Alm. Brand Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alm. Brand Bundle

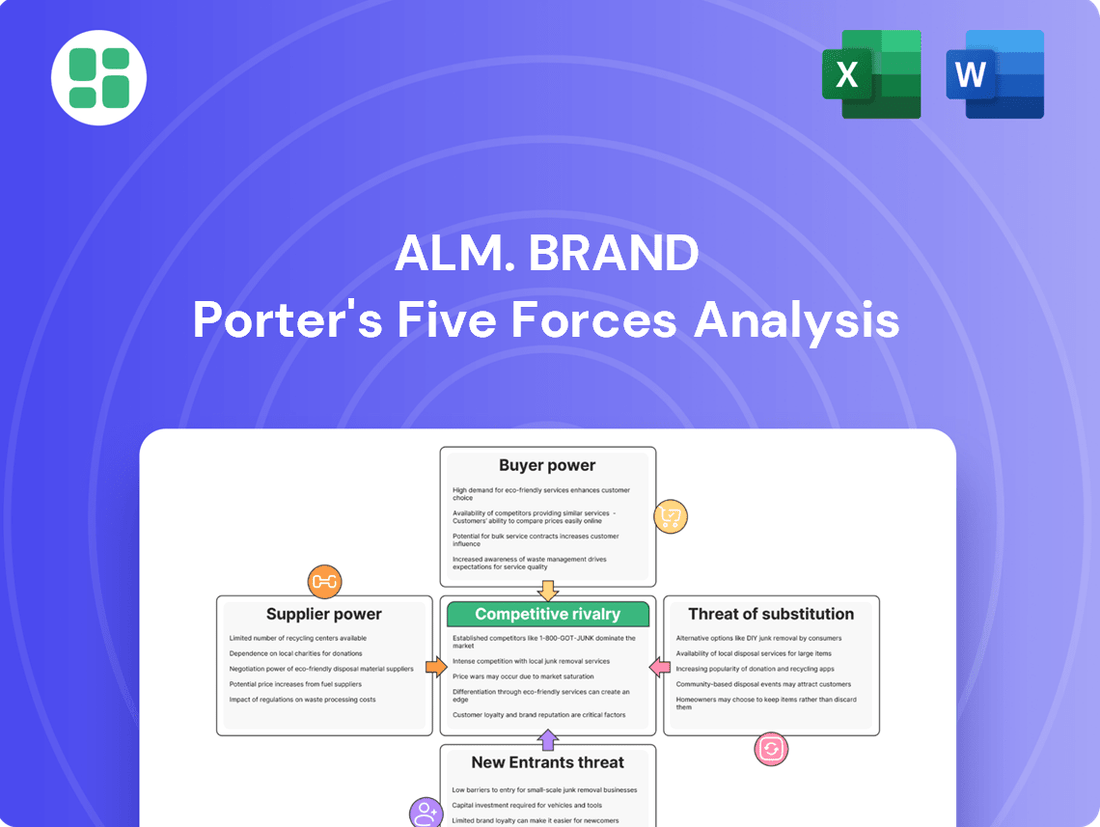

Alm. Brand faces a dynamic competitive landscape shaped by several key forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning. This snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Alm. Brand’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Alm. Brand depends on reinsurers to manage significant risks and ensure steady profits, particularly with more frequent weather events causing claims. The bargaining power of these providers is shaped by their concentration, financial stability, and the overall market environment, including how much capital is available and current pricing.

The financial health and market position of global reinsurers directly affect the cost Alm. Brand incurs for transferring its risks. For instance, in 2024, global reinsurance capital saw a notable increase of 5.4%, reaching $766 billion, which can influence premium rates Alm. Brand must pay for reinsurance protection.

Technology and software vendors hold considerable bargaining power in the insurance sector due to the ongoing digital transformation. In 2024, the insurance industry's investment in digital solutions, particularly for underwriting and claims processing, continued to rise, creating a strong demand for specialized software. Companies like Alm. Brand increasingly rely on these vendors for core operational platforms, making them critical partners.

