Bharti Airtel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharti Airtel Bundle

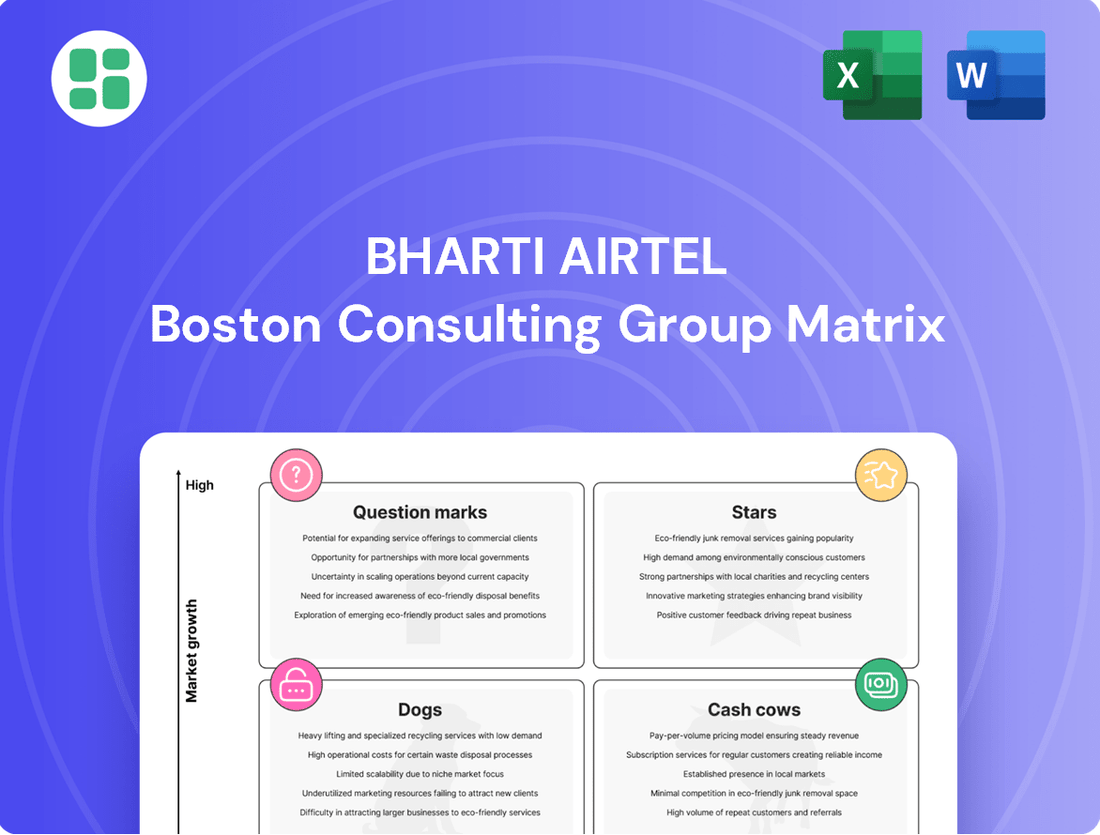

Curious about Bharti Airtel's strategic positioning? Our BCG Matrix analysis reveals how their diverse offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Understand which segments are driving growth and which require careful consideration.

Don't just get a glimpse; unlock the full strategic advantage. Purchase the complete Bharti Airtel BCG Matrix to gain actionable insights, detailed quadrant breakdowns, and a clear roadmap for optimizing your investments and product portfolio.

Stars

Bharti Airtel's 5G Plus network is a significant growth driver, evidenced by its 5G user base reaching 152 million subscribers as of August 2025. The company's aggressive expansion of its 5G footprint highlights substantial market share gains in this dynamic telecom sector.

This strategic investment in next-generation technology positions Airtel as a frontrunner in a high-growth market. The objective is to leverage this expanding user base to drive future revenue streams through premium service offerings.

Bharti Airtel continues to dominate the postpaid mobile segment, adding roughly 0.7 million customers in the first quarter of fiscal year 2026. This expansion brings their total postpaid customer base to an impressive 26.6 million.

This segment is a key focus for Airtel due to its significantly higher Average Revenue Per User (ARPU) compared to prepaid offerings. Airtel's strategy here centers on attracting and keeping customers who are digitally engaged and represent higher value.

