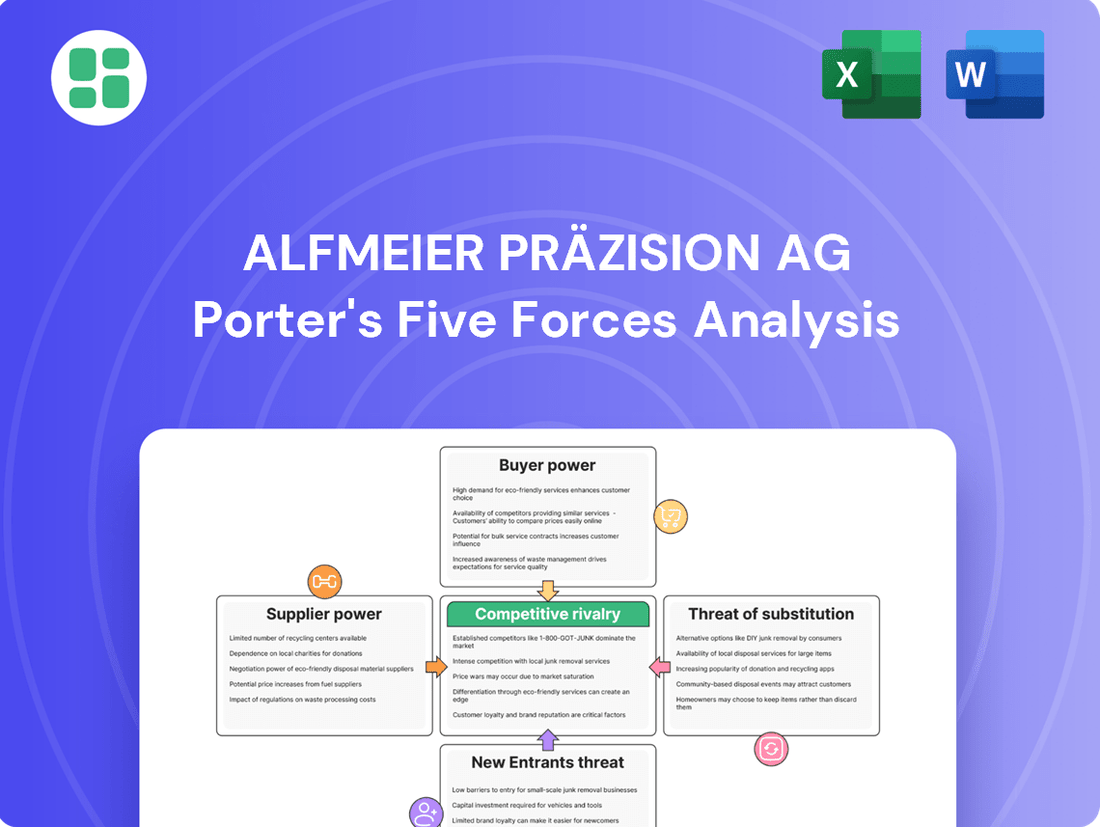

Alfmeier Präzision AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfmeier Präzision AG Bundle

Alfmeier Präzision AG operates within a competitive landscape shaped by moderate supplier power and a significant threat from substitutes. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Alfmeier Präzision AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alfmeier Präzision AG depends on suppliers for highly specialized precision components and crucial raw materials such as advanced polymers, metals, and electronic parts. The distinctiveness or proprietary nature of these materials can grant suppliers considerable influence, particularly when alternative sources are scarce.

Supply chain disruptions, a notable concern throughout 2024 and into 2025, have amplified supplier power by restricting availability and escalating costs for critical inputs.

Alfmeier Präzision AG faces significant supplier bargaining power due to high switching costs for its specialized automotive components. Developing and implementing new suppliers requires substantial investment in re-tooling production lines, a process that can easily run into millions of euros for precision manufacturing. Furthermore, the rigorous re-validation and potential re-design of integrated systems to meet the exacting standards of the automotive sector represent considerable time and financial outlays, often taking 12-24 months for full qualification.

