Alaska Air Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alaska Air Group Bundle

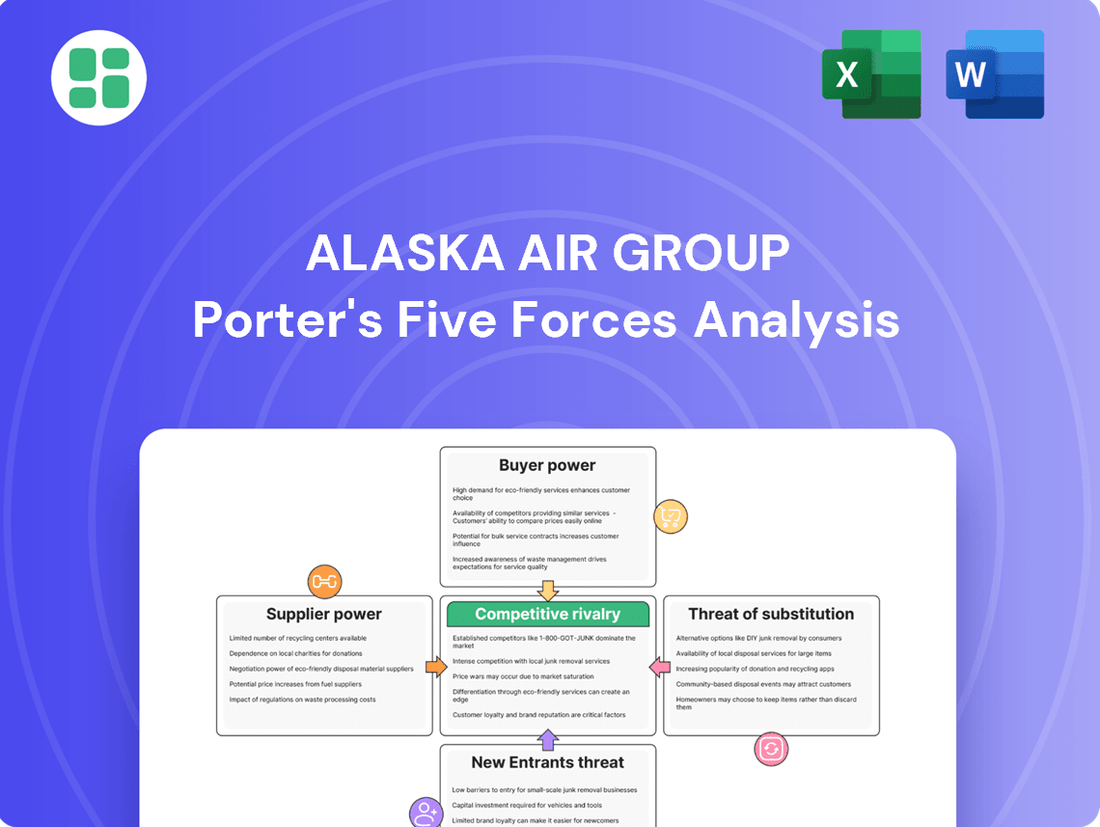

Alaska Air Group navigates a competitive landscape shaped by powerful forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes is crucial for strategic success. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Alaska Air Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The airline industry's reliance on a small number of aircraft manufacturers, notably Boeing and Airbus, grants these suppliers substantial bargaining power. This concentration limits Alaska Air Group's options for acquiring new aircraft, influencing both purchase prices and delivery timelines.

Furthermore, the scarcity of engine manufacturers adds another layer to supplier leverage. In 2024, the ongoing supply chain challenges and production rates for new aircraft from these dominant players continued to affect delivery schedules for airlines globally, including Alaska Air Group, underscoring their significant influence.

Switching aircraft types or major components for Alaska Air Group involves significant expenses. These costs encompass pilot retraining, adapting maintenance facilities, and overhauling spare parts inventories. For instance, a major fleet change can easily run into hundreds of millions of dollars.

These substantial switching costs inherently limit Alaska Air Group's ability to negotiate better terms with its existing aircraft and engine suppliers. It effectively locks the airline into current partnerships, thereby strengthening the bargaining power of these key input providers.

