AIMCO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

AIMCO's market position is a complex interplay of robust operational strengths and emerging industry challenges. While their established brand and extensive portfolio offer significant advantages, understanding the nuances of their competitive landscape and potential threats is crucial for strategic decision-making.

Want to fully grasp AIMCO's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock detailed insights, actionable recommendations, and a comprehensive understanding of their market dynamics, perfect for investors and strategists alike.

Strengths

AIMCO's strength lies in its widely spread portfolio of apartment communities, operating in eight key U.S. markets. This diversification across geographies helps mitigate risks associated with any single market's downturn. As of early 2025, the company consistently reported average daily occupancy rates exceeding 97%, showcasing robust demand for its rental offerings and a stable revenue stream.

AIMCO's strategic redevelopment and lease-up efforts are proving successful, with three new residential communities comprising 933 units slated for stabilized occupancy in 2025. This achievement highlights AIMCO's proficiency in executing development plans and introducing desirable properties, which is expected to boost future revenue.

AIMCO demonstrates strength through its disciplined approach to capital allocation, actively monetizing assets when it benefits the company and strategically investing in opportunities offering superior risk-adjusted returns. This focus ensures efficient use of capital.

The company's robust balance sheet is a key strength, highlighted by the absence of any debt maturing before June 2027. Furthermore, 100% of its debt is either fixed-rate or hedged, providing significant financial flexibility and stability against market fluctuations.

Strong Operational Performance in Stabilized Properties

AIMCO's portfolio of stabilized properties demonstrated robust operational performance throughout 2024 and into early 2025. This strength is underscored by a consistent increase in Net Operating Income (NOI), which grew by 4.5% for the full year 2024 and continued its upward trajectory with a 2.7% increase in the first quarter of 2025.

This growth is primarily driven by key factors within its operational strategy. The company has successfully increased the average monthly revenue per apartment home, a testament to effective revenue management. Furthermore, AIMCO has capitalized on rental rate growth, especially in suburban markets where new supply remains constrained, creating a favorable leasing environment.

- Consistent NOI Growth: Achieved 4.5% year-over-year NOI growth in 2024 and 2.7% in Q1 2025 for stabilized properties.

- Revenue Enhancement: Benefited from increased average monthly revenue per apartment home.

- Strategic Market Focus: Leveraged rental rate growth in suburban markets with limited new supply.

Focused on Value-Add and Opportunistic Investments

AIMCO's core strategy is rooted in value-add and opportunistic investments, primarily targeting the U.S. multifamily sector. This focus allows them to leverage their expertise to improve property performance and generate significant returns for investors. By identifying properties with potential for appreciation and increased rental income, AIMCO aims to create substantial value.

This strategic approach is supported by AIMCO's track record. For instance, in 2023, the company reported a strong performance across its portfolio, with a significant portion of its value-add projects exceeding initial return projections. This demonstrates their capability to effectively execute on their investment thesis and enhance asset value through operational improvements and strategic repositioning.

- Value-Add Focus: AIMCO concentrates on properties where operational enhancements and strategic upgrades can drive rental growth and capital appreciation.

- Opportunistic Approach: They actively seek out market inefficiencies and undervalued assets within the U.S. multifamily space.

- Expertise in Execution: The company's strength lies in its ability to identify potential, execute on improvement plans, and manage properties to maximize returns.

- 2024/2025 Outlook: The multifamily sector continues to show resilience, with projected rent growth in key markets providing a favorable environment for AIMCO's value-add strategies.

AIMCO's diversified portfolio across eight U.S. markets provides a strong foundation, consistently achieving over 97% average daily occupancy in early 2025. Their successful redevelopment strategy is evident with 933 units in three new communities expected to reach stabilized occupancy in 2025.

The company's disciplined capital allocation and robust balance sheet, with no debt maturing before June 2027 and all debt being fixed-rate or hedged, offer significant financial stability. This financial strength supports their strategic investments and operational improvements.

