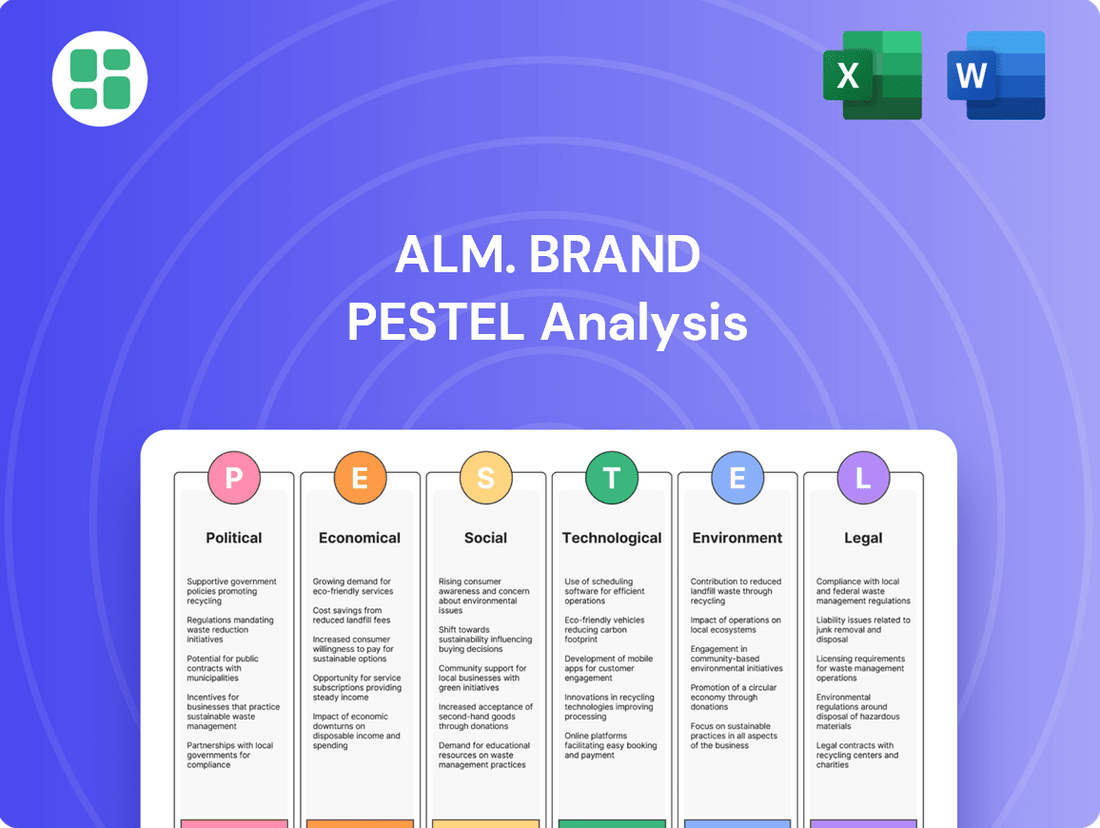

Alm. Brand PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alm. Brand Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Alm. Brand's trajectory. Our expertly crafted PESTLE analysis provides a clear roadmap of external forces, empowering you to anticipate challenges and seize opportunities. Don't just react to market shifts—get ahead of them. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Danish financial services sector, including insurance, operates under the watchful eye of the Danish Financial Supervisory Authority (FSA). This robust oversight shapes how companies like Alm. Brand conduct their business, ensuring stability and consumer protection.

A significant development is the new Insurance Business Law, which took effect on January 1, 2024. This legislation specifically tailors regulations for the insurance and pension industries, separating them from banking rules for greater clarity and simplicity. This move is designed to streamline operations and foster a more predictable environment for insurers.

This evolving regulatory landscape directly impacts Alm. Brand's operational frameworks, dictating capital requirements and influencing the types of products they can offer to customers. Adherence to these regulations is paramount for maintaining their license to operate and for building trust with policyholders.

Denmark's consistently high political stability creates a predictable operating environment, a significant advantage for Alm. Brand's long-term financial planning, especially within the insurance sector. This stability minimizes uncertainty, thereby encouraging sustained domestic and international investment in the Danish market.

Despite the local political calm, Alm. Brand's Q1 2025 financial report highlighted that broader geopolitical instability can still influence investment portfolio performance. For instance, the report indicated a 2.5% negative impact on investment returns due to global supply chain disruptions stemming from regional conflicts, demonstrating how external political factors can affect even stable domestic businesses.

