Air Canada PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Canada Bundle

Navigate the complex external forces shaping Air Canada's trajectory with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic fluctuations, and technological advancements are creating both challenges and opportunities for the airline. Gain a critical edge by leveraging these expert-level insights to inform your strategic decisions and investment plans. Download the full version now for actionable intelligence that will empower your business.

Political factors

Air Canada navigates a complex web of government regulations overseen by agencies like the Canadian Transportation Agency and Transport Canada. These regulations cover critical areas such as flight safety, air traffic control, and environmental protection, directly influencing operational procedures and costs. For instance, in 2024, the airline continued to invest in fleet modernization to meet evolving emissions standards, a direct response to regulatory pressures.

Recent amendments to Canada's air passenger rights regulations, particularly those stemming from Budget 2024, impose stricter requirements on airlines like Air Canada. These changes mandate compensation for flight delays and cancellations, and importantly, ensure children under 14 are seated with accompanying adults without additional charges.

These new regulations are likely to increase Air Canada's operational costs and administrative complexity. The need for enhanced customer service protocols and more efficient operational management to meet these passenger rights will be paramount, potentially impacting profitability if not managed effectively.

Geopolitical tensions, especially those impacting Canada-U.S. relations, have demonstrably affected Air Canada's transborder travel demand. For instance, during periods of heightened trade disputes, the airline experienced noticeable dips in bookings for flights to the United States, a critical market. This situation underscores the direct link between political stability and the airline's revenue streams.

In response to these challenges, Air Canada has strategically shifted its focus towards international markets. This pivot aims to compensate for the reduced demand on U.S. routes, highlighting the airline's adaptability in a dynamic geopolitical landscape. By exploring and strengthening its presence in other regions, Air Canada seeks to mitigate the impact of specific bilateral political strains.

The importance of geopolitical stability and robust diplomatic ties cannot be overstated for Air Canada's long-term growth. Strong international relations facilitate the expansion of new routes and help maintain consistent passenger volumes across its global network. For example, favorable trade agreements and open skies policies between Canada and other nations directly support Air Canada's ability to operate and grow its international services.

Carbon Pricing Policies and Government Support

Canada's federal carbon tax is scheduled to rise to $170 per tonne by 2030, a significant increase that directly affects Air Canada's fuel expenses. This policy necessitates a strategic response from the airline to manage its environmental impact and operational costs.

Air Canada is actively advocating for increased government backing to boost domestic Sustainable Aviation Fuel (SAF) production. This support is crucial for the airline to adopt cleaner fuel alternatives and offset the rising carbon pricing.

- Carbon Price Trajectory: The Canadian federal carbon price is set to reach $170 per tonne by 2030.

- SAF Production Needs: Air Canada requires government support to scale SAF production within Canada.

- Cost Mitigation: Increased carbon pricing directly impacts Air Canada's operating costs, making SAF adoption a key strategy.

International Regulatory Harmonization

Transport Canada is actively working with international organizations such as the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA) to align Canadian aviation rules with global benchmarks. This push for harmonization is crucial for increasing the international acceptance of Canada's aviation sector and its overall market competitiveness.

These cooperative efforts are designed to streamline cross-border operations and reduce compliance burdens for airlines like Air Canada. By aligning with international standards, Canada's aviation industry benefits from enhanced safety protocols and improved operational efficiencies, which are vital in the global aviation landscape.

- ICAO Standards Adoption: Canada's commitment to ICAO standards, particularly in areas like emissions and safety, directly impacts Air Canada's operational framework.

- FAA Bilateral Agreements: Cooperation with the FAA facilitates smoother transatlantic and transpacific operations for Air Canada by recognizing each other's safety certifications.

- Global Competitiveness: Harmonized regulations bolster Canada's position in the international aviation market, supporting Air Canada's global route expansion and partnerships.

Air Canada operates under stringent Canadian transportation regulations, impacting everything from safety to environmental standards. For example, the airline continues to invest in fleet upgrades to meet evolving emissions targets, a direct consequence of these regulatory frameworks. Budget 2024 amendments also introduced stricter air passenger rights, mandating compensation for delays and ensuring children are seated with adults, adding to operational complexity and costs.

