Aldes Aeraulique S.A. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldes Aeraulique S.A. Bundle

Understand how political shifts, economic volatility, and evolving social trends are shaping Aldes Aeraulique S.A.'s operational landscape. Our comprehensive PESTEL analysis delves into these critical external factors, providing you with the foresight needed to navigate challenges and capitalize on opportunities. Gain a strategic advantage by downloading the full report now and unlock actionable intelligence for your business planning.

Political factors

Aldes Aeraulique operates under stringent French and EU regulations focused on energy efficiency and decarbonization. The revised Energy Performance of Buildings Directive (EPBD), effective May 2024 and requiring transposition by May 2026, pushes for substantial energy savings and zero-emission buildings.

France's RE2020 environmental regulation, phased in from 2024 through 2027, imposes increasingly rigorous energy performance standards for both new constructions and renovations, directly impacting the demand for Aldes' ventilation and air treatment solutions.

Growing public health concerns are pushing for stricter indoor air quality (IAQ) regulations, especially in France. This trend is directly shaping the market for ventilation and air quality solutions.

New French legislation, including updates to the Grenelle 2 law, mandates enhanced IAQ monitoring in public buildings. These measures, with decrees in December 2022 and May 2024, introduce requirements for CO2 measurement, self-diagnosis, and action plans, with full implementation by 2027.

While full compliance is set for 2027, voluntary adoption of these IAQ standards is permitted starting October 2024. This creates an opportunity for companies like Aldes to proactively offer their expertise and systems, aligning with future regulatory demands and demonstrating commitment to healthier indoor environments.

The French government is significantly boosting green building and energy-efficient renovations. For 2024, an additional €300 million has been allocated to support green transition initiatives, alongside a reduced VAT rate of 5.5% for eligible energy-efficient renovations, down from the standard 10%.

These supportive policies directly encourage the adoption of sustainable building practices. This translates into heightened demand for Aldes Aeraulique S.A.'s energy-saving ventilation and comfort solutions, benefiting both new construction projects and the substantial retrofit market.

Stricter Fire Safety Regulations

France has significantly tightened its fire safety regulations, with new rules for high-rise buildings and public venues commencing on May 17, 2025. Issued in May 2024, these updates impose more rigorous fire performance requirements on cables and construction materials, bringing them in line with the EU Construction Products Regulation (CPR). This means Aldes' fire protection systems must consistently evolve to meet these escalating standards.

The implications for Aldes are clear:

- Mandatory Compliance: Aldes must ensure all its fire protection solutions meet or exceed the new, stricter fire performance criteria for construction products.

- Product Development Focus: Investment in research and development will be critical to adapt existing products and create new ones that satisfy these enhanced safety mandates.

- Market Opportunity: Companies that can readily adapt and offer compliant solutions may find an advantage in the market as demand for upgraded safety features increases.

Extended Producer Responsibility (EPR) Schemes

France's Anti-Waste and Circular Economy Law (AGEC Law), implemented in 2020, mandates Extended Producer Responsibility (EPR) for building materials. This legislation holds manufacturers like Aldes Aeraulique S.A. accountable for their products' entire lifecycle, from production to end-of-life management. The law aims to foster a more circular economy by encouraging waste reduction and resource efficiency within the construction sector.

Under the AGEC Law, Aldes is required to contribute financially to eco-organizations, establish collection and sorting infrastructure for building waste, and support recycling efforts. These obligations directly impact product development, pushing for more sustainable design choices and influencing supply chain strategies to better manage material flows. For 2024, the French government projects that the building sector's EPR schemes will generate over €300 million in eco-contributions, a significant figure underscoring the financial implications for companies.

The implementation of EPR schemes presents both challenges and opportunities for Aldes. Key considerations include:

- Financial Burden: Managing eco-contributions and funding waste management infrastructure adds operational costs.

- Product Innovation: The need to design for recyclability and durability encourages investment in R&D for greener materials and modular components.

- Supply Chain Restructuring: Establishing efficient take-back systems and reverse logistics requires adjustments to existing supply chain models.

- Market Differentiation: Proactive engagement with EPR can enhance Aldes' brand reputation and appeal to environmentally conscious customers and specifiers.

Political stability in France and the EU significantly influences Aldes Aeraulique's operational environment, with government policies on energy efficiency and indoor air quality being paramount. The French government's commitment to decarbonization, evidenced by substantial funding for green building initiatives and tax incentives for renovations, directly boosts demand for Aldes' sustainable solutions.

