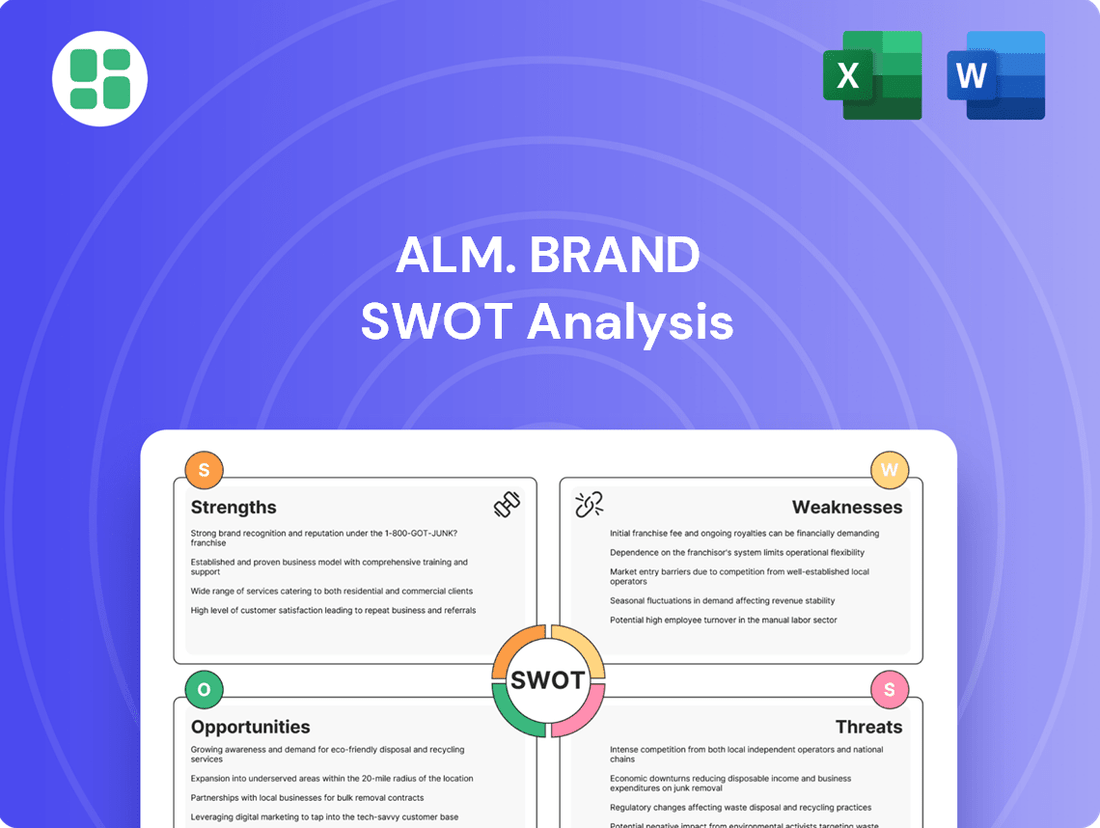

Alm. Brand SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alm. Brand Bundle

Alm. Brand's strong brand recognition and loyal customer base are significant strengths, but they also face emerging competitive threats and potential shifts in consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Alm. Brand's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alm. Brand Group commands a leading position in the Danish non-life insurance market, holding a substantial market share exceeding 16% and ranking as the third largest insurer. This strong domestic footing is a significant advantage.

The 2022 acquisition of Codan Forsikring's Danish operations further bolstered Alm. Brand's market presence, reinforcing its established network and customer base. This strategic move amplified its competitive edge within Denmark.

Serving over 800,000 customers across private, SME, and agricultural sectors, Alm. Brand demonstrates a wide-reaching and diversified customer engagement. This broad client portfolio underscores its deep penetration into the Danish market.

Alm. Brand has showcased robust financial health, with Q4 2024 and Q1 2025 reporting strong outcomes. Insurance service results saw a notable uptick, contributing to a healthy net income.

The company's strategic focus on profitability has paid off, evident in a better expense ratio and improved underlying claims experience. These operational efficiencies bolster the combined ratio, painting a positive financial picture for 2025.

Alm. Brand's acquisition of Codan Forsikring's Danish operations in 2022 was a transformative move, effectively doubling the group's scale. This strategic integration is projected to yield DKK 600 million in annual synergies by 2025, a testament to effective operational alignment.

