Air France-KLM Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air France-KLM Bundle

Uncover the strategic positioning of Air France-KLM's diverse portfolio with our insightful BCG Matrix preview. See which of their services are poised for growth and which require careful management.

This glimpse into their market performance is just the beginning. Purchase the full BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to inform your investment and strategic decisions.

Stars

Air France-KLM is strategically investing in its premium cabins, like the exclusive La Première and expanding Business Class offerings, to solidify these as Stars in its BCG Matrix. These high-yield products are crucial for revenue generation and market positioning.

The focus on premium segments is paying off, with Air France-KLM reporting a substantial 27% year-on-year increase in premium and premium comfort revenue during the first half of 2025. This growth underscores strong customer demand for enhanced travel experiences and contributes significantly to the group's overall financial performance in an expanding luxury travel market.

Air France-KLM's aggressive fleet modernization, featuring fuel-efficient aircraft like the Airbus A350 and A220, positions these as Stars within the BCG matrix. By June 2025, these next-generation planes will make up 30% of the fleet, significantly cutting operating expenses and environmental impact.

Air France-KLM is strategically bolstering its long-haul operations by targeting high-demand markets. This includes launching new routes to destinations such as San Diego, Orlando, Hyderabad, and Riyadh, alongside boosting flight frequencies on popular North American and Asian routes. This aggressive expansion is designed to capitalize on the resurgence and growth in international travel demand.

This strategic move is projected to increase Air France-KLM's overall capacity by an estimated 4-5% in 2025. By focusing on these growth corridors, the airline aims to solidify its global presence and capture a larger share of the expanding long-haul travel market.

Acquisition and Integration of SAS

Air France-KLM's proposed acquisition of a majority stake in SAS, aiming for 60.5% ownership, represents a pivotal Star initiative within its BCG matrix. This strategic move is designed to solidify Air France-KLM's position in the Northern European market. By integrating SAS, the airline group anticipates significant route optimization and a substantial increase in market share, leveraging SAS's established revenue streams and extensive loyalty program membership.

This acquisition is expected to bring considerable benefits, including enhanced network connectivity and operational efficiencies. In 2023, SAS reported revenues of approximately SEK 45 billion (around €4 billion), underscoring the scale of the integration. The deal is anticipated to close in the first half of 2025, pending regulatory approvals.

- Strengthened Northern European Presence: The acquisition of a majority stake in SAS positions Air France-KLM as a dominant player in Northern Europe.

- Route Streamlining and Market Share Capture: Integration aims to optimize flight routes and capture significant market share by combining networks.

- Leveraging SAS Assets: Air France-KLM will benefit from SAS's substantial revenue and its large base of loyalty program members.

- Financial Impact: SAS's reported revenues of around €4 billion in 2023 highlight the scale of the integration and its potential to boost Air France-KLM's financial performance.

Digitalization and AI in Cargo Operations

Air France-KLM is significantly boosting its cargo operations through digitalization and artificial intelligence. The myCargo platform is a prime example, aiming for 85% online bookings by the close of 2024. This digital push, coupled with a strategic partnership with Google Cloud for AI implementation, is designed to streamline operations and elevate the customer journey.

These advancements are crucial for capitalizing on the burgeoning e-commerce market. The focus on AI and digital tools is expected to unlock new revenue streams by enhancing efficiency and providing a superior customer experience in a competitive landscape.

- Digitalization: myCargo platform targeting 85% online bookings by end of 2024.

- AI Integration: Partnership with Google Cloud for AI deployment.

- Benefits: Enhanced operational efficiency and improved customer experience.

- Market Focus: Driving revenue in the e-commerce-driven cargo market.

The premium cabins, including La Première and expanded Business Class, are key Stars for Air France-KLM, driving revenue and market positioning. This focus is yielding strong results, with premium and premium comfort revenue up 27% year-on-year in H1 2025, reflecting robust demand.

The modernization of the fleet with fuel-efficient aircraft like the Airbus A350 and A220, representing 30% of the fleet by June 2025, significantly cuts operating costs and environmental impact, solidifying their Star status.

Air France-KLM's strategic expansion into high-demand long-haul markets, including new routes and increased frequencies, is a significant Star initiative, projected to boost overall capacity by 4-5% in 2025.

The proposed acquisition of a majority stake in SAS is a pivotal Star, aimed at consolidating Air France-KLM's position in Northern Europe, leveraging SAS's SEK 45 billion revenue and extensive loyalty program.