Alfmeier Präzision AG's bargaining power of suppliers is significantly influenced by supplier concentration and product differentiation. If the market for critical raw materials or specialized sub-components is dominated by a small number of large suppliers, their leverage over Alfmeier naturally grows.

Suppliers who provide unique, proprietary technologies or highly differentiated products essential for Alfmeier's advanced fluid management or seat comfort systems can dictate higher prices. For instance, a supplier of a novel sensor technology crucial for a new adaptive seating system would hold considerable power due to its uniqueness and indispensability.

Threat of Forward Integration by Suppliers

Suppliers could potentially move into manufacturing finished products themselves, directly challenging Alfmeier Präzision AG's market position. This threat is amplified if a supplier possesses strong research and development capabilities and identifies a strategic advantage in controlling more of the automotive value chain.

For instance, a supplier of advanced sensor technology might consider integrating it into a complete driver-assistance system, thereby competing with Alfmeier's existing product lines. The automotive sector's high capital expenditure requirements and the intricate nature of system integration, however, often act as significant barriers to such forward integration attempts by suppliers.

- Supplier Forward Integration Risk: Suppliers may enter Alfmeier's market if they have strong R&D and see value in producing finished automotive components.

- Market Entry Barriers: The high capital investment and technical complexity of automotive system manufacturing can deter suppliers from integrating forward.

- Competitive Landscape Impact: Successful forward integration by a supplier could lead to increased competition and pressure on Alfmeier's pricing and market share.

Impact of Supplier Inputs on Product Quality and Performance

The quality of Alfmeier Präzision AG's precision products, such as valves, pumps, and seat comfort systems, is directly tied to the caliber of components sourced from its suppliers. A single substandard part can significantly impact vehicle performance and passenger safety, compelling Alfmeier to prioritize supplier reliability over cost savings.

This reliance on high-quality inputs grants considerable leverage to dependable suppliers. For instance, in the automotive sector, component defects can lead to costly recalls and reputational damage, reinforcing the need for stringent supplier vetting and strong, collaborative relationships.

- Component Dependency: Alfmeier's sophisticated automotive components demand precision-engineered inputs, making supplier quality paramount.

- Safety and Performance Implications: A fault in a critical supplier part can compromise vehicle safety and operational integrity, increasing Alfmeier's sensitivity to supplier performance.

- Reduced Price Sensitivity: The critical nature of these inputs means Alfmeier is less inclined to switch suppliers based solely on price, preserving the power of established, quality-focused vendors.

- Supplier Relationship Value: Maintaining strong relationships with suppliers of high-quality, specialized materials is crucial for consistent product excellence, further enhancing supplier bargaining power.

Alfmeier Präzision AG's bargaining power with suppliers is constrained by the specialized nature of its components and the high costs associated with switching. For instance, re-tooling production lines for new precision parts can cost millions of euros, and the qualification process for automotive suppliers often takes 12-24 months, underscoring the significant financial and temporal barriers to changing vendors.

Supplier concentration and product differentiation also amplify their leverage. When a few dominant suppliers control critical raw materials or unique technologies, they can command higher prices. This is particularly true for suppliers offering proprietary innovations essential for Alfmeier's advanced systems, as seen with novel sensor technologies for adaptive seating.

The quality imperative in the automotive sector further bolsters supplier power. Alfmeier's reliance on high-caliber, defect-free components for safety and performance means that supplier reliability often outweighs cost considerations, making it difficult to negotiate aggressively on price with established, quality-focused vendors.

| Factor | Impact on Alfmeier Präzision AG | Example/Data Point |

|---|---|---|

| Switching Costs | High | Millions of euros for re-tooling; 12-24 months for supplier qualification. |

| Supplier Concentration | High | Dominance by a few suppliers in specialized materials markets. |

| Product Differentiation | High | Suppliers of unique sensor or material technologies for advanced systems. |

| Quality Dependency | High | Component defects can lead to costly recalls and reputational damage in automotive sector. |

What is included in the product

This analysis details the competitive forces impacting Alfmeier Präzision AG, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its specific market segments.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Alfmeier Präzision AG's Porter's Five Forces.