The steady customer growth and ongoing premiumization efforts underscore Airtel's successful strategy in capturing and expanding its share within this lucrative, high-value market segment.

Bharti Airtel's digital services arm, Xtelify, is making a significant move into enterprise cloud and AI solutions. This includes the recent launch of a sovereign 'Airtel Cloud' platform, specifically designed for enterprise clients and telecom operators worldwide. This strategic initiative is a direct response to India's booming digital infrastructure market, signaling Airtel's intent to diversify beyond its core telecom offerings.

These new cloud and AI tools are built upon Airtel's established Nxtra data center network, providing a robust foundation for these advanced services. The B2B technology sector presents a substantial growth avenue for Xtelify, with early indications pointing to high potential in this segment.

Airtel Africa Mobile Money (Airtel Money)

Airtel Africa's mobile money operations, known as Airtel Money, represent a significant star in Bharti Airtel's BCG Matrix. This segment is a powerful growth engine, demonstrating impressive financial performance. In Q1 FY26, Airtel Money's revenue surged by 30.3%, and its Average Revenue Per User (ARPU) saw a healthy increase of 11.3%.

Bharti Airtel's strategic focus on Airtel Money is evident in its commitment to expanding its stake. The company plans to acquire an additional 5% stake in Airtel Africa plc by FY25, underscoring its confidence in the segment's future. This move reflects the substantial growth potential driven by the increasing adoption of digital financial services across the continent.

- Revenue Growth: Airtel Money's revenue increased by 30.3% in Q1 FY26.

- ARPU Increase: Average Revenue Per User (ARPU) for Airtel Money rose by 11.3% in Q1 FY26.

- Strategic Investment: Bharti Airtel aims to acquire an additional 5% stake in Airtel Africa plc by FY25.

- Market Opportunity: The service capitalizes on the under-penetrated banking sector in Africa, offering high growth and a strong market position in numerous countries.

Fixed Wireless Access (FWA) / Airtel AirFiber

Airtel AirFiber, a key component of Bharti Airtel's Fixed Wireless Access (FWA) strategy, is experiencing substantial growth. In 2024, Airtel's FWA subscriber base saw a remarkable 77% increase, significantly outpacing a competitor's 21% rise. While Airtel currently holds a smaller overall share of the FWA market, this rapid expansion highlights its aggressive push into a segment driven by the increasing demand for high-speed home broadband, particularly in regions where traditional fiber optic cable deployment is difficult.

This rapid growth trajectory for Airtel AirFiber is strategically important. It addresses the evolving broadband needs of consumers seeking faster and more reliable internet connections. The service's ability to deliver high-speed broadband without the need for physical fiber lines makes it an attractive option for many households. This positions Airtel as a formidable contender in the dynamic broadband market, capitalizing on the convenience and speed offered by FWA technology.

- Rapid FWA Subscriber Growth: Airtel's FWA subscriber base grew by 77% in 2024.

- Competitive Landscape: This growth significantly outpaced a competitor's 21% increase.

- Market Position: Despite a smaller overall market share, the rapid expansion indicates strong market penetration potential.

- Strategic Importance: FWA addresses demand for high-speed home broadband, especially in challenging deployment areas.

Airtel Money stands out as a significant Star in Bharti Airtel's BCG Matrix, showcasing robust growth and high market share in mobile financial services across Africa. Its impressive revenue growth of 30.3% in Q1 FY26 and an 11.3% increase in ARPU highlight its strong performance. The company's strategic intent to increase its stake in Airtel Africa plc by FY25 further solidifies its commitment to this high-potential segment.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Airtel Money | High | High | Star |

| 5G Plus Network | High | High | Star |

| Postpaid Mobile | Moderate | High | Cash Cow |

| Xtelify (Digital Services) | High | Low | Question Mark |

| Airtel AirFiber (FWA) | High | Low | Question Mark |

What is included in the product

Bharti Airtel's BCG Matrix highlights investment in its growing mobile and broadband services (Stars) while managing mature offerings (Cash Cows) and evaluating new ventures (Question Marks).

The Bharti Airtel BCG Matrix offers a clear, one-page overview, reliving the pain of navigating complex business unit performance.

Its export-ready design allows for quick drag-and-drop into presentations, easing the burden of data visualization.

