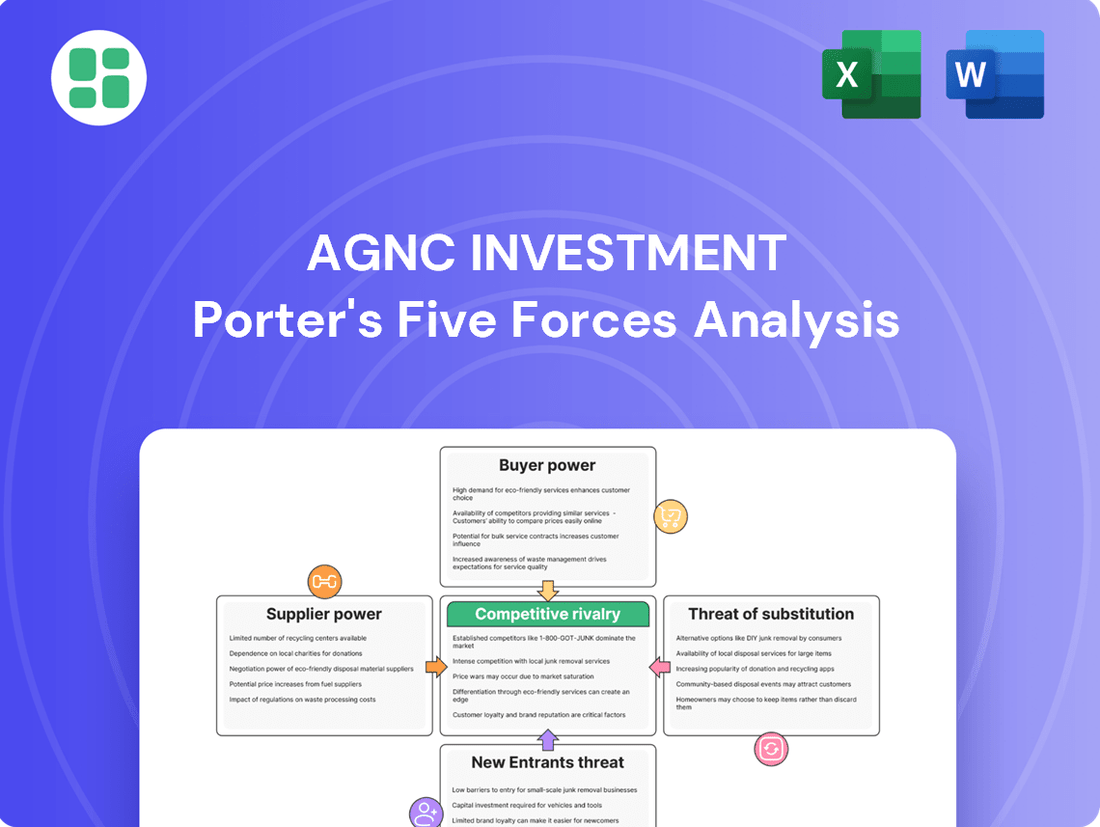

AGNC Investment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

AGNC Investment faces a complex competitive landscape, with significant pressure from the threat of substitutes and the bargaining power of buyers in the mortgage-backed securities market. Understanding these forces is crucial for any investor or strategist.

The complete report reveals the real forces shaping AGNC Investment’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AGNC Investment's access to funding markets is a key determinant of its bargaining power with suppliers, particularly those providing repurchase agreements (repos). AGNC relies heavily on these short-term borrowings to finance its portfolio of agency mortgage-backed securities (MBS). In 2024, the Federal Reserve's monetary policy, including the federal funds rate, directly impacts the cost of these crucial funding sources.

The lenders in the repo market, typically large banks and financial institutions, wield considerable power. They can dictate the terms, collateral requirements, and interest rates for these repurchase agreements. This means that when funding conditions tighten or interest rates rise, AGNC faces higher borrowing costs, squeezing its net interest margins and overall profitability.

