Bharti Airtel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharti Airtel Bundle

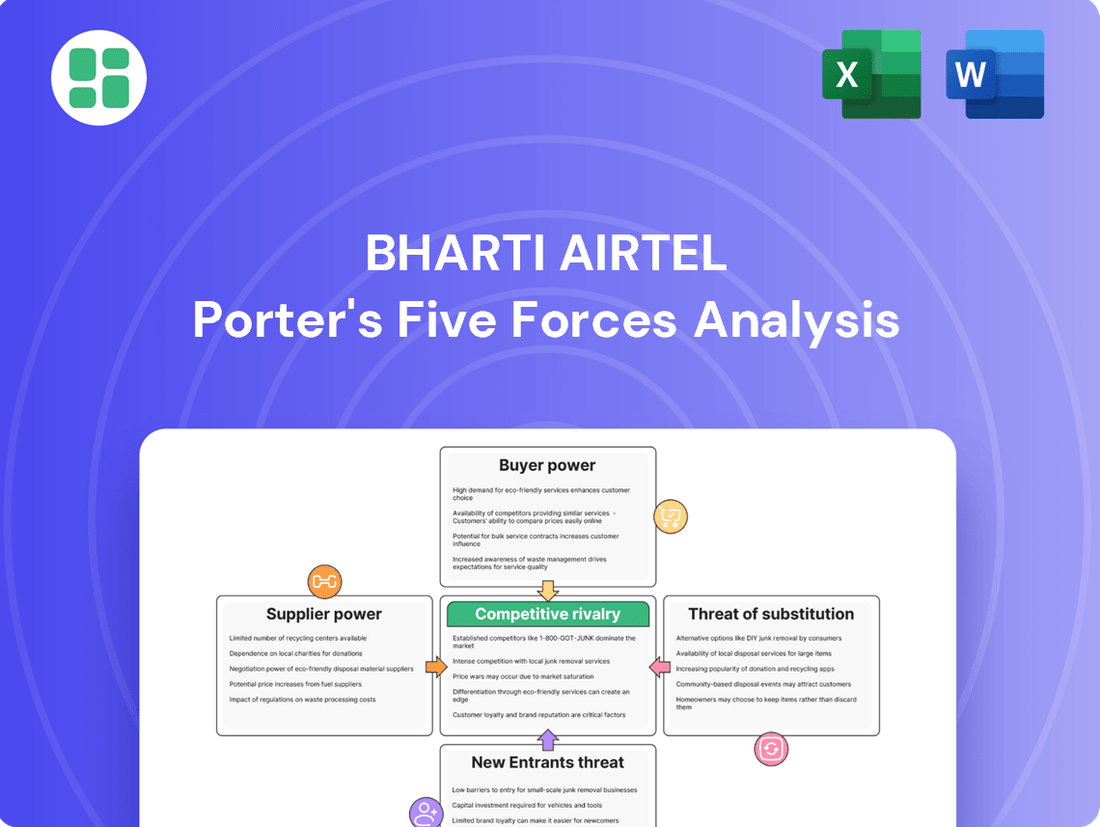

Bharti Airtel navigates a dynamic telecom landscape, facing intense rivalry from established players and the constant threat of new entrants disrupting the market. Understanding the bargaining power of both suppliers and buyers is crucial for maintaining profitability and customer loyalty.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bharti Airtel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The telecommunications sector, including major players like Bharti Airtel, faces concentrated supplier power from specialized network equipment vendors such as Ericsson and Nokia. These companies dominate the market for advanced infrastructure, particularly for 5G deployment, which requires highly complex and proprietary technology. In 2024, the global 5G infrastructure market was valued at over $60 billion, highlighting the significant investment and reliance on these few key suppliers.

Bharti Airtel's reliance on these vendors for critical network components and ongoing upgrades, especially as it expands its 5G network across India, grants these suppliers considerable bargaining leverage. The high technological barriers to entry and the proprietary nature of their solutions mean that switching costs for Airtel are substantial, potentially impacting pricing and contract terms.

Infrastructure providers, particularly tower companies like Indus Towers, exert moderate bargaining power over Bharti Airtel. Their services are crucial for expanding network coverage and ensuring smooth operations, giving them inherent leverage. In 2023, Indus Towers reported a significant number of towers, highlighting the scale of passive infrastructure required by operators.

