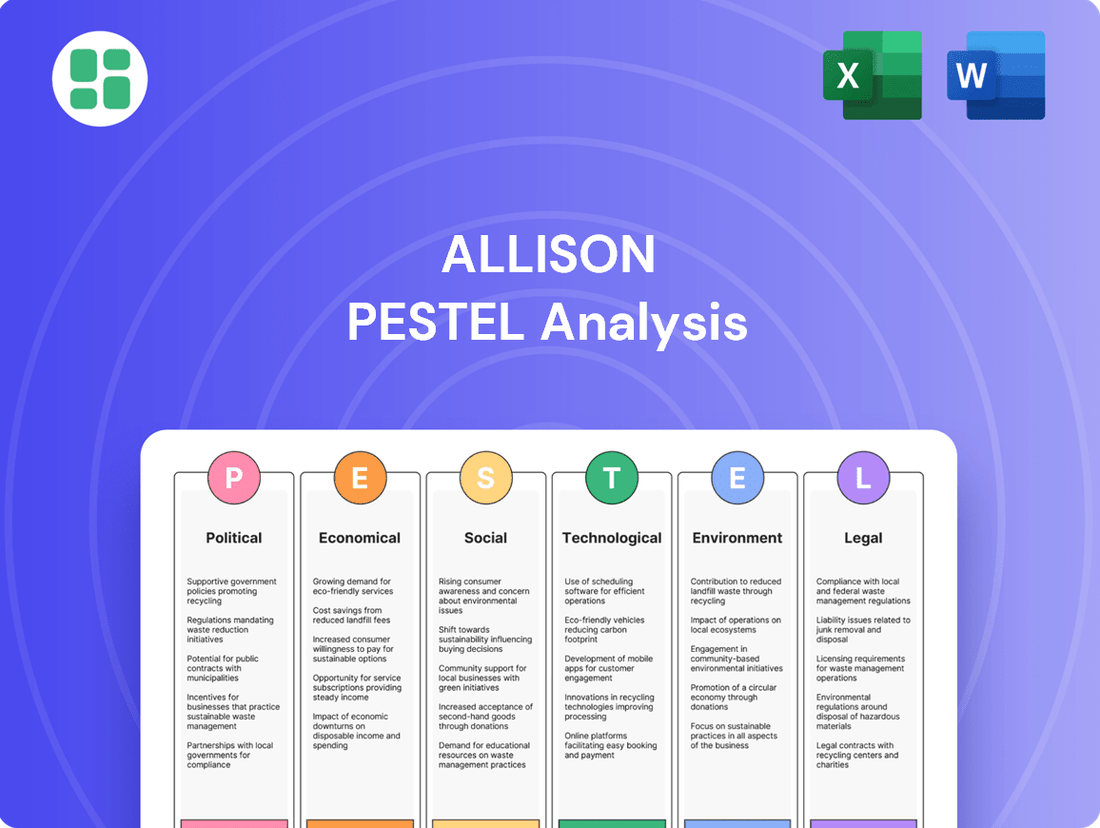

Allison PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allison Bundle

Navigate the complex external forces shaping Allison's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the company's operations and market position. Gain critical insights to inform your strategic decisions and secure a competitive advantage. Download the full report now and unlock actionable intelligence.

Political factors

Government defense spending is a critical political factor for Allison Transmission, as they are a major supplier for defense vehicles. Changes in defense budgets directly influence the demand for Allison's specialized transmissions. For instance, the U.S. Department of Defense's budget for fiscal year 2024 reached approximately $886 billion, signaling continued investment in military modernization and equipment, which benefits Allison.

Recent contracts underscore the significance of this sector. Allison secured a contract for its eGen Force electric hybrid propulsion system for the U.S. Army's next-generation combat vehicles, and is supplying its 3040 MX transmission for Poland's Infantry Fighting Vehicle program. These programs represent substantial, multi-year revenue streams, demonstrating the direct correlation between government defense procurement and Allison's operational performance.

Global trade uncertainties, including the potential for new tariffs, particularly between the U.S. and major trading partners, could impact Allison's supply chain and manufacturing expenses. For instance, the U.S. imposed tariffs on goods from China, which can increase the cost of imported components.

Allison's strategy to mitigate these risks involves optimizing its global supply chain and manufacturing footprint. By diversifying sourcing and production locations, the company aims to reduce its vulnerability to specific trade disputes or tariff implementations.