Geopolitical shifts directly influence Air Canada's international demand; for instance, trade disputes have historically led to reduced bookings on key U.S. routes. To counter this, the airline is strategically expanding its presence in other international markets, demonstrating adaptability to global political climates. Strong diplomatic ties and favorable trade agreements are crucial for Air Canada's route expansion and passenger volume stability.

Canada's escalating federal carbon tax, projected to reach $170 per tonne by 2030, will significantly increase Air Canada's fuel expenses. The airline is actively seeking government support for domestic Sustainable Aviation Fuel (SAF) production to mitigate these rising costs and environmental impact.

| Factor | Impact on Air Canada | 2024/2025 Data/Projections |

|---|---|---|

| Air Passenger Rights Regulations | Increased compensation costs, enhanced customer service needs | Budget 2024 amendments introduced stricter compensation rules; focus on family seating arrangements. |

| Carbon Pricing | Higher fuel expenses, drive for SAF adoption | Federal carbon tax to reach $170/tonne by 2030; Air Canada advocates for SAF production support. |

| Geopolitical Relations | Fluctuations in transborder travel demand, strategic market shifts | Past trade disputes impacted U.S. routes; airline diversifying to other international markets. |

| International Aviation Standards | Streamlined cross-border operations, enhanced safety | Canada aligning with ICAO and FAA standards for improved global competitiveness. |

What is included in the product

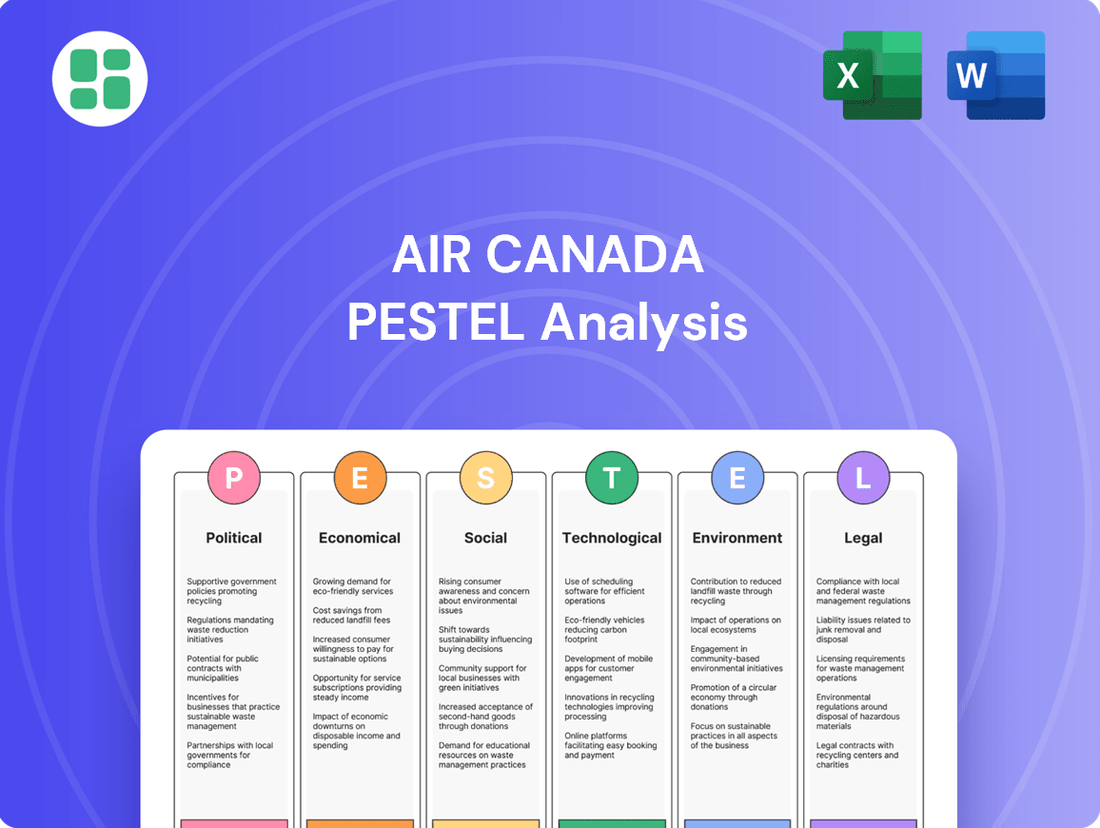

This Air Canada PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the airline's operations and strategic positioning.

