Air France-KLM PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air France-KLM Bundle

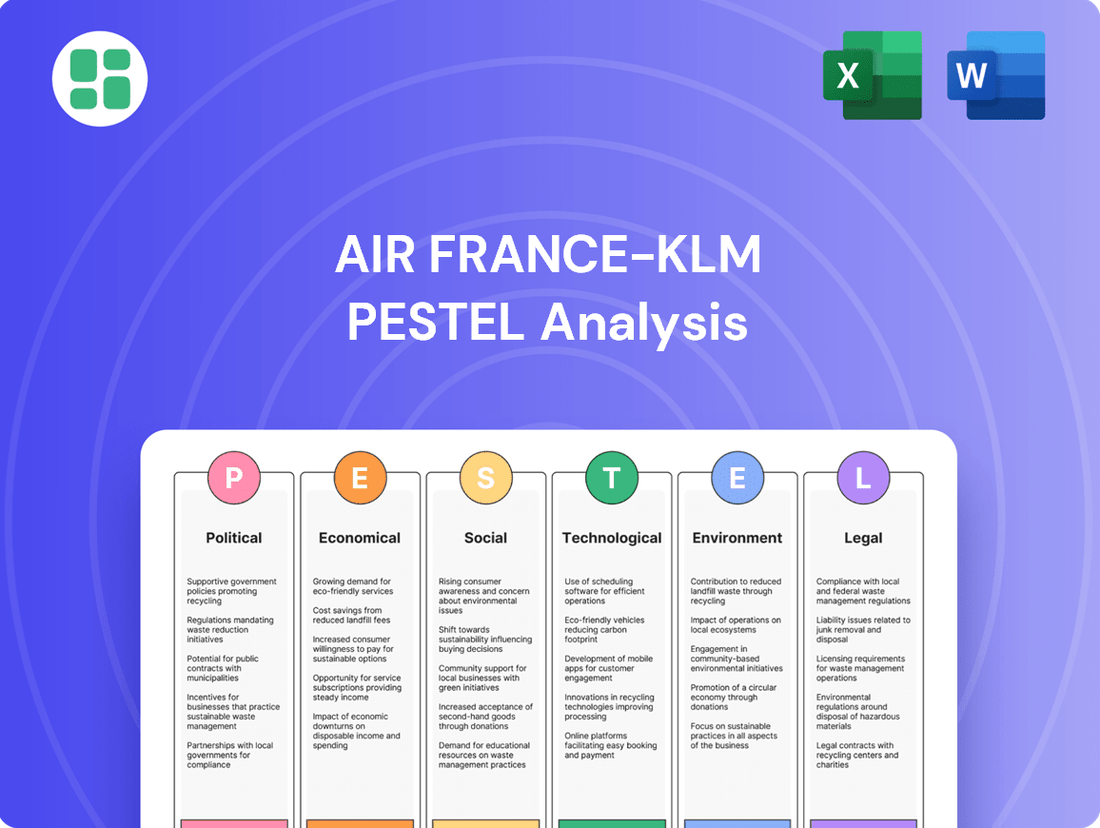

Navigate the complex global landscape impacting Air France-KLM with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are redefining the airline industry. Gain a strategic advantage by uncovering critical external factors influencing Air France-KLM's operations and future growth. Download the full PESTLE analysis now for actionable intelligence to inform your own market strategy.

Political factors

As a flag carrier, Air France-KLM faces considerable government influence, particularly concerning state aid and bailout policies. These interventions can significantly sway strategic choices and financial health. For instance, the French government's stake in Air France, around 29% as of early 2024, means national interests often guide capital allocation and route planning, affecting operational freedom.

Air France-KLM's extensive global operations are fundamentally shaped by bilateral air service agreements (BASAs) between nations. These agreements are the bedrock that permits the airline to fly specific routes, determine flight frequencies, and access markets, directly impacting its network's reach and revenue potential. For instance, as of early 2024, many of these agreements are being reviewed or renegotiated in light of evolving global trade dynamics and national aviation policies.

Geopolitical realignments and trade discussions can significantly alter the landscape for Air France-KLM. A favorable shift in a BASA might unlock access to a previously underserved, high-demand market, boosting passenger and cargo revenue. Conversely, restrictive changes could limit capacity or even lead to the suspension of certain routes, impacting profitability and competitive positioning. The airline must therefore remain agile in adapting to these international accord adjustments.

Air France-KLM's participation in the SkyTeam alliance is crucial for its global network, but these collaborations are subject to regulatory oversight. Antitrust reviews by authorities like the European Commission can shape the terms of these partnerships. For instance, the recent increase in Air France-KLM's stake in SAS, a fellow SkyTeam member, would have undergone such scrutiny.

