Alfmeier Präzision AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfmeier Präzision AG Bundle

Navigate the complex external forces shaping Alfmeier Präzision AG's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage.

Political factors

Geopolitical trade tensions significantly influence the automotive sector, impacting suppliers like Alfmeier Präzision AG. The US imposed a 25% tariff on imported vehicles and auto parts in 2018, a measure that continues to affect global supply chains.

These tariffs, alongside existing duties on steel and aluminum, are projected to elevate production expenses and retail costs for vehicles and their components. For instance, the automotive industry's reliance on imported materials means these tariffs directly translate to higher input costs for manufacturers.

Consequently, companies such as Alfmeier Präzision AG must adapt by re-evaluating their sourcing strategies and potentially localizing production to mitigate financial risks and maintain competitiveness in a shifting trade landscape.

European political bodies are actively engaging in strategic dialogues to support the automotive industry through its disruptive transition, as exemplified by the European Commission's initiative launched in January 2025.

These dialogues aim to boost data-driven innovation, digitalization, and decarbonization, while addressing social elements like jobs and skills. For instance, the EU's €1.5 billion investment in battery gigafactories is a direct result of such strategic support.

Such political backing can provide stability and opportunities for European suppliers like Alfmeier Präzision AG by fostering a more predictable regulatory environment and encouraging investment in future technologies.

Governments globally are intensifying emissions regulations, with examples like Australia's New Vehicle Efficiency Standard (NVES) Act 2024 and the ongoing tightening of US Corporate Average Fuel Economy (CAFE) standards. These legislative actions compel a significant reduction in CO2 output and an increase in fuel efficiency for new vehicles, directly influencing the automotive supply chain.

Alfmeier Präzision AG's core business, centered on fluid management solutions, is directly impacted by these environmental mandates. The company must innovate and adapt its product offerings to align with the industry's push for greater sustainability and reduced emissions, a trend that accelerated significantly through 2024 and is projected to continue its upward trajectory into 2025.

Incentives and Subsidies for Electrification

Government incentives and subsidies play a pivotal role in shaping the electric vehicle (EV) market. The continuation and level of these programs directly impact demand for EVs and the necessary charging infrastructure, which in turn affects component suppliers like Alfmeier Präzision AG. For instance, the European Union's Green Deal aims to significantly boost EV adoption, with many member states offering purchase grants and tax breaks.

While some markets have experienced a temporary dip in EV sales following the reduction or withdrawal of subsidies, sustained governmental backing is essential for the sector's enduring growth. This support is critical for suppliers investing in new technologies and production capabilities for electric and hybrid powertrains.

- European Union's Green Deal: Aims to accelerate EV adoption across member states through various financial incentives.

- Regional Variations: Some countries have seen EV sales soften after subsidy reductions, highlighting the sensitivity to government support.

- Impact on Suppliers: Ongoing incentives encourage investment in electrification technologies for companies like Alfmeier Präzision AG.

- Infrastructure Development: Government funding for charging networks is a key driver for consumer confidence and EV uptake.

Political Stability in Key Markets

Political stability in key automotive markets is paramount for Alfmeier Präzision AG, directly influencing demand and operational planning. For instance, Germany, a core market, experienced a stable political landscape in 2024, though upcoming elections in late 2025 could introduce policy uncertainties impacting the automotive sector.

Global automotive production forecasts for 2024 indicate a slight recovery, with projections around 90 million vehicles, but this is sensitive to geopolitical events. Political tensions in Eastern Europe, for example, continue to pose risks to supply chains and market access for components, a factor Alfmeier must navigate.

The company's strategy must account for potential policy shifts arising from elections. In the United States, a major market, the 2024 election cycle could bring changes in trade agreements and environmental regulations, affecting automotive sales and manufacturing strategies for suppliers like Alfmeier.

- Germany's stable political climate in 2024 provides a predictable operating environment for Alfmeier.

- Global automotive production is projected to reach approximately 90 million units in 2024, but this is subject to geopolitical risks.

- Potential policy shifts in major markets like the US following the 2024 elections require agile adaptation from automotive suppliers.

- Geopolitical tensions can disrupt supply chains and market access, necessitating diversified sourcing and market strategies for Alfmeier.

Governmental regulations concerning emissions and fuel efficiency continue to tighten globally, directly impacting automotive component manufacturers like Alfmeier Präzision AG. For instance, the Australian New Vehicle Efficiency Standard (NVES) Act 2024 mandates reduced CO2 output, a trend mirrored by ongoing adjustments to US CAFE standards, pushing for greater fuel efficiency and influencing product development for suppliers.

