Alliar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliar Bundle

Alliar's market position is shaped by its strong brand recognition and extensive network, but also faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or compete in this sector.

Want the full story behind Alliar's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alliar, rebranded as Alliança Saúde, stands as a dominant force in Brazil's diagnostic medicine landscape. This leading market position translates into substantial brand equity, allowing for greater customer trust and recall. In 2023, Alliar reported revenue growth, indicating their ability to leverage this strong market presence effectively within the competitive Brazilian healthcare environment.

Alliar's comprehensive service portfolio is a significant strength, covering medical imaging, clinical analysis, and specialized medical services. This broad offering allows them to serve a wide range of patient needs and medical requirements.

In 2023, Alliar reported revenue of R$2.1 billion, reflecting the demand for its extensive diagnostic capabilities. This diversified service model enhances revenue streams and positions Alliar as a convenient, all-encompassing healthcare provider.

Alliar Saúde boasts an impressive operational network, with a significant presence across Brazil. This extensive reach, encompassing numerous diagnostic centers and laboratories, ensures broad accessibility for patients nationwide. For instance, as of late 2024, Alliar operates over 150 units, a testament to its commitment to widespread service delivery.

Improved Financial Performance and Efficiency

Alliar has shown remarkable financial gains, highlighted by a 47% surge in Adjusted EBITDA during the first quarter of 2025. This performance builds on a strong 2024, where the company achieved a record gross revenue of R$1.3 billion.

These improvements are largely attributable to enhanced operational efficiency and cost management. A significant 33% reduction in Selling, General, and Administrative (SG&A) expenses in Q1 2025 underscores Alliar's success in streamlining operations and optimizing its cost structure.

- Record Revenue: Achieved R$1.3 billion in gross revenue in 2024.

- EBITDA Growth: Saw a 47% increase in Adjusted EBITDA in Q1 2025.

- Cost Reduction: Reduced SG&A expenses by 33% in Q1 2025.

Strategic Acquisitions and Expansion

Alliança Saúde is demonstrating a strong commitment to growth through strategic acquisitions. A prime example is their recent acquisition of 100% of Cura Medicina Diagnóstica's operations in São Paulo. This move is significant as it's projected to inject roughly R$80 million in annual gross revenue into the company.

This expansion isn't just about revenue; it strategically bolsters Alliança Saúde's footprint in vital urban markets. Furthermore, it enhances their capacity to offer a wider array of complex diagnostic examinations. This targeted approach to acquisition strengthens their competitive position and service portfolio.

- Acquisition of Cura Medicina Diagnóstica for R$80 million in projected annual gross revenue.

- Expansion of presence in key urban centers like São Paulo.

- Enhancement of complex exam offerings to meet growing market demand.

Alliar's market leadership in Brazil's diagnostic medicine sector is a significant strength, fostering strong brand recognition and customer trust. This dominance is supported by a robust financial performance, with R$1.3 billion in gross revenue recorded in 2024 and a notable 47% surge in Adjusted EBITDA in Q1 2025, underscoring their operational effectiveness and market demand.

| Metric | 2024 | Q1 2025 |

| Gross Revenue | R$1.3 billion | N/A |

| Adjusted EBITDA Growth | N/A | 47% |

| SG&A Expense Reduction | N/A | 33% |

What is included in the product

Delivers a strategic overview of Alliar’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning challenges into opportunities.

Weaknesses

Alliança Saúde's reliance on the Brazilian market makes it vulnerable to economic downturns. For instance, Brazil's GDP growth slowed to an estimated 2.9% in 2023, a deceleration from previous years, which could impact consumer disposable income and healthcare spending.

Inflationary pressures, which averaged around 4.62% in Brazil in 2023, can also erode affordability for patients, potentially reducing demand for Alliar's diagnostic services. Currency fluctuations, like the Real's volatility against the US dollar, can further complicate cost management and pricing strategies.

Alliar faces significant challenges due to its high operational and capital expenditures. The diagnostic medicine sector demands substantial investments in cutting-edge medical equipment and technology, alongside the need for highly skilled professionals. For instance, advanced imaging machines like MRI and CT scanners can cost millions of dollars, and their upkeep and upgrades are continuous.