Trade Policies and Geopolitical Tensions

Global trade policies, including tariffs and sanctions, alongside escalating geopolitical tensions, significantly impact Air France-KLM. These factors can disrupt air cargo volumes and passenger demand, especially on crucial long-haul routes. For example, avoiding specific airspaces due to ongoing conflicts, such as the continued closure of Russian airspace for many European carriers, directly increases flight times and operational costs, thereby affecting route profitability.

These political dynamics create substantial uncertainty for airlines, demanding agile and flexible operational strategies to navigate the evolving global landscape. The ability to adapt routes and manage costs in response to geopolitical shifts is paramount for maintaining competitiveness.

- Trade Policy Impact: Tariffs and trade disputes can reduce international business travel and cargo demand, a key revenue stream for carriers like Air France-KLM.

- Geopolitical Risk: Conflicts and political instability can lead to airspace closures, extending flight times and increasing fuel consumption, as seen with the ongoing restrictions related to Russian airspace, which add an average of 1-2 hours to flights between Europe and Asia.

- Regulatory Uncertainty: Shifting government regulations concerning emissions, security, and market access can impose additional compliance costs and operational constraints.

Subsidies and Environmental Policy Pressure

Governments are increasingly pushing for greener aviation through regulations and carbon pricing. For instance, the EU Emissions Trading System (ETS) and the ReFuelEU Aviation Regulation are driving the adoption of Sustainable Aviation Fuel (SAF). These policies, while crucial for environmental goals, can raise operational expenses for airlines like Air France-KLM, though they may also unlock subsidies for green investments.

Air France-KLM is proactively addressing these environmental policy pressures. The company is actively forging partnerships for SAF procurement and investing in modernizing its fleet. This strategic approach aims to ensure compliance with evolving regulations and capitalize on potential support for sustainable aviation initiatives, demonstrated by their commitment to increasing SAF usage.

- EU ETS and ReFuelEU Aviation: Mandating SAF use and carbon pricing.

- Cost Implications: Potential for increased operational costs due to SAF premiums.

- Subsidy Opportunities: Access to government funding for green technologies and SAF production.

- Air France-KLM Strategy: Focus on SAF partnerships and fleet renewal to meet environmental targets.

Government influence is a significant political factor for Air France-KLM, particularly through state ownership and national interests. The French state's substantial stake, around 29% in early 2024, means strategic decisions often align with national priorities, affecting operational autonomy and investment choices.

Bilateral Air Service Agreements (BASAs) are critical, dictating routes and market access, directly impacting Air France-KLM's network reach and revenue. These agreements are constantly being reviewed, reflecting evolving global trade and national aviation policies.

Geopolitical shifts and trade policies profoundly influence Air France-KLM. Conflicts can lead to airspace closures, increasing flight times and costs, as seen with the ongoing restrictions over Russian airspace, which add significant hours to Europe-Asia routes.

Regulatory frameworks, including those governing alliances like SkyTeam, are subject to oversight, potentially shaping partnership terms. For instance, increased stakes in fellow alliance members would face antitrust scrutiny from bodies like the European Commission.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Air France-KLM, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and opportunities.

A concise, actionable summary of the Air France-KLM PESTLE analysis, presented in an easily digestible format, alleviates the pain of sifting through lengthy reports, enabling faster strategic decision-making.

Economic factors

Fluctuations in global jet fuel prices are a critical economic factor for Air France-KLM, as fuel represents a substantial portion of its operating expenses. For instance, in 2023, jet fuel costs were a significant driver of airline expenses globally, with prices experiencing considerable swings throughout the year influenced by geopolitical events and supply-demand dynamics.

While Air France-KLM employs hedging strategies to mitigate the impact of price volatility, prolonged instability can compress profit margins. This necessitates continuous adaptation of ticket pricing and route planning to maintain financial health. The airline group's financial reports consistently highlight fuel expenditure as a primary cost component.

The health of the global economy is a major driver for Air France-KLM. When economies are strong, people and businesses tend to travel more, which directly benefits airlines. This means more passengers on planes and more goods being shipped by air cargo.

In 2024, global GDP growth is projected to be around 2.7%, with a slight uptick to 2.8% in 2025 according to IMF estimates. For Europe specifically, the forecast suggests a GDP growth of 1.7% in 2025, a modest improvement from the 1.5% expected in 2024, indicating a potentially more favorable environment for travel demand.

