AGNC Investment Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

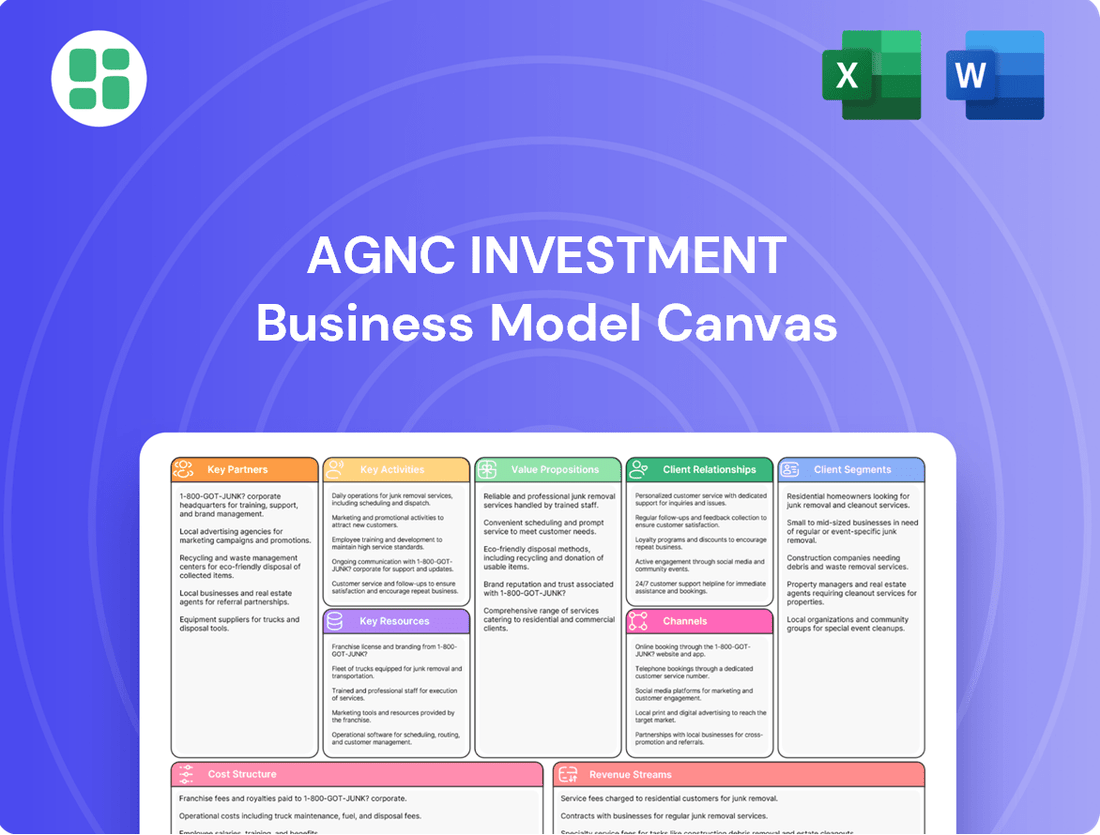

Unlock the strategic blueprint behind AGNC Investment's business model. This comprehensive Business Model Canvas details their core activities, key partners, and revenue streams, offering a clear view of their market approach. Ideal for anyone seeking to understand or replicate success in the mortgage REIT sector.

Partnerships

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac are critical partners for AGNC. Their role in guaranteeing Agency Mortgage-Backed Securities (MBS) is the bedrock of AGNC's investment strategy, significantly reducing credit risk and ensuring the stability of cash flows. This fundamental reliance highlights the symbiotic relationship, as AGNC's substantial investments in Agency MBS support the liquidity and functioning of the housing finance market facilitated by these GSEs.

Investment banks and broker-dealers are crucial for AGNC's business model, primarily by facilitating the trading and financing of Agency Mortgage-Backed Securities (MBS). They provide the essential liquidity and market access AGNC needs to buy and sell securities, as well as manage its leveraged positions. For instance, in the first quarter of 2024, AGNC continued to rely on these partnerships for its funding and trading activities, a consistent theme in its operations.

These partnerships are vital for AGNC's repurchase agreement (repo) market activities. Investment banks act as counterparties in these repo transactions, allowing AGNC to finance its substantial MBS portfolio. This access to short-term funding is fundamental to AGNC's strategy of generating income from the spread between its borrowing costs and the yield on its MBS assets.