The leverage of these suppliers is amplified by the uniqueness and integration complexity of their offerings, exemplified by platforms such as Keylane Axon or IBSuite. High switching costs associated with migrating from established, deeply integrated systems further solidify vendor power. In 2023, the global insurance IT spending was projected to reach over $100 billion, underscoring the significant financial stakes involved in these vendor relationships.

For non-life insurance, the availability of dependable and affordable claims service providers, such as auto repair shops and property damage assessors, significantly impacts operations. The bargaining power of these networks is shaped by factors like their geographic concentration, unique expertise, and the sheer volume of claims Alm. Brand directs their way.

In markets like Denmark, where average repair costs saw an increase in 2023, this trend can amplify the leverage these service providers hold. For example, a significant portion of the 2023 Danish auto insurance market saw repair cost inflation impacting insurer profitability, a dynamic Alm. Brand would need to monitor closely.

Data and Analytics Providers

Data and analytics providers wield considerable bargaining power in the insurance industry. The demand for sophisticated data and AI tools for risk assessment, pricing, and fraud detection is soaring. For instance, the global big data and business analytics market was projected to reach over $350 billion in 2024, highlighting the critical nature of these services.

Suppliers offering high-quality, exclusive, and predictive analytics capabilities gain significant leverage. Their ability to provide insights that enhance underwriting accuracy and streamline claims processing directly impacts insurer profitability and efficiency. Insurers increasingly rely on these advanced analytics to gain a competitive edge, making the providers of these essential tools quite influential.

- Criticality of Data: Robust data and advanced analytics are indispensable for insurance operations, impacting everything from risk assessment to customer experience.

- Supplier Influence: Providers of specialized big data, AI, and machine learning solutions possess power due to the unique and valuable insights they deliver.

- Performance Impact: The capacity of these suppliers to improve underwriting accuracy and expedite claims settlement directly translates to their bargaining strength.

- Market Growth: The expanding market for data analytics, with global revenues in the hundreds of billions for 2024, underscores the essential role and leverage of these providers.

Human Capital and Specialized Talent

The bargaining power of suppliers, particularly concerning human capital and specialized talent, is a critical consideration for Alm. Brand. The availability of skilled professionals in fields such as actuarial science, IT, data analytics, and compliance directly influences operational costs and efficiency. For instance, a report from Robert Half in 2024 indicated persistent talent shortages in tax and finance roles, suggesting that individuals possessing these niche skills can command higher compensation and more favorable terms.

Alm. Brand's capacity to attract and retain top talent, especially in the wake of recent merger activities, is paramount. A highly skilled workforce is essential for driving innovation, ensuring regulatory adherence, and maintaining a competitive edge. The ongoing demand for specialized expertise means that employees with in-demand skill sets possess significant leverage, potentially impacting Alm. Brand's labor costs and project timelines.

- Talent Scarcity Impact: Shortages in actuarial science and data analytics, as noted in industry surveys from 2024, empower professionals in these areas.

- Merger Integration Challenges: Retaining key personnel post-merger is vital for Alm. Brand's operational continuity and strategic execution.

- Competitive Compensation: To counter the bargaining power of specialized talent, Alm. Brand must offer competitive remuneration and a compelling work environment.

- Skill-Specific Leverage: Employees with unique expertise in compliance and IT are likely to have greater influence over their employment conditions.

The bargaining power of suppliers for Alm. Brand is a significant factor, particularly for reinsurers and technology vendors. High concentration among reinsurers and the critical, integrated nature of software solutions grant these suppliers considerable leverage. For instance, the substantial global reinsurance capital of $766 billion in 2024, up 5.4%, influences premium rates Alm. Brand pays. Similarly, the insurance industry's increasing investment in digital transformation, with over $100 billion spent on IT in 2023, highlights the dependency on specialized software vendors.

| Supplier Type | Key Factors Influencing Power | 2023-2024 Data Points |

|---|---|---|

| Reinsurers | Concentration, Financial Stability, Capital Availability | Global Reinsurance Capital: $766 billion (up 5.4% in 2024) |

| Technology Vendors | Uniqueness of Offerings, Integration Complexity, Switching Costs | Global Insurance IT Spending: >$100 billion (2023 projection) |

| Data & Analytics Providers | Data Quality, Predictive Capabilities, Impact on Underwriting/Claims | Global Big Data & Business Analytics Market: >$350 billion (2024 projection) |

| Specialized Talent | Skill Scarcity, Demand in Actuarial Science/Data Analytics | Persistent talent shortages in niche finance/tax roles (2024 report) |

