Alaska Air Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alaska Air Group Bundle

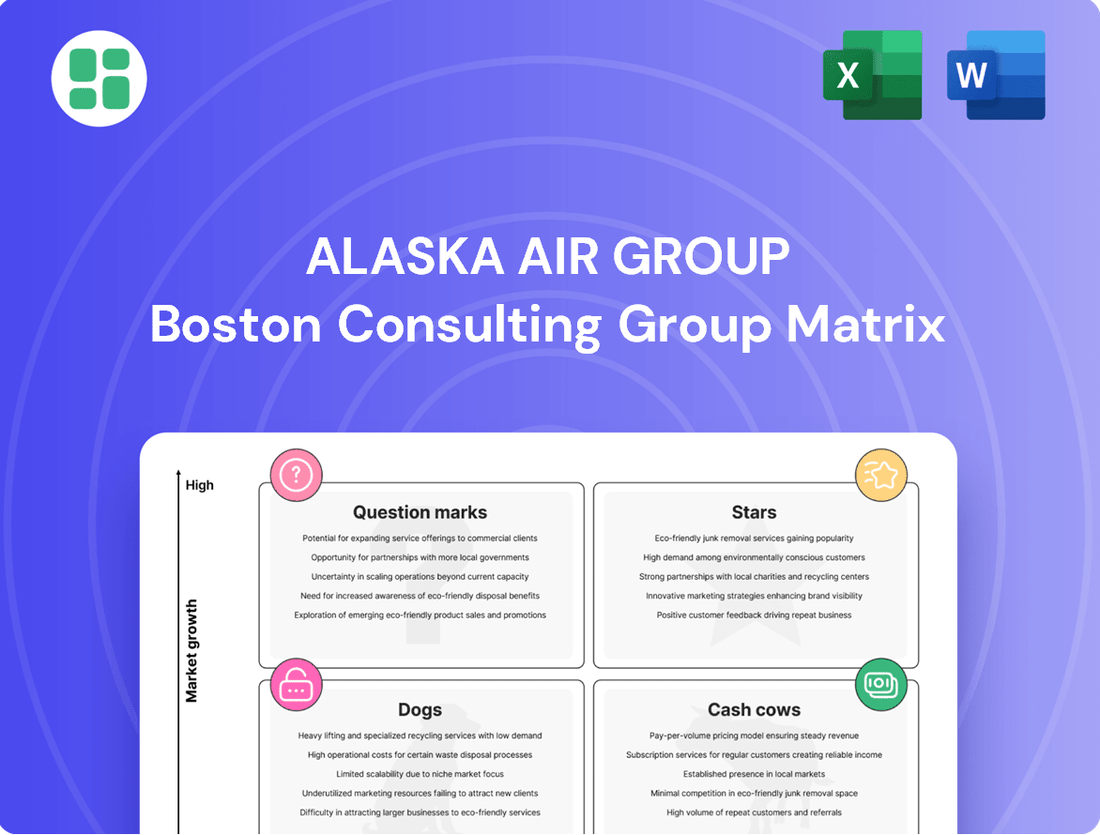

Understanding Alaska Air Group's position within the BCG Matrix is crucial for navigating the competitive airline industry. This analysis helps identify which segments are driving growth, which are stable cash generators, and which require careful consideration. Don't just guess where Alaska Air Group's strategic focus should lie; gain a definitive advantage by purchasing the full BCG Matrix report.

The complete BCG Matrix for Alaska Air Group offers a crystal-clear visualization of their market share and industry growth rates across key business units. This detailed breakdown empowers you to pinpoint potential Stars for future investment, Cash Cows to sustain operations, and Dogs to divest or re-evaluate. Unlock actionable insights and strategic clarity by acquiring the full report today.

This preview offers a glimpse into the strategic landscape of Alaska Air Group, but the full BCG Matrix report provides the comprehensive data and expert analysis you need to make informed decisions. Discover the hidden potential and critical challenges within their portfolio to optimize resource allocation and drive future success. Invest in strategic foresight – purchase the full BCG Matrix now.

