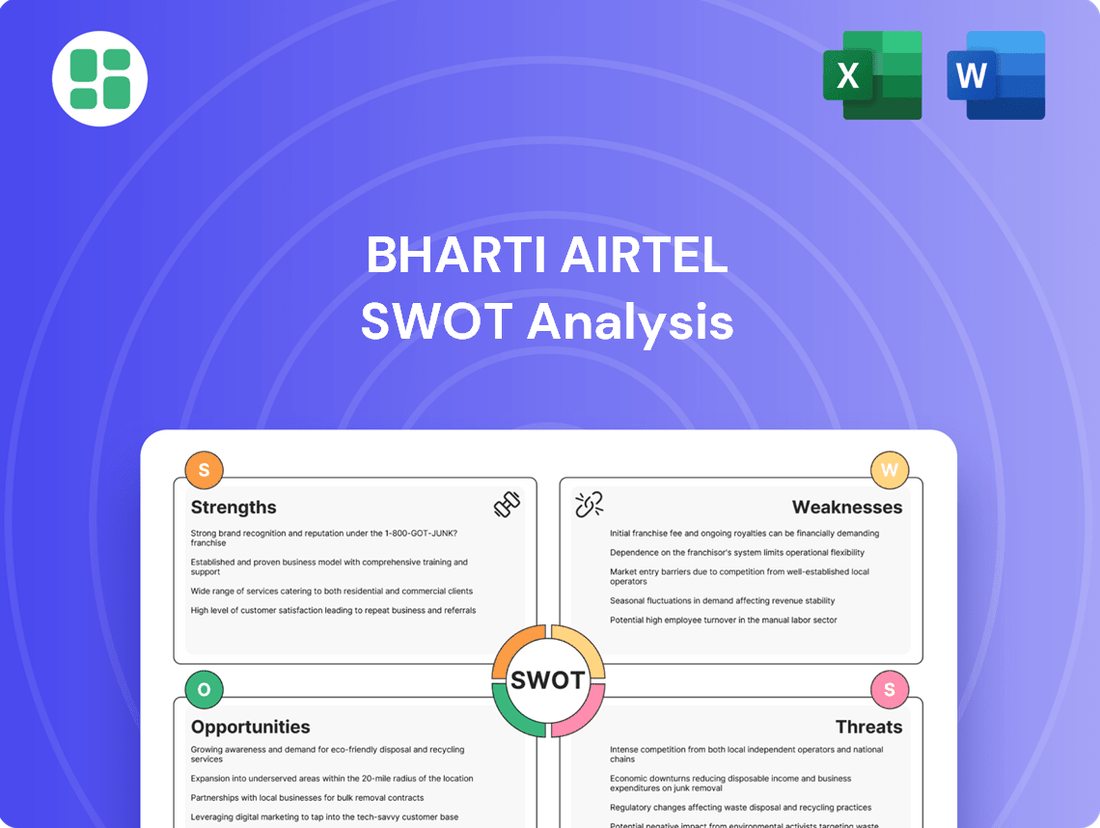

Bharti Airtel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharti Airtel Bundle

Bharti Airtel boasts significant strengths in its vast network infrastructure and strong brand recognition across India and Africa. However, navigating the competitive landscape and managing regulatory complexities presents key challenges. Discover the complete picture behind Airtel's market position with our full SWOT analysis, revealing actionable insights and strategic takeaways ideal for investors and analysts.

Strengths

Bharti Airtel boasts an extensive and diversified service portfolio, encompassing everything from 2G, 3G, 4G, and the burgeoning 5G mobile services to essential fixed-line, high-speed home broadband, and digital TV (DTH). This broad spectrum ensures they can meet a wide range of consumer and enterprise demands.

Beyond traditional telecom, Airtel has strategically expanded into mobile commerce and payment banking services, creating a more integrated ecosystem for its customers. This diversification not only strengthens customer loyalty but also opens up new avenues for revenue generation, as seen in the growing adoption of its digital financial solutions.