Stricter fire safety regulations, aligning with EU standards and effective from May 2025, necessitate continuous product adaptation and R&D investment for Aldes. Similarly, the AGEC Law's Extended Producer Responsibility mandates for building materials impact Aldes' product lifecycle management and supply chain strategies, with projected eco-contributions from the building sector exceeding €300 million in 2024.

| Policy Area | Key Legislation/Initiative | Impact on Aldes Aeraulique | 2024/2025 Data/Target |

|---|---|---|---|

| Energy Efficiency | EPBD (EU), RE2020 (France) | Increased demand for energy-saving ventilation | RE2020 phased implementation from 2024-2027 |

| Indoor Air Quality (IAQ) | French IAQ regulations (Grenelle 2 updates) | Demand for IAQ monitoring and ventilation solutions | Voluntary adoption from Oct 2024, full compliance by 2027 |

| Green Building Incentives | French government support | Boosts adoption of sustainable building practices | €300 million allocated for green transition initiatives in 2024; 5.5% VAT for renovations |

| Fire Safety | French fire safety regulations | Need for enhanced fire protection systems | New rules effective May 17, 2025 |

| Circular Economy | AGEC Law (France) | Extended Producer Responsibility for building materials | Building sector EPR schemes projected to generate >€300 million in eco-contributions (2024) |

What is included in the product

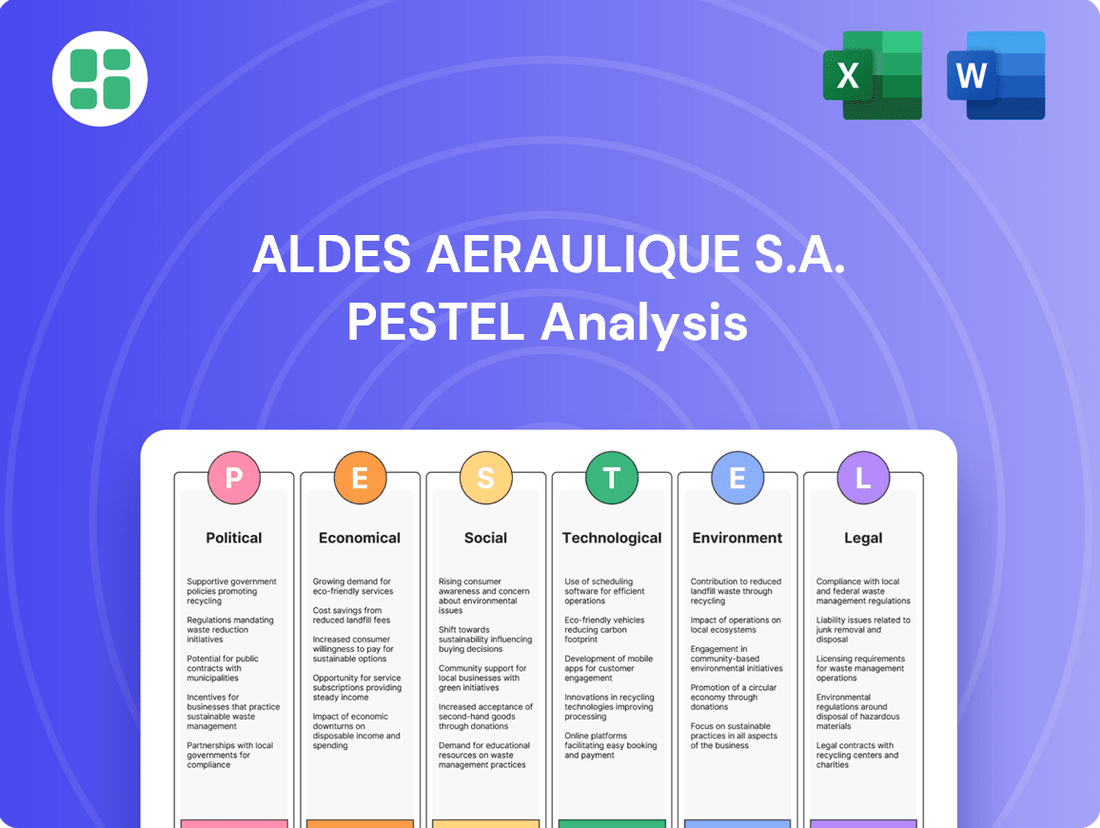

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Aldes Aeraulique S.A., covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for Aldes Aeraulique S.A.

This PESTLE analysis for Aldes Aeraulique S.A. serves as a crucial pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing and informed decision-making during strategic planning and risk assessment.

Economic factors

The global HVAC market is on a strong upward trajectory, with projections indicating a compound annual growth rate (CAGR) between 6.1% and 7.4% for the period spanning 2024 to 2030. This robust expansion is primarily fueled by a growing consumer and industry preference for energy-efficient solutions and the increasing adoption of smart HVAC technologies.