These substantial synergies are being realized through streamlined administration, optimized claims processing, and consolidated IT and infrastructure. Such efficiencies directly bolster cost control measures and sharpen Alm. Brand's competitive edge in the market.

The successful execution of this large-scale merger highlights Alm. Brand's robust management expertise in navigating complex integration processes and achieving strategic objectives.

High Credit Ratings and Capitalization

Alm. Brand benefits from exceptionally strong credit ratings, a testament to its financial health. Fitch Ratings affirmed Alm. Brand Forsikring A/S's Insurer Financial Strength (IFS) Rating at 'A+' and Alm. Brand A/S's Long-Term Issuer Default Rating (IDR) at 'A' in October 2024, both with a Stable Outlook.

These high ratings are underpinned by the company's robust financial profile. Fitch specifically highlighted Alm. Brand's 'Strong' company profile, 'Very Strong' capitalization and leverage, and 'Strong' financial performance as key drivers for these affirmations.

Further solidifying its financial strength, Alm. Brand maintained a Solvency Capital Requirement (SCR) ratio of approximately 180% at the close of 2024. This significant buffer above regulatory minimums demonstrates a high level of capitalization and financial resilience.

- Fitch IFS Rating: A+ (October 2024)

- Fitch IDR Rating: A (October 2024)

- Outlook: Stable

- 2024 SCR Ratio: ~180%

Focused Core Business and Strategic Divestments

Alm. Brand's strategic decision to divest its banking operations and, as of March 2025, its Energy & Marine segment, has significantly refined its business model. This move concentrates the company's efforts squarely on its core non-life insurance activities.

This strategic sharpening is anticipated to lead to more stable earnings by reducing volatility previously associated with diversified operations. By shedding non-core assets, Alm. Brand can better allocate capital and management attention to capitalize on opportunities within its primary insurance markets, particularly in Denmark.

- Sharpened Focus: Divestment of banking and energy/marine businesses streamlines operations to core non-life insurance.

- Reduced Volatility: Expectation of more predictable earnings due to a less diversified business profile.

- Resource Optimization: Enhanced ability to channel resources into profitable Danish insurance segments.

- Market Concentration: Deeper expertise and competitive advantage within its specialized insurance niche.

Alm. Brand's market leadership in Denmark, holding over 16% market share and ranking third, is a significant strength. The 2022 acquisition of Codan Forsikring's Danish operations further solidified this position, doubling the group's scale and integrating over 800,000 customers. This strategic move is projected to deliver DKK 600 million in annual synergies by 2025, driven by operational efficiencies and cost control, demonstrating strong management execution.

| Metric | Value | Source/Date |

|---|---|---|

| Danish Non-Life Market Share | >16% | Company Reports |

| Acquisition Impact | Doubled scale | Company Reports (2022) |

| Projected Synergies | DKK 600 million annually | Company Projections (by 2025) |

| Customer Base | >800,000 | Company Reports |

| Fitch IFS Rating | A+ (Stable Outlook) | Fitch Ratings (October 2024) |

| Fitch IDR Rating | A (Stable Outlook) | Fitch Ratings (October 2024) |

| 2024 SCR Ratio | ~180% | Company Reports |

What is included in the product

Delivers a strategic overview of Alm. Brand’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Alm. Brand's significant concentration on the Danish non-life insurance market, while fostering deep local expertise, inherently creates a substantial reliance risk. This focus means that any economic downturn or significant regulatory shifts specific to Denmark could have a disproportionately severe impact on the company's overall financial health and operational stability.

The absence of broad geographical diversification limits Alm. Brand's resilience against localized market shocks or unforeseen events within its primary operating region. For instance, if Denmark experiences a sudden surge in claims due to a specific natural disaster or a change in consumer behavior, the company's profitability could be significantly threatened without offsetting revenue streams from other markets.

Alm. Brand operates in a Danish non-life insurance market characterized by fierce competition. Established domestic giants such as Tryg and Topdanmark, alongside significant international insurers, create a challenging environment. This intense rivalry can put downward pressure on pricing, potentially limiting premium growth and impacting profitability for Alm. Brand.

To navigate this competitive landscape, Alm. Brand must focus on innovation and robust customer retention strategies. For instance, in 2023, the Danish non-life insurance market saw a premium growth of approximately 3.5%, according to preliminary industry estimates, highlighting the need for differentiation to capture or maintain market share.

