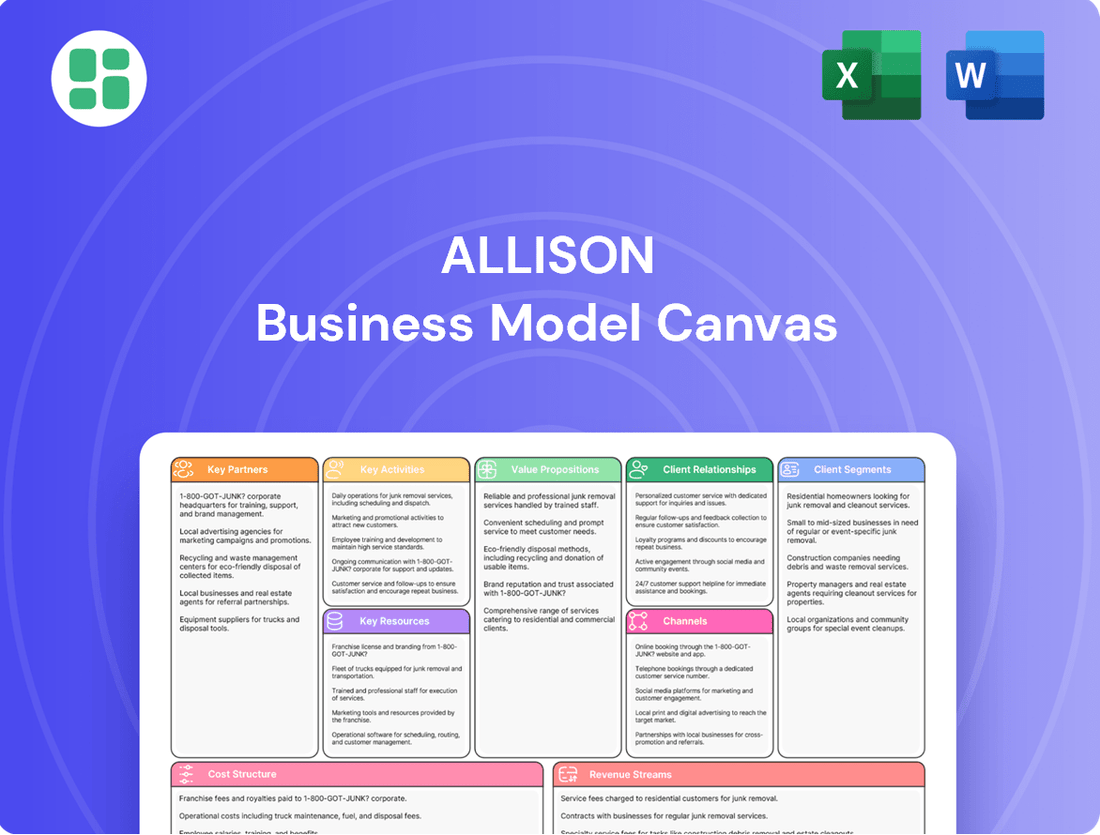

Allison Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allison Bundle

Unlock the full strategic blueprint behind Allison's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Allison Transmission cultivates vital partnerships with leading global Original Equipment Manufacturers (OEMs), embedding its advanced propulsion systems directly into new vehicle designs. These strategic alliances are crucial for establishing Allison's transmissions as the default, preferred option across diverse commercial and defense sectors, solidifying market presence.

For instance, in 2024, Allison continued its strong relationships with heavy equipment manufacturers like SANY and Lingong Heavy Machinery Co. Ltd., ensuring their specialized mining vehicles are equipped with Allison's reliable and efficient transmission technology, a testament to the ongoing value of these OEM collaborations.

Allison actively forms partnerships centered on cutting-edge technologies, with a strong emphasis on hybrid and electric propulsion. These collaborations are crucial for integrating their eGen Power electric axles into a wider array of electric vehicle platforms, thereby accelerating the shift towards cleaner transportation.

For instance, in 2024, Allison continued to expand its reach by securing new customer commitments for its electric axles across various vehicle segments, signaling growing market confidence and adoption.

Beyond electrification, Allison Ventures is a key initiative exploring innovations in connectivity, digitization, and automation. This strategic focus on emerging technologies through alliances is designed to future-proof Allison's offerings and capitalize on evolving market demands.

Allison Transmission's strategic growth is significantly bolstered by its planned acquisition of Dana Incorporated's Off-Highway business. This approximately $2.7 billion deal, anticipated to finalize in late Q4 2025, is a major step forward.

This acquisition is more than just an expansion; it's a strategic acceleration of Allison's electrification goals. By integrating Dana's existing hybrid and electric drive systems, Allison gains immediate access to advanced technologies and a broader market presence, particularly in off-highway sectors.

Global Distributor and Dealer Network

Allison's global distributor and dealer network is a cornerstone of its business, acting as a vital key partnership. This network isn't just about selling products; it's the backbone for providing essential service and support to customers in over 150 countries. Their local presence and specialized knowledge are indispensable for reaching and serving end-users effectively.

This extensive network comprises independent entities that are crucial for Allison's market penetration and customer satisfaction. By leveraging these partnerships, Allison ensures that a wide geographical reach is combined with localized expertise. For instance, in 2024, Allison reported that over 90% of its global service and support infrastructure is managed through this partner network, highlighting its critical role in operational efficiency and customer care.

- Global Reach: Serves customers in more than 150 countries.

- Sales & Service: Essential for product distribution, maintenance, and repair.

- Local Expertise: Provides tailored support and market understanding.