This favorable market environment presents a significant opportunity for Aldes Aeraulique S.A., as the demand for advanced ventilation, thermal comfort, and air quality systems is expected to rise in tandem with the overall market growth.

While the broader global HVAC market shows resilience, France's construction sector experienced a notable downturn. New building permits saw a significant decrease, falling by nearly 30% in 2023, a trend partly attributed to the rising costs associated with new regulatory requirements.

Despite the slowdown in new construction, there's a substantial policy focus and available subsidies aimed at promoting the green renovation of existing buildings. This shift creates a compelling market opportunity for Aldes Aeraulique S.A., particularly for its retrofit solutions designed to improve energy efficiency in older structures.

Global energy costs have seen a significant uptick, with Brent crude oil futures averaging around $80-$90 per barrel in early 2024, impacting manufacturing inputs. This, coupled with broader inflationary pressures, directly increases the cost of raw materials and operational expenses for companies like Aldes Aeraulique S.A. Higher energy prices, for instance, translate to increased costs for transporting goods and powering production facilities.

Conversely, these escalating costs also serve as a catalyst for demand for Aldes' energy-efficient ventilation and air conditioning solutions. As consumers and businesses grapple with higher utility bills, there's a heightened incentive to invest in technologies that reduce energy consumption, thereby lowering long-term operating expenses. This trend is supported by a growing global focus on sustainability and energy conservation, with many regions implementing stricter energy efficiency standards for buildings.

Shifting Demand in Residential and Commercial Sectors

The residential HVAC market, a key driver for companies like Aldes Aeraulique S.A., is bolstered by ongoing urbanization trends and a persistent desire for enhanced home comfort. Globally, the residential construction sector saw a notable uptick in many regions during 2024, with housing starts indicating continued demand for new units and retrofits. This segment remains a cornerstone for HVAC manufacturers.

Conversely, the commercial sector is poised for robust expansion, largely fueled by corporate commitments to sustainability and the increasing demand for energy-efficient office environments. By 2025, many businesses are expected to prioritize upgrades to meet stricter environmental regulations and reduce operational costs, directly benefiting providers of advanced HVAC solutions. This presents a significant growth avenue.

Aldes Aeraulique S.A.'s strategic revenue diversification across residential, collective housing, and tertiary sectors is a critical strength. This balanced approach allows the company to absorb potential downturns in any single market segment. For instance, while residential demand might fluctuate based on interest rates or construction cycles, a strong performance in the commercial sector, driven by energy efficiency mandates, can offset these variations. This resilience is vital in a dynamic economic landscape.

- Residential HVAC Market Growth: Expected to see continued expansion driven by urbanization and consumer demand for comfort, with global housing starts showing positive momentum in 2024.

- Commercial Sector Expansion: Anticipated rapid growth fueled by corporate sustainability goals and the need for energy-efficient office spaces, with upgrades becoming a priority for businesses by 2025.

- Aldes' Revenue Diversification: The company's balanced distribution across residential, collective housing, and tertiary sectors mitigates risks associated with fluctuations in individual market segments.

- Energy Efficiency Focus: Increasing regulatory pressure and corporate responsibility are driving demand for advanced, energy-saving HVAC technologies in both new builds and retrofits.

Impact of Private Equity Investments

Private equity firms are actively targeting the HVAC sector, recognizing its resilience and growth potential. For instance, in 2024, global private equity deal volume in the industrial sector, which includes HVAC, saw significant activity, with many firms seeking to consolidate fragmented markets. This influx of capital means Aldes Aeraulique S.A. may face increased competition from PE-backed entities, potentially impacting pricing power and market share.

This trend towards consolidation, driven by private equity, could lead to more aggressive market strategies from competitors. Companies backed by private equity often have access to substantial capital for expansion, innovation, and acquisitions, allowing them to quickly scale operations and challenge established players like Aldes.

- Market Consolidation: Private equity interest can accelerate the merging of smaller HVAC companies, creating larger, more formidable competitors.

- Increased Competition: PE-backed firms may engage in aggressive pricing or service offerings to gain market dominance.

- Capital Infusion: Competitors may benefit from significant financial backing, enabling faster technological adoption and expansion.

Global energy costs, with Brent crude futures hovering around $80-$90 per barrel in early 2024, directly impact Aldes Aeraulique S.A. through increased raw material and operational expenses, including transportation and manufacturing. This inflationary pressure, however, also drives demand for Aldes' energy-efficient solutions as businesses and consumers seek to lower utility bills.

