Alliar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliar Bundle

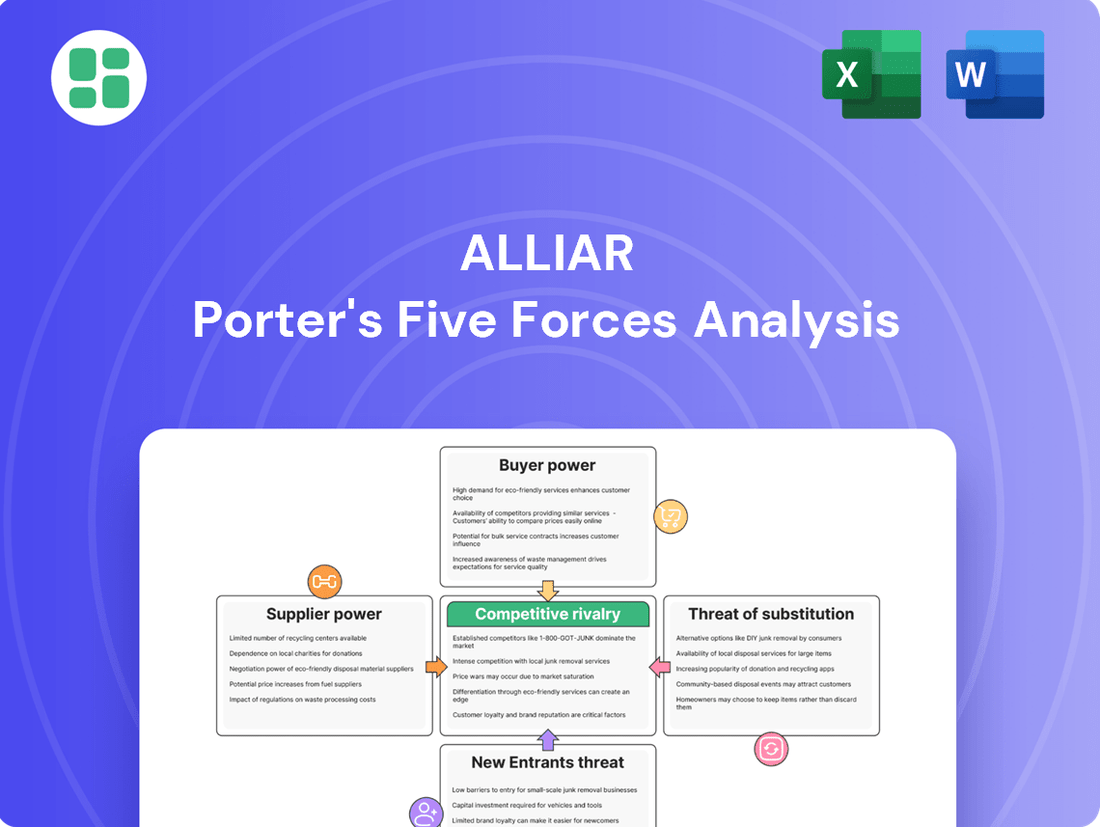

Alliar's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the intensity of rivalry among existing players. Understanding these dynamics is crucial for navigating the healthcare sector effectively.

The complete report reveals the real forces shaping Alliar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alliar's reliance on a concentrated group of global and specialized suppliers for advanced medical equipment, like high-tech imaging machines, and unique diagnostic reagents grants these suppliers considerable leverage. For instance, the market for advanced MRI or CT scanners is dominated by a few major players, meaning Alliar has fewer alternatives when sourcing these crucial technologies.

The proprietary nature and substantial investment required for these cutting-edge medical technologies mean that suppliers can command higher prices and dictate terms. This concentration is evident in the medical device industry, where companies like Siemens Healthineers and GE Healthcare hold significant market share in specialized imaging equipment, impacting Alliar's procurement costs.

Alliar's dependence on these specialized inputs directly translates to supplier bargaining power. Should these key suppliers decide to increase prices or impose less favorable contract terms, it could directly affect Alliar's operational expenses and overall profitability, especially given the critical nature of these supplies for its diagnostic and treatment services.

Alliar's reliance on specialized medical equipment, such as MRI and CT scanners, represents a significant barrier to switching suppliers. The company's extensive network of diagnostic centers requires substantial capital expenditure on these high-value assets.

