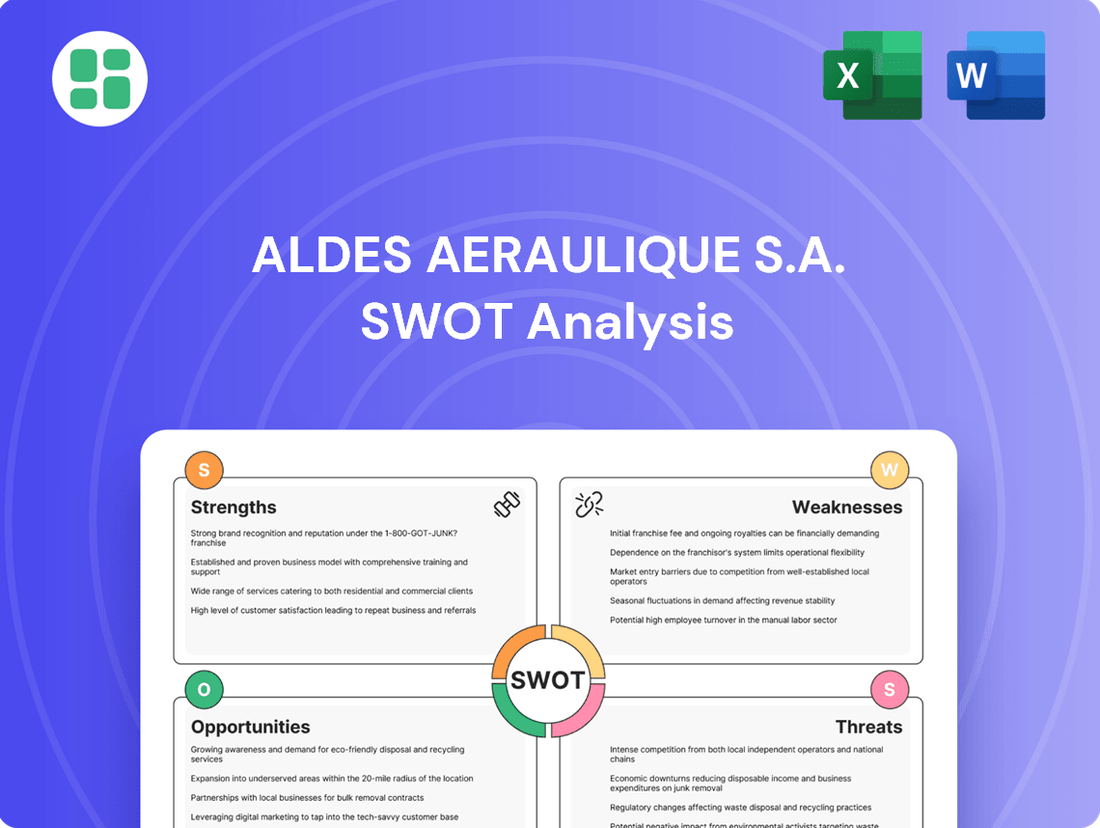

Aldes Aeraulique S.A. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldes Aeraulique S.A. Bundle

Aldes Aeraulique S.A. possesses a strong reputation for innovation in ventilation solutions, a key strength that positions them well in a growing market. However, understanding the full scope of their competitive landscape and potential external threats is crucial for sustained success.

Want the full story behind Aldes Aeraulique S.A.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aldes Aéraulique S.A. boasts a comprehensive product portfolio, covering ventilation, air distribution, central vacuum, and fire protection systems. This integrated approach allows them to offer a complete solution for indoor air quality and thermal comfort, catering to residential, commercial, and industrial sectors. Their broad range addresses diverse client needs effectively.

Aldes Aeraulique S.A.'s core mission is deeply rooted in enhancing indoor health, comfort, and optimizing energy consumption, a strategy that resonates strongly with current global trends. This focus directly addresses the growing public concern for indoor air quality and the escalating demand for energy-efficient building technologies, positioning Aldes favorably for market growth.