Political support for the electric vehicle (EV) transition, such as the European Union's Green Deal, remains a critical factor. While some regions have seen a temporary slowdown in EV sales following subsidy adjustments, sustained government incentives are vital for encouraging investment in new powertrain technologies, a key area for Alfmeier.

Geopolitical trade tensions and potential policy shifts from elections in major markets like the US in 2024 necessitate adaptive strategies for Alfmeier Präzision AG. These factors can influence supply chain stability and market access, highlighting the need for diversified sourcing and operational planning.

What is included in the product

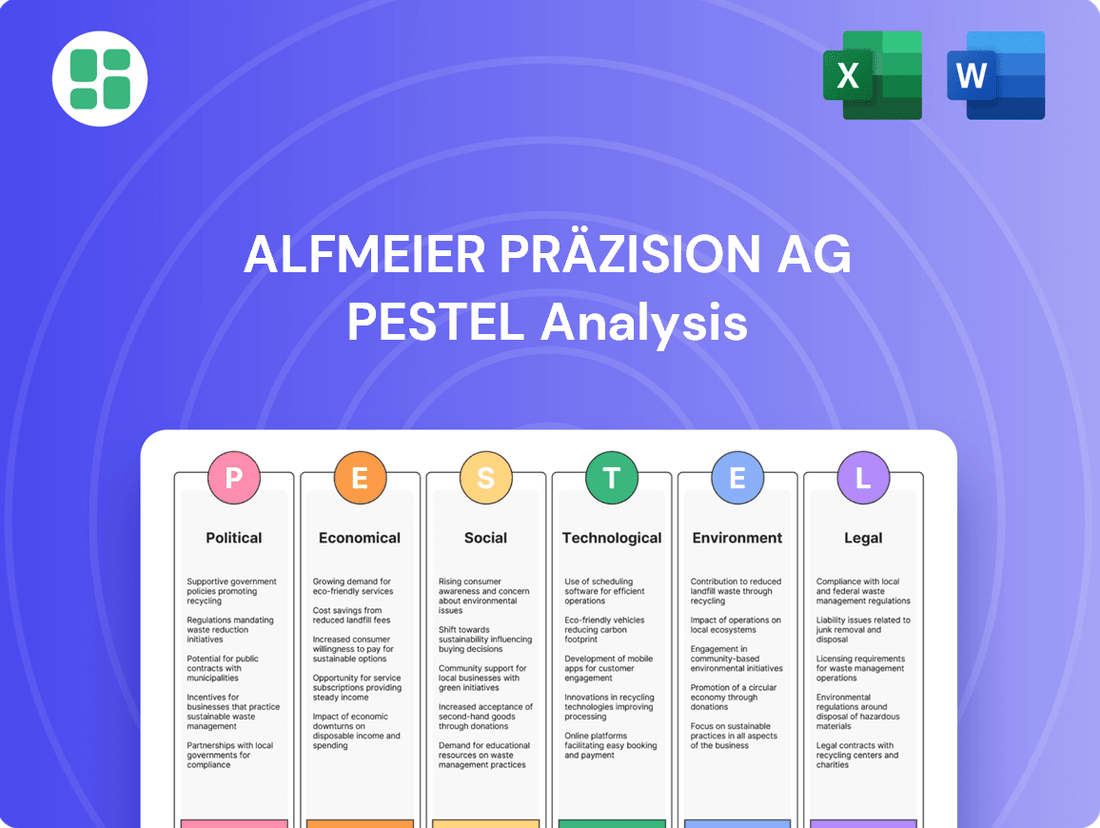

This PESTLE analysis critically examines the external macro-environmental factors impacting Alfmeier Präzision AG, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of how these forces create both challenges and strategic advantages for the company.

This PESTLE analysis for Alfmeier Präzision AG offers a concise, easily digestible format, acting as a pain point reliver by simplifying complex external factors for quick referencing during strategic discussions and team alignment.

Economic factors

The global light vehicle market is anticipated to see modest growth in 2025, with projections pointing to approximately 91.6 million units sold, a slight uptick from the 2024 figures.

This projected expansion, however, is shadowed by considerable uncertainty, stemming from divergent market trends observed across key geographical regions.

For automotive component manufacturers such as Alfmeier Präzision AG, this translates into a complex operating landscape characterized by fluctuating demand patterns and potential regional imbalances in sales performance.

The automotive sector is still dealing with shortages of key parts, such as semiconductor chips and specific metals. This has pushed up the cost of raw materials and manufacturing for companies like Alfmeier Präzision AG. For instance, the average price of copper, a crucial metal in automotive electronics, saw significant increases throughout 2024, impacting production budgets.