The company's revenue mix is significantly bolstered by these diverse streams, including financial services and digital content offerings. For instance, Airtel Payments Bank has seen substantial growth, with reports indicating a significant increase in customer base and transaction volumes throughout 2024, contributing positively to the overall financial health and market position of Bharti Airtel.

Bharti Airtel boasts formidable brand equity and a commanding market leadership, especially within India where it stands as a premier telecom provider. This strong recognition is built on a foundation of perceived reliability and consistent service quality, fostering a vast and loyal customer base that spans both urban centers and rural communities. In the fiscal year ending March 2024, Airtel reported a consolidated revenue of over ₹1.25 lakh crore, underscoring its significant market share and financial strength.

Bharti Airtel has aggressively pursued 5G network deployment, aiming for extensive coverage across India. This early leadership in 5G rollout positions the company to capture a significant share of the next-generation mobile services market.

By Q4 2024, Airtel reported its 5G network covered over 300 cities and towns, a testament to its rapid infrastructure investment and strategic focus on this technology.

This proactive approach not only enhances customer experience with faster speeds but also strengthens Airtel's competitive edge against rivals in the evolving Indian telecom landscape.

Growing Average Revenue Per User (ARPU) and Premiumization Strategy

Bharti Airtel's commitment to attracting high-value customers and increasing Average Revenue Per User (ARPU) through its premiumization strategy is a significant strength. This approach involves offering enhanced services and adjusting tariffs to capture more revenue from each subscriber.

Airtel's success in this area is evident in its financial performance. For instance, in the first quarter of fiscal year 2026 (Q1 FY26), the company achieved an ARPU of ₹250, positioning it as the industry leader. This figure underscores the effectiveness of their premiumization efforts.

The company's strategy centers on acquiring quality subscribers and bundling attractive services. These include lucrative postpaid plans and popular Over-The-Top (OTT) entertainment packages. Such bundled offerings not only boost financial results but also enhance customer loyalty and reduce churn.

- Consistent ARPU Growth: Airtel has demonstrated a steady increase in ARPU, reflecting successful premiumization.

- Industry-Leading ARPU: In Q1 FY26, Airtel's ARPU reached ₹250, the highest in the Indian telecom market.

- Focus on High-Value Customers: The strategy prioritizes acquiring and retaining subscribers who generate higher revenue.

- Bundled Offerings: Integration of postpaid plans and OTT services enhances customer value and stickiness.

Robust Financial Performance and Improving Debt Profile

Bharti Airtel has showcased impressive financial strength, marked by steady revenue expansion and enhanced profitability. For the fiscal year ending March 31, 2025, the company reported a consolidated net profit of INR 15,193 crore, a significant jump from the previous year, alongside annual revenue that reached INR 147,746 crore. This financial robustness is underscored by a consistently improving debt-to-equity ratio, which stood at approximately 1.4x as of March 2025, demonstrating effective leverage management.

The company’s disciplined approach to capital allocation and its ability to generate robust free cash flow provide a strong foundation for continued investment in high-growth sectors. This financial discipline enables Bharti Airtel to pursue strategic expansion, particularly in areas like 5G deployment and digital services, while maintaining a healthy balance sheet.

- Consistent Revenue Growth: Bharti Airtel's consolidated revenue for FY25 rose to INR 147,746 crore, reflecting sustained market demand and effective service delivery.

- Improved Profitability: Net profit for FY25 surged to INR 15,193 crore, indicating enhanced operational efficiency and strong revenue conversion.

- Declining Debt-to-Equity Ratio: The company's debt-to-equity ratio improved to around 1.4x by March 2025, showcasing a healthier financial structure.

- Strong Free Cash Flow: Robust free cash flow generation supports ongoing capital expenditures and strategic growth initiatives.

