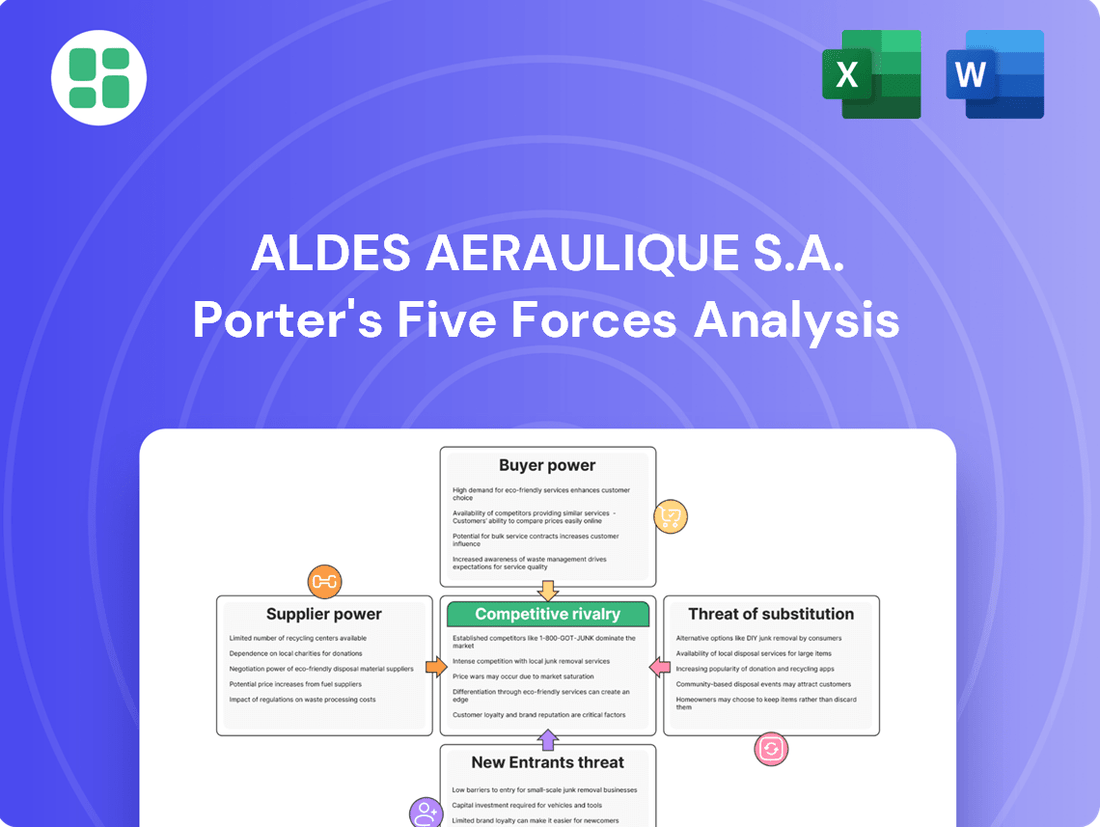

Aldes Aeraulique S.A. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldes Aeraulique S.A. Bundle

Aldes Aeraulique S.A. faces moderate competitive rivalry, with established players and a growing threat from new entrants in the ventilation and air treatment sector. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this landscape. The threat of substitutes, while present, is somewhat mitigated by the specialized nature of their solutions.

Ready to move beyond the basics? Get a full strategic breakdown of Aldes Aeraulique S.A.’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Aldes Aéraulique S.A., operating in the HVAC and fire protection sectors, faces significant supplier power due to its reliance on essential raw materials. Fluctuations in the prices and availability of copper, aluminum, steel, and crucial electronic components like semiconductor chips directly impact Aldes' production costs and efficiency.

The persistent global supply chain disruptions and inflationary pressures observed throughout 2023 and into 2024 have exacerbated these challenges. These factors contribute to elevated material costs and notably longer lead times, thereby strengthening the bargaining position of Aldes' suppliers.

Aldes Aeraulique S.A.'s reliance on advanced components like specialized sensors, filters, and proprietary control systems for its smart ventilation and fire protection solutions grants suppliers considerable leverage. These high-tech or patented parts often have few, if any, substitutes, making their availability and pricing crucial for Aldes' operations.

