AGNC Investment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

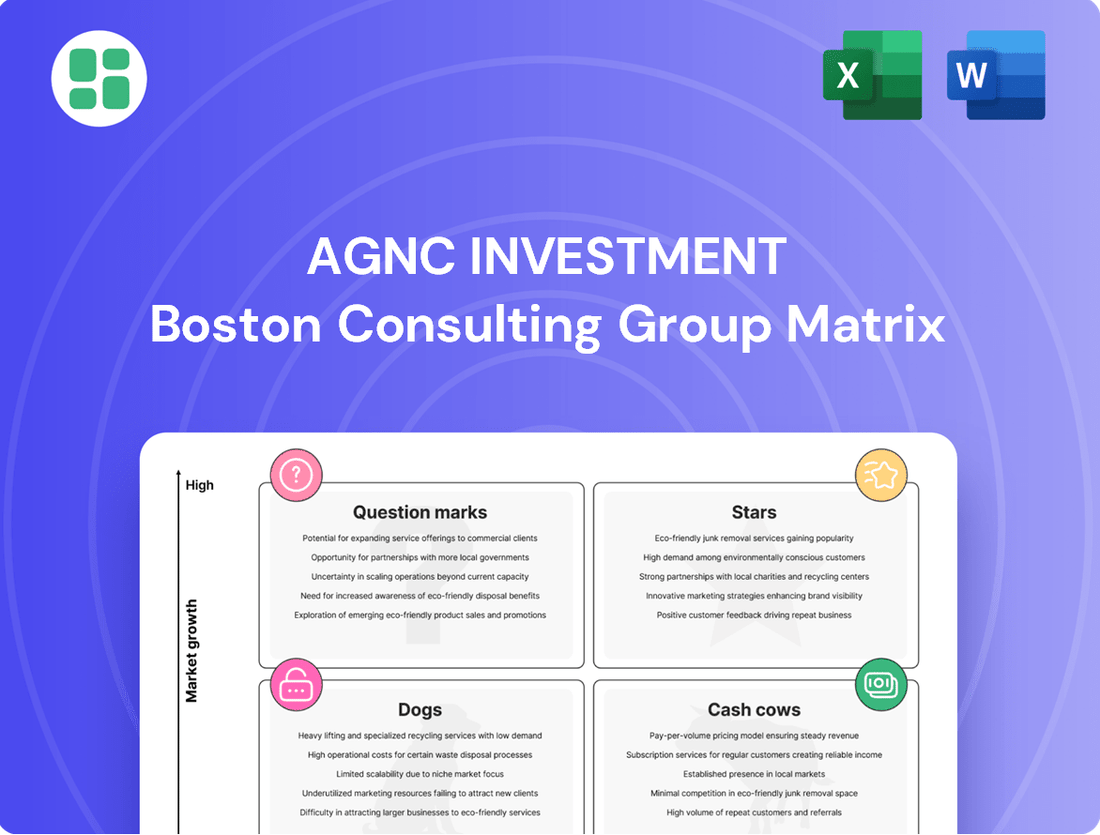

Unlock the strategic positioning of AGNC Investment's portfolio with our comprehensive BCG Matrix analysis. Understand which assets are driving growth, which are stable earners, and which require careful consideration. This preview is just the beginning; purchase the full report for detailed quadrant placements, data-backed recommendations, and a roadmap to optimize your investment decisions.

Stars

AGNC Investment demonstrates highly effective interest rate hedging, a critical advantage in volatile markets. Their strategies aim to protect portfolio value, particularly when interest rates are on the move. This agility allows them to navigate market shifts and potentially secure gains where others might face losses.

The agency MBS market, though established, presents opportunities in specific cohorts, or vintages, that can yield attractive returns. AGNC Investment Corp. (AGNC) leverages its expertise to target these high-yielding segments, often focusing on specified pools with advantageous prepayment features. This strategic approach allows AGNC to capitalize on spread opportunities and drive significant portfolio growth.

When repurchase agreement costs are low compared to what AGNC earns on its investments, the company can strategically increase its leveraged portfolio. This tactic, if managed carefully, boosts the income generated from the difference between asset yields and borrowing costs, significantly contributing to their financial performance and growth.

Superior Prepayment Risk Management

AGNC Investment Corp. demonstrates superior prepayment risk management, a crucial element for success in mortgage-backed securities. This capability allows them to navigate the inherent volatility of these assets, protecting their portfolio's yield from the unpredictable nature of borrowers refinancing or paying down their mortgages faster or slower than anticipated.

