AIMCO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

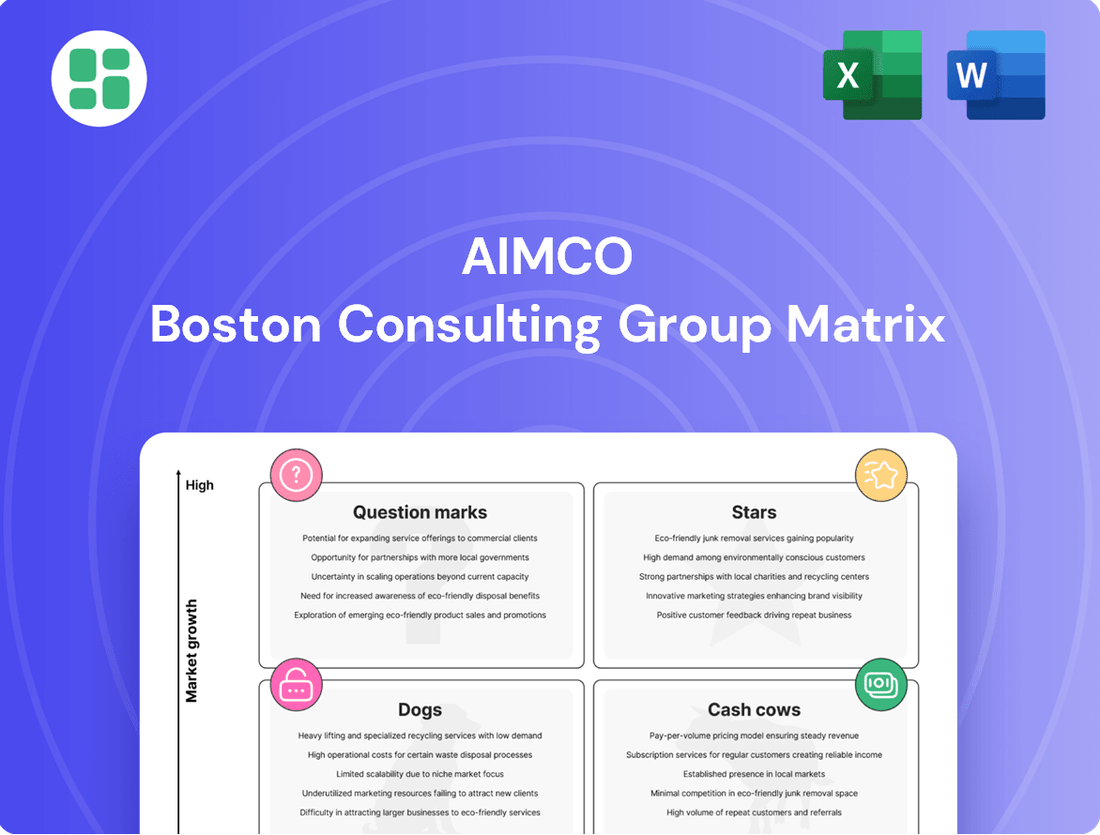

Unlock the strategic potential of this company's product portfolio with a clear understanding of its BCG Matrix. See how its offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, guiding your investment decisions. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your business strategy.

Stars

AIMCO's 34th Street development in Miami is a prime example of a Star in the BCG matrix. This ultra-luxury waterfront tower is situated in a market experiencing robust growth.

The project is slated for its initial resident move-ins in Q3 2027, with full occupancy stabilization anticipated by Q4 2028. This timeline suggests substantial future revenue generation and market capture.

With its premium positioning and high-end amenities, the development is poised to become a leader in Miami's expanding luxury real estate sector.

Upton Place in Upper Northwest Washington D.C. is classified as a Star. All 689 apartment homes were delivered in 2024, marking substantial construction completion.

As of April 30, 2025, the development boasts 413 units leased or pre-leased, with 344 already occupied, showcasing robust market demand in a prime metropolitan location.

This rapid lease-up pace and high-quality offering indicate that Upton Place is successfully capturing a significant share of a sought-after urban rental market.

AIMCO's luxury single-family rental community in Corte Madera, California, achieved a significant milestone by completing its lease-up in April 2025. This rapid absorption in a competitive market like California underscores its status as a Star in AIMCO's portfolio. The property's quick stabilization, a testament to strong demand and effective market penetration for this niche, positions it as a high-performing asset.