Digitalization of cargo operations, exemplified by the myCargo platform targeting 85% online bookings by end-2024 and AI integration with Google Cloud, enhances efficiency and customer experience, driving revenue in the e-commerce market.

| Initiative | BCG Category | Key Data/Impact | Strategic Rationale |

|---|---|---|---|

| Premium Cabins | Stars | 27% YoY revenue growth (H1 2025) in premium segments | High yield, market leadership, customer loyalty |

| Fleet Modernization (A350/A220) | Stars | 30% of fleet by June 2025 | Cost reduction, environmental benefits, operational efficiency |

| Long-Haul Expansion | Stars | 4-5% capacity increase projected for 2025 | Market share growth, capitalizing on travel demand |

| SAS Acquisition | Stars | SEK 45 billion revenue (2023) for SAS | Northern European dominance, network optimization |

| Cargo Digitalization & AI | Stars | 85% online bookings target (myCargo) by end-2024 | E-commerce growth, operational efficiency, customer experience |

What is included in the product

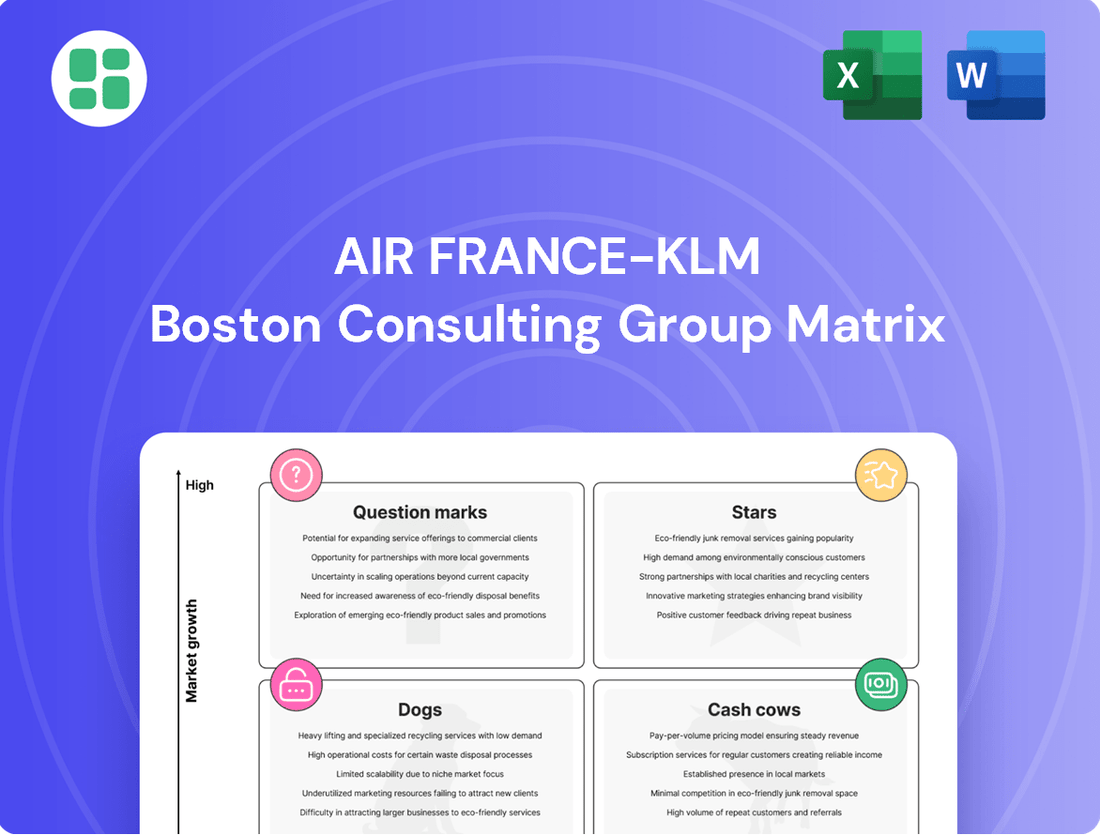

The Air France-KLM BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

A clear BCG Matrix visualizes Air France-KLM's portfolio, easing strategic decisions by highlighting Stars and Cash Cows.

Cash Cows

Air France-KLM's core European short and medium-haul network is a textbook Cash Cow. This segment benefits from a mature market with consistent, predictable demand, ensuring stable passenger volumes and reliable revenue streams. For instance, in 2024, the airline group reported a strong performance in its European network, with load factors often exceeding 85% on key routes, directly contributing to profitability.

