Alaska Air Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alaska Air Group Bundle

Alaska Air Group operates within a dynamic external environment, facing significant political, economic, social, technological, legal, and environmental influences. Understanding these forces is crucial for strategic planning and competitive advantage. Our comprehensive PESTLE analysis dives deep into each of these factors, offering actionable intelligence to navigate the complexities of the airline industry.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Alaska Air Group. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Governmental aviation policies, particularly those from the FAA and DOT, are foundational to Alaska Air Group's operations. These regulations dictate everything from safety protocols to the routes airlines can fly, directly impacting profitability and strategic planning. For instance, the FAA's oversight on maintenance and pilot training ensures compliance but also adds to operational expenses.

Shifts in these governmental stances can significantly alter Alaska Air Group's trajectory. A tightening of safety regulations might necessitate increased investment in fleet upgrades or training programs, affecting cost structures. Conversely, deregulation or favorable route allocations could open new avenues for expansion and revenue generation, influencing competitive dynamics within the industry.

The current landscape includes significant federal initiatives like the Next Generation Air Transportation System (NextGen). While aimed at improving efficiency and capacity, the ongoing implementation of these air traffic control modernization efforts requires airlines to adapt their systems and potentially incur costs. Furthermore, federal investment in airport infrastructure development, such as runway expansions or terminal upgrades, directly impacts Alaska Air Group's ability to operate efficiently and grow its network, especially in key hubs.

Alaska Air Group's international operations are significantly shaped by bilateral and multilateral trade agreements, particularly with Canada and Mexico, which are key markets for the airline. These agreements directly influence route authorizations, capacity allocations, and passenger traffic between the United States and these neighboring countries. For instance, the U.S.-Canada Open Skies agreement facilitates seamless air travel, benefiting Alaska Airlines' extensive network in the Pacific Northwest and beyond.

Any alteration in these trade policies or diplomatic relations can have a tangible impact. A renegotiation or termination of a trade pact could lead to revised air service agreements, potentially restricting existing routes or creating new market access challenges. In 2023, Alaska Airlines reported carrying millions of passengers on its international routes, underscoring the importance of stable international relations for its revenue streams.

The U.S. airline industry, while largely deregulated since the Airline Deregulation Act of 1978, still sees significant government influence on competition. This oversight is particularly evident in antitrust reviews of mergers and joint ventures, which directly affect Alaska Air Group's strategic options and market positioning. For instance, the proposed acquisition of Hawaiian Airlines by Alaska Air Group faced intense scrutiny from the Department of Justice in 2024, illustrating the ongoing regulatory impact on industry consolidation and competitive dynamics.

Political Stability and Regional Support

Political stability within Alaska and its key operational markets is a cornerstone for Alaska Air Group, directly impacting consistent demand for both passenger and cargo services. For instance, in 2023, Alaska's tourism sector saw a significant rebound, with visitor numbers approaching pre-pandemic levels, underscoring the link between a stable environment and travel demand.

Government support at both local and state levels plays a crucial role. Initiatives like infrastructure upgrades, such as airport modernizations, and essential air service programs directly benefit Alaska Air Group by fostering a more efficient and potentially expanded operating landscape. The airline has historically benefited from such programs, which help maintain connectivity in less-served regions.

- Alaska's State Legislature has consistently allocated funds for airport improvements, with over $50 million earmarked for capital projects in the 2024 fiscal year.

- The airline's reliance on federal Essential Air Service (EAS) contracts in certain rural Alaskan communities highlights the impact of government policy on its network.

- Changes in state or federal administrations could potentially alter the prioritization of tourism promotion or infrastructure investment, affecting Alaska Air Group's operating conditions.

Security Regulations and Measures

The Transportation Security Administration (TSA) continually updates its security regulations to counter evolving threats, directly impacting airlines like Alaska Air Group. For instance, in 2024, the TSA continued to emphasize advanced passenger screening technologies and cybersecurity measures, requiring ongoing investment. These mandates often necessitate adjustments to operational procedures, potentially affecting passenger processing times and increasing overall operational costs for Alaska Air Group.

Compliance with these stringent security protocols demands significant capital outlay. Alaska Air Group, like its peers, must invest in updated screening equipment, enhanced surveillance systems, and comprehensive employee training programs to meet these evolving standards. For example, the push for more sophisticated baggage screening in 2024 and 2025 required airlines to upgrade or replace existing machinery, a substantial undertaking.

- TSA Mandates: Ongoing adaptation to new security directives from agencies like the TSA is crucial.

- Operational Impact: Stringent security protocols influence passenger processing, flight schedules, and operational efficiency.

- Financial Burden: Compliance necessitates significant investments in technology upgrades and specialized personnel training, impacting capital expenditure.

- Cybersecurity Focus: Increased emphasis on cybersecurity measures requires continuous investment in protective systems and protocols.

Governmental aviation policies, particularly from the FAA and DOT, are critical for Alaska Air Group, dictating safety, routes, and operational costs. Federal initiatives like NextGen air traffic control modernization require adaptation and investment, while infrastructure development influences operational efficiency and growth potential.