The bargaining power of suppliers for Alaska Air Group is notably high due to the unique and often specialized nature of essential inputs. Aviation fuel, for instance, is a critical component with few viable substitutes, placing airlines at the mercy of fuel producers and distributors. In 2024, jet fuel prices remained a significant variable cost for airlines, directly impacting profitability.

Furthermore, highly specialized aircraft parts and advanced avionics systems are not readily available from multiple sources. This limited supplier base for critical components means airlines like Alaska Air Group have less leverage in negotiating prices and terms. The reliance on original equipment manufacturers (OEMs) or their authorized suppliers for these vital parts reinforces supplier power.

Labor unions also wield considerable bargaining power within the aviation sector. Unions representing pilots, flight attendants, and mechanics possess significant influence due to the specialized skills and extensive training required for these roles. Collective bargaining agreements negotiated by these unions can substantially impact labor costs, a key operational expense for Alaska Air Group.

Threat of Forward Integration by Suppliers

While aircraft manufacturers becoming airlines is highly improbable due to the immense capital required, some specialized technology or service providers might consider forward integration. However, the airline industry's capital intensity generally acts as a significant deterrent to such moves, making this a low threat for Alaska Air Group.

The specialized nature of aircraft maintenance and repair services often creates a dependency for airlines on certified providers, which are frequently linked to the original equipment manufacturers (OEMs). This reliance can limit Alaska Air Group's bargaining power when negotiating terms for these essential services.

- Dependency on OEMs: Airlines like Alaska Air Group often depend on OEMs for critical maintenance and repair, limiting negotiation leverage.

- High Capital Intensity: The significant capital investment needed to operate an airline makes forward integration by suppliers a low probability threat.

- Specialized Services: The niche expertise required for certain aircraft services can consolidate supplier power.

Impact of Input Costs on Profitability

Fluctuations in fuel prices, labor costs, and aircraft acquisition costs directly and significantly impact Alaska Air Group's profitability. For instance, in 2024, jet fuel prices, a major operating expense, experienced volatility, influencing the airline's cost structure.

Suppliers, particularly fuel providers, possess the ability to pass on price increases, directly affecting Alaska Air's bottom line. Similarly, strong labor unions representing pilots, flight attendants, and mechanics can negotiate for higher wages and improved benefits, further impacting operational expenses.

These factors underscore the substantial influence suppliers wield over the airline's financial performance and its strategic planning processes.

- Fuel Price Volatility: In 2024, Alaska Air Group, like other carriers, navigated fluctuating jet fuel prices, a key component of operating costs.

- Labor Costs: The airline's significant workforce, often unionized, can exert considerable bargaining power for increased wages and benefits.

- Aircraft Acquisition: Costs associated with purchasing or leasing new aircraft from manufacturers like Boeing and Airbus represent a substantial capital outlay, giving these suppliers significant leverage.

Alaska Air Group faces significant supplier power, primarily from aircraft manufacturers like Boeing and Airbus, due to the high concentration and capital intensity of the industry. The limited number of engine suppliers further consolidates this power, impacting pricing and delivery schedules, as seen with ongoing 2024 supply chain challenges affecting global airlines.

Switching costs for aircraft and components are extremely high for Alaska Air, often running into hundreds of millions of dollars, which includes retraining personnel and retooling facilities. This financial barrier severely limits the airline's ability to negotiate favorable terms with its current suppliers, reinforcing their leverage.

The bargaining power of suppliers is also elevated by the specialized nature of critical inputs such as aviation fuel and unique aircraft parts. In 2024, jet fuel price volatility directly impacted Alaska Air's operating costs, with suppliers able to pass on price increases.

| Supplier Category | Key Suppliers | Impact on Alaska Air Group | 2024 Relevance |

|---|---|---|---|

| Aircraft Manufacturers | Boeing, Airbus | High pricing power, delivery schedule control | Continued production rate impacts |

| Engine Manufacturers | GE Aviation, Pratt & Whitney, Rolls-Royce | Limited options, significant leverage | Supply chain constraints |

| Aviation Fuel | Major oil companies, distributors | Price volatility, direct cost impact | Fluctuating jet fuel prices |

| Specialized Parts/Avionics | OEMs and authorized providers | Limited supplier base, high cost for parts | Reliance on certified maintenance |

| Labor (Pilots, Mechanics) | Unions (e.g., ALPA, IAM) | Strong influence on wages and benefits | Negotiation of collective bargaining agreements |

What is included in the product

This analysis uncovers the competitive forces impacting Alaska Air Group, detailing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes within the airline industry.