The HVAC market is projected for robust growth, with a CAGR of 6.1% to 7.4% from 2024 to 2030, largely due to the demand for energy efficiency and smart technologies. While France's construction sector saw a nearly 30% drop in building permits in 2023 due to rising regulatory costs, policy support and subsidies for green renovations in existing buildings present a significant opportunity for Aldes' retrofit solutions.

| Economic Factor | Impact on Aldes Aeraulique S.A. | Supporting Data/Trend (2024-2025) |

| Global Energy Costs | Increased input and operational expenses; heightened demand for energy-efficient products. | Brent crude futures averaging $80-$90/barrel (early 2024). |

| HVAC Market Growth | Strong overall market expansion opportunity. | Projected CAGR of 6.1%-7.4% (2024-2030). |

| French Construction Sector | Slowdown in new builds; opportunity in green renovations. | Nearly 30% decrease in French building permits (2023). |

| Private Equity Interest | Potential for increased competition and market consolidation. | Significant private equity deal volume in the industrial sector (2024). |

What You See Is What You Get

Aldes Aeraulique S.A. PESTLE Analysis

The preview shown here is the exact Aldes Aeraulique S.A. PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file, detailing the strategic insights into Aldes Aeraulique S.A.'s market position and future outlook, fully formatted and professionally structured for immediate application.

This is a real screenshot of the Aldes Aeraulique S.A. PESTLE Analysis product you’re buying—delivered exactly as shown, no surprises, providing a robust framework for understanding the company's external environment.

Sociological factors

The post-pandemic era has undeniably amplified public concern for indoor air quality (IAQ), directly linking it to personal health and overall well-being. This societal awakening is a significant tailwind for Aldes Aeraulique, as it fuels a stronger demand for sophisticated ventilation, filtration, and air purification solutions, which are central to the company's business.

Surveys from 2024 indicate that over 70% of consumers are now more conscious of the air they breathe indoors, with a substantial portion willing to invest more in IAQ technologies. This trend is particularly pronounced in commercial spaces and residential buildings, where occupants expect healthier environments.

Consumers and businesses are increasingly prioritizing sustainable and eco-friendly practices. This trend is evident in the growing demand for energy-efficient buildings and products that minimize environmental impact. For instance, in 2024, the global green building market was valued at approximately $1.3 trillion and is projected to reach over $3.1 trillion by 2030, showcasing a significant shift in consumer and corporate preferences towards sustainability.

This growing consciousness directly benefits Aldes Aeraulique S.A., as their core business revolves around optimizing energy consumption and providing sustainable ventilation solutions. Their product lines, designed to enhance indoor air quality while reducing energy waste, are well-positioned to capitalize on this expanding market segment.

The ongoing trend of urbanization, with a significant portion of the global population now residing in cities, is reshaping how people live and interact with their environments. This shift means more time is spent indoors, driving a greater need for controlled and comfortable indoor climates. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, a substantial increase from today's figures, highlighting the growing importance of indoor environmental quality.

As urban centers become more densely populated, the demand for sophisticated indoor climate solutions, like those offered by Aldes Aeraulique S.A., intensifies. This applies across a wide range of buildings, from apartments and offices to factories and public spaces. The desire for healthy and comfortable living and working conditions in these increasingly concentrated environments directly translates into market opportunities for companies specializing in ventilation and air treatment technologies.

Adoption of Smart Home and Building Technologies

Societal trends show a growing demand for smart home and building technologies, driven by a desire for greater convenience and efficiency. This shift means consumers increasingly expect seamless integration and intelligent systems that adapt to their needs. For Aldes, this translates into a need to develop connected and AI-powered solutions for ventilation and thermal comfort that learn user preferences.

The smart home market is expanding rapidly, with projections indicating continued strong growth. For instance, the global smart home market was valued at approximately $105 billion in 2023 and is expected to reach over $250 billion by 2028, demonstrating significant consumer adoption. This upward trajectory underscores the importance for Aldes to stay ahead in offering innovative, user-centric building technologies.

- Consumer Demand: A significant portion of homeowners, particularly in developed markets, are actively seeking smart home features for enhanced comfort and energy savings.

- Technological Integration: The expectation is for devices to work together harmoniously, pushing manufacturers like Aldes to focus on interoperability and robust connectivity.

- AI and Machine Learning: The integration of AI and machine learning in smart systems allows for personalized experiences, enabling devices to anticipate user needs and optimize performance automatically.

Aging Infrastructure and Renovation imperative

A significant societal driver for Aldes Aeraulique S.A. is the aging infrastructure across Europe. A staggering 85% of the existing building stock was constructed before the year 2000, and within this, a substantial 75% suffers from poor energy performance. This presents a clear and pressing need for widespread building renovation.