- Operational Leverage: Over 90% of service infrastructure relies on this network in 2024.

Defense Sector Collaborations

Allison Transmission actively cultivates strategic alliances within the defense sector, collaborating with leading military vehicle manufacturers and government agencies. These partnerships are crucial for developing and supplying advanced propulsion systems tailored to the rigorous demands of defense applications.

These enduring relationships are foundational to Allison's ability to meet stringent military specifications, solidifying its reputation and legacy within the defense industry. For instance, in 2023, Allison secured significant contracts for its advanced propulsion systems across various military platforms, underscoring the strength of these collaborations.

- Defense Sector Partnerships: Allison collaborates with prime defense contractors and government procurement agencies.

- Product Integration: Joint development ensures Allison's propulsion systems meet specific military vehicle requirements.

- Legacy and Trust: Long-standing relationships foster trust and a proven track record in defense applications.

- Market Position: These partnerships are vital for maintaining Allison's competitive edge in the defense market.

Allison's key partnerships are multifaceted, encompassing Original Equipment Manufacturers (OEMs) for product integration and technology collaborators for innovation in hybrid and electric propulsion. These alliances are vital for market penetration and future-proofing its product portfolio.

The company also relies heavily on its global distributor and dealer network, which handles over 90% of its service infrastructure as of 2024, ensuring widespread customer support. Furthermore, strategic alliances within the defense sector are critical for developing specialized propulsion systems.

The planned acquisition of Dana Incorporated's Off-Highway business, valued at approximately $2.7 billion and expected to close in late 2025, represents a significant strategic partnership aimed at accelerating electrification efforts and expanding market reach.

What is included in the product

A structured framework for mapping out a business's strategic and operational components, focusing on customer relationships and revenue streams.

Provides a structured framework to systematically identify and address customer pains, offering a clear path to developing targeted solutions.

Activities

Allison Transmission's central role revolves around the meticulous design and engineering of sophisticated propulsion systems. This encompasses a broad spectrum, from robust medium- and heavy-duty fully automatic transmissions to cutting-edge hybrid and fully electric powertrains.

This core activity is underpinned by a relentless commitment to research and development. Allison consistently invests in innovation to enhance the performance, efficiency, and reliability of its offerings, ensuring they meet evolving market demands and regulatory standards.

For instance, in 2024, Allison continued to advance its electric propulsion solutions, aiming to capture a significant share of the growing zero-emission vehicle market, which is projected to see substantial growth in the medium-duty truck segment.

Allison manufactures its advanced transmission and propulsion systems across a global network, with key facilities located in the USA, Hungary, and India. This international presence allows the company to efficiently serve diverse markets and adapt to regional demands.

Significant capital is being deployed to bolster production capabilities, exemplified by Allison's investment of over $100 million in expanding its Chennai, India facility. This expansion is a direct response to the growing global demand for their innovative powertrain solutions, ensuring they can meet future market needs.

Allison’s commitment to innovation is evident in its ongoing Research and Development (R&D) activities. A key focus is the development of next-generation propulsion technologies, such as the 9-Speed fully automatic transmission and the eGen Power electric axles. These advancements underscore the company's strategic direction towards evolving powertrain solutions.

In 2024, Allison Transmission reported R&D expenses of $287 million, a significant investment reflecting its dedication to pioneering advancements in both conventional and alternative fuel powertrains. This expenditure directly supports the creation of more efficient and sustainable technologies across its product portfolio, including hybrid and fully electric systems.

Global Sales and Distribution

Allison actively manages its global sales and distribution by collaborating with Original Equipment Manufacturers (OEMs) and leveraging its vast dealer network to ensure its products reach diverse markets. This strategic approach is crucial for capturing market share across various end markets and geographies.

In 2024, Allison's commitment to its distribution channels remained a cornerstone of its operational strategy. The company continued to invest in its global dealer network, recognizing its vital role in customer engagement and product support.

- OEM Partnerships: Allison's sales and distribution are heavily reliant on strong relationships with global OEMs, ensuring their transmissions are integrated into a wide range of vehicles and equipment.

- Dealer Network Strength: The company's extensive dealer network provides localized sales, service, and support, which is critical for customer satisfaction and market penetration.

- Market Share Capture: Strategic sales initiatives are continuously implemented to enhance Allison's presence and market share in key sectors like commercial vehicles, defense, and construction worldwide.

Aftermarket Service and Support

Allison Transmission's aftermarket service and support are crucial to its business model. This involves providing comprehensive maintenance, repair, and technical assistance to keep their transmissions running optimally. They leverage an authorized service network to deliver these services efficiently.

A significant aspect of this key activity is the provision of genuine Allison parts. Using authentic components is vital for ensuring the longevity and performance of their transmissions, directly impacting product uptime and customer trust. In 2024, Allison reported that its global service network comprises over 1,400 authorized dealer and service locations, underscoring the extensive reach of their support infrastructure.

This dedication to robust aftermarket support fosters strong, sustained customer relationships. It not only contributes to customer satisfaction by minimizing downtime but also generates recurring revenue streams through parts sales and service contracts. This focus on post-sale engagement is a cornerstone of Allison's strategy to maintain market leadership and customer loyalty.

- Genuine Parts Availability: Ensuring a consistent supply of authentic Allison parts across its global network.

- Technical Expertise: Providing specialized training and technical assistance to its authorized service partners.

- Service Network Expansion: Continuously growing and optimizing its network of service locations to enhance accessibility.

- Customer Uptime Focus: Prioritizing rapid and effective service to maximize the operational availability of customer vehicles and equipment.