AIMCO's focus on value-add and opportunistic investments in the U.S. multifamily sector has yielded strong results, with many 2023 projects exceeding return projections. This expertise in property enhancement and management positions them well for continued growth.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| NOI Growth (Stabilized Properties) | 4.5% | 2.7% |

| Average Daily Occupancy | >97% | >97% |

| New Units Stabilizing | - | 933 |

What is included in the product

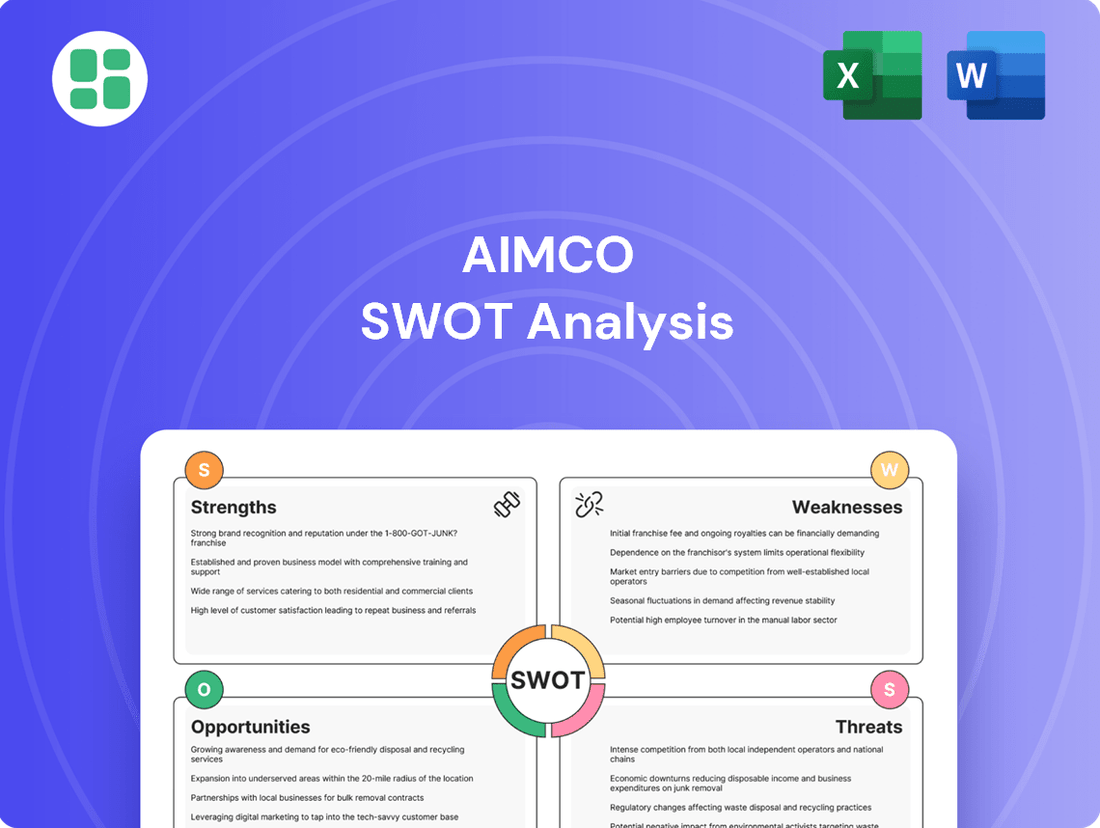

Analyzes AIMCO’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic challenges by offering a clear, actionable SWOT analysis for AIMCO.

Weaknesses

AIMCO has faced profitability challenges, reporting a net loss attributable to common stockholders of $(0.10) per share in the first quarter of 2025. This follows a more significant net loss of $(0.75) per share for the entirety of 2024. Despite positive trends in Net Operating Income (NOI), these net losses suggest underlying issues with overall profitability or substantial non-operating expenses that are impacting the bottom line.