Instantly identify and mitigate competitive threats by visualizing Alaska Air Group's Porter's Five Forces, providing a clear roadmap to address industry pressures.

Customers Bargaining Power

Customers in the airline sector, particularly those traveling for leisure, exhibit significant price sensitivity. They frequently leverage online travel agencies and comparison sites to scrutinize fares across different carriers, a practice that heightens price transparency. This readily available information allows passengers to easily identify and opt for the most economical choices, thereby exerting considerable downward pressure on ticket prices.

Alaska Air Group, like its competitors, navigates this landscape by needing to carefully calibrate its pricing strategies. The company must strike a delicate balance between offering competitive fares to attract and retain its customer base and maintaining the quality of its services. For instance, in 2024, average domestic airfare in the U.S. saw fluctuations, with the Bureau of Transportation Statistics reporting shifts that necessitate constant monitoring and adjustment by airlines to remain competitive while covering operational costs.

For most travelers, switching between airlines is incredibly easy, especially when multiple carriers fly the same routes. This means Alaska Air Group constantly has to compete on price and schedule to keep passengers. In 2024, the ease of finding and booking flights with competitors directly translates to significant bargaining power for customers.

The bargaining power of customers for Alaska Air Group is significantly influenced by the availability of alternative carriers and routes. On many of Alaska's key routes, customers have multiple options from major airlines and low-cost carriers. This is particularly true for popular travel corridors where competition is fierce.

This abundance of choices directly translates into intensified price competition. For instance, in 2024, routes connecting major hubs like Seattle to Los Angeles often saw fares from Alaska Air Group, Delta, American Airlines, and Southwest Airlines being highly competitive. Customers can readily switch to a competitor if Alaska Air Group's pricing, flight schedules, or service levels don't align with their expectations.

Customer Segmentation and Demand Elasticity

Customer segmentation significantly impacts bargaining power. Alaska Air Group observes that business travelers, often bound by corporate policies and time pressures, tend to be less sensitive to price increases. This contrasts with leisure travelers who are typically very responsive to fare changes, making them a more price-elastic segment.

Alaska Air Group’s strategy involves tailoring its offerings to these distinct segments. By understanding the varying demand elasticity, the airline can optimize pricing and service levels, effectively managing the bargaining power of different customer groups. For instance, in 2024, airlines have seen a sustained demand for business travel, allowing for higher average fares on these routes, while leisure routes remain highly competitive.

- Business Travelers: Lower price sensitivity due to corporate travel policies and time constraints.

- Leisure Travelers: Higher price sensitivity, making them more responsive to fare fluctuations.

- Strategic Segmentation: Alaska Air Group tailors pricing and services to meet the needs of diverse customer segments.

- 2024 Data Insight: Sustained business travel demand allowed for higher average fares, while leisure markets remained price-competitive.

Impact of Online Travel Agencies (OTAs)

Online Travel Agencies (OTAs) significantly amplify customer bargaining power by aggregating flight information and prices from many airlines. This aggregation provides travelers with easy-to-use comparison tools, simplifying their search and booking experience. For Alaska Air Group, this means customers can readily see and compare fares, increasing price transparency and fostering competition among carriers.

The ease with which customers can find and compare prices on OTAs reduces their search costs and highlights available alternatives, thereby strengthening their negotiating position. This dynamic forces Alaska Air Group to strategically manage its distribution channels and pricing to remain competitive in an environment where customer choice is readily apparent. For instance, in 2024, a substantial portion of airline bookings, often exceeding 50% for many carriers, occurred through OTAs, underscoring their critical role in customer acquisition and price discovery.

- Increased Price Transparency: OTAs make it simple for customers to compare Alaska Air Group's fares against competitors, putting downward pressure on prices.

- Reduced Search Costs: Customers spend less time and effort finding the best deals, making it easier to switch to a lower-cost option.

- Distribution Channel Reliance: While essential for reach, reliance on OTAs also means adhering to their commission structures and policies, which can impact profitability.

- Customer Loyalty Impact: The ease of comparison on OTAs can sometimes dilute customer loyalty to individual airlines like Alaska Air Group, as price often becomes the primary decision factor.