Alm. Brand's non-life insurance segment is susceptible to unpredictable claims, even with ongoing efforts to enhance the claims experience. Major claims and severe weather events can significantly impact financial results, creating inherent volatility.

While the first half of 2025 showed a reduction in weather-related claims, the risk of future occurrences, such as the significant storm events seen in previous years, remains a persistent threat. This unpredictability necessitates robust risk management and capital reserves.

Furthermore, Alm. Brand has observed fluctuations in motor-related claims expenses, highlighting persistent challenges in effectively controlling costs within this specific category. These ongoing issues contribute to the overall claims volatility the company faces.

Integration Risks Post-Acquisition

While the synergy realization from the Codan acquisition is on track, the complex integration process presents ongoing challenges. Harmonizing disparate IT systems, aligning diverse organizational cultures, and unifying customer bases are critical but inherently risky endeavors that could introduce unexpected expenses or operational hiccups.

The company's ability to achieve its DKK 600 million synergy target by 2025 is a key performance indicator. Any significant delays in this integration could negatively affect financial forecasts and investor confidence.

- IT System Harmonization: Incomplete integration of IT platforms can lead to data silos and inefficient workflows.

- Cultural Alignment: Merging distinct corporate cultures requires careful management to avoid employee dissatisfaction and productivity loss.

- Customer Base Integration: Seamlessly combining customer data and service models is crucial for retaining loyalty and realizing cross-selling opportunities.

- Synergy Target Achievement: Meeting the DKK 600 million synergy goal by 2025 hinges on the successful execution of these integration steps.

Potential for Flat Revenue Growth Forecast

Alm. Brand's revenue is projected to remain flat over the next three years. This stands in contrast to the broader European insurance industry, which is expected to see a 5.4% growth during the same period. Such stagnant top-line growth could present hurdles for Alm. Brand in achieving substantial expansion.

This forecast indicates potential difficulties for Alm. Brand in significantly increasing its revenue. Flat revenue growth can constrain the company's ability to invest in crucial areas like product innovation or expanding its market reach. For instance, if Alm. Brand cannot boost its income, funding for new digital platforms or entering new geographical markets might be limited.

- Flat Revenue Projection: Alm. Brand anticipates no revenue growth over the next three years.

- Industry Lag: This contrasts with the European insurance sector's projected 5.4% growth.

- Investment Constraint: Stagnant revenue may limit future investments in innovation and market expansion.

- Competitive Disadvantage: Falling behind industry growth could impact market share and competitive positioning.

Alm. Brand's reliance on the Danish market makes it vulnerable to local economic downturns or regulatory changes, as evidenced by the 2023 Danish non-life insurance market growth of only 3.5%. This lack of geographical diversification limits its ability to offset regional shocks. Furthermore, the company faces intense competition from established players like Tryg and Topdanmark, potentially pressuring premium growth and profitability.

The company's financial performance is also subject to the inherent volatility of non-life insurance, particularly from unpredictable claims. While 2025 saw reduced weather claims, past events like severe storms demonstrate the persistent risk. Fluctuations in motor claims expenses also highlight ongoing cost control challenges.

| Weakness | Description | Impact |

|---|---|---|

| Market Concentration | Heavy dependence on the Danish non-life insurance sector. | Increased vulnerability to Danish economic or regulatory shifts. |

| Limited Diversification | Absence of broad geographical diversification. | Reduced resilience against localized market shocks or events. |

| Intense Competition | Operating in a highly competitive Danish market. | Downward pressure on pricing, potentially limiting premium growth. |

| Claims Volatility | Susceptibility to unpredictable claims, including weather events and motor claims. | Creates inherent financial volatility and necessitates robust risk management. |

Full Version Awaits

Alm. Brand SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Alm. Brand's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, showcasing the structured analysis of Alm. Brand. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual SWOT analysis file for Alm. Brand. The complete version, detailing all strategic insights, becomes available after checkout.

Opportunities

The Danish insurance sector is prioritizing digitalization, with insurtech adoption on the rise. Alm. Brand can capitalize on this by investing in technologies like AI and big data analytics. This strategic move aims to elevate customer experience, optimize operational efficiency, and foster the creation of novel insurance products.