Stars

Alaska Air Group is positioning Seattle as a major international hub, with new nonstop routes to Tokyo Narita commencing May 2025 and Seoul Incheon in October 2025. This expansion leverages newly acquired widebody aircraft, signaling a significant investment in long-haul international markets.

The airline plans to grow its international widebody destinations to at least 12 by 2030, capitalizing on Seattle’s strategic location. These new routes are in a high-growth sector, where Alaska Air Group is actively increasing its market presence and competitive edge.

Alaska Air Group is strategically growing its cargo operations, aiming to double revenue within a few years and achieve profit margins significantly higher than its passenger services. This expansion is bolstered by the integration of Hawaiian Airlines' widebody aircraft, which provides greater cargo capacity. For instance, in the first quarter of 2024, Alaska Air Group reported cargo revenue of $21 million, a 10% increase year-over-year, indicating a strong start to this growth trajectory.

New passenger routes to Asia are a key enabler for this cargo push, directly linking Alaska's Seattle cargo hub to vital international markets. This strategic move capitalizes on global demand for air freight, diversifying Alaska Air Group's revenue streams and positioning cargo as a high-growth segment for the combined airline entity.

Alaska Air Group is strategically expanding its premium cabin offerings, aiming to increase the premium seat mix on its narrowbody fleet to 29% by 2027 through retrofits. This focus on higher-margin premium revenue has shown robust growth, outperforming the actual increase in premium seats since 2019.

Further enhancing the premium customer journey, Alaska Airlines is investing in new lounges at key hubs like San Francisco, San Diego, and Honolulu. A significant development will be the opening of a new international lounge in Seattle by 2027, underscoring a commitment to a superior travel experience.

Enhanced Mileage Plan Loyalty Program

Alaska's Mileage Plan, a program frequently lauded for its customer value, is set for substantial upgrades in 2025. These enhancements include fresh milestone rewards and more avenues to earn elite-qualifying miles, even on award travel and through credit card usage. This strategic move is designed to solidify customer relationships and broaden the program's appeal.

A key development for summer 2025 is the introduction of a new premium credit card specifically crafted for international travelers. This product is expected to capture a segment of the market seeking robust global travel benefits, thereby boosting ancillary revenue streams.

These initiatives are projected to significantly boost customer retention and attract new members, ultimately strengthening Alaska Airlines' competitive position. By deepening loyalty, the airline aims to drive increased flight bookings and overall revenue growth.

- Program Enhancements: New milestone rewards and expanded EQM earning opportunities are central to the 2025 Mileage Plan upgrades.

- New Premium Credit Card: A global traveler-focused credit card is slated for launch in summer 2025.

- Loyalty and Revenue Focus: These changes aim to deepen customer loyalty and attract new members, driving revenue.

- Market Competitiveness: The enhancements are designed to bolster Alaska's standing in a highly competitive airline industry.

Strategic West Coast Network Expansion

Alaska Airlines is strategically bolstering its West Coast presence, a move that positions its network expansion efforts firmly within the Stars category of the BCG Matrix. By introducing seven new nonstop routes connecting California to the Pacific Northwest and Mountain West, commencing in late 2025 and early 2026, the airline is capitalizing on its established strength in these high-demand regions. This initiative leverages the efficiency of Embraer 175 aircraft to tap into growing markets and exploit opportunities created by competitor withdrawals, reinforcing Alaska's dominant market share in its core operational territory.

This expansion is not just about adding routes; it's about deepening Alaska Air Group's competitive advantage. In 2024, Alaska Airlines continued to lead in passenger traffic share across its key West Coast hubs, a trend this expansion aims to further solidify. For instance, its market share in Seattle (SEA) and Portland (PDX) remained robust throughout the year, providing a strong foundation for these new California-centric connections.

- Reinforced West Coast Dominance: Adding seven new nonstop routes from California to the Pacific Northwest and Mountain West.

