Air Canada Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Canada Bundle

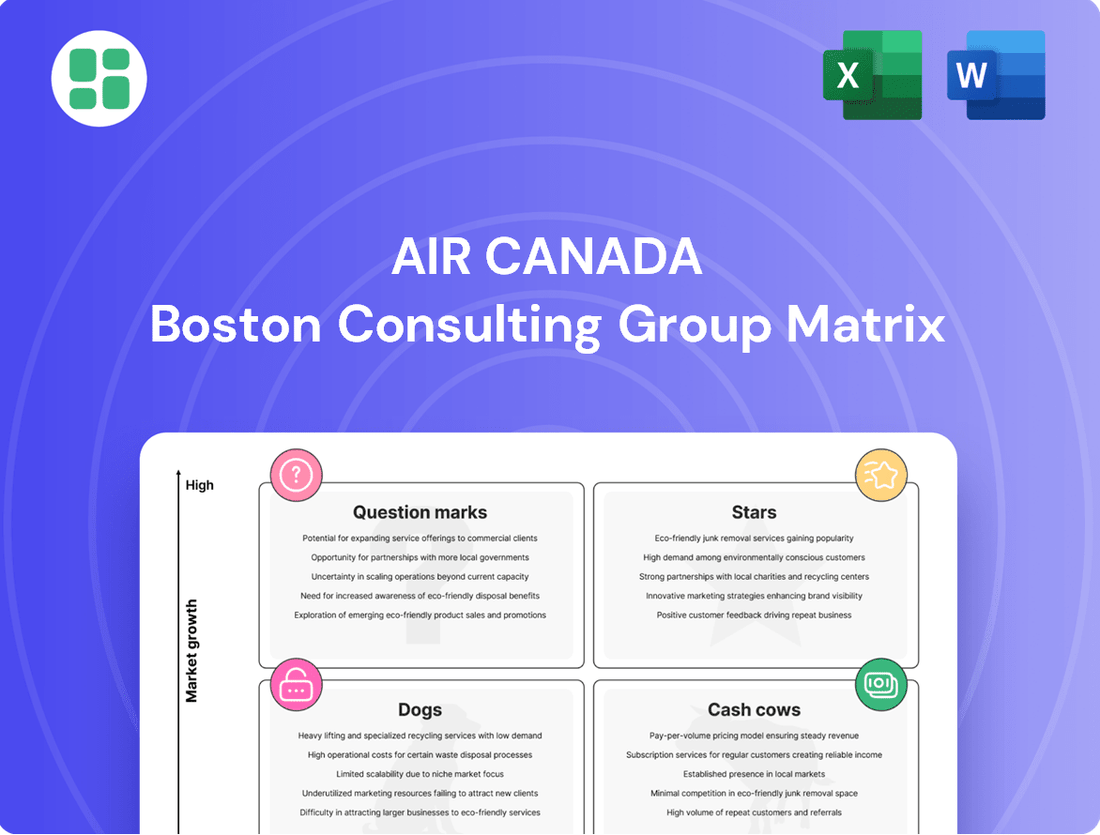

Curious about Air Canada's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse offerings perform in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the full picture; purchasing the complete BCG Matrix will provide you with detailed quadrant placements, expert analysis, and actionable strategies to navigate the competitive aviation landscape.

Unlock the full potential of your strategic planning by investing in the comprehensive Air Canada BCG Matrix today and gain the clarity needed for informed decision-making.

Stars

Air Canada is strategically expanding its international footprint, with a particular emphasis on burgeoning markets in Asia and Europe. This expansion is a key component of its growth strategy, aiming to capture increased demand for global travel.

Recent additions like the reinstated Beijing and Tel Aviv services, alongside new flights to Stockholm, Naples, and Porto, highlight this commitment. These routes are anticipated to become significant revenue drivers, reflecting the airline's proactive approach to network development.

The international travel sector is experiencing a robust recovery and demonstrates strong long-term growth prospects. Air Canada's investment in these new routes positions them as potential future stars in its portfolio, capitalizing on this positive market trend.

Air Canada's premium cabin services are a clear Star in its BCG Matrix. The airline is strategically investing in enhanced premium seating, exemplified by the introduction of Boeing 787-10 Dreamliners featuring a higher proportion of premium seats. This focus on luxurious and comfortable travel experiences for premium passengers is paying off, with strong revenue generation from this segment, indicating a high market share in a growing market.