Gain a strategic advantage by understanding and counteracting market pressures with this comprehensive analysis.

Customers Bargaining Power

Alfmeier Präzision AG's customer base is largely comprised of major global automotive manufacturers. These Original Equipment Manufacturers (OEMs) are significant players, often demanding substantial volumes and wielding considerable influence in negotiations. For instance, in 2023, the top five automotive OEMs accounted for a substantial portion of global vehicle production, underscoring their concentrated purchasing power.

Major automotive manufacturers, as key customers for companies like Alfmeier Präzision AG, often place large volume orders. This significant purchasing power allows them to negotiate aggressively for lower prices on components. For instance, in 2024, the automotive industry continued to grapple with cost optimization, with major OEMs actively seeking to shave off percentage points from their supply chain expenditures.

This intense price sensitivity among Original Equipment Manufacturers (OEMs) is driven by the highly competitive nature of the automotive market and ongoing economic fluctuations. OEMs are under constant pressure to reduce vehicle production costs, which directly translates to demanding lower prices from their suppliers, including those providing specialized systems like those from Alfmeier.

Major automotive manufacturers, with their substantial engineering and manufacturing prowess, hold the potential to bring certain component production in-house. This capability, known as backward integration, could reduce their reliance on suppliers like Alfmeier Präzision AG.

While Alfmeier's precision components demand specialized know-how, the threat of backward integration is ever-present, particularly for less intricate or high-volume parts. For instance, in 2024, the automotive industry continued to explore vertical integration to gain cost efficiencies and control over critical supply chains.

Standardization of Components

The increasing standardization of components within the automotive sector directly impacts Alfmeier Präzision AG's customer bargaining power. If Alfmeier's specialized parts become more commoditized, meaning they are less unique and more easily replicable by competitors, customers gain leverage. This is because they can more readily switch to alternative suppliers offering similar products without significant cost or disruption.

While Alfmeier prides itself on precision engineering and innovative solutions, industry trends towards shared platforms and modular technologies can inadvertently lower customer switching costs. For instance, if a significant portion of the automotive supply chain adopts common interface standards or widely available materials, the perceived value of Alfmeier's unique differentiation might diminish. This shift empowers buyers, as they have a broader selection of suppliers capable of meeting their needs, potentially leading to price negotiations and reduced margins for Alfmeier. In 2024, the automotive industry continued to explore platform strategies to reduce development costs and increase manufacturing efficiency, a trend that could amplify this effect.

- Reduced Differentiation: As automotive components become more standardized, the unique selling propositions of suppliers like Alfmeier may weaken.

- Increased Switching Costs: Lower differentiation translates to lower costs for customers to switch between suppliers, enhancing their bargaining power.

- Platform Strategies: The automotive industry's push for common platforms can lead to greater interchangeability of parts, benefiting buyers.

- Market Trends: In 2024, the ongoing drive for efficiency and cost reduction in automotive manufacturing favored suppliers whose components fit into broader, standardized systems.

Importance of Alfmeier's Components to Customer's Final Product

While Alfmeier's components are vital for vehicle performance, fuel efficiency, and passenger comfort, their impact on the overall vehicle cost is relatively minor. For instance, in 2024, the cost of specialized fluid control systems, a key area for Alfmeier, typically represented less than 2% of a vehicle's total manufacturing cost, especially when compared to major components like powertrains or chassis which can account for 20-30% or more.

This cost dynamic significantly influences the bargaining power of customers, primarily automotive manufacturers. Because Alfmeier's parts are a small fraction of the final product's price, OEMs might prioritize overall vehicle cost reduction, potentially leveraging this to negotiate lower prices for individual components rather than focusing solely on the strategic importance of those parts.