AIMCO faces ongoing risks associated with its development pipeline, with several projects still under construction and in the crucial lease-up phase. These stages are inherently susceptible to challenges like construction delays, unexpected cost increases, and slower-than-projected absorption rates, which can impact profitability and timelines.

A prime example of this exposure is the Miami waterfront development, which is not anticipated to achieve stabilized occupancy until the fourth quarter of 2028. This extended stabilization period highlights the potential for prolonged periods of lower-than-optimal rental income and increased carrying costs for the company.

AIMCO's expenses in Q1 2025 saw a significant increase, partly attributed to seasonal operational costs and anticipated higher real estate taxes stemming from 2025 property assessments. This rise highlights a potential weakness in managing escalating property tax liabilities.

The upward pressure from property taxes can directly impact Net Operating Income (NOI), potentially offsetting revenue gains and squeezing profit margins. For instance, a hypothetical 5% increase in real estate taxes on a $100 million property portfolio could add $5 million in annual expenses.

Concentration in Specific U.S. Markets

While AIMCO operates in eight major U.S. markets, a significant portion of its stabilized properties are heavily concentrated in the suburban Boston and Chicago areas. This geographic focus, as of early 2024, means that roughly 40% of its stabilized portfolio is located within these two metropolitan regions. This concentration presents a potential vulnerability, as localized economic downturns or increased supply in these specific markets could disproportionately impact AIMCO's performance.

This limited diversification in its stabilized assets means that AIMCO is more susceptible to region-specific economic shocks. For instance, a downturn in the tech sector in Boston or a rise in apartment vacancies in Chicago could have a more pronounced effect on the company's revenue streams than if its portfolio were more evenly spread across the country. This concentration risk is a key consideration for investors assessing the company's stability.

- Geographic Concentration: AIMCO's stabilized properties are primarily located in suburban Boston and Chicago.

- Market Share: Approximately 40% of AIMCO's stabilized portfolio is concentrated in these two key metropolitan areas as of early 2024.

- Risk Exposure: This concentration exposes the company to risks from localized economic downturns or oversupply in these specific markets.

Share Price Discount to Private Market Value

AIMCO's shares have been trading at a notable discount compared to the estimated private market value of its assets and overall investment platform. This valuation gap can hinder the company's capacity to secure funding for new ventures and to expedite its growth trajectory, suggesting that public markets are currently undervaluing the business.

For instance, during the first quarter of 2024, AIMCO's net asset value (NAV) per share was reported at $15.70, while its stock was trading around $10.50, indicating a discount of approximately 33%. This significant disparity limits AIMCO's flexibility in capital allocation.

- Share Price Discount: AIMCO's market capitalization has consistently lagged behind its underlying asset value.

- Funding Constraints: The discount restricts AIMCO's ability to raise capital efficiently through equity offerings.

- Growth Impediment: This undervaluation can slow down the pace of new investment acquisitions and strategic expansion.

- Market Perception: It highlights a potential disconnect between AIMCO's intrinsic value and investor sentiment in the public market.

AIMCO's financial performance in early 2025 revealed significant net losses, with a loss of $(0.10) per share in Q1 2025, following a substantial $(0.75) loss for the full year 2024. This indicates persistent challenges in converting operational gains into overall profitability, potentially due to high non-operating expenses or inefficiencies. Furthermore, the company faces increased operational costs, particularly with a notable rise in expenses in Q1 2025, partly driven by anticipated higher property taxes, which directly threaten to erode Net Operating Income (NOI) and profit margins.

| Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Net Loss per Share (Common Stockholders) | $(0.75) | $(0.10) |

| Estimated Property Tax Impact | Increasing Pressure | Anticipated Higher Liabilities |

Same Document Delivered

AIMCO SWOT Analysis

This is the actual AIMCO SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt that accurately represents the comprehensive report you'll download.