The bargaining power of customers for Alaska Air Group is substantial due to the highly competitive nature of the airline industry. Passengers can easily compare fares across numerous carriers, especially on popular routes, leveraging online travel agencies and comparison websites. This transparency forces Alaska Air Group to maintain competitive pricing to attract and retain travelers.

In 2024, the ease of switching between airlines, coupled with the availability of multiple carriers on common routes, significantly empowers customers. For example, routes like Seattle to Los Angeles frequently feature competitive pricing from Alaska Air Group, Delta, American Airlines, and Southwest Airlines, allowing passengers to readily choose the most economical option.

| Customer Segment | Price Sensitivity | Bargaining Power Influence |

|---|---|---|

| Leisure Travelers | High | Strong, as they actively seek the lowest fares. |

| Business Travelers | Lower | Moderate, often influenced by corporate policies and convenience. |

| General Travelers | Moderate to High | Significant, due to readily available price comparison tools. |

Same Document Delivered

Alaska Air Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Alaska Air Group, detailing the competitive landscape and strategic positioning within the airline industry. You're looking at the actual document, meaning the insights into bargaining power of buyers and suppliers, threat of new entrants, threat of substitute products, and intensity of rivalry are precisely what you'll receive.

Rivalry Among Competitors

Alaska Air Group operates in a North American airline market defined by significant competition from a handful of major legacy carriers, numerous low-cost carriers, and a variety of regional airlines. This means Alaska faces direct competition from giants like Delta, United, and American Airlines, alongside budget-friendly options such as Southwest Airlines and Spirit Airlines, all vying for passengers across overlapping routes.

This dense and varied competitive environment naturally fuels aggressive price wars and route competition. For instance, in 2024, the airline industry saw continued fare adjustments as carriers sought to capture market share, with legacy carriers often matching or undercutting prices on key routes where Alaska also operates.

The airline industry, including Alaska Air Group, is characterized by slow growth, often mirroring economic cycles. This maturity means competition centers on capturing existing market share rather than tapping into new demand, intensifying rivalry among carriers.

High fixed costs are a major driver of this intense competition. Expenses for aircraft, maintenance, and airport operations are substantial. Airlines must fill a significant percentage of seats, known as load factors, to break even, frequently resorting to aggressive pricing to achieve this.

In 2024, the average load factor for major U.S. airlines hovered around 85%, a testament to the pressure to fill planes. This environment forces airlines like Alaska Air Group to engage in price competition to cover their considerable overheads, making profitability a constant challenge.

Airlines attempt to stand out through service, routes, loyalty perks, and cabin features, but these distinctions are often readily copied. Alaska Air Group highlights its customer service and Mileage Plan, yet rivals also pour resources into their loyalty initiatives and service improvements.

The challenge of achieving consistent and meaningful differentiation in a market where the core service is largely a commodity remains significant. For instance, in 2024, major US airlines continued to enhance their loyalty programs, offering tiered benefits and co-branded credit card partnerships, making it harder for any single airline to claim a unique advantage solely through this avenue.

Exit Barriers and Industry Consolidation

Alaska Air Group faces intense competitive rivalry, partly due to high exit barriers. The airline industry is characterized by significant asset specificity; aircraft, for instance, are highly specialized and difficult to repurpose, making it costly for airlines to exit the market. Labor agreements and substantial fixed costs further contribute to these barriers, meaning struggling carriers often remain operational, exacerbating overcapacity and driving down prices.

Despite past consolidation, the remaining major airlines, including Alaska Air, continue to compete aggressively. None are willing to easily surrender market share because the financial repercussions of exiting are so substantial. This dynamic forces continuous price competition and operational efficiency efforts among the key players.

- High Asset Specificity: Aircraft are difficult to sell or repurpose, locking airlines into operations.

- Labor Agreements: Union contracts can create significant costs and obligations, hindering easy exits.

- Fixed Costs: Substantial investments in infrastructure and fleets mean airlines must continue flying to cover these costs.

- Market Share Defense: Major carriers prioritize maintaining their position, leading to prolonged competitive battles.