Bharti Airtel benefits from a diverse service portfolio, covering mobile (2G-5G), broadband, and DTH, catering to a wide customer base. Its expansion into mobile commerce and payments banking creates a robust ecosystem, enhancing customer loyalty and revenue streams. This diversification is reflected in its financial performance, with Airtel Payments Bank showing significant growth in customer numbers and transactions throughout 2024.

The company holds strong brand equity and market leadership in India, built on reliability and consistent service. In FY24, Airtel's consolidated revenue exceeded ₹1.25 lakh crore, demonstrating its substantial market share.

Airtel's aggressive 5G rollout positions it for leadership in next-generation services. By Q4 2024, its 5G network already covered over 300 cities, highlighting rapid infrastructure investment.

The focus on high-value customers and increasing ARPU through premiumization is a key strength. In Q1 FY26, Airtel achieved an industry-leading ARPU of ₹250, driven by attractive postpaid and bundled OTT services.

Bharti Airtel demonstrates significant financial strength with consistent revenue growth and improved profitability. For FY25, consolidated revenue reached INR 147,746 crore, with net profit at INR 15,193 crore. The debt-to-equity ratio improved to approximately 1.4x by March 2025, indicating effective leverage management and strong free cash flow generation.

| Metric | FY24 Data | FY25 Data | Q1 FY26 Data |

|---|---|---|---|

| Consolidated Revenue | > ₹1.25 Lakh Crore | INR 147,746 Crore | |

| Net Profit | INR 15,193 Crore | ||

| ARPU | INR 250 | ||

| Debt-to-Equity Ratio | ~1.4x (as of March 2025) |

What is included in the product

Delivers a strategic overview of Bharti Airtel’s internal and external business factors, highlighting its robust network infrastructure and brand recognition while addressing competitive pressures and evolving regulatory landscapes.

Uncovers critical market vulnerabilities and competitive advantages, enabling proactive risk mitigation and strategic resource allocation for Bharti Airtel.

Weaknesses

Bharti Airtel operates in an exceptionally competitive Indian telecom landscape, facing formidable rivals like Reliance Jio and Vodafone Idea. This fierce rivalry frequently triggers price wars, which directly squeeze Airtel's profit margins and limit its ability to implement substantial tariff hikes. For instance, in the fiscal year ending March 2024, average revenue per user (ARPU) across the industry remained under pressure despite data consumption growth.

Bharti Airtel, like many in the telecom sector, has a history of significant debt, primarily to fuel aggressive network upgrades and spectrum purchases. For instance, in the fiscal year ending March 2023, the company's total debt stood at approximately INR 59,000 crore. This substantial debt burden, coupled with the ongoing need for high capital expenditure for 5G deployment and network maintenance, continues to be a critical factor influencing its financial health and investor sentiment.

Bharti Airtel's significant reliance on the Indian market, which accounts for a substantial portion of its revenue and subscriber numbers, exposes it to the inherent price sensitivity of this region. This concentration makes the company particularly susceptible to fluctuations in local economic conditions and consumer spending power.

A large majority of Airtel's Indian customers are on prepaid plans, a segment known for its price-consciousness and propensity to switch providers for better deals. This dynamic directly impacts customer retention efforts and can hinder the growth of Average Revenue Per User (ARPU), as seen in the competitive Indian telecom landscape.

The company's dependence on this price-sensitive market can constrain its ability to implement aggressive pricing strategies, potentially limiting overall profitability and pricing power compared to competitors in less price-sensitive markets.

Regulatory Challenges and Compliance Burdens

Bharti Airtel, like all major telecom players in India, operates within a highly regulated environment. This means navigating complex rules and policies that can shift unexpectedly. For instance, the lingering issue of Adjusted Gross Revenue (AGR) dues has historically presented significant financial uncertainty for the sector, impacting profitability and investment plans.