International operations are shaped by trade agreements, with pacts with Canada and Mexico impacting route authorizations and passenger traffic; in 2023, Alaska Airlines carried millions internationally. Antitrust reviews by the Department of Justice, such as the scrutiny of the Hawaiian Airlines acquisition in 2024, highlight government influence on industry consolidation and competitive strategies.

Political stability in Alaska and key markets is vital for consistent demand, as seen in the 2023 tourism rebound. Government support, including airport improvements and Essential Air Service contracts, fosters operational efficiency and network expansion. Alaska's State Legislature allocated over $50 million for airport projects in fiscal year 2024, demonstrating ongoing support.

TSA security mandates, including advanced passenger screening and cybersecurity measures in 2024-2025, necessitate ongoing investment in technology and training, impacting operational costs and efficiency.

| Policy Area | Impact on Alaska Air Group | Recent Data/Trends (2023-2025) |

|---|---|---|

| Aviation Regulations (FAA/DOT) | Dictates safety, routes, operational costs. | Ongoing NextGen modernization requires system adaptation. |

| Trade Agreements | Influences international route access and traffic. | Millions of international passengers carried in 2023. |

| Antitrust Oversight | Affects consolidation and competitive strategy. | Hawaiian Airlines acquisition faced DOJ scrutiny in 2024. |

| Infrastructure Funding | Supports operational efficiency and network growth. | Alaska State Legislature allocated $50M+ for airport projects in FY2024. |

| Security Mandates (TSA) | Requires investment in technology and training. | Increased focus on advanced screening and cybersecurity in 2024-2025. |

What is included in the product

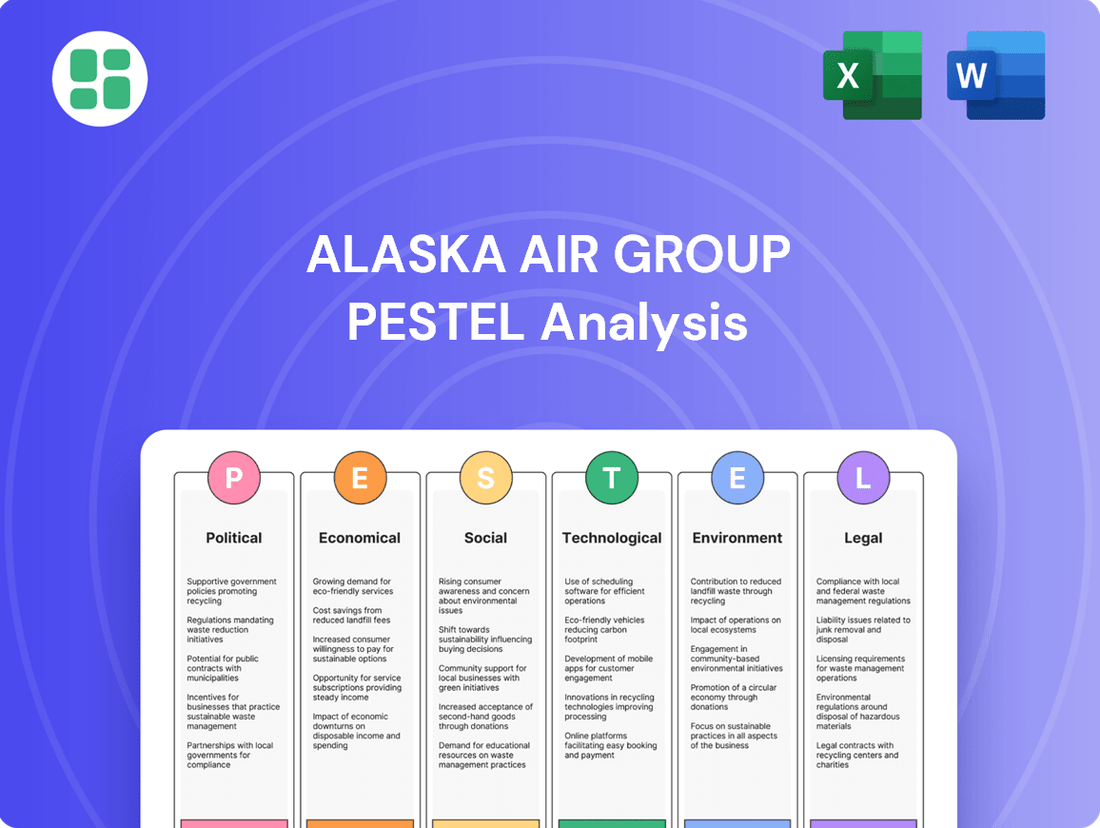

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Alaska Air Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the airline's operating landscape.

This PESTLE analysis of Alaska Air Group offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of information overload.

By presenting the PESTLE analysis of Alaska Air Group in a visually segmented format, it allows for quick interpretation of political, economic, social, technological, environmental, and legal influences, simplifying complex market dynamics.

Economic factors

Fuel price volatility is a major economic concern for Alaska Air Group, as jet fuel represents a substantial portion of their operating costs. Fluctuations in global oil markets, influenced by supply, demand, and geopolitical tensions, directly impact the airline's bottom line. For instance, in 2024, crude oil prices have seen significant swings, with Brent crude averaging around $82 per barrel in the first half of the year, a notable increase from the previous year's averages.