Air France-KLM's established long-haul passenger routes, especially to major North American and Asian destinations, are strong Cash Cows. These routes boast high market share and dependable demand, consistently producing significant cash flow despite modest growth. For instance, in 2024, Air France-KLM reported a notable increase in long-haul passenger traffic, particularly on transatlantic routes, contributing significantly to overall revenue.

Air France-KLM's Engineering & Maintenance (AFI KLM E&M) division operates as a robust Cash Cow. This segment consistently generates substantial revenue from third-party clients, providing a stable and reliable income stream for the group.

The division's resilience is evident in its performance, with third-party revenues surging by 19.3% in the second quarter of 2025. This growth insulates Air France-KLM from the unpredictable nature of passenger demand, underscoring the MRO services' value as a consistent cash flow generator, often secured through long-term agreements.

Flying Blue Loyalty Program

The Flying Blue loyalty program, a significant asset for Air France-KLM, is categorized as a Cash Cow within the BCG Matrix.

With its 20th anniversary celebrated recently and boasting around 30 million members, Flying Blue exemplifies a mature, high-profitability business.

The program consistently generates revenue through a robust network of partnerships and active member engagement. This stable, high-margin contribution requires minimal investment to sustain its extensive customer base, making it a reliable source of income for the airline group.

- Program: Flying Blue Loyalty Program

- Category: Cash Cow

- Key Feature: Generates consistent, high-margin revenue through partnerships and member engagement.

- Member Base: Approximately 30 million members.

Belly Cargo Capacity on Passenger Aircraft

Belly cargo capacity on Air France-KLM's passenger fleet is a significant Cash Cow. This segment generates a steady revenue stream by utilizing underutilized space in the lower decks of passenger aircraft, adding minimal incremental costs. In 2024, the airline continued to leverage this efficient revenue source.

The integrated cargo operations, utilizing belly space, contribute substantially to overall profitability. While air cargo markets can experience volatility, this strategy ensures a consistent income stream, enhancing operational efficiency across the extensive network.

- Consistent Revenue: Belly cargo provides a reliable income source by filling otherwise empty space.

- Minimal Incremental Costs: Utilizes existing infrastructure and flight schedules, reducing additional operational expenses.

- Network Optimization: Maximizes revenue potential across the entire passenger flight network.

- Market Resilience: Offers a degree of stability even when dedicated freighter markets fluctuate.

Air France-KLM's premium cabins, including First and Business Class, function as Cash Cows. These segments cater to a high-yield market, consistently delivering strong profit margins with relatively stable demand. In 2024, the airline group reported robust yields in premium cabins, demonstrating their ongoing profitability.

The ancillary revenue streams, such as baggage fees and on-board sales, are increasingly behaving like Cash Cows. These offerings require minimal additional investment and contribute a growing, predictable income. For instance, ancillary revenues for the group saw a steady increase throughout 2024, underscoring their reliable cash generation.

| Segment | BCG Category | Key Financial Indicator (2024 Data Focus) | Strategic Implication |

|---|---|---|---|

| Premium Cabins | Cash Cow | High Yields, Stable Demand | Maintain service levels, optimize pricing |

| Ancillary Revenues | Cash Cow | Consistent Growth in Contribution | Expand offerings, leverage digital channels |

Delivered as Shown

Air France-KLM BCG Matrix

The Air France-KLM BCG Matrix you see is the identical, fully formatted report you will receive upon purchase, offering a clear strategic overview of their business units.

This preview showcases the actual BCG Matrix analysis, providing immediate insight into the airline group's portfolio without any watermarks or demo content.

Upon purchase, you will instantly download this comprehensive Air France-KLM BCG Matrix, ready for immediate integration into your strategic planning or presentations.

Rest assured, the document you are currently viewing is the exact Air France-KLM BCG Matrix report you will possess after completing your purchase, ensuring no surprises and full professional utility.

Dogs

Certain regional routes within Air France-KLM's network are experiencing significant challenges. These routes, often facing fierce competition from budget airlines and seeing a dip in passenger numbers, are likely candidates for the Dogs category in the BCG Matrix. For instance, by the end of 2023, some of these less-trafficked regional segments reported load factors below 65%, a stark contrast to the group's overall average of 85% for the same period.

