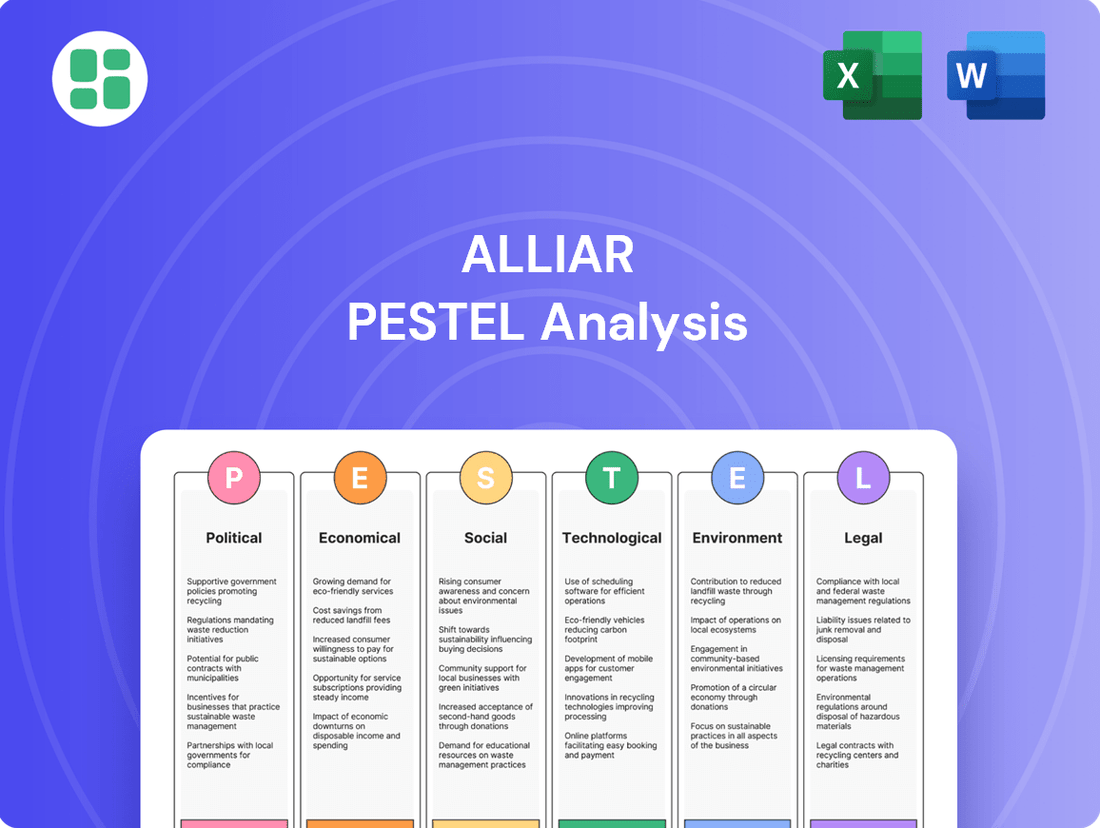

Alliar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliar Bundle

Navigate the complex external forces shaping Alliar's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. Gain a competitive edge by leveraging these expert insights to inform your investment decisions and business strategies. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Brazil's Unified Health System (SUS) is slated for a 6.2% budget increase in 2025, reflecting sustained government commitment to public healthcare. This expansion in primary and specialized care under SUS could shift demand for diagnostic services, potentially influencing the private sector's market share.

Furthermore, the government's strategic emphasis on domestic production of pharmaceuticals and medical equipment, bolstered by programs like the National Strategy for the Development of the Health Economic-Industrial Complex (CEIS), may impact Alliar's sourcing strategies and overall operational expenses.

The Brazilian Health Regulatory Agency (Anvisa) and the National Regulatory Agency for Private Health Insurance and Plans (ANS) are actively shaping the healthcare landscape with their 2024-2025 regulatory agendas. These agendas offer a degree of predictability, outlining plans for simplified medicine registration processes and the exploration of regulatory sandboxes for emerging health technologies. Alliar must remain vigilant, tracking these developments to ensure ongoing compliance and to capitalize on any advantages presented by these evolving frameworks, particularly concerning the integration of AI in healthcare, which is also a focus.