Alaska Air Group, like many airlines, utilizes fuel hedging to manage some of this price risk. However, prolonged periods of elevated fuel prices, such as those experienced in late 2023 and continuing into 2024, can still put considerable pressure on profit margins. If hedging strategies are insufficient or market conditions move unfavorably, these higher costs can lead to reduced profitability for the company.

Consumer discretionary income is a key driver for Alaska Air Group's travel demand. When the economy is strong and people have more money left after essentials, they tend to spend more on travel, both for fun and for business. This directly impacts how many seats Alaska Air can fill and what they can charge for tickets.

For instance, in 2023, U.S. real disposable personal income saw an increase, which generally supports higher consumer spending on services like air travel. However, persistent inflation in early 2024, while showing signs of easing, can still put pressure on discretionary budgets, potentially leading some consumers to postpone or scale back travel plans, affecting Alaska Air's passenger volumes and fare yields.

Conversely, periods of robust economic growth, characterized by low unemployment and rising wages, typically translate into a surge in travel demand. Alaska Air Group benefits from this as both leisure travelers and businesses increase their air travel, boosting revenue and profitability for the airline.

Inflationary pressures significantly impact Alaska Air Group's operating costs. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2024, affecting everything from jet fuel prices to employee wages. These rising expenses, including maintenance parts and airport landing fees, directly challenge the airline's ability to maintain healthy profit margins.

Managing these escalating costs is paramount for Alaska Air Group's financial health. If the airline cannot pass on these increased expenses through higher ticket prices without negatively impacting passenger demand, its profitability will be squeezed. The airline's success in 2024 and 2025 hinges on its capacity to absorb or mitigate these inflationary impacts through strategic pricing and operational efficiency improvements.

Interest Rates and Capital Expenditures

Fluctuations in interest rates directly influence Alaska Air Group's ability to finance significant capital expenditures, such as fleet modernization and expansion projects. For instance, the Federal Reserve's decision to hold interest rates steady in early 2024, following a series of hikes in previous years, has provided a somewhat more stable borrowing environment. However, any upward adjustments in rates can increase the cost of acquiring new, fuel-efficient aircraft or investing in advanced technology.

Higher borrowing costs can make it more challenging for Alaska Air Group to undertake ambitious expansion plans or upgrade its existing fleet with more environmentally friendly options. This financial pressure can potentially slow down investments that are crucial for long-term growth and maintaining a competitive edge in the airline industry. For example, the average interest rate on corporate bonds for the airline industry saw some volatility in late 2023 and early 2024, impacting the cost of debt financing for major airlines.

- Impact on Fleet Modernization: Increased interest rates raise the cost of financing new aircraft, potentially delaying purchases of more fuel-efficient models.

- Borrowing Costs: Higher rates directly increase the expense of debt, affecting Alaska Air Group's overall cost of capital.

- Investment Decisions: Elevated financing costs can lead to a more cautious approach to capital allocation, potentially slowing down expansion or technology adoption.

- Competitiveness: The ability to invest in modern, efficient assets is key to cost control and passenger experience, making interest rate sensitivity a critical factor.

Exchange Rate Fluctuations

While Alaska Air Group's operations are predominantly domestic, its international routes to Canada and Mexico mean it's not entirely immune to exchange rate shifts. A stronger U.S. dollar, for instance, can make trips to these neighboring countries more appealing for American tourists. However, this same strength can make flights into the U.S. less attractive for Canadian and Mexican travelers, impacting Alaska Air's international revenue.

These currency movements directly influence the cost of services or assets Alaska Air might procure in foreign currencies, as well as the value of revenue earned abroad when converted back to U.S. dollars. For example, if the Canadian dollar weakens significantly against the U.S. dollar, revenue generated from flights originating in Canada will translate into fewer U.S. dollars.

- Impact on Revenue: A stronger USD can decrease the dollar value of foreign currency ticket sales.

- Impact on Costs: Conversely, a weaker USD can increase the dollar cost of expenses incurred in foreign currencies.

- 2024/2025 Outlook: The U.S. dollar experienced periods of strength in late 2023 and early 2024, a trend that continued to influence international travel demand and airline revenue streams into 2025. For instance, the USD to CAD exchange rate hovered around 1.35 in early 2024, meaning that for every 1.35 Canadian dollars spent on a ticket, it equated to 1 U.S. dollar in revenue for the airline.

Economic stability is paramount for Alaska Air Group, directly influencing consumer spending on travel. Persistent inflation in early 2024, though showing signs of easing, continued to pressure discretionary incomes, potentially impacting passenger volumes and fare yields. Conversely, a strong economy with low unemployment and rising wages typically boosts travel demand, benefiting the airline.

Fuel price volatility remains a critical economic factor, with jet fuel costs significantly impacting operating expenses. For example, Brent crude averaged around $82 per barrel in the first half of 2024, a rise from previous periods, directly affecting Alaska Air's profitability despite hedging strategies.

Interest rates influence Alaska Air's financing capabilities for fleet modernization. The Federal Reserve's steady rates in early 2024 offered some stability, but any increases would raise borrowing costs for new aircraft, potentially slowing expansion and investment in efficiency.