- Fleet Optimization: Primarily utilizing Embraer 175 aircraft for these new routes, enhancing efficiency.

- Market Gap Exploitation: Targeting growing markets and filling service gaps left by competitors.

- Strengthened Regional Connectivity: Boosting market share and connectivity within Alaska's core geographical stronghold.

Alaska Airlines' expansion of its West Coast network, including seven new routes connecting California to the Pacific Northwest and Mountain West starting late 2025, firmly places these operations within the Stars category. This strategy capitalizes on established strengths in high-demand regions, utilizing efficient Embraer 175 aircraft to capture growth and competitor-vacated markets.

This move reinforces Alaska's dominant market share in its core territories, building on its strong 2024 performance in key hubs like Seattle and Portland. The airline's focus on these lucrative routes demonstrates a clear strategy to maintain and grow its leading position in a competitive landscape.

The 2024 first quarter saw Alaska Air Group report a 10% year-over-year increase in cargo revenue, reaching $21 million, highlighting the overall health of its operations. This expansion into new passenger routes to Asia is a direct enabler for this cargo push, linking Seattle cargo hubs to international markets and capitalizing on global air freight demand.

Alaska's Mileage Plan is undergoing significant upgrades in 2025, including new milestone rewards and expanded elite-qualifying mile earning opportunities. A new premium credit card for international travelers is also set to launch in summer 2025, aiming to deepen customer loyalty and attract new members, thereby driving revenue and strengthening the airline's competitive standing.

What is included in the product

The Alaska Air Group BCG Matrix analyzes its airline segments, identifying Stars for growth, Cash Cows for stable revenue, Question Marks for potential, and Dogs for divestment.

The Alaska Air Group BCG Matrix provides a clear, one-page overview, instantly clarifying business unit performance to alleviate strategic planning headaches.

Cash Cows

Alaska Airlines' core domestic routes, especially those connecting communities across the Lower 48 states and anchoring hubs like Seattle and Portland, are firmly positioned as Cash Cows. This segment operates in a mature market where Alaska enjoys a significant market share, ensuring consistent passenger revenue and robust operational efficiency.

These established routes are the bedrock of Alaska Air Group's financial stability, providing the substantial cash flow necessary to fund ongoing operations and future strategic initiatives. For instance, in the first quarter of 2024, Alaska Airlines reported a 3.1% increase in total operating revenue compared to the same period in 2023, highlighting the consistent performance of its core network.

Horizon Air, a key subsidiary of Alaska Air Group, functions as a Cash Cow within the BCG Matrix. Primarily operating shorter-haul routes and connecting smaller communities to major hubs, Horizon Air maintains a strong regional market share in its operational areas. These services are crucial feeders for Alaska Airlines' broader network, operating within a relatively stable, low-growth segment of the aviation industry.

In 2023, Horizon Air transported approximately 5.1 million passengers. The airline's consistent cash flow is generated through its established regional presence and efficient operations, contributing reliably to Alaska Air Group's overall financial health. This stable performance in a mature market solidifies its Cash Cow status.

Alaska Airlines' Mileage Plan loyalty program is a prime example of a cash cow. Its extensive and engaged member base consistently drives revenue through flight bookings and partnerships. In 2023, Alaska Airlines reported total revenue of $10.4 billion, with loyalty program contributions being a significant, stable component.

This established loyalty ecosystem, renowned for its value proposition, ensures a steady cash flow. Repeat business from loyal members and revenue generated from co-branded credit card partnerships, like the one with Bank of America, are key drivers. These revenue streams are predictable and require minimal new investment to maintain, unlike growth-focused ventures.

Hawaii Inter-Island and West Coast-Hawaii Routes

The Hawaii inter-island and West Coast-Hawaii routes, formerly part of Hawaiian Airlines, are poised to be significant cash cows for Alaska Air Group. These routes operate within a mature market characterized by consistently high demand, a segment where Hawaiian Airlines historically commanded a substantial market share.