The company must also contend with the evolving landscape of spectrum allocation and pricing, which directly affects its ability to expand network capacity and offer new services. Changes in these areas, alongside shifts in taxation policies, can introduce considerable operational and financial risks.

Furthermore, the sheer complexity of telecom regulations in India necessitates substantial resources dedicated to compliance. This includes adhering to data privacy laws, network quality standards, and consumer protection regulations, all of which add to operational overhead and can slow down strategic initiatives.

- Regulatory Scrutiny: The Indian telecom industry is subject to stringent oversight, with ongoing AGR dues and evolving policy frameworks posing persistent challenges.

- Policy Volatility: Changes in government policies regarding spectrum allocation, pricing, and taxation can directly impact Bharti Airtel's financial stability and operational strategies.

- Compliance Costs: Adhering to a complex web of regulations, including data privacy and network standards, incurs significant operational costs and demands continuous adaptation.

Challenges in Monetizing 5G Services

Bharti Airtel, despite its aggressive 5G network expansion and a growing 5G subscriber base, is finding it difficult to translate this into immediate, substantial revenue increases. A key hurdle is the absence of significant price hikes for 5G services, as the company continues to offer unlimited 5G data, which, while attracting users, limits direct monetization.

The path to robust revenue generation from 5G is proving to be a longer journey compared to previous network upgrades. This is partly because the ecosystem of compelling 5G-specific applications and use cases that would justify premium pricing is still in its nascent stages of development.

While 5G technology inherently lowers the cost per gigabyte of data delivered, this efficiency gain doesn't automatically translate into higher average revenue per user (ARPU) without a clear value proposition for consumers to pay more.

- Monetization Lag: Bharti Airtel's 5G ARPU stood at ₹200 in Q4 FY24, showing a modest increase but not yet reflecting the full potential of the technology.

- Limited Tariff Hikes: The company has largely avoided significant tariff increases for 5G, opting for unlimited data offerings to drive adoption, which caps immediate revenue gains.

- Nascent Application Ecosystem: The development of killer 5G applications that can command premium pricing is still in its early phases, delaying the realization of new revenue streams.

- Cost Efficiency vs. Revenue Growth: While 5G reduces data delivery costs, the challenge lies in converting this efficiency into increased service revenue, a process expected to take time.

Bharti Airtel faces intense competition in India, leading to price wars that suppress profit margins and hinder ARPU growth. For instance, the average revenue per user (ARPU) remained under pressure in FY24 despite increased data usage. The company's substantial debt, around INR 59,000 crore as of March 2023, coupled with ongoing capital expenditure for 5G, adds financial strain.

Same Document Delivered

Bharti Airtel SWOT Analysis

This is the same Bharti Airtel SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, allowing for strategic planning.

Opportunities

Bharti Airtel's ongoing 5G network expansion and the increasing consumer uptake of these faster services represent a substantial growth avenue. As of early 2024, Airtel has aggressively deployed 5G in numerous cities across India, aiming for pan-India coverage. This technological advancement allows for the introduction of premium services and innovative applications, potentially driving ARPU (Average Revenue Per User) growth.

The company is well-positioned to capitalize on the burgeoning 5G market by leveraging its existing strong subscriber base and network infrastructure. Monetization strategies are crucial, with potential for tiered pricing for enhanced 5G speeds and the development of new enterprise solutions and IoT (Internet of Things) services that rely on 5G's low latency and high bandwidth.

Bharti Airtel's strategic diversification into digital services like Airtel Payments Bank, Wynk Music, and Airtel Xstream positions it well to capitalize on India's rapidly expanding digital economy. The digital payments sector in India is projected to reach $3 trillion by 2026, a significant tailwind for Airtel Payments Bank. Furthermore, the increasing consumer appetite for digital content and value-added telecom services presents a fertile ground for Wynk Music and Airtel Xstream to gain further traction and revenue.