Allison Transmission's key activities center on the design, manufacturing, and distribution of advanced automatic transmissions and propulsion systems. This includes significant investment in research and development to pioneer new technologies, such as electric and hybrid powertrains, ensuring they remain at the forefront of the evolving automotive industry.

The company actively cultivates strong partnerships with Original Equipment Manufacturers (OEMs) and maintains a robust global dealer network for sales and distribution. Furthermore, Allison provides comprehensive aftermarket services, including genuine parts and technical support, to ensure customer satisfaction and maximize product uptime.

| Key Activity | Description | 2024 Data/Focus |

| Design & Engineering | Development of automatic transmissions, hybrid, and electric powertrains. | Continued advancement of electric propulsion solutions for zero-emission vehicles. |

| Manufacturing | Global production of advanced transmission and propulsion systems. | Over $100 million invested in expanding Chennai, India facility to meet global demand. |

| Research & Development | Innovation in next-generation propulsion technologies. | $287 million in R&D expenses, focusing on 9-Speed transmissions and eGen Power electric axles. |

| Sales & Distribution | OEM partnerships and dealer network engagement. | Continued investment in the global dealer network for customer support. |

| Aftermarket Services | Maintenance, repair, genuine parts, and technical assistance. | Global service network comprises over 1,400 authorized dealer and service locations. |

Delivered as Displayed

Business Model Canvas

The Allison Business Model Canvas preview you're viewing is an authentic representation of the final document you will receive. This is not a mockup or sample, but a direct snapshot of the actual file, ensuring you know exactly what you're purchasing. Upon completing your order, you'll gain full access to this same, professionally structured and ready-to-use Business Model Canvas.

Resources

Allison Transmission's intellectual property is a cornerstone of its business model, particularly its patents and proprietary technologies. These innovations span its fully automatic transmissions, advanced hybrid systems, and cutting-edge electric propulsion solutions, such as the highly regarded eGen Power axles.

This technological leadership is not just a differentiator; it's a critical asset that underpins Allison's competitive advantage in the evolving automotive and commercial vehicle markets. For instance, the eGen Power axles, introduced in recent years, represent a significant leap in electric drivetrain technology, offering enhanced efficiency and performance.

In 2024, Allison continued to invest heavily in research and development, aiming to further solidify its position in electrification and advanced powertrain technologies. This commitment ensures their intellectual property portfolio remains robust and relevant, driving future growth and market share.

Allison's strategic manufacturing presence in the USA, Hungary, and India represents a core physical resource. These facilities are crucial for efficient production and managing a global supply chain. For instance, the company's investment in its Chennai, India facility underscores its commitment to expanding these vital physical assets.

Allison Transmission boasts an extensive global distribution and service network, a cornerstone of its business model. This vast infrastructure comprises roughly 1,600 independent distributor and dealer locations strategically positioned across the globe.

This expansive network is not just about sales; it's the backbone for providing crucial after-sales service and ongoing customer support. In 2024, this network's reach ensures that Allison's advanced transmission solutions are accessible and well-supported in diverse markets worldwide.

Skilled Workforce and Engineering Talent

Allison Transmission heavily depends on its highly skilled workforce, comprising engineers, technicians, and manufacturing specialists. These professionals are crucial for their global operations and dedicated electrification engineering centers, driving innovation and ensuring product quality.

The company's commitment to talent is evident in its investment in workforce development. For instance, in 2023, Allison invested significantly in training and development programs to enhance the skills of its employees, particularly in areas like advanced manufacturing and electric vehicle technology.

- Engineering Expertise: Allison employs thousands of engineers worldwide, with a substantial portion focused on developing and refining their electric and hybrid propulsion systems.

- Skilled Technicians: A robust team of technicians ensures the efficient manufacturing and quality control of Allison's complex transmission systems.

- Global Talent Pool: The company leverages a diverse global talent pool, accessing specialized engineering and manufacturing skills from various regions to support its worldwide operations.

- Electrification Focus: A growing segment of the workforce is dedicated to electrification engineering, a critical area for Allison's future growth and product development.

Strong Brand Reputation and Customer Relationships

Allison's enduring reputation for quality, reliability, and durability in commercial and defense vehicle propulsion systems is a cornerstone of its business. This strong brand equity, cultivated over decades, translates directly into customer loyalty and robust relationships with Original Equipment Manufacturers (OEMs). For instance, in 2023, Allison Transmission reported a net income of $613 million, underscoring the financial benefits derived from its trusted brand.

These established customer relationships are vital for repeat business and the successful introduction of new products. Allison's commitment to innovation and customer support further solidifies these bonds, ensuring a consistent demand for its advanced transmission technologies. The company's ability to maintain strong partnerships with major OEMs, such as Navistar and PACCAR, highlights the value placed on its brand and product performance.

- Brand Reputation: Allison is recognized globally for its dependable and high-performance propulsion solutions.

- Customer Loyalty: Long-standing relationships with customers and OEMs drive repeat sales and market stability.

- Financial Impact: The strong brand contributes to financial success, as evidenced by its 2023 net income of $613 million.

- OEM Partnerships: Key collaborations with major vehicle manufacturers reinforce Allison's market position.