Following Alaska Air Group's acquisition, these established routes are expected to become robust profit centers. The integration allows Alaska Air Group to leverage the strong Hawaiian brand recognition, ensuring continued profitability and cash generation from these valuable assets. For instance, in 2023, Hawaiian Airlines reported carrying approximately 11.7 million passengers, with a significant portion on its inter-island and trans-Pacific routes.

- Strong Market Position: Hawaiian Airlines' established network in Hawaii offers a dominant position in a high-demand, mature market.

- Revenue Generation: These routes are anticipated to be major cash generators for Alaska Air Group post-acquisition.

- Brand Leverage: The Hawaiian brand's strength is expected to drive continued profitability on these key routes.

- Passenger Volume: Hawaiian Airlines transported roughly 11.7 million passengers in 2023, highlighting the scale of operations.

Established Premium Product Offerings

Alaska Air Group's established premium product offerings, specifically its First Class and Premium Class seats, are clear Cash Cows. These services have consistently shown strong profit margins and a stable, high demand, indicating a significant market share in their respective premium travel segments. Their reliable contribution to the company's profitability is a testament to their established nature, requiring minimal new market development to maintain their strong performance.

- High Profitability: First Class and Premium Class seats generate substantial revenue with high profit margins, a hallmark of Cash Cow products.

- Consistent Demand: These offerings benefit from a steady and predictable customer base, ensuring reliable income streams for Alaska Air Group.

- Established Market Share: Alaska Airlines holds a strong position in the premium cabin market, reducing the need for aggressive growth strategies.

- Financial Contribution: In 2023, Alaska Airlines reported a total revenue of $10.4 billion, with premium cabins playing a significant role in achieving this figure.

Alaska Air Group's established domestic routes, particularly those connecting major hubs like Seattle and Portland, function as its primary Cash Cows. These routes operate in mature markets where Alaska holds a substantial market share, ensuring consistent revenue and operational efficiency. For instance, in the first quarter of 2024, Alaska Airlines saw a 3.1% increase in total operating revenue compared to the prior year, underscoring the stable performance of its core network.

Horizon Air, a subsidiary, also represents a Cash Cow. It operates shorter, regional routes that feed into Alaska Airlines' main network, maintaining a strong regional market share. In 2023, Horizon Air transported approximately 5.1 million passengers, contributing reliably to the group's financial health through its efficient operations in a low-growth segment.

The Mileage Plan loyalty program is another significant Cash Cow. Its large, engaged member base consistently drives revenue through bookings and partnerships, including co-branded credit cards. In 2023, Alaska Airlines' total revenue reached $10.4 billion, with loyalty program contributions being a stable and predictable component.

The Hawaii inter-island and West Coast-Hawaii routes, acquired through Hawaiian Airlines, are expected to become strong Cash Cows. These routes are in a mature, high-demand market where Hawaiian Airlines historically performed well, carrying around 11.7 million passengers in 2023. Alaska Air Group anticipates leveraging the Hawaiian brand to ensure continued profitability from these assets.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Core Domestic Routes | Cash Cow | Mature market, high market share, stable revenue | Q1 2024 operating revenue up 3.1% YoY |

| Horizon Air Operations | Cash Cow | Regional feeder routes, stable demand, efficient operations | Carried ~5.1 million passengers in 2023 |

| Mileage Plan Loyalty Program | Cash Cow | Engaged member base, partnership revenue, predictable cash flow | Total revenue $10.4 billion in 2023 |

| Hawaii Routes (Acquired) | Potential Cash Cow | Mature market, high demand, strong brand recognition | Hawaiian Airlines carried ~11.7 million passengers in 2023 |

Preview = Final Product

Alaska Air Group BCG Matrix

The Alaska Air Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning.

Rest assured, the BCG Matrix for Alaska Air Group that you see here is the exact file you will download after completing your purchase. It's been meticulously prepared to offer clear strategic insights, providing you with immediate access to a polished and actionable document.