These price swings directly affect the bottom line for automotive suppliers. Alfmeier needs to carefully plan its procurement and cost management strategies to protect its profit margins in this challenging environment. Navigating these volatile input costs is essential for maintaining financial health and competitive pricing.

High inflation rates and elevated interest rates for auto loans continue to challenge vehicle affordability, potentially deterring consumers from purchasing new vehicles. While inflation has cooled in some regions, for instance, the US CPI eased to 3.3% year-on-year in May 2024, the cost of financing remains a barrier.

This economic climate can prolong vehicle ownership cycles and temper overall demand for new components. For example, the average interest rate on a new car loan in the US hovered around 7-8% in early 2024, a significant increase from previous years.

Profitability Pressure on Automotive Suppliers

Automotive suppliers, especially those in Germany, have faced persistent profitability challenges, with profit margins generally trailing behind Original Equipment Manufacturers (OEMs) since 2020. Projections for 2025 indicate that these pressures are likely to continue.

The current economic climate, often described as 'stagflation,' presents a dual threat. It combines sluggish economic growth with the imperative for suppliers to fundamentally transform their business models. This environment fuels heightened competition and further constrains the profit margins for component manufacturers.

- Margin Squeeze: German automotive suppliers saw their operating profit margins average around 4-5% in 2023, a noticeable dip from pre-2020 levels, while OEMs often maintained margins above 8%.

- Transformation Costs: The shift towards electric vehicles (EVs) and new mobility solutions requires significant R&D and capital investment, diverting funds that could otherwise bolster profitability.

- Supply Chain Volatility: Ongoing disruptions and the need for more resilient, localized supply chains add cost pressures, impacting the bottom line for suppliers navigating these changes through 2025.

Shifting Consumer Demand for Powertrains

Consumer preferences are diverging, with a noticeable slowdown in the adoption of all-battery electric vehicles (BEVs) in several key markets. This muted inertia for BEVs contrasts with a resurgence in demand for internal combustion engine (ICE) and hybrid vehicles, creating a complex landscape for automotive suppliers.

This dual demand trend necessitates that companies like Alfmeier Präzision AG maintain robust production capabilities for both traditional ICE components and emerging electrified powertrains. Such a strategy impacts crucial investment decisions and requires careful diversification of product portfolios to cater to evolving consumer tastes.

For instance, in 2024, while BEV sales growth has moderated in some regions, demand for advanced ICE and hybrid systems remains strong, particularly in emerging markets and for specific vehicle segments. This means suppliers cannot solely focus on electrification; they must also support and innovate within the ICE and hybrid space to remain competitive.

- Segmented Market Growth: While BEV market share is projected to reach approximately 15-20% of global new car sales by 2025 in many developed economies, hybrid vehicle sales are experiencing significant growth, sometimes exceeding 30% year-over-year in specific markets in 2024.

- Component Demand Duality: Suppliers must balance investments in high-voltage components for EVs with continued demand for sophisticated fuel injection systems, exhaust after-treatment, and thermal management solutions for ICE and hybrid vehicles.

- Investment Allocation Challenges: The uncertainty in the pace of BEV adoption versus the sustained demand for ICE/hybrid technology presents a challenge for capital allocation, requiring suppliers to hedge their bets across different powertrain technologies.

Economic factors present a mixed outlook for automotive component suppliers like Alfmeier Präzision AG. While global light vehicle sales are projected to see modest growth to around 91.6 million units in 2025, this is tempered by persistent inflation and high interest rates that impact vehicle affordability. For instance, average new car loan rates in the US remained elevated around 7-8% in early 2024, a significant increase.

The sector also grapples with the lingering effects of supply chain disruptions, leading to increased raw material costs. Copper prices, vital for automotive electronics, saw notable increases throughout 2024, directly squeezing profit margins for manufacturers. German automotive suppliers, in particular, experienced an average operating profit margin of 4-5% in 2023, lagging behind OEMs.

