Alfmeier Präzision AG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfmeier Präzision AG Bundle

Alfmeier Präzision AG's SWOT analysis reveals a company with robust technological capabilities and a strong reputation for quality, yet it faces increasing competition and the need for continuous innovation. Understanding these dynamics is crucial for anyone looking to invest, partner, or compete in their sector.

Want to truly grasp Alfmeier Präzision AG's strategic advantages and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to illuminate their market position and future opportunities.

Strengths

Alfmeier Präzision AG stands out with its specialized product portfolio, particularly its global leadership in lumbar and massage comfort solutions for vehicles. This niche focus allows them to carve out a significant market share and differentiate themselves effectively. Their expertise in precision components directly contributes to enhanced vehicle performance and passenger comfort, making them a sought-after supplier for major automotive manufacturers worldwide.

Alfmeier Präzision AG's core strength is its unwavering commitment to precision engineering and a relentless focus on innovation. This dedication is evident in their consistent development and introduction of cutting-edge solutions, particularly in areas like advanced materials, sophisticated manufacturing processes, and the integration of smart systems into their product offerings.

This proactive approach to innovation allows Alfmeier to not only refine existing product lines but also to pioneer entirely new product categories, thereby expanding their overall portfolio. For instance, their investment in research and development, which contributed to a significant portion of their revenue in 2023, directly fuels this expansion, ensuring they are well-positioned to meet evolving market demands and capitalize on emerging technological trends.

Alfmeier Präzision AG boasts a significant strength in its global customer base, serving major automotive manufacturers such as Audi, BMW, Ford, and Volkswagen. This diverse clientele, coupled with relationships with Tier-1 system suppliers, underscores the company's broad market acceptance and deep integration within the automotive supply chain.

Furthermore, the company's expansive manufacturing footprint, with facilities strategically located in Germany, the USA, Mexico, the Czech Republic, and South Korea, is a key asset. This international presence not only allows for localized production and reduced logistical costs but also bolsters supply chain resilience by diversifying operational risk across multiple regions.

Integration of Advanced Technologies

Alfmeier Präzision AG is making significant strides in integrating advanced technologies like AI and IoT into its product portfolio and operational framework. This strategic push is designed to elevate product capabilities and streamline internal workflows via digital advancements and robust data analysis. By embracing these technologies, the company is positioning itself to remain competitive in the rapidly changing automotive sector.

The company's commitment to technological innovation is evident in its ongoing research and development investments. For instance, in the fiscal year 2024, Alfmeier Präzision AG allocated a substantial portion of its budget towards R&D, focusing on smart fluid management systems that leverage IoT connectivity. This proactive approach is crucial for developing next-generation solutions that meet the increasing demand for connected and intelligent automotive components.

- AI and IoT Integration: Alfmeier Präzision AG is actively embedding artificial intelligence and the Internet of Things into its product offerings, enhancing functionality and data-driven insights.

- Digital Transformation Focus: The company prioritizes digital transformation, utilizing data analytics to optimize operational efficiency and improve customer experiences.

- Competitive Edge: This technological integration is a key strategy to maintain and strengthen its competitive position within the dynamic automotive industry.

- R&D Investment: Significant R&D spending in 2024 was directed towards developing smart fluid management systems, reflecting a commitment to innovation.

Synergies from Gentherm Acquisition

Since its acquisition by Gentherm Inc. in August 2022, Alfmeier Präzision AG has been integrated into a larger, more diversified automotive supplier. This strategic move by Gentherm, a global leader in thermal management technologies, positions Alfmeier to leverage significant synergies.

These synergies are expected to manifest in several key areas, enhancing Alfmeier's competitive standing. Access to Gentherm's substantial financial resources can fuel innovation and expansion. Furthermore, the integration provides Alfmeier with expanded research and development capabilities, allowing for faster product development cycles and the exploration of new technologies. Gentherm's established global market reach and extensive customer network offer Alfmeier a significant advantage in broadening its sales channels and market penetration.

