AIMCO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

AIMCO operates within an industry shaped by the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating its competitive landscape effectively.

This brief overview only hints at the depth of analysis. Unlock the full Porter's Five Forces Analysis to explore AIMCO’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts AIMCO's bargaining power. If the market for key construction materials or specialized labor is dominated by a few large firms, those suppliers gain considerable leverage. For instance, in 2024, the construction industry faced ongoing supply chain challenges, with some critical material manufacturers experiencing production constraints. This limited availability, coupled with a few dominant players, allows these suppliers to command higher prices and more favorable payment terms from companies like AIMCO, reducing AIMCO's ability to negotiate favorable deals.

The uniqueness of inputs significantly impacts supplier bargaining power. If suppliers provide specialized building materials or advanced property management software that are critical to AIMCO's operations and hard to replace, their leverage grows. For instance, if a supplier offers proprietary construction techniques or unique land parcels in prime locations that are essential for AIMCO's development projects, they can command higher prices.

AIMCO, a significant player in the aerospace and defense sector, faces considerable switching costs when dealing with its suppliers. These costs can manifest in various forms, including the expense of retooling manufacturing processes for new components, the investment in retraining personnel to operate different machinery or software systems, and potential penalties or lost discounts from terminating existing long-term supply agreements. For instance, if AIMCO were to switch from a supplier of specialized composite materials, the cost of qualifying new materials, redesigning aerodynamic structures, and revalidating production lines could be substantial, potentially running into millions of dollars.

Threat of Forward Integration by Suppliers

Suppliers, particularly those in construction or material supply, might consider integrating forward into real estate development or management. This move would allow them to capture more of the value chain and directly compete with property owners like AIMCO. For instance, a large-scale builder could directly develop and manage apartment complexes, bypassing existing owners and increasing their leverage.

The threat of forward integration by suppliers can significantly shift bargaining power. If a major construction firm, for example, were to start developing and managing its own properties, it would directly threaten existing operators. This is especially relevant in 2024, where supply chain disruptions have highlighted the potential for upstream players to gain more control.

- Supplier Integration Risk: Suppliers in construction and materials could move into property development and management.

- Increased Leverage: Direct competition from suppliers would enhance their bargaining power against property owners.

- Market Impact: Such integration could lead to increased competition and potentially lower profit margins for existing real estate companies.

Importance of AIMCO to Supplier's Business

The significance of AIMCO as a customer to its suppliers is a key factor in assessing supplier bargaining power. If AIMCO accounts for a substantial portion of a supplier's overall revenue, that supplier may have less leverage. This is because their dependence on AIMCO for continued business could make them hesitant to push for unfavorable terms.

For instance, if a supplier's business relies heavily on AIMCO, they might be more inclined to accept AIMCO's pricing demands or production schedules to maintain the relationship. Conversely, if AIMCO is a small client for a supplier, the supplier is less dependent and thus holds more power.

In 2024, understanding these supplier dependencies is crucial. For example, if AIMCO procures a significant volume of specialized components, and only a few suppliers can meet those specific requirements, those suppliers naturally gain more bargaining power. This is especially true if AIMCO's orders represent a large percentage of their production capacity.

- Supplier Dependence: If AIMCO constitutes a significant revenue stream for a supplier, the supplier's bargaining power is diminished, as they prioritize maintaining the relationship.

- Market Concentration: The number of alternative suppliers available for AIMCO's needs directly impacts supplier power; fewer alternatives mean greater supplier leverage.

- Switching Costs for AIMCO: High costs for AIMCO to switch suppliers (e.g., due to specialized equipment or integration) increase the bargaining power of existing suppliers.

- Supplier's Own Cost Structure: A supplier with high fixed costs or a need for consistent production volume may be more willing to concede terms to a major customer like AIMCO.