Conversely, economic slowdowns or recessions can significantly dampen travel. Reduced consumer spending and corporate budget cuts often translate to fewer leisure trips and less business travel. This directly impacts Air France-KLM's load factors and overall profitability.

Air France-KLM’s global operations mean it’s significantly exposed to exchange rate volatility. As a substantial portion of its expenses, particularly fuel and aircraft acquisition, are denominated in US dollars, a strengthening Euro can provide some cost relief. For instance, in early 2024, the Euro's relative strength against the dollar offered a partial buffer against rising energy prices.

However, adverse currency movements can quickly erode profitability. If the Euro weakens against the dollar, the cost of dollar-priced inputs like jet fuel will rise, directly impacting operating expenses and potentially leading to lower reported earnings. The airline group actively manages this risk through hedging strategies, but significant fluctuations can still affect its financial performance.

Consumer Discretionary Spending

Consumer confidence and disposable income are paramount for Air France-KLM, as they directly fuel demand for leisure travel. When consumers feel financially secure and have more money left after essential expenses, they are more likely to book flights and holidays.

Economic headwinds like inflation and rising interest rates can significantly impact travel budgets. For instance, a persistent inflation rate of 3.5% in the Eurozone during early 2024, as reported by Eurostat, squeezes disposable income, potentially leading travelers to opt for cheaper alternatives or postpone trips. This could shift demand towards economy class or reduce overall travel frequency.

Air France-KLM's strategic focus on premiumization is designed to capture spending from consumers with higher discretionary income. This segment is less sensitive to minor economic fluctuations and more inclined to spend on enhanced travel experiences, supporting the airline's higher-yield offerings.

- Consumer Confidence: Eurozone consumer confidence index showed a gradual improvement in early 2024, though remaining below historical averages.

- Disposable Income: Real disposable income growth in key European markets is projected to be modest in 2024, impacting discretionary spending capacity.

- Inflation Impact: Continued inflation, even if moderating, erodes purchasing power for non-essential expenditures like air travel.

- Premium Segment Focus: Air France-KLM's investment in its La Première and Business cabins targets a clientele with substantial discretionary spending power.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Air France-KLM, potentially increasing operational expenses. This includes higher costs for essential components like labor, aircraft maintenance, and airport landing fees. For instance, the Eurozone inflation rate was 2.4% in April 2024, and while showing signs of easing, persistent inflationary pressures can still impact profitability.

Furthermore, the prevailing higher interest rate environment directly affects Air France-KLM's financial strategy. Increased borrowing costs can make ambitious projects, such as fleet modernization or acquiring new aircraft, more expensive. This impacts the company's financial leverage and the feasibility of its long-term investment plans. As of May 2024, the European Central Bank's key interest rates remain elevated, reflecting ongoing efforts to control inflation.

Air France-KLM itself has acknowledged these headwinds. The company has projected a slight increase in its unit costs for 2025, directly attributing this forecast to ongoing inflationary pressures. This forward-looking statement underscores the direct impact of the macroeconomic environment on the airline's cost structure and financial outlook.

- Inflationary Impact: Increased costs for labor, maintenance, and airport charges due to rising inflation.

- Interest Rate Sensitivity: Higher borrowing costs for capital expenditures like fleet upgrades, affecting financial leverage.

- Company Outlook: Air France-KLM anticipates a slight rise in unit costs in 2025, driven by inflationary pressures.

- Economic Context: Eurozone inflation at 2.4% in April 2024, with elevated European Central Bank interest rates influencing borrowing costs.

The economic landscape significantly shapes Air France-KLM's performance, with factors like global GDP growth, fuel prices, and currency fluctuations being critical. Projections for 2024 and 2025 indicate modest economic expansion, which should support travel demand, though inflation and interest rates remain key concerns. The airline group’s financial health is intrinsically linked to these macroeconomic trends, necessitating careful cost management and strategic pricing.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Air France-KLM |

|---|---|---|---|

| Global GDP Growth | ~2.7% | ~2.8% | Supports travel demand, higher load factors |

| Eurozone GDP Growth | ~1.5% | ~1.7% | Modest improvement in European travel market |

| Jet Fuel Prices | Volatile, significant cost driver | Continued volatility expected | Compresses profit margins if unhedged |

| Euro vs. USD Exchange Rate | Euro strength offers partial buffer | Potential for adverse movements | Affects cost of dollar-denominated expenses |

| Inflation (Eurozone) | ~2.4% (April 2024) | Expected to moderate but persist | Increases operational costs, erodes disposable income |

| ECB Interest Rates | Elevated | Likely to remain a factor | Increases borrowing costs for capital investments |

Same Document Delivered

Air France-KLM PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Air France-KLM PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline group. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities.