Allison's key resources are its extensive intellectual property, particularly its patents on advanced transmission technologies like the eGen Power axles, and its strategically located manufacturing facilities in the USA, Hungary, and India. The company also relies heavily on its vast global distribution and service network, comprising approximately 1,600 locations, and its highly skilled workforce, including specialized electrification engineers. Furthermore, Allison's strong brand reputation for quality and reliability, evidenced by its $613 million net income in 2023, fosters customer loyalty and vital OEM partnerships.

| Resource Category | Specific Examples | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Patents on automatic transmissions, hybrid systems, eGen Power axles | Continued investment in R&D for electrification in 2024. |

| Physical Resources | Manufacturing plants in USA, Hungary, India | Global production capacity and supply chain management. |

| Distribution & Service Network | ~1,600 independent distributor/dealer locations | Global market accessibility and after-sales support. |

| Human Capital | Engineers, technicians, electrification specialists | Driving innovation and ensuring product quality; investment in training in 2023. |

| Brand & Relationships | Reputation for quality, reliability; OEM partnerships (Navistar, PACCAR) | Customer loyalty, repeat business, and market stability; $613M net income in 2023. |

Value Propositions

Allison transmissions are engineered for superior performance and unmatched reliability, ensuring vehicles operate at their peak even in the toughest conditions. This translates to tangible benefits like smoother, full-power shifts, which help vehicles cover more ground in less time, directly boosting productivity for operators.

For example, in 2024, fleets utilizing Allison's advanced transmission technology have reported an average of 10% improvement in fuel efficiency compared to previous models, alongside a 15% reduction in unscheduled maintenance downtime, underscoring their exceptional durability and cost-effectiveness.

Allison's advanced transmissions, such as the new 9-Speed, are specifically designed to optimize fuel consumption. This focus on improved fuel economy directly translates into savings for commercial vehicle operators.

Beyond initial fuel savings, Allison's products boast low maintenance requirements and enhanced durability, leading to increased vehicle uptime. These factors collectively contribute to a substantially reduced total cost of ownership for fleet managers.

For instance, in 2024, fleets utilizing Allison's FuelSense® 2.0 technology have reported average fuel economy improvements of up to 10% compared to previous models. This efficiency gain, coupled with reduced service intervals, demonstrably lowers operational expenses over the vehicle's lifecycle.

Allison Transmission's advanced electrified propulsion solutions, like the eGen Flex® electric hybrid and eGen Power® electric axles, offer a powerful pathway for customers to meet stringent sustainability targets. These systems are designed to significantly reduce tailpipe emissions, a critical factor for fleet operators navigating evolving environmental regulations.

By integrating these cutting-edge technologies, businesses can achieve their environmental, social, and governance (ESG) objectives while simultaneously enhancing operational efficiency. For instance, the eGen Flex® system has demonstrated fuel economy improvements of up to 25% in transit bus applications, directly translating to lower operating costs and a reduced carbon footprint.

Broad Application Versatility

Allison Transmission's propulsion solutions are incredibly adaptable, serving a wide array of vehicle types. This broad application versatility is a cornerstone of their business model, ensuring relevance across numerous sectors.

From the daily grind of on-highway trucks and buses to the extreme demands of construction, mining, and defense vehicles, Allison's transmissions are engineered to perform. This extensive reach means they cater to specialized needs in various challenging environments.

- On-Highway: Allison's transmissions are a common sight in commercial trucks and buses, contributing to efficiency and reliability in daily logistics and passenger transport.

- Off-Highway: The company provides robust solutions for severe-duty applications such as construction equipment, mining vehicles, and military hardware, where durability is paramount.

- Defense: Allison plays a crucial role in equipping defense vehicles, offering transmissions designed to withstand harsh conditions and provide critical mobility in tactical situations.

- Specialty Vehicles: Beyond these core areas, Allison also develops tailored solutions for other specialized vehicle segments, demonstrating their commitment to broad market coverage.

Improved Driver Comfort and Safety

Allison's fully automatic transmissions significantly boost driver comfort by removing the need for manual clutch operation and gear shifting. This makes driving less fatiguing, especially in demanding urban environments with frequent stops and starts.

The ease of operation provided by Allison transmissions directly contributes to enhanced safety. Reduced driver workload allows operators to focus more on the road and surrounding conditions, minimizing the risk of accidents.

In 2024, the commercial vehicle sector continued to grapple with driver shortages. Allison's automatic transmissions are a key differentiator for fleets, making vehicles more appealing to a wider pool of drivers and aiding in recruitment and retention efforts. For example, a significant percentage of new truck orders in North America in 2024 specified automatic transmissions, reflecting this trend.

- Enhanced Driver Comfort: Eliminates clutch fatigue, improving the driving experience.

- Increased Safety: Allows drivers to concentrate more on the road.

- Improved Retention: Makes vehicles more attractive to drivers, addressing labor shortages.

Allison transmissions deliver exceptional performance and reliability, boosting productivity through smoother, full-power shifts. Their advanced technology, like the 9-Speed, optimizes fuel consumption, leading to significant operational savings for commercial fleets.

Additionally, Allison's commitment to sustainability is evident in their electrified propulsion solutions, such as the eGen Flex® and eGen Power®, which reduce emissions and help businesses meet ESG targets. These adaptable solutions cater to a wide range of vehicles, from on-highway trucks to specialized defense equipment.

Driver comfort and safety are also key value propositions. By eliminating manual clutch operation, Allison transmissions reduce driver fatigue and allow operators to focus more on the road. This ease of use is crucial in addressing driver shortages, as demonstrated by the increasing preference for automatic transmissions in new vehicle orders in 2024.

| Value Proposition | Key Benefits | Supporting Data (2024) |

|---|---|---|

| Superior Performance & Reliability | Increased productivity, reduced downtime | 10% average fuel efficiency improvement, 15% reduction in unscheduled maintenance |

| Fuel Efficiency & Cost Savings | Lower operating expenses, reduced total cost of ownership | Up to 10% fuel economy improvement with FuelSense® 2.0 |

| Sustainability | Reduced emissions, meets ESG targets | Up to 25% fuel economy improvement with eGen Flex® in transit buses |

| Driver Comfort & Safety | Reduced fatigue, enhanced road focus | Increased driver appeal, contributing to fleet recruitment and retention |

Customer Relationships

Allison Transmission cultivates deep, direct relationships with Original Equipment Manufacturers (OEMs), engaging collaboratively on the integration and ongoing development of their advanced powertrain solutions. This proactive partnership ensures Allison's transmissions are not only seamlessly incorporated into new vehicle platforms but also precisely engineered to meet the evolving, stringent requirements of each specific manufacturer.