The premium segment is particularly attractive due to its higher profit margins. In 2024, Air Canada reported robust performance in its premium classes, attracting both business and high-end leisure travelers. This strategic positioning allows the airline to capture significant value from a segment that is less price-sensitive and demands superior service and comfort.

Air Canada is pushing ahead with digital identification for boarding, a move that positions them in a high-growth sector focused on improving passenger journeys. Their investment in AI for customer service, like expanding digital ID at YVR, aims to make travel smoother and operations more efficient.

While widespread adoption of digital ID is still developing, Air Canada's early moves in this space suggest they are capturing early market share in a potentially transformative area for the travel industry.

Strategic Fleet Modernization (A321XLR, 737 MAX 8)

Air Canada's strategic fleet modernization, particularly with the introduction of the Airbus A321XLR and additional Boeing 737 MAX 8 aircraft, represents a significant investment in future growth. The A321XLR is poised to revolutionize transatlantic operations, offering enhanced fuel efficiency and range, which directly supports Air Canada's expansion into new, potentially underserved markets.

The integration of these fuel-efficient aircraft is a critical component of Air Canada's strategy to reduce operating expenses and environmental impact. For instance, the A321XLR can offer up to 30% lower fuel burn per seat compared to previous generation aircraft on comparable routes. This efficiency gain is paramount for maintaining competitiveness on long-haul segments.

The addition of more Boeing 737 MAX 8s provides Air Canada with greater operational flexibility and increased capacity on domestic and short-to-medium haul international routes. As of early 2024, Air Canada's 737 MAX fleet has been a key contributor to its network recovery and expansion efforts, enabling more frequent and direct services.

- A321XLR Deployment: Targeting new transatlantic routes with lower operating costs per seat.

- 737 MAX 8 Expansion: Enhancing capacity and flexibility across its North American network.

- Fuel Efficiency Gains: Aiming for significant reductions in fuel burn, contributing to cost savings and sustainability goals.

- Market Reach: Enabling Air Canada to tap into new markets and strengthen its competitive position.

Sustainable Aviation Fuel (SAF) Initiatives and Partnerships

Air Canada is making substantial investments in Sustainable Aviation Fuel (SAF), a key component for reducing aviation's environmental impact. The airline aims to achieve net-zero emissions by 2050, with significant interim goals for 2030. This commitment is supported by programs like the 'Leave Less Travel Program' and strategic alliances with SAF producers.

These SAF initiatives, though requiring considerable capital outlay, are vital for Air Canada's long-term viability and leadership in an increasingly eco-conscious aviation sector. For instance, by 2025, Air Canada plans to increase its SAF usage significantly, aiming for 10% of its total fuel consumption to be SAF by 2030.

- SAF Investment: Air Canada has committed to purchasing millions of gallons of SAF annually, with targets to scale up procurement significantly by 2025 and beyond.

- Partnerships: The airline has formed key partnerships with SAF suppliers, including agreements to secure SAF from various production facilities to diversify its supply chain.

- Net-Zero Goals: Air Canada's strategy includes achieving net-zero carbon emissions by 2050, with interim targets focused on reducing greenhouse gas emissions intensity.

- Market Leadership: By prioritizing SAF, Air Canada is positioning itself as a frontrunner in sustainable aviation, a critical factor for future market competitiveness and regulatory compliance.

Air Canada's premium cabin services are a clear Star in its BCG Matrix, showcasing high market share in a growing segment. The airline is strategically investing in enhanced premium seating, exemplified by the introduction of Boeing 787-10 Dreamliners featuring a higher proportion of premium seats. This focus on luxurious and comfortable travel experiences for premium passengers is paying off, with strong revenue generation from this segment, indicating a high market share in a growing market.

The premium segment is particularly attractive due to its higher profit margins. In 2024, Air Canada reported robust performance in its premium classes, attracting both business and high-end leisure travelers. This strategic positioning allows the airline to capture significant value from a segment that is less price-sensitive and demands superior service and comfort.