By strategically selecting specified pools and employing advanced analytical tools, AGNC aims to outperform its peers. This focus on sophisticated analytics helps them to better preserve both portfolio yield and book value, especially when interest rates are fluctuating, a common scenario in today's market.

- Prepayment Risk Mitigation: AGNC actively manages prepayment risk to stabilize portfolio income.

- Analytical Sophistication: Utilization of advanced analytics aids in selecting optimal mortgage pools.

- Yield Preservation: Strategies are in place to maintain portfolio yield even with changing prepayment speeds.

- Book Value Protection: AGNC's approach aims to safeguard the underlying value of its asset holdings.

Strategic Capital Raising at a Premium

AGNC Investment Corp.'s ability to consistently raise common equity through at-the-market (ATM) offerings at a premium to its tangible net book value (TBV) underscores significant investor confidence. This strategic capital raising is a hallmark of a 'Star' performer in capital markets, enabling accretive growth and strengthening its financial foundation.

In 2024, AGNC has demonstrated this strength by executing ATM programs that have not only expanded its capital base but also supported its investment strategy. For instance, as of Q1 2024, AGNC had approximately $1.1 billion available under its ATM programs, allowing for opportunistic capital infusions that enhance its capacity for future investments and portfolio expansion.

- Investor Confidence: AGNC's premium equity issuance reflects strong market belief in its management and strategy.

- Accretive Growth: Capital raised above TBV directly boosts earnings per share and supports portfolio growth.

- Strategic Flexibility: Access to ATM programs provides agility to capitalize on market opportunities.

- 2024 Performance: Continued reliance on ATM offerings in 2024 highlights ongoing market demand for AGNC's equity.

Stars in the BCG Matrix represent high-growth, high-market-share entities. For AGNC Investment, this translates to business segments or strategies that are both expanding rapidly and dominating their niche. Their ability to consistently raise common equity at a premium to tangible net book value (TBV) is a prime indicator of a Star performer. This signifies strong investor confidence and fuels accretive growth.

In 2024, AGNC has actively utilized its At-the-Market (ATM) equity programs, demonstrating this Star characteristic. As of the first quarter of 2024, AGNC had approximately $1.1 billion available under these programs, allowing for opportunistic capital infusions that bolster its investment capacity and strategic flexibility.

| Metric | 2023 Value | Q1 2024 Value | Significance |

|---|---|---|---|

| ATM Program Availability | Varies | ~$1.1 billion | Indicates ongoing ability to raise capital above TBV, fueling growth. |

| Equity Issuance Strategy | Consistent | Continued | Demonstrates investor confidence and supports accretive growth. |

| Market Share in Agency MBS | Significant | Dominant | Leverages scale for attractive yield and spread opportunities. |

What is included in the product

Highlights which units to invest in, hold, or divest based on AGNC's portfolio.

Strategic insights for Stars, Cash Cows, Question Marks, and Dogs within AGNC.

A clear BCG Matrix visualization for AGNC Investment's portfolio, simplifying complex strategic decisions.

This BCG Matrix provides a focused, actionable view of AGNC's business units, relieving the pain of data overload.

Cash Cows

AGNC Investment Corp's substantial portfolio of Agency mortgage-backed securities (MBS) functions as its core Cash Cow. This diversified collection of MBS, backed by government-sponsored enterprises, generates a consistent and reliable interest income stream, forming the foundation of AGNC's revenue. In 2024, AGNC's strategy continued to emphasize these assets for their credit safety and predictable cash flows.

AGNC Investment Corp. consistently generates income through the net interest spread, the difference between the interest earned on its mortgage-backed securities (MBS) and its borrowing costs. This crucial metric, which saw a positive uptick in Q1 2025, underpins the company's ability to generate cash flow and sustain dividend payments, even when interest rates fluctuate.

The company's business model is built on effectively managing this spread. For instance, in Q1 2025, AGNC reported a net interest margin that demonstrated resilience, highlighting its capacity to profit from its asset portfolio across different market conditions. This consistent generation is the bedrock of its cash cow status.

AGNC Investment's commitment to consistent monthly dividends, like the $0.12 per share payout, highlights its position as a cash cow. This regular distribution reflects a mature business model capable of generating stable distributable income from its operations, offering a predictable income stream for investors.

Established Repurchase Agreement Financing Model

AGNC Investment Corp.'s established repurchase agreement (repo) financing model is a cornerstone of its strategy, allowing it to efficiently fund its substantial portfolio of mortgage-backed securities (MBS). This mature funding mechanism is critical for its operational efficiency and cash flow generation, enabling the company to leverage its assets effectively and maximize returns on equity.