Furthermore, AGNC's captive broker-dealer, Bethesda Securities, LLC, also plays a significant role in its funding operations. This internal capability helps streamline certain aspects of its financial activities, complementing the services provided by external investment banks and broker-dealers by contributing to the overall funding structure and operational efficiency.

AGNC Investment Corp. relies heavily on repurchase agreement (repo) counterparties, primarily large financial institutions, to fund its extensive portfolio of Agency Mortgage-Backed Securities (MBS). These agreements provide the short-term liquidity necessary for AGNC's leveraged investment approach.

As of the first quarter of 2024, AGNC's total repurchase agreement obligations stood at approximately $54.4 billion, highlighting the critical role these partnerships play in its financing structure. Diversifying these counterparties is key to ensuring consistent funding availability and optimizing borrowing costs.

Hedging Counterparties

AGNC Investment Corp. relies heavily on its hedging counterparties, primarily financial institutions and derivatives desks, to manage significant interest rate and market risks. These partnerships are crucial for executing strategies involving interest rate swaps and U.S. Treasury positions, which form the backbone of AGNC's risk mitigation efforts.

These relationships enable AGNC to effectively hedge its substantial portfolio of agency mortgage-backed securities (MBS). For instance, as of the first quarter of 2024, AGNC's portfolio consisted of approximately $60 billion in agency MBS. The ability to enter into derivative contracts with these counterparties allows AGNC to protect the value of these assets against unexpected shifts in interest rates, a primary concern for mortgage REITs.

- Counterparty Role: Facilitate the execution of interest rate swaps and other derivatives to hedge portfolio risk.

- Risk Management Impact: Protect the value of AGNC's $60 billion agency MBS portfolio against adverse market movements, as reported in Q1 2024.

- Financial Institution Dependence: AGNC depends on the stability and capacity of these financial institutions to maintain its hedging strategies.

Custodians and Trust Companies

Custodians and trust companies are critical partners for AGNC Investment, acting as the bedrock for its investment operations. These institutions are responsible for holding AGNC's vast portfolio of investment securities, ensuring their safekeeping and integrity. For instance, as of the first quarter of 2024, AGNC managed assets totaling approximately $76.9 billion, underscoring the sheer scale of assets requiring secure custody.

These partnerships are fundamental to the administrative efficiency of AGNC's portfolio. Custodians manage the intricate details of asset administration, including processing dividends, corporate actions, and other vital administrative tasks. This frees AGNC to focus on its core strategy of investing in agency mortgage-backed securities.

Furthermore, custodians facilitate the seamless settlement of AGNC's trades, a crucial function in the fast-paced world of financial markets. Their reliability directly impacts the operational smoothness and risk management of AGNC's investment activities. Without these trusted entities, AGNC's ability to execute its investment strategy would be severely hampered.

- Asset Safekeeping: Custodians hold AGNC's securities, safeguarding billions in assets.

- Administrative Support: They manage portfolio administration, including income processing.

- Trade Settlement: Essential for the efficient and secure execution of investment transactions.

- Operational Reliability: Their dependable services are vital for AGNC's day-to-day operations.

Key partnerships for AGNC Investment Corp. are centered around its core operations of investing in and financing Agency Mortgage-Backed Securities (MBS). These relationships are crucial for liquidity, risk management, and operational efficiency.

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac are foundational partners, guaranteeing the Agency MBS that form the bulk of AGNC's portfolio. This guarantee significantly mitigates credit risk. Investment banks and broker-dealers are vital for trading, financing, and providing market liquidity for these MBS. AGNC also relies heavily on repurchase agreement (repo) counterparties, primarily large financial institutions, to fund its substantial MBS holdings, with repo obligations totaling approximately $54.4 billion in Q1 2024. Hedging counterparties, also financial institutions, are essential for managing interest rate risk through derivatives, protecting AGNC's roughly $60 billion agency MBS portfolio as of Q1 2024. Custodians and trust companies safeguard AGNC's assets, estimated at $76.9 billion in Q1 2024, and manage administrative tasks and trade settlements.

| Partner Type | Role | Q1 2024 Data/Impact |

|---|---|---|

| GSEs (Fannie Mae, Freddie Mac) | Guarantee Agency MBS | Bedrock of investment strategy, reducing credit risk. |

| Investment Banks/Broker-Dealers | Trading, Financing, Market Liquidity | Facilitate buying/selling and leverage for MBS portfolio. |

| Repo Counterparties | Short-term Funding for MBS Portfolio | Total repo obligations ~$54.4 billion. |

| Hedging Counterparties | Interest Rate Risk Management (Derivatives) | Protect ~$60 billion agency MBS portfolio. |

| Custodians/Trust Companies | Asset Safekeeping, Administration, Trade Settlement | Secure ~$76.9 billion in assets. |

What is included in the product

This Business Model Canvas outlines AGNC Investment's strategy of investing in agency mortgage-backed securities, focusing on its revenue streams from net interest margin and its key partnerships with financial institutions.