The bargaining power of suppliers for AIMCO is influenced by several key factors, all of which can shift leverage in favor of the supplier. When suppliers are concentrated, offer unique or hard-to-substitute inputs, or when AIMCO faces high switching costs, suppliers gain significant power. Furthermore, the threat of suppliers integrating forward into AIMCO's business or the supplier's own dependence on AIMCO's business volume all play a crucial role in determining the balance of power.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance/Example |

|---|---|---|

| Supplier Concentration | High concentration increases power. | In 2024, a few key aerospace material suppliers faced demand surges, allowing them to dictate terms. |

| Uniqueness of Inputs | High uniqueness increases power. | Proprietary composite materials for advanced aircraft are critical and difficult to source elsewhere. |

| Switching Costs for AIMCO | High costs increase supplier power. | Re-tooling for new engine components can cost millions, locking AIMCO into existing supplier relationships. |

| Threat of Forward Integration | Increases supplier power. | A major component manufacturer could potentially offer integrated systems, bypassing AIMCO's assembly. |

| AIMCO's Customer Significance | Low significance for supplier increases power. | If AIMCO represents a small fraction of a supplier's total sales, the supplier has less incentive to accommodate AIMCO. |

What is included in the product

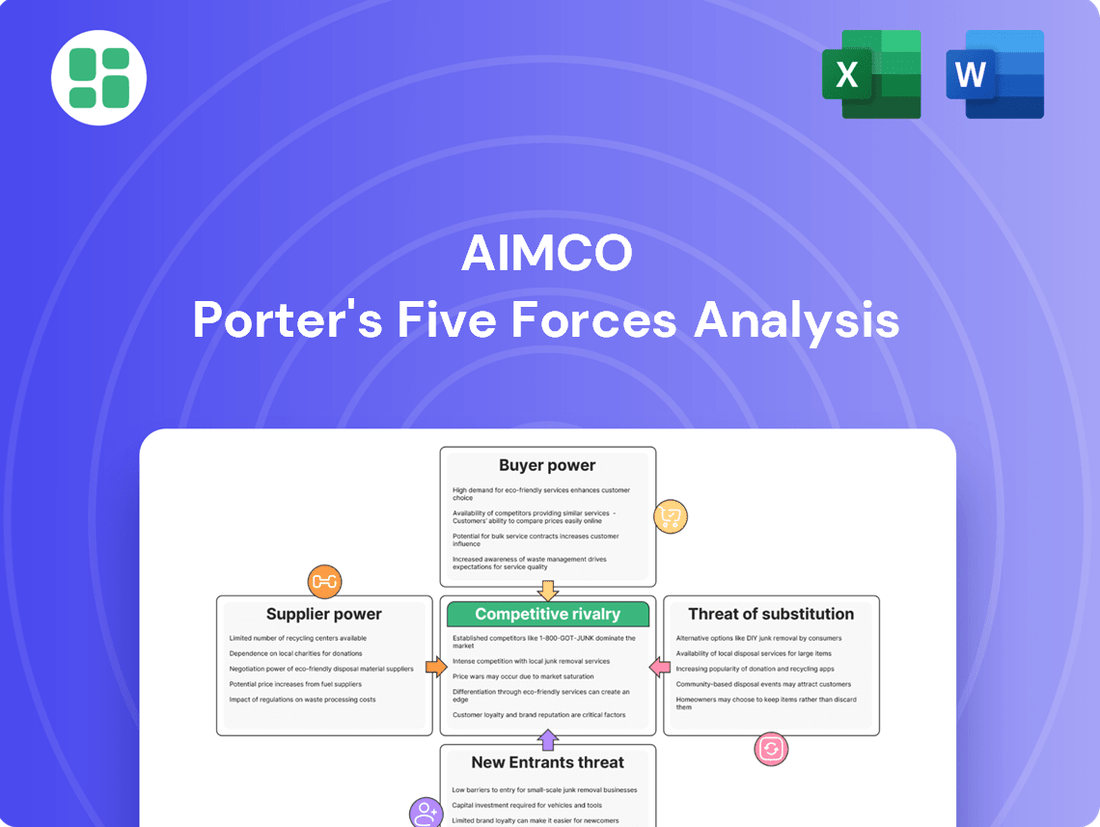

This AIMCO Porter's Five Forces Analysis dissects the competitive intensity within its operating environment, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Tenant price sensitivity is a key factor in their bargaining power. When rents rise significantly, especially in areas with high housing unaffordability, tenants become more inclined to search for cheaper alternatives. This tendency is amplified by local economic conditions and the sheer number of comparable rental units available in the market.

In 2025, housing affordability continues to be a major concern for many American households. Data indicates that a substantial portion of families struggle to afford the median-priced home, which could indirectly boost rental demand but also heighten tenants' sensitivity to rent increases. This means landlords may face greater pressure to keep rents competitive to retain tenants.