Sociological factors

The post-pandemic era has significantly reshaped travel habits, with a notable surge in leisure travel as people prioritize experiences. This trend presents an opportunity for Air France-KLM to adapt its network and service offerings, perhaps by expanding routes catering to popular holiday destinations and enhancing onboard amenities. For instance, a 2024 report indicated a 15% year-over-year increase in bookings for leisure-focused destinations compared to pre-pandemic levels.

Business travel is also undergoing a potential reshaping, with a greater emphasis on flexibility and value. Airlines like Air France-KLM are observing a shift towards premium cabins for longer journeys, reflecting a desire for comfort and productivity. The airline's 2024 financial reports noted a 10% rise in premium economy bookings, suggesting a growing demand for enhanced travel experiences even in a business context.

Furthermore, a growing awareness of environmental impact is influencing consumer choices, pushing airlines towards more sustainable practices. Air France-KLM's commitment to reducing its carbon footprint, including investments in sustainable aviation fuels, is becoming a key differentiator. By 2025, the airline aims to have 10% of its fuel consumption derived from sustainable sources, a target that resonates with environmentally conscious travelers.

Global demographic shifts, like the burgeoning middle class in Asia and Africa, offer significant growth potential for Air France-KLM. For instance, the International Monetary Fund projected global GDP growth to be around 3.2% in 2024, with emerging markets often driving a substantial portion of this expansion, translating into increased travel demand.

Simultaneously, aging populations in Europe and North America necessitate adapting service offerings to cater to seniors, including enhanced comfort and accessibility. This demographic trend, coupled with increasing global connectivity through digital platforms, requires Air France-KLM to strategically expand its network and forge partnerships to reach these evolving customer segments effectively.

Public perception of health and safety is a critical driver for Air France-KLM, especially in the wake of global health events. Maintaining passenger confidence requires constant implementation and clear communication of stringent health and safety measures, ensuring a secure travel experience.

In 2023, Air France-KLM reported a significant improvement in operational performance, with a punctuality rate of 83.7% for Air France and 84.1% for KLM, a key factor in building passenger trust. This focus on reliability directly impacts customer satisfaction and reinforces the airline's commitment to a safe and dependable service.

Cultural Diversity of Workforce and Customers

Air France-KLM's global operations necessitate navigating a rich tapestry of cultural diversity among both its customers and its employees. Effectively managing this diversity, which includes providing multilingual services and ensuring culturally sensitive customer interactions, is paramount for maintaining high levels of customer satisfaction and fostering positive employee relations across its vast network.

The airline group's commitment to inclusivity has been acknowledged, with Forbes naming Air France-KLM among the World's Top Companies for Women and Best Employers in 2024. This recognition underscores the importance of its efforts in creating an environment that respects and leverages its diverse workforce.

- Global Reach, Diverse Clientele: Air France-KLM serves millions of passengers annually from virtually every corner of the globe, requiring a deep understanding of varied cultural norms and expectations in service delivery.

- Multicultural Workforce: The company employs thousands of individuals from numerous nationalities, each bringing unique perspectives and skills that, when harmonized, contribute to operational excellence.

- Inclusivity Initiatives: The 2024 Forbes recognition highlights Air France-KLM's progress in gender diversity and overall employer attractiveness, reflecting a strategic focus on building a representative and equitable workplace.

Public Perception and Brand Reputation

Air France-KLM’s brand reputation is a crucial asset, directly influencing customer acquisition and retention. Public perception is shaped by a multitude of factors, including the quality of service provided, the airline's safety performance, its commitment to environmental sustainability, and the state of its labor relations. Negative press, stemming from issues like labor disputes or significant operational disruptions, can severely damage the brand's image and erode customer loyalty.

For instance, the threat of ground crew strikes in early 2024 highlighted the vulnerability of Air France-KLM's public image. Such events can lead to widespread passenger inconvenience and negative social media coverage, impacting booking decisions. A strong brand reputation, conversely, can command premium pricing and foster a loyal customer base, which is essential in the highly competitive airline industry.

- Brand Reputation Impact: Customer trust and willingness to book are directly tied to public perception.

- Key Influencers: Service quality, safety, environmental efforts, and labor relations are primary drivers of public opinion.

- Negative Publicity Effects: Strikes and operational issues can lead to significant drops in customer loyalty and brand value.

- Competitive Advantage: A positive reputation allows for premium pricing and a stronger market position.

