Air France-KLM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air France-KLM Bundle

Air France-KLM navigates a complex landscape shaped by intense rivalry among legacy carriers and low-cost airlines, while also contending with significant buyer power from price-sensitive travelers. The threat of new entrants is moderate, constrained by high capital requirements but amplified by the rise of budget carriers. Supplier power, particularly from fuel providers and aircraft manufacturers, presents a notable challenge.

The complete report reveals the real forces shaping Air France-KLM’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Air France-KLM is substantial, primarily due to the concentrated nature of aircraft manufacturing. Companies like Boeing and Airbus are the dominant players, meaning Air France-KLM has limited options when sourcing new aircraft or critical parts.

The high cost and lengthy production cycles for aircraft, coupled with specialized maintenance requirements, further entrench these suppliers. For instance, a new Boeing 787 or Airbus A350 represents a multi-million dollar investment with long-term contractual obligations, making switching suppliers incredibly difficult and expensive.

In 2024, the ongoing supply chain challenges and production ramp-ups for new aircraft models continue to give these manufacturers leverage. Any price hikes or delivery schedule adjustments from these key suppliers can significantly impact Air France-KLM's fleet expansion plans and overall operational costs.

Fuel suppliers possess significant leverage over Air France-KLM, as jet fuel represents a substantial portion of operating expenses. The price of this essential commodity is inherently volatile, influenced by global market dynamics and geopolitical instability. In 2023, fuel costs were a major factor impacting airline profitability across the industry, with Air France-KLM actively managing these expenditures through various strategies.

Engine manufacturers like GE, Rolls-Royce, and Pratt & Whitney hold significant bargaining power. Their proprietary technology and the critical nature of engines for an airline's performance mean Air France-KLM is heavily reliant on them.

The high costs associated with engine maintenance, repair, and overhaul (MRO) services, often specific to certain engine models, create substantial switching costs for the airline. This lock-in effect further strengthens the suppliers' position.

While Air France-KLM's fleet modernization, including the introduction of more fuel-efficient aircraft, could potentially involve new engine suppliers, the inherent complexity and cost of engine technology ensure that supplier power in this segment remains robust.

Supplier Power 4

Airport operators and air traffic control (ATC) providers hold significant sway over airlines like Air France-KLM. Their control over crucial infrastructure, such as landing slots and navigation services, often creates a monopolistic or oligopolistic environment. This means airlines have limited alternatives when it comes to accessing these essential facilities, giving suppliers considerable leverage.

Air France-KLM's reliance on major hubs like Paris-Charles de Gaulle and Amsterdam-Schiphol makes it particularly susceptible to increases in airport charges and ATC fees. These costs represent a substantial portion of an airline's operating expenses and are frequently subject to limited negotiation. For instance, in 2023, airport charges at major European hubs continued to be a significant cost factor, with some operators implementing increases to recover pandemic-related losses.

- Monopolistic Infrastructure: Airport operators and ATC services control essential, often unique, infrastructure like runways, gates, and air traffic management systems.

- Limited Substitutes: Airlines have few, if any, viable alternatives for accessing these critical services at their primary operational bases.

- Significant Cost Component: Airport and ATC fees represent a substantial and often non-negotiable operating expense for airlines.

- Price Sensitivity: While airlines are price-sensitive, the essential nature of these services limits their ability to pass on all cost increases to consumers.

Supplier Power 5

The bargaining power of suppliers for Air France-KLM is moderate, influenced by the specialized nature of aviation components and services. While the airline group benefits from its in-house maintenance, repair, and overhaul (MRO) capabilities through AFI KLM E&M, it still depends on external suppliers for critical parts, advanced software, and highly specialized technical services. This reliance can create leverage for suppliers, particularly those holding unique certifications or possessing proprietary technology.

Specialized MRO providers for complex components or specific maintenance tasks can exert significant power due to their unique expertise and necessary certifications. For instance, a supplier of a critical engine component with limited alternative sources can dictate terms. In 2023, the aviation industry saw continued supply chain pressures, with lead times for certain aircraft parts extending, which can embolden suppliers to increase prices or impose stricter contract terms.