This societal imperative to upgrade older structures to meet contemporary energy efficiency and comfort standards directly translates into a robust and enduring market opportunity for Aldes' retrofit solutions. The demand for improved indoor air quality and energy savings in these older buildings is a key factor influencing the market for ventilation and air treatment systems.

- European Building Stock: 85% built before 2000.

- Energy Performance: 75% of older buildings have poor energy performance.

- Market Driver: Societal need for renovation creates demand for retrofit solutions.

- Aldes Opportunity: Significant and sustained market for ventilation and air treatment in older buildings.

The increasing focus on health and wellness, particularly post-pandemic, has made indoor air quality a paramount concern for individuals and organizations. This heightened awareness is a direct driver for Aldes Aeraulique's offerings, as people actively seek solutions for cleaner, healthier indoor environments.

Public demand for sustainable and energy-efficient buildings is growing, with consumers and businesses increasingly prioritizing eco-friendly options. This trend is reflected in the market for green buildings, which was valued at approximately $1.3 trillion in 2024, indicating a strong preference for environmentally responsible solutions.

Urbanization continues to drive demand for sophisticated indoor climate control systems, as more people spend time indoors in densely populated areas. Projections suggest that by 2050, 68% of the global population will reside in urban centers, amplifying the need for effective ventilation and air treatment.

The integration of smart home technology is a significant societal trend, with consumers expecting seamless connectivity and intelligent systems. The global smart home market, valued at around $105 billion in 2023, is expected to exceed $250 billion by 2028, highlighting the demand for AI-powered and user-centric building solutions.

| Societal Factor | Impact on Aldes Aeraulique | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Increased demand for IAQ solutions | 70% of consumers more conscious of IAQ (2024 survey) |

| Sustainability Drive | Preference for energy-efficient products | Global green building market ~ $1.3 trillion (2024) |

| Urbanization | Greater need for indoor climate control | 68% global urban population projected by 2050 |

| Smart Home Adoption | Demand for connected, AI-powered systems | Smart home market ~$105 billion (2023), projected $250+ billion by 2028 |

Technological factors

The HVAC sector is seeing a significant uptake in smart technologies like IoT and AI. Aldes can capitalize on this by integrating these advancements to deliver systems offering real-time performance monitoring and predictive maintenance capabilities. This allows for automated adjustments based on environmental sensor data, enhancing energy efficiency and occupant comfort.

For instance, the global smart HVAC market was valued at approximately $27.5 billion in 2023 and is projected to reach over $60 billion by 2030, demonstrating substantial growth potential. This trend underscores the opportunity for Aldes to develop solutions that leverage big data analytics for optimized operations and remote management, directly addressing increasing demand for intelligent building solutions.

Heightened awareness of indoor air quality (IAQ) is fueling constant advancements in air filtration and purification technologies. This innovation presents opportunities for Aldes to integrate cutting-edge solutions like HEPA, ULPA, electrostatic precipitators, and UV-C light into their ventilation systems.

These technologies are crucial for effectively removing allergens, bacteria, viruses, and various pollutants, directly addressing growing consumer and regulatory demands for healthier indoor environments. For instance, the global air purifier market was valued at approximately USD 12.5 billion in 2023 and is projected to grow significantly, indicating strong market demand for these advanced filtration capabilities.

The advancement of Energy Recovery Ventilation (ERV) systems is a critical technological factor for Aldes. These systems are designed to recover thermal energy from outgoing stale air to pre-condition incoming fresh air, significantly reducing the energy load for heating and cooling. For instance, in 2024, the global ERV market was valued at approximately $3.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 7% through 2030, driven by increasing energy efficiency mandates and growing awareness of indoor air quality.

Aldes can leverage this trend by further innovating its ERV technology to offer superior energy savings and enhanced indoor air quality features. By optimizing humidity and temperature control, Aldes can differentiate its products in a competitive market. The company's focus on developing more efficient heat exchangers and smarter control systems will be key to capturing market share in this expanding segment.

Sustainable Materials and Manufacturing Processes

Technological advancements are increasingly pushing the construction industry towards sustainable practices. This includes the widespread adoption of recycled materials, the development of eco-designed products, and the rise of prefabrication techniques aimed at minimizing waste and reducing the overall carbon footprint of buildings. For Aldes Aeraulique S.A., integrating these trends into their manufacturing processes and product design offers a significant opportunity to align with circular economy principles prevalent in modern construction.

The market for green building materials is expanding rapidly. For instance, the global green building materials market was valued at approximately $274.5 billion in 2023 and is projected to reach $678.8 billion by 2030, growing at a compound annual growth rate of 13.7%. This growth underscores the increasing demand for sustainable solutions that Aldes can leverage.