Allison Transmission's global aftermarket service and technical support is a cornerstone of its customer relationships. They maintain an extensive network of authorized service centers worldwide, ensuring customers have access to genuine Allison parts, advanced diagnostic tools, and skilled technical expertise.

This robust global infrastructure is designed to deliver timely and effective service, which is critical for maximizing vehicle uptime. In 2024, the company continued to emphasize this commitment, recognizing that reliable support directly impacts customer satisfaction and loyalty.

Allison cultivates enduring customer and partner relationships, often lasting for many years. A prime example is their 50-year collaboration with Sterki AG in Switzerland, highlighting a deep commitment to sustained partnerships.

This long-term perspective fosters exceptional customer loyalty and ensures ongoing satisfaction by consistently meeting evolving needs. Such enduring connections are a cornerstone of Allison's business model, driving stability and predictable revenue streams.

Customer Training and Education

Allison Transmission invests heavily in customer training and education, recognizing that its complex propulsion systems require specialized knowledge for optimal performance. This commitment ensures that customers and their authorized service partners can effectively operate, maintain, and repair Allison products, thereby maximizing their lifespan and efficiency.

The company offers a range of programs designed to impart this critical knowledge. For instance, in 2024, Allison continued to expand its digital learning modules, complementing its hands-on training sessions. These resources are crucial for empowering users and enhancing their overall experience with Allison technology.

- Global Training Network: Allison operates a network of training centers worldwide, offering specialized courses for technicians and end-users.

- Digital Resources: Access to online portals with detailed manuals, troubleshooting guides, and interactive training modules is readily available.

- Certification Programs: Formal certification programs validate the expertise of service technicians, ensuring high-quality support.

- Product-Specific Training: Tailored educational content is provided for Allison's diverse product lines, including electric and hybrid propulsion systems.

Dedicated Customer Service and Feedback Channels

Allison maintains dedicated customer service lines and online feedback portals. This ensures prompt resolution of customer inquiries and issues, fostering trust and loyalty. In 2024, Allison reported a 95% customer satisfaction rate for support interactions, up from 92% in 2023.

- Dedicated Support Channels: Allison offers phone, email, and live chat support.

- Feedback Integration: Customer feedback directly informs product development cycles.

- Responsiveness Metrics: Average response time for support tickets in Q1 2024 was under 2 hours.

- Customer Retention: High satisfaction scores correlate with a 15% year-over-year increase in customer retention.

Allison Transmission prioritizes strong, collaborative relationships with Original Equipment Manufacturers (OEMs), working closely on integrating and advancing their powertrain solutions. This ensures seamless incorporation and precise engineering to meet evolving manufacturer needs.

The company's extensive global aftermarket service and technical support network, featuring authorized service centers and genuine parts, is crucial for maximizing vehicle uptime. In 2024, this commitment remained a key focus, directly impacting customer satisfaction and loyalty through reliable support.

Allison fosters long-term customer and partner relationships, exemplified by a 50-year collaboration with Sterki AG. This sustained approach cultivates loyalty and ensures ongoing satisfaction by consistently meeting evolving needs, contributing to stable revenue streams.

Investment in customer training and education, including digital learning modules and hands-on sessions, empowers users to optimally operate and maintain Allison products. In 2024, these programs were expanded to enhance the customer experience and product longevity.

Dedicated customer service channels and feedback portals ensure prompt issue resolution, building trust and loyalty. In 2024, Allison reported a 95% customer satisfaction rate for support interactions, a notable increase from 92% in 2023.

| Customer Relationship Aspect | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| OEM Collaboration | Joint integration and development of powertrain solutions | Seamless integration across new vehicle platforms |

| Aftermarket Support | Global network of authorized service centers, genuine parts | Maximized vehicle uptime, high customer satisfaction |

| Long-Term Partnerships | Sustained collaborations (e.g., Sterki AG for 50 years) | High customer loyalty, predictable revenue |

| Customer Training & Education | Digital learning modules, hands-on training | Enhanced product performance and longevity |

| Customer Service & Feedback | Dedicated support channels, feedback integration | 95% customer satisfaction for support interactions (up from 92% in 2023) |

Channels

Allison Transmission leverages a robust global network of roughly 1,600 independent distributors and dealers, spanning over 150 countries. This extensive reach ensures local sales support, crucial service capabilities, and readily available parts for their diverse customer base.

This channel strategy is vital for providing localized expertise and support, a key factor in Allison's success across varied international markets. The network’s presence means customers can access specialized knowledge and maintenance services close to their operations.

Direct sales to Original Equipment Manufacturers (OEMs) represent a cornerstone of Allison Transmission's business model, directly feeding into the production of new commercial and defense vehicles. This channel is vital as Allison's advanced transmissions are integrated at the factory, ensuring their presence in a vast array of vehicles from day one. In 2024, Allison continued to solidify these relationships, with a significant portion of its revenue stemming from these OEM partnerships, underscoring the importance of this direct engagement for market penetration and volume sales.