Aldes Aeraulique S.A. is celebrating its 100th anniversary in 2025, a testament to its deep roots and extensive experience in the aeraulics industry since its founding in 1925. This remarkable longevity has cultivated a robust brand reputation and a firmly established market presence, especially within France, alongside a growing international reach.

Commitment to Innovation and R&D Investment

Aldes Aeraulique S.A. showcases a robust dedication to innovation, channeling substantial resources into industrial modernization and the development of new products. This commitment is underscored by their consistent investment of over 3% of their annual turnover into research and development activities. Such a strategic focus allows Aldes to maintain a competitive edge by continuously bringing advanced, high-performing solutions to market.

The company’s innovation prowess is further evidenced by its impressive portfolio of 785 patents. These patents represent a tangible output of their R&D efforts, protecting their technological advancements and providing a foundation for future growth. Operating eight dedicated R&D centers across Europe, Aldes fosters a collaborative and cutting-edge environment for its researchers and engineers.

- Significant R&D Investment: Aldes dedicates over 3% of its annual turnover to research and development.

- Extensive Patent Portfolio: The company holds 785 patents, reflecting its innovative output.

- European R&D Network: Eight R&D centers across Europe facilitate continuous product development.

- Focus on High-Performance Solutions: Aldes consistently introduces new products designed for enhanced performance.

Robust International Growth and Diversified Revenue Streams

Aldes Aeraulique S.A. demonstrates significant international reach, with 47% of its total turnover generated outside of France in 2024. This global presence is a key strength, diversifying revenue and mitigating risks associated with any single market.

The company's performance in North America, particularly the 10% growth in dual-flow central units, highlights successful market penetration. Furthermore, positive growth trends in Poland and Germany, averaging 8% in the first half of 2025, showcase Aldes Aeraulique's ability to capitalize on opportunities even as the French new construction market experiences a slowdown. This geographical diversification provides a stable financial foundation.

- International Revenue: 47% of turnover generated outside France in 2024.

- North American Growth: 10% growth in dual-flow central units.

- European Expansion: Average 8% growth in Poland and Germany (H1 2025).

- Diversification Benefit: Balances French market slowdown with international performance.

Aldes Aeraulique S.A.'s commitment to innovation is a significant strength, evidenced by its substantial investment in research and development, consistently exceeding 3% of annual turnover. This dedication fuels a robust pipeline of advanced solutions, protecting their technological edge through an impressive portfolio of 785 patents. Their network of eight R&D centers across Europe ensures continuous product evolution and market responsiveness.

| Strength Category | Specific Strength | Supporting Data/Fact |

|---|---|---|

| Innovation | Significant R&D Investment | Over 3% of annual turnover dedicated to R&D |

| Intellectual Property | Extensive Patent Portfolio | 785 patents held |

| Product Development | European R&D Network | Eight R&D centers across Europe |

| Market Offering | Focus on High-Performance Solutions | Continuous introduction of advanced products |

What is included in the product

This SWOT analysis provides a comprehensive review of Aldes Aeraulique S.A.'s internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework to identify and address Aldes Aeraulique S.A.'s strategic challenges and opportunities.

Weaknesses

Aldes Aeraulique S.A. faces a significant weakness in its vulnerability to construction market fluctuations. While the company has diversified its revenue streams across tertiary, collective housing, and individual homes, the overall health of the construction sector remains a critical factor.

The French new construction market saw a notable contraction of 5% in 2024, presenting a headwind for Aldes’ growth prospects in that segment. Although renovation activities offered a partial buffer against this downturn, the broader slowdown in new builds directly impacts demand for Aldes’ ventilation and air treatment solutions.

Aldes Aeraulique's significant reliance on European regulatory compliance presents a notable weakness. The evolving F-Gas regulations, such as EU 2024/573, and stringent Eco-design directives necessitate continuous and substantial investment in product adaptation and research and development to meet these evolving standards. This ongoing need for compliance can create uncertainty regarding future product viability and requires considerable resources to maintain adherence.

Aldes Aeraulique S.A. operates within a highly competitive indoor air quality and HVAC sector, often contending with much larger global corporations. These dominant players typically possess significantly greater financial resources, enabling them to invest more heavily in research and development, aggressive market expansion, and potentially more competitive pricing strategies. This can create substantial pressure on Aldes, even within its specialized segments.