Air Canada is pushing ahead with digital identification for boarding, a move that positions them in a high-growth sector focused on improving passenger journeys. Their investment in AI for customer service, like expanding digital ID at YVR, aims to make travel smoother and operations more efficient.

While widespread adoption of digital ID is still developing, Air Canada's early moves in this space suggest they are capturing early market share in a potentially transformative area for the travel industry.

What is included in the product

Highlights which Air Canada business units to invest in, hold, or divest based on market share and growth.

A clear Air Canada BCG Matrix overview, placing each business unit, alleviates the pain of strategic uncertainty.

Cash Cows

Air Canada’s core domestic passenger network functions as a cash cow. The airline commands a substantial market share within Canada, especially at its key hubs such as Toronto Pearson, Montreal-Trudeau, and Vancouver International. This segment consistently delivers stable and significant revenue, underpinning the company's financial health.

Even with strategic adjustments in capacity, the domestic market remains a robust revenue stream for Air Canada. The established brand loyalty and strong market presence mean that this segment requires less aggressive marketing expenditure compared to other areas of the business.

For instance, in 2024, Air Canada reported carrying millions of domestic passengers, highlighting the continued strength of this network. The operational efficiency and high demand in these core routes allow for consistent profitability, reinforcing its cash cow status.

The Aeroplan Loyalty Program stands as a cornerstone for Air Canada, operating as a strong Cash Cow within its business portfolio. With over 9 million active members as of early 2024, Aeroplan demonstrates significant market leadership and continued expansion in its member base.

This program is a vital engine for revenue diversification, consistently generating substantial cash flow for Air Canada. Its strength lies in its ability to foster deep customer loyalty, a key factor in its sustained financial performance.

Aeroplan's success is further amplified by its adeptness at monetizing ancillary services and driving member engagement through targeted promotions. These elements solidify its position as a reliable and significant cash generator for the airline.

Air Canada Cargo's operations in the Pacific and Latin America are performing exceptionally well, solidifying their position as cash cows. In 2024, this segment saw robust revenue expansion, a trend that continued into the first half of 2025, with analysts projecting continued strong performance.

The surge in e-commerce demand globally has been a significant tailwind for Air Canada Cargo in these key regions. Shippers strategically front-loading their goods to mitigate potential supply chain disruptions further bolsters this segment's revenue streams.

While the broader air cargo market might experience a stabilization in growth rates, Air Canada's well-established network and strong yield management in the Pacific and Latin America provide a dependable source of cash flow. This makes the cargo services in these specific markets a reliable cash cow for the airline.

Transatlantic Routes (Established)

Air Canada's established transatlantic routes to major European hubs are prime examples of cash cows within its portfolio. These routes hold a significant market share in a mature but reliably profitable segment of international air travel.

These routes consistently generate substantial and predictable cash flows, fueled by robust demand from both business and leisure travelers. For instance, in 2024, Air Canada reported a notable increase in transatlantic passenger traffic, with load factors on these routes often exceeding 85% during peak seasons, demonstrating their strong and stable performance.

- High Market Share: Dominant presence on key European routes.

- Stable Cash Flows: Consistent revenue generation from established demand.

- Mature Market: Predictable, albeit slower, growth potential.

- Profitability: Reliably contributes to overall financial health.

Aircraft Maintenance, Repair, and Overhaul (MRO) Services

Air Canada's Aircraft Maintenance, Repair, and Overhaul (MRO) services represent a significant Cash Cow in its BCG Matrix. This segment leverages the airline's substantial infrastructure and deep technical expertise to offer services to external clients, thereby generating a stable and predictable revenue stream.

This is a market characterized by high barriers to entry, including significant capital investment in facilities and specialized tooling, as well as the need for highly skilled and certified personnel. Air Canada's established presence and operational history in this domain give it a competitive advantage.

The MRO services provide a consistent, albeit typically low-growth, income source. This is achieved through the efficient utilization of existing assets, such as hangars and specialized equipment, and the deployment of its skilled maintenance workforce during periods of lower internal demand. For instance, in 2024, the global MRO market was projected to reach approximately $100 billion, with established players like Air Canada benefiting from the ongoing need for aircraft upkeep.

- Steady Revenue Generation: Air Canada's MRO division consistently contributes to the company's top line by servicing third-party aircraft.