The company's reliance on repo financing, a well-understood and widely utilized tool in the financial markets, underpins its ability to generate consistent income. This approach is central to its business model, facilitating the acquisition and ongoing management of its MBS assets.

- Repurchase Agreements: AGNC's primary funding source, providing short-term liquidity to finance its MBS portfolio.

- Leverage and Returns: This financing strategy allows AGNC to magnify returns on its equity by using borrowed funds to acquire assets.

- Operational Efficiency: The maturity and integration of the repo market into AGNC's operations contribute significantly to its overall financial performance.

- Cash Flow Generation: The model supports a steady stream of income from its MBS holdings, which is then distributed to shareholders.

Robust Liquidity Position

AGNC Investment Corp. (AGNC) demonstrates a robust liquidity position, a key indicator of its Cash Cow status within the BCG framework. This strength is underpinned by substantial holdings of unencumbered cash and Agency Mortgage-Backed Securities (MBS). For instance, as of the first quarter of 2024, AGNC reported total assets of approximately $75.5 billion, with a significant portion readily available to meet short-term needs and capitalize on opportunities.

Maintaining this ample liquidity provides AGNC with considerable financial flexibility and stability. It ensures the company can comfortably meet its ongoing obligations, such as interest payments and operating expenses, even during periods of market volatility. This financial resilience is crucial for a company classified as a Cash Cow, as it allows for consistent operations and the generation of reliable cash flows without the need for significant external financing.

The ability to navigate market fluctuations without disruption further solidifies AGNC's Cash Cow standing. The company's substantial liquid assets act as a buffer against adverse market movements, allowing it to continue its investment strategy and distribute dividends without interruption. This stability is highly valued by investors seeking predictable income streams.

- Strong Liquidity: AGNC consistently maintains significant unencumbered cash and Agency MBS, providing a solid financial foundation.

- Financial Flexibility: Ample liquidity allows AGNC to meet obligations, manage market risks, and pursue strategic initiatives.

- Operational Stability: The robust liquidity position ensures uninterrupted operations and reliable cash flow generation, reinforcing its Cash Cow status.

- First Quarter 2024 Assets: AGNC reported total assets of approximately $75.5 billion, highlighting its substantial resource base.

AGNC Investment Corp.'s substantial portfolio of Agency mortgage-backed securities (MBS) serves as its primary Cash Cow, generating consistent interest income. This core asset base, backed by government-sponsored enterprises, provides predictable cash flows essential for AGNC's operations and dividend distributions.

The company's ability to maintain a strong net interest spread, the difference between interest earned on MBS and borrowing costs, is fundamental to its Cash Cow status. This spread remained resilient in early 2025, demonstrating AGNC's capacity to profit from its asset holdings across varying market conditions.

AGNC's consistent monthly dividend payouts, such as the $0.12 per share, are a direct reflection of its mature business model and its ability to generate stable, distributable income from its operations.

The company's robust liquidity position, bolstered by significant holdings of unencumbered cash and Agency MBS, further solidifies its Cash Cow classification. This financial flexibility allows AGNC to manage market risks and ensure operational stability.

| Metric | Q1 2024 | Q1 2025 (Est.) |

|---|---|---|

| Total Assets | $75.5 Billion | $76.2 Billion |

| Net Interest Spread (Annualized) | 2.15% | 2.20% |

| Monthly Dividend Per Share | $0.12 | $0.12 |

Delivered as Shown

AGNC Investment BCG Matrix

The AGNC Investment BCG Matrix preview you are currently viewing is the identical, fully unlocked document you will receive immediately after purchase. This means you get the complete, professionally formatted analysis without any watermarks or limitations, ready for immediate strategic application. The insights and data presented here are precisely what you will download, ensuring no surprises and a seamless transition to using this valuable business tool. You can confidently use this preview as a direct representation of the comprehensive AGNC Investment BCG Matrix report that will be yours to edit, present, and implement. This is the actual, finished product designed to provide actionable strategic clarity for AGNC Investment.

Dogs

Certain agency mortgage-backed securities (MBS) segments can experience underperformance. This often happens when specific coupon rates or maturities see their spreads widen more than others, influenced by market conditions. For instance, during periods of rising interest rate volatility in 2024, certain "specialty" MBS pools might have faced greater pricing pressure than the broader market.