- Small Cost Contribution: Alfmeier's components typically represent a low single-digit percentage of a vehicle's total manufacturing cost.

- Customer Focus on Total Cost: Automotive manufacturers often prioritize optimizing the overall vehicle price, which can diminish the leverage of individual component suppliers.

- Limited Pricing Power: The relatively low cost impact of Alfmeier's products can constrain its ability to dictate terms, even for critical functions.

- Supplier Consolidation Trends: In 2024, the automotive industry continued to see consolidation among Tier 1 suppliers, potentially increasing the bargaining power of large OEMs.

The bargaining power of customers for Alfmeier Präzision AG is considerable, primarily due to the concentrated nature of its clientele, which consists of major global automotive manufacturers. These Original Equipment Manufacturers (OEMs) possess significant purchasing volume and leverage this to negotiate favorable pricing, especially as they continuously seek cost reductions. For instance, in 2024, automotive OEMs remained focused on optimizing supply chain expenditures, with price sensitivity being a key negotiation driver.

The potential for backward integration by these large OEMs also serves as a significant lever. If an OEM can bring the production of certain components in-house, it reduces their dependence on suppliers like Alfmeier, thereby increasing their bargaining power. This trend was observable in 2024 as the automotive sector explored vertical integration for cost efficiencies.

Furthermore, the increasing standardization of automotive components can diminish differentiation, making it easier for customers to switch suppliers and thus enhancing their bargaining power. The automotive industry's continued emphasis on platform strategies in 2024 further supports this by promoting part interchangeability.

While Alfmeier's products are technologically advanced, their relatively small contribution to the overall vehicle manufacturing cost—often less than 2% in 2024 for systems like fluid control—means customers may prioritize overall vehicle price reduction, potentially squeezing margins for component suppliers.

| Factor | Impact on Alfmeier's Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | High | Major OEMs dominate vehicle production. |

| Purchasing Volume | High | Large orders enable aggressive price negotiations. |

| Backward Integration Potential | Moderate to High | OEMs can bring component production in-house. |

| Switching Costs (due to standardization) | Moderate | Easier for customers to switch suppliers if parts are commoditized. |

| Component Cost Contribution | Low | Less than 2% of total vehicle cost, limiting supplier pricing power. |

What You See Is What You Get

Alfmeier Präzision AG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Alfmeier Präzision AG details the industry's competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This in-depth examination will equip you with critical insights into the strategic positioning and potential challenges faced by Alfmeier Präzision AG within its market.

Rivalry Among Competitors

The automotive components sector, particularly in areas like precision engineering for fluid management and seat comfort, is crowded with many strong players. This means companies like Alfmeier Präzision AG face significant competition from both global giants and specialized regional firms.

Major competitors such as Continental AG, Bosch, Adient, Faurecia, Gentherm, and Lear Corporation are deeply entrenched in these markets. Their established presence and broad product portfolios intensify the rivalry, putting pressure on pricing and innovation for all participants.

While some areas like electric vehicle components and sophisticated comfort systems are seeing expansion, the broader automotive market is experiencing a slowdown, with some regions facing stagnant sales. This creates a more intense competition for market share among suppliers like Alfmeier Präzision AG.

This challenging market environment, sometimes described as 'stagflation' for certain segments, forces companies to compete more fiercely on both price and the introduction of new technologies. For instance, global automotive production was projected to reach around 90 million vehicles in 2024, a slight increase from previous years but indicating a more moderate growth trajectory compared to earlier decades.

Alfmeier Präzision AG operates within the automotive component manufacturing sector, characterized by substantial exit barriers. These barriers stem from deeply specialized assets, such as highly specific machinery and tooling, and considerable capital tied up in manufacturing facilities. For instance, the automotive industry often requires dedicated production lines for particular components, making it difficult and costly to repurpose or sell these assets if a company decides to exit. This immobility of capital and assets means that even during periods of reduced demand, companies are compelled to remain active in the market, intensifying ongoing competitive rivalry.