Furthermore, a divergence in consumer preferences, with a slowdown in all-battery electric vehicle adoption and continued demand for internal combustion engine and hybrid vehicles, creates a complex investment and production landscape. This necessitates a dual focus on powertrain technologies, impacting capital allocation strategies through 2025.

| Economic Factor | 2024/2025 Projection/Observation | Impact on Alfmeier Präzision AG |

|---|---|---|

| Global Light Vehicle Sales | Projected ~91.6 million units in 2025 (modest growth) | Potential for increased order volumes, but regional variations exist. |

| Inflation & Interest Rates | Inflation cooling but interest rates remain high (e.g., US car loans ~7-8% in early 2024) | Reduced consumer demand for new vehicles, pressure on pricing. |

| Raw Material Costs | Persistent increases (e.g., copper prices up in 2024) due to supply chain issues | Increased production costs, margin compression. |

| Supplier Profitability (Germany) | Average operating margins ~4-5% in 2023 | Continued pressure on profitability, need for cost optimization. |

| Powertrain Demand | Divergence: Slowdown in BEV adoption, sustained ICE/Hybrid demand | Need to support diverse product portfolios, complex investment decisions. |

Full Version Awaits

Alfmeier Präzision AG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Alfmeier Präzision AG. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning.

Sociological factors

Consumer expectations for vehicle interiors are shifting dramatically, with a strong emphasis on personalized comfort and advanced technology. This growing demand for features like active seat climate control and sophisticated lumbar and massage systems directly aligns with Alfmeier Präzision AG's core competencies in seating solutions.

The automotive industry is witnessing a surge in consumer interest for features that elevate the in-car experience. For instance, a 2024 survey indicated that over 65% of new car buyers consider advanced comfort features, such as heated and ventilated seats, as a high priority. This trend necessitates ongoing investment in research and development to integrate innovative functionalities that cater to these evolving preferences.

Consumers' growing preference for eco-friendly vehicles is a significant sociological driver for Alfmeier Präzision AG. Surveys in 2024 indicate that over 60% of new car buyers consider sustainability features when making a purchase, directly impacting automakers' demands on their suppliers.

This societal shift necessitates that Alfmeier's product portfolio, particularly components like oil pumps and vacuum pumps, must align with the increasing use of recycled materials and energy-efficient production methods by automotive manufacturers.

By 2025, it's projected that 75% of automotive R&D budgets will be allocated to sustainable technologies, meaning suppliers demonstrating strong environmental, social, and governance (ESG) credentials, like Alfmeier, will gain a competitive advantage.

Younger demographics, particularly Gen Z and Millennials, are increasingly opting for mobility-as-a-service (MaaS) platforms over traditional car ownership. Studies in 2024 indicate that in major European cities, the adoption rate of ride-sharing and subscription-based mobility services has grown by an average of 15% year-over-year. This shift suggests a potential long-term reduction in demand for privately owned vehicles, impacting the automotive supply chain.

Alfmeier Präzision AG must analyze how this evolving consumer preference for flexible, on-demand transportation affects the future volume and specifications of its automotive components. For instance, if shared autonomous vehicles become more common, the wear and tear on certain parts might differ significantly from privately owned cars, requiring product adaptation.

Workforce Skills and Labor Shortages

The automotive sector, including precision component manufacturers like Alfmeier Präzision AG, is grappling with significant workforce skill gaps and labor shortages. This challenge is amplified by the rapid integration of new technologies such as electric vehicle (EV) powertrains, autonomous driving systems, and advanced software. Finding individuals with expertise in these specialized areas is becoming increasingly difficult.

To address this, Alfmeier must prioritize robust workforce development programs. This includes upskilling existing employees and attracting new talent with capabilities in areas like:

- Software development and integration for vehicle electronics

- Advanced manufacturing techniques, including automation and robotics

- Data analytics and AI for process optimization

- High-precision machining and quality control for new materials

The German automotive supply industry, for instance, reported a shortage of around 100,000 skilled workers in early 2024, according to industry associations. This trend necessitates proactive strategies for talent retention and continuous learning to maintain a competitive edge in an evolving market.

Public Perception of Autonomous Vehicles

Public perception of autonomous vehicles (AVs) remains a significant hurdle for widespread adoption, despite technological leaps. Consumer concerns, particularly regarding safety and the reliability of AI-driven systems, persist across key automotive markets. For instance, a 2024 survey indicated that only 35% of US consumers felt comfortable riding in a fully autonomous vehicle.

Building public trust is paramount for the future of AV technology and, consequently, for companies like Alfmeier Präzision AG that supply critical components. Hesitancy directly impacts the pace of AV development and the demand for advanced sensors, sophisticated control systems, and intricate mechatronic solutions that are integral to these vehicles. This sentiment can translate into slower market penetration, affecting sales forecasts for specialized automotive suppliers.

- Consumer Trust: A 2024 study by the American Automobile Association (AAA) found that 71% of drivers are afraid to ride in a self-driving car.