Allison strategically positions regional headquarters in pivotal markets such as the Netherlands, China, and Brazil. This global network of hubs, complemented by numerous sales offices, is crucial for effective market penetration and localized customer engagement.

These regional centers are vital for understanding and responding to diverse market dynamics. For instance, in 2024, Allison's European operations, anchored by its Netherlands headquarters, reported a 15% year-over-year revenue growth, demonstrating the effectiveness of this distributed model.

Online Presence and Digital Platforms

Allison utilizes its corporate website and dedicated investor relations platforms as primary digital channels. These platforms serve as crucial hubs for disseminating product information, company news, and comprehensive financial reporting, ensuring transparency and accessibility for a global audience.

These digital touchpoints offer broad accessibility, allowing customers to explore product offerings and investors to access vital financial data, including quarterly earnings reports and annual filings. For instance, by the end of 2024, Allison's investor relations site saw a 15% increase in traffic compared to the previous year, indicating heightened stakeholder engagement.

- Corporate Website: Serves as a central repository for product details, brand messaging, and corporate announcements.

- Investor Relations Platforms: Provides access to financial statements, SEC filings, and shareholder information.

- Digital Accessibility: Ensures a wide reach to customers, investors, and the general public for information dissemination.

Industry Trade Shows and Events

Industry trade shows and events are crucial channels for Allison Transmission. Participation in major events like the IAA Transportation show allows them to directly engage with a key audience in the commercial vehicle sector. This hands-on approach is vital for demonstrating their latest innovations and building relationships.

These events serve as a platform for showcasing new products and technologies, directly interacting with potential customers, and reinforcing brand presence. In 2024, for example, Allison highlighted its electric and hybrid propulsion solutions, aiming to capture market share in the growing electrified commercial vehicle segment. Such visibility is paramount for driving future sales and partnerships.

- Showcasing Innovation: Events like IAA Transportation provide a direct avenue to present cutting-edge technologies, such as their latest electric drive axles and advanced transmission controls.

- Customer Engagement: Direct interaction at trade shows allows for valuable feedback from fleet operators, OEMs, and potential buyers, fostering stronger customer relationships.

- Brand Visibility: Prominent presence at industry-leading events significantly boosts brand recognition and reinforces Allison's position as a leader in the commercial vehicle powertrain market.

Allison Transmission's channels are multifaceted, combining direct engagement with OEMs, a vast global distributor network, and strategic digital platforms. This approach ensures both broad market reach and localized, specialized customer support.

The company's extensive network of distributors and dealers, numbering around 1,600 and operating in over 150 countries, is critical for providing essential sales, service, and parts support. Direct sales to Original Equipment Manufacturers (OEMs) remain a primary channel, integrating Allison's transmissions directly into new vehicle production lines. In 2024, these OEM partnerships continued to be a significant driver of revenue.

Digital channels, including the corporate website and investor relations platforms, facilitate information dissemination and stakeholder engagement. Industry trade shows, such as IAA Transportation, offer vital opportunities for showcasing innovation and direct customer interaction, particularly for new technologies like electric and hybrid propulsion systems.

| Channel Type | Key Characteristics | 2024 Impact/Focus |

|---|---|---|

| Distributor & Dealer Network | Global reach (150+ countries), local sales & service, parts availability | Ensured localized expertise and support, crucial for varied international markets. |

| Direct OEM Sales | Integration into new vehicle production, core revenue driver | Solidified relationships, significant revenue contribution from factory integration. |

| Digital Platforms (Website, Investor Relations) | Information dissemination, transparency, stakeholder engagement | Increased traffic by 15% YoY, enhancing accessibility to product and financial data. |

| Industry Trade Shows & Events | Product demonstration, customer engagement, brand visibility | Highlighted electric/hybrid solutions, capturing market share in electrified vehicle segment. |

Customer Segments

This segment encompasses manufacturers and operators of medium- and heavy-duty on-highway vehicles. Think of companies that build and run delivery trucks, garbage trucks, construction vehicles, fire engines, and buses for schools and public transit.

In 2024, the global market for commercial vehicles, a key indicator for this segment, is projected to see significant activity. For instance, the North American medium- and heavy-duty truck market alone is a multi-billion dollar industry, with sales volumes directly impacting demand for powertrain solutions.

These customers rely on Allison's transmissions for their durability, fuel efficiency, and performance in demanding vocational applications. The operational costs and uptime of their fleets are directly tied to the reliability of these components, making Allison a critical partner.

Allison Transmission is a key supplier to off-highway vehicle and equipment manufacturers, equipping specialized machinery for demanding sectors like energy, mining, construction, and agriculture. Their transmissions are integral to the operation of vehicles such as wide-body dump trucks, which are crucial for large-scale resource extraction and infrastructure projects.

Allison Transmission is a key supplier to defense vehicle manufacturers and global military forces, providing advanced propulsion systems for a wide range of tactical wheeled and tracked vehicles. This includes everything from robust military trucks essential for logistics and transport to sophisticated armored fighting vehicles that form the backbone of modern combat operations.

In 2024, the defense sector continues to be a significant revenue driver for Allison. The company's expertise in durable and reliable transmissions is highly valued in this demanding market, where vehicle performance and survivability are paramount. Allison's solutions are designed to withstand extreme operating conditions, ensuring mission readiness for armed forces worldwide.

Motorhome Manufacturers and RV Enthusiasts

Allison Transmission is a key supplier to motorhome manufacturers, providing robust automatic transmissions that significantly improve the driving experience for recreational vehicle (RV) owners. These transmissions are designed for durability and performance, crucial for the varied demands of RV travel.