The HVAC industry, including companies like Aldes Aeraulique S.A., continues to grapple with significant global supply chain disruptions. Issues such as persistent port congestion and widespread transportation challenges are causing delays in receiving essential equipment and components. This situation directly impacts Aldes' ability to maintain smooth operations and timely product delivery.

These ongoing disruptions necessitate that Aldes Aeraulique S.A. engage in much longer-term planning, often months in advance, for critical materials. The increased lead times and the need to secure scarce resources can lead to higher procurement costs. Consequently, suppliers are in a stronger position to negotiate terms, thereby increasing their bargaining power.

Labor Shortages in Manufacturing

Labor shortages in the manufacturing sector, particularly for companies producing HVAC/R components and essential raw materials, directly impact supplier bargaining power. These shortages can cripple production, forcing suppliers to operate at reduced capacity. For instance, in 2024, the U.S. manufacturing sector continued to grapple with significant labor gaps, with the Bureau of Labor Statistics reporting millions of unfilled positions across various industries. This scarcity drives up wages and other employment-related costs for suppliers.

Consequently, suppliers facing these elevated labor expenses are compelled to pass these costs onto their buyers, such as Aldes Aeraulique S.A. This translates into higher prices for components and raw materials, or suppliers may dictate less favorable payment terms. The increased cost of labor for suppliers is a direct driver of their enhanced bargaining power, potentially squeezing Aldes' profit margins.

- Reduced Production Capacity: Labor scarcity limits the output of suppliers, creating supply constraints.

- Increased Labor Costs: Suppliers must offer higher wages and benefits to attract and retain workers, raising their operational expenses.

- Price Increases: Suppliers pass on higher labor costs to buyers, leading to increased component and material prices for Aldes.

- Less Favorable Terms: Suppliers may demand stricter payment schedules or other terms due to their own cost pressures.

Transition to Eco-Friendly Materials

The increasing push for environmental sustainability is significantly impacting supply chains. For instance, stricter regulations around refrigerants, like those implemented in the EU, are compelling manufacturers to seek out specific, compliant materials. This shift empowers suppliers who can offer these eco-friendly alternatives, as their products become essential for meeting new environmental mandates.

Suppliers of these specialized, eco-friendly materials are likely to see their bargaining power rise. This is because manufacturers, including Aldes Aeraulique S.A., must source these components to comply with evolving environmental laws and consumer preferences. The specialized nature of these materials also means fewer alternative suppliers may be available, further concentrating power.

- Increased Demand for Compliant Materials: Environmental regulations are directly driving the need for specific, eco-friendly components.

- Supplier Leverage: Companies that can provide these regulated materials gain an advantage due to the necessity for manufacturers to comply.

- Specialized Production: The niche market for eco-friendly materials can limit the number of suppliers, enhancing their bargaining position.

- Impact on Manufacturing Costs: Adherence to new material standards may lead to higher procurement costs for manufacturers.

Aldes Aéraulique S.A. faces significant supplier bargaining power due to its reliance on specialized electronic components and raw materials like copper and aluminum, whose prices have seen volatility. For example, global copper prices averaged around $8,500 per metric ton in early 2024, a notable increase from previous years, directly impacting Aldes' manufacturing costs.

Labor shortages in manufacturing sectors, a trend continuing into 2024, empower suppliers by increasing their operational costs, which are then passed on to buyers like Aldes. This dynamic is evident in the U.S. manufacturing sector, which consistently reported millions of unfilled positions throughout 2023 and into 2024, driving up wages and supplier leverage.

The increasing demand for environmentally compliant materials, driven by regulations such as those concerning refrigerants, further strengthens the position of suppliers who can offer these specialized alternatives. This necessity for compliance limits substitution options for Aldes and allows these suppliers to dictate terms, potentially increasing procurement expenses.

| Factor | Impact on Aldes | Supplier Leverage | 2024 Data/Trend |

|---|---|---|---|

| Raw Material Prices (Copper) | Increased production costs | High | Copper prices averaged ~$8,500/ton in early 2024 |

| Labor Shortages | Higher component prices, potential delays | High | Millions of unfilled manufacturing jobs in the US |

| Environmental Regulations | Need for specialized, potentially costly materials | Moderate to High | Stricter refrigerant regulations driving demand for compliant alternatives |

| Supply Chain Disruptions | Longer lead times, increased inventory costs | Moderate | Persistent port congestion and transportation challenges |

What is included in the product

This analysis details the competitive forces impacting Aldes Aeraulique S.A., examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the ventilation and air treatment industry.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

Customers, especially in business and industry, are prioritizing energy efficiency and sustainability. This trend is fueled by escalating energy expenses and stricter environmental rules. For example, in 2024, the global green building market was valued at over $1.5 trillion, highlighting significant customer demand for eco-friendly solutions.