Product Differentiation and Innovation Race

Alfmeier Präzision AG distinguishes itself through its dedication to precision engineering and continuous innovation, especially in sophisticated systems like active seat climate control and advanced fluid management. This focus allows them to carve out a niche in a competitive landscape.

However, the automotive supplier sector is characterized by intense rivalry, where competitors are also channeling significant resources into research and development. This creates an ongoing race to achieve technological leadership and introduce novel products, aiming to capture market share and secure a competitive advantage.

- Innovation Focus: Alfmeier's strength lies in precision engineering for active seat climate control and fluid management systems.

- Competitive Investment: Competitors are also heavily investing in R&D to stay ahead.

- Technological Race: This leads to a constant pursuit of technological superiority and new product development.

Impact of Electrification and Software-Defined Vehicles

The automotive industry's rapid pivot to electric vehicles (EVs) and software-defined architectures is significantly intensifying competitive rivalry. This fundamental shift is not only attracting new players but also forcing established suppliers like Alfmeier Präzision AG to re-evaluate their offerings and invest heavily in new technological capabilities.

Companies are scrambling to secure advantageous positions within the evolving EV supply chain, leading to heightened competition. For instance, in 2024, the global EV market share continued its upward trajectory, with projections indicating further substantial growth. This expansion creates both opportunities and intense pressure for suppliers to innovate and adapt their product portfolios to meet the demands of this new automotive era.

- Intensified Competition: The move to EVs and software-defined vehicles creates a more crowded and competitive supplier landscape.

- New Entrants: Technology companies and specialized EV component manufacturers are entering the market, challenging traditional suppliers.

- Supplier Adaptation: Existing suppliers must invest in new technologies, such as battery management systems and advanced software integration, to remain competitive.

- Supply Chain Realignment: Companies are vying for crucial roles in the EV supply chain, from battery production to charging infrastructure components.

Competitive rivalry within the automotive component sector, where Alfmeier Präzision AG operates, is exceptionally high due to the presence of numerous well-established global players and specialized regional firms. This intense competition is further amplified by the industry's significant exit barriers, such as specialized machinery and capital-intensive facilities, which compel companies to remain active even in challenging market conditions. The ongoing transition to electric vehicles (EVs) and software-defined architectures is a major catalyst, intensifying this rivalry as companies vie for positions in the evolving supply chain.

The automotive supplier market is characterized by a constant pursuit of technological leadership, forcing companies like Alfmeier Präzision AG to invest heavily in research and development to stay competitive. This technological race is evident as major competitors such as Continental AG, Bosch, Adient, Faurecia, Gentherm, and Lear Corporation continue to channel substantial resources into innovation. For instance, global automotive production was projected to reach around 90 million vehicles in 2024, indicating a market where suppliers must differentiate themselves through advanced offerings.

| Key Competitors | Primary Focus Areas | Competitive Actions |

|---|---|---|

| Continental AG | Powertrain, Chassis, Interior Electronics, Tires | Heavy R&D investment in EV technology, autonomous driving, and digital services. |

| Bosch | Mobility Solutions, Industrial Technology, Consumer Goods, Energy | Leading innovation in EV powertrains, driver assistance systems, and connectivity solutions. |

| Adient | Seating systems, interiors | Focus on lightweight materials, advanced comfort features, and modular seating for EVs. |

| Faurecia | Seating, interiors, clean mobility | Developing sustainable materials and advanced interior technologies for next-generation vehicles. |

| Gentherm | Thermal management systems | Innovating in active seat climate control and advanced cabin heating/cooling solutions. |

| Lear Corporation | Seating, E-Systems | Expanding capabilities in electrification and advanced electronic architectures. |

SSubstitutes Threaten

The increasing adoption of electric vehicles (EVs) poses a significant long-term threat to Alfmeier Präzision AG's core business in traditional internal combustion engine (ICE) fluid management systems. For instance, by the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years. This shift means a reduced demand for ICE-specific components, impacting Alfmeier's established product lines.