What is included in the product

This analysis dissects the competitive forces impacting Alm. Brand, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the risk of substitutes.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customers in the Danish non-life insurance market, particularly for common policies like car or home insurance, show a noticeable sensitivity to price. This means that even small price differences can influence their decisions, especially when competition appears less intense, as suggested by potential investigations into pricing conduct by the Danish Competition and Consumer Authority.

While customer loyalty exists, the willingness to switch providers for more favorable rates is also prevalent, particularly with annual price adjustments. This dynamic suggests that companies need to remain competitive on price to retain and attract customers in this segment of the market.

The insurance industry's digital evolution has significantly boosted customer power. With online platforms, consumers can readily access comparative pricing, obtain instant quotes, and manage policies effortlessly. This increased transparency dismantles traditional information gaps, enabling straightforward comparisons across various insurers.

By 2024, the widespread availability of digital comparison tools has made it simpler than ever for customers to shop around. For instance, a significant portion of consumers now start their insurance search online, actively comparing multiple quotes before making a decision. This shift directly empowers them, forcing insurers to compete more aggressively on price and service.

The concentration of corporate clients can significantly amplify their bargaining power. Large enterprises, due to their substantial purchasing volume and the possibility of self-insuring or developing in-house capabilities, can demand more favorable terms from suppliers like Alm. Brand. This leverage is particularly pronounced when these clients represent a considerable portion of a company's revenue.

While Alm. Brand benefits from a broad customer base, including many small and medium-sized businesses and agricultural entities, and its exposure through Codan further diversifies its reach, the influence of major corporate clients remains a critical factor. For instance, if a few large corporations account for 20% or more of Alm. Brand's commercial insurance premiums, their ability to negotiate discounts or specialized policy features is substantial.

Regulatory Protections and Consumer Advocacy

Regulatory protections significantly bolster the bargaining power of customers in the insurance sector. In Denmark, the Insurance Contracts Act provides robust legal safeguards, empowering policyholders and offering recourse in disputes. This legislative framework ensures a baseline of fair treatment.

The Danish Competition and Consumer Authority plays a crucial role by scrutinizing pricing and transparency. This oversight limits insurers' ability to dictate unfavorable terms, thereby enhancing customer leverage. For instance, in 2024, the authority continued its focus on ensuring competitive practices across various financial services, including insurance.

- Danish Insurance Contracts Act: Provides strong legal recourse for policyholders.

- Regulatory Scrutiny: Danish Competition and Consumer Authority monitors fair pricing and transparency.

- Consumer Advocacy: Supports customer interests, limiting insurers' unilateral power over terms.

Bundling and Loyalty Programs

Insurers can counter customer bargaining power by bundling diverse insurance products, like home and auto, which makes it more complex and costly for customers to switch providers. Loyalty programs further solidify these relationships by rewarding long-term commitment, thereby increasing switching costs.

- Bundling Strategies: Alm. Brand leverages bundling by offering combined policies, potentially reducing overall premiums for customers who opt for multiple coverages.

- Loyalty Incentives: The company's focus on customer retention, reflected in strong loyalty program participation, aims to minimize customer churn.

- Switching Cost Increase: By integrating services and rewarding loyalty, Alm. Brand effectively raises the cost and inconvenience for customers considering alternative insurers.

Customers' ability to influence pricing and terms is significant, especially in the Danish non-life insurance market where price sensitivity is high. The increasing ease of comparing policies online, a trend amplified in 2024, further empowers consumers. Large corporate clients, with their substantial purchasing volumes, also wield considerable bargaining power, capable of negotiating more favorable terms or even considering self-insurance.

Regulatory frameworks, such as the Danish Insurance Contracts Act, and the oversight by the Danish Competition and Consumer Authority, reinforce customer rights and limit insurers' ability to impose unfavorable conditions. This environment necessitates competitive pricing and transparent practices from companies like Alm. Brand.