Sociological factors significantly influence Air France-KLM's operations and market positioning. Shifting travel preferences, such as the post-pandemic surge in leisure travel and a greater emphasis on flexibility in business travel, require strategic adaptation of routes and services. For example, a 2024 report indicated a 15% year-over-year increase in bookings for leisure-focused destinations compared to pre-pandemic levels, and the airline noted a 10% rise in premium economy bookings in its 2024 financial reports.

Growing environmental awareness is another key sociological driver, prompting demand for sustainable aviation practices. Air France-KLM's commitment to reducing its carbon footprint, with a target of 10% sustainable fuel consumption by 2025, aligns with these consumer values. Demographic shifts, including the rise of a middle class in emerging markets and aging populations in developed regions, also present opportunities and necessitate tailored service offerings.

Public perception of health and safety remains paramount, as demonstrated by Air France-KLM's punctuality rates of 83.7% for Air France and 84.1% for KLM in 2023, which build passenger confidence. Furthermore, the airline's diverse workforce and customer base demand effective management of cultural nuances, supported by initiatives recognized by Forbes in 2024 for inclusivity and employer attractiveness.

| Sociological Factor | Impact on Air France-KLM | Supporting Data/Observation |

|---|---|---|

| Leisure Travel Surge | Opportunity for route expansion and service enhancement | 15% YoY increase in leisure destination bookings (2024 report) |

| Business Travel Evolution | Demand for premium cabins and flexibility | 10% rise in premium economy bookings (2024 financial reports) |

| Environmental Consciousness | Need for sustainable practices | Target of 10% sustainable fuel consumption by 2025 |

| Demographic Shifts | Growth potential in emerging markets, need for tailored services for seniors | Global GDP growth around 3.2% in 2024, with emerging markets driving expansion (IMF projection) |

| Health & Safety Perception | Crucial for passenger confidence | Punctuality rates of 83.7% (Air France) and 84.1% (KLM) in 2023 |

| Cultural Diversity | Necessity for culturally sensitive service and workforce management | Forbes recognition for World's Top Companies for Women and Best Employers (2024) |

Technological factors

Continuous advancements in aircraft technology are a major technological driver for airlines like Air France-KLM. These innovations, such as more fuel-efficient engines and lighter materials, directly translate to lower operating costs and better environmental performance, which is increasingly important for regulatory compliance and passenger appeal.

Air France-KLM is actively engaged in fleet modernization, with a strategic goal to have 80% of its fleet composed of new-generation aircraft by 2030. This ambitious plan includes the integration of advanced models like the Airbus A350, A321neo, and A220, all of which offer significant improvements in fuel burn and reduced emissions compared to older aircraft.

These substantial investments in new aircraft are not just about environmental responsibility; they are crucial for enhancing operational efficiency. The newer planes typically require less maintenance and offer greater range, allowing for more direct routes and improved passenger comfort, ultimately strengthening Air France-KLM's competitive position in the global aviation market.

Air France-KLM is increasingly leveraging digital technologies to transform its customer experience. This includes enhancing online booking systems, developing intuitive mobile applications, and offering personalized services. For instance, their mobile app allows for seamless check-in and provides real-time flight updates, aiming to boost customer satisfaction and operational efficiency.

The airline group's investment in digital platforms is crucial for streamlining operations and gathering valuable customer data. This data is then used to optimize services, from in-flight entertainment to baggage tracking. By late 2024, a significant portion of Air France-KLM's bookings were expected to originate from digital channels, highlighting the growing importance of this technological shift.

Air France-KLM is leveraging advanced analytics and AI to streamline operations. This includes optimizing flight schedules, managing crew assignments, and enhancing revenue management, all crucial for efficiency in the airline industry.

A key partnership with Google Cloud is focused on implementing AI technologies to boost operational performance and elevate the customer journey. This collaboration aims to harness data for smarter decision-making across the airline's network.

The airline is already utilizing predictive maintenance tools, such as PROGNOS®, to anticipate and address potential equipment failures before they impact flight schedules. This proactive approach helps minimize disruptions and reduce maintenance costs, contributing to overall operational reliability.

Sustainable Aviation Fuel (SAF) Development

The push for Sustainable Aviation Fuel (SAF) is a significant technological driver for airlines like Air France-KLM. SAF is key to reducing aviation's environmental impact, with the industry aiming for ambitious targets. For instance, the EU's ReFuelEU Aviation initiative mandates that fuel suppliers gradually increase the share of SAF blended into aviation fuel, reaching 6% by 2030 and 70% by 2050. This regulatory pressure directly influences airline operational strategies and investment in cleaner fuel technologies.