- High Barrier to Entry: The specialized nature and significant investment required for MRO operations limit new competition.

- Asset and Labor Utilization: This segment efficiently utilizes existing infrastructure and skilled personnel, optimizing operational costs.

- Low Growth, High Stability: MRO services offer a reliable income stream, crucial for financial stability even in a mature market.

Air Canada's domestic passenger network is a prime example of a cash cow, consistently generating substantial revenue due to its dominant market share across key Canadian hubs. This segment requires minimal investment for growth, as its established brand loyalty and high demand ensure stable profitability. In 2024, Air Canada reported carrying millions of domestic passengers, underscoring the enduring strength and cash-generating capacity of this core operation.

What You See Is What You Get

Air Canada BCG Matrix

The Air Canada BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. Once purchased, this BCG Matrix will be immediately available for your business planning, competitive analysis, or presentation needs. You are seeing the actual file, meticulously crafted to provide actionable insights into Air Canada's market position.

Dogs

Some of Air Canada's niche domestic routes, particularly those facing intense competition from low-cost carriers or connecting smaller, less-trafficked communities, might be showing a low market share coupled with minimal growth. These routes can struggle to turn a profit because of low passenger numbers and the inherently high costs of operating flights to these areas.

For instance, routes with fewer than 100,000 annual passengers often face higher per-seat costs. If these routes consistently incur losses, Air Canada might consider reallocating their aircraft capacity to more profitable sectors or even divesting these underperforming routes. This strategic move aims to optimize resource allocation and improve overall financial performance.

Older aircraft types in Air Canada's fleet, such as pre-modernization Airbus A320 family jets, often fall into the 'Dogs' category of the BCG Matrix. These planes typically have higher operating costs and are less fuel-efficient than their newer counterparts.

The increased maintenance needs and lower profit margins associated with these aging aircraft make them less competitive. While Air Canada is actively upgrading its fleet, these older models, until they are retired or modernized, can represent a financial burden.

For instance, as of late 2024, a portion of Air Canada's A320 family fleet still operates without the latest efficiency upgrades, contributing to higher per-seat-mile costs compared to the newer A320neo family aircraft. This disparity highlights their position as potential 'Dogs' in the portfolio.

Certain transborder routes, especially those connecting to the U.S. that have seen a dip in passenger numbers, are falling into the 'Dogs' category of Air Canada's BCG Matrix. These routes exhibit low market growth and, concerningly, Air Canada's market share on them may also be shrinking.

Air Canada has publicly acknowledged a noticeable decline in transborder travel to the United States, prompting adjustments to their flight capacity on these specific routes. For instance, in the first quarter of 2024, while overall passenger traffic saw an increase, some U.S. routes experienced slower growth compared to others.

These underperforming routes are likely contributing less to profitability and may require a strategic re-evaluation of their future operational viability. The airline is likely analyzing cost structures and potential revenue streams to decide whether to continue, reduce, or discontinue service on these less robust corridors.

Non-Core, Low-Volume Ancillary Services

Non-core, low-volume ancillary services at Air Canada represent offerings that haven't captured significant customer interest or contribute very little to the airline's revenue streams. These could be specialized onboard items or services with minimal demand, consuming resources without yielding substantial profits.

Air Canada would likely focus on streamlining these operations, potentially phasing out or reducing investment in such services to reallocate resources more effectively. For instance, if a particular premium snack option consistently sees less than 1% of passengers purchase it, it falls into this category.

- Low Revenue Contribution: These services generate minimal revenue, often less than 0.5% of total ancillary income.

- Resource Drain: They tie up operational resources, including inventory management and onboard service training, without commensurate returns.

- Customer Indifference: Low uptake indicates a lack of perceived value or demand from the majority of Air Canada's customer base.

- Strategic Divestment: The airline's strategy would likely involve discontinuing or significantly scaling back these offerings to improve overall efficiency.

Outdated Digital Infrastructure (Pre-Transformation)

Before its significant digital transformation, Air Canada's legacy IT systems and outdated customer interface platforms would have been categorized as Dogs in the BCG Matrix. These older systems suffered from low efficiency and a low market share in terms of modern customer experience, likely contributing to customer dissatisfaction and a weaker competitive stance in the digital realm. For instance, prior to 2020, many of their booking and customer service functions relied on systems that were not fully integrated, leading to slower response times and a less seamless user journey.