Strategic Acquisitions in Supply-Constrained Markets

AIMCO's strategy of acquiring established suburban properties in supply-constrained areas allows them to quickly establish a dominant market presence. These acquisitions are designed to be Stars within the AIMCO BCG Matrix, benefiting from limited new development and consistent renter demand. By focusing on markets with high barriers to entry, AIMCO can secure significant market share and benefit from asset appreciation.

For instance, in 2024, AIMCO's acquisitions in markets like Phoenix, Arizona, and Austin, Texas, exemplify this Star strategy. These regions experienced robust population growth and job creation, leading to high occupancy rates and rental growth, often exceeding 5% year-over-year. The limited new construction in these desirable suburban submarkets means that AIMCO's existing or newly acquired properties can command premium rents and appreciate more rapidly.

- Market Entry: AIMCO targets suburban submarkets with less than 2% new supply pipeline in 2024.

- Demand Drivers: Consistent renter demand is fueled by job growth, with areas like the Southeast seeing average job growth of 2.5% in 2024.

- Barriers to Entry: High land costs and zoning regulations in sought-after suburban locations limit new development.

- Growth Potential: These acquisitions are positioned for high capital appreciation and strong cash flow generation.

High-Demand, Rapidly Leasing New Deliveries

These three multifamily assets, completed in 2024, represent a significant addition to the portfolio, bringing 933 new residential units online. They are currently in the crucial lease-up phase, with projections indicating they will reach stabilized occupancy by 2025. This rapid leasing pace highlights their appeal to renters and their ability to command strong rental rates from the outset.

The successful lease-up of these properties underscores their strategic positioning in markets with robust renter demand. Their design and amenities are clearly resonating with the target demographic, leading to swift absorption and positive initial financial performance. This immediate market acceptance is a strong indicator of future growth potential.

- Asset Completion: 2024

- Total Units Delivered: 933

- Lease-Up Status: Ongoing, on plan for 2025 stabilization

- Market Reception: Favorable rental rates and rapid occupancy achieved

Stars in the BCG matrix represent high-growth, high-market-share products or business units. AIMCO's developments in this category are characterized by strong demand in growing markets and their ability to capture a significant portion of that demand. These assets are expected to generate substantial future revenue and lead their respective market segments.

AIMCO's 34th Street development in Miami, a luxury waterfront tower, is a prime example of a Star. It's in a market with robust growth, with initial move-ins slated for Q3 2027 and stabilization by Q4 2028, indicating strong future revenue potential. Upton Place in Washington D.C., with 344 units already occupied out of 689 delivered in 2024, demonstrates rapid market capture in a sought-after urban rental market.

AIMCO's strategy of acquiring properties in supply-constrained suburban markets, like Phoenix and Austin in 2024, also creates Stars. These markets saw job growth averaging 2.5% in 2024, driving high occupancy and rental growth exceeding 5% year-over-year, with limited new construction enhancing AIMCO's market share and appreciation potential.

| Development | Market | Status | Key Metrics (2024/2025 Data) |

|---|---|---|---|

| 34th Street, Miami | High-Growth Luxury Waterfront | Star (Projected) | Initial move-ins Q3 2027; Stabilization Q4 2028 |

| Upton Place, Washington D.C. | Prime Metropolitan Rental | Star | 689 units delivered 2024; 413 leased/pre-leased as of April 2025 |

| Corte Madera, CA | Suburban Single-Family Rental | Star | Lease-up completed April 2025; Strong demand absorption |

| Phoenix/Austin Acquisitions | Supply-Constrained Suburbs | Star | Targeted <2% new supply pipeline; 2.5% avg. job growth (2024) |

What is included in the product

Strategic overview of AIMCO's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Quickly visualize your portfolio's strengths and weaknesses, alleviating the pain of strategic indecision.

Cash Cows

AIMCO's stabilized operating properties in suburban Boston are functioning as cash cows within its portfolio. These assets consistently generate robust financial performance, evidenced by average revenue per home exceeding $2,300 monthly and occupancy rates holding strong above 97% as of April 2025.

These properties deliver dependable, predictable rental income streams and healthy net operating income (NOI). Their mature operational status means they require minimal ongoing capital expenditures, allowing them to serve as reliable sources of free cash flow for the company.