Alm. Brand counters this by bundling products and offering loyalty incentives, increasing switching costs for customers. These strategies aim to foster long-term relationships and mitigate the impact of customer bargaining power.

| Factor | Impact on Alm. Brand | Mitigation Strategy |

|---|---|---|

| Price Sensitivity | High for common policies | Competitive pricing, bundling |

| Digital Comparison Tools | Increased transparency, easier switching | Enhanced online service, loyalty programs |

| Large Corporate Clients | Significant leverage due to volume | Tailored solutions, relationship management |

| Regulatory Environment | Limits unilateral power over terms | Adherence to regulations, transparent practices |

Same Document Delivered

Alm. Brand Porter's Five Forces Analysis

This preview provides an exact representation of the comprehensive Alm. Brand Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, fully formatted document, ensuring no surprises or placeholders. Once your purchase is complete, you’ll gain instant access to this meticulously crafted analysis, ready for your strategic decision-making.

Rivalry Among Competitors

The Danish non-life insurance market exhibits moderate concentration, with Alm. Brand Group, following its acquisition of Codan's Danish operations, now standing as a significant force. This move has reshaped the competitive landscape, placing Alm. Brand Group among the top tier of insurers.

Key players like Tryg, Topdanmark, and Gjensidige are deeply entrenched, creating a dynamic environment. The collective market share held by the leading four companies underscores the intensity of rivalry, as these established entities vie for dominance through product innovation and customer service.

Competitive rivalry in the insurance sector extends beyond mere price competition. It's significantly fueled by product differentiation, encompassing tailored coverage options, specialized insurance solutions, and the integration of value-added services. Danish insurers, including Alm. Brand, are actively innovating, introducing products designed for emerging risks like cyber threats or leveraging technology for usage-based insurance models.

Alm. Brand's strategic emphasis on delivering comprehensive insurance packages and maintaining a strong customer-centric philosophy are vital elements in carving out its distinct market position. For instance, in 2024, the company continued to refine its digital platforms, offering more personalized policy management and claims processing, a key differentiator in a crowded market.

Pricing is a critical battleground in the non-life insurance sector, with many firms actively vying for customers through competitive rates. This dynamic is evident as companies continually adjust their offerings to attract and retain policyholders.

However, the landscape isn't without its complexities. The Danish Competition and Consumer Authority is currently examining the non-life insurance market, specifically looking for signs of restricted competition. A key area of focus is the practice of annual index adjustments, which could potentially stifle genuine price competition among insurers.

This investigation highlights a potential disconnect between the appearance of price competition and the underlying market realities. While insurers may present competitive pricing, regulatory scrutiny suggests that certain practices, like standardized index adjustments, might be limiting the full potential for dynamic price discovery and consumer benefit.

Brand Strength and Customer Loyalty

Established brands like Alm. Brand, with a long history and strong market position, benefit from significant brand recognition and deep-seated customer trust. This loyalty is a key competitive advantage, as indicated by Alm. Brand's reported high customer retention rates. For instance, in 2024, Alm. Brand highlighted a customer retention rate of 85% for its premium product line.

However, the landscape is evolving. Digital transformation and increased transparency mean that even strong brand loyalty can be challenged. Competitors are leveraging these shifts to introduce innovative offerings and personalized experiences, potentially eroding traditional brand advantages. A 2024 industry report noted that 40% of consumers are willing to switch brands for a better digital customer journey.

- Brand Recognition: Alm. Brand benefits from decades of market presence, fostering familiarity and trust among consumers.

- Customer Loyalty: High retention rates, such as Alm. Brand's 85% in 2024 for premium products, underscore a strong existing customer base.

- Digital Disruption: The rise of digital channels and increased transparency empower competitors to challenge established loyalty with innovative and personalized offerings.

- Evolving Consumer Behavior: A significant portion of consumers, around 40% in 2024, are open to switching for improved digital experiences, highlighting a potential vulnerability for brands relying solely on legacy loyalty.