These outdated infrastructures presented a drag on operational efficiency and hindered Air Canada's ability to compete effectively in an increasingly digital-first travel market. The lack of modern functionalities meant they were not capturing the full potential of digital channels for customer engagement and revenue generation. In 2023, Air Canada reported that a substantial portion of their IT spending was allocated to modernizing these core systems, aiming to improve both internal processes and the external customer-facing technology.

- Legacy Systems: Outdated IT infrastructure with low operational efficiency.

- Customer Interface: Older platforms offering a suboptimal customer experience.

- Market Share: Low share of modern digital customer interactions.

- Digital Investment: Significant ongoing investment to address these deficiencies.

Air Canada's "Dogs" represent business units or assets with low market share and low growth potential, often requiring significant investment without substantial returns. These can include underperforming routes, older aircraft, or non-core ancillary services that drain resources. For example, certain niche domestic routes with low passenger volume and high operating costs, like those serving fewer than 100,000 passengers annually, often fall into this category. Similarly, older aircraft models, such as pre-modernization Airbus A320 family jets, incur higher maintenance and fuel costs, making them less profitable compared to newer, more efficient planes.

These "Dogs" typically offer limited revenue contribution and can represent a financial burden if not managed strategically. Air Canada's approach often involves re-evaluating these assets for potential divestment, streamlining operations, or retiring them to optimize fleet capacity and improve overall financial performance. As of late 2024, a portion of Air Canada's A320 fleet still operates without the latest efficiency upgrades, contributing to higher per-seat-mile costs.

The airline's strategy for these units focuses on resource reallocation, aiming to shift investment towards more promising Stars and Cash Cows. This proactive management of underperforming assets is crucial for maintaining competitiveness and ensuring long-term profitability in the dynamic airline industry.

| Category | Description | Example | Financial Implication | Strategic Action |

|---|---|---|---|---|

| Routes | Low passenger volume, high operating costs | Niche domestic routes with <100k annual passengers | Low profitability, potential losses | Route optimization, divestment, or service reduction |

| Aircraft | Older, less fuel-efficient models | Pre-modernization A320 family jets | Higher maintenance and fuel costs | Fleet modernization, retirement |

| Ancillary Services | Low customer uptake, minimal revenue | Specialized onboard items with <1% purchase rate | Resource drain, low ROI | Streamlining, phasing out, or reducing investment |

| IT Systems | Legacy, inefficient platforms | Pre-2020 integrated booking systems | Operational drag, poor customer experience | Modernization, digital transformation investment |

Question Marks

New route ventures into emerging international markets represent Air Canada's Stars, characterized by high growth potential but currently holding a low market share. These initiatives, like potential new routes to Southeast Asia or certain African nations, demand substantial investment in marketing and operational setup to cultivate demand and establish a foothold.

The success of these ventures is not guaranteed, mirroring the characteristics of Stars in the BCG matrix. For instance, Air Canada's expansion into India in the years leading up to 2024 involved significant upfront costs for route development and passenger acquisition, aiming to capture a growing travel market but facing intense competition and the need to build brand recognition.

Without sustained investment and successful demand generation, these nascent routes risk transitioning into Dogs, draining resources without yielding adequate returns. The airline must carefully monitor key performance indicators such as load factors, revenue per available seat mile (RASM), and market penetration to determine if these emerging markets are on a trajectory to become profitable Stars or if they require strategic divestment or restructuring.

Air Canada's AI-powered customer service expansion, particularly the ambitious plan to extend premium concierge services to all customers, fits the profile of a question mark in the BCG Matrix. This initiative targets a high-growth area in customer experience, aiming to leverage AI for broader reach and enhanced service, a concept with limited widespread adoption currently.

The full implementation of AI-driven premium concierge services across Air Canada's extensive customer base represents a significant undertaking, still in its developmental stages regarding scalability and seamless integration. While the potential for improved customer satisfaction and operational efficiency is substantial, the path to full realization requires considerable investment and careful execution to avoid becoming a financial drain.