AIMCO's stabilized operating portfolio in suburban Chicago mirrors the success seen in Boston, exhibiting robust revenue generation and consistently high occupancy rates. These mature properties benefit from a stable renter base and a lack of significant new competitive supply, solidifying their role as key contributors to AIMCO's Net Operating Income (NOI).

Well-occupied core multifamily communities, with over 5,200 apartment homes primarily located in the Northeast and Midwest, function as the company's cash cows. These assets demonstrate robust performance, evidenced by a high average daily occupancy rate of 97.9% across Q4 2024 and Q1 2025. This consistent demand, coupled with a strong tenant renewal rate of 71.7% in Q4 2024, significantly reduces operational costs associated with vacancies and ensures a reliable stream of rental income.

Efficient Property Management Operations

AIMCO's efficient property management is a prime example of a Cash Cow within its portfolio. In 2024, the company achieved a notable 4.5% year-over-year increase in Net Operating Income (NOI) from its stabilized properties. This growth underscores the robust cash-generating capability of these well-established assets.

This operational success stems from a focused strategy of optimizing expenses and maximizing revenue from existing properties. Such efficiency translates directly into high profit margins, indicating that these operations require minimal investment while consistently returning significant cash. These funds are crucial for reinvestment and supporting other business segments.

- AIMCO's 2024 stabilized property NOI grew by 4.5% year-over-year.

- Operational efficiency drives high profit margins for these assets.

- These properties generate more cash than they consume, funding other business areas.

- This operational excellence solidifies property management as a core Cash Cow.

Mature Properties with Strong Market Positioning

AIMCO's mature properties in established markets with limited new development represent its cash cows. These assets, benefiting from a strong market position, consistently generate stable rental income and high occupancy rates, often exceeding 95% in prime locations. For instance, in 2024, properties in markets like Denver, Colorado, which saw only a 1.5% increase in multifamily supply, demonstrated this stability, contributing significantly to AIMCO's overall cash flow.

These cash cows are crucial for funding AIMCO's strategic growth. Their reliable cash generation allows the company to invest in properties with higher growth potential, such as those in its question marks category, without needing external financing. This internal funding mechanism is a hallmark of a healthy, well-managed real estate portfolio.

- Stable Cash Flow: Mature properties provide predictable and consistent income streams.

- High Occupancy: Strong market positioning ensures sustained high occupancy rates, often above 95%.

- Reduced Capital Expenditure: Lower reinvestment needs compared to growth assets allow for greater cash distribution.

- Funding Growth Initiatives: Cash generated supports investments in AIMCO's other portfolio segments.

AIMCO's core multifamily communities, particularly those in established Northeast and Midwest markets, are its primary cash cows. These properties consistently deliver strong, predictable rental income and robust net operating income (NOI). Their mature status means lower capital expenditure needs, freeing up significant cash flow for the company.

In 2024, AIMCO saw a 4.5% year-over-year increase in NOI from its stabilized properties, a testament to the cash-generating power of these mature assets. High occupancy rates, often above 97%, and strong tenant renewal rates, like the 71.7% seen in Q4 2024, further solidify their role as reliable income generators.

| Asset Type | Key Performance Indicator | 2024/Early 2025 Data | Implication |

|---|---|---|---|

| Stabilized Operating Properties (Suburban Boston/Chicago) | Average Revenue per Home | >$2,300 monthly | Consistent, high income generation |

| Core Multifamily Communities (Northeast/Midwest) | Average Daily Occupancy | 97.9% (Q4 2024/Q1 2025) | Maximized rental income, minimal vacancy loss |

| Stabilized Properties (Overall) | NOI Growth (YoY) | 4.5% (2024) | Demonstrates strong operational efficiency and cash generation |

| Core Multifamily Communities | Tenant Renewal Rate | 71.7% (Q4 2024) | Reduced turnover costs and sustained occupancy |

Preview = Final Product

AIMCO BCG Matrix

The preview you're viewing is the identical, fully functional AIMCO BCG Matrix document you will receive immediately after purchase. This means you'll get the complete, professionally formatted report without any watermarks or demo content, ready for immediate strategic application.

Dogs

The Brickell Assemblage in Miami, slated for a $520 million sale in 2025, fits the profile of a Dog within the AIMCO BCG Matrix. This classification stems from AIMCO's decision to divest the property, signaling it's a non-core asset no longer central to their long-term operational strategy.