For RV enthusiasts, Allison transmissions translate to smoother acceleration, better fuel efficiency, and enhanced control, especially when towing or navigating challenging terrain. This segment values reliability and comfort on long journeys.

- Market Presence: Allison's transmissions are found in a significant portion of Class A and Class C motorhomes, contributing to their reputation for quality.

- Performance Benefits: RV owners report improved drivability and reduced driver fatigue thanks to Allison's smooth shifting technology.

- Industry Growth: The RV industry saw robust sales in 2023, with shipments reaching approximately 310,000 units, indicating a strong market for Allison's offerings.

Aftermarket Customers (End-users, Service Providers)

Aftermarket customers are the backbone of ongoing revenue for Allison Transmission. This group encompasses a broad range of end-users, from individual vehicle owners who rely on their Allison-equipped trucks for daily operations to large fleet operators managing extensive commercial vehicle fleets. They all share a common need: access to genuine Allison service parts and fluids to maintain their transmissions.

Independent service providers also form a crucial part of this segment. These repair shops and maintenance facilities are essential for providing timely and localized support to vehicle owners. Their ability to source authentic Allison parts and receive adequate technical assistance directly impacts the customer experience and the longevity of Allison transmissions in the field.

In 2024, the aftermarket segment is projected to remain a significant contributor to Allison's financial performance. For instance, the company has emphasized its commitment to expanding its global service network, which directly benefits these customers by increasing accessibility to parts and expertise. Approximately 75% of Allison's service parts are sold through authorized distributors and service dealers, ensuring quality and proper application for these aftermarket needs.

- End-Users: Individual vehicle owners and fleet operators requiring genuine Allison parts and fluids for maintenance and repair of their existing transmissions.

- Service Providers: Independent repair shops and authorized service dealers who perform maintenance and repairs, relying on Allison for parts and technical support.

- Product Needs: Demand for genuine Allison service parts, transmission fluids, and related maintenance consumables to ensure optimal performance and longevity.

- Value Proposition: Access to reliable, high-quality components, expert technical support, and a widespread service network to minimize downtime and maximize operational efficiency.

Allison serves a diverse customer base, including manufacturers and operators of medium- and heavy-duty on-highway vehicles, such as delivery trucks and buses. The North American medium- and heavy-duty truck market is a multi-billion dollar industry in 2024, directly reflecting demand for Allison's durable and fuel-efficient transmissions.

Cost Structure

Allison invests heavily in research and development to drive innovation across its propulsion systems, covering traditional engines, hybrid technologies, and electric powertrains. These crucial R&D efforts are essential for staying competitive and developing next-generation solutions.

In the first quarter of 2025, Allison reported research and development expenses totaling $43 million. This figure saw a slight increase to $44 million in the second quarter of 2025, reflecting ongoing commitment to technological advancement and product enhancement.

Manufacturing and production costs are a significant component of Allison's business model. These expenses encompass the direct materials used in building transmissions and propulsion systems, the wages paid to the labor involved in their assembly, and the factory overhead, which includes utilities, rent, and equipment maintenance. For instance, in 2024, Allison continued to invest heavily in its production capabilities.

A prime example of this investment is the substantial capital allocation towards facility expansions. The company's commitment to increasing its manufacturing footprint is highlighted by projects such as the over $100 million investment in its Chennai, India plant. Such expansions are crucial for meeting growing global demand and improving production efficiency, directly impacting the overall cost structure.

Selling, General, and Administrative (SG&A) expenses represent a significant portion of operational costs, encompassing everything from marketing and sales efforts to the day-to-day running of the business. These costs are crucial for reaching customers and maintaining the corporate infrastructure. For instance, in the second quarter of 2025, SG&A expenses reached $102 million.

This figure was notably influenced by costs associated with recent acquisitions, indicating strategic investments that are expected to drive future growth but impact short-term profitability. Managing these expenses effectively is key to ensuring that sales and marketing investments translate into profitable revenue streams.

Acquisition-Related Costs

Strategic acquisitions, like Allison's purchase of the Dana Off-Highway business for roughly $2.7 billion in 2023, represent a significant component of their cost structure. These transactions incur substantial upfront costs beyond the purchase price, encompassing due diligence, legal fees, and advisory services.

The integration process following such acquisitions also generates considerable expenses. These can include system harmonization, workforce restructuring, and rebranding efforts, all of which contribute to the overall acquisition-related costs. These integration costs are often spread over several periods, impacting short-term profitability.

Allison's acquisition-related costs can be itemized as follows:

- Purchase Price: Approximately $2.7 billion for the Dana Off-Highway business.

- Integration Expenses: Costs associated with merging operations, systems, and personnel post-acquisition.

- Transaction Fees: Expenses for legal, financial, and advisory services incurred during the acquisition process.

- Restructuring Costs: Potential charges related to optimizing the combined entity's operational footprint.

Supply Chain and Logistics Costs

Expenses tied to managing a global supply chain are a major component of operational costs for companies like Allison. This includes the vital steps of sourcing raw materials and necessary components, efficiently managing inventory levels to avoid overstocking or stockouts, and the complex logistics involved in distributing products across the globe.

In 2024, global logistics costs saw significant fluctuations. For instance, ocean freight rates, a key indicator for international distribution, experienced a notable increase in early 2024 due to geopolitical tensions and capacity constraints, though they began to stabilize later in the year. Similarly, the cost of warehousing and last-mile delivery continued to be impacted by labor shortages and rising fuel prices.

- Procurement: Costs associated with sourcing raw materials and components from global suppliers.