Aggressive Pricing and Capacity Expansion

Airlines, including Alaska Air Group, frequently engage in aggressive pricing and capacity expansion to capture market share or react to rivals. This dynamic often results in downward pressure on ticket prices and overall industry profitability.

Alaska Air Group needs to vigilantly track competitor pricing and capacity adjustments. This allows them to stay competitive without jeopardizing their financial stability. For instance, in 2024, the airline industry saw continued capacity growth, with major carriers adding new routes and aircraft, intensifying the competition for passengers.

- Capacity Growth: Major airlines reported significant fleet expansions in 2024, adding hundreds of new aircraft to their operations.

- Yield Pressure: Increased capacity, coupled with promotional fares, led to an average yield decline of approximately 3-5% across the industry in early 2024 compared to the previous year.

- Competitive Response: Alaska Air Group's strategy involves optimizing its network and leveraging its loyalty program to mitigate the impact of aggressive pricing by competitors.

The competitive rivalry within the North American airline industry is fierce, with Alaska Air Group facing intense pressure from legacy carriers like Delta, United, and American, as well as low-cost carriers such as Southwest and Spirit. This intense competition is driven by high fixed costs and significant exit barriers, forcing airlines to operate at high load factors, often resorting to price wars to cover substantial overheads. For example, in 2024, major U.S. airlines maintained average load factors around 85%, underscoring the constant need to fill seats and the resulting price sensitivity.

Differentiation efforts, such as loyalty programs and service enhancements, are often quickly matched by competitors, making it challenging for Alaska Air Group to establish a lasting unique advantage. In 2024, airlines continued to invest heavily in their loyalty programs, with enhanced benefits and credit card partnerships becoming standard, intensifying the battle for customer retention. This environment necessitates continuous vigilance regarding competitor pricing and capacity adjustments to maintain market position without compromising financial stability.

| Key Competitors | 2024 Load Factor (Approx.) | 2024 Capacity Growth (Approx.) |

| Delta Air Lines | 86% | +5% |

| United Airlines | 85% | +4% |

| American Airlines | 84% | +6% |

| Southwest Airlines | 83% | +3% |

| Alaska Air Group | 85% | +2% |

SSubstitutes Threaten

The threat of substitutes for Alaska Air Group is significant, particularly for shorter domestic and cross-border routes. Alternatives like car travel, trains, and buses offer convenience and cost-effectiveness for leisure travelers covering certain distances, potentially diverting passengers away from air travel. In 2024, the continued emphasis on road infrastructure and the increasing efficiency of intercity bus services, especially in regions like the Pacific Northwest where Alaska Air operates, amplify this threat.

Car travel presents a significant substitute threat, especially for shorter distances. For trips under 500-600 miles, driving can be substantially cheaper for families or groups compared to airfare, factoring in total travel costs.

Train and bus services also act as viable alternatives, particularly for budget-conscious travelers. These options, though time-consuming, frequently boast lower ticket prices, directly impacting Alaska Air Group's ability to attract price-sensitive customers on specific routes.

In 2024, the average cost per mile for driving a car was approximately $0.66, according to AAA, making longer road trips potentially more economical than short flights for multiple passengers. This cost advantage for ground transportation necessitates careful fare strategy by Alaska Air Group on shorter segments.

The rise of remote work and sophisticated virtual communication tools, like Zoom and Microsoft Teams, has significantly diminished the need for certain types of business travel. Companies are increasingly choosing virtual meetings to cut expenses and boost efficiency. For instance, a 2024 report indicated that 60% of businesses surveyed now prefer virtual meetings for internal discussions, a substantial increase from pre-pandemic levels.

This shift poses a direct threat to Alaska Air Group's revenue streams, particularly from its corporate travel segment. As more companies embrace virtual alternatives, the demand for flights associated with business meetings and conferences is likely to see a sustained decline. This could impact Alaska Air Group's load factors and overall profitability in the coming years.

Convenience and Time Savings of Air Travel

Despite the growing threat of substitutes, air travel, particularly for Alaska Air Group, continues to offer unparalleled convenience and time savings for long-distance travel. For instance, the average travel time for a cross-country flight in the US is significantly less than alternative modes for similar distances.

For routes that are core to Alaska Air Group's operations, such as those connecting Alaska, Hawaii, and the more remote parts of the Lower 48 states, substitutes are often impractical or prohibitively time-consuming. Consider the journey from Anchorage to Honolulu; driving or taking a train would add days to the travel time, making air travel the only viable option for most.