The bargaining power of customers, specifically tenants, is significantly influenced by the availability of substitutes for housing. When there are many alternative rental properties or opportunities to own a home, tenants have more leverage.

In 2024, the rental market continues to be attractive due to the cost-to-buy premium, meaning many households are likely to remain renters, which could moderate the availability of substitutes for some. However, high local apartment vacancy rates or a diverse range of rental types, like single-family homes or condos, directly empower tenants by providing them with more choices.

AIMCO primarily operates in the residential rental market, which is characterized by a highly fragmented tenant base. This fragmentation generally limits the bargaining power of individual tenants, as they lack the collective leverage to negotiate significant concessions. For instance, in 2024, the average apartment occupancy rate across the US remained robust, often exceeding 90%, indicating strong demand relative to supply, further diminishing individual tenant power.

Information Availability to Tenants

Tenants today have unprecedented access to information regarding market rents and property conditions. Online listing platforms and readily available rental market data empower renters to easily compare available units, understand prevailing prices, and assess property quality across different neighborhoods. This transparency significantly enhances their ability to negotiate lease terms more effectively.

The bargaining power of tenants is further amplified by current market trends. Multifamily rental growth was projected to turn negative in late 2024, with specific markets anticipating rent declines. For instance, some regions experienced a dip in rental prices during the latter half of the year, indicating a shift in leverage towards tenants in those areas, allowing them to potentially secure more favorable lease agreements.

- Increased Online Transparency: Websites and apps provide detailed listings, photos, and tenant reviews, making it easier for renters to research and compare properties.

- Access to Market Data: Reports on average rental prices and vacancy rates in specific zip codes equip tenants with crucial negotiation leverage.

- Shifting Market Dynamics: Projections of negative multifamily rental growth in late 2024 suggest a renter's market in many locations, potentially leading to concessions.

- Negotiation Power: With greater information and a potentially softening market, tenants are better positioned to negotiate rent amounts, lease duration, and included amenities.

Switching Costs for Tenants

The bargaining power of customers, specifically tenants in the apartment rental market, is significantly influenced by switching costs. These costs encompass both financial outlays and non-financial inconveniences associated with relocating.

Tenants face financial burdens such as security deposit forfeitures, lease break penalties, and the expense of moving itself, including truck rentals and professional movers. Non-financial costs include the time and effort required to search for a new apartment, pack belongings, and re-establish utilities and services. For instance, in 2024, the average cost of a cross-town move for a two-bedroom apartment could range from $500 to $1,500, not including potential lost wages for taking time off work.

These substantial switching costs effectively anchor tenants to their current residences, diminishing their inclination to seek alternative accommodations even when faced with marginally better rental rates or amenities elsewhere. This creates a scenario where landlords can maintain a degree of pricing power. In 2025, it's anticipated that lower renewal rent increases might further incentivize renters to stay put, thereby reducing their effective bargaining power even more.

- Financial Costs: Lease termination fees, security deposit loss, moving expenses (trucks, movers).

- Non-Financial Costs: Time spent searching, packing, unpacking, setting up new utilities.

- Impact on Bargaining Power: High switching costs reduce tenant leverage, making them less likely to negotiate or move.

- 2025 Outlook: Lower renewal rent increases could encourage tenant retention, further suppressing bargaining power.

The bargaining power of tenants is significantly shaped by the availability of comparable rental options and the overall health of the housing market. In 2024, while many remained renters due to the cost of buying, high vacancy rates in certain areas or a diverse rental stock, like single-family homes, gave tenants more leverage.

Information transparency, fueled by online platforms in 2024, empowers tenants to compare rents and property conditions easily, enhancing their negotiation capabilities. Furthermore, projections of negative multifamily rental growth in late 2024 indicated a softening market in many locations, potentially leading to tenant concessions.

Switching costs, including moving expenses and potential lease break penalties, tend to anchor tenants, reducing their inclination to move and thus their bargaining power. These costs can range from hundreds to over a thousand dollars for a typical move in 2024, making relocation a significant consideration.

| Factor | Impact on Tenant Bargaining Power | 2024/2025 Data Point |

|---|---|---|

| Availability of Substitutes | High availability increases power | Robust demand, but localized oversupply exists |

| Information Transparency | Increased information increases power | Widespread use of online rental platforms |

| Market Conditions | Softening market increases power | Projected negative multifamily rental growth late 2024 |

| Switching Costs | High costs decrease power | Moving costs $500-$1,500+ for a 2-bedroom |

Preview the Actual Deliverable

AIMCO Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive AIMCO Porter's Five Forces Analysis details the competitive landscape of the aircraft maintenance, repair, and overhaul industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

AIMCO operates in a highly competitive landscape, facing numerous apartment REITs, private developers, and property management firms within its target markets. This sheer volume and variety of players mean intense rivalry as each entity strives to capture market share.