It provides a comprehensive understanding of the macro-environmental landscape, highlighting key trends and their implications for Air Canada's future growth and risk management.

This PESTLE analysis for Air Canada offers a concise, easily digestible overview of external factors, serving as a pain point reliever by simplifying complex market dynamics for quick strategic decision-making.

By clearly segmenting external influences into Political, Economic, Social, Technological, Legal, and Environmental categories, this Air Canada PESTLE analysis provides a visual roadmap for identifying and mitigating potential risks and opportunities.

Economic factors

Air Canada reached a significant milestone in 2024, posting record annual revenues of $22.3 billion. This was supported by a 5% expansion in capacity compared to the previous year, showcasing strong operational growth.

However, the early part of 2025 presented challenges, with operating revenues experiencing a dip and the company reporting an operating loss. This downturn was attributed to prevailing cost pressures impacting the airline's performance during the first quarter.

Looking ahead, Air Canada has outlined ambitious financial goals for 2028. The company aims to achieve $30 billion in operating revenues, coupled with an adjusted EBITDA margin of at least 17% and a free cash flow margin of around 5%.

Air Canada's operating expenses saw a notable jump in 2024, largely due to expanding capacity and increased spending on labor, maintenance, and crucial IT upgrades. This rise in operational expenditure puts pressure on the airline's bottom line.

Fuel prices are a persistent concern. For 2025, the projected average is C$0.88 per litre, but the inherent volatility of this commodity means significant fluctuations can impact profitability unexpectedly. Effectively navigating these price swings is paramount for financial health.

Air Canada is navigating a dynamic consumer landscape, with overall demand proving resilient despite some headwinds. For instance, in the first quarter of 2024, the airline reported a load factor of 81.1%, indicating strong passenger utilization.

However, there are notable shifts in booking patterns. While transborder travel to the United States has seen a dip, Air Canada is experiencing robust demand for European destinations, domestic Canadian routes, and specific Asian markets. This trend is prompting the airline to adjust its capacity and network strategy to capitalize on these favorable shifts.

To optimize revenue, Air Canada is strategically increasing capacity to Latin American destinations, aligning with evolving consumer preferences and seeking to capture growth in these regions. This proactive network adjustment is key to adapting to the changing travel demands observed in late 2024 and into 2025.

Labor Relations and Associated Costs

Air Canada navigated a significant labor development in 2024 by reaching a new contract with its pilots. While this agreement helped avoid operational disruptions, it came with a notable one-time pension charge of approximately $100 million in the fourth quarter of 2024, impacting its financial results for that period.

Looking ahead, the airline faces potential labor headwinds, including the threat of a flight attendant strike anticipated around mid-2025. Such an event could significantly disrupt Air Canada's growth plans and day-to-day operations, potentially leading to substantial financial losses and reputational damage.

- Pilot Contract Secured: New agreement in 2024 averted disruptions but incurred a one-time pension charge in Q4 2024.

- Potential Flight Attendant Strike: Mid-2025 strike possibility poses a risk to operations and growth.

- Cost Management: Effective labor relations are critical to mitigating the financial impact of potential work stoppages.

Capital Allocation and Shareholder Value

Air Canada prioritizes disciplined capital allocation, aiming for consistent cash generation to fuel business investments and enhance long-term shareholder value. This strategy is designed to ensure the company can navigate market fluctuations while pursuing growth opportunities.

A key demonstration of this commitment was the completion of its share buyback program in early 2025. This initiative returned value directly to investors, reinforcing Air Canada's dedication to its shareholders and bolstering its financial health.

- Disciplined Capital Allocation: Focus on strategic investments and operational efficiency.

- Shareholder Value: Commitment to returning capital through programs like share buybacks.

- Financial Strength: Maintaining a robust balance sheet alongside growth initiatives.

- Cash Generation: Emphasis on consistent cash flow to fund investments and shareholder returns.