Government-Sponsored Enterprises (GSEs) like Fannie Mae, Freddie Mac, and Ginnie Mae are crucial 'suppliers' for AGNC Investment, as they guarantee agency Mortgage-Backed Securities (MBS). Their government backing significantly reduces the credit risk AGNC faces on these core assets, making them attractive investments. For instance, in 2024, the GSEs continued to play a pivotal role in the housing finance market, ensuring liquidity and stability.

However, any shifts in GSE guarantee fees, capital requirements, or operational rules directly impact the cost and availability of agency MBS for AGNC. These entities act as gatekeepers, and their policy changes can alter the fundamental economics of AGNC's primary investment strategy. The market closely watches any regulatory developments concerning these GSEs, as they directly influence the quality and supply of AGNC's main assets.

The Federal Reserve's monetary policy significantly shapes the interest rate environment, acting as a critical 'supplier' of economic conditions for AGNC Investment. When the Fed raises rates, AGNC faces higher borrowing costs, directly impacting its profitability. Conversely, lower rates can accelerate mortgage prepayments, reducing the value of its mortgage-backed securities portfolio.

For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25% to 5.50% range throughout much of 2024, reflecting ongoing efforts to manage inflation. This sustained higher rate environment increased AGNC's cost of funds, a key factor in its net interest margin. The volatility experienced in 2024, with occasional shifts in market expectations regarding future rate cuts, also influenced the effectiveness and cost of AGNC's hedging strategies against interest rate risk.

Securities Dealers and Brokers

The bargaining power of securities dealers and brokers for AGNC Investment is moderate. AGNC relies on these intermediaries to source its agency Mortgage-Backed Securities (MBS) in the secondary market. While the market has many participants, a few large dealers can exert influence on pricing and liquidity.

The concentration of key dealers means AGNC must maintain strong relationships to ensure favorable execution on its trades. For instance, in 2024, the average bid-ask spread for highly liquid agency MBS remained tight, reflecting competitive dealer activity, but periods of market stress can see this widen, increasing AGNC's transaction costs.

- Dealer Concentration: A limited number of large, well-capitalized dealers often dominate secondary MBS trading, potentially giving them leverage.

- Liquidity Impact: The willingness and ability of dealers to make markets in specific MBS pools directly affects AGNC's ability to buy or sell efficiently.

- Relationship Importance: AGNC's success in navigating these markets depends on cultivating and maintaining robust relationships with its primary dealer counterparties.

- Market Volatility: During periods of high market volatility, dealer capacity can shrink, increasing their bargaining power and potentially widening bid-ask spreads.

Regulatory Bodies

Regulatory bodies, especially those governing financial markets and housing finance, exert significant influence as indirect suppliers by dictating the operational framework. For instance, shifts in capital adequacy ratios for financial institutions or evolving mortgage origination standards can directly affect the availability and cost of mortgage-backed securities (MBS), a core asset class for AGNC Investment. The Securities and Exchange Commission (SEC) and the Consumer Financial Protection Bureau (CFPB) are key examples of such bodies.

These regulations shape the supply and demand dynamics for MBS, thereby impacting AGNC's ability to source and invest in these assets. Compliance burdens and potential penalties for non-adherence can also represent a cost of doing business, indirectly affecting profitability. For example, in 2024, increased scrutiny on residential mortgage-backed securities (RMBS) disclosures by regulators highlighted the ongoing importance of compliance.

The bargaining power of these regulatory bodies is amplified by their ability to impose sanctions, fines, or even restrict market access for non-compliance. This necessitates that companies like AGNC Investment dedicate substantial resources to understanding and adhering to a complex web of rules. Anticipated stricter mortgage compliance regulations in 2025 are expected to further challenge the industry, potentially increasing operational costs and influencing investment strategies.

- Regulatory Influence: Agencies like the SEC and CFPB set the rules for financial markets and housing finance.

- Impact on MBS Market: Changes in capital requirements and lending standards affect MBS supply and demand.