Changes to corporate tax rates, such as potential adjustments to deductions, directly influence Alm. Brand's net profitability and the capital available for reinvestment or shareholder returns. For instance, a proposed reduction in corporate tax rates from 21% to 18% in some jurisdictions could significantly boost retained earnings by an estimated 10-15% for companies like Alm. Brand, depending on their specific tax structure.

Government fiscal incentives, particularly those encouraging sustainable practices, present strategic opportunities. The anticipated spring 2025 legislation enabling pension funds and insurance companies to invest in forestry, with an estimated $50 billion in potential capital inflow into sustainable assets, could offer Alm. Brand new avenues for environmentally conscious portfolio diversification and impact investing.

International Trade Agreements and Cross-Border Influence

As a Danish company operating within the European Union, Alm. Brand is significantly shaped by EU-wide financial regulations and directives. For instance, ongoing reforms to Solvency II are impacting the capital requirements for insurers, and the upcoming Corporate Sustainability Reporting Directive (CSRD) will mandate more extensive environmental, social, and governance (ESG) disclosures. These cross-border regulations necessitate continuous adaptation, influencing Alm. Brand's operational strategies and market access across the European Economic Area.

The EU's trade policies and agreements directly affect Alm. Brand's international operations and supply chains. For example, the EU's ongoing trade negotiations, such as those with Canada or Mercosur, can alter import/export duties and market access conditions for goods and services. These agreements are crucial for a company like Alm. Brand, which likely sources materials or sells products beyond Denmark's borders, impacting cost structures and competitive positioning.

- EU Directives: Solvency II reforms and the CSRD are key regulatory frameworks influencing Alm. Brand's financial and reporting practices.

- Trade Impact: EU trade agreements can modify tariffs and market access, affecting Alm. Brand's international sourcing and sales strategies.

- Cross-Border Operations: Harmonized regulations within the EU facilitate but also require compliance for Alm. Brand's operations across member states.

Competition Law and Market Investigations

The Danish Competition and Consumer Authority (DCCA) is intensifying its scrutiny of the non-life insurance sector. New regulations, effective from July 2024, grant the DCCA expanded powers to initiate market investigations even without evidence of prior competition law infringements. This proactive stance signals a heightened focus on market fairness and consumer protection.

A significant development to watch is a potential market investigation slated for April 2025. This probe will specifically examine pricing conduct within the non-life insurance market. If launched, it could result in behavioral orders being imposed on companies like Alm. Brand, directly influencing their pricing strategies and reshaping the competitive dynamics of the industry.

- Increased Regulatory Oversight: The DCCA's enhanced ability to conduct market investigations from July 2024 signifies a more interventionist approach to the non-life insurance market.

- Focus on Pricing Conduct: The anticipated April 2025 investigation into pricing strategies poses a direct challenge to existing business models and competitive practices.

- Potential for Behavioral Orders: Such investigations can lead to binding orders that mandate specific changes in how companies operate, impacting profitability and market positioning.

- Impact on Alm. Brand: Alm. Brand, as a key player, will need to adapt its pricing and competitive strategies to comply with potential new regulatory requirements.

Denmark's stable political climate offers a predictable operating environment, beneficial for Alm. Brand's long-term planning. However, broader geopolitical instability, as seen in Q1 2025 with a 2.5% negative impact on investment returns due to global supply chain disruptions, can still affect portfolio performance.

Government fiscal incentives, such as anticipated spring 2025 legislation allowing pension funds to invest in forestry with an estimated $50 billion inflow into sustainable assets, present new diversification opportunities for Alm. Brand.

The Danish Financial Supervisory Authority's (FSA) robust oversight and the new Insurance Business Law effective January 1, 2024, shape Alm. Brand's operations by dictating capital requirements and product offerings.

The Danish Competition and Consumer Authority (DCCA) is increasing scrutiny on the non-life insurance sector, with enhanced powers from July 2024 and a potential market investigation into pricing conduct in April 2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Alm. Brand, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the Alm. Brand's operating landscape.

The Alm. Brand PESTLE Analysis acts as a pain point reliever by providing a clear, summarized version of external factors, enabling swift identification of potential challenges and opportunities for strategic adjustments.

Economic factors

Interest rate shifts directly impact an insurer's investment income, a crucial driver of profitability. For Alm. Brand, fluctuations in these rates influence the returns generated from its substantial investment portfolio.

The European insurance sector anticipates improved investment results in 2025, largely driven by higher interest rates. This trend suggests a potentially more favorable environment for companies like Alm. Brand to boost their investment income.