Brazil's political landscape has shown increasing stability, fostering a more predictable environment for businesses like Alliar. This stability is bolstered by robust legislation designed to safeguard investor interests, which is a crucial factor encouraging both local and international capital inflow into the dynamic healthcare sector.

While Brazil has made strides in economic stability, persistent inflation and currency volatility remain key concerns. For instance, Brazil's inflation rate in early 2024 hovered around 4.5%, and the Brazilian Real (BRL) experienced fluctuations against the US Dollar. These economic conditions directly influence healthcare affordability and consumer spending patterns, requiring Alliar to implement flexible pricing strategies and cost-management initiatives.

Public-Private Partnerships (PPPs)

The Brazilian government's push for Public-Private Partnerships (PPPs) in healthcare is a significant political factor. This initiative aims to inject private capital and expertise into public health services, potentially improving efficiency and access. For Alliar, this presents a strategic avenue to expand its diagnostic services into underserved areas or collaborate on large-scale public health projects.

These PPPs are designed to attract strategic investors and enhance the operational effectiveness of the public health system. The Ministry of Health's recent guidelines, released in late 2024, are specifically focused on accelerating medical innovation through these collaborative models. This policy shift could lead to new contract opportunities for private diagnostic providers like Alliar.

Key aspects of this political trend for Alliar include:

- Government Incentives: The Brazilian government is actively creating a more favorable regulatory environment for PPPs in healthcare, encouraging private sector participation.

- Expansion Opportunities: Alliar can leverage these PPPs to broaden its geographic footprint and serve a larger patient population, particularly within the public sector.

- Innovation Focus: The emphasis on accelerating medical innovation through partnerships aligns with Alliar's potential to introduce advanced diagnostic technologies and methodologies in public health settings.

- Efficiency Gains: By partnering with the public sector, Alliar can contribute to improving the overall efficiency and quality of healthcare delivery nationwide.

Judicialization of Health

The increasing judicialization of health in Brazil, where citizens sue for access to treatments or services, presents a notable political and social challenge. This trend saw the Ministry of Health incur costs exceeding BRL 2 billion in 2024 alone, underscoring a significant demand for healthcare that outstrips current public provision.

This phenomenon directly impacts healthcare providers like Alliar. The company might experience indirect pressure to fill service gaps highlighted by these lawsuits or find opportunities in providing specialized services that are frequently the subject of legal claims.

Furthermore, evolving judicial interpretations of healthcare rights can shape regulatory expectations and operational requirements for private healthcare entities.

- Judicialization of Health Costs: The Brazilian Ministry of Health spent over BRL 2 billion in 2024 due to judicial demands for healthcare.

- Societal Demand Indicator: This trend reflects a strong societal demand for healthcare services, often unmet by public systems.

- Impact on Alliar: Alliar may face indirect pressure to cover service gaps or adapt its offerings to meet judicially recognized patient needs.

- Regulatory Adaptability: Evolving legal interpretations of healthcare rights necessitate ongoing adaptation by private providers.

Brazil's political landscape is marked by increasing stability, fostering a more predictable environment for businesses like Alliar, supported by legislation safeguarding investor interests and encouraging capital inflow into the healthcare sector.

The government's commitment to public healthcare is evident in the 2025 budget, with a 6.2% increase for SUS, potentially influencing demand for diagnostic services and Alliar's market share.

Public-Private Partnerships (PPPs) are a key political strategy, aiming to integrate private capital and expertise into public health, creating potential expansion and innovation opportunities for Alliar, particularly following late 2024 guidelines from the Ministry of Health to accelerate medical innovation through these models.

The ongoing "judicialization of health" in Brazil, where citizens sue for services, led the Ministry of Health to spend over BRL 2 billion in 2024, highlighting unmet demand and potentially creating new service opportunities for Alliar.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Alliar, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and prospects.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining external factor assessment for Alliar.

Economic factors

Brazil's economic trajectory, with projected GDP per capita growth, is set to significantly boost disposable income for a substantial portion of its population. The anticipated entry of 40 million Brazilians into the middle class by 2025 signifies a major expansion in the consumer market, translating directly to increased purchasing power.

This enhanced financial capacity fuels a greater demand for healthcare services and a heightened willingness to invest in personal health and wellness. Alliar, as a key player in private healthcare, is well-positioned to capitalize on this trend, experiencing increased consumption of its diagnostic tests and comprehensive healthcare offerings.