What you are currently previewing is the actual, complete BCG Matrix document for Alaska Air Group that you will receive once your purchase is confirmed. This ensures you get a professionally crafted, ready-to-use report that can be immediately integrated into your business analysis and decision-making processes.

Dogs

Underperforming domestic routes represent a challenge for Alaska Air Group, often characterized by low market share and minimal profitability, especially in competitive or low-demand areas. These routes can drain resources, acting as cash traps that hinder overall financial performance.

To address this, Alaska Air Group, like many airlines, strategically trims these less profitable flights, particularly during off-peak seasons or as part of network optimization efforts. This focus on efficiency is crucial for improving margins and reallocating valuable assets to more lucrative segments of their operation.

While Alaska Air Group is actively modernizing its fleet with fuel-efficient aircraft like the Boeing 737 MAX and Embraer E175, any remaining older, less fuel-efficient planes could be classified as 'dogs' in the BCG matrix. These older models typically come with higher operating expenses and a greater environmental footprint compared to their newer counterparts.

The reduced efficiency of these older aircraft makes them less competitive and less profitable, especially in today's market where fuel costs and sustainability are significant considerations. Alaska Air Group's strategy involves phasing out these less efficient planes to boost the overall performance and cost-effectiveness of its fleet.

Within Alaska Air Group's BCG Matrix, non-core ancillary services can be categorized as dogs. These are offerings that don't significantly boost revenue or market share and operate in markets that aren't growing much, or are already quite crowded. For example, a very specific, low-demand travel insurance package or a partnership with a niche tour operator that generates minimal bookings would fit this description.

These types of services often demand more resources than they deliver in returns, making them inefficient. In 2024, Alaska Air Group, like many airlines, is focused on optimizing its core operations and high-demand ancillary services such as checked baggage fees and onboard food and beverage sales, which are more predictable revenue streams. Any services that fall into the dog category are prime candidates for divestment to streamline operations and concentrate on profitable ventures.

Inefficient Legacy IT Systems

Inefficient legacy IT systems at Alaska Air Group, particularly those predating recent modernization initiatives, would likely fall into the 'Dogs' category of the BCG Matrix. These systems, often fragmented and difficult to integrate, especially after mergers, can significantly hamper operational efficiency. For instance, the airline has been investing heavily in technology upgrades to address these very issues, aiming to streamline operations and enhance customer experience.

These outdated systems typically exhibit low effectiveness in today's fast-paced digital landscape. They often drain resources through ongoing maintenance costs without offering a discernible competitive advantage. Alaska Air Group's strategic focus on consolidating and modernizing its IT platforms, including cloud migration and data analytics enhancements, directly addresses the limitations imposed by these legacy infrastructures.

- Resource Drain: Legacy IT systems require substantial expenditure for upkeep, diverting funds from innovation.

- Operational Bottlenecks: Fragmented systems create inefficiencies, slowing down critical processes like passenger check-in and baggage handling.

- Integration Challenges: Post-merger integration of disparate IT systems proves costly and complex, impacting seamless operations.

- Competitive Disadvantage: Inability to leverage modern digital tools puts Alaska Air Group at a disadvantage compared to more technologically advanced competitors.

Segments Heavily Impacted by Unforeseen Groundings

Alaska Air Group's operational segments heavily impacted by unforeseen groundings, such as the early 2024 Boeing 737-9 MAX issue, can be viewed as temporary 'dogs' in a BCG Matrix analysis. These disruptions directly affected the company's ability to generate revenue and incurred significant additional costs. For instance, Alaska Air reported a pre-tax profit loss of approximately $150 million in the first quarter of 2024, largely attributable to the grounding.

The grounding of the Boeing 737-9 MAX fleet in January 2024 created a cash trap for Alaska Air. This wasn't a product in the traditional sense, but the operational capacity tied to this specific aircraft type became a significant drain. Lost flight revenues and increased expenses related to irregular operations, including aircraft swaps and passenger re-accommodation, highlighted the vulnerability of relying heavily on a single aircraft model.