- Enhanced Financial Stability: Gentherm's robust financial backing provides Alfmeier with greater stability, enabling investments in long-term growth strategies.

- R&D Acceleration: Collaboration with Gentherm's advanced R&D teams can expedite the development of next-generation thermal management solutions.

- Expanded Market Access: Leveraging Gentherm's established global sales network and customer relationships opens new avenues for Alfmeier's products.

- Diversification Benefits: Becoming part of a larger, diversified entity like Gentherm can mitigate risks associated with reliance on specific markets or product lines.

Alfmeier Präzision AG's strengths lie in its specialized product leadership, particularly in automotive comfort solutions like lumbar and massage systems, where it holds a globally dominant position. This niche focus, combined with a deep commitment to precision engineering and continuous innovation, allows the company to offer high-value components that enhance vehicle performance and passenger experience. Their proactive investment in R&D, exemplified by significant spending in 2024 on smart fluid management systems, ensures they remain at the forefront of technological advancements in the automotive sector.

What is included in the product

Provides a clear SWOT framework for analyzing Alfmeier Präzision AG’s business strategy, detailing its internal capabilities and external market landscape.

Offers a clear, actionable framework for identifying and addressing Alfmeier Präzision AG's strategic challenges.

Weaknesses

Alfmeier Präzision AG's significant reliance on the automotive sector makes it vulnerable to industry-wide downturns. For instance, global light vehicle production forecasts for 2024 anticipate modest growth, but this remains susceptible to geopolitical tensions and supply chain disruptions, directly affecting demand for Alfmeier's products.

The cyclicality of car sales means that periods of high demand can be followed by sharp contractions. This volatility can lead to unpredictable revenue streams for Alfmeier, impacting its ability to forecast and manage resources effectively. For example, a slowdown in EV adoption rates could disproportionately affect suppliers of components for internal combustion engines.

The automotive sector's supply chain remains a significant vulnerability, with ongoing shortages of crucial components like semiconductor chips and escalating raw material costs. For Alfmeier Präzision AG, these persistent challenges translate directly into potential production delays and elevated operational expenses. For instance, the global automotive chip shortage, which persisted through much of 2023 and into early 2024, significantly hampered production volumes across the industry, impacting companies like Alfmeier that rely on these components for their specialized products.

Alfmeier Präzision AG faces a significant challenge as the automotive industry pivots towards electric vehicles (EVs). A faster-than-anticipated shift could reduce demand for their established components, especially those catering to internal combustion engine (ICE) fuel systems. For instance, the global market for automotive fuel injection systems, a segment where Alfmeier has expertise, is projected to see a compound annual growth rate (CAGR) of only 2.5% from 2024 to 2030, a stark contrast to the booming EV component market.

Intense Competition within Automotive Supply

The automotive component market is incredibly crowded, featuring many large, well-known global companies alongside smaller, specialized firms. Alfmeier must continuously push for new ideas, keep its costs down, and ensure top-notch product quality to stay competitive against other suppliers in fluid management and seat comfort technologies.

This intense rivalry means that companies like Alfmeier are under constant pressure to differentiate themselves. For instance, in 2024, the global automotive supplier market was valued at over $2.5 trillion, with significant portions dedicated to the segments Alfmeier operates in. Staying ahead requires substantial investment in research and development, alongside efficient manufacturing processes.

- High Market Saturation: The presence of numerous established global and regional players intensifies competition.

- Innovation Imperative: Continuous development of new technologies and product enhancements is crucial to meet evolving OEM demands.

- Cost Pressures: Automakers often exert significant price pressure on suppliers, requiring efficient operations and supply chain management.

- Quality and Reliability Demands: Meeting stringent automotive quality standards is non-negotiable, adding to operational complexity and cost.