Brazil's healthcare market, the largest in Latin America, is a significant economic driver. Healthcare expenditure is projected to grow at an annual rate of 1.4% from 2021 to 2026, indicating a steady expansion of the sector. This growth presents a fertile ground for companies like Alliar.

The sector is experiencing a surge in mergers, acquisitions, and international investment. Notably, healthcare real estate and digital health solutions are attracting substantial capital. For instance, in 2023, investments in Brazilian healthtech startups reached over $300 million, highlighting strong investor confidence.

This dynamic investment landscape, characterized by robust M&A activity and foreign capital inflow, signals a favorable environment for Alliar's strategic growth and potential expansion initiatives within Brazil's healthcare ecosystem.

Inflationary pressures, particularly in Brazil, can significantly impact healthcare affordability for consumers and increase operational expenses for providers like Alliar. For example, Brazil's inflation rate hovered around 4.62% in early 2024, a slight increase from the previous year, potentially reducing disposable income for medical services.

Currency fluctuations, especially the depreciation of the Brazilian real against major currencies like the US dollar, directly affect Alliar's cost structure. A weaker real makes imported medical equipment and pharmaceuticals more expensive, as these are often priced in foreign currencies, potentially squeezing profit margins if not effectively managed.

Managing these economic volatilities is crucial for Alliar's financial health. The company must implement strategies to mitigate the impact of rising costs and currency swings, perhaps through hedging or optimizing supply chains, to ensure continued profitability and service delivery.

Cost Reduction and Efficiency Focus

Brazilian healthcare providers, including Alliar, are placing a strong emphasis on cost reduction and operational efficiency to thrive in a competitive market. This focus is driven by the need to maintain profitability while navigating complex regulatory landscapes and embracing technological advancements. Alliar's success hinges on its capacity to streamline operations and effectively utilize technology.

Key areas of focus for Alliar and its peers include:

- Cost Optimization: Implementing strategies to lower expenses across all operational facets, from supply chain management to administrative overhead.

- Regulatory Compliance: Ensuring adherence to evolving healthcare regulations, which often involves significant investment in systems and processes.

- Technology Adoption: Leveraging digital tools and innovative solutions to improve patient care, enhance administrative efficiency, and reduce operational costs. For instance, the adoption of AI in diagnostics and administrative tasks is a growing trend, with projections indicating significant cost savings and improved accuracy in the coming years.

- Operational Efficiency: Streamlining workflows, optimizing resource allocation, and improving service delivery to maximize output with minimal waste.

Private Health Insurance Market Dynamics

The Brazilian private health insurance market is experiencing robust growth, driven by employee demand for enhanced benefits and perceived shortcomings in public healthcare. In 2024, the number of individuals covered by private health plans continued its upward trajectory, with collective contracts, often offered by employers, showing particular strength. This preference for private coverage directly benefits diagnostic service providers like Alliar, as these insured individuals are more likely to utilize their services.

This increasing reliance on private health plans fuels a broader consolidation trend within the Brazilian healthcare sector. Companies that can efficiently serve this growing insured population are well-positioned for expansion. For instance, the proportion of Brazilians with private health insurance has been steadily climbing, reaching approximately 25% of the population in recent years, underscoring the market's potential.

- Growing Demand: Employees highly value private health plans, making them a key recruitment and retention tool.

- Public System Weaknesses: Deficiencies in the public health system push more Brazilians towards private alternatives.

- Market Opportunity: Alliar benefits from this trend as a provider of essential diagnostic services to privately insured individuals.

- Sector Consolidation: The expanding private healthcare market encourages mergers and acquisitions, reshaping the industry landscape.

Brazil's economic outlook, with a projected GDP per capita growth, is poised to significantly increase disposable income. By 2025, an estimated 40 million Brazilians are expected to join the middle class, expanding the consumer market and boosting purchasing power for healthcare services.

Healthcare expenditure in Brazil, the largest in Latin America, is a key economic driver. It's anticipated to grow at an annual rate of 1.4% between 2021 and 2026. This sector is also seeing substantial investment, with over $300 million invested in Brazilian healthtech startups in 2023 alone, signaling strong investor confidence.

Inflation remains a concern, with Brazil's inflation rate around 4.62% in early 2024, potentially impacting consumer affordability for medical services. Additionally, currency fluctuations, such as the depreciation of the Brazilian real, increase the cost of imported medical equipment and pharmaceuticals, affecting providers like Alliar.