Exchange rate shifts affect Alaska Air's international revenue. A stronger U.S. dollar, observed in late 2023 and early 2024, can make international travel less attractive for foreign visitors, impacting ticket sales and revenue conversion from foreign currencies.

| Economic Factor | Impact on Alaska Air Group | 2024/2025 Data/Outlook |

|---|---|---|

| Fuel Prices | Increases operating costs, impacting profitability. | Brent crude averaged ~$82/barrel H1 2024; continued volatility expected. |

| Consumer Discretionary Income | Drives travel demand; inflation can reduce spending. | Real disposable income increased in 2023; inflation pressures persist into 2024/2025. |

| Interest Rates | Affects cost of financing fleet upgrades and expansion. | Fed held rates steady early 2024; potential for future adjustments impacts borrowing costs. |

| Exchange Rates | Influences international revenue and cost of foreign services. | USD strength in late 2023/early 2024 impacts international travel demand. USD to CAD ~1.35 early 2024. |

Preview the Actual Deliverable

Alaska Air Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alaska Air Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain a clear understanding of the external forces shaping the airline industry.

Sociological factors

Demographic shifts significantly impact Alaska Air Group. For instance, the aging population in key markets like Florida and Arizona may seek more comfortable seating and accessible services, while a growing millennial and Gen Z demographic, representing a substantial portion of the travel market, prioritizes digital integration, sustainable travel options, and unique experiences. In 2024, travelers under 40 are increasingly vocal about environmental impact, a trend Alaska Air Group is addressing through investments in sustainable aviation fuel initiatives.

The growing desire for work-life balance and the rise of remote work are reshaping traditional business travel. Alaska Air Group must consider how this shift affects corporate travel demand, potentially needing to adapt by offering more flexible options or catering to blended business-leisure trips.

In 2024, many companies are rethinking mandatory travel, with surveys indicating a significant portion of employees prefer virtual meetings for shorter distances. This could mean a sustained reduction in short-haul business trips, a segment Alaska Air Group has historically relied upon.

Public perception of health and safety is paramount for Alaska Air Group, especially following global health events. Travelers are increasingly scrutinizing airline cleanliness and safety measures. For instance, a 2024 survey indicated that 70% of air travelers consider enhanced cleaning protocols a critical factor when choosing an airline.

Alaska Air Group needs to proactively communicate its commitment to passenger well-being. This includes detailing rigorous sanitation procedures and air filtration systems to build and maintain traveler confidence. Demonstrating these efforts is key to encouraging bookings and mitigating concerns about in-flight health risks.

Social Responsibility and Brand Image

Consumers are increasingly prioritizing companies that demonstrate strong social responsibility. This includes a focus on environmental impact and active participation in community initiatives. Alaska Air Group's efforts in these areas directly influence its brand perception, attracting travelers who value ethical operations and sustainable travel.

A robust commitment to sustainability and community support can significantly differentiate Alaska Air Group in the highly competitive airline industry. For instance, in 2023, Alaska Airlines was recognized for its continued investment in sustainable aviation fuel (SAF) initiatives, aiming to reduce carbon emissions. This focus on environmental stewardship, alongside fair labor practices, bolsters its appeal to a growing segment of socially conscious consumers.

- Environmental Stewardship: Alaska Airlines has set ambitious goals for reducing its carbon footprint, including increasing its use of Sustainable Aviation Fuel (SAF).

- Community Engagement: The airline actively supports various communities through charitable partnerships and volunteer programs, enhancing its local presence and goodwill.

- Ethical Labor Practices: Maintaining positive relationships with employees and ensuring fair labor standards contributes to a positive brand image and operational stability.

Customer Service Expectations and Digital Engagement

Customers today expect more than just a flight; they demand a smooth, digital journey from booking to baggage claim. This means airlines like Alaska Air Group need top-notch mobile apps and easy-to-navigate websites. In 2024, a significant portion of bookings are already happening online, highlighting this shift. For instance, a recent industry report indicated that over 70% of airline bookings were made through digital channels, a trend that's only expected to grow.

Meeting these rising expectations for instant communication and personalized service is crucial for customer loyalty. Alaska Air Group's investment in responsive customer support, whether through chat, social media, or email, directly impacts satisfaction. Positive digital interactions can lead to increased repeat business, as customers are more likely to choose airlines that offer a convenient and personalized experience. This focus on digital engagement is becoming a key differentiator in the competitive airline market.

- Digital Booking Dominance: By the end of 2024, it's projected that over 75% of airline ticket purchases will be completed via digital platforms, underscoring the necessity of robust online and mobile booking systems.

- Customer Service Channel Preferences: Surveys in early 2025 show that 60% of travelers prefer digital customer service channels (like chat or app messaging) for quick queries, over traditional phone calls.

- Personalization Impact: Airlines offering personalized travel updates and offers through their apps saw a 15% increase in customer retention rates in 2024 compared to those with generic communication.

- Mobile App Engagement: Alaska Airlines reported a 20% year-over-year increase in mobile app usage for flight management and check-in during 2024, reflecting growing customer reliance on digital tools.