Aldes can benefit by focusing on:

- Material Innovation: Researching and incorporating recycled content and bio-based materials into their ventilation and air distribution components.

- Process Optimization: Implementing energy-efficient manufacturing methods and waste reduction strategies in their production facilities.

- Product Lifecycle Design: Developing products that are designed for disassembly, repair, and recycling, fitting into a circular economy model.

- Digitalization: Utilizing digital tools for design and manufacturing to enhance efficiency and reduce material waste during production.

Digitalization of Construction and Building Information Modeling (BIM)

The construction industry's move towards digitalization, particularly the widespread adoption of Building Information Modeling (BIM) and digital project management platforms, significantly influences how Aldes Aeraulique's ventilation and air treatment solutions are integrated into building designs and project execution. This digital shift means Aldes must ensure its product data is readily compatible with BIM software, allowing for seamless incorporation into digital building models. For instance, the global construction market is projected to reach $14.8 trillion by 2030, with digital technologies playing a crucial role in achieving this growth, highlighting the importance for Aldes to adapt its offerings to these evolving digital workflows.

Embracing these digital tools offers Aldes a strategic advantage by streamlining its integration into modern construction processes. This can lead to improved project efficiency, reduced errors, and faster installation times for its systems. By providing comprehensive digital assets for its products, Aldes can facilitate easier specification and implementation by architects and engineers. The UK BIM Framework, for example, mandates the use of BIM Level 2 for all public sector projects, demonstrating a clear industry trend that Aldes must align with to remain competitive.

- BIM Adoption: Increased use of BIM in building design and construction facilitates the integration of Aldes' HVAC products into digital project models.

- Digital Workflows: Aldes' ability to provide digital product data (e.g., BIM objects, technical specifications) directly impacts its ease of integration into modern construction project management software.

- Efficiency Gains: Digitalization in construction promises improved project timelines and reduced on-site errors, areas where Aldes' product integration can benefit from digital compatibility.

- Market Trends: Global construction digitalization efforts, including government mandates for BIM, create a strong impetus for Aldes to enhance its digital product offerings and support.

The integration of smart technologies, including IoT and AI, is transforming the HVAC sector, enabling real-time monitoring and predictive maintenance for enhanced energy efficiency and comfort. The global smart HVAC market, valued at approximately $27.5 billion in 2023, is expected to exceed $60 billion by 2030, presenting significant growth opportunities for Aldes.

Advancements in air filtration and purification technologies, driven by a heightened focus on indoor air quality (IAQ), are crucial. Aldes can integrate solutions like HEPA filters and UV-C light to address the growing demand for healthier indoor environments, a market segment valued at around $12.5 billion for air purifiers in 2023.

Energy Recovery Ventilation (ERV) systems are becoming increasingly vital for energy efficiency. The global ERV market, valued at approximately $3.5 billion in 2024, is projected to grow at over 7% CAGR, offering Aldes a chance to innovate and capture market share with more efficient solutions.

The construction industry's shift towards digitalization, particularly the adoption of Building Information Modeling (BIM), necessitates Aldes ensuring its product data is BIM-compatible for seamless integration into digital building models. The global construction market is projected to reach $14.8 trillion by 2030, with digital technologies playing a key role.

Legal factors

The recently recast Energy Performance of Buildings Directive (EU/2024/1275), effective May 2024, sets a clear trajectory for building sector decarbonization by 2050. This EU legislation requires member states, including France, to implement new minimum energy performance standards for buildings into national law by May 2026. This directive will directly impact the market demand for Aldes' energy-efficient ventilation and air treatment solutions, as compliance becomes a critical factor for building owners and developers.

France's RE2020 regulation, reinforced by the August 2021 Climate & Resilience Law, is significantly raising the bar for energy efficiency in buildings. This means new constructions and major renovations must meet stricter performance standards, impacting everything from insulation to the systems used for heating, cooling, and ventilation.

The phased implementation, running from 2024 through 2027, directly drives demand for advanced solutions like those offered by Aldes. For instance, the RE2020 mandates a reduction in the carbon footprint of building materials and a focus on low-carbon energy sources, pushing developers towards integrated, high-performance systems that Aldes specializes in.

By 2025, the RE2020 will require new homes to be "positive energy" buildings, meaning they produce more energy than they consume. This ambitious goal underscores the critical role of efficient ventilation and thermal management systems in meeting regulatory compliance and achieving desired performance levels.