Integration Challenges from Acquisitions

The 2022 acquisition of Aereco, though strategically sound, introduces potential integration hurdles. These challenges span operational alignment, cultural assimilation, and technological compatibility between Aereco and Aldes. Successfully merging these distinct entities is paramount to unlocking the acquisition's full value.

Specifically, Aldes needs to address the potential for operational redundancies or inefficiencies that may arise from combining two separate business structures. Furthermore, bridging cultural differences and ensuring smooth technology integration are critical for a unified and productive workforce. Failure to manage these aspects could hinder the realization of expected synergies.

- Operational Integration: Streamlining supply chains and manufacturing processes post-acquisition.

- Cultural Assimilation: Fostering a cohesive work environment that respects and blends the existing cultures of Aldes and Aereco.

- Technological Synergy: Ensuring compatibility and efficient integration of IT systems and platforms.

Supply Chain Sensitivity to New Refrigerant Transitions

Aldes Aeraulique's supply chain faces significant challenges with the mandated transition to low-Global Warming Potential (GWP) refrigerants, such as the introduction of A2L refrigerants from January 1, 2025. This regulatory shift, driven by agreements like the Kigali Amendment to the Montreal Protocol, could disrupt established supply networks. For instance, the availability and cost of these newer, often flammable, refrigerants and their associated components may not be as robust or predictable as current options.

Ensuring a consistent and economically viable supply of these next-generation refrigerants and compatible equipment is a paramount operational concern for Aldes. The company must navigate potential price volatility and secure reliable sourcing channels for these specialized materials. This transition could also necessitate investments in new manufacturing processes or partnerships to handle the unique properties of A2L refrigerants.

- Regulatory Mandates: The global phase-down of high-GWP refrigerants, targeting a 70-85% reduction by 2030 under the Kigali Amendment, directly impacts product development and sourcing strategies.

- Supply Chain Volatility: Limited production capacity for new low-GWP refrigerants and components in 2024-2025 could lead to price increases and potential shortages.

- Technical Compatibility: Sourcing compatible components like specialized seals, lubricants, and compressors that work effectively with A2L refrigerants presents an ongoing challenge.

- Logistical Hurdles: The transportation and handling requirements for flammable A2L refrigerants may introduce new logistical complexities and associated costs for Aldes.

Aldes Aeraulique's reliance on the construction sector makes it susceptible to economic downturns affecting new builds. The French new construction market contracted by 5% in 2024, a direct challenge to Aldes' growth in this segment, even with renovation providing some offset.

The company faces ongoing costs and potential uncertainty due to evolving European regulations like EU 2024/573 concerning F-gases and Eco-design directives, demanding continuous R&D investment for compliance.

Aldes competes with larger global players possessing greater financial resources for R&D, market expansion, and potentially more aggressive pricing, creating competitive pressure.

The acquisition of Aereco introduces integration risks, including operational alignment, cultural assimilation, and technological compatibility, which must be managed to realize full value.

Full Version Awaits

Aldes Aeraulique S.A. SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Aldes Aeraulique S.A.'s internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for Aldes Aeraulique S.A.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights for Aldes Aeraulique S.A.'s strategic planning.

Opportunities

Growing public awareness of health and well-being, alongside heightened concerns about indoor air pollution, is fueling significant expansion in the Indoor Air Quality (IAQ) market. This trend is a key opportunity for Aldes Aeraulique S.A. as demand for their ventilation and air treatment solutions increases.

The IAQ solutions market is projected to reach USD 13.9 billion by 2029, indicating a robust growth trajectory. This presents a substantial avenue for Aldes to capitalize on by offering advanced and efficient IAQ systems that address these evolving consumer and regulatory demands.

New European environmental regulations are a significant opportunity for Aldes. For instance, the F-Gas Regulation (EU 2024/573) and the European Energy Efficiency Directive are pushing for more sustainable refrigerants and improved energy performance. This creates a demand for innovative, eco-friendly solutions, directly aligning with Aldes' focus on energy efficiency.