The cost of replacing or upgrading major equipment is considerable, encompassing not only the purchase price but also installation, essential staff training, and the complex process of recalibrating systems. These substantial expenses effectively create a lock-in situation, enhancing the bargaining power of current equipment providers.

The complex regulatory environment in Brazil, overseen by ANVISA, mandates that medical device and IVD suppliers meet strict safety and performance criteria, often mirroring international standards. This rigorous compliance process means suppliers who can reliably navigate these requirements and secure approvals possess significant bargaining power, as their products are essential and pre-qualified for Alliar's services.

Importance of Supplier Innovation

Alliar's reliance on suppliers for cutting-edge diagnostic technology, especially with AI and molecular diagnostics on the rise, significantly impacts their competitive edge. Suppliers who lead in developing more accurate, quicker, or less invasive diagnostic tools wield substantial bargaining power because these innovations are crucial for Alliar's service quality and market differentiation.

In 2024, the diagnostic medicine market saw continued investment in AI-driven solutions, with companies focusing on early disease detection and personalized treatment plans. For instance, advancements in liquid biopsy technologies, a key area for molecular diagnostics, are enabling earlier cancer detection, a service Alliar aims to provide.

- Technological Dependence: Alliar's ability to offer advanced diagnostic services is directly tied to the innovations provided by its suppliers in areas like AI algorithms for image analysis and novel molecular markers.

- Strategic Importance of Innovation: Suppliers at the forefront of developing next-generation diagnostic equipment and reagents possess higher bargaining power due to the critical nature of their contributions to Alliar's service portfolio.

- Market Trends: The increasing demand for personalized medicine and early disease detection in 2024 highlights the strategic value of suppliers offering advanced molecular and AI-powered diagnostic solutions.

Limited Local Production of Advanced Inputs

Alliar's bargaining power of suppliers is influenced by the limited local production of advanced inputs within Brazil. Despite Brazil's large market size, many sophisticated medical devices, hospital equipment, and specialized diagnostic kits are still imported. This dependency on foreign manufacturers means these international suppliers often hold significant leverage due to their established production capabilities and global supply chains.

The Brazilian government's initiatives to boost domestic manufacturing through public-private partnerships aim to reduce this reliance. However, until local production scales effectively, foreign suppliers will likely maintain a strong position, potentially limiting Alliar's flexibility in sourcing critical components and driving up costs. For instance, in 2023, Brazil's health sector imports continued to be substantial for high-tech medical equipment, reflecting this ongoing dependence.

- Import Dependency: Brazil imports a significant portion of advanced medical and diagnostic supplies.

- Supplier Leverage: Established foreign suppliers benefit from their robust manufacturing and supply networks.

- Domestic Production Push: Government efforts are underway to increase local production, but this is a long-term strategy.

- Cost Implications: Reliance on imports can lead to higher input costs for companies like Alliar.

Alliar's bargaining power with suppliers is weakened by its reliance on a few global manufacturers for specialized medical equipment and diagnostic reagents. This concentration, evident in the advanced imaging market where companies like Siemens and GE dominate, means fewer alternatives for Alliar, allowing suppliers to dictate terms and prices.

The high cost and complexity of switching these critical technologies, coupled with stringent regulatory approvals from bodies like ANVISA in Brazil, create a significant switching cost. This lock-in effect, amplified by the 2024 trend towards AI-driven diagnostics and personalized medicine, grants suppliers of innovative solutions considerable leverage.

Furthermore, Brazil's continued import dependency for advanced medical inputs, despite government efforts to boost local production, means international suppliers with established global supply chains hold substantial power, impacting Alliar's procurement costs.

| Factor | Impact on Alliar | Example/Data Point (2023/2024) |

| Supplier Concentration | High Bargaining Power | Dominance of Siemens Healthineers and GE Healthcare in advanced imaging equipment market. |

| Switching Costs | High Supplier Leverage | Substantial capital expenditure, training, and recalibration for advanced diagnostic systems. |

| Regulatory Environment (ANVISA) | Supplier Advantage | Rigorous approval processes favor established suppliers with pre-qualified products. |

| Technological Dependence (AI/Molecular Diagnostics) | Supplier Leverage | 2024 market focus on AI solutions for early disease detection increases value of innovative suppliers. |

| Import Dependency (Brazil) | Supplier Advantage | Continued substantial imports of high-tech medical equipment in 2023 highlight reliance on foreign manufacturers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alliar's healthcare diagnostics market.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Alliar's individual patient base, while extensive across Brazil, generally exhibits low direct bargaining power. Patient decisions are frequently guided by physician recommendations, insurance plan inclusions, and the perceived quality and accessibility of diagnostic facilities. For instance, in 2024, diagnostic imaging services in Brazil saw a 6% increase in patient volume, yet individual price negotiation remains limited for most.