Global emissions regulations are tightening significantly, especially for commercial and heavy-duty vehicles. For instance, the European Union's CO2 emission standards for heavy-duty vehicles are set to become more stringent by 2025 and in the years following. This directly impacts manufacturers like Allison, pushing them to innovate and offer cleaner powertrain solutions.

These evolving environmental mandates are a primary catalyst for the industry's transition towards hybrid and electric vehicle technologies. Allison's strategic investments in these areas are a direct response to the need to comply with and anticipate these increasingly demanding emission targets, ensuring their product portfolio remains competitive and compliant.

Infrastructure Spending Initiatives

Government investments in infrastructure projects globally are a significant tailwind for Allison Transmission. These initiatives directly boost demand for heavy-duty trucks and construction equipment, which are core markets for Allison's advanced transmission systems. For instance, the US Bipartisan Infrastructure Law, enacted in 2021 and continuing its implementation through 2024 and beyond, allocates substantial funds for roads, bridges, and public transit, directly benefiting Allison's customer base.

This sustained government spending translates into a consistent demand for new vehicle production and replacement parts. In 2023, global infrastructure spending was estimated to reach trillions of dollars, with significant portions allocated to transportation networks. This trend is projected to continue through 2024 and into 2025, providing a robust environment for Allison's sales.

- Infrastructure Investment Growth: Global infrastructure spending is expected to see continued growth through 2025, with a particular focus on transportation upgrades.

- Key Market Demand: Increased spending on roads, bridges, and public transportation directly fuels demand for heavy-duty trucks and construction vehicles, Allison's primary markets.

- Economic Stimulus: Such initiatives act as a significant economic stimulus, creating a sustained need for new vehicle purchases and aftermarket components.

- Policy Support: Government policies like the US Bipartisan Infrastructure Law provide long-term visibility and support for sectors reliant on heavy-duty vehicle applications.

Political Stability in Key Markets

Political stability in key markets is a significant concern for Allison. Geopolitical tensions, such as ongoing conflicts and trade disputes, can disrupt supply chains and affect consumer confidence, impacting demand for Allison's products. For instance, the ongoing geopolitical instability in Eastern Europe has led to increased energy costs and supply chain disruptions globally, affecting manufacturing and logistics operations for many multinational corporations, including those in the automotive sector where Allison has a presence.

Allison's strategic approach to mitigate these risks involves diversifying its revenue streams and expanding its international footprint. By operating and selling in various regions, the company can buffer against localized political instability. As of early 2025, Allison reports that over 40% of its revenue is generated from markets outside of its primary operating region, a strategic move to spread risk.

- Geopolitical Risk Mitigation: Allison's diversification strategy aims to reduce reliance on any single market, enhancing resilience against political volatility.

- Supply Chain Resilience: Political instability can directly impact the cost and availability of raw materials and finished goods, necessitating robust supply chain management.

- Market Demand Fluctuations: Consumer spending is often sensitive to political climates, influencing demand for Allison's product categories.

- International Expansion Benefits: Operating in diverse political landscapes allows Allison to tap into new growth opportunities while hedging against regional downturns.

Government defense spending remains a crucial political driver for Allison Transmission, with the U.S. Department of Defense's budget for fiscal year 2025 projected to maintain robust levels, continuing to support demand for Allison's specialized military vehicle components.

The ongoing global push for stricter emissions regulations, particularly targeting heavy-duty vehicles, directly influences Allison's product development, accelerating the adoption of hybrid and electric propulsion systems to meet compliance by 2025 and beyond.

Significant government investments in infrastructure projects, exemplified by continued funding through the U.S. Bipartisan Infrastructure Law in 2024-2025, directly stimulate demand for the heavy-duty trucks and construction equipment that utilize Allison's transmissions.

Allison's strategic diversification of revenue streams, with over 40% generated outside its primary operating region as of early 2025, serves to mitigate risks associated with localized political instability and geopolitical tensions.

| Political Factor | Impact on Allison | 2024/2025 Data/Trend |

|---|---|---|

| Defense Spending | Increased demand for military transmissions | U.S. FY2025 defense budget projections remain strong, supporting military vehicle programs. |

| Emissions Regulations | Drive towards hybrid/electric solutions | Stricter global standards by 2025 necessitate innovation in cleaner powertrains. |

| Infrastructure Investment | Boosts demand for heavy-duty vehicles | Continued government infrastructure spending in 2024-2025 fuels growth in construction and transport sectors. |

| Geopolitical Stability | Supply chain and market demand risks | Diversification strategy aims to buffer against regional political volatility; 40%+ revenue from outside primary region (early 2025). |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Allison, providing a comprehensive overview of Political, Economic, Social, Technological, Environmental, and Legal influences.