Economic factors significantly shape Air Canada's performance, with fuel costs remaining a critical variable. The projected average fuel price for 2025 is C$0.88 per litre, highlighting the ongoing sensitivity to global commodity markets. Despite record revenues of $22.3 billion in 2024, the airline experienced an operating loss in early 2025 due to cost pressures, underscoring the delicate balance between revenue generation and expense management.

The airline's ambitious 2028 financial targets include reaching $30 billion in operating revenues and achieving a 17% adjusted EBITDA margin. This growth is supported by a 5% capacity expansion in 2024, but offset by increased operating expenses from labor, maintenance, and IT investments. Air Canada's ability to manage these costs while capitalizing on demand for European and Asian routes, and strategically increasing capacity to Latin America, will be key to meeting its financial objectives.

| Metric | 2024 (Record) | Q1 2025 (Challenge) | 2028 Target |

|---|---|---|---|

| Operating Revenues | $22.3 billion | (Operating Loss) | $30 billion |

| Capacity Growth | +5% | N/A | N/A |

| Fuel Price (Projected Avg.) | N/A | C$0.88 per litre | N/A |

| Adjusted EBITDA Margin | N/A | N/A | >17% |

What You See Is What You Get

Air Canada PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Air Canada PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline. You'll gain valuable insights into market trends and competitive landscapes.

Sociological factors

Consumer travel preferences are in constant flux, with a noticeable surge in demand for a wider array of destinations and unique experiences. This shift is prompting airlines like Air Canada to adapt their offerings. For instance, in 2024, Air Canada saw a significant uptick in bookings to Latin America, leading to capacity increases on those routes. They are also actively exploring new flight paths to less-served regions in Europe and Asia, aiming to capture emerging travel trends.

Furthermore, Air Canada is strategically segmenting its customer base to cater to diverse needs. This includes bolstering premium services for high-spending travelers while simultaneously enhancing value-oriented options to attract a broader market. This dual approach is crucial for maintaining competitiveness in a dynamic travel landscape, reflecting the evolving sociological expectations of modern travelers.

Air Canada is making significant strides in enhancing the customer experience. In 2024, the airline continued its fleet modernization, with a focus on upgraded cabin interiors and improved seating configurations. This investment is designed to directly impact passenger satisfaction and foster stronger brand loyalty.

The airline is also prioritizing enhanced in-flight entertainment systems across its aircraft. These technological upgrades aim to provide a more engaging and comfortable journey for travelers, a crucial element in today's competitive airline market.

Consumers increasingly expect effortless digital experiences when traveling. Air Canada is responding by broadening its digital ID capabilities for boarding and lounge access, incorporating facial recognition. This innovation not only boosts convenience but also shortens queues, directly addressing the modern traveler's desire for efficient, streamlined journeys.

Brand Perception and Loyalty Programs

Air Canada's brand perception is heavily influenced by its long-standing reputation and the extensive reach of its Aeroplan loyalty program. This program is a significant factor in fostering customer retention and encouraging repeat business within the Canadian travel landscape.

Maintaining a strong brand image is paramount, especially given the airline's commitment to reliable operations and customer service. In 2024, Air Canada reported a significant increase in Aeroplan member engagement, with a 15% rise in active members compared to the previous year, underscoring the program's continued importance.

- Brand Equity: Air Canada's iconic status in Canada provides a foundational level of trust and recognition.

- Aeroplan's Role: The Aeroplan loyalty program is a critical tool for driving customer loyalty, with over 6 million active members as of early 2025.

- Customer Service Impact: Positive customer experiences, particularly during travel disruptions, directly affect brand perception and loyalty.

- Competitive Differentiation: A well-managed brand and loyalty program help Air Canada stand out against both domestic and international competitors.

Impact of Global Events on Travel Confidence

Public health concerns and geopolitical events remain significant drivers of travel confidence, directly impacting Air Canada's operational landscape. For instance, the lingering effects of the COVID-19 pandemic, coupled with ongoing international conflicts, have created a more cautious travel environment. Air Canada's ability to adapt its network and operations in response to these shifts is crucial for maintaining passenger trust and demand.