In Brazil, large health insurance providers and the public Unified Health System (SUS) wield considerable influence over diagnostic service providers like Alliar. These entities represent a massive concentration of demand, giving them significant leverage in negotiations. Their ability to direct a high volume of patients allows them to dictate terms regarding pricing, service agreements, and payment schedules. This dynamic means Alliar needs to carefully manage its pricing strategy while ensuring top-notch service quality to retain these crucial institutional contracts.

The increasing adoption of digital health solutions and telemedicine in Brazil significantly boosts customer bargaining power. Consumers now have easier access to health information, online consultations, and even at-home testing, offering them more choices and convenience. This allows for better comparison of services, directly influencing demand for specific diagnostic methods and potentially driving down prices.

Demand for Quality and Timely Results

Customers, primarily healthcare professionals and hospitals, place a high premium on the accuracy, reliability, and promptness of diagnostic results. This demand is directly linked to effective patient care and treatment decisions. For instance, in 2024, delays in diagnostic reporting can significantly impact patient pathways, potentially leading to increased hospital stays or suboptimal treatment initiation.

Alliar's standing hinges on its consistent delivery of high-quality diagnostic information. A perceived dip in service quality, whether in accuracy or turnaround time, could swiftly erode its market position. This is particularly true in a competitive landscape where alternative providers can readily capture dissatisfied clientele. In 2023, Alliar reported a customer satisfaction score of 88%, a metric directly tied to the perceived quality and timeliness of its services.

- Customer Prioritization: Healthcare providers demand swift and precise diagnostic outcomes for optimal patient management.

- Reputational Impact: Any compromise in Alliar's diagnostic quality risks immediate referral losses to competitors.

- Market Sensitivity: A decline in service speed or accuracy can quickly shift patient and institutional preferences.

- Competitive Landscape: The availability of alternative diagnostic providers intensifies customer bargaining power when quality falters.

Price Sensitivity Due to Economic Conditions

In Brazil, economic conditions significantly influence consumer spending on healthcare. For instance, rising inflation in 2024 can erode disposable income, making individuals more hesitant about out-of-pocket medical expenses. This heightened price sensitivity directly impacts healthcare providers like Alliar, especially for those without robust health insurance coverage.

The bargaining power of customers increases when economic downturns limit their ability to afford medical services. This forces companies to focus on cost management and competitive pricing strategies to retain patient volume and market share.

- Inflationary Pressures: Brazil's inflation rate, which saw fluctuations through 2023 and into 2024, directly affects the purchasing power of consumers for non-essential or discretionary healthcare services.

- Unemployment Rates: Higher unemployment means fewer people have employer-sponsored health insurance, pushing more individuals to seek affordable options or delay necessary treatments, thus increasing their price sensitivity.

- Impact on Alliar: Alliar may face pressure to offer more accessible pricing tiers or packages to cater to a broader segment of the population concerned about healthcare costs.

Alliar's customer base, largely composed of individual patients and institutional clients like health plans and hospitals, exhibits varying degrees of bargaining power. While individual patients typically have low power due to reliance on physician recommendations and insurance, large institutional buyers can exert significant influence through volume and contract negotiations.

The bargaining power of customers is amplified by the availability of alternative diagnostic providers and the increasing digitization of healthcare, which facilitates price and service comparisons. Economic factors, such as inflation and unemployment in Brazil during 2023 and 2024, also heighten customer price sensitivity, forcing providers like Alliar to remain competitive.

| Customer Segment | Bargaining Power Drivers | Impact on Alliar |

|---|---|---|

| Individual Patients | Physician recommendations, insurance coverage, perceived quality | Low direct bargaining power; price sensitivity influenced by economic conditions. |

| Health Insurance Providers & SUS | High volume of patient referrals, contract negotiation leverage | Significant power to dictate pricing and service terms; crucial for revenue. |

| Healthcare Professionals/Hospitals | Demand for accuracy, reliability, and promptness | High expectations for service quality; risk of client loss if standards slip. |

Preview Before You Purchase

Alliar Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Alliar, meticulously detailing the impact of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the industry. This analysis provides actionable insights to inform strategic decision-making.