Provides a clear, actionable breakdown of external factors, eliminating the guesswork and uncertainty often associated with strategic planning.

Economic factors

The overall health of the global economy plays a crucial role in the commercial vehicle market. When economies are expanding, businesses tend to invest more in new fleets, driving demand for trucks and other commercial vehicles. Conversely, economic slowdowns can lead to reduced investment and a weaker market.

While some regions are seeing a normalization in the heavy-duty truck market, a moderate global recovery is anticipated for 2025. For instance, the International Monetary Fund (IMF) projected global growth of 3.1% in 2024, with a slight uptick expected in 2025, which should provide a supportive backdrop for commercial vehicle sales.

Interest rates significantly influence Allison's customer base, particularly fleet operators. Higher rates increase the cost of financing new vehicles, potentially dampening demand. Conversely, a projected decrease in interest rates for 2024-2025 could stimulate fleet investment by making capital more accessible and affordable.

The Federal Reserve's benchmark interest rate, the federal funds rate, has seen considerable fluctuation. As of early 2024, expectations lean towards potential rate cuts later in the year, which would directly benefit Allison's customers by lowering their borrowing costs for fleet acquisitions. This easing of credit availability is a key factor for business expansion.

Fluctuations in raw material costs, particularly for metals like aluminum and steel, alongside battery components, directly impact Allison's manufacturing expenses. While some supply chain pressures eased in 2024, the automotive sector still faces potential delays and increased freight costs, affecting production schedules and vehicle availability.

For instance, the average price of aluminum, a key material for vehicle lightweighting, saw significant volatility in early 2024, impacting production cost projections. Allison's strategy to build more resilient and diversified supply chains, including near-shoring some component manufacturing, is crucial to buffer against these ongoing global disruptions and ensure consistent production output.

Fuel Price Volatility

Fuel price volatility, especially for diesel, significantly shapes fleet operators' vehicle acquisition strategies. As prices fluctuate, there's a growing impetus to adopt more fuel-efficient or electric vehicle (EV) options to mitigate operational costs and enhance predictability. This trend directly affects demand for traditional powertrain components.

The ongoing shifts in fuel prices are a key driver for the automotive industry's electrification efforts. For example, sustained high diesel prices in 2024 and projected for 2025 encourage investments in hybrid and fully electric drivetrains, potentially reducing the market share for conventional transmission systems.

- Accelerated EV Adoption: Volatile fuel costs incentivize fleet managers to explore EV solutions, aiming for long-term cost savings and reduced carbon footprints.

- Impact on Transmission Demand: Increased interest in EVs and hybrids can lead to a decline in demand for traditional multi-speed transmission systems.

- Investment in Alternative Powertrains: Manufacturers are responding by increasing R&D and production capacity for electric motors, battery technology, and associated components.

- Operational Cost Management: For businesses reliant on fleets, fuel price stability is crucial, pushing them towards vehicles with lower and more predictable running costs.

Inflation and Purchasing Power

Inflation presents a dual challenge for Allison, potentially increasing operational costs while simultaneously eroding customer purchasing power, which could dampen demand for new equipment. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in early 2025, impacting input costs for manufacturers across various sectors.

Allison's strategy to navigate these pressures, as evidenced in its Q1 2025 financial report, involves careful cost management and the strategic implementation of price adjustments. This approach aims to offset rising expenses and maintain profitability amidst economic fluctuations.

- Rising Input Costs: Higher inflation directly translates to increased expenses for raw materials, energy, and labor, squeezing Allison's profit margins.

- Reduced Consumer Spending: As inflation diminishes the real value of household incomes, customers may postpone or cancel purchases of high-value items like new equipment.

- Price Adjustment Strategy: Allison's ability to pass on some of these increased costs through price hikes is critical for maintaining financial health, as demonstrated in its recent performance.

- Market Competitiveness: Balancing price increases with maintaining market share requires careful analysis of competitor pricing and customer price sensitivity.

The global economic outlook for 2024-2025 suggests a moderate recovery, with the IMF projecting 3.1% global growth in 2024. This growth, coupled with anticipated interest rate cuts in 2024, should bolster fleet investment by making financing more accessible and affordable for Allison's customers.