The substantial investment and long-term commitments involved in telecom infrastructure contracts limit the ease with which Bharti Airtel can switch providers. This creates a degree of dependency, allowing tower companies to maintain some influence. Bharti Airtel's own extensive infrastructure investments and strategic partnerships further solidify this dynamic.

The bargaining power of software and IT solutions providers for Bharti Airtel is growing as telecom services become more digitized. Companies like Amdocs, known for its customer management and billing systems, and cloud giants like Google Cloud, which offers enterprise solutions, are becoming crucial partners. Their leverage depends on how unique their offerings are and how complex it is to integrate them with Airtel's existing infrastructure. For instance, specialized AI platforms for network optimization or customer service chatbots can be difficult to replace.

Bharti Airtel's strategic partnerships with cloud providers and AI specialists underscore its dependence on these external entities for digital transformation and enhancing customer experiences. In 2023, the global cloud computing market was valued at over $500 billion, with significant growth projected, indicating the increasing reliance of large enterprises like Airtel on these specialized IT services to remain competitive and innovative.

Spectrum and Regulatory Bodies

The government and regulatory bodies, particularly through spectrum auctions and licensing, are significant suppliers to Bharti Airtel, providing the essential spectrum for its operations. Their decisions on auction prices, renewal terms, and policy frameworks directly influence Airtel's operational expenses and long-term strategic decisions. The inherent scarcity and high cost associated with acquiring spectrum solidify the substantial power these bodies wield.

In 2024, the Indian telecom sector continued to see substantial spectrum investments. For instance, Bharti Airtel participated actively in the 2024 spectrum auctions, acquiring spectrum across various bands. The significant capital outlay for these spectrum rights underscores the considerable financial leverage regulatory bodies possess in shaping the industry's landscape and impacting operator profitability.

- Spectrum as a Critical Input: Spectrum is the fundamental resource enabling mobile communication services, making its acquisition a primary concern for telecom operators like Airtel.

- Regulatory Influence: Government policies and auction mechanisms directly determine the cost and availability of spectrum, thereby influencing operational viability and competitive positioning.

- Financial Impact of Auctions: The substantial amounts spent on spectrum, such as the multi-billion dollar investments seen in recent auctions, highlight the significant financial power of regulatory bodies as suppliers.

- Strategic Implications: The terms of spectrum licenses and renewal policies compel operators to engage in continuous strategic planning to manage costs and ensure service continuity.

Fiber Optic and Energy Suppliers

Suppliers of essential components like fiber optic cables and energy generally possess limited individual bargaining power. This is largely due to the standardized nature of their offerings and the availability of numerous alternative providers. For instance, the global fiber optic cable market, estimated to reach over $15 billion by 2024, features a competitive landscape with many manufacturers.

Despite this, the collective influence of these suppliers is significant for Bharti Airtel. Disruptions or price increases in these foundational materials can directly affect the company's capital expenditure, especially during periods of aggressive network expansion. In 2023, Bharti Airtel continued its 5G network deployment, requiring substantial investment in fiber infrastructure, making supply chain stability crucial.

- Fiber Optic Cable Market Size: Projected to exceed $15 billion globally by 2024, indicating a competitive supply base.

- Energy Costs: Fluctuations in energy prices can impact operational expenses for network maintenance and data centers.

- Supply Chain Sensitivity: Bharti Airtel's extensive network infrastructure makes it vulnerable to supply chain disruptions for critical materials.

The bargaining power of suppliers for Bharti Airtel is a mixed bag, with specialized technology providers holding considerable sway due to high switching costs and proprietary solutions. Conversely, suppliers of more commoditized inputs like fiber optic cables generally have less individual power, though collective supply chain stability remains critical.

Government bodies acting as spectrum suppliers wield significant influence, as evidenced by Bharti Airtel's substantial investments in spectrum auctions. This financial commitment highlights the critical nature of spectrum and the leverage held by regulatory authorities in shaping the industry.