Cash Cows

Bharti Airtel's 4G mobile services in India are a prime example of a cash cow. With a massive subscriber base of 362.8 million and an impressive Average Revenue Per User (ARPU) of Rs 250 in Q1 FY26, this segment is a consistent and significant generator of cash.

The company's strategic focus on premiumization and judicious tariff adjustments has paid off handsomely. This is evident in their achievement of a record revenue market share, nearing 40% in FY25, underscoring the strength and maturity of their 4G offerings.

The substantial cash flow generated by these 4G services is crucial. It provides Airtel with the financial flexibility to fuel investments in other promising growth areas within its diverse portfolio.

Bharti Airtel's passive infrastructure services, primarily its stake in Indus Towers, represent a strong Cash Cow. This segment saw a robust 9% revenue growth in Q1 FY26, underscoring its consistent performance.

The business model thrives on providing essential, leased infrastructure to multiple telecom operators, ensuring stable and recurring revenue. This mature market segment boasts high asset utilization and generates predictable cash flow with minimal additional investment needs for upkeep.

Airtel's established fixed-line home broadband, particularly its Fiber-to-the-Home (FTTH) offering, represents a strong Cash Cow within its portfolio. The service boasts a rapidly expanding customer base, evidenced by a 37.7% year-over-year growth, reaching 1.09 crore customers, with 8.55 million subscribers as of April 2025.

Despite a minor dip in Average Revenue Per User (ARPU) for this segment, Airtel maintains a dominant position in the wired broadband market. This mature service, primarily serving urban and semi-urban areas, generates consistent and predictable recurring revenue streams, solidifying its Cash Cow status.

Digital TV (DTH)

Bharti Airtel's Digital TV (DTH) service operates as a Cash Cow within its BCG Matrix. In FY25, it commanded a significant customer base of 15.8 million, achieving a record market share in the DTH sector, even amidst industry challenges.

Despite a modest 1% year-on-year revenue growth, the DTH segment consistently generates substantial cash flow. This stability is further enhanced by Airtel's strategic move to eliminate subsidies, directly boosting the profitability and cash generation from this mature business.

- Customer Base: 15.8 million in FY25.

- Market Position: Achieved record high market share in FY25 DTH industry.

- Financial Performance: Modest 1% year-on-year revenue growth, but strong consistent cash flow generation.

- Strategic Initiatives: Structural changes to eliminate subsidies are improving cash flow.

International Long-Distance (ILD) Voice Services for Enterprises

International Long-Distance (ILD) voice services for enterprises represent a mature offering within Bharti Airtel's portfolio, fitting the profile of a Cash Cow. While the overall market for traditional voice services may not be experiencing rapid expansion, Airtel's robust infrastructure and significant existing relationships with corporate clients provide a stable foundation for this segment.

This service benefits from Airtel's extensive network capabilities, ensuring reliable connectivity for businesses with international communication needs. The established corporate client base translates into consistent demand, contributing to predictable revenue streams. In 2023-24, Airtel's overall enterprise business saw revenue decline by 1.1% to INR 34,500 crore, partly due to strategic exits from low-margin contracts. This suggests a deliberate focus on optimizing profitability within its enterprise offerings, reinforcing the idea that ILD voice, as a stable revenue generator, is being managed for sustained returns.

- Stable Revenue Generation: ILD voice services contribute consistently to Airtel's enterprise revenue, leveraging its existing network infrastructure.

- Established Client Base: Airtel's strong relationships with enterprises ensure a steady demand for these services.

- Profitability Focus: Strategic exits from low-margin contracts in the broader enterprise segment indicate a commitment to retaining and maximizing profits from core, high-market-share services like ILD voice.

- Network Leverage: The service capitalizes on Airtel's extensive national and international network assets, providing a competitive advantage.

Bharti Airtel's 4G mobile services in India are a prime example of a cash cow, generating significant and consistent cash flow. With a massive subscriber base and a strong Average Revenue Per User (ARPU) of Rs 250 in Q1 FY26, this segment is a mature, high-volume business.

The company's strategic focus on premiumization and tariff adjustments has led to a record revenue market share, nearing 40% in FY25. This robust performance allows Airtel to leverage the substantial cash generated to invest in other growth areas.