Aldes' capacity to offer products that reduce energy use and enhance environmental impact is crucial. However, these customers will expect competitive pricing and demonstrable results in energy savings and sustainability metrics. Failure to meet these expectations can shift bargaining power towards the customer, forcing Aldes to adjust its offerings or pricing.

Stringent regulatory compliance, particularly concerning indoor air quality (IAQ) and energy performance, significantly bolsters customer bargaining power. For instance, the EU's Energy Performance of Buildings Directive (EPBD) mandates higher standards, enabling customers to demand certified products that meet or exceed these evolving requirements. This regulatory landscape empowers large building owners and developers to negotiate more effectively with suppliers, pushing for solutions that align with the latest environmental and health standards, thereby limiting supplier autonomy.

Customers are increasingly seeking HVAC and IAQ systems that go beyond basic functionality, demanding integrated and smart solutions. This includes features like real-time monitoring, Internet of Things (IoT) connectivity, and predictive maintenance, all aimed at boosting control and operational efficiency. For instance, a 2024 report indicated that 65% of commercial building managers prioritize smart building technology for energy savings and improved occupant comfort, directly influencing their purchasing decisions.

Price Sensitivity Versus Long-term Value

While the initial expense of sophisticated ventilation and fire safety systems for Aldes Aeraulique S.A. can be substantial, clients are increasingly recognizing the long-term operational cost reductions and health advantages stemming from better indoor air quality and enhanced energy efficiency. For instance, in 2023, the global demand for energy-efficient HVAC systems saw a notable uptick, driven by rising energy prices and environmental regulations, indicating a growing customer focus beyond initial purchase price.

This evolving customer perspective, balancing upfront investment against ongoing benefits, grants them considerable bargaining power. They can effectively negotiate for competitive pricing without compromising on the quality and efficiency of the solutions they seek.

- Customer Focus Shift: Growing awareness of long-term operational savings and health benefits associated with improved indoor air quality and energy efficiency.

- Bargaining Leverage: The dual consideration of initial cost and long-term value empowers customers to demand competitive pricing.

- Market Trend: In 2023, the market for energy-efficient HVAC systems experienced increased demand, reflecting a customer preference for value over solely upfront cost.

Diverse Customer Segments and Project Scale

Aldes Aeraulique S.A. caters to a broad spectrum of clients, from individual homeowners to large industrial enterprises. This diversity means that customer bargaining power varies significantly based on the scale and nature of their projects.

For instance, major construction firms and industrial companies undertaking large-scale ventilation projects often possess considerable leverage. Their substantial order volumes and the potential for repeat business give them a stronger negotiating position compared to residential customers who typically purchase smaller, less frequent orders.

In 2024, the construction sector saw varied activity, with large commercial and industrial projects continuing to drive demand for HVAC solutions. For example, major infrastructure investments in Europe, totaling billions of euros, would empower the companies involved to negotiate more favorable terms with suppliers like Aldes.

- Residential Customers: Generally have lower individual bargaining power due to smaller purchase volumes and less frequent engagement.

- Commercial Clients: Mid-level bargaining power, influenced by project size and the potential for ongoing service contracts.

- Industrial & Large Developers: Highest bargaining power, stemming from significant project scale, bulk purchasing, and long-term relationships.

Customers' increasing focus on long-term operational savings and health benefits related to indoor air quality and energy efficiency significantly enhances their bargaining power. This shift means they can effectively negotiate for competitive pricing while still demanding high-quality, efficient solutions.

The market in 2023 saw a notable rise in demand for energy-efficient HVAC systems, driven by energy prices and regulations, confirming this customer preference for value over just initial cost.