Rivalry Among Competitors

The Brazilian diagnostic medicine market is intensely competitive, with major players like DASA, Grupo Fleury, and Hermes Pardini vying for dominance alongside Alliar. These established companies boast extensive service offerings and broad geographical reach, intensifying the battle for patients and market share.

This rivalry translates into aggressive pricing strategies and significant investment in technology and service expansion. For instance, DASA, a leading player, has consistently focused on inorganic growth and technological integration, setting a high bar for competitors in terms of operational efficiency and service breadth.

The Brazilian diagnostic laboratory sector is seeing a significant wave of consolidation, with companies like Dasa and Fleury leading the charge through mergers and acquisitions. This trend is driven by a desire to achieve greater economies of scale and broaden service offerings, directly intensifying competition among existing players.

For instance, Dasa's acquisition of Amil's diagnostic units in 2023 significantly boosted its market share and geographic footprint. This strategic move by a major player forces smaller or less consolidated competitors to either seek similar alliances or risk being outmaneuvered by larger, more integrated entities with superior bargaining power and wider reach.

Competitive rivalry in the diagnostic services sector is intense, largely fueled by a relentless pursuit of differentiation through technology and innovation. Companies are constantly integrating advanced tools like AI-driven diagnostics and molecular testing. For instance, in 2024, the global AI in healthcare market, which includes diagnostics, was projected to reach approximately $15.7 billion, highlighting the significant investment in these areas.

This technological race means firms must offer quicker, more precise, or novel diagnostic methods. This imperative drives substantial and continuous investment in research and development, alongside crucial technological upgrades. Companies that fail to keep pace risk falling behind in accuracy, speed, and the breadth of services they can provide to healthcare providers and patients.

Geographic Expansion and Network Coverage

Competitors are aggressively expanding their physical footprints across Brazil, aiming to capture market share through wider geographic coverage. This expansion includes not only major urban centers but also smaller, high-growth potential cities, intensifying the rivalry for customer access.

Alliar's extensive network serves as a significant competitive advantage, but rivals are strategically placing their diagnostic centers and laboratories to mirror and even surpass this reach. For instance, by **2024**, several key competitors have announced plans to open an average of **15-20 new units** each, focusing on regions where Alliar may have less presence.

- Network Density: Competitors are increasing the density of their service points within existing markets to enhance accessibility and convenience for patients.

- Emerging Market Focus: Strategic expansion into smaller cities is a key tactic, as these areas often represent underserved markets with significant growth potential.

- Partnerships and Acquisitions: Some rivals are accelerating their geographic expansion through strategic partnerships with healthcare providers or by acquiring smaller, established laboratory networks.

- Technological Integration: Expansion efforts are increasingly coupled with the integration of advanced diagnostic technologies and digital platforms to offer a more comprehensive service offering.

Service Diversification and Integrated Healthcare Models

Competitive rivalry in the diagnostic sector is intensifying as companies like Alliar expand beyond core lab services. They are increasingly offering a broader spectrum of healthcare solutions, including specialized medical consultations and integrated care management. This diversification aims to create a more comprehensive patient journey and secure a greater portion of the overall healthcare spending.

This strategic shift means that direct competition now encompasses a wider range of healthcare providers, not just traditional diagnostic labs. For instance, companies are investing in telehealth platforms and chronic disease management programs, directly competing with specialized clinics and even primary care providers in certain aspects of patient care. Alliar's own strategic moves in 2024 reflect this trend, with reported investments in expanding their network of specialized clinics and digital health offerings.

- Diversification into specialized medical services: Companies are adding offerings like cardiology, oncology support, and advanced imaging beyond basic diagnostics.

- Integrated care pathways: Focus is shifting to managing patient journeys across multiple touchpoints, from initial diagnosis to treatment and follow-up.

- Health consulting and wellness programs: Expanding into preventative care and corporate wellness services broadens the competitive landscape.

The competitive landscape for diagnostic services in Brazil is characterized by intense rivalry among major players like DASA, Grupo Fleury, and Alliar. This competition drives aggressive pricing, significant investment in technology, and strategic expansion, with companies like DASA acquiring units to boost market share. For example, DASA's 2023 acquisition of Amil's diagnostic units significantly altered the competitive dynamics.