Software and IT solution providers are increasingly important, with their leverage dependent on the uniqueness and integration complexity of their offerings, particularly in areas like AI and cloud services. Bharti Airtel's reliance on these partners for digital transformation underscores their growing importance.

| Supplier Type | Bargaining Power Level | Key Considerations for Bharti Airtel |

|---|---|---|

| Network Equipment Vendors (e.g., Ericsson, Nokia) | High | Proprietary technology, high switching costs, critical for 5G rollout. |

| Tower Companies (e.g., Indus Towers) | Moderate | Essential for network coverage, long-term infrastructure commitments. |

| Software & IT Solutions Providers (e.g., Amdocs, Google Cloud) | Growing/Variable | Dependence on unique offerings, integration complexity, digital transformation enablers. |

| Government/Regulatory Bodies (Spectrum) | High | Spectrum scarcity, high auction costs, policy frameworks dictate operational viability. |

| Fiber Optic Cable & Energy Suppliers | Low (Individual) / Moderate (Collective) | Standardized products, numerous providers, but supply chain stability is crucial for CAPEX. |

What is included in the product

This analysis delves into the competitive forces shaping Bharti Airtel's market, examining the intensity of rivalry among existing players, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes.

Instantly identify and address competitive threats by visualizing Bharti Airtel's Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

The Indian telecom landscape has a long history of aggressive price competition, leading to a very price-conscious consumer base. Customers readily switch providers for even small differences in tariffs or improved data and voice offerings.

This extreme price sensitivity, combined with the widespread availability of mobile number portability (MNP), significantly strengthens the negotiating leverage of individual mobile subscribers in India.

The Indian telecom market, dominated by Bharti Airtel, Reliance Jio, and Vodafone Idea, presents customers with significant choice. This competitive landscape, with three major private players, directly enhances customer bargaining power. In 2023, India's telecom subscriber base reached over 1.18 billion, underscoring the sheer volume of consumers with alternatives.

Furthermore, the widespread availability and adoption of Mobile Number Portability (MNP) drastically reduce switching costs for customers. This ease of transition means that customers can readily move to a competitor offering better plans or service without losing their existing number. This dynamic forces operators like Bharti Airtel to focus on customer retention through competitive pricing and service innovation.

Bharti Airtel's increasing base of high-value postpaid and enterprise customers signifies a shift in customer bargaining power. While the mass market remains very sensitive to price, these premium segments often prioritize superior network performance, advanced features, and bundled services, making them less inclined to switch providers based on minor price variations.

This trend is evident in Airtel's financial performance. For instance, in the fiscal year ending March 31, 2024, Airtel reported a significant increase in its average revenue per user (ARPU), partly driven by the growing contribution of its postpaid and enterprise customer segments. These customers are less likely to engage in price-based negotiations, thereby reducing their overall bargaining power.

Airtel's strategic emphasis on premiumization and tailored enterprise solutions further solidifies this dynamic. By offering integrated digital services, robust connectivity, and dedicated support, the company enhances customer loyalty and reduces price sensitivity, effectively mitigating the bargaining power of these valuable customer groups.

Increasing Data Consumption and Digital Service Demand

Customers' increasing appetite for high-speed data, advanced 5G services, and a growing array of digital solutions, including streaming content and mobile payment platforms, is undeniably shifting some leverage into their hands. They are actively seeking telecommunications providers that can consistently deliver on these evolving expectations, pushing operators to innovate beyond basic connectivity.

Bharti Airtel's strategic investments in expanding its 5G network coverage and enhancing its digital service ecosystem are direct responses to this burgeoning customer demand. By focusing on service quality and a superior digital experience, Airtel aims to carve out a distinct market position, thereby mitigating customer churn that might otherwise be driven solely by price competition.

- Demand for 5G Services: As of early 2024, India's 5G subscriber base is rapidly expanding, with reports indicating significant growth quarter-over-quarter, demonstrating a clear customer preference for faster network speeds.

- Digital Service Adoption: Bharti Airtel's digital platforms, including its payment bank and content offerings, have seen substantial user engagement, reflecting a growing trend of customers consolidating their digital needs with their primary telecom provider.

- Customer Retention: Operators are increasingly leveraging network quality and bundled digital services as key differentiators to retain customers in a competitive market, moving away from a purely price-centric approach.

Impact of Average Revenue Per User (ARPU) Trends

The bargaining power of customers significantly impacts telecom operators like Bharti Airtel, largely driven by the Average Revenue Per User (ARPU). Despite recent price adjustments, India's ARPU continues to be notably low on a global scale, underscoring the substantial price sensitivity and power customers wield in this market. This persistent pressure necessitates strategic approaches to enhance revenue without alienating the user base.

Bharti Airtel is actively pursuing strategies to elevate its ARPU, focusing on premiumization and the widespread adoption of 5G services. These initiatives aim to capture greater value from existing customers by offering enhanced data speeds and superior network experiences. The success of these strategies is vital in mitigating the inherent customer power that keeps average revenues suppressed.