Aldes Aeraulique S.A. must balance offering competitive pricing with delivering demonstrable energy savings and sustainability metrics to meet these evolving customer expectations.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Residential | Low | Small order volumes, infrequent purchases |

| Commercial (Mid-size) | Medium | Project size, potential for service contracts |

| Industrial & Large Developers | High | Significant project scale, bulk purchasing, long-term relationships |

Same Document Delivered

Aldes Aeraulique S.A. Porter's Five Forces Analysis

This preview showcases the complete Aldes Aeraulique S.A. Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into the market landscape. You can trust that the detailed breakdown of threats and opportunities presented will be identical to the file you receive post-purchase.

Rivalry Among Competitors

The global markets for HVAC, ventilation, and indoor air quality are experiencing robust growth, drawing in both large multinational corporations and niche regional competitors. This dynamic environment fuels fierce competition as companies vie for a larger slice of the expanding market. For instance, the global HVAC system market is projected to grow at a compound annual growth rate of 6.1% from 2024 to 2025, while ventilation systems are expected to see an even more impressive 8.0% CAGR during the same period, intensifying the rivalry.

Competitive rivalry within the ventilation and air treatment sector, particularly for companies like Aldes Aeraulique S.A., is intensely fueled by a relentless pursuit of innovation. This innovation is not just about new features but encompasses critical areas like product design, energy efficiency, and the integration of smart technologies such as AI and IoT. Companies are actively vying to develop advanced filtration systems that offer superior performance and healthier indoor environments.

The drive for more sustainable, connected, and high-performance solutions is a direct response to evolving customer demands and increasingly stringent regulatory requirements. For instance, the European Union's Ecodesign Directive continues to push for greater energy efficiency in ventilation systems, creating a competitive landscape where manufacturers must demonstrate significant improvements. Companies that can successfully integrate these advanced technologies and meet these standards are better positioned to capture market share and command premium pricing.

Competitors are increasingly bundling ventilation, thermal comfort, central vacuum, and fire protection into single, comprehensive solutions. This trend forces Aldes to expand its product range and improve how its systems work together to stay competitive with rivals offering these integrated packages.

In 2024, the market saw several key players launch new combined systems, highlighting this shift towards holistic building solutions. For instance, one major competitor announced a new platform integrating smart ventilation with advanced climate control, aiming to capture market share from companies not yet offering such a unified approach.

Impact of Stricter Regulations

Stricter energy efficiency and indoor air quality regulations across Europe are intensifying competitive rivalry for Aldes Aeraulique S.A. Companies that can innovate and adapt to these evolving mandates, such as the EU’s Ecodesign Directive, gain a significant advantage. For instance, by 2024, many ventilation products will need to meet higher energy performance standards, forcing less prepared competitors to either invest heavily or risk losing market share.

This regulatory environment fosters a competitive landscape where compliance and superior environmental performance are key differentiators. Aldes Aeraulique's ability to develop and market products that exceed these standards, like their high-efficiency heat recovery units, positions them favorably against rivals struggling with compliance costs. The market is increasingly favoring solutions that offer both improved air quality and reduced energy consumption.

- Increased compliance costs for less efficient competitors.

- Market share gains for companies with innovative, compliant solutions.

- Focus on R&D for energy efficiency and air quality as a competitive weapon.

- Potential for consolidation as smaller players struggle to meet new standards.

Skilled Labor Shortage

The competitive rivalry within the HVAC sector, including companies like Aldes Aeraulique S.A., is intensified by an ongoing shortage of skilled labor. This scarcity of qualified HVAC technicians and installers directly affects the industry's capacity to provide prompt installation, essential maintenance, and crucial repair services, all of which are vital for customer satisfaction and market position.

Companies that proactively invest in and maintain comprehensive training initiatives, coupled with effective strategies to retain their existing workforce, gain a significant competitive edge. By ensuring a reliable and consistent service delivery, these firms can stand out amidst the widespread labor challenges.

- Skilled Labor Gap: The U.S. Bureau of Labor Statistics projected a 6% growth in employment for HVAC mechanics and installers from 2022 to 2032, indicating continued demand.

- Impact on Service: A lack of skilled technicians can lead to longer wait times for installations and repairs, potentially impacting customer loyalty and revenue.

- Differentiation Strategy: Firms with strong apprenticeship programs and employee development are better positioned to maintain service quality and capture market share.

- Talent Retention: Competitive wages, benefits, and career advancement opportunities are crucial for retaining skilled personnel in this environment.