Companies are heavily investing in advanced technologies, such as AI-driven diagnostics, to differentiate themselves. The global AI in healthcare market, including diagnostics, was projected to reach approximately $15.7 billion in 2024, underscoring the commitment to innovation. This technological race necessitates continuous R&D and upgrades to maintain accuracy and service breadth.

Furthermore, rivals are expanding their physical footprints, aiming for broader geographic coverage by opening new units, with key competitors planning an average of 15-20 new units each by 2024. This expansion often targets underserved smaller cities and is frequently coupled with technological integration and strategic partnerships or acquisitions to enhance reach and service offerings.

The rivalry extends beyond traditional diagnostics, with companies diversifying into specialized medical services and integrated care pathways. This includes offerings like cardiology and oncology support, as well as health consulting and wellness programs, broadening the competitive scope to include primary care and specialized clinics.

| Competitor | Key Strategic Move (2023-2024) | Focus Area | Market Impact |

| DASA | Acquisition of Amil's diagnostic units (2023) | Market share expansion, geographic footprint | Increased consolidation, intensified rivalry |

| Grupo Fleury | Continued investment in technological integration and service expansion | Operational efficiency, service breadth | Sets high bar for competitors |

| Alliar | Expansion of specialized clinics and digital health offerings | Comprehensive patient journey, digital health | Diversification into new healthcare segments |

| Other Key Competitors | Planned opening of 15-20 new units each (2024) | Geographic coverage, emerging markets | Increased accessibility, direct competition in new areas |

SSubstitutes Threaten

The burgeoning digital health and telemedicine sector in Brazil presents a substantial threat of substitutes for Alliar's traditional in-person diagnostic services. These platforms provide convenient remote consultations and monitoring, which can bypass the need for physical visits, particularly for routine check-ups or initial symptom evaluations.

As of early 2024, the adoption of telemedicine in Brazil has seen remarkable growth, with millions of consultations conducted remotely. This trend is expected to continue, as patients increasingly value the accessibility and cost-effectiveness offered by digital health solutions, potentially diverting a segment of Alliar's customer base.

Technological advancements are significantly impacting the threat of substitutes for diagnostic services. The increasing sophistication and accessibility of at-home testing kits and wearable medical devices empower individuals to conduct health screenings and monitor conditions independently. For instance, the global market for digital health, which includes wearables and telehealth, was projected to reach over $600 billion by 2024, indicating a substantial shift towards self-monitoring and remote diagnostics.

These innovative solutions can directly substitute for certain laboratory tests traditionally offered by diagnostic centers. Wearable devices, such as continuous glucose monitors or advanced heart rate trackers, provide real-time data that previously required clinical intervention. This trend suggests a potential reduction in demand for routine diagnostic procedures as consumers opt for more convenient and immediate self-assessment tools, thereby increasing the threat of substitutes.

The increasing focus on preventive care and lifestyle changes presents a significant threat of substitutes for diagnostic companies. For instance, a growing trend towards proactive health management, emphasizing diet, exercise, and early intervention, could potentially slow the progression of chronic diseases like diabetes and cardiovascular conditions. This shift means fewer individuals might require the extensive and frequent diagnostic testing that has historically driven revenue for many companies in the sector.

In 2024, the global preventive healthcare market was valued at approximately $1.5 trillion, with projections indicating continued robust growth. This expansion directly competes with the demand for diagnostic services, as successful preventive strategies aim to reduce the incidence and severity of illnesses that necessitate diagnostic procedures. For example, advancements in wearable technology and personalized wellness programs are empowering consumers to take more control over their health, potentially reducing reliance on traditional diagnostic pathways.

Development of Point-of-Care Testing (POCT)

The advancement of Point-of-Care Testing (POCT) presents a significant threat of substitutes for traditional, centralized laboratory diagnostics. POCT devices provide rapid results directly where the patient is, such as clinics or pharmacies, bypassing the need to send samples to larger labs. This convenience and speed can divert testing volume away from established diagnostic providers.

The growing use of POCT for a range of conditions, including infectious diseases, directly impacts the demand for services from large diagnostic laboratories. For instance, the global POCT market was valued at approximately USD 34.8 billion in 2023 and is projected to grow substantially, indicating a clear shift in testing preferences.

- Market Growth: The POCT market is expected to reach over USD 50 billion by 2028, driven by demand for faster diagnoses and decentralized healthcare.

- Technological Advancements: Innovations in biosensors and microfluidics are making POCT more accurate and versatile, expanding its applications.