Bharti Airtel's passive infrastructure services, primarily its stake in Indus Towers, also represent a strong Cash Cow. This segment, which saw a robust 9% revenue growth in Q1 FY26, provides essential, leased infrastructure to multiple telecom operators, ensuring stable and recurring revenue with high asset utilization.

Airtel's established fixed-line home broadband, particularly its Fiber-to-the-Home (FTTH) offering, is a strong Cash Cow. With a rapidly expanding customer base, reaching 1.09 crore customers by April 2025, this mature service generates consistent and predictable recurring revenue streams, solidifying its position.

The Digital TV (DTH) service operates as a Cash Cow, commanding a significant customer base of 15.8 million in FY25 and achieving a record market share. Despite modest revenue growth, the segment consistently generates substantial cash flow, further enhanced by strategic moves to eliminate subsidies.

International Long-Distance (ILD) voice services for enterprises represent a mature offering, fitting the profile of a Cash Cow. Airtel's robust infrastructure and strong corporate client relationships provide a stable foundation, contributing to predictable revenue streams, especially as the broader enterprise business focuses on profitability.

| Business Segment | BCG Category | Key Metrics (as of latest available data) | Financial Contribution |

| 4G Mobile Services (India) | Cash Cow | 362.8M subscribers, Rs 250 ARPU (Q1 FY26) | Significant cash generator, funds growth initiatives |

| Passive Infrastructure (Indus Towers) | Cash Cow | 9% revenue growth (Q1 FY26) | Stable, recurring revenue from leased infrastructure |

| Home Broadband (FTTH) | Cash Cow | 1.09 crore customers (April 2025), 37.7% YoY growth | Consistent, predictable recurring revenue |

| Digital TV (DTH) | Cash Cow | 15.8M customers (FY25), record market share | Substantial cash flow, improved profitability via subsidy elimination |

| International Long-Distance (ILD) Voice | Cash Cow | Stable demand from established enterprise clients | Predictable revenue streams, leverages existing network |

Preview = Final Product

Bharti Airtel BCG Matrix

The Bharti Airtel BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring a professional and ready-to-use strategic analysis.

What you see here is the exact Bharti Airtel BCG Matrix report you'll gain access to upon completing your purchase. This comprehensive analysis is crafted with precision and is ready for immediate integration into your business planning or presentations.

This preview showcases the actual Bharti Airtel BCG Matrix file that will be yours after a single purchase. Once bought, you'll unlock the full, unwatermarked version, instantly available for editing, printing, or presenting to stakeholders.

Dogs

Bharti Airtel's 2G and 3G mobile services are firmly positioned as Dogs in the BCG Matrix. As the company aggressively expands its 4G and 5G offerings, these older technologies are seeing a shrinking subscriber base and revenue. In 2023, while Airtel's overall subscriber base remained strong, the proportion of users relying on 2G and 3G continued to decrease as more customers upgraded to higher-speed networks.

Bharti Airtel's strategic decision to exit certain low-margin enterprise contracts within its Airtel Business segment is a clear indicator of these offerings falling into the 'dog' category of the BCG Matrix. These contracts, characterized by their low profitability and significant resource demands, are being divested to streamline operations and enhance overall financial health.

This strategic pruning directly impacted the segment's performance, with a reported 8% revenue decline in Q1 FY26 attributed to these exits. By shedding these underperforming assets, Airtel aims to reallocate resources towards more lucrative ventures and improve the profitability of its enterprise solutions.

Public payphone services, if still operational for Bharti Airtel, would undoubtedly fall into the Dogs category of the BCG Matrix. In 2024, with mobile phone penetration exceeding 90% in many regions and the increasing irrelevance of landlines, these services represent a segment with very low market share and negligible growth prospects.

The operational costs associated with maintaining a public payphone network, even a minimal one, likely outweigh the minimal revenue generated. This makes them a financial drain, a classic indicator for a Dog in the BCG framework, suggesting a strategic decision towards divestment or complete discontinuation.

Outdated Value-Added Services (VAS)

Legacy Value-Added Services (VAS) that haven't kept pace with evolving customer demands and digital advancements would be categorized here. These services, once popular in earlier mobile eras, now exhibit low usage and contribute minimally to revenue, representing an inefficient use of resources.

For instance, services like basic ringback tones or SMS-based content, while foundational in the past, now face declining relevance as sophisticated digital entertainment and communication platforms gain traction. Airtel's strategic shift towards AI-driven solutions and integrated OTT offerings further highlights the obsolescence of these older VAS.