Mergers, Acquisitions, and Synergy Realization

The insurance sector is experiencing substantial consolidation, directly impacting competitive rivalry. Alm. Brand's acquisition of Codan's Danish business is a prime example of this trend. This strategic move is designed to unlock significant synergies and bolster Alm. Brand's standing in the market.

The company explicitly targets DKK 600 million in annual synergies by 2025 from this acquisition. Such large-scale mergers and acquisitions inherently intensify competition. They create more formidable and efficient market players, compelling remaining companies to reassess their strategies and operational efficiencies to remain competitive.

- Market Consolidation: Increased M&A activity, like Alm. Brand's acquisition of Codan's Danish operations, reshapes the competitive landscape.

- Synergy Targets: Alm. Brand aims for DKK 600 million in annual synergies by 2025, demonstrating the financial drivers behind consolidation.

- Intensified Rivalry: Larger, more efficient entities emerging from mergers put pressure on smaller or less integrated competitors.

- Strategic Adaptation: Other market participants must adapt their strategies to counter the enhanced competitive power of consolidated players.

Competitive rivalry in the Danish non-life insurance market is intense, driven by a few dominant players including Alm. Brand Group following its acquisition of Codan's Danish operations. This consolidation, with Alm. Brand targeting DKK 600 million in annual synergies by 2025, creates larger, more efficient competitors, forcing others to adapt. While pricing remains a key battleground, product differentiation and digital customer experience are increasingly crucial for retaining market share, especially as 40% of consumers in 2024 were willing to switch for better digital journeys.

| Key Competitors | Market Position (Post-Codan Acquisition) | Key Competitive Strategies |

| Alm. Brand Group | Major player, significantly strengthened | Product innovation, digital platforms, customer retention (85% in 2024 for premium products) |

| Tryg | Established leader | Brand recognition, comprehensive offerings |

| Topdanmark | Significant market presence | Customer service, tailored solutions |

| Gjensidige | Strong competitor | Competitive pricing, digital engagement |

SSubstitutes Threaten

For large corporations, self-insurance and the establishment of captive insurance companies present a significant threat to traditional non-life insurers. These alternatives allow businesses to manage predictable or substantial risks internally, potentially lowering costs and increasing control over their risk management strategies. For instance, in 2023, the global captive insurance market was valued at over $100 billion, demonstrating a substantial shift towards alternative risk financing.

Alternative risk transfer mechanisms, such as catastrophe bonds, represent a growing threat to traditional insurance markets. These financial instruments allow companies, including large corporations, to offload specific risks directly to capital markets. The market for catastrophe bonds has seen significant growth, with issuance reaching approximately $12.4 billion in 2023, demonstrating increasing investor appetite for these specialized products.

Businesses are increasingly prioritizing proactive risk management over traditional insurance. For instance, the global risk management market was valued at approximately $40 billion in 2023 and is projected to grow, indicating a strong trend towards investing in prevention. This focus on consulting and technology to mitigate incidents directly challenges the necessity of extensive insurance coverage, especially as the cost-benefit analysis favors prevention.

Government and Industry-Specific Schemes

Government and industry-specific schemes can act as potent substitutes for private non-life insurance. In Denmark, for instance, mandatory schemes like motor vehicle liability insurance offer a baseline level of protection. Should these government-backed initiatives expand to cover a broader range of risks or offer more comprehensive benefits, they could significantly diminish the demand for private insurance products.

These schemes often provide a cost-effective or even free alternative for consumers, especially when funded through general taxation or mandatory contributions. For example, in 2024, the Danish government continued to review and potentially expand social welfare programs, which could indirectly impact the insurance market by covering certain types of personal injury or property damage. This presents a direct threat as it offers a comparable, or in some cases superior, form of security without the direct premium cost associated with private insurance.

- Government-backed schemes offer alternative protection, potentially reducing demand for private non-life insurance.

- Statutory insurances, like motor vehicle liability in Denmark, can serve as substitutes.

- Expansion of government schemes could directly impact the market share of private insurers.

- Industry-specific mutual funds or associations can also provide alternative risk management solutions.