Developing a robust, interconnected ecosystem that seamlessly integrates its core telecom offerings with these burgeoning digital services and fintech solutions offers a powerful avenue for growth. This integrated approach not only strengthens customer loyalty by providing a comprehensive digital experience but also acts as a significant draw for new subscribers seeking convenience and a wider range of services, thereby enhancing customer lifetime value.

Bharti Airtel has a significant opportunity to tap into India's rural and semi-urban markets, which are still largely underserved by robust telecom infrastructure. This presents a substantial avenue for subscriber growth.

By strategically investing in network expansion and developing cost-effective service plans, Airtel can attract a large, untapped customer base in these areas. This aligns with the government's focus on digital inclusion.

For instance, as of Q4 FY24, Airtel's rural ARPU (Average Revenue Per User) showed potential for uplift, and initiatives like the BharatNet project are actively working to connect villages, creating a fertile ground for Airtel's service expansion.

Expansion of Enterprise and B2B Solutions

The ongoing digital transformation across industries fuels a substantial opportunity for Airtel's enterprise and B2B offerings. Businesses are increasingly seeking robust cloud services, enhanced cybersecurity, and integrated IoT solutions to streamline operations and foster innovation.

Airtel is well-positioned to leverage this demand by providing advanced connectivity coupled with customized B2B solutions. This strategy directly addresses the growing need for reliable remote work infrastructure and comprehensive digital integration, essential for businesses operating in the current economic landscape.

- Enterprise segment revenue growth: Airtel's enterprise segment demonstrated robust growth, with revenues increasing by approximately 11.4% year-on-year in FY24, reaching ₹12,581 crore.

- Cloud and data center expansion: The company is actively expanding its cloud and data center capabilities, recognizing the critical role these play in supporting B2B digital transformation initiatives.

- IoT deployments: Airtel is facilitating the adoption of IoT solutions across various sectors, including manufacturing and logistics, enabling enhanced efficiency and data-driven decision-making for its business clients.

- Digital transformation services: The demand for managed services, cybersecurity, and network integration solutions for enterprises continues to rise, creating a fertile ground for Airtel to deepen its B2B relationships.

Increasing Demand for Fixed Broadband and FWA

The persistent surge in demand for high-speed home internet, fueled by evolving work-from-home policies and escalating data usage, presents a significant growth opportunity for Bharti Airtel. This trend is directly translating into increased adoption of fixed broadband services.

Airtel's strategic emphasis on broadening its fiber-to-the-home (FTTH) and fixed wireless access (FWA) offerings places it advantageously to capitalize on this expanding market. The company's commitment to network upgrades and service expansion is crucial for capturing this demand.

The company's homes business has indeed witnessed remarkable expansion, demonstrating record growth. This segment is proving to be a pivotal contributor to Airtel's overall revenue growth trajectory, highlighting the success of its broadband strategy.

- Record Growth: Airtel's homes business achieved a 15.4% year-on-year revenue growth in Q4 FY24, reaching INR 1,407 crore.

- FTTH Expansion: The company continues to expand its FTTH footprint, aiming to connect more households with high-speed internet.

- FWA Potential: Fixed Wireless Access (FWA) is emerging as a strong alternative for customers seeking high-speed internet without fiber installation, and Airtel is actively developing this segment.

- Data Consumption: Average data consumption per user on Airtel's fixed broadband network reached 200 GB in FY24, underscoring the increasing reliance on home internet.

Bharti Airtel's aggressive 5G network rollout and increasing customer adoption of these faster services present a significant growth opportunity, with 5G services expanding rapidly across India as of early 2024. This technological advancement enables the introduction of premium services and innovative applications, potentially boosting Average Revenue Per User (ARPU).

The company is strategically diversifying into digital services, including Airtel Payments Bank and digital content platforms like Wynk Music and Airtel Xstream, capitalizing on India's rapidly expanding digital economy. The digital payments sector alone is projected to reach $3 trillion by 2026, offering a substantial tailwind for Airtel Payments Bank.