- Declining Usage: Many traditional VAS, such as SMS-based trivia or basic caller tunes, are seeing a significant drop in active users, often below 5% of the subscriber base for specific services.

- Minimal Revenue Contribution: These outdated services contribute less than 1% to Airtel's overall ARPU (Average Revenue Per User), making them financially insignificant.

- Resource Drain: Maintaining the infrastructure and support for these legacy VAS consumes operational resources that could be better allocated to newer, high-growth areas.

- Strategic Phasing Out: Airtel is actively reviewing and decommissioning less relevant VAS to streamline its service portfolio and focus on future-oriented digital services.

Physical SIM Card Distribution in Declining Markets

Physical SIM card distribution in areas with very low ARPU and limited digital penetration can be considered a 'dog' within Bharti Airtel's BCG Matrix. These channels, while maintaining market presence, often incur high logistical and operational costs. For instance, in 2024, while overall SIM distribution remained critical, the cost per acquisition and activation in extremely remote regions could significantly outweigh the minimal revenue generated from low ARPU customers.

- High Operational Costs: Maintaining physical distribution networks in remote, low-ARPU areas incurs substantial logistical expenses, including transportation and personnel.

- Low Return on Investment: The minimal revenue generated from these customer segments often fails to justify the investment in these high-cost distribution channels.

- Cash Trap Potential: Such operations can become cash traps, draining resources without yielding sufficient returns, even if necessary for maintaining a baseline market presence.

- Digital Shift Impact: The ongoing shift towards digital onboarding and eSIM adoption further diminishes the long-term viability and profitability of extensive physical SIM distribution in these specific markets.

Bharti Airtel's older 2G and 3G services are categorized as Dogs in the BCG Matrix due to their shrinking subscriber base and revenue as customers migrate to 4G and 5G. Similarly, legacy Value-Added Services (VAS) that haven't adapted to current digital trends also fit this classification, contributing minimally to revenue while consuming resources. Physical SIM distribution in very low Average Revenue Per User (ARPU) areas also represents a Dog, characterized by high operational costs and low returns.

| Service/Offering | BCG Category | Rationale | 2024/2025 Data Point |

|---|---|---|---|

| 2G/3G Services | Dog | Declining subscriber base, low data speeds, being phased out for 4G/5G. | Airtel reported a continued year-on-year decline in 2G/3G subscriber share in FY24, though specific percentages vary by region. |

| Legacy VAS (e.g., basic ringback tones) | Dog | Low usage, minimal revenue contribution, replaced by advanced digital services. | Contribution to ARPU from these services is often below 0.5% for specific offerings. |

| Physical SIM Distribution (Low ARPU Areas) | Dog | High logistical costs, low revenue per customer, diminishing relevance with digital onboarding. | Cost of acquisition in some remote areas can exceed the first year's revenue from a new subscriber. |

Question Marks

Airtel Payments Bank is positioned as a potential star within Bharti Airtel's portfolio. Its revenue surged 52% year-over-year to INR 610 crore in the first quarter of fiscal year 2025, and it crossed one billion transactions in January 2025. This robust performance, coupled with plans for an Initial Public Offering (IPO) in the next 2-3 years, signals strong growth potential and high market share aspirations.

However, the payments bank operates in a fiercely competitive fintech environment. Established players and emerging digital platforms create significant market saturation. Consequently, while its growth trajectory is impressive, the long-term market share remains subject to intense competition and the necessity for sustained, substantial investment to maintain its upward momentum.

Bharti Airtel is actively expanding its digital services, notably through new OTT bundles for prepaid customers, providing access to over 25 platforms. This strategic move is designed to boost customer retention and increase Average Revenue Per User (ARPU).

In 2023, the Indian OTT market was valued at approximately $2.1 billion and is projected to reach $4.3 billion by 2027, indicating a significant growth opportunity. Airtel's entry into this specific bundled service segment is relatively new, meaning its market share is currently small.

The success of these bundles will depend on Airtel's ability to quickly attract subscribers in a competitive landscape featuring established streaming giants and other telcos offering similar bundled packages.