Emerging Technologies and IoT-driven Solutions

The increasing prevalence of Internet of Things (IoT) enabled devices and telematics is a significant threat of substitutes for traditional insurance models. These technologies facilitate real-time monitoring of assets and behaviors, enabling proactive risk mitigation. For example, smart home devices can detect water leaks or fires early, potentially reducing the need for extensive property damage coverage.

Usage-based insurance (UBI) is a prime example of this shift. In the Danish market, UBI models are gaining traction, allowing policyholders to pay premiums based on their actual usage and risk profile. This granular approach could disincentivize consumers from opting for broad, comprehensive policies, favoring instead more tailored, data-driven solutions that offer perceived cost savings and greater control.

This trend directly impacts the perceived value of traditional insurance. As consumers become more accustomed to data-driven services and proactive risk management tools, the appeal of static, one-size-fits-all insurance policies may diminish. This could lead to a reduction in demand for certain types of coverage, particularly those where IoT solutions can demonstrably lower risk.

Key impacts include:

- Reduced Claims Potential: IoT devices can alert users to issues before they escalate, leading to fewer and less severe claims for insurers.

- Shifting Consumer Expectations: Customers may increasingly expect personalized, data-driven insurance products that reflect their actual risk.

- Emergence of New Competitors: Technology companies and data analytics firms could enter the insurance market with innovative, substitute offerings.

The threat of substitutes in non-life insurance is amplified by technological advancements and changing consumer behavior. As individuals and businesses adopt proactive risk management strategies and leverage data-driven solutions, the necessity of traditional insurance policies may diminish. This shift challenges insurers to adapt their offerings to remain competitive.

For instance, the rise of usage-based insurance (UBI) models, particularly in the automotive sector, offers a direct substitute for traditional, static policies. In 2024, telematics data usage in car insurance continued to expand, with a notable increase in policies incorporating driving behavior analysis. This allows policyholders to potentially lower premiums by demonstrating safer driving habits, directly impacting the appeal of undifferentiated coverage.

Furthermore, the increasing integration of Internet of Things (IoT) devices in homes and businesses provides real-time risk monitoring and early intervention capabilities. This proactive approach can significantly reduce the likelihood and severity of claims, thereby lessening the perceived need for comprehensive insurance. The global IoT market itself saw substantial growth, with projections indicating continued expansion throughout 2024 and beyond, underscoring the growing influence of these technologies.

| Substitute Type | Description | Market Trend/Data (2023-2024) |

|---|---|---|

| Self-Insurance/Captives | Internal risk financing by corporations. | Global captive insurance market valued over $100 billion in 2023. |

| Alternative Risk Transfer | Financial instruments like catastrophe bonds. | Cat bond issuance reached approximately $12.4 billion in 2023. |

| Proactive Risk Management | Investment in prevention and mitigation technologies. | Global risk management market valued around $40 billion in 2023, with ongoing growth. |

| Government/Industry Schemes | Mandatory or subsidized insurance programs. | Continued review and potential expansion of social welfare programs in various nations in 2024. |

| IoT & Telematics | Data-driven risk monitoring and usage-based insurance. | Increasing adoption of UBI models and IoT devices in consumer sectors throughout 2024. |

Entrants Threaten

The Danish insurance market presents a formidable barrier to new entrants due to stringent regulatory oversight by the Financial Supervisory Authority (FSA). This includes mandatory licensing and strict adherence to capital requirements, such as those mandated by Solvency II. For instance, in 2023, Danish insurance companies collectively held over DKK 300 billion in solvency capital, underscoring the substantial financial commitment required to enter the market.

Established players like Alm. Brand benefit from strong brand recognition and deep-rooted customer trust, built over many years. In 2024, Alm. Brand continued to leverage its long-standing reputation, which has been a cornerstone of its market position since its founding in 1792.

New entrants face the significant challenge of building credibility and trust in a mature market where consumers often prefer known and reliable providers for their financial protection needs. This is a substantial barrier, as acquiring customer loyalty in the financial services sector typically requires substantial time and investment.