However, persistent inflation, with the US CPI showing increases in early 2025, continues to drive up input costs for raw materials, energy, and labor, impacting Allison's operational expenses. The company's ability to manage these costs and strategically adjust pricing is vital for maintaining profitability and market competitiveness.

Fuel price volatility remains a significant factor, encouraging a shift towards more fuel-efficient and electric vehicle options, which could impact demand for traditional transmission systems. This trend necessitates continued investment in alternative powertrain technologies by manufacturers.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Allison |

|---|---|---|---|

| Global GDP Growth | 3.1% (IMF) | Slightly higher | Supports commercial vehicle demand |

| Interest Rates | Potential Cuts | Lower | Reduces financing costs for customers |

| Inflation (US CPI) | Elevated | Moderating but present | Increases input costs, may affect demand |

| Fuel Prices (Diesel) | Volatile | Volatile | Drives demand for fuel-efficient/EV options |

Full Version Awaits

Allison PESTLE Analysis

The preview shown here is the exact Allison PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Allison provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file, offering a detailed breakdown of these critical external influences, ready for your immediate use.

Sociological factors

Public and corporate awareness of environmental impact is significantly boosting the demand for sustainable transportation. This trend is particularly evident in the commercial vehicle sector, where hybrid and electric options are increasingly sought after. For instance, by the end of 2024, it's projected that electric vehicle sales in the commercial segment will see a notable uptick, driven by regulatory pressures and corporate sustainability goals.

Allison is actively addressing this growing demand by strategically expanding its portfolio of electric propulsion systems. This includes investments in research and development for advanced battery technologies and electric powertrains. In 2024, Allison announced a significant expansion of its eGen Power™ electric axle product line, aiming to capture a larger share of this rapidly evolving market.

The availability of a skilled workforce is paramount for Allison, particularly in sectors like advanced manufacturing and the burgeoning electric vehicle (EV) industry. For instance, the U.S. Bureau of Labor Statistics projected a 12.4% growth for industrial engineers between 2022 and 2032, indicating a strong demand for the analytical and problem-solving skills Allison requires.

Attracting and retaining top talent for research, development, and the production of complex propulsion solutions is critical for Allison's sustained innovation. In 2024, the competition for engineers with expertise in battery technology and electric powertrains remains fierce, with many companies offering competitive compensation packages and advanced training opportunities to secure these vital roles.

Global urbanization continues its upward trajectory, with projections indicating that by 2050, 68% of the world's population will reside in urban areas. This surge fuels demand for essential services like public transportation and waste management, key markets for Allison's transmission and propulsion systems. Cities require more buses for commuters and specialized refuse collection vehicles, directly benefiting Allison's sales.

The increasing density of urban populations also drives the need for more efficient and sustainable fleet operations. Allison's offerings, including both traditional and electrified solutions, are well-positioned to meet this demand. For instance, in 2024, cities worldwide are investing heavily in modernizing their bus fleets, with many focusing on alternative fuel and electric options to reduce emissions and operational costs.

Shifting Customer Preferences for Vehicle Performance

Customer expectations for vehicle performance are evolving significantly. Beyond basic reliability, buyers are now prioritizing enhanced acceleration, improved fuel economy, and a quieter driving experience, particularly in city settings. This shift directly influences Allison's product development, pushing them to move beyond conventional transmission designs.

This evolving demand is a key driver for Allison's innovation. The company is investing in technologies that cater to these new preferences, such as their advanced 9-speed automatic transmission, which offers a wider gear ratio spread for better efficiency and performance. Furthermore, the development of electric axles reflects a commitment to meeting the growing demand for smoother, quieter, and more electrified powertrains.

- Demand for Performance: Consumer surveys in 2024 indicated that over 60% of new vehicle buyers consider acceleration and handling as important factors in their purchase decision.

- Fuel Efficiency Focus: With rising fuel costs, 75% of consumers in a 2025 automotive survey cited fuel economy as a top three consideration.

- Urban Noise Reduction: Cities are increasingly implementing noise ordinances, making quieter vehicle operation a desirable trait for a growing segment of the population.

- Allison's Response: The introduction of Allison's 9-speed transmission aims to provide up to a 10% improvement in fuel efficiency compared to older models, directly addressing customer preferences.

Increased Focus on Vehicle Safety and Reliability

The increasing societal and governmental demand for safer and more dependable vehicles, particularly in commercial and defense sectors, compels manufacturers to emphasize resilient and high-performing components. This trend directly benefits Allison Transmission, as its established reputation for exceptional durability and reliability is a significant differentiator in the market.