Societal expectations for airlines are evolving, with a strong emphasis on sustainability and corporate social responsibility. Alaska Air Group's commitment to environmental initiatives, such as increasing its use of Sustainable Aviation Fuel (SAF), is a key factor in attracting environmentally conscious travelers. In 2024, consumer surveys consistently show a preference for brands that demonstrate ethical practices and community engagement, directly influencing purchasing decisions.

The airline industry faces scrutiny regarding its environmental impact, pushing companies like Alaska Air Group to adopt greener practices. By investing in SAF and setting carbon reduction targets, the airline aims to align with societal demands for more sustainable travel options. This focus not only enhances brand reputation but also appeals to a growing segment of travelers who prioritize ecological responsibility.

Customer expectations for seamless digital experiences are paramount, with a significant portion of bookings and interactions occurring online. Alaska Air Group's investment in user-friendly mobile apps and websites caters to this trend, with over 75% of airline ticket purchases expected via digital platforms by the end of 2024. Personalized communication and efficient digital customer service channels are critical for fostering loyalty.

Technological factors

Ongoing advancements in aircraft design and materials are yielding more fuel-efficient, quieter, and longer-range planes. These innovations directly impact airlines like Alaska Air Group by enabling cost reductions and improved passenger experience.

Alaska Air Group's strategic investments in modern aircraft, such as their recent orders of Boeing 737 MAX aircraft, are designed to capitalize on these technological leaps. The 737 MAX, for instance, offers a significant improvement in fuel efficiency compared to older models, projecting a 14% reduction in fuel burn for Alaska Airlines. This translates to lower operating expenses and a more competitive cost structure.

Furthermore, the adoption of new-generation aircraft not only enhances operational efficiency but also contributes to a reduced environmental footprint. Alaska Air Group is committed to sustainability, and these technological upgrades are a cornerstone of that strategy, aligning with growing passenger and regulatory expectations for environmental responsibility.

Technology is revolutionizing how customers interact with airlines, from booking flights to managing their travel experience. Alaska Air Group is at the forefront of this digital transformation, using technology to innovate across the entire customer journey. This includes making booking easier, streamlining check-in processes, improving baggage handling, and even enhancing in-flight services.

Alaska Air Group actively uses digital tools to create a smoother and more efficient customer experience. Their mobile app, for instance, allows for easy flight bookings, check-ins, and real-time updates. Self-service kiosks at airports further reduce wait times, and advanced online platforms offer personalized travel options. For example, in Q1 2024, Alaska Airlines reported a 10% increase in mobile app usage for bookings compared to the previous year.

The airline recognizes that continually improving these digital touchpoints is key to keeping customers happy and loyal. By investing in and refining their digital offerings, Alaska Air Group aims to provide a seamless, personalized, and convenient travel experience, which is increasingly important in today's competitive market. This focus on digital enhancement is a core part of their strategy for maintaining customer satisfaction and operational efficiency moving forward.

Data analytics and AI are revolutionizing airline operations, impacting everything from how tickets are priced to how planes are maintained. Alaska Air Group can leverage these powerful tools to refine its route planning, predict passenger demand with greater accuracy, and ultimately boost both efficiency and safety across its network. This data-centric approach enables more informed strategic choices throughout the organization.

Sustainable Aviation Fuels (SAF) Development

The advancement and broader use of Sustainable Aviation Fuels (SAF) mark a crucial technological evolution for the airline sector's environmental objectives. Alaska Air Group has committed to increasing its SAF usage, aiming for 100% by 2030, a move that directly addresses its carbon emissions and aligns with worldwide sustainability initiatives. This technology is foundational for achieving long-term decarbonization in aviation.

While SAF is still gaining traction for widespread implementation, its development is accelerating. For instance, in 2023, the global SAF production capacity was estimated to be around 1.5 billion gallons, a significant increase from previous years, though still a small fraction of total jet fuel consumption. Alaska Air Group's proactive engagement, including a significant investment in SAF producer Prometheus Fuels, positions it to leverage this growing technology.

- SAF Adoption: Alaska Air Group's goal to use 100% SAF by 2030 directly impacts its operational technology and fuel sourcing strategies.

- Investment in Innovation: The company's investment in SAF producers like Prometheus Fuels demonstrates a commitment to technological advancement in sustainable energy.

- Carbon Footprint Reduction: SAF technology offers a tangible pathway for airlines to significantly lower their greenhouse gas emissions, with SAF reducing lifecycle carbon emissions by up to 80% compared to conventional jet fuel.

- Industry Alignment: Alaska Air Group's SAF strategy aligns with broader industry trends and regulatory pressures pushing for greener aviation solutions.

Enhanced Security and Biometric Technologies

Technological advancements are significantly reshaping airport security and passenger processing. Innovations like advanced imaging technology and biometric identification are not only bolstering safety but also streamlining passenger movement through airports. For instance, the TSA's continued rollout of Credential Authentication Technology (CAT) units across U.S. airports, including those Alaska Air Group serves, allows for more efficient verification of traveler IDs and boarding passes, reducing bottlenecks.