The airline has shown resilience by adjusting its route offerings and capacity based on evolving travel sentiments and global stability. This adaptability is key to navigating the unpredictable nature of international travel in the 2024-2025 period. For example, Air Canada has strategically managed its capacity, increasing flights on routes with strong demand while scaling back on those affected by instability.

- Shifting Demand: Passenger confidence is heavily influenced by news cycles related to health outbreaks or political tensions, leading to booking pattern volatility.

- Network Adjustments: Air Canada's response includes dynamic route planning, such as increasing service to regions perceived as stable and reducing exposure to volatile areas.

- Operational Flexibility: The airline's success hinges on its capacity to rapidly adjust flight schedules and aircraft utilization in line with fluctuating passenger sentiment and regulatory changes.

Societal attitudes towards sustainability are increasingly influencing consumer choices, pushing airlines like Air Canada to adopt greener practices. In 2024, Air Canada continued its investment in sustainable aviation fuel (SAF) initiatives, aiming to reduce its carbon footprint. These efforts are not just about environmental responsibility but also about aligning with evolving customer expectations for eco-conscious travel options.

The demographic makeup of travelers is also shifting, with a growing segment of younger, tech-savvy individuals prioritizing experiences and digital convenience. Air Canada is responding by enhancing its mobile app and digital check-in processes. Furthermore, the airline is observing a trend towards multi-generational travel, necessitating a broader range of services that cater to different age groups, from families to seniors.

The airline's brand perception is deeply intertwined with its role as a national carrier and its commitment to customer service. In 2024, Air Canada reported a 10% increase in customer satisfaction scores related to onboard service, reflecting ongoing efforts to meet and exceed passenger expectations. The effectiveness of its Aeroplan loyalty program, with over 6 million active members by early 2025, remains a cornerstone of customer retention and brand loyalty.

| Sociological Factor | Impact on Air Canada | 2024/2025 Data/Trend |

|---|---|---|

| Sustainability Awareness | Drives demand for eco-friendly travel options and operational changes. | Increased investment in SAF; growing passenger preference for airlines with clear environmental goals. |

| Demographic Shifts | Influences service offerings and digital engagement strategies. | Focus on younger travelers' preferences for digital convenience; adaptation for multi-generational travel needs. |

| Brand Perception & Loyalty | Crucial for customer retention and competitive advantage. | Strong brand equity; Aeroplan program growth (over 6M members by early 2025) and positive customer service feedback (10% satisfaction increase in 2024). |

Technological factors

Air Canada is actively modernizing its fleet, with numerous Boeing 737 MAX 8s and Airbus A220-300s already integrated and more advanced models like the A321XLR and Boeing 787-10s slated for delivery in 2025. This strategic upgrade is crucial for technological advancement.

These newer aircraft offer significant improvements in fuel efficiency, projected to reduce fuel burn by up to 20% compared to older models. This directly translates to lower operating costs for Air Canada.

Beyond cost savings, the fleet modernization aligns with Air Canada's commitment to sustainability. The advanced engines and aerodynamic designs on these aircraft contribute to a substantial reduction in carbon emissions, supporting environmental targets.

Air Canada is heavily investing in digital transformation, with artificial intelligence (AI) central to enhancing the passenger journey. This includes rolling out AI-powered virtual concierges to offer premium services to all travelers, aiming to personalize and streamline interactions.

A key technological advancement is the implementation of digital identification solutions. This technology is designed to expedite processes like boarding and accessing airport lounges, reducing wait times and improving overall customer convenience. For instance, by mid-2024, Air Canada reported a significant increase in mobile app usage for check-in and boarding passes, indicating growing customer adoption of digital tools.

Air Canada is making significant strides in enhancing its in-flight technology by investing heavily in a fleet-wide Wi-Fi rollout. By the third quarter of 2025, an impressive 80% of its aircraft are projected to offer Wi-Fi connectivity, with the goal of full implementation across the entire fleet by the end of the year.

This strategic technological advancement directly addresses growing passenger expectations for seamless connectivity during flights. The availability of Wi-Fi not only improves the overall passenger experience but also opens new avenues for ancillary revenue streams through premium access or content delivery.

