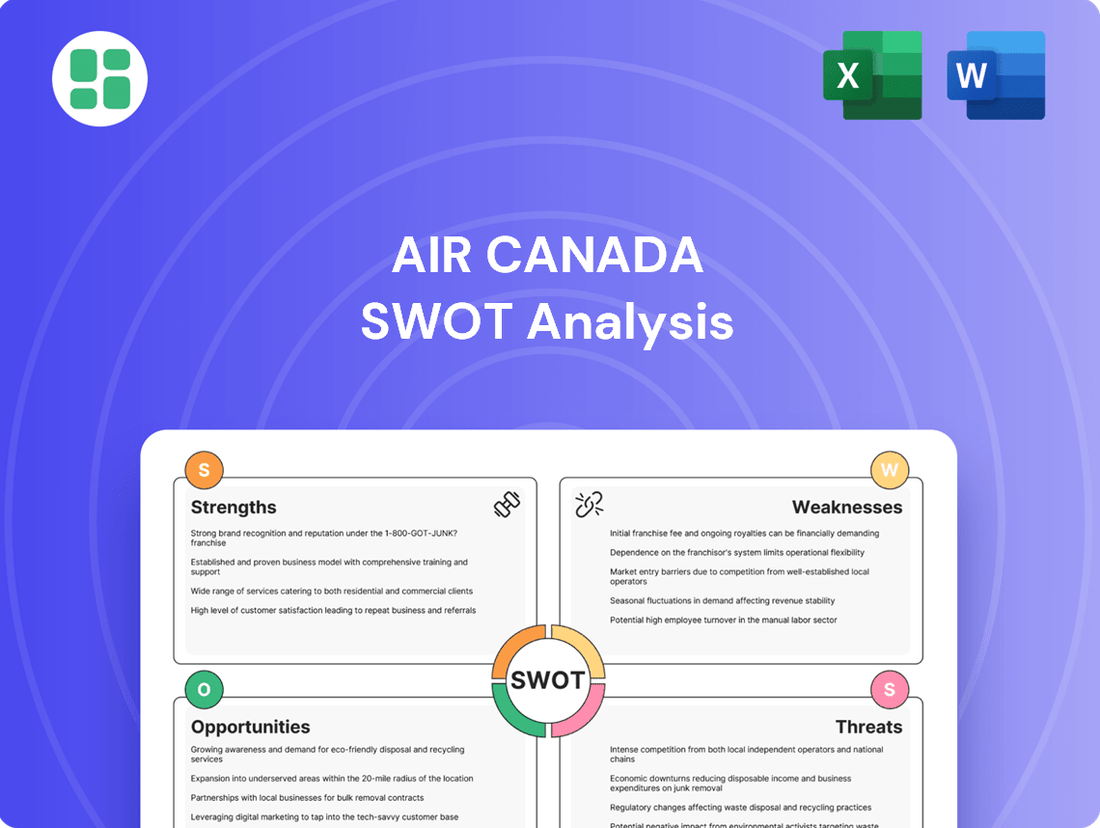

Air Canada SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Canada Bundle

Air Canada navigates a dynamic aviation landscape, leveraging its extensive network and brand recognition as key strengths. However, it faces significant challenges from intense competition and fluctuating fuel costs, impacting its operational efficiency. Discover the complete picture behind Air Canada’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Air Canada is the largest airline in Canada, serving as its flag carrier and holding a substantial share of both domestic and international routes. This leadership position is a considerable strength, enabling the airline to benefit from economies of scale and a well-established operational infrastructure.

The brand recognition for Air Canada is exceptionally high, built over decades of service. This familiarity translates into customer loyalty and trust, a crucial asset in the competitive airline industry, especially as travel rebounds post-pandemic.

In 2023, Air Canada carried over 47 million passengers, reinforcing its position as a dominant player. This extensive network and passenger volume allow for significant revenue generation and operational efficiencies not available to smaller competitors.

Air Canada's position as a founding member of the Star Alliance is a significant strength, providing access to an extensive global network that spans over 222 destinations on six continents. This vast reach is further amplified through strategic codeshare agreements and joint ventures with alliance partners, allowing Air Canada to offer a more comprehensive travel experience and attract a wider array of international customers.