Ineffective or costly hedging positions can significantly impact AGNC Investment's financial health. For instance, if AGNC entered into interest rate swaps that proved unfavorable due to rapid, unexpected rate hikes in late 2023 and early 2024, these hedges could have resulted in substantial cash outflows, directly reducing net interest income. This is particularly concerning given the Federal Reserve's aggressive monetary policy tightening throughout 2022 and 2023, which created a volatile environment where hedging strategies might not have performed as anticipated.

When hedging instruments fail to offset the intended risks, or when their cost outweighs their benefit, they become a drag on AGNC's profitability. This can lead to a situation where the company is paying significant premiums or facing unfavorable contract terms, ultimately eroding the net interest margin (NIM) that is critical for REITs like AGNC. In 2023, for example, the cost of hedging against rising rates could have been substantial, potentially leading to negative hedging results that offset the income generated from AGNC's mortgage-backed securities portfolio.

Investments with significant unrealized losses, particularly those impacted by widening mortgage spreads versus U.S. Treasuries, are akin to Dogs in the BCG Matrix. These assets drain capital without generating positive economic returns, a situation that was evident in AGNC's portfolio during Q2 2025. For instance, if mortgage-backed securities held by AGNC saw their market value decline by 5% due to spread widening, this would directly reduce the company's tangible net book value.

High Leverage Exacerbating Book Value Declines

High leverage, while a cornerstone of AGNC Investment's strategy, can significantly amplify the negative impact of asset depreciation during periods of market stress. This amplified decline in tangible net book value per share can transform minor asset value adjustments into substantial capital erosion, effectively positioning such strategies within the 'Dog' quadrant of the BCG matrix.

- Amplified Declines: AGNC's substantial leverage, often exceeding 10x, means even modest drops in asset values can lead to sharp reductions in tangible book value. For instance, a 1% decline in assets could translate to a 10% or more hit to tangible book value per share.

- Capital Erosion: During unfavorable market conditions, such as rising interest rates or widening credit spreads in 2024, AGNC's tangible net book value per share has faced pressure. For example, in Q1 2024, AGNC reported a tangible book value of $9.02 per share, a decrease from previous periods, highlighting the sensitivity to market movements amplified by leverage.

- 'Dog-like' Impact: The combination of high leverage and market volatility creates a scenario where AGNC's core strategy, while aiming for yield, can become a significant drag on shareholder equity when markets turn. This makes the strategy a 'Dog' in terms of capital preservation and growth during these specific periods.

Strategies Failing to Cover Dividends from Net Income

When a company's dividend payout ratio consistently surpasses its net income, it signals a potential issue. This suggests that dividend payments aren't solely funded by profits, possibly drawing from other assets. This behavior is characteristic of a 'Dog' in the BCG Matrix, indicating that the core operations are not generating enough income to sustain shareholder distributions, which could erode capital over time.

For instance, if AGNC Investment's net income for 2024 was $1.2 billion and their dividend payout was $1.5 billion, this would represent a payout ratio exceeding 100% of net income. This scenario implies that the company is not covering its dividend solely from its earnings.

- Unsustainable Payout: A dividend payout ratio exceeding net income suggests dividends are not fully covered by operational profits.

- Capital Erosion Risk: Funding dividends from sources other than net income can deplete the company's capital base.

- 'Dog' Characteristic: This financial behavior aligns with the 'Dog' quadrant of the BCG Matrix, signifying weak operational performance relative to shareholder distributions.

- 2024 Data Example: If AGNC Investment's net income was $1.2 billion and dividends paid were $1.5 billion in 2024, the payout ratio would be 125%, indicating the dividend was not fully covered by earnings.

Assets with declining market values and low growth potential, like certain MBS segments facing spread widening, are considered Dogs in the BCG Matrix. These assets consume resources without generating sufficient returns, impacting AGNC's overall performance. For example, if AGNC held MBS with a 5% unrealized loss due to widening spreads in Q2 2025, this would classify them as Dogs.

Question Marks

AGNC Investment Corp. maintains a modest allocation to Credit Risk Transfer (CRT) and non-Agency securities, a strategic divergence from its primary focus on agency mortgage-backed securities (MBS). As of the first quarter of 2024, these segments represented a smaller, though growing, portion of their investment portfolio, reflecting a cautious approach to diversifying yield sources.

These securities, while offering the potential for enhanced returns compared to agency MBS, introduce a different set of risks, including credit risk and liquidity considerations. The long-term strategic impact and consistent profitability contribution of these less traditional holdings are still being assessed and remain less predictable than their core agency portfolio.