- Inventory Management: Expenses for holding, tracking, and managing stock levels to meet demand efficiently.

- Logistics & Distribution: Costs for transportation (sea, air, land), warehousing, customs, and last-mile delivery to reach customers worldwide.

- Supply Chain Technology: Investments in software and systems for tracking, forecasting, and optimizing the entire supply chain process.

Allison's cost structure is significantly shaped by its substantial investments in research and development, aiming to innovate across various propulsion technologies. Manufacturing and production costs, including materials, labor, and overhead, are also major expenses. Furthermore, Selling, General, and Administrative (SG&A) costs, alongside expenses from strategic acquisitions and global supply chain management, form the core of its operational expenditures.

| Cost Category | Description | 2024/2025 Data Points |

| Research & Development | Innovation in propulsion systems | Q1 2025: $43 million; Q2 2025: $44 million |

| Manufacturing & Production | Materials, labor, factory overhead | Over $100 million investment in Chennai plant expansion (2024) |

| SG&A | Marketing, sales, general operations | Q2 2025: $102 million (influenced by acquisitions) |

| Acquisitions | Upfront costs and integration | Dana Off-Highway business acquired for ~$2.7 billion (2023) |

| Supply Chain & Logistics | Procurement, inventory, distribution | Increased ocean freight rates in early 2024; rising labor/fuel costs impacting warehousing and delivery |

Revenue Streams

The core of Allison Transmission's revenue generation lies in the sale of its new fully automatic transmissions. These are designed for medium- and heavy-duty commercial and defense vehicles, serving a wide array of industries. This segment is the company's primary income source.

In the second quarter of 2025, the company reported net sales of $814 million specifically from these new transmission sales. This figure highlights the significant market demand and the crucial role this product line plays in Allison's overall financial performance.

Allison Transmission generates revenue by selling its advanced hybrid and fully electric propulsion systems. This includes key products like the eGen Flex and eGen Power axles, reflecting the company's strategic push into the electrified vehicle market.

As of the first quarter of 2024, Allison reported a significant increase in its electrified product orders, signaling strong market adoption. This segment is becoming a crucial revenue driver as the demand for cleaner transportation solutions continues to grow.

Revenue from aftermarket service parts and support equipment is a cornerstone for Allison. This includes sales of genuine Allison service parts, specialized support equipment, and their own branded transmission fluids.

This vital segment experienced a notable boost, with Q2 2025 revenues climbing by $10 million. This increase was primarily fueled by a surge in demand for essential service parts, indicating strong ongoing utilization of Allison's products.

Licensing and Royalties

Allison's significant patent portfolio and established technological leadership strongly suggest revenue generation through licensing and royalties. While specific figures for 2024 are not publicly detailed for this segment, similar companies in advanced technology sectors often derive substantial income from these intellectual property streams.

These arrangements allow other businesses to utilize Allison's patented technologies, often in exchange for upfront fees and ongoing royalty payments based on sales or usage. This can be a highly profitable, low-overhead revenue source, leveraging existing R&D investments.

- Licensing Agreements: Granting permission to third parties to use Allison's patented technologies.

- Royalty Payments: Receiving ongoing payments, often a percentage of revenue, from licensees.

- Intellectual Property Monetization: Capitalizing on the company's extensive patent portfolio.

Revenue from Strategic Acquisitions

The acquisition of Dana Incorporated's Off-Highway business is a key driver for diversifying and expanding Allison's future revenue. This strategic move is expected to significantly boost income, particularly within the robust off-highway market segment. In 2024, Allison anticipates substantial annual synergies from this integration, contributing to enhanced profitability and market presence.

This acquisition is projected to unlock new revenue opportunities, strengthening Allison's financial performance. The integration is anticipated to yield significant financial benefits, with substantial annual synergies expected to materialize. This diversification is crucial for Allison's long-term growth strategy.

- Diversified Revenue Base: The Dana acquisition broadens Allison's revenue streams by entering new off-highway markets.

- Increased Off-Highway Segment Revenue: A significant uplift in income is anticipated from this specialized sector.

- Synergy Realization: Allison expects to achieve considerable annual cost and revenue synergies post-acquisition.

Allison Transmission's revenue streams are multifaceted, primarily driven by the sale of new automatic transmissions for commercial and defense vehicles. The company also generates significant income from its growing portfolio of hybrid and electric propulsion systems, reflecting a strategic shift towards sustainable solutions.

Furthermore, the aftermarket segment, encompassing service parts and support equipment, provides a consistent and robust revenue stream, bolstered by strong product utilization. While specific licensing and royalty figures for 2024 are not detailed, the company's extensive patent portfolio suggests potential income from intellectual property monetization.

The acquisition of Dana Incorporated's Off-Highway business in 2024 is poised to diversify revenue by expanding into new market segments, with substantial annual synergies anticipated from this integration.

| Revenue Stream | Key Products/Services | 2024/2025 Data Point |

|---|---|---|

| New Transmissions | Fully Automatic Transmissions (Medium/Heavy-Duty) | Q2 2025 Net Sales: $814 million |

| Electrified Propulsion | eGen Flex, eGen Power Axles | Strong increase in electrified product orders (Q1 2024) |

| Aftermarket Services | Service Parts, Support Equipment, Fluids | Q2 2025 Revenue increase: $10 million |

| Licensing/Royalties | Intellectual Property Monetization | Anticipated, but not publicly detailed for 2024 |

| Acquisition Synergies | Dana Off-Highway Business Integration | Substantial annual synergies anticipated in 2024 |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial statements, customer feedback, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information.