France's new legislation, taking effect January 1, 2027, mandates continuous air quality monitoring in public buildings, with voluntary adoption beginning October 2024. This law requires detailed risk analyses and action plans for indoor air quality (IAQ) issues, creating a substantial market opportunity for Aldes' ventilation and monitoring technologies.

This legal framework directly benefits Aldes by establishing a consistent demand for their IAQ monitoring and ventilation systems, particularly for sensitive locations like schools and healthcare facilities. The phased implementation, starting with voluntary adoption, allows Aldes to build early market presence and refine its offerings.

Extended Producer Responsibility (EPR) for Construction Products and Materials

France's Anti-Waste and Circular Economy Law (AGEC Law) has significantly broadened Extended Producer Responsibility (EPR) to encompass construction products and materials. This legislation places a legal onus on manufacturers, such as Aldes Aeraulique S.A., to manage their products' end-of-life. This directly impacts product development, pushing for eco-design principles and mandating contributions to waste management and recycling efforts.

The implications for Aldes include adapting product design to facilitate easier disassembly and material recovery. Furthermore, the company will face financial obligations tied to the collection, sorting, and recycling of construction waste generated from its products. For instance, the French Ministry of Ecological Transition reported that in 2023, the construction sector generated approximately 225 million tonnes of waste, with a significant portion being recyclable materials.

- EPR Mandate: Manufacturers are now legally responsible for the entire lifecycle of their construction products, including disposal and recycling.

- Eco-Design Push: The law incentivizes the design of products that are more durable, repairable, and made from recycled or recyclable materials.

- Financial Contributions: Companies like Aldes will contribute financially to national waste management and recycling schemes.

- Market Impact: This shift is expected to foster innovation in sustainable building materials and circular economy business models within the construction sector.

Updated Fire Safety Standards for Public and High-Rise Buildings

New French regulations, effective May 17, 2025, impose stricter fire safety standards on public and high-rise buildings. This decree, issued on May 17, 2024, mandates that construction materials and systems must achieve higher fire performance classifications. Consequently, Aldes Aeraulique S.A. must ensure its ventilation and fire protection components meet these enhanced safety requirements.

These legal updates directly impact Aldes' product development and compliance strategies. The company will need to verify that its offerings align with the updated European fire classification standards. Failure to comply could lead to market access issues or require significant product modifications.

- Stricter Fire Safety: French decree of May 17, 2024, elevates fire safety rules for ERP and IGH.

- Effective Date: New standards are legally binding from May 17, 2025.

- Material Compliance: Construction materials, including ventilation and fire protection, need higher fire performance classifications.

- Aldes Impact: Aldes Aeraulique S.A. must ensure its products meet these new, enhanced safety benchmarks.

France's commitment to energy efficiency, particularly through the RE2020 regulation and the EU's Energy Performance of Buildings Directive, creates a strong legal impetus for Aldes' sustainable ventilation solutions. The upcoming requirement for new homes to be positive energy buildings by 2025 directly drives demand for high-performance systems. Furthermore, new legislation mandating continuous air quality monitoring in public buildings from January 2027, with voluntary adoption starting October 2024, opens significant market avenues for Aldes' IAQ technologies.

Environmental factors

The drive towards decarbonization is a major environmental force, with the European Union targeting climate neutrality by 2050 and aiming to slash energy consumption by 2030. This creates a significant market opportunity for companies like Aldes Aeraulique S.A.

Aldes' ventilation and heat recovery systems directly address this push by enhancing building energy efficiency and thermal comfort. For instance, their solutions can contribute to the EU's goal of reducing building energy consumption by 14% by 2030.

Growing environmental awareness and escalating energy prices are significantly pushing for lower energy consumption in buildings. This trend directly benefits Aldes Aeraulique S.A., whose expertise lies in developing ventilation and thermal comfort systems designed for energy efficiency. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) continues to tighten standards, with updated regulations expected to further drive demand for high-efficiency solutions like those offered by Aldes.

France's AGEC Law, enacted in 2020, is a significant driver for circular economy adoption in construction, pushing for waste reduction and material reuse. This legislative push directly impacts companies like Aldes, requiring a focus on the environmental footprint of their products throughout their entire lifecycle.

The construction sector is increasingly prioritizing the reuse and recycling of materials, a trend that aligns with Aldes' need to integrate eco-design. For instance, France aims to increase the share of recycled materials in new constructions, a goal that will shape product development and sourcing strategies for HVAC manufacturers.

Transition to Low Global Warming Potential (GWP) Refrigerants

Environmental regulations are increasingly pushing for a shift away from high Global Warming Potential (GWP) refrigerants in HVAC systems, with new mandates effective from 2025. This regulatory landscape directly influences Aldes' strategic planning, necessitating significant investment in research and development to ensure their thermal comfort solutions meet these evolving environmental standards. For instance, the European Union's F-Gas Regulation continues to tighten quotas on HFCs, driving the market towards alternatives like HFOs and natural refrigerants.