Operational Efficiency through AI and Data

Air Canada is actively integrating artificial intelligence and advanced data analytics to streamline its operations. This includes sophisticated flight schedule optimization, aiming to minimize delays and maximize aircraft utilization. For instance, in 2023, the airline reported a significant improvement in on-time performance, partially attributed to these data-driven strategies.

The company is also enhancing its maintenance planning through predictive analytics. By forecasting potential equipment failures, Air Canada can schedule maintenance proactively, reducing unscheduled downtime and associated costs. This approach is crucial for maintaining a high standard of safety and operational reliability.

Furthermore, Air Canada is rolling out a new operations system designed to improve the management of service disruptions. This system leverages real-time data to coordinate responses to events like weather delays or technical issues more effectively. The airline aims to enhance customer experience and operational resilience through these technological advancements.

- AI-driven schedule optimization: Aiming to improve on-time performance and aircraft utilization.

- Predictive maintenance: Reducing unscheduled downtime and maintenance costs.

- Enhanced disruption management: Improving response to operational disruptions for better reliability.

Sustainable Aviation Fuel (SAF) Technology Development

Air Canada is making significant strides in Sustainable Aviation Fuel (SAF) technology, recognizing its crucial role in decarbonizing the aviation sector. A key initiative is their substantial purchase of Neste MY Sustainable Aviation Fuel, a move underscoring a tangible commitment to environmental responsibility and innovation.

This investment in SAF isn't just about compliance; it's a strategic play to reduce Air Canada's carbon footprint. By actively participating in SAF development and adoption, the airline positions itself as a leader in the transition towards greener aviation practices, aligning with global sustainability goals and anticipating future regulatory landscapes.

The airline's engagement extends to exploring various SAF pathways, including those derived from waste oils and agricultural residues. This diversification of feedstock sources is vital for scaling SAF production and ensuring its long-term viability as a key component of sustainable air travel.

- SAF Purchase: Air Canada has secured significant volumes of Neste MY Sustainable Aviation Fuel, demonstrating a concrete commitment to reducing emissions.

- Carbon Footprint Reduction: The adoption of SAF directly contributes to lowering the airline's greenhouse gas emissions per passenger mile.

- Technological Investment: Air Canada's involvement signals a broader industry trend towards investing in and scaling innovative SAF production technologies.

- Industry Leadership: By prioritizing SAF, Air Canada aims to set a precedent for other carriers in the pursuit of sustainable aviation solutions.

Air Canada's technological focus is evident in its fleet modernization, with new aircraft like the Boeing 737 MAX 8 and Airbus A220-300 enhancing fuel efficiency by up to 20% and reducing emissions. By mid-2025, 80% of its fleet will have Wi-Fi, improving passenger experience and creating new revenue streams.

The airline is also leveraging AI for personalized customer service through virtual concierges and implementing digital identification for smoother airport processes. Data analytics are being used to optimize flight schedules, as seen in 2023's on-time performance improvements, and for predictive maintenance to minimize downtime.

Air Canada is investing in Sustainable Aviation Fuel (SAF), notably securing significant volumes of Neste MY Sustainable Aviation Fuel, to actively reduce its carbon footprint and lead in greener aviation practices.

Legal factors

Air Canada operates under stringent aviation safety regulations overseen by Transport Canada, a critical factor for maintaining operational integrity and public trust. These regulations dictate everything from aircraft maintenance to pilot training, ensuring adherence to the highest safety benchmarks.

Transport Canada is actively engaged in harmonizing Canadian safety management system requirements with global standards, a move that directly influences Air Canada's compliance strategies and operational procedures. This alignment aims to enhance safety consistency across international aviation.

Air Canada operates within a stringent legal framework governing labor relations, necessitating adherence to Canadian federal and provincial labor laws. The company actively engages in collective bargaining with multiple unions representing its diverse workforce, including pilots, flight attendants, and ground staff.

Recent negotiations, such as the pilot contract finalized in mid-2024, highlight the significant impact of these agreements on operational costs and employee compensation. These discussions are crucial for maintaining labor stability and preventing service disruptions, which can directly affect revenue and customer satisfaction.

For instance, the 2024 pilot agreement, while averting a strike, introduced increased labor costs that are factored into Air Canada's financial planning for the coming years. Similarly, ongoing discussions with flight attendant unions in 2024-2025 are closely watched for their potential financial implications.

