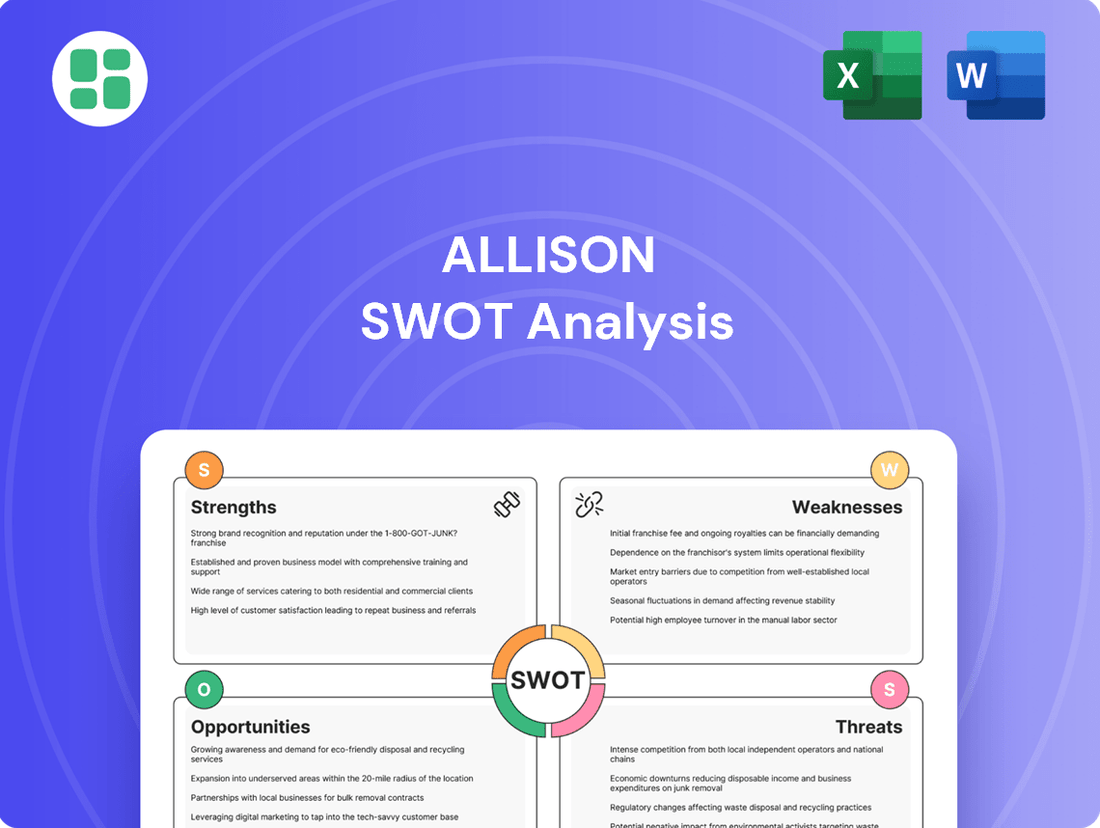

Allison SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allison Bundle

Allison's market position is strong, but understanding its full potential requires a deeper dive. Our comprehensive SWOT analysis reveals crucial internal capabilities and external market dynamics that shape its future.

Want to truly grasp Allison's competitive edge and potential challenges? Purchase the full SWOT analysis for actionable insights, expert commentary, and an editable format perfect for strategic planning and investor pitches.

Strengths

Allison Transmission holds a commanding position as the world's largest manufacturer of fully automatic transmissions for medium and heavy-duty vehicles. This global market leadership isn't just a title; it translates into a substantial market share, giving them a significant edge over competitors in their primary business segments.

Allison’s strength lies in its diversified end markets, serving critical sectors like refuse, construction, bus, motorhomes, and defense. This broad reach significantly reduces the company's vulnerability to downturns in any single industry.

The defense sector, in particular, has shown exceptional performance, with a substantial 47% year-over-year sales increase in Q2 2025. This robust growth in a key segment bolsters Allison's overall financial stability and provides a reliable revenue stream.