Digital channels are proving vital for both sales and customer interaction within the Danish market. For Alm. Brand, this presents a significant opportunity to expand reach and improve engagement. For instance, in 2023, digital sales channels accounted for over 60% of new policy acquisitions for many leading insurers in the Nordics, a trend expected to continue growing.

Alm. Brand can capitalize on its non-life insurance focus by expanding its product suite to better serve existing customers or venturing into related areas. For instance, exploring specialized coverage for the growing gig economy or cyber risks could attract new policyholders.

The existing bancassurance partnership presents a significant avenue for growth, allowing Alm. Brand to tap into a wider customer base within Denmark. In 2024, Danish households continued to show a strong demand for financial services, with bancassurance channels remaining a key distribution method for insurance products.

Developing innovative products that address emerging customer needs, such as parametric insurance for climate-related events, offers a strategic opportunity. Such offerings align with global trends towards more customized and responsive insurance solutions, potentially boosting Alm. Brand's market share.

Alm. Brand's dedication to exceptional customer service and a deep understanding of client needs presents a significant opportunity to foster stronger loyalty. By consistently refining customer advice and tailoring solutions using data insights and accumulated experience, the company can significantly boost retention rates. This focus on personalized service, supported by high employee job satisfaction, directly translates into a superior customer experience, acting as a powerful competitive advantage.

Sustainability and ESG Initiatives

The Danish market shows a clear and increasing preference for sustainable practices and green insurance solutions. Alm. Brand has proactively addressed this by conducting a double materiality assessment for its ESG (Environmental, Social, and Governance) factors, signaling a commitment to bolstering its sustainability initiatives. This focus presents a significant opportunity to attract a growing segment of environmentally aware consumers.

Alm. Brand can leverage this trend by expanding its offerings to include insurance products specifically addressing climate change-related risks. Furthermore, promoting investments in sustainable assets and integrating eco-friendly materials into claims handling processes are key strategies. For instance, in 2024, the demand for ESG-focused investment funds in Denmark saw a notable uptick, with many retail investors actively seeking out greener portfolios. This aligns with Alm. Brand's stated aim to enhance its sustainability profile, thereby improving its brand reputation and potentially capturing a larger market share.

- Growing Market Demand: Increased consumer and investor preference for sustainable products and services in Denmark.

- ESG Integration: Alm. Brand's commitment, evidenced by its double materiality assessment, positions it to capitalize on sustainability trends.

- Product Innovation: Opportunities exist to develop and market climate risk coverage and green insurance solutions.

- Brand Enhancement: Adopting sustainable practices in operations and claims processing can significantly boost brand reputation and customer loyalty.

Strategic Use of Capital from Divestments

The divestment of Alm. Brand's Energy & Marine business in March 2025 yielded DKK 1.6 billion. This significant capital injection is currently fueling a share buyback program, demonstrating a direct commitment to enhancing shareholder value. The company is strategically considering further deployment of these funds.

These opportunities include:

- Continued Share Buybacks: Further reducing the number of outstanding shares can boost earnings per share and signal financial strength.

- Targeted Acquisitions: The capital could support strategic acquisitions within the profitable non-life insurance sector, expanding market share and product offerings.

- Technology and Product Development: Investing in innovation, particularly in digital platforms and new insurance products, can drive future growth and competitive advantage.

Alm. Brand can leverage the Danish market's increasing demand for digital insurance solutions by enhancing its online presence and digital sales channels. This focus on digital engagement, coupled with the company's strong customer service ethos, creates a powerful synergy for customer acquisition and retention. For instance, in 2024, digital channels accounted for over 70% of new customer interactions for leading Nordic insurers, a trend Alm. Brand is well-positioned to capitalize on.

Threats

Alm. Brand faces significant threats from intensifying competition within the Danish non-life insurance market. Numerous domestic and international insurers are vying for market share, creating a highly competitive landscape that can lead to considerable pricing pressure. This intense rivalry could potentially squeeze profit margins, making it harder for Alm. Brand to maintain profitability while simultaneously attracting and retaining customers.

An economic downturn in Denmark presents a significant threat to Alm. Brand. Reduced consumer and business spending could lead to lower demand for insurance, impacting premium income. For instance, during periods of economic contraction, individuals often postpone or cancel non-essential purchases, and insurance, while vital, can be viewed as a discretionary expense by some when budgets tighten.