The integration of facial recognition technology presents a compelling opportunity to enhance operational efficiency. Alaska Air Group can explore its application for processes like boarding or baggage drop-off, potentially leading to reduced wait times and a smoother passenger journey. This aligns with industry trends; for example, Delta Air Lines has been piloting facial recognition for international departures at select airports, showcasing the growing adoption of such technologies.

To remain competitive and meet evolving passenger expectations, Alaska Air Group must proactively evaluate and adopt these emerging security and biometric solutions. Staying abreast of technological shifts is crucial for maintaining high safety standards and elevating the overall customer experience, especially as air travel volume continues to recover and grow post-pandemic. The airline's investment in these areas will be a key differentiator in the coming years.

- Advanced Imaging Technology: TSA's CAT units improve ID verification efficiency at airports Alaska Air Group utilizes.

- Biometric Identification: Facial recognition pilots by competitors like Delta Air Lines indicate industry-wide adoption potential.

- Passenger Flow Enhancement: These technologies aim to reduce wait times and improve the overall travel experience.

- Strategic Integration: Continuous assessment and adoption are vital for Alaska Air Group to meet security needs and competitive pressures.

Technological advancements are critical for Alaska Air Group's operational efficiency and customer experience. The ongoing integration of advanced digital tools, from booking platforms to in-flight connectivity, directly impacts passenger satisfaction and operational streamlining. For instance, Alaska Airlines saw a 10% increase in mobile app bookings in Q1 2024 compared to the prior year, highlighting the effectiveness of their digital investments.

The airline's fleet modernization, particularly with the Boeing 737 MAX, exemplifies the adoption of fuel-efficient technology, projecting a 14% reduction in fuel burn. This focus on newer aircraft also supports sustainability goals, aligning with industry-wide pushes for reduced environmental impact. Furthermore, the development and adoption of Sustainable Aviation Fuels (SAF) are central to Alaska Air Group's strategy, with a commitment to 100% SAF usage by 2030, a significant move supported by investments in SAF producers.

Airport technology, such as Credential Authentication Technology (CAT) units for ID verification, also plays a role in improving passenger flow. Alaska Air Group's strategic evaluation of emerging security and biometric solutions, like facial recognition, is essential for enhancing safety and elevating the overall customer journey in a competitive market.

| Technology Area | Alaska Air Group's Focus/Impact | Relevant Data/Example |

| Fleet Modernization | Fuel efficiency, reduced emissions | Boeing 737 MAX offers ~14% fuel burn reduction. |

| Digital Customer Experience | Booking ease, real-time updates, personalization | 10% increase in mobile app bookings (Q1 2024). |

| Sustainable Aviation Fuel (SAF) | Carbon footprint reduction, long-term sustainability | Goal of 100% SAF by 2030; investment in SAF producers. SAF reduces lifecycle emissions by up to 80%. |

| Airport Security & Processing | Streamlined passenger flow, enhanced safety | TSA's CAT units improve ID verification; industry exploring facial recognition. |

Legal factors

Alaska Air Group, like all airlines, navigates a complex web of safety regulations set by the Federal Aviation Administration (FAA) and equivalent international bodies for its transborder operations into Canada and Mexico. These rules govern everything from meticulous aircraft maintenance schedules to rigorous pilot training programs and operational protocols. For instance, the FAA's Part 121 regulations outline extensive requirements for air carrier operations, impacting Alaska Air Group's maintenance and training budgets significantly.

Compliance with these stringent safety standards is not merely a legal obligation but a critical operational imperative. Failure to adhere to these regulations can lead to substantial penalties, including hefty fines from regulatory bodies. In 2023, the FAA issued fines totaling millions of dollars to various airlines for safety violations, highlighting the financial risks involved.

Beyond financial penalties, non-compliance can trigger severe operational disruptions, such as grounding of aircraft or suspension of routes, directly impacting revenue and customer service. Furthermore, any safety lapse or regulatory infraction can inflict significant reputational damage, eroding passenger trust and potentially impacting market share, a crucial consideration for Alaska Air Group's competitive standing.

Alaska Air Group operates under stringent consumer protection laws designed to safeguard passenger rights. These regulations, often overseen by bodies like the U.S. Department of Transportation (DOT), mandate specific actions for issues such as flight delays, cancellations, lost baggage, and pricing fairness. For instance, DOT rules require airlines to compensate passengers or offer alternative travel arrangements when flights are involuntarily denied boarding or significantly delayed due to controllable causes.

Compliance with these passenger rights is not merely a legal obligation but a critical factor in maintaining customer loyalty and brand reputation. Failure to adhere to these regulations can result in substantial fines and damage to Alaska Air Group's public image. In 2023, the DOT collected over $2.7 million in fines from airlines for various passenger protection violations, underscoring the financial and reputational risks of non-compliance.

Antitrust laws are crucial for the airline industry, regulating mergers, acquisitions, and partnerships to prevent monopolies and foster fair competition. Alaska Air Group's proposed acquisition of Hawaiian Airlines, announced in late 2023 for approximately $1.9 billion, is undergoing intense scrutiny from regulators like the U.S. Department of Justice.

These legal frameworks directly influence how much consolidation can occur and how much market power airlines can wield. The outcome of such reviews can significantly shape the competitive landscape for carriers like Alaska Air Group.