Allison Transmission showcased impressive financial strength in the second quarter of 2025, exceeding market forecasts. The company reported a record diluted earnings per share (EPS) of $2.29, alongside a healthy 4% rise in net income, reaching $195 million.

This strong performance is further underscored by an impressive Adjusted EBITDA margin of 38.5% for Q2 2025. This figure highlights Allison's adeptness in managing costs and maintaining high operational efficiency, contributing significantly to its overall financial health.

Advanced Electrification Portfolio

Allison is aggressively growing its electric and hybrid propulsion offerings, notably with its eGen Power e-Axle and eGen Flex electric hybrid systems. This expansion directly addresses the growing global demand for zero-emission transportation solutions.

These advanced systems are designed for versatility, fitting a wide range of electric and hybrid vehicle applications. This adaptability positions Allison to capitalize on the ongoing industry-wide shift towards electrification, meeting diverse customer needs.

The company's investment in electrification is a strategic move to secure its future in a rapidly evolving automotive landscape. For instance, Allison announced in early 2024 that its eGen Power™ 100D e-Axle achieved over 1 million miles in commercial vehicle testing, demonstrating real-world durability and performance.

- Expanded Electric Portfolio: Includes eGen Power e-Axles and eGen Flex electric hybrid systems.

- Market Responsiveness: Directly caters to the increasing demand for zero-emission vehicles.

- Versatile Applications: Compatible with a broad spectrum of electric and hybrid platforms.

- Proven Technology: eGen Power e-Axles have surpassed 1 million miles in commercial testing as of early 2024.

Strategic Acquisition and Growth Initiatives

Allison's strategic acquisition of Dana Incorporated's Off-Highway business for approximately $2.7 billion, slated for completion in late Q4 2025, represents a significant expansion of its market presence and technological capabilities. This move is poised to unlock substantial annual synergies, estimated to be in the tens of millions of dollars, and solidify Allison's standing in the global off-highway vehicle sector.

The integration of Dana's off-highway operations is expected to bolster Allison's product portfolio and geographic reach, particularly in key growth markets. Analysts project that this acquisition will contribute positively to Allison's revenue growth trajectory, with an estimated uplift in earnings per share in the fiscal year following the transaction's close.

- Market Expansion: Acquisition of Dana's Off-Highway business broadens Allison's global footprint.

- Synergy Potential: Anticipated significant annual synergies are expected to enhance profitability.

- Portfolio Enhancement: Integration strengthens Allison's product offerings in the off-highway sector.

- Financial Impact: Transaction valued at approximately $2.7 billion, closing late Q4 2025.

Allison's market leadership in medium and heavy-duty automatic transmissions is a significant strength, translating into a substantial market share and a competitive advantage. This dominance is further amplified by its diversified end-market exposure, which mitigates risks associated with single-industry downturns. The company's robust financial performance, evidenced by a record diluted EPS of $2.29 and an impressive 38.5% Adjusted EBITDA margin in Q2 2025, underscores its operational efficiency and profitability.

| Metric | Q2 2025 | Year-over-Year Change |

|---|---|---|

| Diluted EPS | $2.29 | N/A (Record) |

| Net Income | $195 million | +4% |

| Adjusted EBITDA Margin | 38.5% | N/A |

| Defense Sector Sales | N/A | +47% |

What is included in the product

Delivers a strategic overview of Allison’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic thinking by offering a clear, actionable framework for identifying and addressing challenges.

Weaknesses

Allison's significant reliance on traditional internal combustion engine (ICE) transmissions presents a notable weakness. While the company is investing in electrification, its current revenue streams are predominantly tied to ICE technology, a market facing a secular decline as the automotive industry transitions to electric vehicles. This dependency could become a substantial hurdle as regulatory pressures and consumer preferences increasingly favor electric powertrains.

Allison's susceptibility to market fluctuations is evident in recent performance. For instance, the company saw a $39 million decrease in net sales in its North America On-Highway segment during Q2 2025. Similarly, the Global Off-Highway segment experienced a $7 million sales decline in the same quarter. These figures highlight a clear weakness in Allison's ability to weather downturns in specific, crucial market segments, suggesting a vulnerability to reduced demand or broader economic pressures within those areas.