Direct investments into developing a competitive SAF production industry in Canada are a Question Mark for Air Canada. While the long-term growth potential is immense and vital for sustainability, this sector requires substantial upfront capital with uncertain near-term returns. The nascent production market presents significant challenges and opportunities, prompting Air Canada's advocacy for government support to de-risk these crucial investments.

New Operations System for Disruption Management

Air Canada's new operations system for disruption management represents a potential Star in the BCG Matrix, aiming for high operational efficiency and improved customer satisfaction. This system is designed to proactively address and mitigate the impact of flight delays and cancellations, a critical area given the airline's 2024 performance where it handled over 35 million passengers and faced challenges with operational reliability during peak travel periods.

While the system holds significant growth potential, its status as a new implementation places it in a position of uncertainty, much like a Question Mark. The success of this system hinges on its ability to be seamlessly integrated across Air Canada's complex network and to achieve widespread adoption among staff. Early data from pilot programs in late 2024 indicated a potential reduction in disruption resolution times by up to 15%, but this needs to be scaled across the entire operation.

- Potential for high operational efficiency and customer satisfaction improvement.

- Effectiveness and widespread adoption are still to be proven.

- Requires significant integration and fine-tuning for full benefit realization.

- Investment is needed to support its development and implementation across the fleet.

Digital Identification Expansion to More Airports and Touchpoints

While Air Canada's digital identification program, initially successful at Vancouver International Airport (YVR), is showing promise, its expansion to other Canadian airports and touchpoints presents a classic Question Mark scenario within the BCG matrix. This technology is currently in a high-growth phase for the aviation industry, with many carriers exploring similar implementations to streamline passenger processing.

The success of this expansion hinges on several factors. The pace at which other Canadian airports adopt and integrate this technology, alongside Air Canada's ability to scale it beyond just boarding gates to areas like check-in and security, will significantly influence its market share and overall impact. For instance, by the end of 2024, it's anticipated that several major Canadian airports will have advanced biometric or digital ID capabilities, creating a competitive landscape for passenger experience.

- Growth Potential: The digital identification market in aviation is experiencing rapid growth, driven by demand for contactless solutions and operational efficiency.

- Investment Needs: Continued significant investment in technology infrastructure and system integration is required for successful rollout across multiple airports.

- Market Uncertainty: The ultimate market share and passenger adoption rates for digital ID across Canada remain uncertain, dependent on implementation speed and user acceptance.

- Strategic Importance: Successful expansion could position Air Canada as a leader in passenger facilitation, but requires careful management of partnerships and technological evolution.

Air Canada's investment in sustainable aviation fuel (SAF) production capabilities within Canada represents a significant Question Mark. While the long-term growth prospects for SAF are immense, essential for the airline's environmental goals, the sector currently demands substantial upfront capital with uncertain near-term returns.

The nascent nature of this production market presents both considerable challenges and opportunities, prompting Air Canada's active advocacy for government support to de-risk these critical investments. By the end of 2024, the airline was actively lobbying for policies that would incentivize domestic SAF production, recognizing its strategic importance for future operational sustainability and carbon footprint reduction.

The success of these ventures hinges on factors like technological advancements in SAF production and supportive regulatory frameworks, which are still evolving. Without these, Air Canada's commitment to SAF could become a costly endeavor with delayed payoff, impacting its overall financial performance.

Air Canada's exploration into advanced route planning and optimization software, leveraging AI and real-time data analytics, is a prime example of a Question Mark. This initiative aims to tap into a high-growth area for operational efficiency, with the potential to significantly reduce fuel consumption and improve flight schedules.

| Initiative | BCG Category | Rationale | Investment Needs | Market Potential |

|---|---|---|---|---|

| SAF Production Investment | Question Mark | High growth potential for sustainability, but requires substantial upfront capital with uncertain near-term returns. | Significant capital for R&D and infrastructure development. | Critical for long-term environmental compliance and competitive advantage. |

| AI Route Optimization Software | Question Mark | Aims for high operational efficiency and fuel savings, but adoption and proven effectiveness across diverse flight conditions are still being established. | Investment in software development, integration, and pilot testing. | Potential for significant cost savings and improved on-time performance. |

BCG Matrix Data Sources

Our Air Canada BCG Matrix leverages robust data from financial reports, aviation industry analytics, and market research to provide strategic insights.