These evolving standards are compelling the HVAC industry to adapt, presenting a clear advantage for companies like Aldes that are already invested in sustainable technologies. By developing products that meet or exceed these stricter requirements, Aldes can capture a larger market share and solidify its position as a leader in environmentally conscious ventilation.

The growing trend of smart buildings presents a significant avenue for Aldes. By integrating its ventilation solutions with IoT platforms, Aldes can offer enhanced building management, contributing to a more efficient and responsive environment. This integration allows for real-time data on air quality and energy consumption, valuable for building owners aiming for LEED certification or improved operational efficiency.

Leveraging Growth in the Renovation Market

Aldes' strong footing in the renovation market, with 75% of its French turnover already derived from this sector, positions it perfectly to benefit from the current renovation surge. This is especially true in commercial buildings and schools, areas seeing increased activity due to regulations like the Tertiary Decree.

The company can leverage this trend by focusing on energy efficiency upgrades and modernizing ventilation systems in these key segments.

- Tertiary Sector Focus: The Tertiary Decree in France, enacted in 2023, mandates energy efficiency improvements for commercial buildings, creating a substantial opportunity for Aldes' renovation solutions.

- Educational Establishments: There's a growing need to upgrade ventilation in schools and universities to improve air quality and energy performance, a direct market for Aldes.

- Existing Market Share: Aldes' established 75% renovation turnover in France provides a solid base to expand its offerings and capture a larger share of this growing market.

Strategic Partnerships and Geographic Expansion

Aldes can leverage its existing success in forming strategic alliances, such as its collaborations with Hisense and Mitsubishi Heavy Industries for heat pump and air conditioning solutions, to broaden its product portfolio and penetrate new markets. These partnerships provide access to new technologies and distribution channels, enhancing Aldes' competitive edge.

Building on recent growth in North America and key European regions, Aldes has a significant opportunity for further geographic expansion. This strategic move could involve establishing a stronger presence in emerging markets or deepening penetration in underserved segments within existing territories.

- Strategic Partnerships: Aldes has a proven track record, exemplified by its successful collaborations in the HVAC sector, which can be replicated to introduce innovative solutions and expand market access.

- Geographic Expansion: Continued focus on regions like North America, where Aldes has seen positive traction, alongside targeted entry into new, high-growth markets, presents a clear avenue for revenue diversification and increased market share.

The increasing demand for improved indoor air quality, driven by health concerns and evolving regulations, presents a substantial growth opportunity for Aldes Aeraulique S.A. The global IAQ solutions market is anticipated to reach USD 13.9 billion by 2029, a testament to this expanding sector.

New European environmental directives, such as the F-Gas Regulation and the Energy Efficiency Directive, are creating a favorable market for Aldes' energy-efficient and sustainable ventilation solutions. These regulations are pushing the HVAC industry towards greener technologies, a space where Aldes is well-positioned.

Aldes' strong presence in the French renovation market, which already accounts for 75% of its turnover, is a significant advantage. The Tertiary Decree, mandating energy efficiency in commercial buildings, and the ongoing need to upgrade ventilation in educational facilities, offer direct avenues for growth.

Strategic alliances and geographic expansion also represent key opportunities. Building on successful partnerships, like those with Hisense and Mitsubishi Heavy Industries, Aldes can broaden its product offerings and market reach, particularly in growing regions like North America.

Threats

The indoor air quality and thermal comfort market is a crowded space, with many big names and emerging companies vying for attention. This means Aldes Aeraulique faces constant pressure from rivals who might offer similar products or even lower prices. For instance, the global ventilation market, a key segment for Aldes, was projected to reach approximately $30 billion by 2024, indicating substantial competition.

The relentless march of technology, especially in areas like indoor air quality (IAQ) monitoring through advanced sensors, artificial intelligence (AI), and the Internet of Things (IoT), presents a significant threat to Aldes Aeraulique S.A. If Aldes fails to continuously invest in and integrate these innovations, its current product lines risk becoming obsolete, potentially impacting market share and competitiveness.

For instance, the global IAQ monitoring market was valued at approximately $4.8 billion in 2023 and is projected to grow substantially, with new technologies constantly emerging. Staying ahead demands substantial and ongoing R&D expenditure, a commitment Aldes must maintain to avoid falling behind competitors who are rapidly adopting these advancements.