Airtel has a considerable opportunity to expand its subscriber base in underserved rural and semi-urban markets, aligning with government initiatives for digital inclusion. For instance, rural ARPU showed potential for uplift in Q4 FY24, and projects like BharatNet are actively connecting villages, creating fertile ground for service expansion.

The ongoing digital transformation across industries fuels demand for Airtel's enterprise and B2B offerings, including cloud services, cybersecurity, and IoT solutions. Airtel's enterprise segment saw robust revenue growth of approximately 11.4% year-on-year in FY24, reaching ₹12,581 crore.

The increasing demand for high-speed home internet, driven by remote work trends and escalating data usage, presents a significant growth avenue for Airtel's fixed broadband services. Airtel's homes business achieved a 15.4% year-on-year revenue growth in Q4 FY24, reaching INR 1,407 crore.

| Opportunity Area | Key Driver | Supporting Data |

|---|---|---|

| 5G Expansion & Monetization | Increasing 5G adoption, premium service potential | Aggressive 5G deployment across India (early 2024) |

| Digital Services & Ecosystem | Growth of digital economy, digital payments | Digital payments market projected to reach $3 trillion by 2026 |

| Rural & Semi-Urban Market Penetration | Untapped customer base, digital inclusion initiatives | Rural ARPU uplift potential (Q4 FY24), BharatNet project |

| Enterprise & B2B Solutions | Digital transformation, demand for cloud & IoT | Enterprise segment revenue grew 11.4% YoY in FY24 to ₹12,581 crore |

| Home Broadband Growth | Increased data consumption, remote work trends | Homes business revenue grew 15.4% YoY in Q4 FY24 to INR 1,407 crore |

Threats

The Indian telecom sector is characterized by fierce competition, with Reliance Jio consistently employing aggressive pricing strategies. This intense rivalry, particularly concerning data tariffs, directly impacts Bharti Airtel's average revenue per user (ARPU) and overall profitability.

Airtel's ARPU, while showing resilience, faces pressure from ongoing price wars. For instance, while Airtel reported an ARPU of ₹209 in Q4 FY24, the sustained competitive environment necessitates strategic responses to prevent margin erosion and potential subscriber attrition.

The threat of subscriber churn remains a significant concern. Competitors' aggressive data pricing can lure price-sensitive customers away, forcing Airtel to balance market share defense with the need to maintain healthy profit margins, a delicate act in this dynamic market.

The telecommunications sector is a hotbed of innovation, demanding constant, significant investments in upgrading infrastructure and adopting new technologies. Bharti Airtel, like its peers, faces the challenge of keeping pace with these rapid advancements. For instance, the ongoing rollout and optimization of 5G services require substantial capital, and the emergence of future communication standards, like potential 6G research and development, necessitates forward-looking investment to avoid obsolescence.

Failure to invest adequately in staying current with evolving technologies, such as next-generation wireless standards or entirely new communication paradigms, poses a direct threat of technological obsolescence. This could erode Bharti Airtel's competitive edge and lead to a decline in market share. The company's capital expenditure plans for FY25 are crucial in mitigating this risk, with significant outlays expected for network expansion and technology upgrades to maintain its position in a dynamic market.

Changes in government regulations, particularly concerning spectrum allocation and pricing, pose a significant threat to Bharti Airtel. For instance, the Telecom Regulatory Authority of India (TRAI) has historically adjusted spectrum usage charges and renewal policies, which can directly impact operational costs and future investment capacity. Policy uncertainty around areas like net neutrality or data localization also creates a challenging operating environment, potentially affecting service delivery and revenue streams.

Cybersecurity Risks and Data Privacy Concerns

As a leading digital services provider, Bharti Airtel's extensive handling of customer data makes it a prime target for cybersecurity threats and data privacy breaches. A major incident could severely damage its reputation and erode customer trust. For instance, the global cybersecurity market was valued at over $200 billion in 2023, highlighting the scale of these risks.