These ongoing costs translate into high operational expenses, impacting Alliar's profitability. The company must also allocate considerable capital to maintain and enhance its facilities to remain competitive and meet evolving industry standards. This financial strain can limit reinvestment opportunities or necessitate significant borrowing, potentially affecting financial flexibility.

Alliar operates within Brazil's diagnostic medicine sector, a market characterized by fierce competition from both domestic and global entities. This includes other major diagnostic chains, large hospital networks, and numerous smaller, specialized clinics vying for market share.

The crowded nature of this market exerts significant pressure on pricing, potentially squeezing profit margins for Alliar. To counter this, the company must continuously invest in advanced technology and develop unique service offerings to stand out from its rivals.

Regulatory and Compliance Burdens

Alliança Saúde faces significant regulatory and compliance burdens within Brazil's dynamic healthcare sector. The company must navigate a complex web of health regulations, licensing mandates, and stringent data privacy laws, which demand substantial resources for effective management. Failure to comply with these evolving requirements can lead to costly penalties and operational disruptions, impacting profitability and market standing.

- Complex Regulatory Landscape: Brazil's healthcare system is governed by numerous regulations from bodies like ANS (National Agency for Supplementary Health) and ANVISA (National Health Surveillance Agency).

- Data Privacy Compliance: Adherence to the Lei Geral de Proteção de Dados (LGPD) is critical, requiring robust data security measures for patient information.

- Licensing and Accreditation: Maintaining necessary licenses and accreditations for all facilities and services is an ongoing, resource-intensive process.

- Evolving Standards: The constant updates and changes in healthcare regulations necessitate continuous adaptation and investment in compliance infrastructure.

Challenges in Standardizing Quality Across Vast Network

Alliar faces a significant hurdle in ensuring uniform service quality and diagnostic accuracy throughout its extensive and growing network of health centers and laboratories. This challenge is amplified by the sheer scale of operations, which necessitates sophisticated management and quality control systems to maintain high standards across diverse locations.

Maintaining consistent patient experience and operational efficiency across a vast geographical spread requires continuous investment in training and technology. For instance, in 2024, Alliar reported a network of over 150 units, each needing to adhere to stringent protocols to guarantee reliable diagnostic results and a positive patient journey.

- Maintaining consistent service quality across over 150 units.

- Ensuring uniform diagnostic accuracy through robust quality control.

- Implementing standardized operational efficiencies nationwide.

- Providing continuous training to a large, dispersed workforce.

Alliar's dependence on the Brazilian economy exposes it to risks from economic slowdowns and inflation, which can reduce patient spending. For example, Brazil's projected GDP growth for 2024 is around 2.2%, and inflation averaged approximately 4.5% in 2023, impacting affordability.

The company grapples with high operational and capital expenditures due to the technology-intensive nature of diagnostic medicine, requiring continuous investment in equipment and skilled personnel. This strain can limit financial flexibility and reinvestment capacity.

Intense competition within Brazil's diagnostic market pressures pricing and profit margins, forcing Alliar to constantly innovate and differentiate its services. Navigating Brazil's complex and evolving healthcare regulations also demands significant resources and poses risks of penalties for non-compliance.

Ensuring uniform service quality and diagnostic accuracy across its extensive network of over 150 units presents a significant operational challenge, requiring robust quality control and consistent training for a dispersed workforce.