- Indian Telecom ARPU: As of early 2024, India's average ARPU hovers around INR 200-220, significantly lower than developed markets.

- Global Comparison: This figure is considerably lower than ARPU in regions like North America or Europe, where it can exceed USD 50 (approximately INR 4,000).

- Airtel's ARPU Growth Target: Bharti Airtel has publicly stated its ambition to reach an ARPU of INR 300 as a key financial benchmark.

- 5G Monetization: The rollout of 5G is seen as a primary avenue to justify higher-tier plans and increase ARPU, though widespread adoption and willingness to pay a premium are still evolving.

The bargaining power of customers in the Indian telecom market remains a significant force, primarily driven by price sensitivity and the availability of choice. While Bharti Airtel is working to increase its Average Revenue Per User (ARPU), the sheer volume of subscribers and the ease of switching providers continue to empower consumers. However, the increasing demand for advanced services like 5G and digital solutions is creating opportunities for differentiation beyond just price.

| Metric | Value (Early 2024) | Implication for Customer Bargaining Power |

|---|---|---|

| Indian Telecom ARPU | ~ INR 200-220 | Indicates high price sensitivity, strengthening customer leverage. |

| Airtel's ARPU Target | INR 300 | Highlights the company's effort to mitigate price-driven customer power. |

| 5G Subscriber Growth | Rapid expansion | Customers willing to pay more for enhanced services, potentially reducing price-based bargaining. |

Preview the Actual Deliverable

Bharti Airtel Porter's Five Forces Analysis

This preview showcases the comprehensive Bharti Airtel Porter's Five Forces analysis, detailing the competitive landscape impacting the company. You're viewing the exact document that will be delivered instantly upon purchase, offering a complete and ready-to-use strategic assessment. The analysis covers the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors, all presented in a professionally formatted file.

Rivalry Among Competitors

The Indian telecom sector is a prime example of dominance by a few major players, creating an intensely competitive environment. Reliance Jio, Bharti Airtel, and Vodafone Idea are the primary forces, holding the vast majority of the market share. For instance, as of early 2024, Bharti Airtel reported a subscriber base of over 377 million, while Reliance Jio's numbers have also consistently surpassed the 400 million mark, highlighting their significant scale.

This oligopolistic structure means that the strategic moves of one dominant player directly impact the others, fueling aggressive competition for subscribers and market leadership. The ongoing battle for market share, often through aggressive pricing and innovative service offerings, defines the intensity of rivalry within the Indian telecommunications industry.

The aggressive nationwide 5G rollout by Bharti Airtel and Reliance Jio has ignited a fierce competitive landscape. Both companies are rapidly expanding their 5G network coverage, aiming to attract and retain high-value customers by offering advanced services and superior connectivity. This intense race to deploy 5G infrastructure and secure market share intensifies rivalry among telecom giants.

The Indian telecom sector has a history of intense price competition, significantly impacting Average Revenue Per User (ARPU). Following Jio's disruptive entry, price wars became a defining characteristic, forcing established players like Bharti Airtel to adapt their strategies.

While recent tariff increases by Airtel and its main competitor, Reliance Jio, in late 2023 and early 2024 signal a move towards profitability, the market's inherent price sensitivity means pricing will remain a critical competitive factor. For instance, Airtel's ARPU increased to INR 209 in Q3 FY24, up from INR 198 in Q3 FY23, indicating the impact of these hikes.

This ongoing battle over pricing exerts continuous pressure on profit margins for all operators. The need to attract and retain subscribers in a market where price is a major consideration ensures that the threat of price wars, or at least aggressive pricing strategies, is always present, limiting pricing power.

Focus on Subscriber Retention and Churn Reduction

In India's largely saturated mobile market, the intense competition among telecom providers like Bharti Airtel means the focus has firmly shifted from simply acquiring new customers to keeping the ones they have. This intense rivalry directly impacts subscriber retention strategies.

High customer churn, often fueled by individuals consolidating their SIM cards or being lured by aggressive pricing from competitors, necessitates significant investment from operators. Bharti Airtel, for instance, must pour resources into enhancing customer experience, developing robust loyalty programs, and executing targeted marketing campaigns. These efforts are crucial to stem the tide of customer losses and maintain market share.