Integration Challenges Post-Acquisition

While Gentherm's acquisition of Alfmeier Präzision AG in late 2023, valued at approximately €165 million, promises synergies, the actual integration process can be complex. Merging distinct operational systems, IT infrastructures, and corporate cultures often leads to initial inefficiencies. For instance, a study by McKinsey found that over 50% of mergers fail to achieve their expected synergies due to poor integration.

Alfmeier's specialized product lines and established processes might require significant adaptation to align with Gentherm's broader manufacturing and supply chain strategies. This could manifest as temporary disruptions in production or delivery schedules as systems are harmonized.

- Organizational Complexity: Reconciling different management structures and employee roles can create overlap and slow down decision-making.

- System Harmonization: Integrating disparate IT systems, from ERP to quality control, is a significant undertaking that can lead to compatibility issues.

- Cultural Assimilation: Bridging differing corporate cultures requires proactive management to ensure employee buy-in and maintain morale.

- Potential for Redundancy: Identifying and managing duplicate functions across both organizations is crucial to avoid operational inefficiencies and cost overruns.

Alfmeier's dependence on the automotive industry makes it susceptible to its inherent cyclicality and the rapid technological shifts occurring within it. The ongoing transition to electric vehicles presents a particular challenge, as demand for components tied to internal combustion engines may decline. For instance, the global market for automotive fuel injection systems, a key area for Alfmeier, is projected to grow at a modest 2.5% CAGR between 2024 and 2030, significantly lagging behind the EV sector.

The competitive landscape is also a significant weakness. Alfmeier operates in a crowded market with numerous established global and regional players, necessitating continuous innovation and cost efficiency. The global automotive supplier market, valued at over $2.5 trillion in 2024, underscores the intense pressure to differentiate and maintain high-quality standards. This environment demands substantial investment in R&D and efficient manufacturing to remain competitive.

Following its acquisition by Gentherm in late 2023 for approximately €165 million, Alfmeier faces integration challenges. Merging disparate IT systems, operational processes, and corporate cultures can lead to initial inefficiencies and potential disruptions. Studies suggest over 50% of mergers fail to achieve expected synergies due to integration issues, highlighting the risk of operational complexities and the need for careful management of organizational and cultural assimilation.