Air France-KLM's reliance on external suppliers for certain parts, software, or highly specialized services, even with its strong MRO division, can lead to higher costs or dependency. For example, the acquisition of new generation aircraft often necessitates long-term supply agreements for proprietary parts and technical support, giving those original equipment manufacturers (OEMs) considerable influence. The airline group's fleet modernization efforts, including the introduction of new aircraft types, mean ongoing engagement with these specialized suppliers.

- Specialized MRO Expertise: Suppliers with unique certifications for complex aircraft components, such as advanced avionics or engine parts, hold considerable bargaining power.

- Dependency on External Services: Despite AFI KLM E&M, Air France-KLM still requires external providers for specific software solutions and highly specialized technical services, creating supplier leverage.

- Supply Chain Pressures: Ongoing global supply chain disruptions in the aerospace sector, evident through extended lead times for parts in 2023 and 2024, have generally strengthened the negotiating position of suppliers.

- OEM Relationships: Long-term agreements for proprietary parts and technical support with Original Equipment Manufacturers (OEMs) for new aircraft types solidify supplier power.

The bargaining power of suppliers for Air France-KLM is significant, particularly from aircraft and engine manufacturers like Boeing, Airbus, GE, Rolls-Royce, and Pratt & Whitney. These suppliers dominate the market, offering limited alternatives for critical aircraft and engine components, which are essential for airline operations.

The high cost of aircraft, lengthy production cycles, and specialized maintenance requirements create substantial switching costs for Air France-KLM, further solidifying supplier leverage. In 2024, ongoing supply chain issues and production ramp-ups for new aircraft models continue to empower these manufacturers, impacting fleet expansion and operational expenses.

Fuel suppliers also wield considerable power, as jet fuel constitutes a major operating expense. The volatile nature of fuel prices, influenced by global events, directly affects airline profitability, as seen in industry-wide impacts in 2023.

| Supplier Category | Key Players | Leverage Factors | 2024 Impact/Context |

|---|---|---|---|

| Aircraft Manufacturers | Boeing, Airbus | Market concentration, high capital costs, long production cycles | Continued supply chain challenges, production ramp-ups |

| Engine Manufacturers | GE, Rolls-Royce, Pratt & Whitney | Proprietary technology, critical performance role, high MRO costs | Ongoing reliance for new aircraft and maintenance |

| Fuel Suppliers | Global Oil Companies | Commodity price volatility, geopolitical influence | Significant operating expense, direct impact on profitability |

| Airport Operators & ATC | Major Hubs (e.g., CDG, AMS) | Monopolistic infrastructure, limited substitutes, essential services | Airport charges and ATC fees are substantial cost components |

| Specialized MRO & Parts | Various certified providers | Unique expertise, certifications, proprietary technology | Extended lead times for parts in 2023-2024 due to supply chain pressures |

What is included in the product

This analysis dissects the competitive forces impacting Air France-KLM, revealing the intensity of rivalry, the power of buyers and suppliers, and the threats from new entrants and substitutes.

Instantly visualize competitive pressures across the airline industry, from supplier bargaining power to the threat of new entrants, providing a clear roadmap for strategic adjustments.

Customers Bargaining Power

Individual passengers, particularly those traveling for leisure, wield considerable bargaining power. The widespread availability of online travel agencies and price comparison sites means flight prices are highly transparent, allowing customers to easily shop around. This ease of access to information and low switching costs empower them to select the most affordable option, directly impacting Air France-KLM's revenue per passenger.

Corporate clients, though sometimes less focused on price for particular routes, hold significant sway through substantial volume contracts and requests for customized services. Air France-KLM must carefully balance competitive pricing with the appeal of added benefits, such as loyalty programs and enhanced cabin experiences, to keep these valuable customer groups engaged.