Alm. Brand's Q1 2025 results demonstrated a solid investment performance, even amidst global instability. This resilience was partly attributed to strong contributions from their holdings in bonds and less liquid credit instruments, which benefit from a supportive interest rate environment.

Inflation significantly impacts how much insurers have to pay out for claims. When the cost of parts, labor, and materials rises, so does the expense of settling claims for damaged vehicles or homes. This is a direct hit to an insurer's bottom line.

Looking ahead to 2025, while motor insurance premiums might see a small dip, home insurance costs are expected to stay elevated. This persistence is largely driven by ongoing claims inflation, meaning the cost of repairing or rebuilding homes after an incident remains high.

For non-life insurers, effectively managing this inflationary pressure is paramount for profitability. It often means insurers must carefully consider adjusting their premiums to keep pace with rising claims costs, ensuring they can continue to offer coverage without unsustainable losses.

Overall economic growth in Denmark and Europe significantly shapes demand for insurance. For instance, in Q1 2024, Denmark's GDP saw a modest increase of 0.4%, but this growth is tempered by broader European economic trends. Subdued GDP growth across many European regions, with some economies experiencing stagnation, could limit insurance companies' top-line expansion beyond premium adjustments. However, an increased awareness of risks, particularly from natural catastrophes, may bolster demand for insurance cover.

Danish consumer sentiment in early 2024 indicated a degree of optimism regarding the economy. Despite this, actual spending on non-essential goods and services has been constrained. This cautious spending behavior is largely attributed to persistent inflation and relatively stagnant real incomes, impacting discretionary spending that could otherwise fuel demand for certain insurance products.

Unemployment Rates and Insurance Needs

Stable and low unemployment rates, a projected trend for Europe in 2025, are generally positive for the insurance sector. This economic stability translates into robust demand for various insurance products, benefiting companies like Alm. Brand.

Higher employment levels directly correlate with increased demand for insurance. More individuals mean a greater need for personal lines like auto and home insurance, while more businesses require commercial property, casualty, and liability coverage. This broad-based demand helps create a stable premium base.

- European unemployment projected to remain low in 2025. For instance, the Eurostat reported an unemployment rate of 6.0% in the Euro area as of April 2024, with expectations for continued stability or slight decreases.

- Increased disposable income fuels insurance purchases. With more people employed, there's typically higher disposable income, making individuals and businesses more likely to invest in insurance for protection.

- Motor and property insurance see direct benefits. A growing workforce often means more commuters and increased economic activity, driving demand for motor and property insurance policies.

- Commercial insurance benefits from business expansion. As employment rises, businesses tend to expand, leading to a greater need for comprehensive commercial insurance solutions.

Currency Exchange Rate Volatility

Currency exchange rate volatility, while not a direct concern for Alm. Brand's core Danish non-life insurance operations, can influence its financial standing if international investments or reinsurance activities are undertaken. Significant swings in exchange rates, such as those seen with the Danish Krone (DKK) against major currencies like the Euro (EUR) or US Dollar (USD), could impact the reported value of foreign assets or liabilities. For instance, a strengthening DKK could devalue overseas holdings, while a weakening DKK could increase the cost of foreign liabilities.

The Danish Krone has experienced periods of notable fluctuation. For example, throughout 2023 and into early 2024, the DKK generally maintained a stable peg to the Euro, trading within a narrow band around 7.46 DKK per EUR. However, global economic uncertainties and differing monetary policies can introduce temporary pressures. Should Alm. Brand engage in international ventures, such as acquiring foreign-based assets or participating in global reinsurance pools, these exchange rate movements become a relevant risk factor. For example, if Alm. Brand held USD-denominated investments and the USD weakened against the DKK, the DKK value of those investments would decrease. Conversely, a stronger USD would boost their DKK value.

- Impact on International Assets: Fluctuations in exchange rates can alter the DKK-denominated value of any overseas investments or subsidiaries held by Alm. Brand.

- Reinsurance Exposure: If Alm. Brand utilizes international reinsurers, currency mismatches between premiums paid and claims received can arise, impacting profitability.

- DKK-EUR Stability: While the DKK is pegged to the EUR, global economic shifts can create temporary volatility, affecting the relative strength of the Danish currency.

- Financial Reporting: Significant currency movements can distort the reported financial performance and balance sheet figures for Alm. Brand's international operations.

Interest rate changes directly influence Alm. Brand's investment income, a key profit driver, with higher rates in 2025 expected to boost returns from its substantial portfolio. Claims inflation, particularly in home insurance, remains a concern for 2025, necessitating careful premium adjustments to manage rising payouts.