- Adoption Rate Impact: Slower public acceptance could delay the anticipated market growth for AV components, potentially impacting revenue streams for suppliers.

- Regulatory Influence: Public opinion often influences regulatory bodies, which can further shape the development and deployment timelines of autonomous driving technologies.

Societal trends are increasingly prioritizing personalized comfort and advanced technology within vehicles, directly benefiting Alfmeier Präzision AG's expertise in seating solutions. Consumer demand for features like active climate control and massage systems is on the rise, with a 2024 survey showing over 65% of new car buyers prioritizing such amenities.

The growing emphasis on sustainability is also a key sociological factor, as over 60% of new car buyers in 2024 considered eco-friendly features. This necessitates Alfmeier's alignment with automotive manufacturers' push for recycled materials and energy-efficient production, with 75% of automotive R&D budgets projected for sustainable tech by 2025.

Shifting mobility preferences, with younger demographics favoring mobility-as-a-service, could impact traditional vehicle demand and component specifications. Furthermore, persistent public concerns regarding the safety of autonomous vehicles, with only 35% of US consumers comfortable in them in 2024, could slow the adoption of advanced components.

Technological factors

The automotive sector's shift to software-defined vehicles (SDVs) means core functions are now software-driven, enabling over-the-air updates and greater personalization. This transition requires substantial investment in software, AI, and digital integration for vehicle components and systems.

Suppliers like Alfmeier Präzision AG must ensure their offerings seamlessly integrate with these new digital frameworks. For instance, the global market for automotive software is projected to reach over $100 billion by 2027, highlighting the scale of this technological evolution.

The automotive sector's pivot to electrification fuels a significant demand for sophisticated fluid and thermal management systems, crucial for battery electric vehicles (BEVs) and hybrid powertrains. Alfmeier Präzision AG's established proficiency in fluid control components, such as valves and pumps, places it advantageously to address this burgeoning market. For instance, the global market for automotive thermal management systems was valued at approximately $27.7 billion in 2023 and is projected to reach $45.1 billion by 2030, growing at a CAGR of 7.2%.

The automotive industry is seeing rapid advancements in autonomous driving and ADAS, with Level 2.5 and 3 systems becoming more prevalent. This surge is fueled by sophisticated AI, advanced sensors, and real-time data analysis, creating a significant market for highly specialized automotive components.

Alfmeier Präzision AG, as a supplier of precision fluid and air management systems, is well-positioned to benefit from this trend. The demand for components like sensors, control units, and specialized fluid systems that enable these advanced driving functions is growing. For example, by the end of 2024, it's projected that over 50% of new vehicles sold globally will feature some level of ADAS, a figure expected to climb significantly by 2025.

Adoption of Sustainable Materials and Manufacturing

Technological progress is making it easier to use environmentally friendly and lighter materials like recycled plastics, bio-based substances, and composites in car manufacturing. This trend is driven by the need to cut vehicle weight, boost energy efficiency, and reduce overall carbon emissions. For instance, by 2025, the automotive industry is projected to see a significant increase in the use of recycled plastics, with estimates suggesting it could reach over 10 million metric tons globally, a substantial rise from previous years.

Alfmeier Präzision AG must adapt its manufacturing methods and material selections to keep pace with these sustainable technological advancements. Staying competitive means integrating these innovations, which can lead to cost savings and improved product performance. Companies that embrace these changes are better positioned for future market demands and regulatory shifts.

- Material Innovation: Development of advanced composites and bio-polymers offering comparable or superior performance to traditional materials.

- Manufacturing Efficiency: Technologies like additive manufacturing (3D printing) for complex, lightweight components, reducing waste and production time.

- Lifecycle Assessment Tools: Increased availability and use of software to analyze and optimize the environmental impact of materials and processes from cradle to grave.

- Regulatory Alignment: Growing pressure from regulations like the EU's End-of-Life Vehicles Directive, encouraging the use of recyclable and sustainable materials.

Digitalization and Industry 4.0 in Production

The automotive sector's rapid adoption of digitalization and Industry 4.0 principles is transforming production. This includes the integration of artificial intelligence, advanced automation, and sophisticated analytics aimed at boosting precision, operational efficiency, and supply chain resilience. Smart factory concepts are becoming mainstream, with vertical integration strategies designed to streamline manufacturing workflows.

Alfmeier Präzision AG stands to benefit significantly from these technological shifts. By embracing smart factory methodologies and advanced data analytics, the company can achieve greater production accuracy and reduce waste. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the scale of investment in these areas.