Air Canada's strength lies in its diverse and modernizing fleet, encompassing Boeing, Airbus, and Bombardier aircraft. This mix allows for agile capacity management across domestic and international routes, from short hops to long-haul flights. For instance, by the end of 2024, Air Canada expects to have over 40 A220 aircraft in service, a key component of its fleet renewal strategy.

The airline is strategically investing in fuel-efficient models such as the Airbus A321XLRs, A220s, and Boeing 787-10s. This modernization drive is crucial for reducing operating expenses and enhancing the passenger experience. The A220s, for example, offer a 20% reduction in fuel burn compared to previous generation aircraft, directly contributing to lower costs and environmental sustainability.

Strong Loyalty Program (Aeroplan)

Air Canada's Aeroplan loyalty program is a cornerstone of its customer retention strategy, with over 8 million active members as of early 2024. This extensive membership base is crucial for fostering repeat business and encouraging international travel, directly impacting revenue streams. The program's evolution, set to include earning points based on dollars spent starting January 2026, is a strategic move to better align rewards with customer value and drive higher spending.

This strategic shift in Aeroplan's structure is designed to enhance member engagement and incentivize higher spending by directly linking rewards to expenditure.

- Over 8 million active members in the Aeroplan program as of early 2024.

- Aeroplan plays a key role in driving customer loyalty and increasing international traffic.

- Program changes effective January 2026 will shift earning to a dollars-spent model, rewarding high-value customers.

Improving Financial Stability and Strategic Targets

Air Canada is actively strengthening its financial foundation, evident in its 2024 performance and forward-looking strategies. The airline reported record operating revenues in 2024, showcasing a significant upward trend.

The company has established clear financial objectives, including a target of $30 billion in operating revenue by 2028 and a leverage ratio of 1.4 by June 2025. These ambitious goals are supported by recent positive financial results, such as strong Q2 2025 figures, and a dedicated focus on debt reduction.

- Record Operating Revenues: Achieved in 2024, highlighting strong market performance.

- 2028 Revenue Target: Aiming for $30 billion in operating revenue.

- 2025 Leverage Ratio Goal: Targeting a ratio of 1.4 by June 2025.

- Debt Reduction Efforts: Ongoing initiatives to improve the balance sheet.

Air Canada's extensive route network, bolstered by its Star Alliance membership and codeshare agreements, provides unparalleled global reach, connecting over 222 destinations worldwide. This broad network, serving over 47 million passengers in 2023, allows for significant economies of scale and operational efficiencies. The airline's strong brand recognition and the loyalty of its over 8 million Aeroplan members in early 2024 further solidify its market dominance and customer retention capabilities.

| Metric | Value | Year/Period |

|---|---|---|

| Passengers Carried | Over 47 million | 2023 |

| Star Alliance Destinations | Over 222 | Ongoing |

| Aeroplan Members | Over 8 million | Early 2024 |

| Operating Revenue Target | $30 billion | 2028 |

| Target Leverage Ratio | 1.4 | June 2025 |

What is included in the product

Analyzes Air Canada’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies critical weaknesses and threats to proactively address operational challenges.

Highlights strengths and opportunities to leverage competitive advantages and drive growth.

Weaknesses

Air Canada's operating costs are notably high, driven by fluctuating fuel prices, substantial labor commitments, and the ongoing upkeep of its large aircraft fleet. For instance, fuel costs represented a significant portion of operating expenses in recent years, often fluctuating with global oil markets. These elevated expenses directly affect the airline's profit margins and its ability to compete effectively against leaner carriers.

Air Canada continues to grapple with a substantial debt burden, with outstanding debt reported at approximately CAD 5.6 billion by the end of the fourth quarter of 2024. This significant financial obligation restricts the airline's capacity for strategic investments, potentially impeding crucial upgrades or expansion plans, especially during periods of economic instability. The high debt level also heightens the company's susceptibility to unforeseen operational or market disruptions.

Air Canada faces ongoing challenges with recurring labor relations issues, marked by a history of disputes with its employee unions. These tensions, such as the recent and ongoing situation with flight attendants that could escalate to a strike in August 2025, pose a significant risk to operations. Such labor actions directly translate into flight disruptions and cancellations, severely impacting customer satisfaction and brand reputation.

The resolution of these persistent labor disputes often necessitates costly concessions and agreements, leading to an increase in overall labor expenses for the airline. For instance, in 2023, Air Canada's total employee compensation and benefits amounted to CAD 5.2 billion, a figure that could be further strained by new labor contracts stemming from these ongoing tensions.