The bargaining power of customers for Air France-KLM is substantial, largely due to the abundance of alternative airlines available on many routes. This includes both full-service carriers and budget-friendly competitors, giving travelers numerous choices.

Air France-KLM operates in a fiercely competitive aviation landscape. Customers can readily switch to other airlines for comparable destinations, compelling the company to constantly adjust its pricing strategies and service packages to remain competitive.

For instance, in 2024, the European airline market saw continued growth in low-cost carriers, which often offer significantly lower fares on popular routes. This intensifies the pressure on legacy carriers like Air France-KLM to match or counter these price points, directly impacting their revenue and profit margins.

Buyer Power 4

The bargaining power of customers for Air France-KLM is significant, primarily due to low switching costs. Passengers can readily opt for alternative carriers with minimal hassle, especially when loyalty program benefits are not a strong deterrent. This ease of choice empowers travelers to seek out better prices or more convenient schedules from competitors.

Air France-KLM actively works to mitigate this by investing in its Flying Blue loyalty program and focusing on improving the overall customer experience. However, the inherent simplicity of booking with other airlines means that price and convenience often remain the dominant factors for many passengers. In 2023, the airline industry saw continued price sensitivity among travelers, with many seeking value for money.

- Low Switching Costs: Passengers can easily switch between airlines without substantial penalties, impacting Air France-KLM's pricing power.

- Loyalty Programs: Initiatives like the Flying Blue program aim to retain customers, but their effectiveness is challenged by the ease of booking alternatives.

- Customer Experience Focus: Enhancing service quality is a key strategy to counter the inherent buyer power in the market.

- Competitive Landscape: The prevalence of budget carriers and online travel agencies further amplifies customer choice and bargaining power.

Buyer Power 5

Customers of Air France-KLM possess significant bargaining power, largely driven by their sensitivity to service quality and punctuality. A single negative experience, amplified by social media, can lead to swift customer migration to competitors, severely impacting brand reputation. For instance, in 2024, airlines faced increased scrutiny over operational reliability, with passenger complaints about flight delays and cancellations impacting loyalty.

Air France-KLM's ability to consistently meet or exceed service expectations is paramount. Operational disruptions, such as those experienced during peak travel seasons in 2024 due to staffing issues or weather events, directly erode customer loyalty. This means that the perceived value of their service is directly tied to its reliability, giving customers leverage.

- Customer Sensitivity: Passengers prioritize on-time departures and quality in-flight service.

- Social Media Impact: Negative reviews and complaints spread rapidly, influencing purchasing decisions.

- Brand Reputation: Consistent service delivery is crucial for maintaining customer trust and loyalty.

- Competitive Landscape: The availability of numerous alternative carriers empowers customers to switch easily.

The bargaining power of customers for Air France-KLM is considerable, fueled by transparent pricing and low switching costs. The proliferation of online travel agencies and comparison sites in 2024 means passengers can easily find the cheapest fares, directly pressuring airlines to remain competitive. This environment allows travelers to readily switch to alternative carriers, especially with the continued growth of budget airlines offering lower price points on popular routes.

Corporate clients, while valuable, also exert influence through bulk contracts and demands for tailored services. Air France-KLM must therefore balance competitive pricing with the allure of loyalty programs and superior in-flight experiences to retain these key segments. In 2023, price sensitivity remained a dominant factor for many travelers, underscoring the need for airlines to offer compelling value propositions.

| Factor | Impact on Air France-KLM | 2024 Trend/Data |

|---|---|---|

| Price Transparency | Reduces pricing power, increases comparison shopping. | High availability of online comparison tools. |

| Low Switching Costs | Enables easy migration to competitors. | Minimal penalties for changing airlines. |

| Availability of Alternatives | Intensifies competition, especially from budget carriers. | Continued expansion of low-cost carriers in Europe. |

| Loyalty Programs | Aims to retain customers but can be overcome by price. | Flying Blue program focuses on enhanced benefits. |