Leveraging these advancements allows Alfmeier to enhance its own operational efficiency and elevate product quality. This strategic alignment with industry trends is crucial for maintaining a competitive edge in the evolving automotive landscape.

- Increased Precision: AI-driven quality control systems can identify defects with greater accuracy than traditional methods.

- Efficiency Gains: Automation in assembly lines can reduce cycle times and labor costs.

- Supply Chain Optimization: Real-time data analytics improve inventory management and logistics.

- Smart Factory Integration: Connected systems enable predictive maintenance and flexible production scheduling.

The automotive industry's embrace of software-defined vehicles (SDVs) necessitates deep integration of AI and digital systems, with the global automotive software market expected to exceed $100 billion by 2027. This shift demands suppliers like Alfmeier Präzision AG to ensure their components seamlessly interface with these evolving digital architectures, impacting everything from vehicle performance to user experience.

Electrification is driving demand for advanced thermal and fluid management, critical for BEVs and hybrids. Alfmeier's expertise in fluid control components positions it well, as the automotive thermal management market was valued at approximately $27.7 billion in 2023 and is projected to grow to $45.1 billion by 2030.

The rise of autonomous driving and ADAS, fueled by AI and sophisticated sensors, creates a market for specialized components. By the end of 2024, over 50% of new vehicles globally are expected to feature some ADAS functionality, a trend that will continue to grow through 2025.

Technological advancements in materials, such as recycled plastics and bio-polymers, are crucial for reducing vehicle weight and emissions. The use of recycled plastics in automotive manufacturing is projected to exceed 10 million metric tons globally by 2025, underscoring the importance of sustainable material innovation.

| Technological Trend | Impact on Automotive Sector | Alfmeier Präzision AG Relevance | Market Data/Projections |

| Software-Defined Vehicles (SDVs) | Core vehicle functions driven by software, enabling over-the-air updates and personalization. | Need for seamless integration of fluid/air systems with digital frameworks. | Global automotive software market > $100 billion by 2027. |

| Electrification & Thermal Management | Increased demand for sophisticated fluid and thermal management systems for BEVs and hybrids. | Leveraging expertise in fluid control components (valves, pumps). | Automotive thermal management market: $27.7 billion (2023) to $45.1 billion (2030) at 7.2% CAGR. |

| Autonomous Driving & ADAS | Growth in AI, sensors, and real-time data analysis for advanced driving functions. | Demand for precision fluid and air management systems supporting sensors and control units. | >50% of new vehicles to feature ADAS by end of 2024; continued growth through 2025. |

| Sustainable Materials | Use of recycled plastics, bio-polymers, and composites to reduce weight and emissions. | Adaptation of manufacturing methods and material selection for sustainability. | Recycled plastics in automotive: >10 million metric tons globally by 2025. |

| Industry 4.0 & Smart Factories | Integration of AI, automation, and analytics for enhanced production efficiency and precision. | Opportunity to improve operational efficiency, reduce waste, and elevate product quality. | Global industrial automation market > $200 billion (2024 projection). |

Legal factors

The automotive sector is experiencing significant shifts in quality management, with the 2024 releases of the IATF 16949 6th edition and the APQP 3rd edition manual. These updated standards are crucial for suppliers like Alfmeier Präzision AG to maintain product integrity and customer satisfaction.

Adherence to these stringent, evolving quality benchmarks is not optional; it's a prerequisite for participation in the automotive supply chain. Failure to comply can directly impact a supplier's ability to secure contracts and maintain their market position, especially as OEMs increasingly prioritize robust quality assurance processes.

Regulatory bodies, especially within the European Union, are intensifying their focus on supply chain transparency and corporate accountability. New mandates, such as the EU's Corporate Sustainability Reporting Directive (CSRD), are now in effect, compelling companies to disclose extensive details about their environmental and social footprints throughout their entire supply chains.

This surge in regulatory oversight translates into a significant increase in compliance obligations for global suppliers like Alfmeier Präzision AG. For instance, the CSRD, fully applicable from fiscal year 2024 for large companies, requires detailed reporting on a wide array of sustainability matters, impacting how companies manage and communicate their supplier relationships and practices.

Regulations concerning vehicle safety systems, like California's Vehicle Safety Systems Inspection (VSSI) for ADAS features, are tightening, demanding that component manufacturers ensure their products integrate flawlessly with and support these advanced safety functionalities. Alfmeier's precision components must therefore meet these increasingly rigorous performance and safety benchmarks.