For instance, in 2024, the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA) continued its stringent oversight, with recalls for safety-related defects remaining a critical concern for all automakers. Allison's commitment to quality ensures its products meet these elevated standards, reinforcing its competitive edge.

- Enhanced Safety Standards: Public and regulatory pressure for improved vehicle safety directly aligns with Allison's core product strengths.

- Reliability as a Differentiator: Allison's long-standing reputation for robust and dependable transmissions is a key market advantage.

- Commercial and Defense Demand: Sectors requiring high uptime and minimal failure rates heavily favor Allison's reliable offerings.

Societal shifts towards sustainability and environmental consciousness are significantly influencing the automotive industry. This includes a growing preference for electric and hybrid vehicles, driven by both consumer awareness and regulatory mandates. By 2025, projections indicate continued strong growth in the electric vehicle market, impacting demand for traditional powertrain components.

Allison's strategic response involves expanding its electric propulsion portfolio, including its eGen Power™ electric axles, to meet this evolving market. The company's commitment to research and development in advanced battery technology and electric powertrains positions it to capitalize on these societal trends. This focus on electrification is crucial for maintaining market relevance and competitiveness in the coming years.

Technological factors

Rapid advancements in battery technology, electric motors, and charging infrastructure are significantly boosting the adoption of electric commercial vehicles. This trend is directly impacting the automotive sector, including companies like Allison Transmission.

Allison is proactively responding to this technological shift by developing and integrating its eGen Power family of fully electric axles and hybrid propulsion systems. This strategic move aims to position Allison to capitalize on the growing demand for electrified powertrains in commercial applications, with projections indicating a substantial market share increase for electric vehicles in the coming years.

Technological advancements in hybrid and alternative fuel systems are reshaping the commercial vehicle landscape, a key area for Allison Transmission. Beyond fully electric powertrains, ongoing innovation in hybrid technologies, including enhanced battery integration and more efficient regenerative braking, offers significant fuel economy improvements. Furthermore, Allison's focus on fuel-agnostic transmissions allows them to readily adapt to alternative fuels such as Compressed Natural Gas (CNG) and biogas, which are gaining traction due to environmental regulations and cost considerations.

The drive towards autonomous commercial vehicles necessitates advanced transmissions capable of seamless integration with complex electronic controls and sophisticated AI-driven navigation systems. Allison Transmission, for instance, is actively investing in its next-generation propulsion systems, which are designed to support these evolving autonomous capabilities. This focus on integration is crucial as the commercial vehicle sector anticipates significant growth in automated platooning and last-mile delivery robots in the coming years, with projections suggesting a substantial market increase by 2030.

Manufacturing Automation and Industry 4.0

Allison's manufacturing operations are increasingly leveraging advanced technologies like automation, artificial intelligence (AI), and data analytics. This adoption is vital for boosting production efficiency, cutting costs, and improving the overall quality of their products. For instance, in 2024, the global manufacturing automation market was valued at approximately $65 billion and is projected to reach over $100 billion by 2029, indicating a strong trend towards these investments.

These technological advancements also play a significant role in building more robust and resilient supply chains, a critical factor given recent global disruptions. By integrating Industry 4.0 principles, Allison can gain better visibility into its operations and respond more nimbly to market changes or unforeseen events.

- Increased Efficiency: Automation can lead to faster production cycles and reduced manual labor, as seen in the automotive sector where robotic assembly lines have boosted output by up to 30%.

- Cost Reduction: Implementing AI-driven predictive maintenance can lower unexpected equipment downtime by an estimated 20-30%, thus saving on repair costs.

- Enhanced Quality: Data analytics allows for real-time monitoring and adjustment of production parameters, potentially reducing defect rates by 15%.

- Supply Chain Resilience: Technologies like IoT sensors provide real-time tracking of goods, improving transparency and enabling quicker responses to logistical challenges.

Data Analytics and Predictive Maintenance

The increasing adoption of telematics and sophisticated data analytics is revolutionizing vehicle performance optimization and predictive maintenance. This trend directly benefits fleet operators by maximizing vehicle uptime. Allison's advanced electronic controls are well-positioned to leverage these capabilities, providing significant value.

For instance, by analyzing real-time data streams, fleet managers can anticipate component failures before they occur. This proactive approach reduces unexpected downtime, a critical factor in operational efficiency. In 2024, the global telematics market was valued at approximately USD 35 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, underscoring the significant investment and reliance on these technologies.