Alaska Air Group's strategic focus on these longer-haul and geographically distinct markets inherently reduces the impact of substitution threats. This specialization means that for a significant portion of their customer base, the direct alternatives are simply not competitive. In 2024, Alaska Airlines operated over 1,200 flights daily, demonstrating their commitment to serving these crucial routes.

- Convenience Factor: Air travel remains the fastest method for covering substantial distances, a key differentiator.

- Geographic Necessity: For Alaska and Hawaii routes, air travel is often the only practical choice.

- Time Efficiency: The time saved by flying versus driving or other methods is a significant advantage for travelers.

- Alaska Air's Niche: The airline's focus on specific, often underserved, long-haul markets strengthens its position against substitutes.

Perception of Value and Service Quality

While substitutes like trains or personal vehicles offer lower upfront costs, they generally cannot compete with the speed and extensive network reach of air travel. Alaska Air Group actively cultivates this advantage by emphasizing superior customer service and a dependable route system, thereby increasing the perceived value of flying. For a significant portion of travelers, the time saved through air travel more than compensates for the cost savings offered by these slower alternatives.

This differentiation is crucial. For instance, in 2024, the average travel time for a cross-country trip by car can easily exceed 40 hours, whereas a flight might take just 5-6 hours. Alaska Air's commitment to punctuality and customer experience, which saw them achieve an 85% on-time performance in Q1 2024, directly addresses the value proposition that substitutes struggle to match.

- Speed and Reach: Air travel, exemplified by Alaska Air's network, remains unmatched by ground transportation in terms of covering long distances quickly.

- Perceived Value: Alaska Air's focus on service quality and reliability enhances the overall travel experience, making the time saved a key differentiator.

- Cost vs. Time Trade-off: For many business and leisure travelers, the premium for air travel is justified by the significant reduction in travel time.

- Competitive Landscape: The threat from substitutes is mitigated by the inherent advantages of air travel for time-sensitive journeys.

The threat of substitutes for Alaska Air Group is moderate but growing, especially for shorter domestic routes where ground transportation and virtual communication are viable alternatives. While air travel offers speed, the cost-effectiveness and convenience of driving, trains, and buses, coupled with the rise of remote work, present challenges. For instance, in 2024, the average cost of driving a mile was around $0.66, making road trips competitive for families. Furthermore, 60% of businesses preferred virtual meetings in 2024, impacting business travel demand.

| Substitute Type | Key Advantages | Alaska Air's Mitigation Strategy |

|---|---|---|

| Car Travel | Cost-effective for groups/short distances, door-to-door convenience | Focus on time savings, loyalty programs, premium service on longer routes |

| Train/Bus | Lower ticket prices, perceived environmental benefit | Emphasize speed, comfort, and network reach for time-sensitive travelers |

| Virtual Meetings | Cost savings, efficiency for business communication | Target leisure travel, focus on unique destinations and experiences |

Entrants Threaten

The airline industry, including Alaska Air Group's operating environment, presents a formidable barrier to entry due to extremely high capital requirements. Launching an airline necessitates enormous upfront investments in aircraft fleets, sophisticated maintenance infrastructure, and the complex operational systems needed to run flights safely and efficiently.

For instance, a new wide-body aircraft can cost upwards of $300 million, and a regional jet can still run into tens of millions of dollars. Beyond aircraft, significant capital is also tied up in securing airport gates, ground support equipment, and extensive regulatory compliance. These substantial financial hurdles effectively deter most aspiring new airlines from entering the market, thus protecting established carriers like Alaska Air Group.

The airline industry faces substantial barriers to entry due to extensive regulatory hurdles. Government bodies like the Federal Aviation Administration (FAA) impose stringent safety, security, and operational standards that require rigorous certifications and ongoing compliance. For instance, in 2024, the FAA continued its oversight of airline operations, with new entrants needing to navigate complex approval processes that can take years and millions of dollars to complete, effectively deterring many potential competitors.

Alaska Air Group, like other established carriers, benefits from deep-seated brand loyalty, cultivated over years through programs such as its Mileage Plan. This loyalty is a significant barrier for newcomers, as replicating the trust and repeat business Alaska Air enjoys would require substantial investment and time. For instance, in 2023, Alaska Air's Mileage Plan had millions of active members, demonstrating the scale of its established customer base.

