards these mobile options if fixed broadband pricing remains a barrier. For instance, in 2023, the ACP provided a discount of up to $30 per month on internet service for eligible households, and its expiration could increase the appeal of cheaper, albeit potentially less robust, mobile alternatives.

The increasing capability and affordability of mobile broadband present a growing substitute. As 5G technology continues to roll out and data plans become more competitive, the performance gap between fixed and mobile internet narrows for many users. This trend could lead to a gradual migration of some customer segments away from traditional cable or fiber services, impacting Altice USA's market share and pricing power.

- Mobile-Only as a Substitute: Consumers with lower incomes or strong mobile coverage may opt for mobile hotspots or data plans instead of fixed-line internet.

- Impact of ACP Wind-Down: The discontinuation of programs like the ACP could accelerate the shift to mobile-only solutions if fixed broadband costs remain high.

- Technological Advancements: Improvements in 5G and mobile data plan competitiveness are making mobile solutions a more viable substitute for fixed broadband.

Satellite Internet

Satellite internet acts as a potential substitute, particularly in rural or underserved areas where Altice USA's fixed broadband infrastructure is less prevalent. While typically slower and with higher latency compared to cable or fiber, it offers a viable connectivity option for those without access to traditional terrestrial networks. For instance, in 2024, Starlink, a major satellite internet provider, continued its expansion, aiming to serve millions of households in areas lacking reliable broadband.

This threat is more pronounced in specific geographic pockets rather than across Altice USA's core urban and suburban markets. However, as satellite technology advances and adoption grows, its ability to offer a functional alternative, even if not always ideal, increases. The cost and performance trade-offs remain key factors influencing consumer choice between satellite and fixed broadband solutions.

The threat of substitutes for Altice USA is significant, primarily from fiber-to-the-home (FTTH) internet, which offers superior speeds and reliability. Additionally, 5G Fixed Wireless Access (FWA) is rapidly gaining traction, with major carriers leveraging it to capture broadband subscribers, accounting for all U.S. broadband subscriber growth since mid-2022. Direct-to-consumer streaming services are also eroding Altice USA's traditional cable TV business through cord-cutting, impacting video subscriber numbers.

Mobile-only solutions and satellite internet present further substitution threats, especially for price-sensitive consumers or those in underserved areas. As 5G technology advances and satellite providers like Starlink expand, these alternatives become more viable, challenging Altice USA's market position across various customer segments.

| Substitute Type | Key Characteristics | Impact on Altice USA | Market Trend/Data (2024) |

|---|---|---|---|

| Fiber-to-the-Home (FTTH) | Higher speeds, lower latency, greater reliability | Direct competition for broadband customers; necessitates own fiber investment | Estimated 80% of U.S. households to have FTTH access by 2028 |

| 5G Fixed Wireless Access (FWA) | Wireless, high-speed internet, competitive pricing | Capturing broadband growth, challenging cable's core offering | Responsible for all U.S. broadband subscriber growth since mid-2022 |

| Direct-to-Consumer Streaming | Vast content libraries, lower cost than bundles | Driving cord-cutting, reducing demand for traditional cable TV | Continued decline in pay-TV subscribers in 2023; pressure ongoing in 2024 |

| Mobile-Only Internet | Potentially lower cost, accessible with strong cellular signal | Alternative for price-sensitive users, especially with ACP wind-down | ACP provided up to $30/month discount in 2023; expiration may boost mobile appeal |

| Satellite Internet | Connectivity in rural/underserved areas, increasing capabilities | Alternative where fixed broadband is unavailable or costly | Starlink continues expansion in 2024, serving areas with limited broadband |

Entrants Threaten

The broadband, video, and mobile services sector demands substantial upfront investment in network infrastructure. This includes the costly process of laying fiber optic cables, deploying hybrid fiber-coaxial (HFC) networks, and establishing 5G towers. Altice USA itself has demonstrated this barrier through its significant capital expenditures for network upgrades and expansion, making it exceptionally challenging for new competitors to enter and build a meaningful presence.