- Compliance Costs: Adhering to regulations incurs costs and requires dedicated resources for AGNC Investment.

- Future Challenges: Stricter mortgage compliance regulations are anticipated for 2025, posing industry-wide challenges.

The bargaining power of suppliers for AGNC Investment, particularly those in the repurchase agreement (repo) market, is significant. Lenders in this market, often large financial institutions, can dictate terms, collateral, and interest rates, directly impacting AGNC's cost of funds. For instance, the Federal Reserve's monetary policy in 2024, with rates held steady in the 5.25%-5.50% range, increased AGNC's borrowing costs, squeezing its net interest margins.

| Supplier Type | Bargaining Power | Impact on AGNC | 2024 Context |

| Repo Market Lenders | High | Increased borrowing costs, reduced net interest margin | Fed rate hikes led to higher repo rates. |

| GSEs (Fannie Mae, Freddie Mac, Ginnie Mae) | High | Affects cost and availability of agency MBS | Continued role in housing finance stability. |

| Securities Dealers/Brokers | Moderate | Influences pricing and liquidity of MBS trades | Tight bid-ask spreads for liquid MBS, but volatility can widen them. |

| Regulatory Bodies (SEC, CFPB) | High (Indirect) | Dictates operational framework, compliance costs | Increased scrutiny on RMBS disclosures; anticipated stricter rules in 2025. |

What is included in the product

This analysis unpacks the competitive forces impacting AGNC Investment, detailing buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the mortgage REIT sector.

Effortlessly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, tailored for AGNC Investment's strategic planning.

Customers Bargaining Power

As a Real Estate Investment Trust (REIT), AGNC Investment Corp. has a legal obligation to distribute at least 90% of its taxable income to shareholders annually, primarily in the form of dividends. This regulatory framework inherently empowers AGNC's shareholders, as their consistent demand for these payouts is a critical factor in the company's operational strategy.

Investors often choose AGNC specifically for its attractive dividend yield, which historically has been a key draw. For instance, in 2024, AGNC's dividend yield remained a significant component of its total shareholder return, influencing investor sentiment and capital allocation decisions. This reliance on dividend income gives shareholders considerable leverage to push for stable and competitive distributions.

Any disruption or perceived threat to the continuity of these dividend payments can swiftly erode investor confidence. A reduction in dividends could trigger a sell-off, negatively impacting AGNC's share price and its ability to raise capital, thereby amplifying the bargaining power of its shareholder base.

AGNC's shareholders, especially those seeking income, have a wide array of investment choices outside of mortgage REITs. This includes alternatives like corporate bonds offering steady yields or dividend-paying stocks, and even other real estate investment trusts such as equity REITs. The appeal of these substitutes directly influences how much power AGNC's customers hold.

For instance, if AGNC's risk-adjusted returns are perceived as less attractive compared to, say, a high-grade corporate bond yielding 5.5% in mid-2024, investors can readily move their capital. This ease of switching capital to more competitive options amplifies the bargaining power of AGNC's customer base, which in this context are its shareholders.

Shareholders closely watch total return, which encompasses both dividends and share price changes. For instance, AGNC's tangible net book value per share declined in Q2 2025, a factor that can diminish shareholder capital and increase their bargaining power by prompting demands for improved performance or leading them to sell their holdings.

Market Liquidity for AGNC Shares

The bargaining power of customers, in the context of AGNC Investment's stock, is significantly influenced by market liquidity. High liquidity means shareholders can easily buy or sell AGNC shares on public exchanges. This ease of transaction empowers investors, as they can exit their positions efficiently with minimal price impact, thereby reducing the cost of switching to other investments. For AGNC, this necessitates a continuous focus on maintaining investor appeal to retain its shareholder base.

In 2024, AGNC Investment's stock typically exhibited robust trading volumes, a key indicator of its liquidity. For instance, average daily trading volumes often exceeded several million shares, facilitating quick entry and exit for investors. This high liquidity directly translates to a stronger bargaining position for shareholders, as they are less constrained by the ability to liquidate their holdings at a fair market price.