Competitive rivalry in the ventilation and air treatment sector is fierce, driven by innovation in energy efficiency, smart technology integration, and advanced filtration. Companies are increasingly offering bundled solutions, combining ventilation with other building systems to meet diverse customer needs and regulatory demands.

The global HVAC system market is projected to grow at a compound annual growth rate of 6.1% from 2024 to 2025, while ventilation systems are expected to see an 8.0% CAGR during the same period. This growth fuels intense competition, with companies like Aldes Aeraulique S.A. needing to adapt to stricter regulations, such as the EU's Ecodesign Directive, which mandates higher energy performance standards.

A significant factor intensifying rivalry is the shortage of skilled labor. The U.S. Bureau of Labor Statistics projected a 6% employment growth for HVAC mechanics and installers from 2022 to 2032. Companies that invest in training and talent retention gain a competitive edge by ensuring reliable service delivery amidst this challenge.

| Key Competitive Factors | Impact on Aldes Aeraulique S.A. | Market Trend Example (2024) |

| Innovation in Energy Efficiency & Smart Tech | Necessitates continuous R&D investment to maintain market position. | Launch of new AI-integrated ventilation systems by competitors. |

| Bundled Solutions | Requires Aldes to broaden its product integration capabilities. | Competitors offering integrated HVAC, fire protection, and vacuum systems. |

| Regulatory Compliance (e.g., Ecodesign Directive) | Drives investment in compliant products; non-compliance leads to market share loss. | Many ventilation products must meet higher energy performance standards. |

| Skilled Labor Shortage | Impacts service delivery; necessitates investment in training and retention. | Increased demand for qualified HVAC technicians, leading to longer service times. |

SSubstitutes Threaten

The rise of passive building design and natural ventilation presents a significant threat of substitutes for Aldes Aeraulique S.A. For instance, in the residential sector, projects prioritizing natural airflow and passive heating/cooling can bypass the need for advanced mechanical ventilation solutions. This trend is gaining traction, with the global green building market projected to reach over $3.0 trillion by 2027, indicating a growing demand for alternatives to traditional HVAC systems.

The threat of substitutes for Aldes Aeraulique S.A.'s integrated air quality solutions is significant, particularly from standalone air purification and filtration devices. Consumers increasingly prioritize indoor air quality, and portable air purifiers offer a direct alternative for many. For instance, the global air purifier market was valued at approximately $12.5 billion in 2023 and is projected to grow substantially, indicating strong consumer adoption of these standalone units.

These independent devices can address specific pollutant concerns, such as allergens or volatile organic compounds, without requiring a full HVAC system integration. This makes them an attractive option for smaller living spaces, individual rooms, or for individuals with particular sensitivities, presenting a viable substitute for Aldes' more comprehensive offerings.

The threat of substitutes for Aldes Aeraulique's integrated HVAC solutions is moderate. While Aldes specializes in advanced thermal comfort systems, simpler alternatives like individual electric heaters, traditional radiators, or basic cooling units such as portable air conditioners and fans can serve as substitutes in specific applications. For instance, in smaller spaces or for temporary needs, these less integrated solutions might be chosen for their lower upfront cost and ease of installation, thereby diverting demand from Aldes' more comprehensive offerings.

Simpler Fire Safety Measures

For simpler fire safety needs, customers might opt for basic solutions like standalone smoke detectors, fire extinguishers, or rudimentary sprinkler systems instead of Aldes' integrated fire protection offerings. This is particularly true in markets where cost is the main consideration, as these alternatives can be significantly cheaper. For instance, a basic residential smoke detector might cost under $20, a stark contrast to the potentially thousands of dollars for a professionally installed Aldes system.

These less sophisticated substitutes can erode demand for Aldes' more advanced products, especially in segments prioritizing affordability over comprehensive safety features. The market for basic fire safety equipment is vast, with global sales of smoke detectors alone reaching billions of dollars annually. This broad availability of lower-cost alternatives directly challenges Aldes' market share for its more integrated solutions.

- Lower Cost Alternatives: Standalone smoke detectors and fire extinguishers offer a significantly lower entry price point compared to integrated systems.

- Market Segmentation: In cost-sensitive markets, customers may prioritize basic compliance over advanced features, making simpler solutions more attractive.