The multifamily sector is projected for moderate, albeit slower, growth in 2025, largely due to the substantial influx of new apartment units entering the market. This increased supply can further intensify competition for renters, putting pressure on pricing and occupancy rates for all participants.

The apartment rental market is experiencing a period of moderating growth. While demand remains robust, the pace of new household formation has slowed compared to recent years. This shift means that as the industry growth rate adjusts, competition among apartment operators could intensify, particularly in markets with ample new supply coming online.

Looking ahead, multifamily construction starts are projected to see a dip in the initial half of 2025, followed by a stabilization. Despite this anticipated slowdown in new project initiations, a significant number of units are still in various stages of construction, which will continue to influence market dynamics and competitive pressures throughout the year.

Apartment properties can indeed be differentiated through a variety of factors. Think about the amenities offered, like state-of-the-art fitness centers or rooftop lounges, and the quality of service provided by the management team. Location is also a huge differentiator, with properties closer to transit hubs or desirable urban centers commanding higher rents.

When offerings are highly differentiated, it tends to lessen direct price competition among apartment providers. However, if properties are seen as very similar, or commoditized, the rivalry intensifies, often leading to price wars. For instance, reports from early 2025 indicate a significant increase in the introduction of new apartment community amenities, with a strong focus on personalization and fostering social connections among residents.

Exit Barriers

Exit barriers for Aimco, a real estate investment trust focused on apartment properties, are generally considered moderate to high. Significant capital is tied up in physical real estate assets, including land and buildings, which are not easily liquidated without substantial transaction costs and potential price concessions. Specialized property management infrastructure and long-term leases also contribute to these barriers, making a swift exit from specific markets or the entire portfolio challenging.

The ease with which competitors can exit the multifamily market is influenced by the liquidity of their assets. While the multifamily sector is generally more liquid than some other real estate classes, large-scale divestitures can still be time-consuming and subject to market conditions. For instance, while multifamily sales volume saw an increase in Q1 2025, signaling investor interest, the ability to exit profitably still depends on finding willing buyers at favorable prices, which can be constrained by economic cycles or local market saturation.

High exit barriers can indeed prolong competitive intensity. If firms cannot easily divest unprofitable assets, they may continue to operate, potentially leading to price wars or reduced profitability for all players in the market. This dynamic is particularly relevant in the apartment sector where repositioning or redeveloping properties can involve substantial upfront investment and extended timelines.

- High Capital Investment: Real estate assets require substantial upfront capital, making divestiture costly.

- Transaction Costs: Brokerage fees, legal expenses, and due diligence add to the difficulty of exiting.

- Market Specificity: Properties are tied to specific geographic locations, limiting exit options to regional buyers.

- Specialized Assets: Certain properties may have unique features that appeal only to a narrow buyer pool.

Fixed Costs and Capacity

Apartment ownership, like many real estate ventures, carries a significant proportion of fixed costs. These include ongoing expenses such as property taxes, insurance premiums, and routine maintenance, which remain relatively constant regardless of occupancy levels. For instance, in 2024, property taxes and insurance can represent a substantial portion of an owner's operating budget, often exceeding 20% of rental income in many major metropolitan areas.

The weight of these high fixed costs creates a strong incentive for apartment owners to maintain high occupancy rates. Operating at or near full capacity is crucial to spread these fixed expenses over more units, thereby reducing the per-unit cost and improving profitability. This pressure to fill vacancies can intensify competitive rivalry.

When markets experience oversupply or a slowdown in demand, owners may resort to aggressive pricing strategies, including rent reductions or offering concessions, to attract and retain tenants. This can lead to price wars, especially in densely populated urban areas where multiple apartment complexes compete for the same renter pool. For example, in late 2023 and early 2024, some Sun Belt markets saw vacancy rates climb, prompting landlords to offer one or two months free rent to secure leases.