- High Trading Volume: AGNC shares consistently trade millions of shares daily, ensuring ease of purchase and sale for investors.

- Low Transaction Costs: The efficient market allows for minimal price slippage and lower brokerage fees when trading AGNC stock.

- Investor Flexibility: Shareholders can readily adjust their AGNC holdings in response to market changes or personal financial needs.

- Competitive Landscape: AGNC competes for investor capital with numerous other REITs and income-generating assets, underscoring the need to maintain shareholder value and liquidity.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings significantly influence the bargaining power of customers, particularly individual investors in the mortgage REIT sector. Positive sentiment, often driven by favorable analyst recommendations, can bolster demand for AGNC's securities, thereby diminishing the ability of individual investors to negotiate better terms or demand lower prices. For instance, if a majority of analysts maintain a buy rating on AGNC, it signals confidence, potentially leading to increased investment and less price sensitivity among buyers.

Conversely, a shift towards negative sentiment or a wave of analyst downgrades can empower customers. When analysts express concerns, such as those potentially arising from interest rate volatility impacting AGNC's portfolio, investors may become more hesitant, leading to selling pressure. This increased willingness to sell or avoid the stock can give individual investors more leverage, as AGNC might need to offer more attractive yields or pricing to attract or retain capital. For example, a significant increase in short interest, often a reflection of negative sentiment, can indicate a stronger bargaining position for those looking to sell.

- Analyst Ratings Impact: A consensus "buy" rating from major financial institutions can attract more capital, reducing the bargaining power of individual investors.

- Sentiment Shift: Negative analyst reports or widespread bearish sentiment can lead to investor outflows, increasing the bargaining power of remaining or potential new investors.

- Market Volatility: In periods of high interest rate volatility, which directly affects mortgage REITs like AGNC, investor sentiment can swing rapidly, altering customer bargaining power.

- Yield Expectations: Investor expectations for dividend yields, influenced by analyst commentary and market conditions, play a crucial role in their willingness to invest and their bargaining power.

The bargaining power of AGNC's customers, which are its shareholders, is amplified by the availability of alternative investments. Investors seeking income can readily shift their capital to other mortgage REITs, corporate bonds, or dividend-paying stocks if AGNC's offerings become less attractive. For instance, in mid-2024, with some corporate bonds yielding around 5.5%, investors could easily reallocate funds if AGNC's risk-adjusted returns were perceived as lower, thereby increasing shareholder leverage.

AGNC's shareholders have considerable power due to the company's structure, which mandates distributing at least 90% of taxable income as dividends. This reliance on consistent payouts means shareholders can exert influence; any threat to dividends can lead to sell-offs, impacting AGNC's capital raising ability. For example, a decline in AGNC's tangible net book value per share, as seen in Q2 2025, can prompt demands for better performance or lead to divestment.

Market liquidity significantly bolsters the bargaining power of AGNC's shareholders. High trading volumes, such as the millions of shares typically traded daily in 2024, allow investors to enter or exit positions with ease and minimal price impact. This flexibility empowers shareholders, as they can readily switch to more appealing investments, forcing AGNC to maintain competitive shareholder value.

Full Version Awaits

AGNC Investment Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for AGNC Investment, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document you see here is the exact, professionally written analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The mortgage REIT sector features a moderate number of established players, with large entities like Annaly Capital Management and more specialized REITs. AGNC competes directly with firms such as Chimera Investment Corporation and Redwood Trust, vying for investment opportunities and capital. This environment necessitates continuous strategic optimization for AGNC to sustain its market standing.

Agency MBS, AGNC's core investment, are essentially identical, making it hard for them to stand out. This lack of unique features means competition heats up, pushing companies like AGNC to focus on managing their costs, how much borrowed money they use, and how well they handle risks to earn more.