Labor Laws and Union Relations

Alaska Air Group, as a substantial employer, navigates a complex web of labor laws dictating everything from minimum wage and overtime to workplace safety and anti-discrimination. These regulations are fundamental to its operations and employee treatment.

The airline's significant unionized workforce, including pilots, flight attendants, and ground staff, means that labor relations are a constant legal and operational focus. Ongoing negotiations, contract renewals, and the potential for labor disputes directly influence the company's financial stability and operational continuity.

- Compliance Burden: Adherence to federal and state labor statutes, such as the Fair Labor Standards Act (FLSA) and the Railway Labor Act (RLA), requires significant legal and administrative resources.

- Unionized Workforce Dynamics: Alaska Airlines' major unions, including the Air Line Pilots Association (ALPA) and the Association of Flight Attendants-CWA (AFA-CWA), represent thousands of employees, making collective bargaining a critical aspect of management.

- Impact of Labor Disputes: Past or potential labor disruptions can lead to significant financial losses and reputational damage, underscoring the importance of proactive and constructive labor relations. For instance, the threat of strikes or work stoppages can ground flights and impact revenue streams.

- Wage and Benefit Pressures: Evolving labor laws and union demands for competitive wages and benefits, particularly in light of inflation and industry standards, directly affect operating costs and profitability.

Data Privacy and Cybersecurity Regulations

Alaska Air Group must navigate a complex web of data privacy and cybersecurity regulations. The collection of extensive passenger data makes compliance with laws like the California Consumer Privacy Act (CCPA) essential. For international routes, adherence to regulations such as the General Data Protection Regulation (GDPR) is also a necessity, impacting how customer information is handled and protected.

Maintaining strong cybersecurity is paramount for Alaska Airlines to safeguard sensitive passenger information. A data breach could lead to significant financial penalties, reputational damage, and a loss of customer trust. For instance, the CCPA can impose fines of up to $7,500 per intentional violation, and GDPR violations can reach up to 4% of global annual revenue.

- CCPA Fines: Potential penalties of up to $7,500 per intentional violation.

- GDPR Fines: Up to 4% of annual global turnover or €20 million, whichever is higher.

- Customer Trust: Data protection is directly linked to maintaining passenger confidence and loyalty.

- Operational Impact: Regulatory non-compliance can lead to operational disruptions and increased legal costs.

Legal frameworks profoundly shape Alaska Air Group's operations, from stringent FAA safety mandates to consumer protection laws enforced by the DOT. The airline's proposed $1.9 billion acquisition of Hawaiian Airlines in late 2023 highlights the impact of antitrust regulations on industry consolidation and competition.

Labor laws, including the FLSA and RLA, govern the airline's significant unionized workforce, directly influencing operating costs and the potential for costly labor disputes. For instance, union negotiations can lead to wage and benefit pressures that impact profitability.

Data privacy laws like CCPA and GDPR are critical, with potential fines reaching up to 4% of global annual revenue for violations, underscoring the importance of robust cybersecurity and customer data protection for maintaining trust and avoiding significant financial penalties.

Environmental factors

Alaska Air Group, like all airlines, faces increasing scrutiny over its carbon emissions. Regulations such as CORSIA, designed to stabilize international aviation emissions, mean that Alaska Air must actively manage its environmental impact. This is a significant operational challenge.

To comply and stay ahead, Alaska Air is investing in newer, more fuel-efficient aircraft, like its Boeing 737 MAX fleet, which offers a roughly 20% improvement in fuel efficiency compared to older models. The airline is also exploring the use of sustainable aviation fuels (SAFs), aiming to incorporate them into its operations. For instance, Alaska Airlines announced a partnership in 2023 to advance SAF development, demonstrating a commitment to these cleaner alternatives.

These environmental pressures translate directly into financial considerations. The cost of acquiring and maintaining fuel-efficient aircraft, alongside the potential expense of purchasing carbon offsets or investing in SAF production, will impact Alaska Air's operating costs and strategic planning for the coming years. Meeting evolving environmental targets is becoming a core component of their business model.

Alaska Air Group, like all airlines, must navigate a complex web of noise pollution regulations, particularly around airports. These rules dictate flight paths, takeoff, and landing procedures, directly impacting operational efficiency. For instance, many airports implement specific noise abatement procedures during nighttime hours, which can affect Alaska Air’s schedule flexibility and route planning.

Compliance with these local and federal noise limits influences fleet modernization efforts. Airlines are incentivized to invest in newer, quieter aircraft technologies. Alaska Air's ongoing fleet renewal, including the introduction of Boeing 737 MAX aircraft, often brings advancements in noise reduction technology, helping to meet stricter environmental standards and reduce operational impact on communities.

Airlines, including Alaska Air Group, produce substantial waste from onboard services and airport operations. In 2023, the aviation industry faced increasing scrutiny over its environmental footprint, with a particular focus on waste reduction. For instance, a significant portion of airline waste consists of single-use plastics and food packaging, prompting a push for more sustainable alternatives.