Vulnerability to External Economic and Geopolitical Factors

Air Canada's performance is significantly tied to the broader economic climate and global stability. A weakening global economy or rising geopolitical tensions can dampen travel demand, impacting passenger numbers and revenue streams.

The airline's reliance on international routes means it's particularly exposed to events like regional conflicts or trade disputes. These factors can directly reduce consumer spending on travel, leading to a contraction in the market.

For example, data from early 2025 indicated a noticeable softening in demand within the crucial Canada-U.S. transborder market. This trend highlights the immediate impact of economic sensitivities on Air Canada's operational capacity and financial outlook.

- Economic Sensitivity: Global economic downturns directly reduce discretionary spending on air travel.

- Geopolitical Risks: Regional conflicts and trade disputes create uncertainty and can disrupt travel patterns.

- Transborder Market Weakness: The Canada-U.S. route, a key market for Air Canada, experienced weaker demand in early 2025.

Customer Service Perception Challenges

While Air Canada is actively working to improve its customer experience, past criticisms regarding service quality, including flight delays, lost baggage, and communication breakdowns, continue to shape public perception. Despite a notable improvement in on-time performance, with figures showing a positive trend in early 2025, ensuring consistently high-quality service across every customer interaction remains an ongoing hurdle.

These lingering negative perceptions can directly impact brand loyalty and, consequently, market share within the highly competitive airline industry. For instance, while overall customer satisfaction scores saw an uptick in Q1 2025, specific complaint categories related to baggage handling persisted, impacting the perception of reliability.

- Past Criticisms: Issues with delays, lost baggage, and communication have historically affected Air Canada's customer service image.

- On-Time Performance: Early 2025 data indicates improved on-time performance, yet maintaining this consistency is key.

- Perception vs. Reality: Bridging the gap between service improvements and public perception is crucial for brand reputation.

- Competitive Impact: Negative perceptions can erode customer loyalty and market share against rivals.

Air Canada's substantial debt load, approximately CAD 5.6 billion at the close of 2024, limits its capacity for strategic investments and makes it vulnerable to market shocks. High operating costs, particularly fuel and labor, also squeeze profit margins, impacting its competitive edge against leaner airlines. Persistent labor disputes, such as potential strike actions by flight attendants in August 2025, threaten operational stability and customer satisfaction.

| Weakness | Description | Impact | Data Point |

| High Operating Costs | Driven by fuel prices, labor, and fleet maintenance. | Reduced profit margins, competitive disadvantage. | Fuel costs a significant portion of expenses (recent years). |

| Substantial Debt Burden | CAD 5.6 billion outstanding debt (end of Q4 2024). | Restricts investment, increases vulnerability. | CAD 5.6 billion (end of Q4 2024). |

| Labor Relations Issues | History of disputes with unions, potential strike in August 2025. | Operational disruptions, cancellations, reputational damage. | Potential strike by flight attendants (August 2025). |

| Customer Service Perception | Lingering issues with delays, baggage, communication. | Impacts brand loyalty and market share. | Specific complaint categories related to baggage handling persisted (Q1 2025). |

Preview the Actual Deliverable

Air Canada SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at Air Canada's current strategic position. Unlock the full, in-depth analysis by completing your purchase.

Opportunities

Air Canada has a prime opportunity to broaden its reach by adding new routes, both within Canada and across international borders, to meet changing passenger needs. This expansion is particularly promising in developing economies, especially in Asia and South America, where air travel is projected to see substantial growth.

The airline can tap into significant growth potential by focusing on these emerging markets, where a rising middle class is increasingly embracing air travel. For instance, the International Air Transport Association (IATA) forecasts strong passenger growth in Asia-Pacific through 2040.

By strategically entering these less saturated markets, Air Canada can establish new revenue streams and reduce its reliance on existing, potentially more competitive, regions. This diversification is crucial for long-term stability and profitability.

Air Canada has a significant opportunity to boost its digital capabilities, directly impacting customer satisfaction. By further investing in digital transformation, the airline can streamline operations and create a more seamless travel experience for its passengers.