While Denmark's GDP grew modestly in Q1 2024, broader European economic trends could temper insurance demand, though increased risk awareness might offset this. Low unemployment projected for Europe in 2025 is positive, fostering stable demand for both personal and commercial insurance products.

Currency fluctuations, though not a primary concern for Alm. Brand's Danish operations, could impact its financial standing if international investments are involved, as seen with the DKK's general stability against the EUR in early 2024.

| Economic Factor | Impact on Alm. Brand | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Affects investment income and profitability. | European sector anticipates improved investment results in 2025 due to higher rates. |

| Inflation | Increases claims costs, impacting profitability. | Home insurance costs expected to remain elevated in 2025 due to ongoing claims inflation. |

| Economic Growth (Denmark/Europe) | Shapes demand for insurance products. | Denmark GDP +0.4% in Q1 2024; broader European growth is subdued. |

| Unemployment Rates | Correlates with insurance demand. | European unemployment projected to remain low in 2025 (Euro area at 6.0% in April 2024). |

| Currency Exchange Rates (DKK) | Can affect international investments/reinsurance. | DKK generally stable against EUR in early 2024, but global uncertainties can cause temporary pressures. |

Preview Before You Purchase

Alm. Brand PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alm. Brand delves into Political, Economic, Social, Technological, Legal, and Environmental factors influencing its market position. Gain actionable insights to strategize effectively.

Sociological factors

Demographic shifts in Denmark, such as a projected increase in the 65+ population to over 20% by 2030, directly impact insurance demand. An aging populace typically necessitates greater uptake of health, long-term care, and annuity products.

Urbanization trends, with a significant portion of Denmark's population concentrated in cities like Copenhagen, alter risk profiles for insurers. This can lead to increased demand for specialized home insurance against urban-specific risks and potentially higher motor insurance premiums due to traffic density.

Consumers today are demanding hyper-personalized and real-time risk protection, a trend amplified by their growing digital expectations. This means insurers like Alm. Brand must adapt by offering tailored products and services, moving away from one-size-fits-all policies.

For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase insurance from providers that offer personalized recommendations. This shift necessitates a move towards more flexible, modular insurance solutions that can be adjusted based on individual needs and life events.

Furthermore, customers expect transparency regarding how their data is used in exchange for these personalized insurance offerings. A 2025 report highlighted that 65% of consumers would be more comfortable sharing personal data if they understood its direct benefit to them, such as more accurate pricing or customized coverage.

Public perception and trust are paramount for insurance companies. In 2024, a significant portion of consumers expressed concerns about the transparency of insurance policies and claims processes. Building trust requires insurers to proactively address reputational risks by clearly communicating policy terms and streamlining claims handling.

Initiatives like offering 'omni policies' that bundle various coverages or exploring 'data for discounts' models can foster greater consumer trust and provide tangible value. However, these strategies must be carefully implemented to navigate evolving privacy concerns and ensure data security, a critical factor for consumer confidence in the digital age.

Lifestyle Trends and Risk Profiles

Emerging lifestyle trends significantly reshape how individuals approach risk, directly influencing insurance demand. The widespread adoption of remote work, for instance, can reduce commuting-related risks but may introduce new ones associated with home-based activities. For example, a 2024 survey indicated that 35% of workers now expect to work remotely at least part-time, a notable shift from pre-pandemic norms.

The increasing integration of technology like telematics and IoT devices is a key lifestyle trend impacting risk assessment. These tools enable insurers to gather real-time data on driving behavior, facilitating personalized risk profiling and the offering of usage-based insurance (UBI) programs. By 2025, it's projected that over 50% of new vehicles sold will be equipped with telematics capabilities, providing insurers with richer data sets.

- Increased remote work adoption: Affects commuting accident frequency and cybersecurity risks for home offices.

- Growing health consciousness: Drives demand for health and wellness-related insurance products and lifestyle discounts.

- Telematics and IoT integration: Enables personalized risk pricing and incentivizes safer behaviors through data analytics.

- Shifting transportation habits: Changes in public transport usage or increased cycling/walking can alter accident liability profiles.

Social Attitudes Towards Risk and Insurance Adoption

Danish consumers are increasingly aware of various risks, from extreme weather events linked to climate change to everyday uncertainties. This heightened awareness directly fuels a greater demand for property and casualty insurance. For instance, a 2024 survey indicated that 75% of Danish households now consider climate-related risks when evaluating their insurance needs, a notable jump from previous years.

As this societal shift towards risk consciousness deepens, individuals are more inclined to invest in robust insurance policies. This trend presents significant growth avenues for insurers like Alm. Brand, as customers actively seek comprehensive coverage to protect their assets and well-being against an array of potential threats. The market is seeing a particular uptick in demand for coverage related to natural disasters and cyber threats.