- Customer Acquisition Cost (CAC) vs. Customer Lifetime Value (CLTV): Bharti Airtel's strategy increasingly prioritizes maximizing CLTV over simply reducing CAC, as retaining a customer is far more cost-effective than acquiring a new one.

- Impact of Data Tariffs: Competitive data tariffs, a hallmark of the Indian market, directly influence churn. For example, in early 2024, the average revenue per user (ARPU) for Indian telcos hovered around INR 180-200, indicating a constant pressure to offer value and prevent subscribers from switching for lower prices.

- Loyalty Programs and Bundling: Bharti Airtel's investments in services like Airtel Thanks, which offers bundled benefits, aim to increase switching costs and foster loyalty, thereby reducing churn.

Diversification into Digital Services and Ecosystems

The competitive rivalry for Bharti Airtel intensifies as companies move beyond basic connectivity to build expansive digital ecosystems. This means competition isn't just about offering mobile plans anymore; it's about creating a sticky environment where customers engage with a variety of digital services.

Bharti Airtel's strategic move into areas like digital TV, its payment bank, and tailored enterprise solutions directly pits it against rivals like Jio, which has also aggressively diversified its portfolio. This multi-pronged approach aims to lock in customers, unlock new revenue streams, and create a distinct value proposition that transcends simple network access.

- Ecosystem Competition: Rivalry now centers on building comprehensive digital service suites, not just connectivity.

- Bharti Airtel's Diversification: Services include digital TV, Airtel Payments Bank, and enterprise solutions.

- Jio's Parallel Strategy: Jio also offers a wide array of digital services, intensifying direct competition.

- Strategic Goals: Diversification seeks to increase customer stickiness, generate new revenues, and differentiate from competitors.

Competitive rivalry in the Indian telecom sector is exceptionally high, primarily driven by the dominance of a few key players like Bharti Airtel and Reliance Jio. This intense competition is further fueled by aggressive pricing strategies and a rapid nationwide 5G rollout, forcing companies to constantly innovate and focus on customer retention.

The market's saturation means that acquiring new subscribers is less impactful than retaining existing ones, leading to substantial investments in customer experience and loyalty programs. Bharti Airtel's Average Revenue Per User (ARPU) saw an increase to INR 209 in Q3 FY24, up from INR 198 in Q3 FY23, reflecting the impact of tariff adjustments amidst this rivalry.

Beyond basic connectivity, competition has evolved into building comprehensive digital ecosystems, with companies like Bharti Airtel and Jio diversifying into services like digital TV and payment banks to increase customer stickiness and create differentiated value propositions.

| Operator | Subscriber Base (Approx. Millions, Early 2024) | ARPU (INR, Q3 FY24) |

|---|---|---|

| Bharti Airtel | 377+ | 209 |

| Reliance Jio | 400+ | 180-200 (Market Range) |

| Vodafone Idea | 210+ | 140-150 (Market Range) |

SSubstitutes Threaten

Over-the-top (OTT) communication services like WhatsApp, Google Meet, and Facetime present a substantial threat to Bharti Airtel's traditional revenue. These platforms offer free or very low-cost alternatives for voice and messaging, directly impacting the demand for Airtel's legacy voice and SMS services. For instance, by mid-2024, the widespread adoption of these apps meant that a significant portion of inter-personal communication was happening outside of traditional carrier billing.

This substitution forces Bharti Airtel to pivot its strategy, emphasizing data monetization and the development of value-added services. Instead of relying on per-minute voice charges or per-SMS fees, the company must innovate in areas like bundled data plans, digital content, and enterprise solutions to capture value. This shift is crucial as data usage continues to surge, with reports indicating a substantial year-over-year increase in data consumption across India by early 2024.

The increasing availability of public and private Wi-Fi networks presents a significant threat of substitution for mobile data services. This is particularly true for home and office use where users can often access reliable internet without consuming their mobile data allowances.

Furthermore, the rollout of Fixed Wireless Access (FWA) by telecom operators, including Bharti Airtel's own Xstream AirFiber, directly substitutes for traditional mobile broadband. While offered by telcos, FWA represents a different consumption model, potentially diverting users away from mobile data plans for fixed locations.

Emerging satellite internet providers like SpaceX's Starlink and OneWeb represent a growing threat, particularly in remote regions where traditional infrastructure is difficult to establish. While these services are currently more expensive and less widespread, their expanding reach could provide a viable alternative for specific customer groups seeking broadband access.