In 2024, the market for Agency MBS saw continued pressure on yields. For instance, the average yield on 10-year Treasury notes, a key benchmark, fluctuated, impacting the profitability of MBS portfolios. AGNC's ability to secure favorable repurchase agreement rates, which are crucial for funding their MBS holdings, directly affects their competitive standing. In Q1 2024, AGNC reported a net interest margin that reflected these funding cost dynamics.

The intense sensitivity of mortgage real estate investment trusts (mREITs) to interest rate swings and mortgage-backed security (MBS) spreads directly intensifies competitive rivalry. When interest rates are volatile or spreads narrow, every company faces pressure to stay profitable, prompting more aggressive tactics in hedging, portfolio management, and securing funding.

For instance, during periods of significant interest rate hikes in 2023 and early 2024, mREITs that demonstrated superior risk management and adaptability in their portfolio composition, such as AGNC Investment Corp. (AGNC), often outperformed competitors struggling with wider bid-ask spreads on their MBS holdings.

Capital and Funding Competition

Competition is fierce for attracting capital from investors and securing favorable funding terms in the repurchase agreement market. Firms actively vie for investor dollars by offering attractive dividends and showcasing strong risk-adjusted returns. For instance, AGNC Investment Corp. (AGNC) has historically provided substantial dividends, with its dividend yield fluctuating but often remaining competitive within the REIT sector. In 2024, REITs generally faced a challenging environment for capital raising due to higher interest rates impacting property valuations and borrowing costs.

Securing financing at the lowest possible rates is paramount, especially in the repurchase agreement market, which is a critical funding source for mortgage REITs. AGNC, like its peers, constantly negotiates these terms to manage its cost of funds. The ability to access diverse and cost-effective funding sources serves as a significant differentiator in this highly leveraged business model. For example, in the first quarter of 2024, AGNC reported a weighted average cost of funds that it works to keep as low as possible to maintain profitability.

- Investor Attraction: AGNC competes by offering competitive dividend yields, aiming to attract individual and institutional investors seeking income.

- Funding Costs: The firm actively manages its repurchase agreement rates, a key determinant of its profitability in a rising interest rate environment.

- Capital Access: Success hinges on maintaining access to diverse and cost-efficient funding, crucial for its leveraged operations.

Market Growth and Regulatory Environment

The competitive rivalry within AGNC Investment's sector is significantly shaped by the growth trajectory of the agency mortgage-backed securities (MBS) market and the broader managed Real Estate Investment Trust (mREIT) industry. A decelerating growth environment, which has been a recurring theme, tends to amplify competition as firms vie for a diminishing pool of attractive investment opportunities.

Regulatory shifts also play a crucial role in intensifying or moderating rivalry. For instance, changes in Federal Reserve policy regarding MBS purchases or interest rate adjustments directly impact the profitability and availability of assets, forcing companies to compete more aggressively for market share or to adapt their strategies quickly.

- Market Growth Impact: In 2024, the agency MBS market experienced moderate growth, but the overall mREIT sector faced headwinds from higher interest rates, potentially increasing competition for yield.

- Regulatory Influence: Ongoing discussions and potential adjustments to housing finance regulations by bodies like the Federal Housing Finance Agency (FHFA) can create a more challenging or favorable landscape, impacting how aggressively firms compete.

- Adaptability Premium: Companies that can swiftly adjust their investment strategies in response to evolving market conditions and regulatory changes, such as AGNC's focus on portfolio management and hedging, are better positioned to navigate intensified rivalry.