Preview Before You Purchase

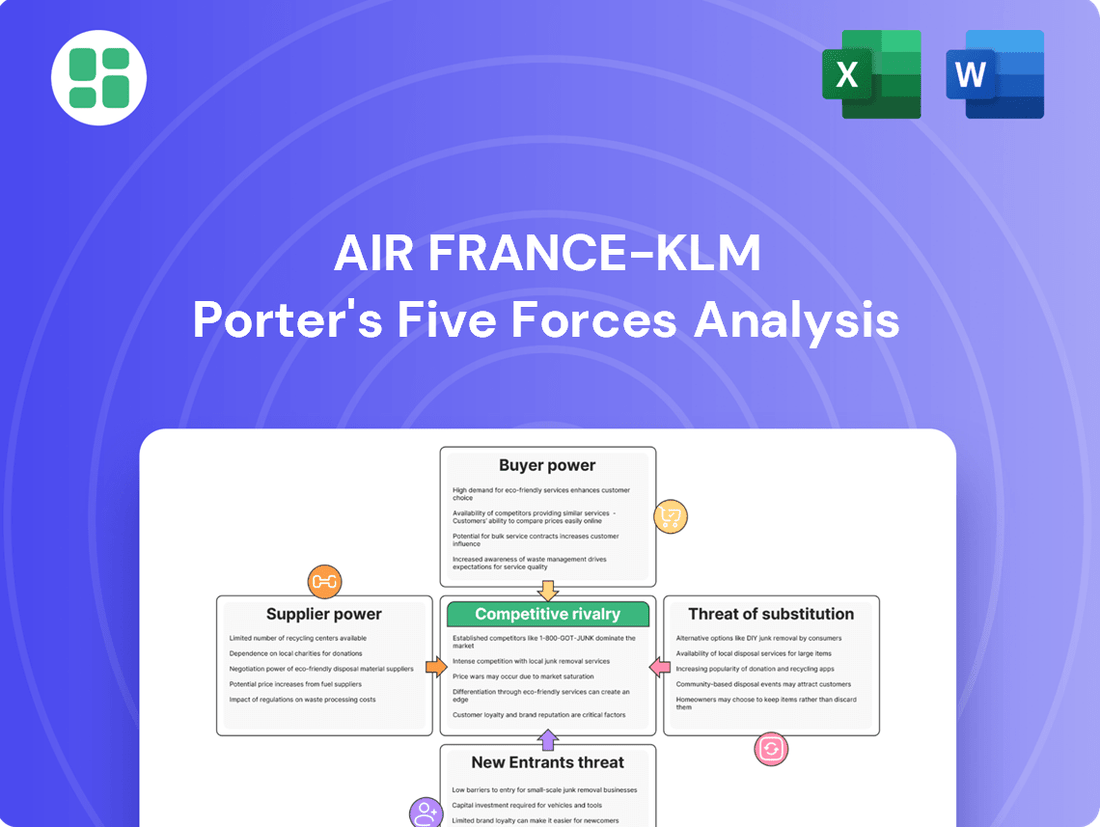

Air France-KLM Porter's Five Forces Analysis

This preview showcases the complete Air France-KLM Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. You are looking at the actual document, ensuring that the insights and strategic implications presented are precisely what you will receive. Once your purchase is complete, you’ll gain instant access to this exact, professionally formatted analysis, ready for immediate application to your business strategy.

Rivalry Among Competitors

Competitive rivalry within the airline industry is exceptionally fierce, with a crowded field of global and regional airlines constantly battling for passenger and cargo business. Air France-KLM is directly impacted by this intense competition from established legacy carriers such as Lufthansa Group and International Airlines Group (IAG), which includes British Airways and Iberia. These major players compete across similar long-haul and premium routes.

Adding to the pressure, Air France-KLM also contends with the increasing presence of low-cost carriers (LCCs) like Ryanair and EasyJet. These LCCs are particularly aggressive on short and medium-haul routes, often undercutting prices and capturing a significant share of the leisure and price-sensitive business travel markets. For instance, in 2024, the continued expansion of LCCs in Europe has put downward pressure on fares across many of Air France-KLM's core European markets.