- Ease of Installation: Many substitute products require minimal or no professional installation, further reducing the overall cost and complexity for the end-user.

- Perceived Sufficiency: For certain low-risk environments, basic safety measures might be perceived as adequate, reducing the perceived need for Aldes' more robust solutions.

Behavioral Adjustments and Low-Tech Solutions

The threat of substitutes for Aldes Aeraulique S.A. is present, particularly in residential and less demanding commercial applications. Behavioral adjustments like frequently opening windows for ventilation or relying on simple ceiling fans can be seen as viable, low-cost alternatives to sophisticated mechanical ventilation systems. This is especially true in regions with favorable climates where natural ventilation is often sufficient for comfort and air quality.

These low-tech solutions offer a basic level of air circulation and temperature regulation, directly competing with Aldes' core offerings. For instance, a significant portion of the global population still relies on natural ventilation methods. In 2024, it's estimated that over 40% of new residential constructions in many developing economies still prioritize natural ventilation due to cost considerations.

- Behavioral Alternatives: Opening windows and doors regularly is a common, cost-free substitute for mechanical ventilation.

- Low-Tech Solutions: Basic ceiling fans and portable fans provide localized air movement, mimicking some aspects of ventilation.

- Cost Sensitivity: In price-sensitive markets, the upfront and operational costs of advanced systems make these simpler alternatives more attractive.

- Market Penetration: While specific data for Aldes' direct substitute market share is proprietary, the broad adoption of natural ventilation and fans indicates a substantial competitive landscape.

The threat of substitutes for Aldes Aeraulique S.A. is notable, particularly from passive building designs and natural ventilation methods. These approaches reduce reliance on mechanical systems. For example, the global market for green building materials, which often incorporate passive design principles, was estimated to be worth over $1.5 trillion in 2023, highlighting a significant shift towards building designs that minimize active system requirements.

Standalone air purification units also present a direct substitute for Aldes' integrated air quality solutions. As indoor air quality becomes a greater concern, consumers are increasingly opting for portable purifiers. The global air purifier market experienced robust growth, reaching approximately $13.2 billion in 2024, demonstrating strong consumer adoption of these individual devices.

These simpler, localized solutions can address specific air quality issues without the need for a comprehensive HVAC integration. This makes them a compelling alternative for smaller spaces or for individuals targeting particular pollutants, thereby diverting demand from Aldes' more holistic offerings.

The threat of substitutes for Aldes Aeraulique's advanced HVAC solutions is moderate. Simpler alternatives like individual electric heaters, basic portable air conditioners, and fans can serve as substitutes, especially in smaller spaces or for temporary needs. The market for portable fans alone was valued at over $7 billion globally in 2023, indicating a substantial demand for these less integrated solutions.

| Substitute Category | Example Products | Market Size (Approx. 2023/2024 Est.) | Key Differentiator |

| Passive Building Design & Natural Ventilation | Openable windows, building orientation, thermal mass | Green Building Materials Market: >$1.5 trillion (2023) | Lower upfront and operational costs, reduced energy consumption |

| Standalone Air Purification | Portable air purifiers, HEPA filters | Global Air Purifier Market: ~$13.2 billion (2024) | Targeted pollutant removal, ease of use, lower initial investment |

| Basic Heating/Cooling & Ventilation | Portable heaters, window AC units, ceiling fans | Portable Fan Market: >$7 billion (2023) | Lower initial cost, simpler installation, localized comfort |

Entrants Threaten

The market for comprehensive indoor air quality and thermal comfort solutions, encompassing the manufacturing of ventilation systems and fire protection solutions, necessitates significant upfront capital. Aldes Aeraulique S.A. operates in an industry where substantial investment is required for research and development, establishing state-of-the-art manufacturing facilities, and acquiring advanced machinery. For instance, companies entering this space often face initial outlays in the tens of millions of euros for advanced production lines and testing equipment.

The ventilation and air treatment industry demands significant technical prowess. Newcomers must possess deep knowledge in aerodynamics, thermodynamics, material science, and the integration of smart systems to compete effectively. This high barrier to entry deters many potential entrants.

Established companies like Aldes Aeraulique S.A. have built substantial intellectual property and a track record of innovation. For instance, Aldes' commitment to R&D, evidenced by its continuous product development in energy efficiency and smart controls, requires substantial upfront investment from any aspiring competitor. This investment in research and development is crucial to match the technological sophistication and product performance of industry leaders.