- High fixed costs in apartment ownership include property taxes, insurance, and routine maintenance.

- These costs incentivize owners to maximize occupancy to cover expenses.

- In markets with high supply, this can lead to price competition to fill vacancies.

- For example, in 2024, property taxes and insurance could account for over 20% of rental income.

AIMCO faces intense competition from a wide array of apartment REITs, private developers, and management firms. This rivalry is amplified by the projected influx of new apartment units entering the market in 2025, which is expected to moderate growth and pressure pricing and occupancy rates.

The differentiation of apartment properties through amenities, service, and location can mitigate direct price competition. However, if properties are perceived as similar, competition intensifies, potentially leading to price wars, as seen with increased amenity introductions in early 2025.

High fixed costs, such as property taxes and insurance which can exceed 20% of rental income in 2024, compel owners to maintain high occupancy. This pressure can trigger aggressive pricing strategies, including rent concessions, especially in markets with oversupply or slowing demand, as observed with free rent offers in some markets in late 2023 and early 2024.

| Factor | Impact on Rivalry | 2024/2025 Data Point |

| Number of Competitors | High | Numerous apartment REITs, private developers, property managers |

| New Supply | Increases Rivalry | Moderate, slower growth projected for 2025 due to new units |

| Differentiation | Reduces Rivalry (if high) | Focus on personalized amenities and social connections increasing |

| Fixed Costs | Increases Rivalry (pressure for occupancy) | Property taxes/insurance can exceed 20% of rental income |

SSubstitutes Threaten

The attractiveness of substitute housing options for AIMCO is largely determined by their price relative to apartment rentals and the benefits they offer. Homeownership, while offering long-term equity, often presents a higher upfront cost and ongoing maintenance expenses compared to renting. In 2024, the median home price in the U.S. hovered around $417,000, a significant barrier for many compared to the average monthly rent for a one-bedroom apartment, which was approximately $1,370 nationally.

Tenant propensity to substitute is a key consideration. Many renters are finding homeownership increasingly out of reach due to escalating prices. For instance, the median home price in the U.S. continued its upward trend throughout 2024, making renting a more financially viable option for a larger segment of the population.

This shift is further influenced by evolving lifestyle preferences and demographic trends, where flexibility and avoiding long-term maintenance commitments are valued. As housing affordability remains a significant challenge, the likelihood of tenants seeking alternatives to traditional apartment rentals, such as co-living spaces or extended-stay hotels, may increase if rental prices become prohibitive.

The threat of substitutes for AIMCO's rental properties is influenced by how easily potential renters can find alternative housing. If there's a strong supply of single-family homes available for rent or a growing market for different living arrangements, this can increase the pressure from substitutes. For example, a surge in new single-family home construction for rent could divert demand from apartment complexes.

However, projections for new multifamily construction deliveries indicate a decline in 2025 and 2026. This anticipated drop could lead to a tighter rental market, potentially creating housing shortages and driving up rents. In such scenarios, substitute options might become less attractive as overall housing affordability and availability decrease.

Switching Costs for Tenants to Substitutes

Switching from renting an apartment to a substitute like homeownership involves significant financial hurdles. These can include substantial down payments, closing costs, and the immediate expense of renovations or furnishing a new property. For instance, in many major US markets, down payments alone can easily exceed tens of thousands of dollars, a stark contrast to the typically lower security deposits required for rental properties.

Beyond the direct financial outlays, renters also face psychological costs and disruption when moving. This includes the stress of packing, the logistical challenges of relocating, and the effort involved in adapting to a new neighborhood or a different living environment. The emotional toll of such a transition can be considerable, making the familiar comfort of a current residence more appealing.

Indeed, factors are emerging that suggest renters may be less inclined to move. As renewal rents become more attractive compared to the escalating costs of new leases, the perceived switching costs for tenants are increasing. This widening gap between current and new rental prices incentivizes staying put, effectively raising the barrier to seeking alternative housing solutions.

- Financial Barriers: Down payments, closing costs, and immediate renovation expenses for homeownership present significant financial obstacles compared to rental security deposits.

- Psychological and Logistical Costs: The stress and effort associated with moving, packing, and adapting to a new environment contribute to higher perceived switching costs.

- Rental Market Dynamics: Lower renewal rents relative to rising new lease rates are expected to reduce renter mobility, indicating an increase in perceived switching costs.