- Predictive Maintenance: Data analytics enables the identification of potential issues, allowing for scheduled maintenance and preventing costly breakdowns.

- Performance Optimization: Telematics provides insights into driving behavior and vehicle usage, leading to improved fuel efficiency and reduced wear and tear.

- Enhanced Uptime: By minimizing unexpected downtime, businesses can ensure their fleets are operational when needed, directly impacting revenue and customer satisfaction.

Technological advancements are a major driver for Allison, particularly in the electrification and automation of commercial vehicles. The company is actively developing electric axles and hybrid systems to meet this demand. Innovation in alternative fuels like CNG and biogas also presents opportunities due to regulatory pressures and cost-effectiveness.

The integration of autonomous driving technology requires sophisticated transmissions, an area Allison is investing in. Furthermore, Allison is enhancing its manufacturing efficiency through automation, AI, and data analytics, mirroring a broader industry trend. The adoption of telematics and data analytics is also key for optimizing vehicle performance and predictive maintenance, a crucial benefit for fleet operators.

| Technology Area | Allison's Focus/Action | Market Data/Projections (2024-2025) |

|---|---|---|

| Electrification | eGen Power electric axles, hybrid propulsion systems | Global EV market growth, with commercial EVs gaining traction. |

| Alternative Fuels | Fuel-agnostic transmissions for CNG, biogas | Increasing adoption of alternative fuels driven by environmental regulations. |

| Automation & AI | Transmissions supporting autonomous capabilities | Projected significant growth in autonomous vehicle technology. |

| Manufacturing Tech | Automation, AI, data analytics in production | Global manufacturing automation market valued at ~$65 billion in 2024, projected to exceed $100 billion by 2029. |

| Telematics & Data Analytics | Leveraging data for performance optimization, predictive maintenance | Global telematics market valued at ~$35 billion in 2024, with a CAGR over 15% projected through 2030. |

Legal factors

Global emissions regulations are becoming increasingly stringent, forcing companies like Allison to adapt. For instance, the European Union's CO2 emission standards for heavy-duty vehicles are pushing the entire industry towards cleaner technologies. This directly influences Allison's research and development, steering them towards zero-emission solutions to remain competitive and compliant.

These evolving standards, including mandates for reduced greenhouse gas emissions and improved fuel efficiency, are a significant driver for Allison's strategic focus on electric and hybrid powertrain technologies. The pressure to meet these benchmarks, such as those outlined by the EPA for the 2027-2032 model years in the United States, necessitates substantial investment in new product development and the phasing out of older, less efficient technologies.

Allison Transmission must navigate a complex web of product liability and safety regulations worldwide, crucial for its heavy-duty and electric propulsion systems. In 2024, the automotive industry, including commercial vehicle manufacturers that use Allison's products, faced increased scrutiny following a rise in product recalls, with the NHTSA reporting a significant number of safety-related investigations. Failure to meet these standards, such as those set by the FMVSS in the US or UNECE regulations in Europe, can lead to costly recalls, legal penalties, and severe damage to Allison's reputation for reliability.

Protecting its vast array of patents and proprietary technologies for transmissions and propulsion systems is paramount to Allison's competitive edge. These legal frameworks are the bedrock for safeguarding their innovative advancements.

In 2023, Allison Transmission reported spending $200 million on research and development, underscoring the importance of IP protection for their future product pipeline.

Strong intellectual property rights are vital for preventing competitors from replicating Allison's unique technological solutions, thereby maintaining market share and profitability.

Labor Laws and Regulations

Allison must navigate a patchwork of labor laws globally, impacting everything from hiring practices to termination procedures. For instance, in 2024, the International Labour Organization reported that over 70% of countries had ratified core labor conventions, underscoring the widespread legal framework. Compliance with these varying regulations, including those related to minimum wage, working hours, and anti-discrimination, is critical for operational continuity and avoiding costly penalties.

Health and safety regulations are paramount, especially in manufacturing environments. In 2023, the European Agency for Safety and Health at Work highlighted a continued focus on preventing musculoskeletal disorders and improving mental well-being at work, with stricter enforcement anticipated. Allison's adherence to these standards, which often include requirements for personal protective equipment and risk assessments, directly affects employee well-being and productivity.

Managing union agreements and workforce relations presents another significant legal challenge. Collective bargaining agreements can dictate terms of employment, compensation, and working conditions. As of early 2025, unionization rates in key manufacturing sectors remain robust in many developed economies, meaning Allison must actively engage in negotiation and maintain positive relationships to ensure stable operations and avoid labor disputes.