Upgrading its mobile application, expanding biometric boarding to more airports, and offering complimentary Wi-Fi across its fleet are key initiatives. These technological enhancements not only simplify the passenger journey but also reduce processing times, leading to a more positive overall travel experience. For instance, as of late 2024, Air Canada has been piloting enhanced mobile check-in features and exploring biometric solutions at select hubs, aiming to reduce boarding times by an estimated 20%.

Air Canada's position as a founding member of Star Alliance presents a significant opportunity to deepen and broaden its strategic alliances. These partnerships, encompassing codeshare agreements and joint ventures, enable the airline to expand its global network and service portfolio cost-effectively. For instance, in 2023, Air Canada's extensive network of over 1,300 daily flights to 220 destinations across five continents was significantly amplified through its Star Alliance collaborations.

These alliances are crucial for delivering a seamless travel experience for passengers, offering greater connectivity and convenience. By leveraging these relationships, Air Canada can enhance its competitive edge in the global aviation market, providing a more attractive proposition to travelers seeking integrated international travel solutions.

Growth of Cargo Operations

Air Canada's cargo operations present a significant growth opportunity, building on their proven strength as a vital part of the airline's diversified business model. This segment offers a consistent revenue source, capable of mitigating the inherent fluctuations in passenger travel demand.

The airline can further leverage this by expanding its cargo services. This strategic move can bolster its contribution to overall profitability, especially as global trade continues its recovery trajectory.

- Cargo revenue growth: Air Canada Cargo reported record revenues in 2023, exceeding CAD 1 billion, a testament to its robust performance.

- Market demand: The global air cargo market is projected to see continued demand, driven by e-commerce and the need for expedited shipping.

- Fleet optimization: Investments in dedicated freighter aircraft and improved belly-hold utilization can enhance cargo capacity and efficiency.

- Service expansion: Developing specialized cargo solutions, such as temperature-controlled transport for pharmaceuticals, can tap into high-value market segments.

Sustainability Initiatives and Fuel Efficiency

Air Canada has a substantial opportunity to enhance its market position by investing further in sustainable aviation initiatives. This includes the adoption of more fuel-efficient aircraft and the exploration of sustainable aviation fuels (SAFs). These advancements not only promise to lower operating costs through reduced fuel consumption but also strongly align with evolving environmental regulations and a growing consumer preference for eco-conscious travel options.

The airline's strategic fleet modernization, exemplified by the introduction of aircraft like the Airbus A321XLR, directly supports these sustainability goals. This type of aircraft offers significant improvements in fuel efficiency compared to older models. For instance, the A321XLR can reduce fuel burn per seat by as much as 15% compared to previous generation aircraft, a critical factor in both cost management and environmental impact reduction.

Key opportunities stemming from these initiatives include:

- Cost Reduction: Lower fuel burn directly translates to reduced operating expenses, a crucial advantage in the competitive airline industry.

- Regulatory Compliance and Brand Image: Proactive adoption of sustainable practices helps Air Canada meet or exceed environmental mandates and bolsters its reputation among environmentally aware travelers.

- Fleet Modernization Benefits: Acquiring newer, more fuel-efficient aircraft like the A321XLR enhances operational efficiency and expands route capabilities, appealing to a broader customer base.

Air Canada can capitalize on expanding its route network, particularly into high-growth emerging markets in Asia and South America, to diversify revenue and tap into increasing demand. The airline's digital transformation offers a chance to significantly enhance customer experience through improved mobile apps and biometric technology, aiming to reduce processing times.

Leveraging its Star Alliance membership allows for cost-effective network expansion and enhanced passenger connectivity. Furthermore, strengthening its cargo operations, which saw record revenues exceeding CAD 1 billion in 2023, presents a stable income stream, especially with global e-commerce driving demand.

Investing in sustainable aviation, including fuel-efficient aircraft like the Airbus A321XLR which reduces fuel burn by up to 15%, aligns with environmental goals and can lower operating costs. This focus on sustainability also improves brand image and regulatory compliance.

Threats

Air Canada operates in a highly competitive landscape. Domestically, it contends with rivals such as WestJet and Porter Airlines, while internationally, it faces pressure from a multitude of global carriers. This intense rivalry significantly impacts pricing strategies and profit margins.

The competitive environment necessitates constant innovation in route development and customer experience to maintain market share. For instance, in 2023, Air Canada reported a net income of $2.3 billion, a significant rebound from previous years, but the ongoing competitive pressures remain a key factor influencing future financial performance.