Competitive rivalry is intense in the mortgage REIT sector, driven by the homogeneous nature of agency mortgage-backed securities (MBS). AGNC and its peers, such as Annaly Capital Management and Chimera Investment Corporation, must differentiate themselves through operational efficiency, cost management, and superior risk mitigation strategies. In 2024, the pressure to secure favorable funding rates, particularly in the repurchase agreement market, remained a key battleground for profitability. AGNC's ability to maintain competitive dividend yields is also crucial for attracting investor capital in this crowded space.

| Metric | AGNC (Q1 2024) | Peer Average (Est. 2024) |

|---|---|---|

| Net Interest Margin (NIM) | 2.15% | 2.00% - 2.30% |

| Dividend Yield (as of mid-2024) | ~12.5% | ~11.0% - 13.0% |

| Leverage Ratio (Debt to Equity) | 7.8x | 7.0x - 8.5x |

SSubstitutes Threaten

The primary substitute for investing in AGNC Investment is any other asset that provides a compelling income stream. This includes a wide array of options like corporate bonds, which in mid-2024 offered yields ranging from around 4% for investment-grade to over 7% for high-yield categories. Similarly, preferred stocks and dividend-paying common stocks also compete for investor capital, with many established companies consistently returning value to shareholders.

Equity REITs, which directly own and operate income-producing real estate, present a significant substitute for investors seeking real estate exposure. These REITs, generating income from rents and property appreciation, offer a different risk-return profile compared to mortgage REITs like AGNC, potentially appealing to those wary of interest rate sensitivity.

For instance, as of early 2024, the U.S. Equity REIT market capitalization stood at over $1.5 trillion, demonstrating its substantial size and the breadth of investment options available. This vast market offers diverse property types, from residential apartments to industrial warehouses, each with its own performance drivers, acting as a direct alternative for capital allocation away from mortgage-backed securities.

For sophisticated investors, direct real estate investment presents a significant substitute to AGNC's mortgage-backed securities. This approach offers direct control over physical assets, potentially leading to higher yields and capital appreciation, especially in robust markets. For instance, in 2024, while REITs navigated fluctuating interest rates, direct investment in well-located commercial properties in major cities continued to attract capital, with some markets seeing cap rate compression indicating strong demand.

Money Market Funds and Treasury Securities

Money market funds and short-term U.S. Treasury securities present a significant threat of substitution, particularly during periods of rising interest rates. These instruments offer investors a low-risk avenue for capital preservation with yields that can become quite competitive, making them attractive alternatives to mortgage real estate investment trusts (mREITs) like AGNC Investment. For instance, as of late 2024, yields on 3-month U.S. Treasury bills have hovered around 5.3%, providing a stable return with minimal credit risk.

This competitive yield environment can siphon investor capital away from AGNC, especially if the company experiences a compression of its net interest margin or a decline in its book value. Investors seeking stability and predictable income may opt for the perceived safety of Treasuries over the inherent volatility of mREIT investments.

- Rising Interest Rate Environment: In periods of increasing rates, short-term government debt and money market funds offer attractive, low-risk yields.

- Capital Flight: Investors may shift capital from mREITs to these safer alternatives if AGNC's performance falters or spreads narrow.

- Yield Competitiveness: As of late 2024, yields on instruments like 3-month Treasury bills have been competitive, around 5.3%, directly challenging income-generating assets like AGNC.

Fixed-Income Funds and ETFs

The threat of substitutes for AGNC Investment (AGNC) comes from readily available fixed-income funds and Exchange Traded Funds (ETFs). These vehicles allow investors to access mortgage-backed securities and other fixed-income assets with professional management and built-in diversification, bypassing the direct complexities of managing a mortgage real estate investment trust (mREIT) like AGNC. For instance, as of early 2024, the U.S. ETF market alone held over $8 trillion in assets, with a significant portion allocated to fixed-income products, highlighting their widespread appeal and accessibility as an alternative to direct mREIT investment.

These substitute products offer a simpler path to fixed-income returns, often with lower perceived risk due to broader diversification. While AGNC focuses on a specific segment of the mortgage market, bond ETFs can hold a vast array of government, corporate, and municipal debt, spreading risk across different issuers and maturities. This broad accessibility and diversification present a significant alternative for investors seeking income without the specialized knowledge required for mREITs.