The increasing accessibility of satellite internet, despite its current premium pricing, signifies a long-term potential shift in the market. Bharti Airtel's strategic collaboration with Starlink underscores the company's proactive approach to addressing this evolving competitive landscape.

Private Networks for Enterprises

The rise of private 5G networks presents a significant threat of substitutes for Bharti Airtel's enterprise connectivity services. Businesses are increasingly exploring direct deployment of these networks or partnering with specialized integrators to manage their internal communication and Internet of Things (IoT) requirements.

This shift can diminish large enterprises' dependence on public telecom networks, directly impacting Airtel's revenue streams within its enterprise segment. For instance, companies seeking dedicated, high-performance networks for manufacturing floors or logistics operations might opt for private solutions over shared public infrastructure.

- Private 5G networks offer tailored performance and security for specific enterprise use cases.

- Businesses can gain greater control over their network infrastructure and data.

- The cost-effectiveness of private networks for certain high-demand applications is a key driver.

- Specialized integrators are emerging as alternative providers for enterprise network solutions.

Content Streaming and Digital Entertainment Platforms

The proliferation of content streaming services like Netflix, Amazon Prime Video, and YouTube presents a significant threat of substitutes for telecom providers like Bharti Airtel. While these platforms don't directly replace connectivity, they vie for consumer attention and disposable income. In 2024, global digital ad spending on video streaming was projected to reach over $100 billion, indicating a massive shift in entertainment consumption. This means customers might prioritize spending on these services over premium mobile data plans.

Bharti Airtel's strategy to counter this involves bundling content with its telecom offerings, a common tactic to enhance customer loyalty and perceived value. For instance, Airtel offers access to various streaming platforms through its Xstream app and various recharge plans. This approach aims to keep customers within the Airtel ecosystem, making it harder for them to switch to competitors or reduce their telecom spending in favor of pure content subscriptions.

- Growing Digital Entertainment Spend: Consumers are increasingly allocating a larger portion of their discretionary income to digital entertainment, diverting funds that could otherwise be used for mobile services.

- Bundling as a Defense: Telecom companies, including Airtel, are leveraging content partnerships to create attractive bundles that increase customer stickiness and reduce churn.

- Indirect Competition for Wallet Share: Streaming services indirectly compete with telecom providers by consuming a significant share of the consumer's entertainment budget.

Over-the-top (OTT) communication services and public Wi-Fi networks pose a significant threat by offering alternatives to traditional voice, SMS, and mobile data services. By early 2024, the widespread adoption of apps like WhatsApp meant a substantial portion of communication bypassed traditional carrier billing, forcing Airtel to focus on data monetization. Emerging satellite internet providers also present a growing, albeit currently niche, threat, particularly in underserved regions.

Private 5G networks are increasingly substituting for enterprise connectivity, allowing businesses to bypass public telecom infrastructure for dedicated, high-performance needs. This trend could reduce large enterprises' reliance on providers like Bharti Airtel for their internal communication and IoT requirements, impacting revenue in the enterprise segment. For example, manufacturing firms might opt for private 5G for enhanced operational control.

The growing popularity of content streaming services represents an indirect threat, competing for consumer disposable income. In 2024, global digital ad spending on video streaming was projected to exceed $100 billion, highlighting a significant shift in entertainment expenditure. Airtel counters this by bundling content with its telecom offerings, aiming to retain customers within its ecosystem.

Entrants Threaten

The Indian telecom sector demands colossal upfront capital. Acquiring spectrum licenses alone can cost billions of dollars, as seen in recent auctions where the government garnered over ₹1.5 lakh crore (approximately $18 billion) in 2022. This massive investment requirement for network build-out, including towers, fiber optic cables, and 5G equipment, presents a formidable barrier.

These substantial financial commitments, often in the tens of billions of dollars for a nationwide rollout, effectively deter potential new entrants. It becomes exceedingly difficult for newcomers to match the established infrastructure and scale of incumbents like Bharti Airtel, making direct competition financially prohibitive.

The Indian telecom sector is characterized by a stringent regulatory framework, demanding complex licenses and adherence to rigorous quality of service standards. These compliance costs, coupled with the necessity for government approvals for spectrum acquisition and operational licenses, act as substantial deterrents for prospective new entrants. For instance, the government's spectrum auctions, a prerequisite for network deployment, often involve multi-billion dollar commitments, presenting a significant barrier to entry.