Air France-KLM is proactively engaging with SAF development, recognizing its strategic importance. The airline has established long-term agreements with major SAF producers, such as TotalEnergies, to secure future supply and drive market growth. These partnerships are essential for meeting evolving environmental regulations and demonstrating a commitment to decarbonization. By actively pursuing these collaborations, Air France-KLM aims to solidify its position as a leader in sustainable aviation practices.

The economic viability and scalability of SAF production remain critical technological challenges. While demand is increasing, the current production capacity and cost of SAF are still significant hurdles. Air France-KLM's commitment to SAF, including its participation in pilot programs and investments in SAF production facilities, signals a belief in the long-term potential of these cleaner fuels. The airline's strategy is to not only use SAF but also to help shape its future availability and affordability.

Key aspects of SAF development impacting Air France-KLM include:

- Increased SAF Mandates: Regulations like the EU's ReFuelEU Aviation are creating a guaranteed market for SAF, incentivizing production and adoption.

- Supplier Partnerships: Securing long-term agreements with SAF producers ensures supply and supports the growth of the SAF market.

- Technological Advancements: Ongoing research and development in SAF production methods are crucial for improving efficiency and reducing costs.

- Carbon Footprint Reduction: SAF offers a direct pathway for airlines to significantly lower their greenhouse gas emissions, aligning with sustainability goals.

Cybersecurity Threats

Air France-KLM, as a deeply digitalized enterprise, confronts escalating cybersecurity threats. These risks encompass potential data breaches impacting millions of passengers and disruptions to mission-critical IT systems that underpin flight operations and customer service. The airline group's ongoing investments reflect the critical need to safeguard sensitive information and maintain operational resilience.

Protecting passenger data and ensuring uninterrupted operations are paramount for Air France-KLM. The company's commitment to robust cybersecurity measures is not just a compliance issue but a fundamental requirement for maintaining customer trust and business continuity. Recent reports highlight the aviation sector as a prime target for cyberattacks, underscoring the urgency of these investments.

- Increased Sophistication of Attacks: Cybercriminals are developing more advanced methods to breach corporate defenses.

- Data Breach Impact: A significant data breach could lead to substantial financial penalties and severe reputational damage for Air France-KLM.

- Operational Disruption Costs: Downtime in IT systems can halt flights, leading to direct revenue loss and passenger inconvenience.

- Ongoing Security Investment: Air France-KLM continually allocates resources to upgrade its IT infrastructure and bolster its cybersecurity defenses to counter evolving threats.

Technological advancements are reshaping Air France-KLM's operations and customer engagement. The airline is prioritizing fleet modernization, aiming for 80% of its fleet to be new-generation aircraft by 2030, including models like the Airbus A350 and A220, which offer improved fuel efficiency and reduced emissions.

Digital transformation is a key focus, with investments in enhanced online booking systems and mobile applications to improve customer experience and operational efficiency. By late 2024, a significant portion of bookings were expected to come from digital channels.

The airline is also leveraging advanced analytics and AI, including a partnership with Google Cloud, to optimize flight schedules, crew management, and revenue. Predictive maintenance tools are in use to minimize disruptions and reduce costs.

Sustainable Aviation Fuel (SAF) is a critical technological area, with the EU's ReFuelEU Aviation initiative mandating a gradual increase in SAF blending. Air France-KLM is securing SAF supply through long-term agreements with producers like TotalEnergies.

Cybersecurity remains a significant technological challenge, with ongoing investments to protect passenger data and critical IT systems from increasingly sophisticated attacks, ensuring operational resilience and customer trust.

Legal factors

Air France-KLM operates under stringent aviation safety regulations, primarily overseen by the European Union Aviation Safety Agency (EASA). These rules dictate everything from aircraft maintenance schedules and pilot proficiency checks to the intricate systems of air traffic control. Adherence to these evolving standards is paramount, necessitating ongoing financial commitments to training programs, advanced safety equipment, and robust safety management frameworks.

For instance, EASA's continuous updates to airworthiness directives and operational procedures require airlines to adapt swiftly. In 2024, the agency continued its focus on enhancing cybersecurity measures for aviation systems, a significant area of investment for carriers like Air France-KLM. Furthermore, regulatory shifts impacting ground handling procedures, such as those addressing baggage handling and passenger boarding, directly influence operational efficiency and costs.

Air France-KLM's strategic moves, including acquisitions and alliances, face rigorous scrutiny under competition laws and anti-trust regulations globally. These rules are in place to ensure a level playing field and prevent any single entity from gaining excessive market power.