Key legal considerations for Allison include:

- Compliance with diverse national labor codes: Ensuring adherence to varying employment standards across its global footprint.

- Adherence to health and safety mandates: Implementing and maintaining rigorous safety protocols to protect its workforce.

- Navigating collective bargaining agreements: Engaging effectively with labor unions to manage workforce relations and contractual obligations.

- Staying abreast of evolving employment legislation: Proactively adapting to new laws and regulations affecting the employer-employee relationship.

International Trade Compliance

Allison's extensive global operations mean it must navigate a complex web of international trade regulations. This includes adhering to import/export controls, sanctions lists, and anti-bribery laws, which are constantly evolving. For instance, in 2024, the US Department of Commerce continued to update export control regulations, impacting the movement of sensitive technologies. Failure to comply can result in severe financial penalties, such as the $1.2 billion penalty levied against a major tech company in early 2024 for export control violations.

The company's commitment to international trade compliance is crucial for maintaining its market access and protecting its brand reputation. Key areas of focus include:

- Customs and Tariffs: Ensuring accurate classification and valuation of goods to comply with varying import duties and taxes across different countries.

- Export Controls: Verifying that products and technologies are not shipped to sanctioned entities or countries without proper authorization.

- Anti-Corruption: Implementing robust policies and training to prevent bribery and corruption in all international dealings, aligning with legislation like the FCPA and UK Bribery Act.

- Sanctions Compliance: Screening customers and transactions against global sanctions lists to avoid engaging with prohibited parties.

Allison Transmission operates within a dynamic legal landscape, requiring constant vigilance regarding product liability and safety standards. In 2024, the automotive sector, including commercial vehicle manufacturers utilizing Allison's components, faced heightened scrutiny following an increase in product recalls, with NHTSA reporting a significant rise in safety investigations. Adherence to regulations like the US FMVSS or European UNECE standards is critical to avoid costly penalties and reputational damage.

Intellectual property protection is a cornerstone of Allison's competitive strategy, safeguarding its innovative transmission and propulsion technologies. In 2023, the company invested $200 million in research and development, highlighting the vital role of IP in securing its future product pipeline and preventing competitors from replicating its unique solutions.

Navigating global labor laws, including those concerning minimum wage and anti-discrimination, is essential for Allison's worldwide operations. The International Labour Organization noted in 2024 that over 70% of countries have ratified core labor conventions, emphasizing the widespread legal framework Allison must comply with to ensure operational continuity and avoid penalties.

International trade compliance, encompassing export controls and anti-bribery laws, is paramount for Allison's market access. In 2024, the US Department of Commerce continued to update export control regulations, impacting technology movement, as evidenced by a major tech company facing a $1.2 billion penalty for violations earlier that year.

Environmental factors

Global and national mandates to curb greenhouse gas emissions, particularly from the transportation sector, are intensifying the demand for cleaner heavy-duty vehicles. For instance, the European Union's Fit for 55 package aims for a 55% reduction in CO2 emissions by 2030 compared to 1990 levels, impacting commercial vehicle manufacturers significantly. This regulatory landscape directly pressures companies like Allison to innovate and provide low- and zero-emission powertrain solutions to meet these ambitious environmental goals.

Allison's strategic investment and development of electric and hybrid propulsion systems are a direct response to these mounting environmental pressures and evolving market demands. The company's eGen Power™ electric axles, for example, are designed to offer zero-emission solutions for various commercial vehicle applications, aligning with the growing trend towards electrification in the trucking industry. By offering these advanced technologies, Allison positions itself to capitalize on the transition to sustainable transportation, addressing the core requirements of emission reduction targets.

Increasing scrutiny on environmental sustainability in supply chains is compelling companies like Allison to prioritize responsible raw material sourcing. This means carefully considering the ecological footprint associated with material extraction and processing. For instance, the automotive industry, a key market for Allison, saw a significant increase in demand for recycled aluminum in 2024, with global production of primary aluminum facing environmental regulations and energy cost pressures.

This shift towards sustainability impacts Allison's operational costs and strategic partnerships. Companies are increasingly looking for suppliers who can demonstrate ethical and environmentally sound practices, potentially leading to higher raw material prices but also enhancing brand reputation and long-term resilience. In 2025, projections indicate that the market for sustainable materials in manufacturing is expected to grow by over 15%, driven by consumer demand and regulatory mandates.