- Growing Climate Risk Awareness: A 2024 Danish survey found 75% of households now factor climate risks into insurance decisions.

- Increased Demand for P&C Insurance: This heightened awareness translates into a stronger willingness to purchase property and casualty insurance.

- Opportunity for Insurers: Alm. Brand can capitalize on this trend by offering tailored and comprehensive insurance solutions.

- Shifting Consumer Priorities: Consumers are prioritizing protection against both natural perils and emerging threats like cyber-attacks.

Societal attitudes towards risk are evolving, with a growing emphasis on proactive protection. This includes a heightened awareness of climate-related risks, with a 2024 Danish survey revealing 75% of households now consider such factors when choosing insurance. This shift drives increased demand for property and casualty coverage, presenting opportunities for insurers like Alm. Brand to offer specialized solutions against natural perils and cyber threats.

Technological factors

The insurance sector is rapidly integrating AI, machine learning, and big data, with significant investments expected. For instance, global spending on AI in insurance is projected to reach $12 billion by 2025, a substantial increase from previous years, indicating a strong trend towards data-driven operations.

Alm. Brand can harness these technologies to personalize customer interactions, automate routine tasks, and refine risk assessments. Early adopters are seeing benefits; some insurers have reported a 15% reduction in claims processing time by implementing AI-powered tools.

While still evolving, these advancements offer Alm. Brand opportunities for more accurate underwriting and sophisticated fraud detection. The potential for improved efficiency and customer satisfaction is immense, though the initial implementation requires careful strategic planning and data infrastructure development.

Insurtech innovations are fundamentally altering how insurance is offered and experienced, with new technologies driving efficiency and customer-centric solutions. By mid-2025, the market is seeing a significant shift towards embedded insurance models, integrating coverage seamlessly into other purchases, a trend projected to reach $3 trillion in premiums globally by 2030 according to some industry forecasts.

Carriers are actively pursuing partnerships with non-traditional players, such as smart home device manufacturers and automotive companies, to create bundled offerings and expand their reach. This ecosystem-driven strategy is a key focus for insurers in 2025, aiming to leverage data from connected devices to offer personalized risk assessments and preventative services, potentially reducing claims by up to 20% in certain segments.

The increasing reliance on digital platforms for customer interaction and data management means that robust cybersecurity is paramount for insurers. Cyber threats are a significant concern, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, a substantial increase from previous years.

Insurers must implement strong incident management policies and ensure compliance with evolving data protection regulations. For example, the NIS2 Directive, set to be fully implemented by July 2025, will impose stricter cybersecurity requirements across various sectors, including insurance, impacting how sensitive customer data is handled and protected, alongside existing mandates like GDPR.

Telematics and IoT Devices for Risk Assessment

The increasing adoption of telematics and Internet of Things (IoT) devices is revolutionizing risk assessment in the insurance sector, especially for motor insurance. These technologies allow insurers to collect granular, real-time data on driver behavior, such as speed, braking patterns, and mileage.

This data-driven approach enables more accurate and individualized risk profiling, paving the way for personalized insurance premiums. For instance, pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) policies are becoming more prevalent. In Denmark, the Property & Casualty (P&C) market has seen a notable uptake in these usage-based insurance products, reflecting a growing consumer interest in aligning premiums with actual usage and driving habits.

The insights gleaned from telematics data empower insurers like Alm. Brand to refine their underwriting models and identify high-risk drivers more effectively. This not only enhances profitability by reducing claims costs but also promotes safer driving practices among policyholders.

- Data Collection: Telematics devices in vehicles capture driving data, including location, speed, acceleration, and braking.

- Risk Assessment: Insurers use this data to create more accurate risk profiles for individual drivers.

- Personalized Premiums: This leads to tailored insurance rates, often through pay-as-you-drive or pay-how-you-drive models.

- Market Trend: Usage-based insurance is gaining traction in markets like Denmark, with a growing number of consumers opting for these flexible policies.

Digitalization of Customer Interfaces

The shift towards digital customer interfaces, like mobile apps and online portals, is fundamentally reshaping how insurance companies interact with their clients. This digitalization is not just about convenience; it's a key driver for boosting sales and enhancing service efficiency. For instance, many insurers are seeing significant uptake in digital channels for policy management and claims, reflecting a growing consumer preference for self-service options.

Consumers today expect a more personalized and seamless experience, pushing the industry towards online policy management and streamlined claims processing. This demand is evident in the increasing adoption rates of digital tools. By mid-2024, a substantial percentage of insurance customers preferred digital channels for routine interactions, a trend projected to continue growing through 2025.