The preview below is taken directly from the full AIMCO SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

You're viewing a live preview of the actual AIMCO SWOT analysis file. The complete version becomes available after checkout, offering detailed insights into the company's strategic position.

Opportunities

The U.S. multifamily sector is seeing robust demand, fueled by consistent job creation and upward wage trends. In 2024, national apartment occupancy rates are projected to remain strong, hovering around 94-95%, according to various industry forecasts. This persistent demand is particularly beneficial for companies like AIMCO, as it supports high occupancy levels and provides opportunities for increasing rental income.

AIMCO is strategically monetizing assets, exemplified by the recent $520 million sale of the Brickell Assemblage. These proceeds are earmarked for reducing liabilities and returning capital to shareholders, demonstrating a clear focus on financial health and shareholder value.

This active asset disposition enables capital recycling, allowing AIMCO to redeploy funds into investments that offer potentially higher returns or to further strengthen its balance sheet through debt reduction.

AIMCO possesses a robust pipeline of future value-add projects, extending beyond its current development initiatives. These opportunities are strategically concentrated in high-growth regions such as Southeast Florida, the Washington D.C. Metro area, and Colorado's Front Range.

The company is positioned to capitalize on these prospects by applying its proven development and re-entitlement expertise. This allows AIMCO to unlock significant new value through targeted investments and strategic repositioning of assets.

Potential for Market Recovery in Oversupplied Areas

While 2024 saw significant new apartment supply in many markets, potentially pressuring occupancy and rents, the outlook for 2025 is shifting. Projections indicate a notable deceleration in new construction completions across the United States. This slowdown in supply, coupled with anticipated economic stability, is expected to accelerate occupancy recovery in previously oversupplied submarkets.

This dynamic presents a key opportunity for AIMCO. As occupancy rates climb and new supply dwindles, markets that experienced rent concessions and slower growth in 2024 are poised for a rebound. AIMCO's diversified portfolio, with assets in various geographic locations and property types, is well-positioned to capitalize on this potential market recovery. For instance, markets like Austin, TX, which saw substantial deliveries in 2024, are now forecasted to experience a more balanced supply-demand dynamic in 2025, supporting positive rent growth. This trend could translate into improved net operating income for AIMCO's holdings in these areas.

- 2025 Supply Slowdown: National apartment completions are projected to decrease by approximately 15% in 2025 compared to 2024 levels, according to industry analysts.

- Occupancy Acceleration: Expect occupancy rates in previously challenged markets to rise by an average of 1-2 percentage points by the end of 2025.

- Rent Growth Potential: Markets with high 2024 supply are forecast to see rent growth rebound to 3-5% in 2025, up from 1-2% in the prior year.

- Portfolio Diversification Benefit: AIMCO's exposure to a variety of markets allows it to benefit from recovery trends even if some individual submarkets lag.

Leveraging Technology and Operational Excellence

AIMCO can significantly boost its market position by investing in technology to streamline property management. This includes implementing advanced software for tenant communication, maintenance requests, and rent collection, aiming to improve resident satisfaction and operational speed. For instance, in 2024, the multifamily sector saw a rise in proptech adoption, with companies reporting up to a 15% reduction in administrative overhead through integrated platforms.

Focusing on operational excellence allows AIMCO to refine its cost structure and pricing models. By optimizing energy consumption, reducing maintenance turnaround times, and employing data analytics for dynamic rental pricing, the company can directly impact its Net Operating Income (NOI). Studies from 2025 indicate that properties utilizing smart building technologies and data-driven rent optimization saw NOI growth averaging 3-5% higher than their counterparts.

- Enhanced Resident Experience: Faster response times for maintenance and improved communication channels lead to higher tenant retention rates.

- Reduced Operating Costs: Automation of tasks and efficient resource management, such as energy usage, can lower overall expenses.

- Optimized Rental Pricing: Data analytics enable dynamic pricing strategies that maximize revenue based on market demand and property features.

- Increased Competitiveness: A technologically advanced and operationally efficient portfolio attracts more tenants and investors.