These underperforming routes can become cash traps for Air France-KLM. They consume valuable resources, such as aircraft maintenance and crew hours, without generating sufficient returns. This situation can drain capital that could otherwise be invested in more promising areas of the business, impacting overall profitability and growth potential.

Older, less fuel-efficient aircraft in Air France-KLM's fleet are classified as Dogs. These planes, being phased out due to their age and higher operating costs, represent a drag on profitability. For instance, older Boeing 777-200ERs, while still operational, typically consume around 15-20% more fuel per passenger mile than their newer counterparts, impacting the bottom line.

Niche, low-volume cargo operations represent Air France-KLM's potential Dogs. These segments may not be riding the e-commerce wave, and some even grapple with overcapacity. Despite a general increase in cargo volumes in 2024, these specific niches saw revenue dips due to market pressures and limited access to high-growth sectors.

Legacy IT Systems and Infrastructure

Legacy IT systems and infrastructure at Air France-KLM, particularly those contributing to past 'troubled roll outs' and impacting cargo revenue, are positioned as Dogs in the BCG Matrix. These outdated systems inherently lead to increased operational expenses and diminished efficiency. For instance, in 2023, the airline group reported €3.06 billion in operating income, but significant investments in IT modernization are ongoing to address such inefficiencies.

These technological limitations directly translate to lower returns on investment and create a significant barrier to adapting swiftly to evolving market demands. The inability to seamlessly integrate new technologies or optimize existing processes due to these legacy systems can stifle growth potential and competitiveness.

- Operational Inefficiencies: Past issues with IT system rollouts have demonstrably impacted operational smoothness, particularly in critical areas like cargo revenue generation.

- Increased Costs: Maintaining and operating outdated IT infrastructure often incurs higher costs compared to modern, integrated solutions.

- Reduced Agility: Legacy systems hinder the airline's ability to quickly implement new services or respond to dynamic market shifts, a critical factor in the competitive aviation industry.

- Low ROI: The ongoing expenses and limited functionality of these systems result in a low return on the capital invested in them.

Routes Affected by Geopolitical Restrictions

Air France-KLM's BCG Matrix analysis highlights routes significantly impacted by geopolitical restrictions. For instance, the closure of Russian airspace in the first half of 2024 directly affected numerous flight paths, leading to operational challenges.

These restrictions resulted in tangible consequences for the airline group. Payload limitations were imposed, and unit revenues saw a decline on affected routes. This necessitated the redeployment of airline capacity to mitigate the impact.

- Russian Airspace Closure Impact: In H1 2024, the closure of Russian airspace forced Air France-KLM to reroute flights, increasing flight times and fuel consumption.

- Reduced Unit Revenue: The need for longer routes and potential payload restrictions contributed to a decrease in revenue per available seat kilometer (RASK) on affected long-haul segments.

- Capacity Redeployment: The group shifted capacity from these challenged routes to others with better performance, indicating a strategic response to geopolitical headwinds.

- Low Market Share/Growth Segments: Routes experiencing prolonged geopolitical restrictions often represent segments where Air France-KLM might have had lower market share or faced diminished growth prospects even before the disruptions.

Air France-KLM's "Dogs" category encompasses underperforming regional routes, older aircraft, niche cargo operations, and legacy IT systems. These segments consume resources without generating sufficient returns, acting as cash traps that hinder overall profitability and growth. The group's strategic response involves addressing these inefficiencies, such as by modernizing IT infrastructure and optimizing fleet composition to improve financial performance.

| Category | Description | Impact on Air France-KLM | 2023/2024 Data Point |

| Underperforming Regional Routes | Low passenger numbers, high competition | Consume resources, low load factors | Load factors below 65% on some routes vs. 85% group average (end of 2023) |

| Older Aircraft | Less fuel-efficient, higher operating costs | Drag on profitability | Older Boeing 777-200ERs consume 15-20% more fuel per mile than newer models |

| Niche Cargo Operations | Low volume, limited access to high-growth sectors | Revenue dips due to market pressures | Specific niches saw revenue dips despite general cargo volume increase in 2024 |

| Legacy IT Systems | Outdated infrastructure, operational inefficiencies | Increased costs, reduced agility | Ongoing investments in IT modernization to address inefficiencies; 2023 operating income was €3.06 billion |

| Geopolitically Restricted Routes | Affected by airspace closures and restrictions | Payload limitations, reduced unit revenues | Russian airspace closure in H1 2024 increased flight times and fuel consumption on affected routes |

Question Marks

The recent introduction of new long-haul routes such as San Diego, Orlando, Hyderabad, Georgetown, Riyadh, Kilimanjaro, Salvador de Bahia, and Manila positions Air France-KLM in markets with considerable growth potential. These destinations represent strategic plays into emerging territories where the airline currently holds a modest market share, necessitating substantial investment in marketing and service expansion to establish a stronger presence.