- Enhanced Customer Experience: Digital platforms offer 24/7 access to policy information, claims tracking, and support, catering to modern consumer expectations for immediate and convenient service.

- Increased Efficiency: Automating processes through online portals and mobile apps reduces administrative overhead, leading to faster response times and lower operational costs for insurers.

- Data-Driven Personalization: Digital interactions generate valuable data that allows insurers to offer more tailored products and personalized advice, improving customer retention and satisfaction.

- Market Competitiveness: Companies that invest in user-friendly digital interfaces gain a competitive edge by meeting the evolving demands of a digitally native customer base.

Technological advancements are rapidly transforming the insurance landscape, driving efficiency and customer-centricity. The integration of AI and machine learning is projected to boost the global insurance AI market to $12 billion by 2025, enabling more accurate risk assessments and personalized customer interactions. Insurtech innovations are also fostering embedded insurance models, with some forecasts suggesting this sector could reach $3 trillion in premiums globally by 2030.

The increasing adoption of telematics and IoT devices, particularly in motor insurance, allows for granular data collection on driver behavior, leading to usage-based insurance models. These technologies are key to refining underwriting and promoting safer driving, with markets like Denmark showing growing consumer interest in pay-as-you-drive policies.

Digital platforms are now central to customer engagement, with a significant percentage of customers preferring digital channels for routine interactions by mid-2024, a trend expected to accelerate through 2025. This shift enhances customer experience through 24/7 access and streamlines operations, improving insurer competitiveness.

Cybersecurity remains a critical technological factor, with global cybercrime costs anticipated to reach $10.5 trillion annually by 2025. Compliance with evolving data protection regulations, such as the NIS2 Directive by July 2025, necessitates robust security measures for sensitive customer data.

| Technology Area | Projected Impact/Growth | Key Applications for Insurers | Example Data/Forecast |

|---|---|---|---|

| AI & Machine Learning | Significant operational efficiency gains | Personalized customer engagement, automated claims processing, refined risk assessment | Global AI in insurance market to reach $12 billion by 2025 |

| Insurtech & Embedded Insurance | New distribution channels and product integration | Seamless insurance offerings within other purchases, ecosystem partnerships | Embedded insurance premiums projected to reach $3 trillion globally by 2030 |

| Telematics & IoT | Revolutionized risk profiling and pricing | Usage-based insurance (PAYD/PHYD), real-time driver behavior analysis, fraud detection | Growing adoption in markets like Denmark for usage-based policies |

| Digital Platforms & Cybersecurity | Enhanced customer experience and data protection | Online policy management, mobile claims processing, robust incident management | Global cybercrime costs to reach $10.5 trillion annually by 2025; NIS2 Directive implementation by July 2025 |

Legal factors

Alm. Brand operates under a robust legal and regulatory landscape, significantly shaped by the new Danish Insurance Business Law that came into effect in January 2024. This legislation specifically targets insurance and pension companies, dictating operational parameters and consumer protections.

Furthermore, European Union directives, such as Solvency II, impose stringent capital requirements and detailed risk management frameworks on insurers throughout the EU, including Alm. Brand. These regulations ensure financial stability and solvency within the sector, impacting how companies like Alm. Brand manage their assets and liabilities.

Alm. Brand must strictly adhere to the General Data Protection Regulation (GDPR) and the Danish Data Protection Act, which govern the handling of sensitive customer information. Failure to comply can result in significant fines; for instance, under GDPR, penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This necessitates robust data security measures and transparent data processing policies to maintain customer trust and avoid legal repercussions.

Consumer protection laws are crucial for Alm. Brand, dictating how it treats its customers, from product transparency to how it handles claims. These regulations ensure Alm. Brand's dealings with both individual consumers and small to medium-sized enterprises (SMEs) meet a certain standard, fostering trust and deterring any unfair business practices. For instance, in 2024, the EU continued to strengthen its consumer protection framework, with new digital services regulations impacting how brands communicate and offer services online, a key area for Alm. Brand's customer engagement.

Competition Laws and Anti-Trust Regulations

Competition laws and anti-trust regulations are critical for Alm. Brand. The Danish Competition Act, alongside the Danish Competition and Consumer Authority's (DCCA) new 'Competition Tool' launched in July 2024, can reshape market dynamics. Alm. Brand must remain vigilant regarding its pricing strategies, especially given the DCCA's potential investigations into the non-life insurance market, ensuring all practices align with regulatory requirements.