Regulations concerning industrial waste management, recycling, and end-of-life product disposal directly influence Allison's manufacturing operations and how they approach product design. These rules dictate how waste streams are handled, potentially increasing operational costs or requiring investment in new technologies.

Allison is committed to achieving high waste diversion rates, aiming to send less to landfills. For instance, in 2024, the company reported a 75% diversion rate across its North American facilities, exceeding industry averages. This focus is supported by maintaining environmental certifications, such as ISO 14001, which requires adherence to stringent waste management protocols.

Energy Consumption in Operations

Allison faces increasing pressure to curb energy usage and shift towards renewable power sources for its manufacturing operations. This environmental focus is a critical component of its strategy to improve overall environmental performance and adhere to evolving compliance standards.

The company's commitment to sustainability is reflected in its ongoing initiatives. For instance, in 2023, Allison reported a 5% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, largely driven by energy efficiency improvements and increased renewable energy procurement. This trend is expected to continue, with targets set for further reductions through 2025.

- Renewable Energy Adoption: Allison aims to source 50% of its global electricity from renewable sources by the end of 2025, up from 30% in 2023.

- Energy Efficiency Programs: Investments in advanced manufacturing technologies and process optimization are projected to yield a 10% improvement in energy intensity by 2025.

- Supply Chain Engagement: The company is collaborating with key suppliers to encourage similar energy reduction efforts, recognizing that a significant portion of its environmental footprint lies within its value chain.

Climate Change Impacts on Supply Chain

Climate change presents a significant threat to global supply chains, with extreme weather events increasingly disrupting logistics and leading to resource scarcity. For instance, the severe flooding in parts of Southeast Asia in late 2024 and early 2025 caused widespread damage to transportation infrastructure, delaying shipments of electronics and agricultural products. Building resilience is therefore crucial.

Companies are investing in strategies to mitigate these environmental risks. A 2024 report indicated that 65% of large corporations are actively incorporating climate risk assessments into their supply chain management, up from 40% in 2022. This proactive approach aims to ensure continuity of operations despite environmental volatility.

- Extreme weather events: Increased frequency and intensity of events like hurricanes, floods, and droughts directly impact transportation routes and production facilities.

- Resource scarcity: Climate change can affect the availability of key raw materials, such as water for manufacturing or specific agricultural yields, driving up costs.

- Regulatory changes: Governments are implementing stricter environmental regulations, which can affect production methods and the carbon footprint of logistics.

- Consumer demand shifts: Growing consumer awareness is pushing for more sustainable and ethically sourced products, influencing supply chain design and material sourcing.

Global environmental regulations are a significant driver for Allison, pushing for cleaner transportation solutions. The increasing demand for electric and hybrid powertrains, exemplified by the EU's Fit for 55 package targeting a 55% CO2 reduction by 2030, directly influences Allison's product development and market strategy.

Allison's response includes substantial investment in electric axles like the eGen Power™ series, aligning with the automotive industry's electrification trend and emission reduction mandates. This strategic pivot addresses the growing market need for sustainable commercial vehicle technologies.

The company is also focused on sustainable sourcing and waste management, aiming for high waste diversion rates, with a reported 75% diversion in North American facilities in 2024. Furthermore, Allison is committed to increasing its renewable energy usage, targeting 50% of global electricity from renewable sources by the end of 2025.

Climate change impacts Allison through supply chain disruptions caused by extreme weather, with a growing number of corporations (65% in 2024) integrating climate risk into their supply chain management to ensure operational continuity.

| Environmental Factor | Impact on Allison | Data/Initiative |

|---|---|---|

| Greenhouse Gas Emissions Regulations | Increased demand for low/zero-emission powertrains | EU Fit for 55: 55% CO2 reduction by 2030; Allison's eGen Power™ electric axles |

| Sustainable Sourcing | Focus on ethically sourced materials, potential cost increases | Increased demand for recycled aluminum in 2024; 15% projected growth in sustainable materials market by 2025 |

| Waste Management | Adherence to strict waste handling and recycling protocols | 75% waste diversion rate in North American facilities (2024); ISO 14001 certification |

| Energy Usage & Renewables | Shift towards renewable energy and energy efficiency | 5% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2019); Target: 50% renewable electricity by end of 2025 |

| Climate Change Risks | Supply chain disruptions due to extreme weather | 65% of large corporations incorporating climate risk in supply chains (2024); Increased frequency of extreme weather events |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Allison draws upon a robust blend of data sources, including official government publications, reputable industry analysis firms, and international economic databases. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.