Preview the Actual Deliverable

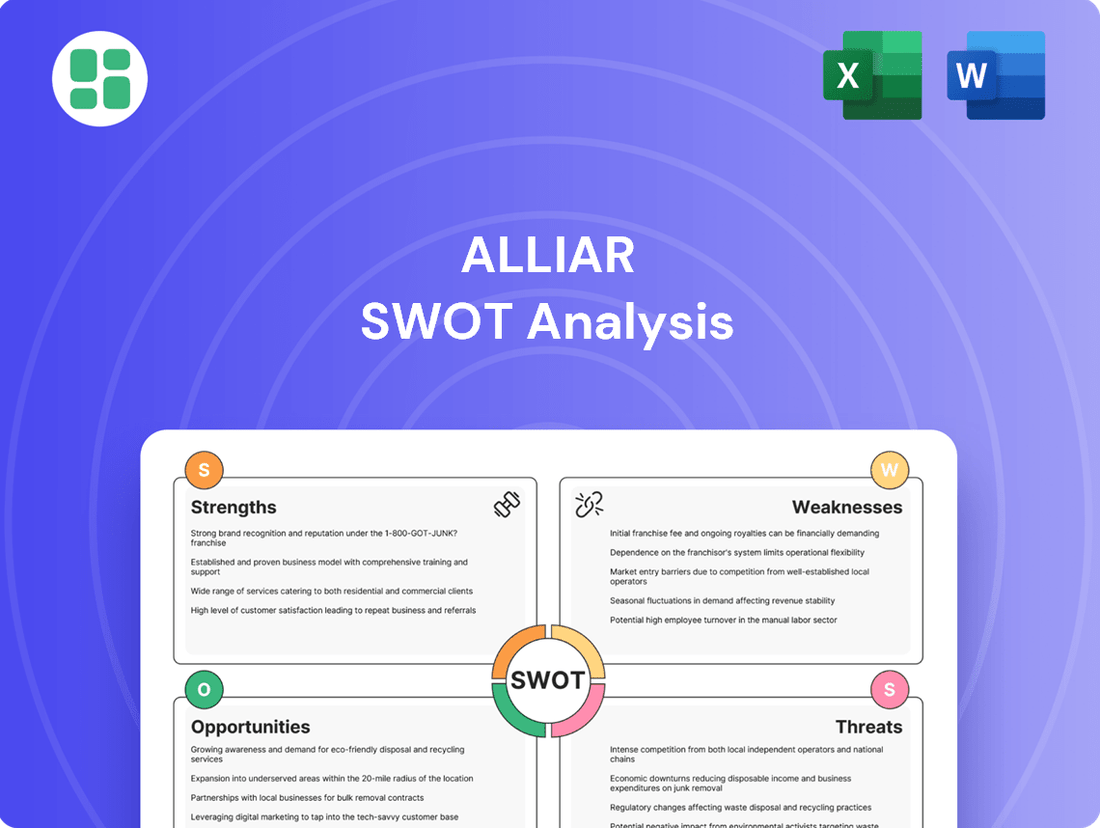

Alliar SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This ensures transparency and allows you to assess the quality and depth of the analysis before committing. You're viewing a live preview of the actual SWOT analysis file, and the complete version becomes available after checkout.

Opportunities

Brazil's demographic shifts, including an aging population and heightened health consciousness, are fueling consistent growth in demand for diagnostic and healthcare services. This trend presents a significant opportunity for Alliar Saúde to capitalize on the expanding market.

The in-vitro diagnostics market in Brazil is on a strong growth trajectory, with projections indicating substantial expansion. This robust market outlook provides Alliar Saúde with a clear avenue to increase its service capacity and broaden its range of offerings to meet this rising demand.

Alliança Saúde can capitalize on the rapid evolution of medical technology, such as AI-driven diagnostics and telemedicine, to boost its service offerings. For instance, integrating AI in radiology can improve diagnostic speed and accuracy, a critical factor in patient care. In 2023, the global AI in healthcare market was valued at approximately $15.4 billion and is projected to grow significantly, indicating a strong demand for such innovations.

By investing in and adopting these cutting-edge technologies, Alliança Saúde can enhance its operational efficiency and introduce novel, specialized services. The company could explore advanced genetic testing and molecular diagnostics, areas experiencing substantial growth. The global molecular diagnostics market, for example, was estimated to be around $15.6 billion in 2023, with strong compound annual growth rates anticipated in the coming years.

The Brazilian diagnostic market remains quite fragmented, offering Alliança Saúde ongoing chances to grow through strategic mergers and acquisitions. This consolidation strategy allows the company to expand its reach and solidify its market position by integrating smaller, specialized laboratories or businesses that offer complementary services.

Alliança Saúde's acquisition strategy, exemplified by the Cura acquisition, has proven effective in expanding its geographical presence and diversifying its service offerings. This approach not only consolidates market share but also enhances its competitive edge by integrating new technologies and customer bases, contributing to its overall growth trajectory.

Expansion into Preventative and Personalized Medicine

The global shift towards proactive health management presents a significant opportunity. Alliança Saúde can capitalize on this by developing specialized diagnostic services for early disease detection and personalized risk assessment. This aligns with the growing consumer demand for preventative care, a trend that saw the global personalized medicine market valued at approximately USD 500 billion in 2023 and projected to grow substantially in the coming years.