Air France-KLM operates in an industry characterized by substantial fixed costs, including aircraft acquisition or leasing, extensive maintenance, and significant labor expenses. These high overheads necessitate a constant drive to fill as many seats as possible, often leading to aggressive pricing strategies to achieve high load factors. For instance, in 2023, the airline group reported a load factor of 88.1%, demonstrating the critical importance of capacity utilization.

This intense pressure to maintain high capacity utilization, especially for a global player like Air France-KLM, frequently ignites price wars among competitors. Airlines often resort to discounting fares to attract passengers, which can severely erode profit margins across the industry. The competitive rivalry is further intensified by the relatively low switching costs for consumers, who can easily opt for a cheaper alternative if prices differ.

The European aviation market is quite mature, meaning airlines often gain passengers and cargo by taking them from rivals. This creates a tough environment where every bit of growth is hard-won, leading to intense competition for even small gains in market share. For instance, in 2023, Air France-KLM carried approximately 93.5 million passengers, a figure that highlights the sheer volume of travelers these major carriers vie for.

Competitive Rivalry 4

The airline industry, including Air France-KLM, faces intense competitive rivalry. Product differentiation is often subtle, focusing on network reach, service levels, cabin configurations, and frequent flyer programs. Competitors actively work to match or surpass these offerings, creating a dynamic environment.

Air France-KLM's strategy of premiumization and leveraging its vast global network is constantly challenged. For instance, in 2023, Air France-KLM reported a significant increase in passenger numbers, carrying 93.5 million passengers, up from 81.1 million in 2022. However, other major carriers also saw substantial growth, indicating persistent competition across the board.

- Network Breadth: Air France-KLM's extensive route network is a key differentiator, but rivals like Lufthansa Group and IAG (International Airlines Group) also boast substantial global presences.

- Service Quality: While Air France-KLM aims for premium service, other airlines invest heavily in cabin comfort, in-flight entertainment, and dining to attract discerning travelers.

- Loyalty Programs: The Flying Blue program is crucial for customer retention, yet competitors' loyalty schemes are equally robust, often offering reciprocal benefits across alliances.

- Pricing Strategies: Despite premium offerings, competitive pricing remains a significant factor, forcing Air France-KLM to balance service quality with fare competitiveness.

Competitive Rivalry 5

Competitive rivalry within the airline sector, particularly for a carrier like Air France-KLM, is intensified by substantial exit barriers. The industry demands massive capital for aircraft acquisition and maintenance, coupled with long-term lease agreements and complex labor contracts. These significant sunk costs make it exceedingly difficult for airlines facing financial distress to simply cease operations.

This inability to easily exit the market often results in persistent overcapacity. Even when demand falters, airlines may continue to fly routes, albeit at reduced load factors, to cover at least variable costs. This dynamic directly translates into prolonged and intense price competition among remaining players, squeezing profit margins for established carriers such as Air France-KLM.

For instance, in 2024, the global airline industry continued to grapple with the aftermath of economic slowdowns and geopolitical uncertainties, leading to a delicate balance between capacity and demand. Airlines that cannot efficiently manage their costs or adapt their networks face severe pressure from competitors who can maintain lower operational expenses.

- High Capital Investment: Aircraft orders represent multi-billion dollar commitments, locking airlines into long-term operational strategies.

- Lease and Labor Commitments: Existing agreements for aircraft leases and employee contracts create significant fixed costs that are hard to shed quickly.

- Persistent Overcapacity: The difficulty in exiting the market means that even underperforming airlines often remain operational, contributing to excess seat availability and downward pressure on fares.

- Intense Price Competition: As a result of overcapacity and high fixed costs, airlines frequently engage in price wars to fill seats, directly impacting profitability.