- Operational Capacity as a Dog: The grounding of the 737-9 MAX fleet in early 2024 turned the operational segment dependent on this aircraft into a temporary 'dog.'

- Financial Impact: Alaska Air experienced a pre-tax profit loss of roughly $150 million in Q1 2024 due to these groundings.

- Cash Trap: Lost revenues and increased irregular operation costs associated with the grounding created a cash trap, draining resources.

- Fleet Dependency Vulnerability: The event underscored the risks associated with significant reliance on a single aircraft type for a substantial portion of operations.

Within Alaska Air Group's portfolio, certain underperforming domestic routes with low market share and minimal profitability can be classified as 'dogs.' These routes often act as cash traps, draining resources and hindering overall financial performance due to low demand or intense competition.

Alaska Air Group strategically trims these less profitable flights as part of network optimization, a move crucial for improving margins and reallocating assets to more lucrative segments. This focus on efficiency is key to shedding underperforming operations.

Inefficient legacy IT systems also fall into the 'dog' category, requiring substantial upkeep without offering a competitive edge and creating operational bottlenecks. Alaska Air Group's ongoing investments in modernizing its IT infrastructure directly address these limitations.

The grounding of the Boeing 737-9 MAX fleet in early 2024 temporarily turned the operational capacity dependent on this aircraft into a 'dog,' causing significant financial strain and highlighting fleet dependency risks.

Question Marks

The full integration of Hawaiian Airlines into Alaska Air Group presents a significant question mark within the BCG matrix, likely positioning it as a Question Mark or potentially a Star depending on early synergy realization. The goal is to consolidate operations onto a single platform, a complex undertaking that will determine its future growth trajectory and market share.

Achieving the projected $1 billion in incremental profit and $500 million in synergies is contingent on the seamless execution of this integration. As of early 2024, the process is still underway, requiring substantial investment and meticulous strategic management to overcome operational hurdles and cultural differences.

Alaska Air Group's ambitious plan to reach at least 12 international widebody destinations by 2030 positions these new routes as Question Marks in the BCG Matrix. This expansion beyond existing Asian routes represents a significant growth opportunity with currently low or no market share.

These ventures necessitate substantial investment in market research, route planning, and capital, with no assurance of immediate profitability. For example, a new route to Europe would require extensive analysis of passenger demand, competitor pricing, and operational costs before launch.

The success of these international expansions will be critical in determining whether they mature into Stars, generating substantial returns, or remain as cash-draining investments that require ongoing funding without significant market penetration.

Alaska Air Group's new premium global credit card, slated for a summer 2025 launch, represents a significant investment in the high-growth travel loyalty market. This product aims to capture a share of the global traveler segment with enhanced benefits, capitalizing on the Alaska Airlines brand. However, its success hinges on overcoming the inherent uncertainties of new product adoption in a competitive landscape.

The card's position as a question mark in the BCG matrix stems from its high market growth potential coupled with uncertain market share. Alaska Air Group will need substantial marketing and operational investment to drive initial adoption and establish profitability. For context, the travel credit card market saw significant activity in 2024, with major issuers continuing to innovate on rewards and benefits to attract and retain customers, indicating a dynamic but challenging environment.

Investment in Novel Propulsion Technologies

Alaska Air Group's investments in novel propulsion technologies, primarily through Alaska Star Ventures, represent a strategic move into high-potential, albeit currently high-risk, segments of the aviation industry. These initiatives, focusing on electrification for regional aircraft and the development of sustainable aviation fuel (SAF), are positioned as future growth drivers.

These ventures are characteristic of the 'Question Marks' in a BCG matrix due to their significant investment requirements and uncertain market adoption. While the long-term potential for profitability and market leadership is substantial, the current reality involves low market share and substantial research and development expenditures. For instance, the aviation industry aims for net-zero carbon emissions by 2050, a goal that necessitates substantial innovation in propulsion systems, creating a fertile ground for these nascent technologies.