Quality and Features of Substitutes

The quality and features of substitute housing options directly impact AIMCO. For instance, single-family rentals or even condominiums, especially those offering more space or private yards, can be seen as strong substitutes. If these alternatives provide comparable or better amenities, such as updated kitchens, in-unit laundry, or pet-friendly policies, at a competitive price point, the threat to AIMCO escalates. In 2024, the multifamily market is indeed witnessing a surge in demand for wellness-focused amenities like fitness centers, co-working spaces, and outdoor recreational areas, alongside resilience features such as backup power systems. These trends can make substitute options more attractive if they better align with evolving tenant preferences.

The competitive landscape is further shaped by the increasing availability of short-term rental options, like those on platforms such as Airbnb. While not a direct long-term housing substitute, they can impact demand for traditional apartment rentals, particularly in urban centers or tourist-heavy areas. For example, in major metropolitan areas, the growth of the short-term rental market can divert potential renters who might otherwise consider a longer lease with AIMCO. This is especially true for individuals seeking flexible living arrangements or temporary stays, thereby fragmenting the overall housing market and presenting a nuanced competitive threat.

AIMCO must continually assess how its apartment communities stack up against emerging housing trends and substitute offerings. The proliferation of build-to-rent single-family homes, for example, offers a product that combines the benefits of homeownership with the convenience of renting. These communities often feature private garages, backyards, and higher levels of customization, which can appeal to a segment of the renter population that might otherwise consider AIMCO's apartments. As of early 2024, the build-to-rent sector has seen significant investment, indicating a growing competitive force.

- Quality and Features of Substitutes

- Substitutes like single-family rentals and condos may offer more space and private amenities, potentially drawing renters away from AIMCO if priced competitively.

- The multifamily sector's focus on wellness amenities (fitness, co-working) and resilience features in 2024 can enhance the appeal of apartments but also sets a higher bar for all housing options, including substitutes.

- Short-term rentals pose a threat by offering flexibility, potentially capturing renters seeking temporary or adaptable living situations, especially in high-demand urban markets.

- The growing build-to-rent single-family home market presents a substitute that blends homeownership perks with rental ease, appealing to renters seeking private yards and customization.

The threat of substitutes for AIMCO is moderate. While homeownership remains a significant alternative, its high upfront costs, evidenced by a median U.S. home price around $417,000 in 2024, make renting more accessible for many. Furthermore, increasing renter preference for flexibility and reduced maintenance, coupled with potentially lower renewal rents compared to new leases, can limit the appeal of switching.

However, the rise of build-to-rent single-family homes and the continued demand for enhanced amenities in multifamily living mean AIMCO must remain competitive. These substitutes offer attractive features like private yards and wellness facilities, potentially drawing renters seeking a blend of homeownership benefits and rental convenience.

| Housing Option | Key Characteristics | 2024 Data Point |

|---|---|---|

| Apartment Rental | Lower upfront cost, flexibility | National average rent (1-bedroom): ~$1,370 |

| Homeownership | Equity building, higher upfront cost | Median U.S. home price: ~$417,000 |

| Build-to-Rent Single-Family | Homeownership perks with rental ease | Significant investment growth in the sector |

Entrants Threaten

Entering the apartment real estate sector, especially for large-scale communities, demands substantial capital. This high barrier to entry significantly deters new players. For instance, developing a new multifamily property can easily cost tens of millions, if not hundreds of millions, of dollars, covering land acquisition, construction, and initial operating expenses.

While multifamily originations faced headwinds in 2023 and 2024, with transaction volumes significantly reduced compared to prior years, the market is anticipated to see a recovery and pick up in activity by 2025. This expected rebound, however, will still require considerable financial resources for any new entrants aiming to compete.

AIMCO, like many large real estate investment trusts (REITs), benefits significantly from economies of scale. This means their per-unit costs decrease as their operations grow. For instance, in property acquisition, larger entities can negotiate better bulk purchase prices or secure more favorable financing terms than smaller, newer companies.

These cost advantages create a substantial barrier to entry for potential new competitors. A new entrant would struggle to match the operational efficiencies and lower per-unit costs that established players like AIMCO have built over time. This is particularly evident in property management, where larger portfolios allow for more efficient allocation of resources like maintenance staff and administrative support.