The competitive rivalry within the airline industry is a dominant force, significantly shaping Air France-KLM's operational landscape. This rivalry is characterized by a multitude of global and regional carriers vying for market share, often leading to aggressive pricing and strategic maneuvering. The presence of both established legacy airlines and increasingly influential low-cost carriers (LCCs) means Air France-KLM must constantly adapt its strategies to remain competitive.

In 2024, the European market, a core region for Air France-KLM, continued to see LCCs exert downward pressure on fares, impacting profitability on many routes. The high fixed costs inherent in the airline business, such as aircraft maintenance and labor, compel carriers to maximize seat utilization. For instance, Air France-KLM's 2023 load factor of 88.1% underscores the critical importance of filling seats to cover these substantial overheads.

This pressure to fill capacity often results in price wars, as airlines resort to discounting to attract passengers, which can erode margins across the board. The relatively low switching costs for consumers further exacerbate this, making price a key decision factor. Air France-KLM's efforts to differentiate through network breadth, service quality, and loyalty programs are met with similar investments from competitors like Lufthansa Group and IAG.

| Key Competitor | 2023 Passenger Numbers (Millions) | 2023 Revenue (Billion EUR) |

| Lufthansa Group | 123 | 31.9 |

| International Airlines Group (IAG) | 115 | 29.3 |

| Air France-KLM | 93.5 | 29.9 |

SSubstitutes Threaten

High-speed rail presents a substantial threat to Air France-KLM, especially on shorter European routes. In 2024, the efficiency and convenience of rail travel, often connecting city centers directly, are increasingly competitive with air travel, particularly when factoring in airport transit times and security. This is further amplified by growing environmental consciousness, making rail a more attractive option for many travelers.

Technological advancements are increasingly impacting the airline industry. For instance, high-quality video conferencing tools, like those offered by Zoom and Microsoft Teams, are becoming more sophisticated, allowing for more effective virtual meetings. This trend directly threatens business travel, a key revenue source for airlines like Air France-KLM. In 2023, business travel spending in Europe was projected to reach over €200 billion, highlighting the segment's importance.

While these technologies may not entirely replace the need for in-person interactions, they are undeniably reducing the frequency of business trips. This shift means fewer passengers on flights, particularly in premium cabins, which often carry higher profit margins. Companies are also scrutinizing travel budgets more closely, further incentivizing the use of virtual alternatives.

Personal vehicles and buses present a substitution threat, particularly for very short-haul routes where cost is a significant factor for leisure travelers. While Air France-KLM's primary focus isn't on these minimal distances, the aggregate impact on feeder routes can still be felt.

For instance, in 2024, the demand for regional train services in Europe saw a notable increase, with some routes reporting passenger growth exceeding 15% year-over-year, directly competing with flights under 500 kilometers. This trend suggests a growing willingness among consumers to opt for ground transportation when it offers a more economical alternative, even if it means longer travel times.

Threat of Substitution 4

Environmental concerns are increasingly shaping travel decisions, presenting a significant threat of substitution for traditional air travel. As awareness grows around the carbon footprint of flying, customers are exploring lower-emission alternatives such as high-speed rail for shorter distances or even reconsidering travel altogether. This shift is particularly pronounced in regions with well-developed rail infrastructure.

Air France-KLM is actively addressing this threat through substantial investments in sustainability initiatives. The airline group is committed to fleet modernization, aiming to incorporate more fuel-efficient aircraft and explore sustainable aviation fuels (SAFs). For instance, in 2024, Air France-KLM continued its rollout of SAFs, with a target to increase their use significantly in the coming years, aiming to reach 10% SAF mix by 2030.

- Sustainable Aviation Fuel (SAF) Investment: Air France-KLM aims to increase SAF usage, a key strategy to mitigate environmental concerns and retain environmentally conscious travelers.

- Fleet Modernization: The ongoing replacement of older, less fuel-efficient aircraft with newer models like the Airbus A350 and A220 directly reduces emissions per passenger kilometer.

- Rail Partnerships: Collaborations with rail operators, such as the existing partnership with SNCF for flights between Paris-Orly and certain French cities, offer customers viable, lower-emission travel options for specific routes.