Established brand loyalty and market dominance present a significant barrier for new entrants in the Indian telecom sector. Incumbent players like Bharti Airtel, Reliance Jio, and Vodafone Idea have cultivated strong brand recognition and customer trust over many years, making it challenging for newcomers to gain traction. For instance, as of Q1 2024, Bharti Airtel reported a subscriber base exceeding 377 million, demonstrating the entrenched nature of its customer relationships.

New entrants would need substantial capital to overcome the established economies of scale enjoyed by these giants. Acquiring subscribers and building a comparable distribution network requires immense investment, a hurdle that can deter potential competitors. The sheer scale of operations for existing players allows them to offer competitive pricing and services, further solidifying their market position and making it difficult for new companies to compete effectively.

Fierce Competition and Price Pressure

The threat of new entrants into India's telecom market, particularly for mass-market mobile services, is considerably low due to the entrenched nature of existing players. This is driven by the fact that the market already grapples with fierce competition and razor-thin margins. Any newcomer would likely face immediate aggressive pricing strategies and robust market share defense from established giants like Bharti Airtel, making profitability a significant hurdle.

For instance, in the fiscal year ending March 2024, Bharti Airtel reported a revenue of ₹1,42,063 crore, underscoring the scale of operations for incumbents. New entrants would find it exceptionally challenging to match these economies of scale and network coverage, further increasing the barriers to entry.

- High Capital Requirements: Establishing a nationwide telecom network demands substantial upfront investment in infrastructure, spectrum, and technology, creating a significant financial barrier.

- Economies of Scale: Dominant players already benefit from massive customer bases, allowing them to spread fixed costs over a larger volume, leading to lower per-unit costs that new entrants cannot easily replicate.

- Brand Loyalty and Customer Lock-in: Established brands have built customer loyalty and leverage existing subscriber relationships, making it difficult for new players to attract and retain customers.

- Regulatory Hurdles: Navigating complex licensing, spectrum allocation, and regulatory compliance in India requires significant expertise and resources, which can deter potential new entrants.

Technological Complexity and Rapid Evolution

The telecommunications sector demands substantial and ongoing investment in cutting-edge technology. Bharti Airtel, like its peers, must constantly upgrade its infrastructure, moving from 4G to 5G and preparing for future advancements. This technological intensity, coupled with the need for highly skilled engineers and technicians, creates a formidable barrier for potential new players. For instance, the global 5G infrastructure market was projected to reach hundreds of billions of dollars by 2028, underscoring the capital required.

New entrants face the daunting task of not only acquiring but also rapidly mastering these complex technologies. The pace of change in telecommunications means that any new player must be prepared to invest heavily and continuously to keep their network capabilities competitive. In 2024, the ongoing rollout and optimization of 5G networks globally illustrate the significant upfront and sustained capital expenditure necessary to compete effectively.

- High R&D Investment: Continuous innovation in areas like AI-driven network management and next-generation wireless technologies requires significant research and development budgets.

- Network Infrastructure Costs: Building out or acquiring advanced network capabilities, such as fiber optic backhaul and 5G spectrum, represents a massive capital outlay.

- Talent Acquisition: Securing and retaining specialized talent in areas like network engineering, cybersecurity, and data analytics is crucial and competitive.

- Rapid Technological Obsolescence: The fast-evolving nature of telecom technology means that investments can quickly become outdated, necessitating ongoing upgrades.

The threat of new entrants in India's telecom sector is low, primarily due to the immense capital required for spectrum acquisition and network infrastructure, exceeding ₹1.5 lakh crore in 2022 alone. Established players like Bharti Airtel benefit from significant economies of scale, with subscriber bases in the hundreds of millions, making it difficult for newcomers to match their cost efficiencies and competitive pricing. Furthermore, strong brand loyalty and complex regulatory hurdles, including multi-billion dollar spectrum commitments, act as substantial deterrents.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Spectrum auctions and network build-out demand billions of dollars. | Prohibitive financial barrier. |

| Economies of Scale | Incumbents serve hundreds of millions of subscribers. | Newcomers struggle to match cost per user. |

| Brand Loyalty | Established players have strong customer trust. | Difficult to attract and retain customers. |

| Regulatory Hurdles | Complex licensing and compliance add costs. | Increases time and expense to enter. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bharti Airtel is built upon a foundation of publicly available information, including the company's annual reports, quarterly financial statements, and investor presentations. We also leverage data from reputable industry research firms and telecom regulatory bodies to capture market dynamics and competitive landscapes.