By offering tailored health plans and advanced screening, Alliança Saúde can tap into new revenue streams and differentiate itself in the market. This strategic move positions the company to meet evolving healthcare needs, with personalized medicine expected to become a cornerstone of future medical practice.

- Growing Trend: Global and local markets are increasingly prioritizing preventative health and personalized medicine.

- Service Development: Alliança Saúde can create specialized diagnostic panels for early detection and risk assessment.

- Revenue Streams: This expansion offers new avenues for income by catering to tailored treatment plans.

- Market Alignment: The strategy directly addresses future healthcare trends and consumer preferences for proactive wellness.

Digital Transformation and Telemedicine Integration

Further digitalization of patient services, including online scheduling and result delivery, alongside the integration of telemedicine platforms, presents a significant opportunity for Alliar. This digital push can dramatically enhance patient convenience and streamline operational efficiency across its network.

By embracing telemedicine, Alliar can extend its reach to a broader patient base, particularly those in remote or underserved areas, thereby increasing market penetration and accessibility. This strategic move is expected to improve the overall patient experience and solidify Alliar's position in the evolving healthcare landscape.

- Enhanced Patient Convenience: Online scheduling and digital result delivery improve accessibility and user experience.

- Broader Market Reach: Telemedicine allows access to patients in remote areas, expanding the customer base.

- Operational Efficiency Gains: Digitalization and telemedicine integration can reduce administrative burdens and optimize resource allocation.

- Improved Patient Outcomes: Increased accessibility and timely consultations through digital channels can lead to better health management.

Alliar can leverage the increasing demand for specialized diagnostic services, particularly in areas like oncology and cardiology, to drive revenue growth. The company can also expand its service portfolio by incorporating advanced genetic testing and molecular diagnostics, reflecting the global trend towards personalized medicine. The global molecular diagnostics market, valued at approximately $15.6 billion in 2023, demonstrates the significant potential in this segment.

Strategic acquisitions and partnerships remain a key opportunity for Alliar to consolidate its market position and expand its geographical footprint within Brazil. The company's successful acquisition of Cura in 2023 highlights its capability to integrate new entities and enhance its service offerings, further strengthening its competitive advantage.

Embracing digital transformation, including telemedicine and AI-powered diagnostic tools, offers Alliar a pathway to improved operational efficiency and enhanced patient experience. The global AI in healthcare market, estimated at $15.4 billion in 2023, underscores the value of integrating such technologies to boost diagnostic accuracy and speed.

The growing emphasis on preventative healthcare presents an opportunity for Alliar to develop and promote early disease detection and risk assessment services. This aligns with the projected growth of the personalized medicine market, which was valued at around USD 500 billion in 2023, indicating a strong consumer interest in proactive health management.

Threats

Brazil's persistent economic instability, marked by high inflation and potential political shifts, poses a significant threat. For instance, Brazil's inflation rate hovered around 4.62% in 2023, a figure that could escalate, impacting consumer purchasing power and government budgets.

Such economic pressures could force reductions in public and private healthcare spending. This would likely translate to lower reimbursement rates for diagnostic services and a potential decrease in patient volumes for Alliança Saúde, directly affecting its revenue streams and overall profitability.

Furthermore, economic downturns might steer demand towards more basic, lower-cost diagnostic options, potentially diminishing the demand for Alliança Saúde's more specialized or premium services.

Alliança Saúde faces significant threats from the constantly shifting regulatory environment in Brazil's healthcare sector. For instance, potential government-imposed price controls on medical procedures or medications, as seen in past discussions around the National Agency for Supplementary Health (ANS) regulations, could directly impact revenue streams and profit margins. Furthermore, changes in how private health insurers reimburse providers, perhaps a reduction in coverage for certain treatments or a shift towards more restrictive payment models, could squeeze profitability.

Adapting to these evolving regulations presents its own set of challenges. New compliance requirements, such as stricter data privacy laws or updated quality reporting standards, necessitate investment in technology and training, leading to increased operational costs and potential disruptions to existing workflows. For example, the implementation of new digital health record mandates could require significant IT upgrades across Alliança's facilities.