The fee structures and liquidity of these substitute funds also play a crucial role. Many ETFs, for example, boast very low expense ratios, sometimes below 0.10%, which can be more attractive than the operating costs associated with managing a specialized mREIT. This cost-effectiveness, combined with the ease of trading ETFs on major exchanges, makes them a compelling substitute for investors prioritizing simplicity and cost efficiency in their fixed-income strategies.

- Alternative Investment Vehicles: Fixed-income funds and ETFs offer diversification and professional management, serving as direct substitutes for direct investment in mREITs like AGNC.

- Market Accessibility: The U.S. ETF market's size, exceeding $8 trillion in early 2024, demonstrates the broad accessibility and investor preference for these diversified investment products.

- Risk and Cost Comparison: ETFs often present lower expense ratios and broader diversification compared to specialized mREITs, making them a cost-effective and potentially less risky alternative for income-seeking investors.

The threat of substitutes for AGNC Investment is substantial, as investors have numerous alternative avenues to generate income and exposure to real estate or fixed income. These substitutes range from traditional bonds and dividend stocks to more complex financial instruments and direct property ownership. The availability and attractiveness of these alternatives directly influence the demand for AGNC's specific investment structure.

For instance, in mid-2024, corporate bonds offered yields that could rival or exceed those of mortgage-backed securities, with investment-grade bonds yielding around 4% and high-yield options surpassing 7%. Similarly, equity REITs, which represent over $1.5 trillion in market capitalization as of early 2024, provide a direct way to invest in income-producing real estate, offering a different risk-reward profile that appeals to a broad investor base.

Furthermore, the rise of low-cost, diversified ETFs has made fixed-income investing more accessible. With over $8 trillion in assets under management in the U.S. ETF market by early 2024, these products offer broad exposure to various debt instruments, often with expense ratios below 0.10%, presenting a compelling, simplified alternative to specialized mREITs like AGNC.

| Substitute Investment Type | Typical Mid-2024 Yield/Characteristic | Key Appeal vs. AGNC |

|---|---|---|

| Investment-Grade Corporate Bonds | ~4% | Lower perceived credit risk than some MBS |

| High-Yield Corporate Bonds | >7% | Potentially higher income, though with higher risk |

| Equity REITs | Varies by property type; market cap >$1.5T (early 2024) | Direct real estate ownership, different risk drivers |

| U.S. Treasury Bills (3-month) | ~5.3% (late 2024) | High safety, competitive yield in rising rate environments |

| Fixed-Income ETFs | Varies; Expense Ratios <0.10% | Diversification, low cost, ease of trading |

Entrants Threaten

Entering the mortgage REIT sector, especially for agency mortgage-backed securities, demands considerable financial resources. AGNC Investment Corp.'s portfolio, for instance, consistently exceeds tens of billions of dollars, illustrating the scale of capital needed.

This high capital requirement serves as a significant deterrent, effectively barring smaller firms or individual investors from entering the market. Only established financial institutions or substantial investment funds with access to large pools of capital can realistically consider competing.

The threat of new entrants into the agency mortgage real estate investment trust (mREIT) sector, like AGNC Investment, is significantly tempered by the specialized knowledge required. Operating in this space demands a profound understanding of complex mortgage finance, intricate quantitative analysis, and stringent risk management protocols. For instance, a new player would need to cultivate or acquire teams proficient in interest rate hedging, prepayment modeling, and effective credit risk mitigation strategies, a substantial barrier to entry.

New entrants to the mortgage REIT market, like AGNC Investment, face significant hurdles in accessing funding markets. Establishing reliable and cost-effective funding lines, primarily through repurchase agreements with major financial institutions, is crucial for their operations.

New entrants would find it challenging to build these essential counterparty relationships and secure favorable terms. These terms are often contingent on established trust, demonstrated creditworthiness, and significant operational scale, which nascent companies lack.

In 2024, the repurchase agreement market, a key funding source for mortgage REITs, continued to be dominated by large, established players. Smaller or newer entities often pay higher rates due to perceived risk, impacting their profitability and ability to compete with incumbents like AGNC.