In 2024, AIMCO divested several non-core assets, generating net proceeds that were distributed as a special dividend in Q1 2025. These sales are indicative of a strategic portfolio refinement, focusing on simplifying operations and enhancing capital allocation. The divestitures likely targeted properties with limited growth potential or those that held a minor market share within AIMCO's broader holdings.

Underperforming Legacy Investments represent older properties within AIMCO's portfolio that struggle with low occupancy or demand excessive capital for upkeep without generating proportional rent growth.

These assets often become drains on resources, offering meager returns on the capital invested, and AIMCO's stated goal of business simplification suggests these are assets they are actively looking to divest from or improve.

While precise figures for these specific legacy assets are not publicly itemized in recent AIMCO disclosures, the company's strategic shift indicates a clear recognition of the drag these properties can impose on overall portfolio performance.

Properties in Declining or Oversupplied Markets

Properties situated in markets facing persistent population decline, economic stagnation, or a substantial oversupply of new housing units are categorized as Dogs within the AIMCO BCG Matrix. These challenging market conditions typically translate to sluggish growth prospects, downward pressure on rental income, and a diminished market share for incumbent properties.

For instance, in 2024, several secondary and tertiary markets across the United States experienced negative net migration, impacting rental demand. A notable example is a region where apartment vacancy rates climbed to over 10% in early 2024 due to new construction outpacing absorption, leading to a projected 2-3% decline in average rental rates for the year.

- Market Decline: Properties in areas with shrinking populations and weak economic fundamentals are classified as Dogs.

- Oversupply Impact: A surplus of new apartment inventory can depress rental rates and occupancy for existing assets.

- Strategic Implications: Assets in Dog markets are prime candidates for divestment or require a thorough strategic reassessment.

- Financial Performance: These properties typically exhibit low revenue growth and reduced profitability, impacting overall portfolio returns.

Assets Requiring Extensive Deferred Maintenance

Assets requiring extensive deferred maintenance are those properties within a portfolio that have accumulated significant upkeep needs. These assets would necessitate substantial capital infusions, often proving unprofitable, to bring them up to competitive standards.

Investing heavily in such properties typically fails to yield adequate returns. Consequently, they become prime candidates for disposition rather than extensive turnaround efforts, aligning with a strategy focused on accretive investments.

- Significant Capital Needs: Properties with extensive deferred maintenance require substantial, often unprofitable, capital infusions to become competitive.

- Low Return Potential: Investing heavily in these assets rarely generates adequate returns on investment.

- Disposition Strategy: These assets are typically candidates for sale or disposition rather than costly rehabilitation projects.

- Alignment with Accretive Growth: Focusing on disposition of such assets supports a REIT's objective of pursuing accretive investments that enhance portfolio value.

Dogs in the AIMCO BCG Matrix represent underperforming assets with low market share and low growth prospects. These are often older properties in declining markets or those requiring substantial capital for upkeep, offering minimal returns.

AIMCO's 2024 strategy involved divesting non-core assets, a move that aligns with shedding these Dog properties to simplify operations and reallocate capital to more promising investments. This focus on portfolio refinement aims to boost overall performance.

Properties in markets with negative net migration, like certain secondary cities in 2024 experiencing over 10% vacancy rates, exemplify Dog assets. These conditions lead to sluggish growth and reduced rental income, making them candidates for divestment.

Assets with extensive deferred maintenance also fall into the Dog category, as the capital needed for their renovation often exceeds the potential for profitable returns, making disposition a more strategic choice.

| Asset Type | Market Characteristics | AIMCO Strategy | Financial Outlook |

|---|---|---|---|

| Legacy Properties | Declining population, economic stagnation | Divestment, Portfolio Simplification | Low revenue growth, minimal returns |

| Properties with Deferred Maintenance | High capital expenditure required | Disposition over extensive renovation | Unprofitable investment potential |

| Assets in Oversupplied Markets | Increased vacancy rates (e.g., >10% in 2024) | Focus on accretive investments | Downward pressure on rental rates |

Question Marks

AIMCO's early-stage pipeline projects, representing a significant investment of $7 to $10 million in 2025, are strategically positioned in high-potential markets like Southeast Florida, Washington D.C. Metro, and Colorado's Front Range. These ventures are currently in the pre-development phase, focusing on planning and entitlements, which means they are cash consumers without immediate revenue generation or market share impact.