Data Security and Privacy Legislation for Connected Cars

As vehicles become increasingly connected and software-defined, the landscape of data security and privacy legislation is rapidly evolving. Component suppliers like Alfmeier Präzision AG must navigate a complex web of regulations designed to protect sensitive vehicle data and communication channels. Failure to comply can result in significant penalties and damage to reputation.

The increasing reliance on connected car technology means that protecting user data and ensuring the integrity of vehicle systems are paramount. This necessitates robust cybersecurity measures embedded within every component. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, sets stringent standards for data processing and privacy, impacting how connected car data is handled.

Component suppliers are therefore required to ensure their systems and products meet these strict data security laws. This includes implementing secure coding practices, encryption for data transmission, and secure storage of personal information. The automotive industry is also seeing the development of specific cybersecurity standards, such as ISO/SAE 21434, which provides a framework for managing cybersecurity risks throughout the vehicle lifecycle, with many automakers mandating compliance by 2024/2025.

- Data Protection Laws: Compliance with regulations like GDPR and CCPA (California Consumer Privacy Act) is essential for handling personal data collected by connected car systems.

- Cybersecurity Standards: Adherence to evolving automotive cybersecurity standards, such as ISO/SAE 21434, is becoming a critical requirement for component suppliers.

- Over-the-Air (OTA) Updates: Legislation is emerging to govern the security and privacy implications of software updates delivered wirelessly to vehicles.

- Vehicle Data Ownership: Discussions and potential regulations around who owns and can access vehicle-generated data are ongoing, impacting how data is managed and shared.

Anti-Dumping and Trade Remedy Laws

Anti-dumping and trade remedy laws, such as the US's 25% tariffs on imported auto parts, directly impact global suppliers like Alfmeier Präzision AG. These measures can significantly increase the cost of components sourced from abroad, potentially altering competitive dynamics. Navigating these trade regulations requires strategic adjustments to manufacturing and distribution to manage financial and operational risks.

Alfmeier must actively monitor evolving trade policies worldwide. For instance, the ongoing trade tensions between major economies could lead to further tariffs or non-tariff barriers. This necessitates a flexible approach to supply chain management and potentially diversifying sourcing locations to mitigate the impact of such legal factors.

- Tariff Impact: The US imposed a 25% tariff on steel and aluminum in 2018, affecting automotive supply chains.

- Global Trade Landscape: As of early 2024, numerous countries are reviewing or implementing new trade remedies in response to economic shifts.

- Compliance Costs: Adhering to diverse international trade laws involves significant legal and administrative expenses for global manufacturers.

Legal factors significantly shape Alfmeier Präzision AG's operational landscape, particularly concerning evolving quality and safety standards. The 2024 updates to IATF 16949 and APQP are critical, as is compliance with the EU's Corporate Sustainability Reporting Directive (CSRD), which mandates detailed supply chain disclosures from fiscal year 2024. Furthermore, tightening vehicle safety regulations, like those for ADAS features, demand rigorous component performance. Cybersecurity laws and standards, such as ISO/SAE 21434, are also increasingly important for connected vehicle systems, with many automakers requiring compliance by 2024/2025.

Environmental factors

The automotive sector is facing significant pressure to hit ambitious decarbonization goals, aiming for net-zero emissions. This is fundamentally reshaping how vehicles are made and designed. For instance, the European Union's Fit for 55 package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, impacting component suppliers like Alfmeier.

Alfmeier Präzision AG, as a key player in the automotive supply chain, must actively participate in reducing greenhouse gas (GHG) emissions. This involves scrutinizing its own manufacturing processes and developing products that support the industry-wide shift towards sustainability, contributing to a cleaner automotive ecosystem.

The automotive industry is increasingly embracing circular economy principles, pushing for greater material recyclability in vehicle production. This shift aims to significantly reduce waste and conserve natural resources. For instance, by 2025, the EU is targeting a 70% recycling rate for end-of-life vehicles, a figure that directly influences component design and material sourcing.

Alfmeier Präzision AG is therefore encouraged to prioritize product designs that facilitate easier disassembly and recycling, alongside incorporating recycled materials wherever technically and economically viable. This strategic alignment with circularity not only addresses environmental concerns but also presents opportunities for innovation in material selection and end-of-life management for automotive components.

Automakers are pushing for greener supply chains, with many mandating sustainable manufacturing practices from their suppliers. This includes a significant shift towards renewable energy sources; for instance, by the end of 2024, many major automotive manufacturers aim to power at least 30% of their operations with renewables. Alfmeier Präzision AG's commitment to integrating solar and wind power into its factories is crucial for meeting these evolving industry standards and improving its environmental footprint.