Air France-KLM is making substantial commitments and forging key alliances in the realm of Sustainable Aviation Fuel (SAF). This strategic focus positions SAF as a critical component for the airline's long-term environmental goals and operational viability.

Despite SAF's considerable growth potential and its essential role in aviation's decarbonization, its current market penetration remains low, accounting for only 1.25% of total aviation fuel consumption in 2024. This limited adoption, coupled with elevated production costs, means that while SAF represents a significant cash outflow for Air France-KLM, its immediate return on investment is modest, though its future prospects are exceptionally strong.

Transavia, Air France-KLM's low-cost arm, is strategically positioning itself as a Question Mark within the group's BCG Matrix. The airline is aggressively expanding its network, adding 26 new routes and targeting a significant 10% capacity growth for 2025. This expansion is a clear indicator of its potential, but also its need for substantial investment to capture market share.

While the budget travel market continues to grow, Transavia faces formidable competition from established low-cost carriers. Its operating results in Q2 2025, though showing progress, were more modest compared to other group entities, underscoring the capital-intensive nature of this expansion. Continued investment is crucial for Transavia to solidify its position and become a Star in the future.

New Engine Leasing Joint Ventures

Air France-KLM's new engine leasing joint ventures, like the one with AerCap for LEAP engines, are positioned as Question Marks in the BCG Matrix. This strategic move taps into the expanding MRO market for next-generation aircraft, a sector projected to see significant growth. For instance, the global aviation MRO market was valued at approximately $80 billion in 2023 and is anticipated to reach over $100 billion by 2028, with new engine maintenance being a key driver.

These ventures require substantial initial investment and focused strategic development to gain traction and establish a profitable market presence. As a nascent undertaking in a competitive landscape, its future success hinges on its ability to capture market share and demonstrate a clear path to profitability. The airline group's commitment to this area signals a belief in the long-term potential of specialized engine leasing services.

- Market Growth: The global aviation MRO market is expanding, with new engine services being a significant contributor.

- Strategic Investment: New joint ventures require upfront capital and ongoing strategic focus to succeed.

- Competitive Landscape: Establishing market share in engine leasing demands a robust strategy against existing players.

- Profitability Potential: The long-term success depends on proving the economic viability of these new ventures.

Exploration of New Strategic Acquisitions

Air France-KLM's exploration of new strategic acquisitions, such as their prior interest in Air Europa, positions these ventures as Question Marks within the BCG framework. These potential deals represent opportunities to bolster network reach and market share, particularly in high-growth areas like Latin America. However, they also carry significant financial outlays and integration complexities, with success far from guaranteed.

The airline group’s strategic acquisitions are characterized by high investment requirements and inherent integration risks. For instance, a deal like the potential acquisition of Air Europa would demand substantial capital, and the success of merging operations, cultures, and systems is uncertain. This uncertainty means these strategic plays require meticulous due diligence and careful planning to transition from Question Marks to potential Stars, which would signify market leadership and strong growth.

- Strategic Acquisitions as Question Marks: Air France-KLM's pursuit of new acquisitions, like the previously considered Air Europa deal, falls into the Question Mark category due to their high investment needs and uncertain outcomes.

- Growth Potential: These acquisitions are aimed at expanding the airline's network and market share, especially in promising regions such as Latin America, offering significant growth prospects.

- Risks and Evaluation: The ventures involve substantial financial commitments and integration challenges, necessitating thorough evaluation to determine their potential to become Stars in the portfolio.

- Financial Implications: For example, the Air Europa bid was reportedly valued in the hundreds of millions of euros, underscoring the significant capital deployment required for such strategic moves.

Transavia, Air France-KLM's low-cost carrier, is positioned as a Question Mark due to its aggressive expansion and need for significant investment to capture market share in a competitive budget travel landscape. Despite promising growth, its Q2 2025 operating results were more modest compared to other group entities, highlighting the capital-intensive nature of its network expansion. Continued investment is vital for Transavia to evolve into a Star performer within the BCG matrix.

BCG Matrix Data Sources

Our Air France-KLM BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.