The Brazilian private health insurance market is expanding, with a growing number of individuals covered by private plans, often through employer-sponsored benefits. This trend, with approximately 25% of the population now having private health insurance, directly benefits diagnostic service providers like Alliar.

| Economic Factor | 2024/2025 Projection/Data | Impact on Alliar |

|---|---|---|

| GDP Per Capita Growth | Positive trajectory | Increased disposable income, higher demand for services |

| Middle Class Expansion | 40 million new entrants by 2025 | Significant market expansion and increased purchasing power |

| Healthcare Expenditure Growth | 1.4% annual growth (2021-2026) | Steady sector expansion, fertile ground for growth |

| Healthtech Investment | Over $300 million in 2023 | Investor confidence, opportunities for innovation and partnerships |

| Inflation Rate | ~4.62% (early 2024) | Potential impact on affordability and operational costs |

| Currency Depreciation (BRL) | Weaker real against USD | Increased costs for imported equipment and pharmaceuticals |

| Private Health Insurance Penetration | ~25% of population | Increased utilization of diagnostic services by insured individuals |

Full Version Awaits

Alliar PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alliar provides an in-depth look at the political, economic, social, technological, legal, and environmental factors influencing the company. It’s a valuable resource for understanding Alliar's strategic landscape.

Sociological factors

Brazil is projected to enter a significant aging phase by 2025, meaning a larger portion of the population will be elderly. This demographic shift, combined with a growing understanding of chronic conditions such as diabetes, heart disease, and obesity, is expected to boost the demand for healthcare services, including diagnostic medicine.

This trend presents a clear opportunity for Alliar to meet the escalating need for specialized diagnostic tests and ongoing patient monitoring services. For instance, as the elderly population grows, so does the incidence of chronic diseases, requiring more frequent and sophisticated diagnostic interventions. In 2023, chronic diseases accounted for a substantial percentage of deaths in Brazil, underscoring the ongoing demand for diagnostic solutions.

The COVID-19 pandemic significantly amplified public focus on preventive health measures, including better nutrition and the adoption of telehealth. This heightened awareness translates to a greater willingness among consumers to invest in proactive health management, directly benefiting companies like Alliar that offer essential diagnostic services for early detection and intervention.

Brazil's Unified Health System (SUS) aims for universal access, but significant disparities remain, especially affecting rural and low-income populations. In 2023, while SUS covered over 70% of the Brazilian population, access to specialized care and timely treatments varied greatly by region.

The adoption of digital health and telemedicine is rapidly expanding, bridging geographical gaps and offering greater convenience. By the end of 2024, it's projected that over 40% of Brazilian healthcare providers will offer some form of telemedicine service, reaching an estimated 20 million patients.

Alliar can capitalize on this trend by integrating digital health platforms, enhancing its reach to underserved areas and improving patient engagement. This strategic move is expected to boost service delivery efficiency and expand its market share in the growing digital health sector.

Lifestyle Changes and Demand for Wellness Services

The Brazilian health and wellness sector is booming, driven by consumers who are increasingly embracing digital healthcare options and prioritizing natural, functional, and locally sourced food products. This surge reflects significant lifestyle shifts and a growing desire for comprehensive well-being. Alliar's focus on services that bolster overall health management directly taps into these evolving consumer preferences.

This trend is supported by data showing a significant uptick in digital health adoption. For instance, reports from 2023 indicated that over 60% of Brazilians used at least one digital health service, a figure projected to climb further in 2024 and 2025. The demand for functional foods, which offer health benefits beyond basic nutrition, also saw a substantial rise, with market growth estimates reaching double digits annually in recent years.

- Growing Digital Health Adoption: Over 60% of Brazilians utilized digital health services in 2023, with continued growth expected.

- Demand for Natural and Functional Foods: Consumers are actively seeking products with health-enhancing properties, boosting this market segment.

- Preference for Local Sourcing: There's an increasing appreciation for locally produced goods, influencing purchasing decisions in the food sector.

- Holistic Well-being Focus: Lifestyles are shifting towards a more integrated approach to health, encompassing physical, mental, and nutritional aspects.