- Accessibility: POCT enables testing in remote areas or during public health emergencies, offering an alternative to lab-dependent testing infrastructure.

- Cost-Effectiveness: While initial device costs can vary, POCT can reduce overall healthcare costs by enabling earlier intervention and minimizing patient travel.

Therapeutic Innovations Reducing Diagnostic Needs

Breakthroughs in therapeutic innovations can significantly reduce the reliance on diagnostic services, acting as a potent substitute. For instance, the development of gene therapies or highly targeted drug treatments that address the root cause of a disease might lessen the need for ongoing, complex diagnostic monitoring. This shift could directly impact the demand for diagnostic testing providers.

In 2024, the pharmaceutical industry continued to see substantial investment in novel treatment modalities. Companies are increasingly focusing on personalized medicine and curative therapies. For example, advancements in oncology have led to treatments that can significantly reduce tumor burden, potentially decreasing the frequency of required imaging or biomarker tests for patients.

The threat is amplified when these new therapies become widely accessible and cost-effective. If a new drug can effectively manage a chronic condition with minimal diagnostic follow-up, patients and healthcare systems may opt for it over treatment pathways that necessitate regular, expensive diagnostic procedures. This could lead to a contraction in the market for certain diagnostic services.

Consider the impact on a company like Quest Diagnostics. While they offer a broad range of services, a significant shift towards curative therapies that bypass traditional diagnostic pathways for prevalent diseases could represent a tangible threat. For example, if a widely adopted treatment emerges for a condition currently managed through frequent blood tests, the volume of those specific tests could decline.

- Therapeutic Substitution: New treatments that cure or manage diseases without extensive diagnostic monitoring reduce demand for diagnostic services.

- Market Impact: A decline in the need for frequent testing can directly impact revenue streams for diagnostic companies.

- Innovation Trend: The ongoing focus on personalized and curative medicine in the pharmaceutical sector exacerbates this threat.

- Example Scenario: A new, highly effective therapy for a chronic condition could decrease the need for regular diagnostic tests, impacting companies reliant on those specific services.

The rise of digital health platforms and telemedicine in Brazil poses a significant threat of substitutes for Alliar's traditional diagnostic services. These convenient remote options, particularly for routine check-ups, are gaining traction. By early 2024, millions of remote consultations had already taken place, highlighting a growing patient preference for accessibility and cost-effectiveness.

Advancements in wearable devices and at-home testing kits also offer substitutes by empowering individuals with self-monitoring capabilities. The global digital health market, including wearables, was projected to exceed $600 billion by 2024, signaling a substantial move towards self-assessment and remote diagnostics.

Point-of-Care Testing (POCT) is another growing substitute, offering rapid results at the patient's location and bypassing traditional lab work. The global POCT market was valued at approximately USD 34.8 billion in 2023 and is expected to grow substantially, indicating a clear shift in testing preferences.

Breakthroughs in therapeutic innovations, such as gene therapies, can also reduce the need for ongoing diagnostic monitoring. The pharmaceutical sector's focus on personalized and curative medicine in 2024, with significant investment in novel treatment modalities, could lead to a contraction in demand for certain diagnostic services.

| Substitute Type | Market Trend/Data Point | Impact on Diagnostics |

|---|---|---|

| Telemedicine/Digital Health | Millions of remote consultations in Brazil by early 2024 | Diverts routine check-ups and initial symptom evaluations |

| Wearables & At-Home Testing | Global digital health market projected >$600 billion by 2024 | Reduces demand for routine lab tests through self-monitoring |

| Point-of-Care Testing (POCT) | Global POCT market valued at ~$34.8 billion in 2023 | Bypasses centralized labs, offering faster, localized testing |

| Curative Therapies | Focus on personalized/curative medicine in pharma (2024) | Potentially lessens need for complex diagnostic monitoring |

Entrants Threaten

The diagnostic medicine sector, particularly for companies like Alliar offering a broad spectrum of services, presents a formidable barrier to entry due to extensive capital requirements. Establishing a presence necessitates significant investment in cutting-edge medical imaging technology, sophisticated laboratory infrastructure, and a widespread network of patient service points.

For instance, a single advanced MRI scanner can cost upwards of $1.5 million, and building a network of dozens or even hundreds of collection centers across a country like Brazil, as Alliar operates, easily runs into hundreds of millions of dollars. This high initial outlay effectively deters many potential competitors from entering the market, thereby reducing the threat of new entrants.