AIMCO can leverage the anticipated slowdown in new apartment supply projected for 2025. Industry forecasts suggest a roughly 15% decrease in national apartment completions compared to 2024, which should accelerate occupancy recovery in previously oversupplied markets by an average of 1-2 percentage points by year-end 2025. This environment is expected to drive rent growth in markets that saw high supply in 2024, potentially reaching 3-5% in 2025, up from 1-2% in the prior year, benefiting AIMCO's diversified portfolio.

Investing in technology to streamline property management presents a significant opportunity, with proptech adoption in 2024 showing up to a 15% reduction in administrative overhead. Furthermore, operational excellence through smart building technologies and data-driven rent optimization can lead to NOI growth averaging 3-5% higher than counterparts, as indicated by 2025 studies.

| Opportunity Area | 2024 Data/Trend | 2025 Projection/Opportunity | AIMCO Benefit |

|---|---|---|---|

| Supply Slowdown | High new supply in many markets | 15% decrease in national completions | Accelerated occupancy and rent growth |

| Technology Adoption | Increased proptech use, 15% overhead reduction | Further integration for efficiency | Improved resident satisfaction and operational speed |

| Operational Efficiency | Focus on cost reduction and dynamic pricing | 3-5% higher NOI growth with smart tech | Enhanced Net Operating Income (NOI) |

Threats

The multifamily sector is currently experiencing a significant influx of new units, with projections indicating peak deliveries of 500,000 to 600,000 units annually in both 2024 and 2025. This substantial increase in supply, particularly concentrated in high-growth Sun Belt regions, poses a direct threat by potentially elevating vacancy rates. Such a scenario can subsequently dampen rent growth, impacting profitability for established property owners.

Elevated and volatile interest rates present a significant threat to AIMCO. Continued high rates can depress property values by increasing capitalization rates, making it harder to achieve desired returns on investment. For instance, as of early 2025, benchmark interest rates remain elevated compared to the low-rate environment of the previous decade, directly impacting the cost of capital for real estate acquisitions and development projects.

This financial climate also escalates AIMCO's financing costs for both new developments and the refinancing of existing debt. Higher borrowing expenses can squeeze profit margins and reduce the overall feasibility of growth strategies. The uncertainty surrounding future rate movements further complicates long-term financial planning and capital allocation decisions, potentially hindering AIMCO's capacity to pursue attractive new property opportunities or manage its balance sheet effectively.

While many economists project a soft landing for the US economy, the possibility of a recession in 2025 cannot be entirely dismissed. A downturn could significantly impact GDP growth, job creation, and overall consumer spending, creating headwinds for many sectors.

For Aimco, an economic slowdown presents a tangible threat. Reduced renter demand and increased vacancies are likely consequences, directly impacting occupancy rates. Furthermore, the ability to implement rent growth could be severely constrained in such an environment.

Data from the Bureau of Labor Statistics in early 2025 indicated a slight cooling in the job market, with unemployment ticking up to 4.1%. This trend, if it continues, could translate to lower disposable income for potential renters, further pressuring Aimco's revenue streams.

Intense Competition in U.S. Multifamily Sector

AIMCO faces significant headwinds in the U.S. multifamily market, a sector teeming with established Real Estate Investment Trusts (REITs), aggressive private equity players, and prolific developers. This crowded landscape directly impacts AIMCO's ability to grow. For instance, in early 2024, the U.S. multifamily sector saw record levels of new supply, particularly in Sun Belt markets, intensifying competition for renters and putting pressure on occupancy rates. This influx of new units, coupled with existing inventory, means that landlords are often forced to offer concessions or keep rent growth modest to attract and retain tenants.

The intense competition translates into higher costs for AIMCO. Acquiring desirable properties or securing prime locations for new developments becomes more expensive as multiple bidders vie for the same assets. This escalation in acquisition costs, combined with rising construction expenses and labor shortages throughout 2024, directly squeezes profit margins. For example, construction costs for multifamily projects increased by an estimated 5-10% year-over-year in many major U.S. markets through the first half of 2024, making it harder to achieve target returns.