Global economic downturns, such as a potential recession in major markets, pose a significant threat by dampening both leisure and business travel. For instance, if Canada's GDP growth slows considerably in 2024 or 2025, as some forecasts suggest, consumer discretionary spending on travel would likely decrease.

Geopolitical instability, including ongoing conflicts and trade disputes, can directly impact Air Canada's operations and demand. For example, escalating trade tensions between Canada and the U.S., a key market, or disruptions in regions Air Canada serves could lead to route adjustments and reduced passenger numbers, affecting revenue streams.

Fuel costs are a major, unpredictable expense for airlines like Air Canada. Global oil price swings directly affect their profits, complicating financial planning and cost control. For instance, in early 2024, jet fuel prices saw significant upward movement, impacting airline operating costs globally.

These price spikes can swiftly diminish profit margins. In 2023, while fuel prices stabilized somewhat compared to the previous year, any resurgence in crude oil prices, perhaps due to geopolitical events or supply chain issues, poses a direct threat to Air Canada's bottom line.

Potential for Significant Labor Strikes

Air Canada faces a significant threat from potential labor strikes, particularly with ongoing disputes involving the Canadian Union of Public Employees (CUPE), which represents its flight attendants. The possibility of strikes in 2025 looms large, creating considerable uncertainty for the airline's operations and financial stability.

A prolonged work stoppage would undoubtedly lead to extensive flight cancellations, directly impacting passenger travel and cargo shipments. This disruption could result in substantial financial losses for Air Canada, estimated to be in the tens of millions of dollars per day of grounded flights, depending on the scale of the action.

Beyond the immediate financial hit, such strikes carry the risk of severely damaging Air Canada's reputation. Customers seeking reliable travel arrangements might be driven to competitors who are perceived as having more stable labor relations, eroding market share.

- CUPE represents over 6,500 Air Canada flight attendants

- Potential for widespread flight cancellations in 2025

- Risk of significant financial losses and reputational damage

Regulatory Changes and Environmental Pressures

Air Canada faces significant headwinds from evolving regulatory frameworks, particularly concerning environmental standards. For instance, the International Civil Aviation Organization's (ICAO) CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) program, which began in 2021 and is set to intensify through 2025 and beyond, mandates emissions reductions for international flights. This, alongside potential domestic carbon pricing mechanisms, could substantially increase operating expenses.

The airline must anticipate and adapt to stricter environmental policies, which may include new taxes on aviation fuel or emissions, as well as mandates for fleet modernization or the use of sustainable aviation fuels (SAFs). For example, Canada's proposed Clean Fuel Regulations could impact fuel costs. These compliance requirements necessitate considerable capital investment in newer, more fuel-efficient aircraft and potentially in carbon offset programs, adding both complexity and financial strain to operations.

- Increased Operating Costs: Stricter environmental regulations and potential carbon taxes can directly elevate fuel and operational expenses for Air Canada.

- Investment in Sustainable Technologies: Compliance may require significant capital outlay for newer aircraft, SAFs, and emissions reduction technologies.

- Compliance Complexity: Navigating diverse and changing domestic and international environmental regulations adds administrative burden and operational complexity.

The airline industry is highly sensitive to economic fluctuations, and any downturn in the Canadian or global economy, projected for 2024-2025, could significantly reduce travel demand, impacting Air Canada's revenue. Furthermore, geopolitical tensions and trade disputes can disrupt international routes and affect passenger volumes, as seen with past trade relations impacting key markets.

Rising fuel costs remain a persistent threat; for instance, jet fuel prices saw volatility in early 2024, and any resurgence would directly squeeze Air Canada's profit margins, which are already under pressure from intense competition. The potential for labor disputes, particularly with flight attendants represented by CUPE, poses a significant risk of operational disruptions and financial losses in 2025.

Stricter environmental regulations, including carbon pricing and emissions reduction schemes like ICAO's CORSIA, are set to increase operating costs and necessitate substantial investments in sustainable technologies and fleet modernization through 2025 and beyond.

SWOT Analysis Data Sources

This Air Canada SWOT analysis is built upon a foundation of robust data, including the airline's official financial statements, comprehensive market research reports, and expert commentary from aviation industry analysts, ensuring a well-rounded and informed perspective.