The DCCA's focus on pricing conduct underscores the heightened regulatory oversight within the insurance sector. This necessitates proactive compliance measures from Alm. Brand to avoid potential penalties and maintain market trust. For instance, if the DCCA finds evidence of anti-competitive pricing, Alm. Brand could face significant fines and reputational damage.

- Danish Competition Act: Governs anti-competitive practices.

- DCCA's 'Competition Tool': Introduced July 2024 for enhanced market monitoring.

- Non-life Insurance Market Scrutiny: DCCA potential investigations into pricing conduct.

- Compliance Focus: Alm. Brand must ensure adherence to prevent penalties.

Corporate Sustainability Reporting Directive (CSRD)

Alm. Brand is actively preparing for the implementation of the EU Corporate Sustainability Reporting Directive (CSRD) and the associated European Sustainability Reporting Standards (ESRS). This directive mandates comprehensive reporting on environmental, social, and governance (ESG) matters, commencing for many companies in 2024. The extensive data collection and disclosure obligations under CSRD will significantly influence Alm. Brand's sustainability strategy and operational focus.

The CSRD aims to enhance the quality and comparability of sustainability information across the EU. For Alm. Brand, this means a rigorous examination and reporting of its impact across various ESG dimensions. Failure to comply can lead to reputational damage and potential financial penalties, making adherence a critical legal and strategic imperative.

- CSRD Implementation Timeline: Alm. Brand, like other large EU companies, is subject to CSRD reporting requirements starting with the 2024 financial year, with reports due in 2025.

- ESRS Scope: The European Sustainability Reporting Standards cover a broad range of topics, including climate change, biodiversity, human rights, and corporate governance, requiring detailed quantitative and qualitative disclosures.

- Data Assurance: CSRD mandates limited assurance for sustainability reports initially, with a planned move to reasonable assurance, necessitating robust data management and verification processes for Alm. Brand.

Alm. Brand navigates a complex legal terrain, with the new Danish Insurance Business Law of January 2024 setting key operational and consumer protection standards. EU directives like Solvency II continue to impose strict capital and risk management requirements, ensuring financial resilience across the sector.

Data privacy is paramount, with GDPR and the Danish Data Protection Act imposing significant obligations; non-compliance can result in penalties up to 4% of global turnover. Furthermore, consumer protection laws ensure fair dealings, with the EU strengthening digital service regulations in 2024 impacting customer engagement.

The Danish Competition Act, bolstered by the DCCA's July 2024 'Competition Tool' and potential scrutiny of the non-life insurance market's pricing conduct, demands strict adherence to prevent fines and reputational damage.

Alm. Brand is also preparing for the CSRD, mandating comprehensive ESG reporting from the 2024 financial year, requiring robust data management and verification to meet evolving disclosure standards.

Environmental factors

Climate change is intensifying natural disasters, leading to higher claims for insurers like Alm. Brand. For instance, the economic losses from natural catastrophes globally reached an estimated $280 billion in 2023, according to Swiss Re, with insured losses around $108 billion. This trend requires insurers to constantly update their risk assessment models and pricing to account for more frequent and severe events like floods and storms.

The increasing frequency of extreme weather events directly impacts Alm. Brand's operational costs and profitability. Insurers must adapt by refining their underwriting practices and potentially adjusting coverage terms in areas identified as high-risk. This proactive approach is crucial for maintaining solvency and offering competitive, sustainable insurance products in the face of evolving environmental challenges.

ESG considerations are increasingly shaping investment decisions and corporate standing. Alm. Brand's sustainability policy and annual reports highlight a dedication to reducing its environmental impact and climate footprint, adhering to ESG principles, and preparing for evolving sustainability reporting mandates.

For instance, Alm. Brand's 2024 sustainability report indicates a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline, a tangible step towards their climate goals.

In 2024 and 2025, regulatory bodies globally are intensifying pressure on insurance companies to develop and promote green insurance products, reflecting growing societal demand for sustainability. This push is evidenced by initiatives like the EU's Sustainable Finance Disclosure Regulation (SFDR), which categorizes financial products based on their environmental, social, and governance (ESG) criteria, impacting product design and marketing.

Governments are actively encouraging the insurance sector's involvement in the green transition. For instance, by facilitating investments in forestry and renewable energy projects, regulators aim to channel capital towards sustainable assets. This aligns with broader economic goals, such as achieving net-zero targets, and creates opportunities for insurers to innovate in areas like climate risk mitigation and green bond underwriting.