While EVs necessitate entirely different fluid management solutions, such as those for battery thermal management, the market isn't moving to EVs exclusively overnight. Hybrid vehicles, which still utilize ICE technology alongside electric powertrains, offer a transitional phase where Alfmeier's expertise might still be relevant. Furthermore, emerging technologies like hydrogen-powered internal combustion engines could present new avenues for fluid management systems, potentially mitigating the direct substitute threat.

Simpler comfort systems, like basic heated seats, can act as substitutes for Alfmeier Präzision AG's more advanced offerings. These less sophisticated options are often found in budget-friendly vehicles, potentially capping the adoption of premium, precision-engineered climate and comfort solutions. For instance, in 2024, the global automotive market saw continued demand for entry-level vehicles where cost is a primary driver, making these simpler comfort features a more attractive choice for a significant segment of buyers.

The rise of integrated vehicle systems poses a significant threat of substitution for specialized component suppliers like Alfmeier Präzision AG. As automotive original equipment manufacturers (OEMs) increasingly embrace software-defined architectures, they may opt for larger, consolidated modules from Tier 1 suppliers, bypassing the need for individual, highly specialized parts. This trend could fundamentally alter the automotive value chain.

For instance, the increasing complexity of vehicle electronics and the push towards autonomous driving are driving demand for integrated cockpit modules and advanced driver-assistance systems (ADAS). In 2024, the global ADAS market was valued at approximately $35 billion and is projected to grow substantially, indicating a move towards bundled solutions rather than discrete components.

New Materials or Manufacturing Processes

Advances in materials science, such as the increasing use of advanced composites and lighter, more durable plastics, present a significant threat to traditional precision-engineered components. These new materials can offer comparable or even superior performance characteristics at potentially lower production costs, directly challenging Alfmeier Präzision AG's established methods.

Furthermore, innovations in manufacturing processes, particularly in areas like advanced additive manufacturing (3D printing), allow for the creation of intricate parts with complex geometries that might have previously required expensive, multi-stage precision engineering. This technological shift could enable competitors to produce substitute components more efficiently.

For instance, the automotive sector, a key market for Alfmeier, has seen substantial investment in lightweight materials. In 2024, the global automotive lightweight materials market was valued at approximately USD 100 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, indicating a strong trend toward alternatives that could bypass traditional precision manufacturing.

- New materials like advanced composites and high-performance plastics offer lighter weight and enhanced durability.

- Additive manufacturing allows for the production of complex parts, potentially at lower costs and with faster lead times.

- The automotive industry's push for lightweighting, with a market size exceeding USD 100 billion in 2024, highlights the growing adoption of material substitutes.

- These advancements could reduce demand for Alfmeier's traditional precision-engineered solutions if cost and performance parity is achieved.

Behavioral or Lifestyle Shifts

Shifts in consumer behavior, like a greater preference for ride-sharing services, could reduce the demand for certain traditional automotive components. For instance, if ride-sharing fleets prioritize durability and low maintenance over premium comfort features, this could impact demand for specialized interior components.

Autonomous vehicle technology might also alter component needs, focusing more on sensor integration and less on traditional driver-centric ergonomics. However, the enduring appeal of personal vehicle ownership and the desire for comfort continue to be significant factors supporting the market for many of Alfmeier Präzision AG's offerings.

- Ride-sharing adoption: While specific 2024 data on ride-sharing's direct impact on component demand is still emerging, the growth trend in the sector suggests a potential long-term influence.

- Autonomous vehicle development: Significant investments continue in AV technology, with projections indicating a gradual but impactful integration into the automotive landscape.

- Personal vehicle ownership: Despite alternative mobility trends, personal vehicle ownership remains robust globally, underpinning the demand for comfort-focused automotive interior solutions.