Reducing water consumption and minimizing waste are also key environmental objectives within the automotive sector. By 2025, the industry is targeting a 15% reduction in water usage per vehicle produced compared to 2022 levels. Alfmeier's proactive measures in optimizing water efficiency and implementing robust waste reduction programs will be vital for maintaining its competitive edge and demonstrating environmental stewardship.

Stringent Regulations on Hazardous Substances

Environmental regulations, like California's Proposition 65, are increasingly targeting chemicals found in automotive components, compelling manufacturers to reformulate products and adhere to stricter compliance. This trend is pushing companies like Alfmeier Präzision AG to meticulously select materials and manufacturing processes to eliminate hazardous substances, ensuring their products align with evolving global environmental health and safety standards.

The automotive industry, in particular, is facing heightened scrutiny. For instance, by the end of 2024, several new chemical restrictions were anticipated to come into effect in the European Union under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), impacting a wide array of manufacturing inputs. Companies must proactively manage their supply chains and material compositions to avoid disruptions and maintain market access.

- Expanding Chemical Scrutiny: Regulations like Prop 65 are broadening their scope to encompass more chemicals used in automotive parts.

- Reformulation Demands: Manufacturers are increasingly required to reformulate components to eliminate or reduce hazardous substances.

- Global Standard Alignment: Achieving compliance with diverse international environmental, health, and safety standards is critical for market access.

- Supply Chain Impact: Stringent regulations necessitate careful material selection and robust supplier management to ensure compliance throughout the value chain.

Water Management and Resource Efficiency

Beyond energy and emissions, the automotive sector is increasingly prioritizing efficient water management and overall resource efficiency. This shift means optimizing manufacturing processes to significantly reduce water consumption and minimize environmental impact. Alfmeier Präzision AG must therefore implement robust water management strategies across its facilities to align with these evolving industry standards and regulatory pressures.

The automotive industry's commitment to sustainability extends to water usage, with a growing emphasis on circular economy principles. For instance, by 2024, many automotive manufacturers are setting ambitious targets to reduce their freshwater withdrawal per vehicle produced. Alfmeier's proactive approach to water conservation, including water recycling and wastewater treatment technologies, will be crucial for maintaining operational efficiency and environmental stewardship.

- Water Consumption Reduction: Implementing closed-loop water systems in production lines to minimize freshwater intake.

- Wastewater Treatment: Investing in advanced wastewater treatment facilities to ensure discharged water meets stringent environmental standards.

- Resource Efficiency Metrics: Tracking and reporting water usage per unit of production to identify areas for further improvement.

- Supplier Engagement: Encouraging and collaborating with suppliers to adopt similar water management best practices.

The automotive industry is heavily focused on decarbonization, with ambitious goals for net-zero emissions influencing vehicle design and manufacturing. For example, the EU's Fit for 55 package targets a 55% reduction in greenhouse gas emissions by 2030, directly impacting component suppliers like Alfmeier Präzision AG.

Alfmeier Präzision AG needs to actively reduce its own greenhouse gas emissions and develop products that support the industry's sustainability shift, contributing to a cleaner automotive ecosystem.

Circular economy principles are gaining traction, emphasizing material recyclability in vehicle production to reduce waste and conserve resources. The EU aims for a 70% recycling rate for end-of-life vehicles by 2025, influencing component design and material choices.

Alfmeier Präzision AG should prioritize designs that allow for easier disassembly and recycling, while also incorporating recycled materials where feasible, aligning with circularity goals and creating innovation opportunities.

Automakers are demanding greener supply chains, with many requiring sustainable manufacturing practices from suppliers, including a significant shift to renewable energy. By the end of 2024, numerous major manufacturers aim to power at least 30% of their operations with renewables, making Alfmeier's integration of solar and wind power crucial.

Reducing water consumption and waste are key environmental objectives, with the industry targeting a 15% reduction in water usage per vehicle produced by 2025 compared to 2022 levels. Alfmeier's water efficiency and waste reduction programs are vital for competitiveness.

Environmental regulations, such as California's Proposition 65, are increasingly scrutinizing chemicals in automotive components, pushing manufacturers like Alfmeier Präzision AG to reformulate products and ensure compliance with evolving global health and safety standards.

By the end of 2024, new chemical restrictions under EU REACH were anticipated, impacting manufacturing inputs and requiring companies like Alfmeier to manage supply chains and material compositions to maintain market access.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alfmeier Präzision AG is grounded in data from official government publications, reputable economic databases, and leading industry research firms. We incorporate insights from technological trend reports, environmental policy updates, and socio-economic indicators to provide a comprehensive view.