The trend of REITs building extensive operating platforms further amplifies these economies of scale. As of late 2023, the U.S. REIT market capitalization exceeded $2.5 trillion, with major players managing vast portfolios. This scale allows for centralized procurement, sophisticated technology adoption, and optimized capital deployment, all of which are difficult for smaller, emerging companies to replicate, thus deterring new entrants.

New entrants into the multifamily real estate market, particularly those looking to compete with established players like AIMCO, often face significant hurdles in securing access to critical distribution channels. This includes gaining entry into prime geographic locations where AIMCO already holds a strong presence and leveraging established property management networks that are difficult for newcomers to replicate.

AIMCO's extensive existing portfolio provides a substantial advantage, as it already occupies desirable markets and has cultivated relationships with key stakeholders, including brokers and potential tenants. These pre-existing market relationships act as a considerable barrier, making it challenging for new entrants to gain visibility and attract residents without substantial investment and time.

Government Policy and Regulation

Government policy and regulation significantly shape the threat of new entrants in real estate. Zoning laws, building codes, and environmental regulations can dramatically increase the cost and complexity of new construction, acting as a substantial barrier. For instance, in 2024, the average cost to obtain building permits in major US cities often exceeded tens of thousands of dollars, with extensive review periods adding further delays.

However, the current housing affordability crisis is prompting many local governments to actively encourage new apartment construction. This can lead to a relaxation or streamlining of certain regulatory processes, potentially lowering barriers for new developers. In some areas, expedited permitting processes for affordable housing projects have been introduced, aiming to boost supply.

- Increased Development Costs: Stringent environmental reviews and complex building codes can add 15-25% to the overall cost of a new project.

- Permitting Delays: Average permit approval times in 2024 ranged from 3 to 12 months depending on the jurisdiction, impacting project timelines and capital costs.

- Regulatory Easing for Affordable Housing: Some municipalities are offering incentives like reduced impact fees or faster approvals for projects meeting affordability criteria.

Brand Identity and Tenant Loyalty

For apartment REITs like AIMCO, a strong brand identity and established tenant loyalty significantly deter new entrants. Newcomers would need substantial investment in marketing and potentially offer lower rents to lure residents away from trusted names. AIMCO’s performance in Q4 2024 highlights this advantage, with an impressive average daily occupancy of 97.9% and a solid 71.7% tenant renewal rate, demonstrating a sticky customer base.

This tenant loyalty translates directly into a barrier for new competitors. Building a comparable level of trust and resident satisfaction requires considerable time and resources, making it difficult for emerging players to gain immediate traction. AIMCO’s ability to maintain high occupancy and retain existing tenants suggests a competitive moat built on reputation and resident experience.

- Brand recognition can reduce customer acquisition costs for established players.

- Tenant loyalty directly impacts renewal rates and occupancy stability.

- High renewal rates like AIMCO's 71.7% in Q4 2024 indicate a strong competitive advantage.

- New entrants face the challenge of overcoming established brand equity and tenant relationships.

The threat of new entrants in the apartment real estate sector, particularly for large-scale operations like those managed by AIMCO, remains relatively low due to significant capital requirements and established economies of scale. Developing new multifamily properties requires tens to hundreds of millions of dollars, a substantial hurdle for any newcomer. Furthermore, established players benefit from lower per-unit costs in areas like property acquisition and management, making it difficult for new companies to compete on price or efficiency.

While some regulatory easing for affordable housing in 2024 might slightly lower barriers in specific niches, overall, the industry's high development costs, permitting delays averaging 3-12 months in 2024, and stringent environmental reviews continue to deter new competition. These factors, combined with the brand loyalty and high renewal rates, such as AIMCO's 71.7% in Q4 2024, create a formidable moat for existing, well-capitalized entities.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High cost of land acquisition and construction | Significant deterrent | New multifamily project costs: $10M - $100M+ |

| Economies of Scale | Lower per-unit costs for established players | Disadvantage for newcomers | Bulk purchasing, favorable financing |

| Regulatory Hurdles | Zoning, building codes, permitting | Increases cost and time | Permit delays: 3-12 months; Permit costs: $10,000s |

| Brand Loyalty/Tenant Retention | Established trust and relationships | Difficult to replicate | AIMCO Q4 2024 renewal rate: 71.7% |

Porter's Five Forces Analysis Data Sources

Our AIMCO Porter's Five Forces analysis is built upon a robust foundation of data, drawing from financial statements, investor relations disclosures, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.