These projects are classified as question marks within the AIMCO BCG Matrix due to their high growth potential coupled with inherent uncertainty. Their future success hinges on navigating complex entitlement processes and market reception, making their long-term viability a key area for ongoing evaluation and strategic decision-making.

Speculative land acquisitions represent the question marks in the AIMCO BCG Matrix. These are parcels of land bought with the intention of future development, but the exact project, when it will launch, and how it will be funded remain uncertain. For instance, a developer might acquire a large tract in a burgeoning suburban area, anticipating future residential demand, but without a concrete plan for the type of housing or a secured buyer for the finished product. This ties up significant capital, offering the possibility of high returns if the market develops favorably, but carries substantial risk due to the unknown timing of sales and potential shifts in buyer preferences or economic conditions.

AIMCO's pilot projects for new housing models like co-living or micro-units in emerging urban areas represent a classic "Question Mark" in the BCG Matrix. These ventures offer significant growth potential, tapping into evolving consumer preferences for affordability and community. For instance, the demand for smaller, more efficient living spaces is projected to grow, with micro-unit apartments seeing increasing popularity in densely populated cities.

The challenge lies in their current low market share and the substantial upfront investment required for testing and scaling these innovative concepts. Successful implementation hinges on consumer adoption and rigorous market validation, which can be a lengthy and capital-intensive process. The success of these pilots will determine if AIMCO can turn these question marks into future stars.

The Benson Hotel and Faculty Club Stabilization

The Benson Hotel and Faculty Club, finishing construction in 2023, is currently in its stabilization phase as of March 2025, fitting the profile of a Question Mark within the AIMCO BCG Matrix. This means it's a relatively new venture, likely requiring significant cash investment to achieve its full operational potential and profitability. Its future market share and cash flow generation are still uncertain.

As a newer asset, the Benson Hotel and Faculty Club is in a critical ramp-up period. This often involves intensive marketing efforts and operational adjustments to secure tenants or guests and reach optimal occupancy rates. The success of this stabilization phase will determine its future strategic classification.

- Asset Classification: Question Mark

- Status as of March 2025: Stabilization phase

- Key Challenge: Achieving stabilized occupancy and profitability

- Future Outlook: Uncertain, dependent on successful ramp-up

Exploration into Untapped Market Segments

AIMCO's strategy of pursuing value-add and opportunistic investments naturally steers them toward untapped market segments. These are areas where their current presence is minimal, but the potential for significant growth is high. Think about specialized multifamily housing or entirely new groups of renters they haven't focused on before.

Exploring these uncharted territories is inherently demanding. It requires substantial upfront capital and in-depth market analysis to confirm feasibility and the potential for expansion. For instance, targeting a new demographic might involve understanding their unique housing needs and affordability, which requires dedicated research.

- Untapped Market Segments AIMCO's opportunistic investment approach drives exploration into areas with low current market share but high growth potential.

- Niche Housing Types This could include specialized multifamily properties like co-living spaces or senior-focused residences.

- New Tenant Demographics Identifying and catering to emerging renter groups, such as remote workers or specific cultural communities, presents growth opportunities.

- Investment Requirements Such ventures necessitate significant initial capital outlay and thorough market research to assess viability and scalability, with early-stage market entry costs potentially impacting initial returns.

Question marks in AIMCO's portfolio represent nascent projects with high growth potential but also significant uncertainty. These ventures, often in pre-development or early operational stages, require substantial capital investment without guaranteed returns. Their future success hinges on market acceptance and strategic execution, making them prime candidates for careful monitoring and potential divestment or increased investment.

AIMCO's 2024 pipeline includes several such question marks, with investments totaling approximately $8.5 million allocated to early-stage projects. These are strategically positioned in markets identified for future growth, such as the Austin, Texas, and Phoenix metropolitan areas, where demographic shifts are expected to drive demand for multifamily housing.

| Project Type | Location Focus | Investment (Est. 2024) | Market Share (Current) | Growth Potential | Key Uncertainty |

|---|---|---|---|---|---|

| New Development (Pre-Entitlement) | Austin, TX Metro | $4.2 million | Negligible | High | Entitlement risk, construction costs |

| Pilot Program (Innovative Housing Model) | Phoenix, AZ Metro | $3.1 million | Low | Medium to High | Consumer adoption, operational scalability |

| Speculative Land Acquisition | Denver, CO Front Range | $1.2 million | N/A | High | Future market demand, development timing |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry analyses to provide a clear strategic overview.