The Brazilian healthcare sector presents significant barriers to entry due to stringent regulations, particularly from ANVISA. These regulations cover everything from initial registration and ongoing operational standards to rigorous quality control for diagnostic services and medical devices. For instance, in 2024, the average time to secure a new medical device registration with ANVISA remained a considerable hurdle, often extending beyond a year, demanding substantial investment in compliance and documentation.

New companies must navigate a complex and often lengthy process to obtain the necessary licenses and approvals. This intricate web of compliance, coupled with regulations that frequently evolve, acts as a powerful deterrent for potential market entrants. The sheer effort and cost associated with meeting these ever-changing requirements can make the Brazilian healthcare market a challenging landscape for newcomers to penetrate effectively.

The diagnostic medicine industry demands a highly specialized workforce, encompassing radiologists, pathologists, biomedical engineers, and skilled technicians. This need for expert talent presents a substantial barrier to entry for newcomers, as attracting and retaining such professionals is both difficult and expensive.

For instance, in 2024, the demand for radiologists continued to outstrip supply, with some reports indicating a shortage of over 5,000 radiologists in the United States. This talent gap directly translates into higher recruitment costs and longer onboarding times for new market entrants, impacting their ability to scale operations quickly and compete effectively.

Brand Recognition and Customer Trust

Established players like Alliar have cultivated significant brand recognition and patient trust through years of dedicated service in the healthcare sector. This deep-seated trust is a formidable barrier for any new competitor seeking to enter the market. For instance, as of early 2024, Alliar continued to leverage its established network and reputation, a key factor in maintaining its market position.

New entrants must invest heavily and patiently to build similar levels of credibility with both patients and referring physicians. This process is inherently slow and demands substantial resources, making it a significant hurdle to overcome. The healthcare landscape, in particular, relies on established relationships and proven track records, which are difficult for newcomers to replicate quickly.

- Brand Loyalty: Existing customer loyalty to established brands like Alliar reduces the immediate market share available to new entrants.

- Reputation Capital: Years of positive patient experiences and physician referrals translate into a strong reputation that new players must painstakingly build.

- Trust Deficit: New entrants often face a trust deficit, requiring extensive marketing and service delivery to overcome patient and physician skepticism.

- Market Inertia: Patients and physicians may be hesitant to switch from familiar and trusted providers, creating inertia that new entrants must actively disrupt.

Emergence of Disruptive MedTech Startups

The threat of new entrants in Brazil's MedTech sector is intensifying, despite existing high barriers. Agile startups are emerging, often focusing on digital health and AI-driven diagnostic solutions. These companies can bypass traditional infrastructure requirements, offering specialized and potentially more cost-effective services.

For instance, the Brazilian digital health market saw significant growth, with venture capital investments reaching an estimated R$1.5 billion in 2023, fueling startup innovation. These new players often target niche segments, providing specialized diagnostic tools that can disrupt established players like Alliar by offering innovative alternatives.

- Agile Startups: Leveraging digital health and AI to offer specialized diagnostic solutions.

- Lower Infrastructure Needs: Bypassing traditional capital-intensive infrastructure.

- Niche Market Focus: Targeting specific segments with innovative, cost-effective services.

- Investment Growth: Brazilian digital health startups attracted significant venture capital in 2023, indicating a growing threat.

The threat of new entrants in diagnostic medicine, particularly for companies like Alliar in Brazil, is moderated by substantial capital requirements, stringent regulatory hurdles overseen by bodies like ANVISA, and the critical need for specialized talent. Established brands also benefit from significant patient and physician trust, creating a loyalty barrier.

| Barrier | Description | 2024 Data/Impact |

|---|---|---|

| Capital Requirements | High investment in technology and infrastructure | MRI scanners cost >$1.5 million; network build-out costs hundreds of millions. |

| Regulatory Hurdles | ANVISA registration and compliance | Device registration can take over a year, demanding significant compliance investment. |

| Specialized Workforce | Need for skilled professionals (radiologists, technicians) | Shortage of radiologists in some markets impacts recruitment costs and onboarding times. |

| Brand Recognition & Trust | Established reputation and patient loyalty | Alliar leverages its network and reputation; new entrants need time and resources to build credibility. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from company annual reports, industry-specific market research, and publicly available financial filings to provide a comprehensive view of competitive dynamics.