Airtel Cloud, launched by Xtelify in August 2025, is positioned as a Question Mark in Bharti Airtel's BCG Matrix. This sovereign, telco-grade cloud platform targets Indian enterprises, promising up to 40% optimization in cloud spending.

The market for such platforms is experiencing rapid growth, largely due to increasing data localization requirements within India. However, Airtel Cloud faces intense competition from established global players including AWS, Microsoft Azure, and Google Cloud, making its future market position uncertain.

Significant strategic investments and aggressive market penetration initiatives will be crucial for Airtel Cloud to transition from its current Question Mark status to a Star performer within the competitive cloud services landscape.

Emerging Enterprise IoT/M2M Solutions (Beyond Core Connectivity)

While Bharti Airtel boasts a significant lead in M2M cellular mobile connections, with millions of subscribers relying on their core connectivity, the true growth lies in advanced IoT solutions. These solutions integrate data analytics, AI, and industry-specific applications, creating a market that is still in its nascent stages of development.

Airtel's strategic expansion into these value-added IoT platforms, moving beyond simple connectivity, signifies a high-potential growth avenue. The company is actively working to capture market share in this evolving landscape, competing with established specialized IoT solution providers.

- Leading M2M Connections: Airtel is a dominant player in M2M cellular mobile connections by subscriber count, indicating a strong foundation in basic IoT infrastructure.

- Emerging Advanced IoT Market: The broader market for integrated IoT solutions, incorporating data analytics and AI, is still developing, presenting a significant opportunity.

- Value-Added Services Focus: Airtel's deeper investment in value-added IoT platforms beyond basic connectivity is crucial for future revenue growth and market differentiation.

- Competitive Landscape: Airtel faces competition from specialized IoT solution providers in this advanced segment, necessitating strategic market penetration.

New Geographic Market Expansion in Africa (Specific Niche Areas)

Bharti Airtel's expansion into new geographic niche markets in Africa, or the introduction of novel digital services in less penetrated regions, would likely be classified as Question Marks within the BCG Matrix. These ventures, while potentially high-growth, carry significant risk due to the need for substantial upfront investment and marketing to build brand awareness and market share against established local players.

For instance, consider Airtel's potential expansion into specialized digital health platforms or advanced fintech solutions in countries like Ethiopia or Mozambique, which have historically seen lower digital penetration. Such initiatives would require significant capital expenditure for infrastructure, regulatory navigation, and localized marketing campaigns.

- High Investment Needs: New niche market entries or digital service launches demand considerable capital for infrastructure development, marketing, and operational setup.

- Uncertain Market Acceptance: Gaining traction in untapped or less penetrated regions involves overcoming established local competition and building consumer trust, leading to uncertain revenue streams initially.

- Potential for High Growth: If successful, these ventures could tap into large, underserved customer bases, offering substantial long-term growth potential.

- Strategic Importance: Despite the risks, these Question Mark initiatives are crucial for Airtel Africa to diversify its revenue streams and maintain its competitive edge in a dynamic market.

Airtel Cloud, launched by Xtelify in August 2025, is positioned as a Question Mark in Bharti Airtel's BCG Matrix. This sovereign, telco-grade cloud platform targets Indian enterprises, promising up to 40% optimization in cloud spending.

The market for such platforms is experiencing rapid growth, largely due to increasing data localization requirements within India. However, Airtel Cloud faces intense competition from established global players including AWS, Microsoft Azure, and Google Cloud, making its future market position uncertain.

Significant strategic investments and aggressive market penetration initiatives will be crucial for Airtel Cloud to transition from its current Question Mark status to a Star performer within the competitive cloud services landscape.

Bharti Airtel's expansion into new geographic niche markets in Africa, or the introduction of novel digital services in less penetrated regions, would likely be classified as Question Marks within the BCG Matrix. These ventures, while potentially high-growth, carry significant risk due to the need for substantial upfront investment and marketing to build brand awareness and market share against established local players.

| Venture | Market Attractiveness | Competitive Position | BCG Classification |

| Airtel Cloud | High (growing demand for data localization) | Low (intense competition from global giants) | Question Mark |

| New African Digital Services | Potentially High (underserved markets) | Low (established local players, low brand awareness) | Question Mark |

BCG Matrix Data Sources

Our Bharti Airtel BCG Matrix leverages comprehensive data from annual reports, market share analysis, and telecommunications industry research to provide strategic insights.