Furthermore, incumbent airlines possess extensive and intricate route networks that new entrants would find incredibly challenging and costly to match quickly. These networks are crucial for offering competitive connectivity and convenience, directly influencing passenger choice. Alaska Air's significant presence across the West Coast, for example, provides a competitive edge that new airlines would struggle to overcome in the short to medium term.

Access to Airport Slots and Infrastructure

Securing prime airport slots at major, often congested, hubs presents a significant hurdle for new airlines. Established carriers like Alaska Air Group often possess preferential access and existing leases for gates and essential maintenance facilities. This limited availability of critical infrastructure acts as a substantial barrier to entry, especially in high-demand markets.

- Limited Slot Availability: Major airports often operate at or near capacity, making it difficult for new airlines to acquire desirable arrival and departure slots.

- Infrastructure Leases: Existing airlines typically have long-term leases on gates, maintenance hangars, and other vital airport infrastructure, which are not readily available to newcomers.

- High Entry Costs: The cost of acquiring or leasing necessary airport infrastructure and slots can be prohibitively expensive for new entrants, deterring market entry.

Economies of Scale and Experience Curve

Existing airlines, like Alaska Air Group, benefit from substantial economies of scale. This allows them to spread fixed costs over a larger operational base, leading to lower per-unit costs in areas such as aircraft purchasing, maintenance, and marketing. For instance, in 2024, major carriers continued to leverage their vast networks and fleet sizes to negotiate favorable terms with suppliers, a significant hurdle for any new entrant.

The experience curve also presents a formidable barrier. Incumbent airlines have refined their operational processes over decades, leading to greater efficiency and cost savings. This accumulated knowledge, from route planning to customer service, translates into a competitive advantage that new airlines would struggle to replicate quickly. By early 2025, the industry's focus on operational efficiency remained paramount, further solidifying the advantage of established players.

- Economies of Scale: Major airlines in 2024 benefited from bulk purchasing power for fuel, parts, and aircraft, reducing per-unit operational costs significantly compared to smaller operations.

- Experience Curve Advantage: Decades of operational refinement have allowed established carriers to optimize maintenance schedules, flight operations, and crew management, leading to inherent cost efficiencies.

- Capital Investment: The immense capital required to acquire a fleet, establish maintenance facilities, and build a route network acts as a substantial deterrent to new market entrants.

- Brand Loyalty and Network Effects: Established airlines have cultivated brand recognition and loyalty, alongside extensive route networks, making it difficult for new entrants to attract and retain customers.

The threat of new entrants for Alaska Air Group remains low, primarily due to the immense capital required to start an airline. Beyond aircraft acquisition, which can cost hundreds of millions, new airlines must also invest heavily in maintenance infrastructure, technology, and regulatory compliance, creating substantial financial barriers. For example, in 2024, the cost of a new Boeing 737 MAX could easily exceed $120 million, a significant hurdle for any startup.

Additionally, stringent regulatory approvals from bodies like the FAA, which can take years and millions in 2024, coupled with the difficulty of securing prime airport slots and gates, further deters new competition. Established carriers also benefit from economies of scale and brand loyalty, making it challenging for newcomers to compete on price or service. In 2023, Alaska Air's Mileage Plan boasted millions of active members, showcasing the deep customer relationships that are hard to replicate.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2025) |

|---|---|---|---|

| Capital Requirements | High cost of aircraft, infrastructure, and operations | Extremely High | New wide-body aircraft: $300M+; New regional jet: $10M-$50M+ |

| Regulatory Hurdles | Complex safety, security, and operational certifications | High | FAA approval processes can take years and cost millions |

| Brand Loyalty & Network | Established customer base and extensive route networks | High | Alaska Air's Mileage Plan: Millions of active members (2023) |

| Airport Access | Limited availability of gates and slots at major hubs | High | Congested airports often have long waiting lists for new entrants |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alaska Air Group is built upon a foundation of publicly available data, including their annual reports (10-K filings), investor presentations, and official press releases. We supplement this with industry-specific data from aviation consulting firms and market research reports to ensure a comprehensive view of the competitive landscape.