Healthcare Workforce Distribution

The distribution of medical professionals in Brazil presents a significant sociological factor for Alliar. While the nation is expected to see a substantial rise in doctors, with projections indicating over 2.5 million physicians by 2034, their concentration remains heavily skewed towards urban centers and wealthier regions. This unevenness means that access to specialized diagnostic interpretations, a core service for Alliar, could be limited in underserved areas.

This disparity directly impacts Alliar's strategic considerations for expanding its diagnostic center network. The company must weigh the potential demand in regions with fewer existing specialists against the logistical challenges of establishing and staffing new facilities. For instance, a 2023 study highlighted that certain Northeastern states have significantly fewer doctors per capita compared to the Southeast, creating a clear geographical gap in healthcare access.

- Regional Disparities: Brazil faces a concentration of medical professionals, particularly specialists, in the South and Southeast regions, leaving other areas with shortages.

- Projected Physician Growth: The number of physicians in Brazil is anticipated to grow, potentially reaching over 2.5 million by 2034, but distribution remains a key concern.

- Impact on Diagnostics: Uneven distribution can hinder the accessibility of advanced diagnostic services and the interpretation of complex medical images, affecting patient outcomes.

- Strategic Network Expansion: Alliar's growth strategy must account for these sociological patterns, potentially focusing on underserved regions or developing innovative service delivery models.

Brazil's aging population, projected to increase significantly by 2025, coupled with a growing awareness of chronic diseases like diabetes and heart disease, is fueling demand for healthcare services, including diagnostics. This demographic shift presents a substantial opportunity for Alliar to expand its offerings in specialized testing and patient monitoring, directly addressing the rising prevalence of these conditions.

The pandemic has heightened public interest in preventive health, including better nutrition and telehealth adoption, encouraging consumers to invest more in proactive health management. This trend benefits Alliar by increasing the willingness of individuals to utilize diagnostic services for early detection and intervention, aligning with the growing demand for comprehensive well-being and digital health solutions.

Significant disparities in access to Brazil's Unified Health System (SUS) persist, particularly affecting rural and low-income populations, with regional variations in specialized care availability. Concurrently, the rapid expansion of digital health and telemedicine, expected to reach over 20 million patients by the end of 2024, offers Alliar a pathway to bridge these geographical gaps and enhance service delivery efficiency.

The uneven distribution of medical professionals, concentrated in urban centers, poses a challenge for Alliar in expanding its diagnostic network into underserved regions. Despite a projected increase in physicians to over 2.5 million by 2034, the scarcity in certain areas necessitates strategic planning for facility placement and service models to ensure accessibility.

Technological factors

Technological advancements are significantly shaping Brazil's clinical diagnostics sector. The market is experiencing robust growth, fueled by increasing demand for sophisticated diagnostic tests and the integration of cutting-edge imaging and biomarker analysis. These innovations are vital for early disease detection and personalized treatment approaches.

Alliar, a key player in this landscape, must prioritize investment in state-of-the-art diagnostic equipment and novel methodologies to maintain its competitive edge. For instance, the adoption of AI-powered imaging analysis and advanced molecular diagnostics can offer more accurate and efficient patient care pathways.

The integration of artificial intelligence and advanced data analytics is rapidly transforming healthcare, offering significant opportunities for efficiency and personalized patient care. Brazil's National Data Protection Authority (ANPD) is actively working to define how AI applications will be interpreted within the existing General Data Protection Law (LGPD), aiming to establish clear guidelines for AI-driven data processing. For Alliar, this technological shift presents a crucial avenue to improve diagnostic precision, streamline operations, and ultimately elevate patient treatment and outcomes by harnessing these powerful tools.

The digital health and telemedicine sectors in Brazil are booming, fueled by significant investments and government programs aimed at improving healthcare accessibility, particularly in underserved regions. This trend is projected to continue, with the digital diabetes management market expected to see substantial expansion.

Alliar can strategically leverage this growth by integrating telehealth platforms into its service model. This would allow for the convenient delivery of diagnostic consultations and the efficient transmission of results, broadening its reach and enhancing patient experience.

Laboratory Automation and Genetic Sequencing

Advances in laboratory automation and genetic sequencing are revolutionizing diagnostic medicine, significantly increasing processing capacity and enabling the detection of a wider array of diseases, from various cancers to rare genetic conditions. In 2024, the global market for laboratory automation was valued at approximately $5.6 billion, with projections indicating substantial growth driven by these technological advancements.