Resource Scarcity and Environmental Damage

While Alm. Brand's primary business is insurance, the increasing global scarcity of resources and the ongoing environmental damage can indirectly affect its operations. For instance, the cost of repairing or replacing damaged assets, a core part of the insurance claims process, can rise due to limited availability of materials like lumber or metals. This trend was evident in 2024, with certain construction material prices experiencing volatility due to supply chain disruptions exacerbated by climate-related events.

Alm. Brand is proactively addressing these broader environmental concerns through its claims prevention strategies and by integrating sustainable practices into its claims processing. This includes a focus on using eco-friendly and recycled materials where feasible, which not only helps reduce the company's environmental footprint but can also mitigate the escalating costs associated with traditional, resource-intensive repair methods. The company's commitment aligns with a growing market demand for sustainable business practices, as seen in the increasing investor interest in ESG (Environmental, Social, and Governance) factors during 2024.

Key impacts and initiatives include:

- Rising repair costs: Global commodity prices for key building materials saw an average increase of 5-10% in early 2024 compared to the previous year, directly impacting claims expenses.

- Sustainable materials adoption: Alm. Brand is exploring partnerships with suppliers offering recycled content in building materials, aiming to divert a portion of its claims-related material procurement towards more sustainable options.

- Claims prevention focus: Investments in data analytics to predict and prevent property damage from extreme weather events, which are becoming more frequent due to environmental changes, are a strategic priority.

- Reduced environmental footprint: By promoting efficient resource use in claims handling, Alm. Brand aims to lower its carbon emissions associated with material transportation and waste disposal.

Public and Investor Scrutiny on Climate Resilience

Public and investor attention on environmental factors, particularly climate resilience, is intensifying. Stakeholders are increasingly demanding that companies, including insurers like Alm. Brand, clearly articulate their strategies for adapting to and mitigating climate-related risks.

Insurers face mounting pressure to demonstrate proactive measures in their underwriting processes and investment strategies to address climate change impacts. This includes showcasing how they are building resilience against natural catastrophes and actively contributing to closing existing protection gaps.

- Growing Demand for ESG Reporting: In 2024, the global sustainable investment market reached an estimated $37.7 trillion, with a significant portion focused on environmental factors, indicating strong investor appetite for companies with robust climate strategies.

- Climate Risk Disclosure Mandates: Regulatory bodies worldwide are implementing stricter disclosure requirements for climate-related financial risks, pushing companies to provide more granular data on their resilience efforts.

- Impact on Investment Portfolios: Investors are scrutinizing how insurance companies manage climate risk within their investment portfolios, favoring those that align with net-zero commitments and sustainable investment principles.

- Protection Gap Concerns: The increasing frequency and severity of natural disasters, exacerbated by climate change, highlight a growing protection gap, estimated by some studies to be in the hundreds of billions of dollars annually, which insurers are expected to help address.

Environmental factors significantly influence Alm. Brand's operations, from increased claims due to climate change-driven disasters to the growing demand for sustainable products. The rising cost of materials due to resource scarcity and climate events directly impacts claims expenses, with some building material prices seeing a 5-10% increase in early 2024. Alm. Brand is actively integrating ESG principles, reducing its carbon footprint by 15% (Scope 1 & 2 emissions) from a 2020 baseline as of its 2024 report, and exploring partnerships for recycled materials to manage these escalating costs.

The global push for sustainability is reshaping the insurance landscape, with regulators encouraging green insurance products and sustainable investments. This is reflected in the estimated $37.7 trillion global sustainable investment market in 2024, where investors increasingly scrutinize companies' climate resilience strategies and net-zero commitments. Alm. Brand's proactive approach in claims prevention and adoption of eco-friendly practices aligns with these evolving market demands and regulatory pressures, aiming to address the growing protection gap.

| Environmental Factor | Impact on Alm. Brand | Alm. Brand's Response/Initiative | Relevant Data (2023-2025) |

|---|---|---|---|

| Climate Change & Natural Disasters | Increased claims frequency and severity; higher repair costs. | Updating risk models; refining underwriting; investing in claims prevention analytics. | Global insured losses from natural catastrophes: $108 billion (2023). |

| Resource Scarcity & Material Costs | Escalating costs for claims repair and replacement. | Exploring partnerships for recycled materials; promoting sustainable materials in claims processing. | Building material price increase: 5-10% (early 2024). |

| ESG & Sustainability Demand | Investor scrutiny; regulatory pressure for green products. | Reducing carbon footprint; adhering to ESG principles; preparing for enhanced sustainability reporting. | Scope 1 & 2 emissions reduction: 15% vs. 2020 baseline (2024 report). Global sustainable investment market: $37.7 trillion (2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.