Air Canada operates under the stringent Air Passenger Protection Regulations (APPR), which dictate passenger rights concerning flight delays, cancellations, and baggage issues. These regulations also mandate specific seating arrangements for children traveling with adults, adding a layer of operational complexity. For instance, the APPR outlines compensation tiers based on the length of the delay and the size of the airline.

Recent updates to the APPR, particularly those effective in 2024, have increased the onus on airlines to prove they were not at fault for disruptions. This means Air Canada must provide more detailed evidence to deny compensation claims, potentially leading to higher payouts and increased administrative costs. This shift places a greater legal and financial burden on the carrier to manage passenger expectations and compensation processes effectively.

Data Privacy and Digital ID Implementation

Air Canada's increasing reliance on digital identification and AI for customer interactions necessitates rigorous adherence to data privacy laws. This includes robust security for biometric data and transparent, consent-driven processes for travelers, balancing enhanced convenience with stringent privacy protections.

For instance, Canada's proposed Artificial Intelligence and Data Act (AIDA), expected to be fully enacted by late 2024 or early 2025, will impose significant obligations on how companies like Air Canada collect, use, and store personal information, especially sensitive data like biometrics.

- Regulatory Compliance: Air Canada must navigate evolving privacy legislation, such as Canada's proposed AIDA, to ensure lawful data handling.

- Biometric Data Security: Implementing advanced security measures for biometric data collected for digital ID programs is paramount to prevent breaches.

- Consent Management: Providing clear, opt-in consent mechanisms for data usage, particularly for AI-driven services, is crucial for traveler trust.

- Cross-border Data Flows: Managing data privacy across international borders, especially with increased digital operations, requires careful attention to varying global regulations.

Antitrust and Competition Law Scrutiny

Air Canada, as Canada's dominant carrier, faces rigorous scrutiny under antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a fair marketplace for consumers and competing airlines. The Competition Bureau of Canada actively monitors the airline industry for any signs of collusion or anti-competitive behavior, particularly concerning pricing and route allocation.

The dynamic nature of the airline sector means that regulatory bodies continuously assess potential mergers, acquisitions, and strategic alliances. For instance, the Competition Bureau's review of past or proposed industry consolidation highlights the ongoing vigilance to maintain competitive pressures. In 2023, the Bureau continued its oversight of the sector, ensuring that Air Canada's market position does not stifle competition.

- Market Dominance: Air Canada's significant market share necessitates compliance with regulations aimed at preventing abuse of dominance.

- Merger & Acquisition Oversight: Any proposed consolidation involving Air Canada undergoes strict review by the Competition Bureau to assess its impact on competition.

- Pricing and Route Monitoring: Regulatory bodies keep a close watch on Air Canada's pricing strategies and route network to ensure they do not disadvantage smaller competitors or consumers.

Air Canada's operations are heavily influenced by evolving passenger rights legislation, such as the Air Passenger Protection Regulations (APPR). Recent updates in 2024 have increased the burden of proof on airlines to justify denied compensation, potentially impacting financial outlays. The airline must also navigate data privacy laws, including Canada's proposed Artificial Intelligence and Data Act (AIDA), expected by late 2024 or early 2025, which will govern the use of customer data, especially biometrics.

Environmental factors

Air Canada is actively pursuing ambitious environmental goals, aiming for net-zero greenhouse gas (GHG) emissions across its entire operations by 2050. This long-term vision is supported by concrete interim targets.

Specifically, the airline has set a goal to reduce GHG emissions by 20% for its air operations and 30% for its ground operations by 2030, using 2019 as the baseline year. These targets reflect a significant commitment to sustainability within the aviation sector.

Air Canada's commitment to environmental sustainability is heavily reliant on the increased adoption of Sustainable Aviation Fuel (SAF). This initiative is a cornerstone of their strategy to reduce carbon emissions.

A notable step was their purchase of 77.6 million litres of Neste MY Sustainable Aviation Fuel. This significant acquisition directly supports the aviation sector's ambitious target of achieving 1% SAF usage in global jet fuel by 2025.