Partnerships between healthcare providers and technology firms are crucial for expanding the reach and application of genetic sequencing in markets like Brazil. For instance, collaborations are enabling more accessible and affordable genetic testing, which is vital for early disease detection and personalized treatment plans.

Alliar can strategically leverage these cutting-edge technologies to enhance operational efficiency and reduce costs associated with diagnostic procedures. By integrating advanced automation and genetic sequencing capabilities, the company can offer more thorough and personalized diagnostic services, thereby improving patient outcomes and strengthening its competitive position in the healthcare sector.

- Increased Diagnostic Accuracy: Automation reduces human error in sample handling and analysis.

- Cost Reduction: Higher throughput and efficiency lead to lower per-test costs.

- Personalized Medicine: Genetic sequencing allows for tailored treatment based on individual genetic makeup.

- Early Disease Detection: Advanced diagnostics can identify diseases at earlier, more treatable stages.

Wearable Medical Devices and IoT

The Brazilian market for wearable health devices is experiencing robust growth, fueled by increasing consumer interest in actively managing their well-being. This trend positions wearable technology as a significant technological factor for healthcare providers like Alliar.

These devices, increasingly sophisticated with AI and IoT capabilities, are no longer just fitness trackers. They provide detailed health metrics and personalized advice, offering a deeper understanding of an individual's health status. For instance, the global wearable medical device market was projected to reach over $100 billion by 2025, with significant contributions from regions like Latin America.

Alliar can strategically leverage this technological advancement by integrating data from these wearable devices into its existing diagnostic platforms. This integration would enable more comprehensive patient care, offering a richer, more personalized health profile. Such a move could also pave the way for expanding Alliar's service portfolio into areas like remote patient monitoring and preventative health programs.

- Market Growth: The Brazilian wearable health device market is expanding rapidly due to consumer demand for proactive health management.

- Technological Advancement: Wearables enhanced by AI and IoT provide advanced health insights and personalized recommendations.

- Integration Opportunity: Alliar can integrate wearable data into its diagnostic platforms for holistic patient care.

- Service Expansion: This integration allows for the potential development of new services, such as remote monitoring.

Technological advancements in AI and automation are revolutionizing diagnostics, improving accuracy and efficiency. Brazil's digital health sector is booming, with telehealth and wearable tech offering new avenues for patient engagement and data collection.

Alliar can leverage these trends by integrating AI for diagnostics and adopting telehealth platforms to expand its reach. The company can also explore integrating data from wearable devices to offer more personalized and proactive health services.

The global laboratory automation market reached approximately $5.6 billion in 2024, highlighting the significant investment in these technologies. These advancements enable earlier disease detection and more personalized treatment plans.

| Technology | Impact on Diagnostics | Alliar's Opportunity |

|---|---|---|

| AI in Imaging | Enhanced accuracy, faster analysis | Improved diagnostic precision |

| Telehealth | Increased accessibility, remote consultations | Broader patient reach, enhanced convenience |

| Wearable Devices | Continuous health monitoring, personalized data | Holistic patient profiles, preventative care |

| Laboratory Automation | Higher throughput, reduced costs | Operational efficiency, cost savings |

Legal factors

The Brazilian General Data Protection Law (LGPD), effective since September 2020, places substantial responsibilities on organizations handling personal and sensitive data, a critical aspect for healthcare providers like Alliar. This law mandates robust data protection practices, impacting how patient information is collected, processed, and stored.

Recent regulatory developments from the Brazilian Data Protection Authority (ANPD) in 2024 and 2025 are particularly relevant, focusing on stricter rules for international data transfers and establishing guidelines for artificial intelligence (AI) governance and data subject rights. These updates require Alliar to continuously adapt its data handling protocols.

Ensuring strict adherence to the LGPD and these evolving regulations is paramount for Alliar, especially concerning the privacy and security of sensitive patient data. Non-compliance could lead to significant penalties, impacting both operational integrity and public trust.

Anvisa's 2024-2025 regulatory agenda is extensive, covering 172 topics crucial for companies like Alliar, from medicines to health services.

Recent Anvisa updates, such as streamlined medicine registration and revised clinical research rules, directly impact Alliar's operational efficiency and market entry timelines.

Alliar must proactively monitor Anvisa's evolving guidelines on product registration, post-market surveillance, and overall compliance to ensure continued licensure and access to the Brazilian healthcare market.