The U.S. telecom sector is a minefield of regulations, covering everything from how airwaves are assigned to how data is protected. For any new company looking to enter, understanding and complying with these rules, including obtaining the right permits, is a major hurdle.

In 2024, the Federal Communications Commission (FCC) continued to enforce stringent rules on broadband deployment and net neutrality principles, adding layers of complexity. For instance, the cost associated with securing the necessary federal and state licenses alone can run into millions of dollars, effectively deterring smaller, less capitalized players.

Established infrastructure and economies of scale present a significant barrier for new entrants into the U.S. telecommunications market. Incumbent providers, such as Altice USA, have invested billions in building out extensive fiber optic networks and acquiring content. For instance, Altice USA reported capital expenditures of $1.1 billion in 2023 alone, a testament to the ongoing investment in infrastructure.

New companies would face immense costs to replicate this network footprint or secure reliable wholesale access. This capital requirement, coupled with the operational efficiencies gained through scale in areas like customer service and content negotiation, makes it exceedingly difficult for newcomers to compete effectively on price or service quality from the outset.

Brand Recognition and Customer Loyalty

Altice USA benefits significantly from its established brands, Optimum and Suddenlink. These names carry considerable weight, having cultivated strong customer bases and recognition within their operating regions. This brand equity presents a substantial hurdle for any new company attempting to enter the market.

New entrants face the difficult task of building trust and loyalty from the ground up. This requires extensive and costly marketing campaigns, alongside significant investment in customer acquisition strategies, to even begin to compete with established players like Altice USA.

- Brand Strength: Optimum and Suddenlink have a long history of service, fostering deep customer relationships.

- Customer Loyalty: Existing customers are less likely to switch providers due to familiarity and established service agreements.

- Acquisition Costs: New entrants must overcome brand inertia, necessitating higher spending on marketing and promotions to attract initial customers.

- Market Penetration: Altice USA's established market presence makes it challenging for newcomers to gain significant traction quickly.

Access to Content and Programming Rights

For video services, securing access to premium content and negotiating favorable programming rights presents a substantial barrier to entry. Major content providers often have established relationships with incumbent providers, potentially demanding high fees or exclusivity, which hinders new entrants from assembling a competitive content offering.

In 2024, the escalating costs of sports broadcasting rights, a key driver of subscriber retention, continued to be a significant hurdle. For instance, major sports leagues like the NFL and NBA command billions in media rights, making it exceptionally challenging for new players to match the content portfolios of established cable and streaming giants.

- Content Acquisition Costs: The price of premium content, especially live sports and exclusive series, remains a primary barrier.

- Exclusivity Agreements: Long-term deals between content creators and incumbents limit availability for newcomers.

- Negotiating Power: Established players leverage their scale to secure more favorable terms with content providers.

The threat of new entrants for Altice USA is generally low due to significant barriers. Building out broadband infrastructure requires massive capital investment, with companies like Altice USA investing over $1 billion annually in network upgrades. Regulatory hurdles, including securing federal and state licenses that can cost millions, further deter new players. The established brand recognition of Optimum and Suddenlink also creates a loyalty hurdle, requiring substantial marketing spend for newcomers to gain traction.

| Barrier | Description | Example for Altice USA (2023/2024) |

|---|---|---|

| Capital Requirements | High upfront costs for network infrastructure (fiber, 5G). | Altice USA's $1.1 billion in capital expenditures in 2023. |

| Regulatory Hurdles | Complex licensing, permits, and compliance. | FCC's continued enforcement of broadband deployment rules in 2024. |

| Brand Loyalty & Acquisition Costs | Established customer bases and brand recognition. | Need for extensive marketing by new entrants to overcome Optimum/Suddenlink's equity. |

| Content Access | Difficulty in securing premium content and negotiating rights. | Escalating costs of sports broadcasting rights (billions for major leagues) in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Altice USA leverages data from company annual reports, investor presentations, and SEC filings to understand strategic positioning. We also incorporate insights from industry research reports and market share data from firms like Kagan and Leichtman Research Group.