The threat of substitutes for Alfmeier Präzision AG is multifaceted, stemming from evolving automotive technologies and changing consumer preferences. The rapid growth of electric vehicles (EVs) directly impacts demand for internal combustion engine (ICE) fluid management systems, as EVs require entirely different thermal management solutions. While hybrid vehicles offer a transitional market, the broader shift suggests a long-term decline for ICE-specific components.

Furthermore, advancements in materials science and manufacturing processes, such as additive manufacturing, present alternatives that could challenge traditional precision engineering. The automotive industry's focus on lightweighting, a market valued at over USD 100 billion in 2024, underscores the adoption of new materials that may bypass conventional component manufacturing methods.

Integrated vehicle systems, where automakers consolidate functions into larger modules, also pose a substitution threat by reducing the need for specialized, individual components. This trend, coupled with the potential impact of ride-sharing services and autonomous vehicle development on personal vehicle ownership, highlights the dynamic landscape of potential substitutes Alfmeier must navigate.

| Threat Category | Key Substitute/Trend | Impact on Alfmeier | Supporting Data/Context |

| Technological Shift | Electric Vehicles (EVs) | Reduced demand for ICE fluid management systems | Global EV sales exceeded 13.6 million units by end of 2023. |

| Technological Shift | Hybrid Vehicles | Transitional demand, potential for adaptation | Continued presence of ICE technology in hybrids. |

| Materials & Manufacturing | Advanced Composites/Plastics | Potential to replace traditional precision-engineered parts | Global automotive lightweight materials market valued at ~USD 100 billion in 2024. |

| Materials & Manufacturing | Additive Manufacturing (3D Printing) | Enables complex parts with potentially lower costs | Growing investment in advanced manufacturing techniques. |

| System Integration | Integrated Vehicle Modules | Bypasses need for specialized, discrete components | Trend towards software-defined architectures and consolidated modules. |

| Consumer Behavior | Ride-Sharing Services | Potential reduction in personal vehicle demand | Growing adoption of alternative mobility solutions. |

| Consumer Behavior | Autonomous Vehicles | Shift in component focus (e.g., sensors over ergonomics) | Significant ongoing investment in AV technology. |

Entrants Threaten

Entering the automotive precision components market, like the one Alfmeier Präzision AG operates in, demands a considerable financial outlay. New companies need to invest heavily in specialized machinery and advanced manufacturing facilities to produce parts that meet the rigorous quality and safety standards of the automotive sector. For instance, setting up a state-of-the-art production line for complex engine components can easily run into tens of millions of euros.

Furthermore, the automotive industry is characterized by rapid technological advancements, necessitating continuous and significant investment in research and development. Companies must innovate to develop lighter, more efficient, and more durable components, often requiring substantial R&D budgets. This commitment to innovation, coupled with the high initial capital expenditure, acts as a formidable barrier, deterring many potential new entrants from challenging established players like Alfmeier Präzision AG.

The automotive sector is intensely regulated, demanding adherence to rigorous quality, safety, and environmental mandates, such as the upcoming Euro 7 emissions standards. Newcomers must navigate a protracted and expensive certification journey, concurrently building a reputation for dependability, which presents a significant barrier when challenging established firms like Alfmeier Präzision AG.

Established relationships with major automotive manufacturers present a significant barrier to new entrants. These OEMs often favor a select group of suppliers with a proven history of quality, reliability, and technological advancement. For instance, in 2024, the automotive industry continued to emphasize supplier consolidation and long-term partnerships, making it challenging for newcomers to gain traction without a compelling value proposition or prior industry experience.

Proprietary Technology and Patents

Alfmeier Präzision AG's commitment to precision engineering and continuous innovation is a significant deterrent to new entrants. The company's focus on advanced solutions in fuel management, fluid management, and sophisticated seat comfort systems is underpinned by proprietary technologies and a robust patent portfolio. This intellectual property creates a formidable barrier, making it exceedingly difficult for competitors to replicate Alfmeier's established and advanced product offerings without substantial investment in research and development.