- Customer Awareness Campaigns: The airline is also focusing on educating customers about its sustainability efforts, aiming to build confidence and loyalty among those prioritizing eco-friendly travel.

Threat of Substitution 5

The threat of substitutes for Air France-KLM is a significant factor, particularly on shorter routes. While air travel remains the undisputed leader for long-haul and time-critical journeys, alternative transportation methods can present a compelling cost-performance trade-off for shorter distances.

For instance, high-speed rail networks are increasingly competitive with air travel for journeys under 500 miles. In 2024, European rail operators reported a substantial increase in passenger numbers, with some routes seeing double-digit growth as travelers opt for the convenience and environmental benefits of rail. This trend directly challenges Air France-KLM on routes where train travel offers comparable total journey times when factoring in airport security and transit, often at a lower overall cost.

- Cost-Performance Trade-off: For shorter trips, the combined cost and time of air travel (including airport transfers, check-in, security, and potential delays) can be less attractive than high-speed rail or even efficient bus services.

- Long-Haul Dominance: Air France-KLM maintains a strong position for long-haul and time-sensitive travel where substitutes are either non-existent or prohibitively slow.

- Regional Competition: On routes within Europe, particularly those connecting major cities with excellent rail infrastructure, the airline faces intensified competition from rail providers.

- Shifting Consumer Preferences: Growing environmental awareness and a desire for more seamless travel experiences are driving some consumers towards rail, even on routes where air travel is technically faster.

The threat of substitutes for Air France-KLM is most pronounced on shorter European routes where high-speed rail offers a compelling alternative. In 2024, the convenience of city-center to city-center rail travel, coupled with growing environmental consciousness, makes it a strong competitor to air travel, especially when factoring in airport transit and security times. This is further exacerbated by the increasing sophistication of virtual communication tools, which reduce the necessity for business travel.

| Substitute | Key Advantages | Impact on Air France-KLM (2024) |

|---|---|---|

| High-Speed Rail | City-center connectivity, shorter total journey times on some routes, lower carbon footprint | Direct competition on key European corridors, potential reduction in short-haul passenger volume |

| Video Conferencing | Cost savings, reduced travel time, environmental benefits | Reduced demand for business travel, particularly for meetings and conferences |

| Personal Vehicles/Buses | Cost-effectiveness for very short distances, flexibility | Minor impact on feeder routes, primarily for highly price-sensitive leisure travelers |

Entrants Threaten

The threat of new entrants for Air France-KLM is generally low due to the immense capital required to start an airline. The cost of acquiring a fleet of modern aircraft alone can run into billions of dollars, a significant hurdle for any newcomer. For instance, in 2024, the list price for a new Boeing 787 Dreamliner can exceed $300 million, and airlines typically operate dozens, if not hundreds, of aircraft.

Beyond aircraft acquisition, new entrants must also invest heavily in establishing extensive route networks, obtaining regulatory approvals, and building sophisticated ground infrastructure, including maintenance facilities and booking systems. This high barrier to entry protects established carriers like Air France-KLM from disruptive new competition.

The threat of new entrants for Air France-KLM is moderately low, primarily due to the significant capital investment and regulatory hurdles required to establish an airline. Existing carriers benefit from substantial economies of scale in fleet maintenance, fuel purchasing, and operational efficiencies across a vast network. For instance, in 2023, Air France-KLM reported a fleet size of 325 aircraft, enabling significant cost advantages that new entrants would struggle to replicate, making it challenging to compete on price or profitability.

New airlines face significant hurdles accessing essential distribution channels like global distribution systems (GDS), online travel agencies (OTAs), and crucial airport slots. For instance, in 2024, securing prime airport slots at major hubs like Paris Charles de Gaulle (CDG) or Amsterdam Schiphol (AMS) remains highly competitive, often favoring incumbents with established flight schedules and operational histories.