Existing large insurers, like Alm. Brand, leverage significant economies of scale in operations such as underwriting and claims processing. This allows them to achieve lower per-unit costs, making it challenging for new entrants to match their competitive pricing without substantial upfront investment and achieving considerable market share.

Alm. Brand's ongoing integration of the Codan acquisition is a prime example of how scale benefits are being enhanced. This synergy realization is expected to further solidify Alm. Brand's cost advantages, creating a higher barrier to entry for potential new competitors aiming to compete on price in the insurance market.

Distribution Channels and Market Access

The threat of new entrants in the insurance sector, particularly concerning distribution channels and market access, is significantly mitigated by the substantial investment and time required to establish effective networks. Incumbent insurers have already cultivated extensive relationships, including crucial bancassurance agreements, granting them unparalleled market reach. For example, in 2024, the average cost for a new insurance company to establish a comparable distribution network could easily exceed tens of millions of dollars, factoring in technology, sales force training, and partnership development.

New players face a steep climb, needing to either build their own distribution infrastructure from scratch or acquire existing ones, both of which present considerable financial and operational hurdles. In 2023, the acquisition of a mid-sized insurance brokerage firm, which often includes established distribution agreements, could cost upwards of $50 million, demonstrating the high entry barrier.

- High Capital Investment: Establishing direct online platforms or securing partnerships with agents and brokers demands significant upfront capital.

- Incumbent Advantage: Existing players benefit from long-standing distribution networks and exclusive agreements, particularly in bancassurance.

- Acquisition Costs: Gaining market access through acquiring established channels is prohibitively expensive for many new entrants.

- Brand Trust and Recognition: New entrants must overcome the trust and recognition built by incumbents over years of operation.

Access to Data and Advanced Analytics Capabilities

The increasing reliance on data analytics and artificial intelligence for accurate risk assessment and competitive pricing presents a significant hurdle for new entrants in the insurance market. Established insurers often possess vast historical datasets and well-developed analytical platforms, giving them a distinct advantage. For instance, by mid-2024, many leading insurers were leveraging AI for claims processing, with some reporting efficiency gains of up to 30%.

Developing comparable capabilities requires substantial investment in technology infrastructure and specialized talent. New players must not only acquire and process large volumes of data but also build sophisticated AI models, a process that demands considerable financial resources and technical expertise. This technological barrier can deter potential competitors who lack the necessary capital or access to cutting-edge analytical tools.

- Data Volume and Quality: Established insurers benefit from years of accumulated customer and claims data, which is crucial for training robust AI models.

- Analytical Infrastructure: Significant investment is needed in data warehousing, processing power, and specialized software for advanced analytics.

- Talent Acquisition: A shortage of skilled data scientists and AI engineers makes it challenging and expensive for new entrants to build in-house expertise.

- Regulatory Compliance: Navigating complex data privacy regulations (like GDPR or CCPA) adds another layer of difficulty and cost for newcomers.

The threat of new entrants in the Danish insurance market is considerably low, largely due to high capital requirements and stringent regulatory frameworks. Established players like Alm. Brand benefit from significant economies of scale, brand loyalty, and advanced data analytics capabilities, making it difficult for newcomers to compete on price or trust. For instance, in 2024, the Danish insurance sector's robust solvency capital requirements, exceeding DKK 300 billion collectively in 2023, present a substantial financial barrier.

| Factor | Impact on New Entrants | Alm. Brand's Position |

| Regulatory Capital | High barrier due to solvency requirements | Well-capitalized, meeting and exceeding mandates |

| Brand Reputation | Requires significant time and investment to build | Long-standing trust since 1792, reinforced in 2024 |

| Economies of Scale | Challenging to match cost efficiencies | Enhanced by Codan acquisition, driving cost advantages |

| Distribution Networks | Costly to establish or acquire, often millions of dollars | Extensive existing networks, including bancassurance |

| Data Analytics & AI | Requires substantial tech investment and talent | Leveraging AI for efficiency gains up to 30% by mid-2024 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, company annual filings, and expert commentary from financial analysts.

We leverage data from reputable sources such as IBISWorld, Statista, and SEC filings, alongside proprietary market intelligence, to provide a thorough evaluation of industry attractiveness and competitive dynamics.