The acquisition of Dana's Off-Highway business, while strategically important, brought with it significant costs. In the second quarter of 2025, these acquisition-related expenses amounted to $15 million, which directly impacted the company's selling, general, and administrative expenses. This financial burden highlights a key weakness stemming from large-scale integration activities.

Such substantial acquisition costs can strain a company's financial resources, potentially diverting capital from other critical areas like research and development or operational improvements. Furthermore, the success of these integrations hinges on meticulous planning and execution to ensure that the anticipated synergies are actually realized, a process that is often complex and resource-intensive.

Increased Financial Leverage

Allison's acquisition of Dana's Off-Highway business for $2.7 billion, funded by cash and debt, will notably increase its financial leverage. This move is expected to push the company's debt-to-equity ratio higher, a key metric to monitor. While Allison has historically maintained strong financial health, managing this elevated debt load will be a critical factor in its future financial stability and strategic flexibility.

Intense Competition in Emerging Powertrain Markets

The market for advanced powertrains, particularly electric and hybrid solutions, is intensely competitive and highly fragmented. Allison faces significant pressure from a broad range of players, including established automotive giants, specialized Tier-1 suppliers, and agile electric vehicle startups, all pouring substantial resources into developing next-generation technologies.

This crowded landscape means Allison must contend with formidable rivals like ZF Friedrichshafen AG, a major player in automotive drivetrain technology, as well as numerous emerging companies focused specifically on electric drivetrains. The sheer volume of investment and innovation across the sector presents a constant challenge to maintain market share and leadership.

- Intense Competition: Numerous traditional OEMs, Tier-1 suppliers, and EV startups are heavily investing in electric and hybrid powertrains.

- Key Competitors: Allison faces strong competition from established players such as ZF Friedrichshafen AG and various new entrants in the electric drivetrain space.

- Market Fragmentation: The powertrain transformation market is characterized by a high degree of fragmentation, with many companies vying for dominance.

Allison's substantial reliance on internal combustion engine (ICE) transmissions is a significant weakness as the automotive industry shifts towards electrification. This dependency is highlighted by the $39 million decrease in North America On-Highway sales and a $7 million decline in Global Off-Highway sales in Q2 2025, indicating vulnerability to market shifts.

The company's acquisition of Dana's Off-Highway business for $2.7 billion, while strategic, has increased financial leverage, pushing its debt-to-equity ratio higher. This move also incurred $15 million in acquisition-related expenses in Q2 2025, impacting administrative costs and potentially diverting resources from R&D.

Allison faces intense competition in the advanced powertrain market from established players like ZF Friedrichshafen AG and numerous agile EV startups, all investing heavily in electric and hybrid solutions, creating a highly fragmented and challenging landscape.

| Weakness | Impact | Supporting Data (Q2 2025) |

| ICE Dependency | Vulnerability to declining ICE market | $39M decrease in North America On-Highway sales |

| Increased Financial Leverage | Higher debt-to-equity ratio, potential strain | $15M in acquisition-related expenses |

| Intense Competition | Pressure from EV startups and established players | N/A (Market trend) |

What You See Is What You Get

Allison SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The global commercial vehicle transmission market is on a significant upward trajectory, with projections indicating robust growth. This expansion is largely fueled by the escalating demand for more efficient and dependable commercial vehicles, especially those embracing hybrid and fully electric powertrains. By 2028, the market is expected to reach approximately $35 billion, a substantial increase from previous years.

Allison Transmission is strategically positioned to benefit from this industry shift towards electrification. Their innovative eGen Power and eGen Flex systems are specifically designed to meet the growing need for low and zero-emission solutions in the commercial vehicle sector. The company has already secured significant orders, with a notable increase in production capacity for their electric axle systems in 2024.

The defense sector presents a robust growth avenue for Allison, evidenced by substantial sales increases and sustained contracts for their propulsion systems in tactical wheeled and tracked vehicles. This strong performance is expected to continue as military modernization efforts globally intensify.

Ongoing military modernization programs worldwide offer significant opportunities for Allison's advanced propulsion solutions. Furthermore, the burgeoning investment in electrified combat vehicle technology creates a substantial opening for Allison to leverage its expertise and expand its market share in this critical and evolving segment.