The National Regulatory Agency for Private Health Insurance and Plans (ANS) plays a crucial role in shaping the landscape for companies like Alliar. As the overseer of the supplementary health sector, ANS regulations directly influence private health insurance carriers, which in turn impacts diagnostic companies that rely on these insured patients for business. For instance, recent ANS resolutions are exploring regulatory sandboxes, a move designed to encourage new health solutions and boost competition within the market.

Alliar must remain vigilant in its compliance with ANS directives. Key areas of focus include adherence to financial regulatory mechanisms and the intricate rules surrounding health plan adjustments. These regulations have a direct bearing on Alliar's revenue streams and how it navigates its interactions within the broader health insurance ecosystem.

Medical Device and Clinical Trial Regulations

Brazil is actively reforming its medical device regulations to speed up clinical trials. New legislation like Law 14.874/24 and RDC 837/2023 are designed to make the process more efficient. This regulatory evolution is a significant legal factor for companies like Alliar operating in the healthcare sector.

Anvisa, Brazil's health regulatory agency, has introduced streamlined analysis processes for medical devices already approved by equivalent foreign regulatory bodies. This initiative, detailed in recent Anvisa publications, aims to reduce review times for innovative products. Such changes can significantly reduce the time-to-market for new diagnostic technologies, potentially benefiting Alliar's adoption of advanced medical equipment.

- Streamlined Approval Pathways: Brazil's new regulations, including Law 14.874/24 and RDC 837/2023, are designed to expedite the clinical trial process for medical devices.

- Foreign Equivalency Recognition: Anvisa's updated instructions allow for a faster review of products already cleared by recognized foreign regulatory authorities, potentially shortening import and adoption timelines.

- Impact on Innovation Adoption: These legal reforms are expected to accelerate the availability of new medical and pharmaceutical supplies, offering opportunities for Alliar to integrate cutting-edge diagnostic technologies into its services.

Consumer Protection Laws and Judicialization

Consumer protection laws are increasingly vital, particularly as patients are recognized as data subjects with distinct rights concerning their personal health information. This means Alliar must navigate regulations ensuring transparency and consent in data processing.

The growing trend of the judicialization of health means courts are more frequently involved in resolving healthcare disputes, often stemming from patients asserting their constitutional rights. This highlights the importance of Alliar proactively addressing service quality and patient rights to mitigate legal risks.

- Data Subject Rights: Patients have rights regarding access, correction, and deletion of their health data under various consumer protection frameworks.

- Judicial Intervention: Increased litigation in healthcare means Alliar faces potential legal challenges over service delivery and patient care standards.

- Compliance Focus: Robust internal policies are essential for Alliar to manage legal exposure related to patient rights and data privacy.

Brazil's legal landscape for healthcare is actively evolving, with recent reforms in 2024 and 2025 aimed at streamlining processes and enhancing patient rights. The implementation of Law 14.874/24 and RDC 837/2023 signals a push for faster clinical trials for medical devices, directly impacting how quickly new diagnostic technologies can be adopted.

Anvisa's updated guidelines, particularly those recognizing foreign equivalency for medical device approvals, are designed to reduce review times, potentially accelerating market entry for innovative products. Simultaneously, the National Regulatory Agency for Private Health Insurance and Plans (ANS) is exploring regulatory sandboxes, fostering new health solutions and competition.

Alliar must remain compliant with the Brazilian General Data Protection Law (LGPD) and its evolving interpretations by the ANPD, especially concerning international data transfers and AI governance. Increased judicial intervention in healthcare disputes also necessitates a strong focus on service quality and patient rights to mitigate legal risks.

Environmental factors

Companies like Alliar, operating in Brazil's healthcare sector, face significant environmental responsibilities concerning medical waste. Proper storage, transportation, and disposal are mandated by Brazil's National Policy on Solid Waste and the new Regulatory Standard NR-38, with non-compliance leading to severe administrative, criminal, and civil penalties.

Alliar must maintain rigorous waste management systems to adhere to these regulations. For instance, in 2023, Brazil's Ministry of Health reported a substantial volume of healthcare-associated waste requiring specialized handling, underscoring the critical need for robust protocols to ensure environmental safety and avoid legal repercussions.