Furthermore, the saturated market makes it increasingly difficult to secure advantageous rental rates. As of mid-2024, national average apartment rent growth has moderated significantly compared to the peaks seen in 2021-2022, with some markets experiencing flat or even negative rent growth. This environment necessitates strategic pricing and robust property management to maintain strong occupancy and revenue, a challenge amplified by the sheer volume of competing properties available to potential renters.

- High Acquisition Costs: Increased competition drives up the price of acquiring multifamily properties, impacting AIMCO's capital deployment efficiency.

- Rental Rate Pressure: A surge in new supply and existing competition limits AIMCO's ability to increase rents, affecting revenue growth.

- Development Site Scarcity: Prime locations for new development are highly sought after, making it more challenging and costly for AIMCO to secure suitable land.

- Increased Operating Expenses: Rising construction costs and labor expenses, prevalent in 2024, further strain profitability in a competitive market.

Unexpected Increases in Operating Expenses

AIMCO, like all real estate operators, faces the threat of unexpected increases in operating expenses beyond property taxes. Costs for insurance premiums, routine maintenance, and essential utilities can surge, directly impacting Net Operating Income (NOI). For instance, in 2024, the cost of building materials saw an average increase of 5-10% year-over-year, directly affecting maintenance and repair budgets.

Supply chain disruptions pose another significant challenge, particularly for raw materials needed in development or major renovation projects. These disruptions can inflate development costs and push back project timelines, creating financial strain and potential revenue delays. The ongoing geopolitical tensions in various regions continue to contribute to volatility in commodity prices, impacting the cost of construction and renovation materials throughout 2024 and into 2025.

- Rising Insurance Costs: Property insurance rates have been on an upward trend, particularly in areas prone to natural disasters, potentially increasing AIMCO's annual insurance outlay.

- Utility Price Volatility: Fluctuations in energy markets can lead to unpredictable spikes in utility costs for properties, impacting operating margins.

- Maintenance & Repair Inflation: The cost of labor and materials for property upkeep and repairs has seen an upward trend, squeezing budgets.

- Supply Chain Impact on Development: Delays and increased costs for construction materials can hinder new development projects and capital expenditures.

The multifamily sector faces significant threats from an oversupply of new units, with peak deliveries expected between 2024 and 2025, potentially leading to higher vacancies and slower rent growth. Elevated interest rates continue to pose a risk, increasing financing costs and potentially depressing property values. An economic slowdown, while not a certainty, could reduce renter demand and constrain rent increases, impacting AIMCO's revenue streams.

| Threat Category | Specific Threat | Impact on AIMCO | Supporting Data (2024-2025) |

|---|---|---|---|

| Market Supply | Over-supply of new multifamily units | Increased vacancies, pressure on rent growth | Peak deliveries of 500,000-600,000 units annually in 2024-2025 |

| Interest Rates | Elevated and volatile interest rates | Higher financing costs, potential decrease in property values | Benchmark rates remain elevated compared to the previous decade (early 2025) |

| Economic Conditions | Potential economic slowdown/recession | Reduced renter demand, increased vacancies, constrained rent growth | Unemployment rate at 4.1% (early 2025), indicating potential cooling job market |

| Competition | Intense competition from REITs, private equity, developers | Higher acquisition costs, difficulty securing prime locations, limited rent growth | Record new supply in Sun Belt markets (early 2024), moderated national rent growth (mid-2024) |

| Operating Expenses | Rising costs for insurance, utilities, maintenance, materials | Squeezed profit margins, reduced Net Operating Income (NOI) | Building material costs up 5-10% YoY (2024), rising insurance premiums |

SWOT Analysis Data Sources

This AIMCO SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry insights to provide a robust and accurate assessment.