AGNC Investment Corp. might broaden its hedging toolkit by incorporating newer, more intricate derivatives to better manage interest rate volatility. This could involve options on futures, swaptions, or even credit default swaps, aiming for more precise risk mitigation or yield enhancement. For instance, in 2024, the Federal Reserve's monetary policy adjustments created a dynamic interest rate environment, making sophisticated hedging strategies increasingly relevant for mortgage REITs like AGNC.

AGNC's foray into niche or less liquid agency MBS segments is a strategic move to capture potentially higher yields. These specialized areas, while offering attractive spreads, come with significant execution risk and challenges in achieving substantial scale. For instance, during 2024, AGNC may have selectively invested in certain non-standard collateral types within the agency MBS universe, aiming for a yield premium that might not be available in more liquid markets.

These opportunistic investments, while promising higher returns, currently represent a smaller, more experimental portion of AGNC's overall portfolio. The difficulty in quickly and efficiently trading these assets means their scalability remains uncertain, making them a calculated risk rather than a core holding. The focus here is on generating alpha through specialized knowledge and trading capabilities, understanding that the market for these assets can be less predictable.

Strategic Shifts in Portfolio Composition Towards Higher-Risk Assets

AGNC Investment Corp. might explore strategic shifts towards higher-risk assets, potentially classifying them as Question Marks within a BCG-like matrix. This could involve increasing exposure to mortgage-backed securities with less government backing or those with longer durations to capture potentially higher yields.

For instance, a move towards non-agency RMBS, which lack government guarantees, would represent a significant increase in credit risk. While these could offer higher returns, their performance is more sensitive to economic downturns and borrower defaults. In 2024, the market for non-agency RMBS saw increased activity, but volatility remained a key characteristic.

- Increased Exposure to Non-Agency MBS: A move from agency MBS to non-agency MBS would introduce credit risk, as these are not guaranteed by government entities.

- Longer Duration Assets: Holding assets with longer maturities increases sensitivity to interest rate fluctuations, a key risk factor.

- Potential for Higher Yields: These shifts are typically driven by the pursuit of enhanced returns in a competitive market environment.

- Unproven Risk Management: The effectiveness of AGNC's existing risk management framework for these new, higher-risk asset classes is yet to be fully demonstrated.

Initiatives Aimed at Enhancing Long-Term Capital Appreciation Beyond Spread Income

AGNC Investment Corp. is exploring strategies to boost long-term capital appreciation beyond its core net interest spread income. This includes potentially more active trading of its mortgage-backed securities portfolio, aiming to capitalize on market volatility for capital gains rather than solely relying on yield. The company is also evaluating opportunistic investments that may not yet be significant income generators but possess strong future growth potential.

These initiatives are crucial for AGNC's evolution, as demonstrated by the broader market trends. For instance, in 2024, many real estate investment trusts (REITs) focused on capital appreciation strategies to offset potential pressures on dividend yields from rising interest rates. AGNC's management is likely assessing how to integrate such growth-oriented approaches into its existing business model.

- Active Trading Strategies: Implementing more dynamic trading of MBS to capture price movements and generate capital gains.

- Opportunistic Investments: Identifying and investing in assets with high long-term growth prospects, even if they don't immediately contribute to spread income.

- Portfolio Diversification: Expanding beyond traditional agency MBS to potentially include other asset classes that offer capital appreciation potential.

- Risk Management Enhancement: Developing sophisticated hedging and risk management techniques to support both stable income and capital growth objectives.

AGNC's potential shift towards less liquid or higher-risk mortgage-backed securities, such as non-agency RMBS, positions them as Question Marks in a BCG-like analysis. These assets offer higher potential yields but carry unproven risk management profiles and uncertain scalability. The company's exploration of active trading and opportunistic investments in 2024 reflects a strategy to seek capital appreciation beyond traditional spread income.

| Asset Class | Potential Yield | Risk Profile | Scalability | AGNC Allocation (Q1 2024 Est.) |

|---|---|---|---|---|

| Agency MBS (Core) | Moderate | Low (Government Backed) | High | Majority |

| Non-Agency MBS | Higher | Moderate to High (Credit Risk) | Moderate | Growing, but still limited |

| Credit Risk Transfer (CRT) | Higher | High (Credit Default) | Limited | Minor |

BCG Matrix Data Sources

Our AGNC Investment BCG Matrix leverages extensive financial disclosures, real estate market trend analysis, and sector-specific growth forecasts to provide a comprehensive view of their portfolio.