This transition requires Aldes to innovate its product lines, potentially redesigning existing systems or developing entirely new ones that can effectively utilize lower GWP refrigerants. The company must ensure these new refrigerants are not only compliant but also offer comparable or improved performance and efficiency to maintain customer satisfaction and market competitiveness. The global HVAC market, valued at over $130 billion in 2023, is actively adapting, with manufacturers exploring refrigerants such as R-32 and R-454B, which have significantly lower GWPs than legacy refrigerants like R-410A.

- Regulatory Impact: New environmental regulations, effective 2025, mandate the use of low-GWP refrigerants in HVAC systems.

- R&D Investment: Aldes must invest in research and development to ensure product compliance and sustainability.

- Market Adaptation: The global HVAC sector is moving towards alternatives like R-32 and R-454B, reflecting a broader industry trend.

- Performance Challenges: Ensuring new refrigerant technologies offer comparable efficiency and performance is crucial for market acceptance.

Increased Focus on Sustainable Building Materials

The construction industry is experiencing a significant shift towards sustainable building materials, driven by both consumer demand and evolving regulations. This trend emphasizes materials with lower embodied carbon, recycled content, and those designed for future reuse. For instance, in 2024, the global green building materials market was valued at approximately $250 billion and is projected to grow substantially in the coming years, reflecting this increasing preference.

Aldes Aeraulique S.A. can actively participate in this movement. By refining its manufacturing to incorporate eco-friendly sourcing and product design that considers the entire lifecycle impact, Aldes can align with this market evolution. This includes exploring materials with reduced environmental footprints and designing ventilation solutions that are durable and easily recyclable.

The company's commitment to sustainability can be further demonstrated through initiatives such as:

- Optimizing manufacturing processes to reduce energy consumption and waste.

- Prioritizing the sourcing of recycled or sustainably certified raw materials for product components.

- Designing ventilation systems for longevity and ease of disassembly for material recovery at end-of-life.

- Investing in research and development for innovative materials that meet stringent environmental standards.

The increasing focus on climate neutrality and energy efficiency, exemplified by the EU's 2050 target and a 2030 goal to slash energy consumption, presents a significant market opportunity for Aldes Aeraulique S.A. Their ventilation and heat recovery systems directly contribute to reducing building energy use, aligning with the EU's aim to cut building energy consumption by 14% by 2030.

Growing environmental awareness and rising energy costs are accelerating the demand for lower energy consumption in buildings, directly benefiting Aldes' expertise in energy-efficient thermal comfort solutions. The European Union's updated Energy Performance of Buildings Directive (EPBD) continues to raise standards, further stimulating demand for high-efficiency products like those Aldes offers.

France's AGEC Law, enacted in 2020, promotes a circular economy in construction, emphasizing waste reduction and material reuse, which influences Aldes' product lifecycle environmental impact. The construction sector's growing preference for recycled and reusable materials aligns with Aldes' need for eco-design, impacting product development and material sourcing strategies.

New environmental regulations effective from 2025 mandate the use of low-GWP refrigerants in HVAC systems, necessitating significant R&D investment from Aldes to ensure compliance and sustainability. The global HVAC market, valued at over $130 billion in 2023, is actively adopting alternatives like R-32 and R-454B, which have lower GWPs than older refrigerants, requiring Aldes to innovate for comparable performance.

| Environmental Factor | Impact on Aldes Aeraulique S.A. | Supporting Data/Trend |

|---|---|---|

| Decarbonization & Energy Efficiency | Market opportunity for ventilation and heat recovery systems. | EU target: Climate neutrality by 2050; 14% building energy reduction by 2030. |

| Circular Economy & Waste Reduction | Need for eco-design and lifecycle assessment. | France's AGEC Law (2020) promotes material reuse and recycling in construction. |

| Refrigerant Regulations (Low-GWP) | Requires R&D investment in compliant and efficient solutions. | Mandates effective 2025; Global HVAC market adopting R-32, R-454B. |

| Sustainable Building Materials | Opportunity to integrate eco-friendly sourcing and design. | Global green building materials market valued at ~$250 billion in 2024. |

PESTLE Analysis Data Sources

Our Aldes Aeraulique S.A. PESTLE Analysis is constructed using data from official government publications, reputable industry associations, and leading market research firms. We incorporate economic indicators, environmental regulations, technological advancements, and socio-cultural trends to provide a comprehensive overview.