Established carriers such as Air France-KLM benefit from decades of cultivated relationships and preferential access to these vital networks. This existing infrastructure and preferred status create a formidable barrier, making it difficult for new entrants to achieve comparable visibility and market penetration in the highly saturated airline industry.

Threat of New Entrants 4

The aviation industry presents a significant threat of new entrants due to its highly regulated nature. Stringent safety, security, and environmental standards, coupled with complex international agreements governing landing rights, demand substantial expertise, time, and capital investment. For instance, obtaining necessary certifications and approvals can take years and millions of dollars, creating a formidable barrier.

New airlines must also contend with established players who benefit from economies of scale, brand loyalty, and existing infrastructure. Air France-KLM, as a major carrier, already possesses these advantages, making it difficult for newcomers to compete on price or service. The capital required to acquire aircraft, establish maintenance facilities, and build a route network is immense, often running into billions of euros.

- High Capital Requirements: Launching an airline typically requires hundreds of millions to billions of dollars for aircraft acquisition, infrastructure, and operational setup.

- Regulatory Hurdles: Obtaining air operator certificates, route licenses, and complying with international aviation regulations is a lengthy and costly process.

- Economies of Scale: Established airlines like Air France-KLM benefit from lower per-unit costs due to their size, making it hard for new entrants to match pricing.

- Brand Loyalty and Network Effects: Existing carriers have built customer loyalty and extensive route networks, which are difficult for new players to replicate quickly.

Threat of New Entrants 5

The threat of new entrants for Air France-KLM is relatively low, primarily due to significant barriers to entry in the airline industry. Established brands like Air France-KLM have cultivated strong brand loyalty and extensive customer bases over many years. This loyalty, built on consistent service quality and attractive loyalty programs, creates substantial switching costs for passengers, making it difficult for newcomers to gain traction.

New airlines must overcome the challenge of attracting passengers who are accustomed to the reliability and familiarity of incumbent carriers. For instance, Air France-KLM's Flying Blue loyalty program boasts millions of members, representing a significant hurdle for any new airline attempting to capture market share. The capital investment required for fleet acquisition, regulatory approvals, and route development further deters potential new entrants.

- Brand Loyalty: Decades of service have built strong customer allegiance for Air France-KLM, making it hard for new airlines to lure passengers.

- Switching Costs: Loyalty programs and established networks create significant costs and inconvenience for customers switching to a new airline.

- Capital Intensity: The airline industry demands massive upfront investment in aircraft and infrastructure, a major deterrent for new players.

- Regulatory Hurdles: Obtaining necessary certifications and operating licenses is a complex and time-consuming process for any new airline.

The threat of new entrants for Air France-KLM remains low, largely due to the colossal capital investment required to launch an airline. For example, in 2024, a new wide-body aircraft like the Airbus A350 can cost upwards of $350 million, and airlines operate fleets numbering in the hundreds.

Beyond aircraft, new entrants face immense regulatory hurdles, including obtaining air operator certificates and securing landing rights at busy airports. In 2024, securing prime slots at hubs like Amsterdam Schiphol is exceptionally competitive, favoring established carriers with existing operational histories.

Economies of scale enjoyed by incumbents like Air France-KLM, which operated 325 aircraft in 2023, significantly lower per-unit costs for maintenance, fuel, and operations, making it difficult for newcomers to compete on price.

| Barrier to Entry | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | Cost of acquiring and maintaining aircraft, infrastructure, and technology. | New Airbus A350: ~$350M+; New Boeing 787: ~$300M+ |

| Regulatory Hurdles | Obtaining certifications, licenses, and adhering to safety/environmental standards. | Years and millions of dollars for approvals. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Air France-KLM fleet: 325 aircraft (2023). |

| Access to Distribution | Securing slots in Global Distribution Systems (GDS) and Online Travel Agencies (OTAs). | Highly competitive access at major hubs like CDG, AMS. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Air France-KLM leverages data from their annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from aviation regulatory bodies and macroeconomic data to provide a comprehensive view of the competitive landscape.