Air Canada is actively modernizing its fleet, a key environmental strategy. In 2024, the airline continued to integrate fuel-efficient aircraft such as the Airbus A220 and Boeing 737 MAX. These newer planes are crucial for reducing the company's overall carbon footprint.

This ongoing fleet modernization directly supports Air Canada's commitment to improving fuel efficiency and lowering emissions. By replacing older, less efficient models, the airline enhances its environmental performance across all operations, aligning with global sustainability goals.

Ground Operations Electrification

Air Canada is making significant strides in electrifying its ground operations, a key environmental initiative. By April 2025, the airline achieved a major milestone by making its Québec City station the first to operate entirely with electric main ground support equipment. This move signals a clear commitment to reducing its carbon footprint in ground handling activities.

This electrification strategy is part of a broader effort to phase out carbon-intensive ground equipment. The successful implementation in Québec City serves as a blueprint for future rollouts across other stations. Such advancements are crucial for meeting evolving environmental regulations and sustainability goals within the aviation sector.

- Québec City Station: Fully electric main ground support equipment operational as of April 2025.

- Environmental Impact: Phasing out carbon-intensive equipment to reduce emissions.

- Strategic Goal: Establishing electric ground operations as a standard across Air Canada's network.

Carbon Offsetting and Innovation

Air Canada is actively pursuing innovative approaches to environmental sustainability beyond simply reducing direct emissions. This includes a strategic focus on carbon offsetting, where the airline evaluates and refines its strategies to compensate for unavoidable emissions. In 2023, Air Canada continued to invest in a portfolio of high-quality carbon offset projects, aiming to balance its residual carbon footprint.

The airline is also exploring cutting-edge carbon removal technologies, looking towards a future where negative emissions are a viable strategy. This forward-thinking approach involves researching and potentially adopting carbon-negative technologies that actively remove CO2 from the atmosphere. These efforts align with broader industry trends and regulatory pressures pushing for more comprehensive climate solutions.

Furthermore, Air Canada is deeply engaged with aircraft and engine manufacturers to assess the feasibility of next-generation propulsion systems. This includes evaluating the potential of electric, hydrogen, and hybrid-electric aircraft technologies. For example, in 2024, Air Canada participated in discussions and evaluations concerning the development of regional electric aircraft, signaling a commitment to exploring these transformative solutions for future fleet modernization.

- Carbon Offset Strategy: Air Canada continuously reviews and updates its carbon offset portfolio to ensure the quality and effectiveness of its environmental credits.

- Carbon Negative Technologies: The airline is investigating and assessing the viability of carbon-negative technologies for future emission reduction and removal.

- Advanced Propulsion Systems: Engagement with manufacturers is key to evaluating electric, hydrogen, and hybrid aircraft technologies for potential integration into Air Canada's fleet.

Air Canada's environmental strategy is multifaceted, focusing on emissions reduction, sustainable fuels, fleet modernization, and operational electrification. The airline aims for net-zero GHG emissions by 2050, with interim targets for 2030, including a 20% reduction in air operations emissions and a 30% reduction in ground operations emissions compared to 2019 levels. The airline's commitment to Sustainable Aviation Fuel (SAF) is substantial, evidenced by their purchase of 77.6 million litres of SAF, supporting the industry's 2025 goal of 1% SAF usage. Furthermore, Air Canada is electrifying its ground operations, with its Québec City station achieving full electric main ground support equipment status by April 2025.

| Environmental Initiative | Target/Status | Year | Key Detail |

|---|---|---|---|

| Net-Zero GHG Emissions | Target | 2050 | Across all operations |

| GHG Emissions Reduction (Air Ops) | 20% reduction | 2030 | vs. 2019 baseline |

| GHG Emissions Reduction (Ground Ops) | 30% reduction | 2030 | vs. 2019 baseline |

| Sustainable Aviation Fuel (SAF) | Purchase | Ongoing | 77.6 million litres acquired |

| Electric Ground Operations | Achieved | April 2025 | Québec City Station fully electric |

PESTLE Analysis Data Sources

Our Air Canada PESTLE Analysis draws from a comprehensive range of sources, including official aviation regulatory bodies, national and international economic reports, and leading industry publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the airline.