Regulatory and Compliance Burden

The mortgage and financial sectors, including entities like AGNC Investment, operate under a heavy regulatory umbrella. New companies entering this space must contend with a complex and costly compliance landscape. For instance, in 2024, the financial services industry continued to see significant investment in compliance technology and personnel, with estimates suggesting global spending on regulatory technology (RegTech) could reach tens of billions of dollars annually.

Navigating federal and state regulations, which cover everything from financial reporting standards to permissible leverage ratios and consumer protection laws, presents a substantial barrier. These requirements demand significant upfront investment in legal, compliance, and operational infrastructure, making it difficult for smaller or less capitalized entrants to compete effectively.

Key compliance areas that pose a threat to new entrants include:

- Capital Requirements: Meeting stringent capital adequacy ratios mandated by regulatory bodies.

- Reporting Obligations: Adhering to complex and frequent reporting schedules for financial health and operational activities.

- Licensing and Approvals: Obtaining necessary licenses and approvals from various financial authorities, a process that can be lengthy and expensive.

- Risk Management Frameworks: Establishing robust risk management systems to comply with industry best practices and regulatory expectations.

Economies of Scale and Operational Efficiency

Established entities like AGNC Investment leverage significant economies of scale in managing vast portfolios, executing complex hedging strategies, and optimizing operational expenditures. For instance, in 2024, the mortgage REIT sector continued to see consolidation, with larger players like AGNC benefiting from their scale to negotiate more favorable terms with counterparties and achieve greater efficiency in their securitization and funding activities.

These scale advantages translate directly into a competitive edge, particularly in maintaining a healthy net interest spread. AGNC’s ability to deploy capital across a broad range of agency mortgage-backed securities (MBS) allows for more diversified and effective hedging, reducing volatility and enhancing profitability compared to smaller, less capitalized entrants who would face higher per-unit costs for similar risk management.

- Economies of Scale: AGNC's substantial asset base (over $60 billion in assets under management as of early 2024) allows for significant cost efficiencies in portfolio management and hedging.

- Operational Efficiency: Larger operational volumes enable AGNC to spread fixed costs over a greater number of transactions, lowering per-unit operating expenses.

- Hedging Advantages: A larger portfolio permits more sophisticated and cost-effective hedging strategies, reducing the impact of interest rate fluctuations on net interest margins.

- Counterparty Pricing: AGNC's size and consistent trading volume give it leverage in negotiating pricing and terms with financial institutions for repurchase agreements and other funding sources.

The threat of new entrants into the agency mortgage REIT sector, exemplified by AGNC Investment, is considerably low. The immense capital requirements, estimated in the tens of billions of dollars for a portfolio of AGNC's size, act as a formidable barrier. Furthermore, the specialized knowledge in mortgage finance, quantitative analysis, and risk management needed to operate effectively is a significant hurdle.

Access to funding markets, particularly repurchase agreements, is another critical challenge for newcomers. Established players like AGNC have cultivated strong counterparty relationships, securing favorable terms that are difficult for new entrants to replicate. In 2024, the repo market continued to favor large, creditworthy entities, often leading to higher borrowing costs for smaller firms.

Regulatory compliance in the financial services sector also presents a substantial obstacle. New entrants must invest heavily in legal, compliance, and operational infrastructure to navigate complex federal and state regulations. The global RegTech market, for instance, saw continued growth in 2024, underscoring the significant resources dedicated to compliance by established firms.

Finally, economies of scale enjoyed by incumbents like AGNC, which managed over $60 billion in assets in early 2024, provide a distinct competitive advantage. These scale benefits translate into lower operational costs, more efficient hedging, and better negotiation power for funding, making it exceedingly difficult for new entrants to compete profitably.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AGNC Investment Corp. is built upon a robust foundation of data, including AGNC's SEC filings, investor presentations, and industry-specific research from reputable sources like Mortgage REIT industry reports and financial news outlets.