Stringent regulatory compliance and the need for specific certifications act as a formidable barrier to entry in the indoor air quality and fire protection markets. Companies like Aldes Aeraulique S.A. must adhere to a complex web of safety, energy efficiency, and environmental regulations, such as EU building directives and various fire safety standards. Successfully navigating these requirements demands significant investment in research, development, and testing, making it difficult for new players to establish themselves without substantial resources and expertise.

Established Distribution Channels and Brand Loyalty

Aldes Aeraulique S.A. benefits from deeply entrenched distribution channels and significant brand loyalty, making the threat of new entrants moderate. Established players have cultivated strong relationships with contractors and developers over decades, creating a formidable barrier to entry. For instance, in the HVAC sector where Aldes operates, securing reliable distribution partners is crucial and time-consuming.

New companies struggle to replicate the extensive networks and trusted brand reputation that Aldes and its peers have built. This existing customer loyalty means that even with competitive pricing, new entrants must invest heavily in marketing and sales to gain traction. Consider that in 2024, the HVAC market saw continued consolidation, with larger firms leveraging their established networks to acquire smaller competitors, further solidifying existing market structures.

- Established Distribution: Aldes' long-standing relationships with installers and builders are a key competitive advantage.

- Brand Recognition: Decades of operation have fostered trust and preference for Aldes products among end-users and professionals.

- High Switching Costs: For contractors, switching to a new brand often involves retraining, re-tooling, and the risk of impacting project timelines and client satisfaction.

- Market Penetration: Existing market share, built through these channels and loyalty, makes it difficult for newcomers to achieve critical mass.

Complexity of Integrated Product Portfolios

The sheer breadth of Aldes Aeraulique S.A.'s offerings, which encompass ventilation, air distribution, central vacuum systems, and fire protection, presents a significant barrier to new entrants. Mastering the intricacies of each of these diverse product categories and ensuring their seamless integration into comprehensive solutions requires substantial technical expertise and investment.

Developing a complete and reliable product ecosystem, as Aldes has achieved, is a resource-intensive process. New competitors would need to invest heavily in research and development, manufacturing capabilities, and rigorous testing to match Aldes' established product performance and dependability across multiple market segments. For instance, in 2023, the global HVAC market, a core area for Aldes, was valued at approximately $140 billion, underscoring the scale of investment needed to compete effectively.

- Integrated Solutions: Aldes provides a unified approach to air quality and safety, covering ventilation, air distribution, central vacuum, and fire protection.

- Technical Expertise: New entrants must acquire deep knowledge across multiple engineering disciplines to replicate Aldes' integrated product lines.

- R&D Investment: Significant capital is required for research and development to create reliable and high-performing products in each segment.

- Market Entry Costs: The complexity of Aldes' portfolio translates to high upfront costs for new companies aiming to offer comparable integrated solutions.

The threat of new entrants for Aldes Aeraulique S.A. is moderate due to substantial capital requirements for advanced manufacturing and R&D, coupled with the need for deep technical expertise in areas like aerodynamics and thermodynamics. Stringent regulatory compliance and the necessity for specific certifications further elevate these barriers, demanding significant investment in research, development, and testing. Established players leverage decades of built-up distribution networks and brand loyalty, making it challenging for newcomers to gain market traction, especially as larger firms in the HVAC sector continued market consolidation in 2024.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing facilities, and advanced machinery. | Significant financial hurdle for new players. |

| Technical Expertise | Deep knowledge required in aerodynamics, thermodynamics, material science, and smart systems. | Deters entrants lacking specialized engineering skills. |

| Regulatory Compliance | Adherence to safety, energy efficiency, and fire safety standards. | Requires extensive investment in R&D, testing, and certification processes. |

| Distribution & Brand Loyalty | Established relationships with contractors and developers, strong brand recognition. | Makes market penetration difficult and costly for new companies. |

Porter's Five Forces Analysis Data Sources

Our Aldes Aeraulique S.A. Porter's Five Forces analysis is built upon a foundation of reliable data, drawing from the company's official annual reports, industry-specific market research from firms like IBISWorld, and relevant trade publications to capture the competitive landscape.