Same Document Delivered

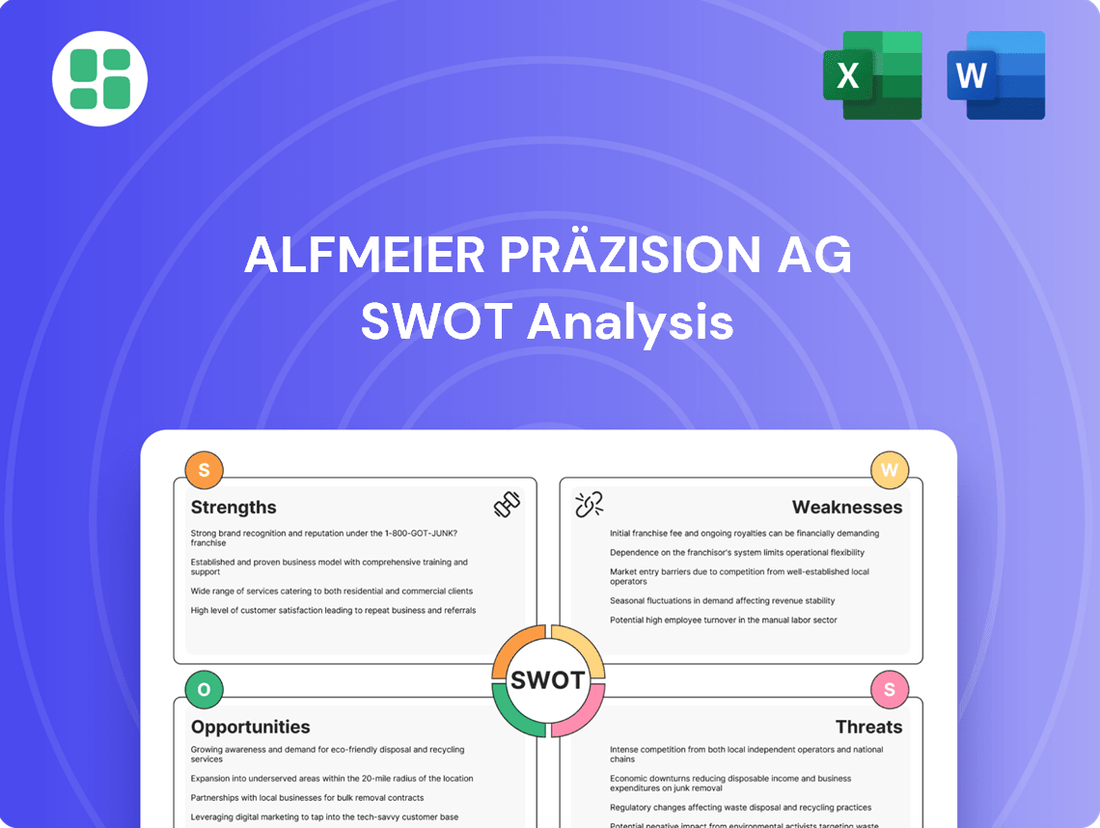

Alfmeier Präzision AG SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Alfmeier Präzision AG's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering detailed insights into the company's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the analysis to your specific needs.

Opportunities

The automotive seat comfort systems market is booming, with projections indicating continued strong expansion. This growth is fueled by consumers increasingly prioritizing luxury, ergonomic design, and sophisticated features like heating, cooling, and massage functions in their vehicles. For instance, the global automotive seat market was valued at approximately $60 billion in 2023 and is expected to reach over $80 billion by 2028, showcasing a significant upward trend.

Alfmeier Präzision AG, as a prominent player in this sector, is strategically positioned to benefit from this market surge. The company's expertise in developing and supplying cutting-edge comfort solutions for a wide range of vehicles, from passenger cars to commercial transport, allows it to capture a substantial share of this growing demand.

The burgeoning electric vehicle (EV) market presents a significant growth avenue for Alfmeier Präzision AG. As EV production accelerates globally, the demand for advanced fluid management systems, particularly for battery thermal regulation, is set to surge. This trend is projected to drive substantial revenue increases for companies like Alfmeier with established expertise in this niche.

Alfmeier Präzision AG can significantly boost its competitive edge by integrating advanced technologies like AI and IoT into its product lines. This strategic move is projected to foster the creation of innovative, next-generation solutions that redefine automotive comfort and efficiency.

By embedding AI and advanced sensor systems, Alfmeier can unlock new functionalities, such as predictive maintenance and highly personalized cabin experiences, directly appealing to evolving consumer demands. This technological infusion is crucial for maintaining market leadership in an increasingly digitized automotive landscape, with the global automotive AI market expected to reach over $20 billion by 2026.

Emerging Markets Expansion

The automotive sector's growth in emerging markets, especially in Asia-Pacific, is a key opportunity for Alfmeier Präzision AG. With increasing vehicle production and rising consumer spending power in these regions, there's a strong demand for automotive components. For instance, the Asia-Pacific region is projected to see continued robust growth in vehicle sales, with many countries experiencing double-digit percentage increases in production year-over-year in recent periods leading up to 2025. This expansion offers Alfmeier a chance to significantly boost its revenue streams by establishing a stronger foothold and adapting its product offerings to local market needs.

Alfmeier can capitalize on this trend by:

- Targeting high-growth automotive markets such as India, Vietnam, and Indonesia, which are experiencing rapid industrialization and a burgeoning middle class.

- Developing localized product portfolios that cater to the specific requirements and price sensitivities of consumers in these emerging economies.

- Forming strategic partnerships with local manufacturers and distributors to streamline market entry and enhance operational efficiency.

- Leveraging technological advancements to offer competitive and innovative solutions that meet the evolving demands of these dynamic markets.