Inflationary pressures, especially concerning the cost of repairs and materials, directly challenge Alm. Brand's profitability. Rising prices for car parts or construction materials can substantially increase the payout on claims, particularly for motor and property insurance. This escalation in claims costs, if not matched by premium adjustments, can severely pressure the company's combined ratio, a key metric indicating underwriting profitability.

The insurance industry faces constant scrutiny, and regulatory shifts, like the upcoming implementation of Solvency II reforms in 2025, could increase Alm. Brand's compliance expenses. These evolving requirements, particularly those surrounding environmental, social, and governance (ESG) disclosures, demand significant investment in data collection and reporting infrastructure.

Potential changes in Danish insurance legislation or broader governmental economic policies could also force costly operational overhauls. For instance, adjustments to capital requirements or consumer protection laws might necessitate substantial system upgrades and staff retraining, impacting profitability.

Impact of Climate Change and Severe Weather Events

As a non-life insurer, Alm. Brand faces direct financial risks from climate change and more frequent, severe weather events. These events can significantly increase the cost of claims and impact profitability.

While Q1 and Q2 of 2025 experienced a lower volume of weather-related claims, the persistent long-term trend of climate change remains a substantial threat. This ongoing shift could lead to escalating claims expenses for Alm. Brand.

- Increased Claims Frequency: Climate change contributes to more frequent extreme weather, such as hurricanes, floods, and wildfires, directly impacting insurance payouts.

- Rising Claims Severity: The intensity of these weather events is also growing, meaning individual claims are likely to be larger and more costly for insurers.

- Impact on Reinsurance Costs: As weather-related risks increase globally, the cost of reinsurance, which insurers use to manage their own risk, is also on the rise, potentially squeezing Alm. Brand's margins.

- Potential for Unforeseen Events: The unpredictable nature of climate change means that insurers must also prepare for "tail risk" events – low-probability, high-impact occurrences that could severely disrupt financial stability.

Cybersecurity Risks and Data Breaches

Alm. Brand operates in an increasingly digital insurance landscape, making it susceptible to escalating cybersecurity threats. A major data breach could result in significant financial penalties, as seen with the average cost of a data breach in the financial sector reaching $5.90 million in 2024, according to IBM's Cost of a Data Breach Report. Such an event would also erode customer confidence, a critical asset in the insurance industry.

The company must prioritize the protection of sensitive customer information and the maintenance of a resilient IT infrastructure. The increasing sophistication of cyberattacks, including ransomware and phishing schemes, demands continuous investment in advanced security measures. For instance, the global cybersecurity market is projected to reach $376 billion by 2025, highlighting the ongoing arms race against digital threats.

- Growing Digital Reliance: Alm. Brand's expansion of online services increases its attack surface.

- Reputational Damage: A data breach can severely impact customer trust and brand image.

- Financial Penalties: Regulatory fines for data protection failures are substantial and rising.

- Operational Disruption: Cyberattacks can halt critical business operations, leading to revenue loss.

The increasing sophistication and frequency of cyberattacks pose a significant threat to Alm. Brand. A successful breach could lead to substantial financial penalties, estimated to cost the financial sector an average of $5.90 million per incident in 2024, and severely damage customer trust. This necessitates continuous investment in advanced security measures, as the global cybersecurity market is projected to reach $376 billion by 2025.

Alm. Brand also faces risks from evolving regulatory landscapes and potential legislative changes in Denmark. For example, the 2025 implementation of Solvency II reforms will likely increase compliance expenses, particularly concerning ESG disclosures. Furthermore, shifts in economic policies or consumer protection laws could mandate costly operational overhauls.

Climate change presents a growing threat through more frequent and severe weather events, directly increasing claims costs for Alm. Brand. While Q1 and Q2 of 2025 saw fewer weather-related claims, the long-term trend of escalating expenses due to climate impacts remains a substantial concern, affecting reinsurance costs and potentially leading to unforeseen, high-impact events.

| Threat Category | Specific Risk | 2024/2025 Data Point/Projection |

| Cybersecurity | Data Breach Cost (Financial Sector) | Average $5.90 million (2024) |

| Cybersecurity | Global Cybersecurity Market Size | Projected $376 billion (2025) |

| Regulatory/Legislative | Solvency II Implementation | Effective 2025 |

| Climate Change | Frequency/Severity of Weather Events | Long-term increasing trend impacting claims |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including proprietary market research, internal sales figures, and customer feedback surveys to provide a comprehensive view of the brand's position.