For instance, any potential majority stake in SAS, as discussed in recent years, would require approval from competition authorities like the European Commission. These bodies assess whether such a deal could harm consumers through reduced choice or higher prices, a critical consideration for a major player like Air France-KLM.

Regulations like EU261 significantly impact Air France-KLM by mandating compensation for denied boarding, cancellations, or substantial delays. For instance, in 2023, airlines operating in the EU faced numerous claims under this regulation, underscoring the financial exposure. Compliance demands streamlined operations and strong customer support to avoid penalties and protect brand image.

Labor Laws and Union Negotiations

Air France-KLM navigates a complex web of labor laws in both France and the Netherlands, necessitating constant engagement with multiple employee unions representing pilots, ground staff, and cabin crew. These ongoing negotiations over workload and compensation are crucial for operational stability. For instance, in early 2024, KLM faced threats of strike action from ground staff over wage demands, highlighting the potential for significant financial and operational disruption.

Labor disputes and potential strike actions represent a persistent risk for Air France-KLM, capable of causing substantial operational disruptions and financial losses. The company's financial performance is directly impacted by the outcomes of these negotiations and the frequency of industrial action.

- Complex Legal Frameworks: Operating under distinct labor regulations in France and the Netherlands.

- Union Power: Significant influence of unions representing pilots, cabin crew, and ground staff.

- Negotiation Dynamics: Continuous bargaining on wages, working conditions, and staffing levels.

- Risk of Disruption: Potential for strikes and industrial action leading to flight cancellations and financial penalties.

Data Privacy Regulations

Air France-KLM must navigate a complex web of data privacy regulations, with the General Data Protection Regulation (GDPR) in Europe being a prime example. Compliance is crucial given the airline's handling of extensive customer and employee data. Failure to comply can lead to significant financial penalties and reputational harm.

The upcoming EU entry-exit system, slated for operation by 2025, will introduce further data protection challenges. This system involves collecting and storing biometric data, necessitating strict adherence to evolving data protection standards. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- EU Entry-Exit System (2025): Requires enhanced biometric data protection measures.

- Reputational Risk: Data breaches can severely damage customer trust and brand image.

- Operational Impact: Implementing robust data protection protocols is a continuous operational necessity.

Air France-KLM faces significant legal challenges related to passenger rights, particularly under EU Regulation 261/2004. This regulation mandates compensation for flight delays, cancellations, and denied boarding, impacting the airline's financial performance. For example, in 2023, the airline likely processed thousands of claims, reflecting the ongoing financial exposure from these passenger protection laws.

The company's operations are also governed by stringent aviation safety regulations, with the European Union Aviation Safety Agency (EASA) setting standards for airworthiness and operational procedures. EASA's continued emphasis on cybersecurity in 2024 necessitates ongoing investment in protecting sensitive passenger and operational data.

Labor laws in France and the Netherlands create a complex environment for Air France-KLM, with strong unions representing various employee groups. The potential for strikes, as seen with KLM ground staff in early 2024, poses a direct risk of operational disruption and financial loss.

| Legal Factor | Impact on Air France-KLM | 2024/2025 Relevance |

| Passenger Rights (EU261) | Mandatory compensation for disruptions, impacting costs. | Continued claims processing and operational adjustments to minimize payouts. |

| Aviation Safety Regulations (EASA) | Compliance with airworthiness, operational, and cybersecurity standards. | Ongoing investment in safety upgrades and data protection measures. |

| Labor Laws and Union Relations | Navigating distinct regulations and union demands in France and Netherlands. | Risk of industrial action and wage negotiations impacting operational stability and finances. |

Environmental factors

The aviation sector is under immense pressure to curb its carbon emissions, with initiatives like the EU Emissions Trading System (ETS) and the ReFuelEU Aviation regulation imposing stricter environmental controls. Air France-KLM is actively pursuing decarbonization, targeting a 15% reduction in CO2 emissions intensity per passenger-kilometer by 2030 compared to 2019, and aiming to source 10% of its jet fuel from Sustainable Aviation Fuels (SAF) by the same year.

Achieving these ambitious goals necessitates significant capital allocation towards modernizing its fleet with more fuel-efficient aircraft and investing in the development and adoption of sustainable aviation technologies. For instance, the airline has committed to acquiring new generation aircraft like the Airbus A350 and A220, which offer substantial fuel savings.

Airports worldwide are increasingly enforcing stringent noise pollution restrictions, especially concerning nighttime operations and flights near populated zones. These regulations directly impact airline scheduling and operational costs.