Sustainability and Lightweighting Trends

The automotive industry's accelerating push towards sustainability and lightweighting presents a significant opportunity for Alfmeier Präzision AG. By developing more eco-friendly manufacturing methods and designing components that contribute to vehicle weight reduction, the company can better align with increasingly stringent environmental regulations and evolving consumer demands. This strategic focus can bolster their product attractiveness and strengthen their competitive standing in the market.

For instance, the global automotive lightweight materials market was valued at approximately USD 38.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% through 2030. This growth is driven by the need to improve fuel efficiency and reduce emissions, directly benefiting suppliers like Alfmeier who can offer advanced lightweight solutions.

- Sustainability Focus: Developing components that meet Euro 7 emission standards and beyond.

- Lightweighting Solutions: Offering advanced materials and designs that reduce vehicle curb weight, improving fuel economy.

- Market Alignment: Capitalizing on the projected 6.5% CAGR in the automotive lightweight materials market through 2030.

- Consumer Preference: Catering to the growing consumer demand for environmentally responsible vehicles.

Alfmeier Präzision AG can leverage the increasing demand for advanced automotive comfort features, as the global automotive seat market is projected to exceed $80 billion by 2028. The company is also well-positioned to benefit from the accelerating growth of the electric vehicle sector, particularly in fluid management systems for battery thermal regulation. Furthermore, tapping into emerging markets, especially in Asia-Pacific, offers substantial revenue growth potential, with the region experiencing robust vehicle sales increases. Alfmeier can also enhance its market standing by focusing on sustainability and lightweighting solutions, aligning with stricter environmental regulations and consumer preferences for eco-friendly vehicles, a trend supported by the automotive lightweight materials market’s projected 6.5% CAGR through 2030.

Threats

Global economic uncertainties, including persistent inflation and the looming threat of recessions, are significantly dampening consumer confidence. This directly translates into lower demand for new vehicles, forcing major automotive manufacturers to implement production cuts. For instance, in early 2024, several leading automakers announced revised production targets for the year due to weaker-than-expected sales forecasts.

These industry-wide production declines create a ripple effect, directly impacting suppliers like Alfmeier Präzision AG. Reduced order volumes from car manufacturers translate into lower revenue streams and potential profit margin erosion for component providers. The automotive sector's cyclical nature means that downturns can lead to substantial financial pressures for companies reliant on consistent manufacturing output.

The rapid shift towards electric vehicles (EVs) is fundamentally reshaping the automotive supply chain. New players specializing in EV technology are entering the market, while established suppliers are aggressively reorienting their product portfolios. This dynamic creates a more challenging environment for companies like Alfmeier Präzision AG, especially in areas where their traditional internal combustion engine (ICE) expertise may see diminishing demand.

For instance, the global EV market is projected to grow significantly, with BloombergNEF estimating that EVs will account for over 77% of new passenger vehicle sales by 2035. This rapid adoption means suppliers heavily reliant on ICE components face increasing pressure to adapt or risk losing market share to EV-centric competitors. Alfmeier's strategic response to this evolving landscape will be critical in navigating the intensified competition.

Ongoing volatility in raw material prices, particularly for metals and plastics essential for automotive components, presents a significant challenge for Alfmeier Präzision AG. For instance, the London Metal Exchange saw copper prices fluctuate by over 15% in early 2024, directly impacting manufacturing costs.

Persistent shortages of key components, such as semiconductors, continue to disrupt production schedules. The global automotive chip shortage, which began in 2020, saw lead times for certain components extend to over 52 weeks in late 2023, directly affecting Alfmeier's ability to fulfill orders promptly.

These combined pressures can lead to increased production costs, potentially eroding profit margins for Alfmeier Präzision AG if these costs cannot be passed on to customers. Furthermore, manufacturing delays caused by supply chain disruptions make it difficult to maintain stable operations and predictable pricing for their precision fluid technology systems.