The financial and operational repercussions of a security lapse are substantial. These can include significant fines from regulatory bodies, increased costs for incident response and system upgrades, and potential lawsuits. In 2023, companies globally faced an average cost of over $4 million per data breach, a figure Airtel must actively mitigate.

- Vulnerability to Cyberattacks: Airtel's vast digital infrastructure, including mobile networks, broadband services, and digital payment platforms, presents numerous entry points for malicious actors.

- Data Privacy Compliance: Adherence to evolving data protection regulations like India's Digital Personal Data Protection Act of 2023 necessitates continuous investment in privacy-preserving technologies and practices.

- Reputational Damage: A significant breach could lead to a loss of customer confidence, impacting subscriber growth and retention, a critical factor in the competitive telecom market where Airtel has over 370 million mobile subscribers as of early 2024.

- Operational Disruption and Costs: Remediation efforts following a cyber incident can be extremely costly and disruptive, diverting resources from core business operations and innovation.

Economic Slowdown and Impact on Consumer Spending

An economic slowdown or persistent inflationary pressures present a significant threat to Bharti Airtel by potentially dampening consumer spending. This could translate into lower Average Revenue Per User (ARPU) or a reduced uptake of higher-tier services as customers become more price-sensitive.

While telecom services are generally considered essential, extended economic hardship might compel customers to opt for more basic plans or switch providers, increasing churn. This down-trading behavior directly impacts Bharti Airtel's revenue streams and overall profitability.

For instance, if inflation continues to rise, impacting disposable incomes, consumers might cut back on non-essential upgrades or data-heavy services. This could be seen in a slowdown in 5G adoption if the perceived value proposition doesn't outweigh the increased cost for consumers during tough economic times.

- Economic Uncertainty: Global economic forecasts for 2024 and 2025 indicate potential slowdowns in key markets, which could affect discretionary spending on telecom.

- Inflationary Impact: Rising inflation directly erodes purchasing power, making consumers more cautious about their monthly mobile bills and service upgrades.

- ARPU Pressure: Bharti Airtel's ARPU, which stood at INR 209.5 in Q4 FY24, could face downward pressure if customers downgrade plans or reduce usage to save money.

- Churn Risk: Increased competition and economic strain can lead to higher customer churn rates as consumers seek cheaper alternatives, impacting subscriber base growth.

Intense competition, particularly from Reliance Jio's aggressive pricing, continues to exert pressure on Bharti Airtel's Average Revenue Per User (ARPU). This rivalry, especially concerning data tariffs, directly impacts profitability and necessitates strategic responses to retain market share without significant margin erosion.

The rapid evolution of telecommunications technology demands continuous and substantial investment in infrastructure upgrades and new technology adoption. Bharti Airtel faces the challenge of keeping pace with advancements like 5G rollout and potential future standards, requiring significant capital expenditure to avoid technological obsolescence and maintain its competitive edge.

Changes in government regulations, including spectrum allocation policies and pricing, represent a significant threat. Policy uncertainties surrounding areas like net neutrality or data localization can also create a challenging operating environment, potentially affecting service delivery and revenue streams.

Bharti Airtel's extensive digital infrastructure makes it a prime target for cybersecurity threats and data privacy breaches. A significant incident could lead to substantial financial penalties, reputational damage, and a loss of customer trust, impacting subscriber growth and retention, especially given its over 370 million mobile subscribers as of early 2024.

Economic slowdowns and persistent inflation pose a threat by potentially reducing consumer spending on telecom services. This could lead to a decrease in ARPU as customers opt for cheaper plans or reduce usage, increasing churn risk in a highly competitive market.

SWOT Analysis Data Sources

This SWOT analysis draws from a comprehensive blend of publicly available financial reports, detailed market research from reputable firms, and expert commentary from industry analysts to provide a robust and well-informed perspective.