Air France-KLM is actively addressing this by investing in a modern fleet. For instance, the Airbus A350, a key component of their fleet modernization, is significantly quieter than previous generations. This strategic move not only aids in complying with local environmental laws but also enhances the airline's standing within communities by reducing noise disturbance.

Airlines are significant waste producers, with Air France-KLM generating substantial waste from onboard services, aircraft maintenance, and airport operations. The company's commitment to environmental stewardship necessitates robust waste management and recycling initiatives, aligning with global trends towards a circular economy.

In 2023, Air France-KLM reported a continued focus on reducing waste, with specific targets for increasing recycling rates across its operations. Their sustainability reports highlight ongoing projects aimed at minimizing single-use plastics and maximizing the recovery of materials from decommissioned aircraft and operational waste streams.

Sustainable Aviation Fuel (SAF) Mandates

Mandates for sustainable aviation fuel (SAF) usage are a significant environmental factor shaping the airline industry. Regulations like the EU's ReFuelEU Aviation initiative are increasingly requiring airlines to blend a growing percentage of SAF into their fuel supply, with targets escalating over time. For instance, ReFuelEU Aviation mandates that by 2025, 2% of aviation fuel must be SAF, rising to 6% by 2030 and 70% by 2050.

Air France-KLM is actively addressing these mandates by securing SAF supplies. The company has entered into long-term partnerships to ensure it can meet these escalating requirements and support the industry's shift towards lower-carbon operations. This proactive approach is crucial for compliance and for positioning the airline as a leader in sustainable aviation practices.

- ReFuelEU Aviation Targets: 2% SAF by 2025, 6% by 2030, 70% by 2050.

- Air France-KLM Strategy: Securing SAF through long-term partnerships.

- Industry Impact: Driving the transition to lower-carbon aviation fuels.

Climate Change Impact on Operations

Climate change poses significant operational challenges for Air France-KLM. More frequent and intense extreme weather events, such as severe storms and heatwaves, directly impact flight schedules. These disruptions can lead to costly delays, cancellations, and rerouting, affecting passenger satisfaction and overall efficiency. For instance, the airline group experienced significant operational disruptions in 2023 due to widespread weather events impacting European airspace.

Air France-KLM must proactively address these environmental risks by enhancing its operational planning and investing in infrastructure resilience. This includes developing more robust contingency plans for weather-related disruptions and assessing the vulnerability of its key hubs and assets to rising sea levels or extreme temperatures. The airline is actively working on reducing its carbon footprint, which indirectly mitigates the severity of future climate impacts on its operations.

- Increased operational costs: Weather disruptions in 2023 led to an estimated €1.5 billion in losses for the European aviation sector due to delays and cancellations.

- Infrastructure resilience: Airports in coastal areas, critical for Air France-KLM's network, face long-term threats from rising sea levels.

- Service reliability: Maintaining consistent flight schedules amidst unpredictable weather patterns is a key challenge for customer retention.

The aviation industry faces intense scrutiny regarding its environmental impact, driving significant regulatory changes. Air France-KLM is responding by targeting a 15% reduction in CO2 emissions intensity per passenger-kilometer by 2030 and aiming for 10% Sustainable Aviation Fuel (SAF) usage by the same year, reflecting a commitment to decarbonization efforts and fleet modernization with fuel-efficient aircraft like the Airbus A350 and A220.

Noise pollution regulations at airports are tightening, impacting flight schedules and operational expenses. Air France-KLM is addressing this by investing in quieter aircraft, such as the A350, to comply with local environmental laws and reduce community disturbance.

Waste management is a critical environmental consideration for Air France-KLM, with ongoing initiatives to increase recycling rates and minimize single-use plastics, aligning with circular economy principles. The company is actively working on recovering materials from operational waste streams and decommissioned aircraft.

Mandates for SAF usage are escalating, with EU regulations requiring 2% SAF by 2025 and 6% by 2030. Air France-KLM is securing SAF supplies through long-term partnerships to meet these requirements and lead the industry's transition to lower-carbon fuels.

Climate change presents operational risks through extreme weather events that disrupt flight schedules, leading to increased costs and reduced efficiency. Air France-KLM is enhancing operational planning and infrastructure resilience to mitigate these impacts, acknowledging that reducing its own carbon footprint indirectly addresses future climate-related disruptions.

PESTLE Analysis Data Sources

Our Air France-KLM PESTLE Analysis is built on a comprehensive review of data from official aviation regulatory bodies, international economic organizations, and leading market research firms. We integrate insights from government policy documents, industry association reports, and reputable financial news sources to ensure a robust understanding of the macro-environment.