Growing environmental awareness among consumers and regulators is fueling demand for enhanced waste management and recycling programs within the airline sector. Alaska Air Group's commitment to sustainability is reflected in its initiatives to reduce waste, such as exploring biodegradable service ware and expanding recycling efforts on flights. These actions are crucial for maintaining a positive brand image and complying with potential future mandates.

The company's approach to waste management directly impacts its sustainability credentials and operational costs. As of early 2024, many jurisdictions are considering or implementing stricter regulations on landfill disposal and the use of certain materials, which could further shape Alaska Air Group's waste reduction strategies. For example, some regions are targeting a reduction in single-use plastics by 2025, a trend that will likely influence airline practices across the board.

Resource Consumption and Efficiency

Beyond the significant consumption of jet fuel, airlines like Alaska Air Group utilize substantial amounts of other resources, including water for aircraft cleaning and passenger services, and energy to power airport operations, maintenance facilities, and onboard amenities. The airline industry is under increasing pressure to enhance efficiency across all these areas. For instance, optimizing ground operations and streamlining inflight catering can significantly reduce water and energy usage.

Implementing robust resource-saving measures offers a dual benefit: it directly contributes to reducing the company's environmental footprint and simultaneously unlocks considerable operational cost savings. For Alaska Air Group, this means scrutinizing every aspect of their operations for potential efficiencies. This focus on efficiency is becoming a critical component of sustainable business practices in the aviation sector.

Consider these specific areas for resource efficiency:

- Water Conservation: Implementing water-efficient cleaning processes for aircraft and optimizing water usage in airport lounges and catering.

- Energy Management: Upgrading to energy-efficient lighting in facilities, optimizing HVAC systems, and exploring renewable energy sources for ground operations.

- Waste Reduction: Enhancing recycling programs for onboard materials and reducing single-use plastics in inflight services.

- Operational Streamlining: Improving flight planning to reduce taxi times and ground delays, thereby saving fuel and energy.

Public Perception and Green Initiatives

Growing public awareness of climate change is significantly impacting consumer choices in the travel industry, making airlines' sustainability efforts a crucial factor in brand perception. Alaska Air Group's proactive engagement in environmental initiatives, such as their investment in Sustainable Aviation Fuel (SAF) and participation in conservation efforts, directly bolsters their public image and appeals to an increasingly eco-conscious traveler base. For instance, by 2023, Alaska Airlines had committed to achieving net-zero carbon emissions by 2040, a target that resonates with consumers who prioritize environmental responsibility.

Transparency in these green initiatives is paramount for building trust and credibility. Alaska Air Group's reporting on their carbon footprint reduction strategies and investments in cleaner technologies, like their 2024 partnership with Microsoft to explore carbon capture solutions, directly influences how the public views their commitment to sustainability. This focus on visible environmental action can translate into a competitive advantage, attracting travelers who actively seek out airlines demonstrating genuine environmental stewardship.

- Public Demand for Sustainability: A 2024 survey indicated that over 60% of travelers consider an airline's environmental policies when booking flights.

- Alaska's SAF Investment: By the end of 2024, Alaska Airlines aimed to source 20% of its jet fuel from SAF, demonstrating a tangible commitment to reducing emissions.

- Brand Reputation Enhancement: Positive public perception stemming from green initiatives can lead to increased customer loyalty and a stronger brand identity in a competitive market.

Alaska Air Group faces increasing pressure to reduce its carbon footprint, with regulations like CORSIA impacting operations. The airline is investing in fuel-efficient aircraft, such as the Boeing 737 MAX, which offers a 20% improvement in fuel efficiency over older models, and exploring Sustainable Aviation Fuels (SAFs), announcing a partnership in 2023 to advance SAF development.

These environmental efforts have direct financial implications, including the costs of new aircraft and SAFs, influencing strategic planning. By 2024, Alaska Airlines aimed to source 20% of its jet fuel from SAF, demonstrating a tangible commitment to reducing emissions.

Public demand for sustainable travel is growing, with a 2024 survey showing over 60% of travelers consider an airline's environmental policies. Alaska Air's commitment to net-zero emissions by 2040 and its 2024 partnership with Microsoft to explore carbon capture solutions enhance its brand reputation among eco-conscious consumers.

| Environmental Factor | Alaska Air Group Action/Impact | Data/Target |

|---|---|---|

| Carbon Emissions | Investment in fuel-efficient aircraft, exploration of SAFs | Boeing 737 MAX: ~20% fuel efficiency gain; Target: 20% SAF by end of 2024 |

| Noise Pollution | Fleet modernization to quieter aircraft | Newer aircraft models typically feature reduced noise footprints |

| Waste Management | Reducing single-use plastics, expanding recycling | Focus on biodegradable service ware; potential regional mandates on single-use plastics by 2025 |

| Resource Efficiency | Water conservation, energy management, operational streamlining | Optimizing ground operations and inflight catering to reduce usage |

| Public Perception | Transparency in green initiatives, net-zero targets | Net-zero by 2040; 2024 partnership with Microsoft on carbon capture |

PESTLE Analysis Data Sources

Our Alaska Air Group PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research. This approach ensures that insights into political stability, economic forecasts, technological advancements, and environmental regulations are derived from credible and current information.