The presence of strong patents in key areas like emission control systems and advanced fluid transfer solutions directly limits the ability of newcomers to enter the market with comparable products. For instance, patents related to their innovative fuel injection technologies or complex mechatronic seat adjustment systems provide a distinct competitive advantage. This technological moat, built through sustained R&D, effectively raises the cost and complexity for any potential new player seeking to challenge Alfmeier's market position.

- Proprietary Technology: Alfmeier's expertise in precision engineering for automotive applications, particularly in fuel and fluid management, is protected by unique technological processes.

- Patent Portfolio: A strong and active patent portfolio shields their core innovations, such as advanced valve technologies and intricate mechatronic systems for vehicle interiors.

- R&D Investment: Significant and ongoing investment in research and development, likely in the hundreds of millions of Euros annually, fuels the creation of new intellectual property and reinforces existing barriers.

Economies of Scale and Experience Curve

Established players like Alfmeier Präzision AG enjoy significant advantages due to economies of scale in their manufacturing processes and procurement of raw materials. This allows them to spread fixed costs over a larger production volume, leading to lower per-unit costs. For instance, in 2023, the automotive supplier industry, where Alfmeier operates, saw major players leveraging their scale to maintain competitive pricing amidst rising material costs.

Furthermore, Alfmeier benefits from an experience curve, meaning that as they have produced more components over time, their processes have become more refined and efficient. This accumulated knowledge translates into lower production costs and higher quality output. New entrants would initially struggle to match this cost efficiency and operational maturity, facing a considerable hurdle to overcome.

- Economies of Scale: Alfmeier's large production volumes in 2023 likely enabled them to negotiate better prices with suppliers, reducing their cost of goods sold compared to smaller, newer competitors.

- Experience Curve: Decades of production experience have allowed Alfmeier to optimize its manufacturing techniques, potentially reducing waste and improving throughput, thereby lowering unit labor costs.

- Cost Disadvantage for New Entrants: A new entrant would need substantial upfront investment to build similar-scale facilities and invest in training to reach Alfmeier's level of operational efficiency, creating a significant barrier.

The threat of new entrants into the precision automotive components market, where Alfmeier Präzision AG operates, is generally considered moderate. Significant capital investment is required for specialized machinery and advanced manufacturing facilities to meet stringent automotive quality standards. For example, establishing a new production line for complex components could easily cost tens of millions of euros.

Furthermore, the industry's reliance on proprietary technology and extensive patent portfolios, like those Alfmeier holds in fuel and fluid management systems, creates a substantial barrier. Newcomers would need to invest heavily in R&D to develop comparable innovations, a process that is both time-consuming and costly, making it difficult to compete directly with established players' technological advantages.

Established relationships with major automotive manufacturers (OEMs) favor suppliers with proven track records, making it challenging for new entrants to secure contracts. In 2024, OEMs continued to prioritize supplier consolidation and long-term partnerships, meaning new companies need a compelling value proposition or prior industry experience to gain market access.

| Barrier Type | Description | Impact on New Entrants | Example Data/Factor |

|---|---|---|---|

| Capital Requirements | High initial investment in specialized machinery and facilities. | Significant barrier, requiring substantial funding. | Setting up a new automotive component plant can cost €50M+. |

| Technology & Patents | Proprietary technologies and strong patent portfolios protect innovations. | Makes replication difficult and costly. | Alfmeier's patents in advanced valve technology. |

| Brand Loyalty & OEM Relationships | OEMs prefer established, reliable suppliers. | Difficult to gain initial market access and contracts. | In 2024, OEMs focused on supplier consolidation. |

| Economies of Scale | Established players benefit from lower per-unit costs. | New entrants face a cost disadvantage. | Large-volume production in 2023 reduced costs for established suppliers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alfmeier Präzision AG is built upon a foundation of reliable data, including the company's annual reports, industry-specific market research from firms like IHS Markit, and news from reputable trade publications within the automotive supply sector.