The diagnostic market is intensely competitive, with established giants and agile newcomers vying for market share. Alliar Saúde faces the threat of rivals, potentially larger entities, engaging in mergers and acquisitions. This consolidation could create formidable competitors with greater economies of scale, potentially diminishing Alliar's market standing and its ability to set prices.

For instance, in 2024, the diagnostics sector has seen significant M&A activity globally, with companies like Quest Diagnostics and Labcorp consistently exploring strategic partnerships and acquisitions to expand their service offerings and geographic reach. This trend puts pressure on smaller or mid-sized players like Alliar to innovate and maintain a competitive edge to avoid market share erosion.

Disruptive Technologies and New Business Models

The healthcare sector is constantly evolving due to technological advancements. New diagnostic methods or direct-to-consumer testing models could emerge, potentially disrupting traditional diagnostic services offered by companies like Alliar. For instance, the global point-of-care diagnostics market was valued at approximately USD 35.8 billion in 2023 and is projected to grow significantly, indicating a shift towards more accessible testing.

New market entrants with innovative, lower-cost, or more convenient solutions pose a significant competitive threat. These disruptors might offer services that bypass traditional healthcare channels, directly impacting Alliar's established business model. The rise of telehealth and AI-driven diagnostic tools, for example, could fragment the market and attract patients seeking faster or more personalized care.

- Technological Disruption: Emergence of advanced diagnostic technologies could render existing methods obsolete.

- Direct-to-Consumer (DTC) Models: Increased adoption of DTC testing bypasses traditional lab services.

- New Entrants: Agile startups with lower cost structures and innovative service delivery models challenge established players.

- Market Fragmentation: Telehealth and AI integration could lead to a more segmented and competitive diagnostic landscape.

Cybersecurity Risks and Data Privacy Concerns

Alliança Saúde, like any healthcare provider, grapples with significant cybersecurity threats. Holding extensive sensitive patient data makes it a prime target for cyberattacks, including data breaches and ransomware. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial implications of such breaches.

A successful cyberattack could result in substantial financial penalties, potentially impacting Alliança Saúde's bottom line. Beyond monetary losses, the reputational damage and erosion of patient trust can be even more detrimental. Operational downtime caused by these incidents could also disrupt critical healthcare services, leading to further financial strain and a decline in patient satisfaction.

- Data Breach Impact: A data breach could expose millions of patient records, leading to identity theft and significant legal liabilities for Alliança Saúde.

- Ransomware Threat: Ransomware attacks can cripple hospital systems, halting operations and demanding substantial payments for data recovery.

- Regulatory Fines: Non-compliance with data privacy regulations like LGPD in Brazil can result in fines up to 2% of revenue, capped at R$50 million per infraction.

- Reputational Damage: Loss of patient trust due to security failures can lead to a decline in patient volume and market share.

Alliança Saúde faces substantial threats from Brazil's volatile economic climate, with inflation potentially impacting consumer spending on healthcare services. Furthermore, evolving regulatory landscapes, including potential price controls and changes in insurer reimbursement policies, could directly squeeze profit margins. The company also contends with intense competition, the risk of market consolidation, and the disruptive potential of new technologies and direct-to-consumer diagnostic models.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Example |

| Economic Instability | Inflation and reduced consumer spending | Lower patient volumes, decreased revenue | Brazil's 2023 inflation rate was 4.62%; economic downturns may decrease demand for premium services. |

| Regulatory Changes | Price controls, altered reimbursement models | Reduced revenue, squeezed profitability | Past discussions around ANS regulations; potential new data privacy mandates (LGPD fines up to 2% of revenue). |

| Competition | Market consolidation, new entrants | Market share erosion, pricing pressure | Global M&A activity in diagnostics (e.g., Quest, Labcorp); rise of agile startups. |

| Technological Disruption | New diagnostic methods, DTC models | Obsolescence of existing services, market fragmentation | Global point-of-care diagnostics market valued at USD 35.8 billion in 2023; rise of telehealth and AI. |

| Cybersecurity | Data breaches, ransomware | Financial penalties, reputational damage, operational downtime | Global cybercrime projected to reach $10.5 trillion annually by 2025. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Alliar's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded strategic overview.