Broader economic instabilities, like the slowdown in new construction observed in France during 2024, pose a significant threat to Aldes Aeraulique S.A. This downturn directly impacts demand for the company's ventilation and air treatment solutions.

Reduced investment in new building projects and renovations, a common feature of economic slowdowns, directly curtails the need for Aldes' products and services, thereby affecting revenue streams.

Fluctuating Raw Material and Energy Costs

Aldes Aeraulique S.A.'s manufacturing processes for HVAC and air quality systems are susceptible to significant cost fluctuations due to the reliance on various raw materials like copper, aluminum, and steel, as well as energy prices. For instance, global commodity prices have seen considerable movement. Copper prices, a key component in many HVAC systems, experienced volatility throughout 2024, with fluctuations impacting manufacturers' input costs.

This volatility directly threatens Aldes' profit margins. When raw material and energy expenses rise unexpectedly, the company faces a dilemma: absorb the costs, which shrinks profitability, or pass them on to customers, which could reduce demand and market share. This pressure is amplified by the competitive landscape of the HVAC industry, where price sensitivity is a major factor for consumers and businesses alike.

The impact on competitiveness is substantial. Companies that can better manage or hedge against these cost increases will likely maintain more stable pricing and potentially gain an advantage.

- Increased production expenses due to volatile commodity markets.

- Compressed profit margins as input costs rise, potentially impacting reinvestment.

- Risk of reduced market competitiveness if price increases are necessary for consumers.

Complexity and Cost of Regulatory Compliance

The evolving landscape of environmental and energy efficiency regulations presents a significant challenge for Aldes Aeraulique. Increased stringency, while driving demand for their solutions, also escalates the costs of compliance, including rigorous testing and certification processes. For instance, new EU Ecodesign directives, like those impacting ventilation systems, can necessitate substantial investment in product redesign and re-certification, potentially impacting Aldes' margins if not managed proactively.

Failure to keep pace with these complex regulatory demands could lead to substantial penalties or even exclusion from key markets. The ongoing updates to energy performance standards for buildings across major European economies in 2024 and 2025 mean Aldes must continuously invest in R&D to ensure its product portfolio remains compliant and competitive. This presents a tangible threat to profitability and market access if compliance efforts lag behind regulatory changes.

The financial burden of adhering to these growing regulations is a critical consideration. Aldes Aeraulique may face increased operational expenses related to:

- Meeting new energy efficiency benchmarks for ventilation units, potentially requiring advanced motor technologies or improved insulation.

- Securing certifications and approvals for products in multiple jurisdictions, each with its own evolving set of requirements.

- Investing in research and development to adapt existing product lines or create entirely new solutions that meet future regulatory standards.

- Potential fines or market access restrictions if products do not meet the latest environmental and energy performance criteria.

Aldes Aeraulique faces intense competition in the crowded indoor air quality market, with rivals potentially offering similar products at lower price points. The global ventilation market, a key area for Aldes, was projected to reach around $30 billion by 2024, highlighting the competitive intensity.

Rapid technological advancements in areas like AI-powered IAQ monitoring and IoT integration pose a threat of product obsolescence if Aldes doesn't invest sufficiently in R&D. The global IAQ monitoring market, valued at approximately $4.8 billion in 2023, is a prime example of a segment where innovation is critical for staying competitive.

Economic downturns, such as the slowdown in French new construction observed in 2024, directly impact demand for Aldes' ventilation and air treatment solutions, affecting revenue streams.

Volatility in raw material prices, like copper which saw significant fluctuations in 2024, and energy costs directly threaten Aldes' profit margins and competitiveness. This makes it challenging to maintain stable pricing against competitors.

Increasingly stringent environmental and energy efficiency regulations, such as new EU Ecodesign directives impacting ventilation systems, necessitate significant investment in product redesign and certification, potentially impacting profitability and market access if compliance lags.

SWOT Analysis Data Sources

This Aldes Aeraulique S.A. SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market intelligence reports, and expert industry analyses to ensure a robust and insightful assessment.