- High Investment, Uncertain Returns: Alaska Star Ventures' focus on electrification and SAF development requires significant capital outlay with no guarantee of immediate or even near-term returns.

- Nascent Market Position: These technologies currently represent a very small fraction of the aviation market, indicating low current market share.

- Strategic Importance for Future Growth: Despite current uncertainties, these investments are crucial for Alaska Air Group's long-term competitiveness and sustainability goals.

- Industry-Wide Shift: The broader aviation sector is increasingly prioritizing decarbonization, making investments in novel propulsion a strategic imperative rather than a discretionary choice.

AI and Advanced Technology Integration

Alaska Air Group's investment in AI and advanced technologies positions it for future growth, aiming to streamline operations like schedule development. This focus on innovation is crucial for maintaining a competitive edge in the evolving airline industry.

While the potential benefits are significant, the actualization of market leadership through these technological advancements is still in its nascent stages. Continued investment and successful implementation are key to unlocking the full value of these initiatives.

- AI for Schedule Optimization: Alaska Air Group is exploring AI to enhance the complexity of its flight scheduling, aiming for greater efficiency and passenger satisfaction.

- Operational Efficiency Gains: The integration of new technologies is targeted at improving day-to-day operations, potentially reducing costs and improving on-time performance.

- Developing Market Leadership: While these technologies are critical for future success, their ability to establish market leadership is contingent on ongoing development and successful deployment.

- Investment in Innovation: Significant capital is being allocated to research and development in AI and other advanced technologies to ensure Alaska Air Group remains at the forefront of the industry.

Alaska Air Group's strategic expansion into international widebody routes by 2030 places these new ventures firmly in the Question Mark category of the BCG matrix. These routes represent high-growth potential but currently possess minimal market share, necessitating substantial upfront investment in market research, route planning, and aircraft acquisition. For example, establishing a new route to a European city in 2025 would involve significant capital expenditure and carries the inherent risk of lower-than-expected passenger uptake, a common challenge for new international services.

The success of these international expansions is crucial for their future classification. If they gain traction and build market share, they could evolve into Stars, generating substantial returns. However, without sufficient demand or facing intense competition, they risk becoming cash drains requiring continuous funding without achieving profitability, a scenario that would necessitate a strategic re-evaluation.

The launch of Alaska Air Group's premium global credit card in summer 2025 also falls into the Question Mark quadrant. While the travel loyalty market offers high growth potential, the card's success in capturing market share against established competitors is uncertain. Significant marketing and operational investments are required to drive adoption and achieve profitability, a challenge underscored by the competitive landscape observed in 2024, where major issuers actively innovated on rewards.

Alaska Air Group's investments in novel propulsion technologies, such as electrification for regional aircraft and sustainable aviation fuel (SAF) development through Alaska Star Ventures, are classic Question Marks. These initiatives require substantial capital for research and development with uncertain market adoption timelines. The aviation industry's commitment to net-zero emissions by 2050, however, highlights the strategic importance and potential long-term payoff of these high-risk, high-reward ventures.

| Initiative | BCG Category | Key Characteristics | Investment Focus | Market Outlook |

| International Widebody Routes (by 2030) | Question Mark | High growth potential, low current market share, high investment needs. | Route planning, market research, aircraft acquisition. | Uncertain demand, competitive pressures. |

| Premium Global Credit Card (Summer 2025) | Question Mark | High market growth, uncertain market share, significant marketing investment. | Product development, marketing, operational setup. | Competitive loyalty market, customer acquisition challenges. |

| Novel Propulsion Technologies (Alaska Star Ventures) | Question Mark | High potential, high risk, low current market share, substantial R&D. | Electrification, SAF development, research. | Long-term industry shift towards sustainability. |

BCG Matrix Data Sources

Our Alaska Air Group BCG Matrix is constructed using a blend of financial disclosures, industry growth forecasts, and operational performance data.