Allison's record quarterly net sales outside North America, particularly in the On-Highway sector, highlight a significant opportunity for international market penetration. This growth, fueled by robust demand in South America and Europe, suggests a receptive market for Allison's products.

Further leveraging strategic localization efforts, such as establishing closer proximity to customer bases in these expanding regions, can unlock substantial revenue growth potential. This approach allows for tailored solutions and more efficient supply chains, directly addressing regional needs and preferences.

Synergies from Dana Off-Highway Acquisition

Allison's acquisition of Dana's Off-Highway business is poised to unlock significant value, with projected annual synergies reaching around $120 million by year four. These gains are anticipated to stem from enhanced operational efficiencies and the exploitation of cross-selling avenues across a broader customer base.

This strategic move significantly expands Allison's footprint into key growth sectors.

- Construction Market: Gaining access to a robust construction equipment segment.

- Agriculture Market: Strengthening presence in the vital agricultural machinery sector.

- Industrial Markets: Broadening reach within diverse industrial applications.

The integration is expected to fuel long-term growth by tapping into these expanding markets, solidifying Allison's competitive position.

Technological Advancements and Partnerships

Allison's commitment to innovation is evident in its ongoing investment in research and development. For instance, a significant $10 million investment was made in EnerTech Capital, signaling a strategic focus on emerging technologies within the energy sector. This proactive approach ensures Allison stays at the forefront of industry advancements.

Strategic partnerships are crucial for Allison's growth and adaptation. The collaboration with Cummins to develop new electric hybrid drivetrains exemplifies this strategy. Such alliances allow Allison to leverage external expertise and resources, accelerating the development of cutting-edge solutions that meet evolving market demands and increasingly stringent regulatory standards.

- R&D Investment: $10 million invested in EnerTech Capital.

- Key Partnership: Collaboration with Cummins for electric hybrid drivetrains.

- Market Adaptation: Focus on innovation to meet evolving demands and regulations.

The growing demand for electric and hybrid commercial vehicles presents a significant opportunity for Allison, driven by increasing environmental regulations and a push for greater fuel efficiency. The company's eGen Power and eGen Flex electric axle systems are well-positioned to capture market share in this expanding segment. Furthermore, Allison's strategic acquisition of Dana's Off-Highway business is expected to unlock substantial synergies, estimated at around $120 million annually by year four, by expanding their reach into construction, agriculture, and other industrial markets.

| Opportunity Area | Key Drivers | Allison's Position/Action | Projected Impact/Data |

|---|---|---|---|

| Electrification of Commercial Vehicles | Environmental regulations, fuel efficiency demand | eGen Power and eGen Flex systems | Market projected to reach $35 billion by 2028 |

| Defense Sector Modernization | Global military upgrades, new vehicle technology | Proven propulsion systems, focus on electrified combat vehicles | Sustained contracts and sales increases |

| International Market Expansion | Robust demand in South America and Europe | Record net sales outside North America, strategic localization | Increased revenue potential through tailored solutions |

| Off-Highway Market Penetration | Acquisition of Dana's Off-Highway business | Expanded footprint in construction, agriculture, industrial sectors | Projected annual synergies of ~$120 million by year 4 |

Threats

The accelerating transition to fully electric vehicles (EVs) presents a significant challenge to Allison's core business. While commercial EV adoption is still developing, a quicker-than-anticipated move towards electric powertrains, particularly in crucial sectors, could substantially impact Allison's traditional automatic transmission sales. This trend underscores the urgent need for ongoing innovation and swift strategic adjustments to remain competitive.

The electric vehicle powertrain market is a crowded arena, with many specialists focusing on integrated eAxles, electric motors, and complete propulsion solutions. This dynamic landscape presents a significant challenge for established players like Allison.

Companies such as Bosch Mobility and ZF are aggressively investing in innovation, developing advanced electric powertrains that directly compete with Allison's offerings. Their rapid development cycles and focused expertise in electrification put pressure on Allison to maintain its competitive edge in this evolving sector.

Economic downturns can significantly impact Allison's performance, particularly in segments like North America On-Highway and Global Off-Highway where demand may soften. For instance, a projected slowdown in global economic growth for 2024-2025 could translate to fewer new vehicle orders.