Geopolitical Tensions and Trade Barriers

Escalating geopolitical tensions and ongoing trade disputes present a significant threat to Alfmeier Präzision AG. The imposition of tariffs, for instance, can directly increase the cost of imported components and finished goods, impacting Alfmeier's supply chain efficiency and potentially raising its production expenses. For example, the trade friction between major economic blocs in 2024 continues to create uncertainty regarding raw material costs and the smooth flow of goods across borders.

These disruptions can lead to increased import and export costs, directly affecting Alfmeier's bottom line. Furthermore, trade barriers can limit market access for its products in key international regions, hindering sales growth and market penetration efforts. The company's reliance on a globalized supply chain means that instability in any major region could have cascading negative effects on its operations and overall profitability.

- Supply Chain Volatility: Increased risk of delays and higher costs for essential components due to trade restrictions and geopolitical instability.

- Market Access Limitations: Potential for new or increased tariffs to make products less competitive in certain export markets.

- Rising Operational Costs: Direct impact of tariffs on imported materials and indirect costs associated with navigating complex trade regulations.

- Reduced Profit Margins: The combined effect of higher costs and potential sales limitations can squeeze profitability.

Technological Disruption and Rapid Innovation Pace

The automotive sector's swift technological evolution, particularly in autonomous driving and electric vehicle (EV) architectures, presents a significant threat. Alfmeier Präzision AG must navigate this landscape, as failure to adapt quickly to new demands and invest adequately in research and development could render existing products outdated and erode its competitive standing. For instance, the projected global market for Advanced Driver-Assistance Systems (ADAS), a key area of technological disruption, was estimated to reach over $40 billion in 2023 and is expected to grow substantially, highlighting the need for continuous innovation.

The rapid pace of innovation means that companies must be agile and forward-thinking to avoid falling behind. A failure to invest in next-generation technologies, such as advanced sensor integration for autonomous systems or new materials for lightweight EV components, could lead to a loss of market share. The ongoing shift towards software-defined vehicles, where functionality is increasingly determined by code rather than hardware, further underscores the need for substantial R&D investment in these areas.

- Technological Obsolescence: Failure to invest in R&D for autonomous driving and EV technologies could make current product lines obsolete.

- Competitive Disadvantage: Companies that do not adapt to new vehicle architectures and connectivity demands risk losing market share to more agile competitors.

- R&D Investment Gap: Insufficient investment in areas like ADAS and advanced sensor technology could widen the gap with industry leaders.

The automotive industry's ongoing transition to electric vehicles (EVs) presents a significant challenge for Alfmeier Präzision AG. As demand for internal combustion engine (ICE) components wanes, the company faces pressure to adapt its product portfolio. For instance, by 2030, it's projected that over 60% of new vehicle sales in major markets could be electric, necessitating a strategic pivot for suppliers like Alfmeier.

Increased competition from new market entrants specializing in EV technology and existing players rapidly retooling their operations intensifies this threat. Companies that fail to innovate and invest in EV-specific solutions risk obsolescence. The projected global market for EV components is expected to reach hundreds of billions of dollars in the coming years, a segment Alfmeier must effectively penetrate.

Furthermore, the rapid pace of technological advancement in areas like autonomous driving and advanced driver-assistance systems (ADAS) requires substantial and continuous research and development investment. A failure to keep pace could lead to a loss of market share and a diminished competitive position. For example, the ADAS market alone was valued at over $40 billion in 2023 and is growing rapidly.

Supply chain volatility, exacerbated by geopolitical tensions and trade disputes, also poses a considerable risk. Tariffs and trade barriers can increase raw material costs and disrupt the flow of essential components, impacting production efficiency and profitability. For instance, fluctuations in key metal prices, like copper, saw over 15% volatility in early 2024, directly affecting manufacturing costs.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Alfmeier Präzision AG's financial statements, comprehensive market research reports, and expert analyses of the automotive and industrial sectors.