Operating a widespread network of diagnostic centers and laboratories inherently involves substantial energy consumption, a key environmental factor for Alliar. The increasing global and national focus on sustainability means companies are actively integrating these principles into their core business strategies. For instance, in 2023, the healthcare sector in Brazil, where Alliar operates, saw a growing demand for eco-friendly solutions, with a notable uptick in investments towards renewable energy sources within healthcare facilities.

Brazil's environmental landscape is actively evolving, with significant developments like the formal establishment of the Brazilian Greenhouse Gas Emissions Trading System (SBCE) in 2024. New decrees concerning the import of solid waste are also being implemented, reflecting a commitment to reducing emissions and boosting recycling. These changes underscore a push towards a circular economy.

Alliar must navigate these evolving environmental regulations, particularly those impacting emissions and waste management. Non-compliance with these new frameworks, such as the SBCE which aims to cap and trade emissions, could lead to substantial penalties and operational disruptions. Proactive adaptation is crucial for maintaining a sustainable business model.

Climate Change Impact on Health

While climate change doesn't directly affect Alliar's laboratories, shifts in weather patterns can indirectly influence the demand for its diagnostic services by impacting public health. For instance, warmer temperatures and altered rainfall can create environments conducive to the spread of vector-borne diseases like dengue and Zika, increasing the need for diagnostic testing.

Emerging infectious diseases linked to climate change can also drive demand. The World Health Organization (WHO) has noted that climate change is already exacerbating health risks, with projections indicating a rise in climate-sensitive diseases.

Alliar needs to monitor these broader public health trends, as they could lead to increased utilization of its services:

- Increased prevalence of heat-related illnesses requiring medical attention and potential diagnostic workups.

- Potential rise in respiratory conditions due to worsening air quality, often linked to climate events like wildfires, necessitating pulmonary function tests.

- Changes in water quality and availability can lead to outbreaks of waterborne diseases, driving demand for microbiological testing.

Reverse Logistics and Circular Economy Initiatives

Brazil's new environmental regulations are significantly impacting the circular economy by prohibiting recycling credit certificates for imported waste, thereby channeling focus towards domestically generated materials. This shift mandates that industries relying on waste as industrial inputs must prioritize local sourcing. For Alliar, while not directly a waste management company, this creates a ripple effect on its procurement and disposal strategies, potentially requiring adjustments to align with national circular economy goals and influencing its supply chain choices.

These regulatory changes underscore a growing national commitment to strengthening domestic recycling infrastructure and fostering a more robust circular economy within Brazil. By prioritizing local waste streams, the government aims to stimulate local job creation and reduce reliance on imported materials. This could present both challenges and opportunities for businesses like Alliar, necessitating a review of their sourcing and waste management practices to ensure compliance and leverage potential cost efficiencies from local circular supply chains.

- Regulatory Shift: Brazil's ban on recycling credit certificates for imported waste favors domestic waste streams.

- Circular Economy Focus: Prioritizing local waste supports national circular economy initiatives and domestic recycling industries.

- Supply Chain Impact: Alliar may need to adapt procurement and disposal practices to align with these new environmental regulations.

- Economic Implications: The policy aims to boost local recycling efforts and reduce dependence on imported waste materials.

Alliar must navigate Brazil's evolving environmental regulations, particularly those concerning waste management and emissions. The nation's commitment to a circular economy, exemplified by new decrees on imported waste and the establishment of a greenhouse gas emissions trading system in 2024, necessitates strict adherence to avoid penalties. For instance, the prohibition of recycling credit certificates for imported waste directly impacts supply chain considerations.

The indirect impact of climate change on public health, such as increased vector-borne diseases like dengue and Zika, can also influence Alliar's diagnostic service demand. Warmer temperatures and altered weather patterns create environments conducive to disease spread, potentially increasing the need for testing services.

Companies like Alliar face increasing pressure to adopt sustainable practices, including efficient energy consumption. In 2023, the Brazilian healthcare sector saw a rise in demand for eco-friendly solutions and investments in renewable energy sources within facilities.

Alliar's environmental responsibilities include the proper management of medical waste, as mandated by Brazil's National Policy on Solid Waste and NR-38. Non-compliance carries significant penalties, highlighting the critical need for robust waste handling protocols, especially given the substantial volumes of healthcare waste requiring specialized treatment reported in 2023.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alliar is built on a robust foundation of data from official Brazilian government agencies, reputable financial institutions, and leading market research firms. We incorporate economic indicators, regulatory updates, and societal trends to provide a comprehensive view.