Market softness, characterized by reduced consumer and business spending, directly affects the commercial vehicle industry. This can lead to lower sales volumes for Allison's transmissions, as seen in potential year-over-year declines in certain market segments.

Furthermore, geopolitical tensions and trade restrictions create uncertainty, disrupting global supply chains and potentially hindering international logistics. This can indirectly impact Allison's sales by affecting customer operations and overall demand for commercial vehicles.

Supply Chain Disruptions and Raw Material Costs

Allison's heavy-duty truck and transmission business is vulnerable to ongoing supply chain issues, especially concerning critical components like semiconductors. The availability and pricing of essential raw materials such as steel and aluminum also pose significant risks. These factors can directly increase production expenses and squeeze profit margins for Allison.

For instance, the automotive industry, which Allison serves, experienced significant semiconductor shortages throughout 2023 and into early 2024, leading to production slowdowns for many manufacturers. Furthermore, steel prices saw volatility in 2024, with some reports indicating a 10-15% increase in certain grades compared to the previous year, directly impacting the cost of goods sold for truck manufacturers and their suppliers.

- Semiconductor Shortages: Continued scarcity of microchips impacts production capacity.

- Raw Material Price Volatility: Fluctuations in steel and aluminum costs affect manufacturing expenses.

- Increased Production Costs: These disruptions lead to higher per-unit manufacturing expenses for Allison.

- Margin Pressure: Rising input costs can erode profitability if not passed on to customers.

Stringent Emissions Regulations

Increasingly stringent global emissions regulations, particularly those targeting fuel efficiency and CO2 output, demand significant and ongoing investment in research and development for cleaner transmission technologies. For instance, by 2025, the European Union aims for an average fleet emission of 95 grams of CO2 per kilometer, a target that pushes manufacturers like Allison to innovate rapidly.

Failure to adapt to these evolving environmental standards can result in substantial competitive disadvantages, including potential market exclusion and financial penalties. Allison's commitment to developing advanced hybrid and electric propulsion systems is a direct response to these pressures, aiming to maintain market relevance and avoid compliance costs.

- R&D Investment: Continued substantial capital allocation is required for developing advanced, eco-friendly transmission solutions.

- Compliance Risk: Non-compliance with evolving emissions standards can lead to significant fines and market access restrictions.

- Competitive Landscape: Competitors investing heavily in electrification and alternative fuels may gain an advantage.

- Technological Obsolescence: Existing product lines may face reduced demand if they do not align with future regulatory requirements.

The rapid shift towards electric vehicles poses a substantial threat to Allison's traditional transmission business, as specialized eAxle manufacturers gain traction and established players like Bosch and ZF invest heavily in competing electric powertrains. Economic slowdowns projected for 2024-2025 could further dampen demand for commercial vehicles, impacting Allison's sales volumes, while ongoing supply chain disruptions, particularly semiconductor shortages and raw material price volatility, increase production costs and squeeze margins.

Additionally, increasingly stringent global emissions regulations necessitate continuous R&D investment in cleaner technologies, risking competitive disadvantage and potential market exclusion if Allison fails to adapt its product lines to meet evolving environmental standards, such as the EU's 2025 target of 95g CO2/km.

| Threat Category | Specific Threat | Impact on Allison | Example/Data Point (2024-2025 Focus) |

|---|---|---|---|

| Technological Disruption | EV Powertrain Competition | Reduced demand for traditional transmissions | Companies like ZF are investing billions in electric drive units. |

| Market Conditions | Economic Slowdown | Lower commercial vehicle sales | Projected global GDP growth moderation for 2024-2025 impacting fleet orders. |

| Supply Chain & Costs | Semiconductor Shortages / Raw Material Volatility | Increased production costs, margin erosion | Steel prices saw potential 10-15% increases in certain grades during 2024; ongoing chip scarcity impacting production. |

| Regulatory Environment | Emissions Regulations | Need for significant R&D investment, risk of obsolescence | EU 2025 target of 95g CO2/km requires advanced powertrain development. |

SWOT Analysis Data Sources

This Allison SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research studies, and expert industry analyses to ensure a well-rounded and informed strategic perspective.