It details AGNC's customer segments, primarily institutional investors, and its channels for distribution, along with its value proposition of providing stable income and liquidity.

AGNC Investment's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex mortgage REIT operations, simplifying understanding for stakeholders.

It streamlines the identification of key strategic elements, alleviating the pain of navigating intricate financial structures and fostering efficient decision-making.

Activities

AGNC Investment Corp's core business revolves around actively investing in and meticulously managing a substantial portfolio of Agency residential mortgage-backed securities (MBS). This strategic focus involves carefully selecting MBS to maximize returns, with a keen eye on critical factors such as prepayment speeds and the prevailing yield curve. For instance, as of the first quarter of 2024, AGNC reported an investment portfolio valued at approximately $57.8 billion, primarily composed of Agency MBS.

The company's profitability is intrinsically linked to its deep expertise in valuing and trading these complex securities. This involves sophisticated analytical tools and market insights to navigate the dynamic MBS landscape. In 2023, AGNC's net interest income, a key indicator of its MBS investment performance, stood at $2.6 billion, reflecting the income generated from its extensive MBS holdings.

AGNC's core operational strength lies in its adept management of repurchase agreements (repos) for leveraged financing. This involves borrowing funds short-term, using its mortgage-backed securities (MBS) as collateral, to acquire additional MBS. This strategy amplifies potential returns by increasing the company's asset base beyond its equity capital.

In 2024, AGNC's ability to secure favorable repo rates directly impacts its profitability. The company's net interest spread, a key performance indicator, is heavily influenced by the cost of this short-term borrowing relative to the yield earned on its MBS portfolio. Efficiently negotiating and managing these financing costs is therefore a critical activity for maintaining and enhancing shareholder value.

AGNC Investment Corp. actively manages its portfolio's exposure to interest rate fluctuations and prepayment uncertainties through dynamic risk management. This is crucial for a company heavily invested in mortgage-backed securities.

Sophisticated hedging strategies are employed, primarily utilizing interest rate swaps and positions in U.S. Treasuries, to mitigate these risks. For instance, in the first quarter of 2024, AGNC reported a net interest margin of 1.03%, highlighting the impact of their interest rate management on profitability.

Continuous monitoring and timely adjustments to these hedging instruments are paramount to safeguarding the value of AGNC's assets and ensuring overall financial resilience. This proactive approach is essential in navigating the volatile interest rate environment characteristic of 2024.

Capital Management and Shareholder Distributions

AGNC Investment Corp. actively manages its capital structure by issuing and repurchasing common and preferred stock. This is crucial for maintaining its desired leverage and optimizing its cost of capital. For example, in the first quarter of 2024, AGNC repurchased approximately 1.4 million shares of common stock.

As a Real Estate Investment Trust (REIT), AGNC is legally obligated to distribute at least 90% of its taxable income to shareholders annually, typically through consistent monthly dividends. This distribution strategy is a core component of its business model, aiming to provide stable income to investors. In 2023, AGNC paid out $1.12 per share in common stock dividends.

- Capital Structure Management: AGNC strategically issues and repurchases its common and preferred stock to optimize its financial leverage and capital costs.

- Shareholder Distributions: A significant portion of AGNC's taxable income is distributed to shareholders, primarily through consistent monthly dividends, a REIT requirement.

- Dividend Payouts: AGNC's commitment to regular dividends is a key aspect of its value proposition to investors, reflecting its income-generating capacity.

Market Analysis and Economic Forecasting

AGNC Investment Corp. dedicates significant resources to market analysis and economic forecasting to guide its investment and hedging strategies. This involves a constant watch on interest rate trends, Federal Reserve actions, and the broader housing market. For instance, in the first quarter of 2024, AGNC's portfolio performance was heavily influenced by shifts in the yield curve and expectations surrounding monetary policy.

Key activities within this area include:

- Monitoring Interest Rate Movements: AGNC closely tracks the direction and magnitude of changes in short-term and long-term interest rates, which directly impact the value of its mortgage-backed securities.

- Analyzing Federal Reserve Policy: Understanding the Federal Reserve's stance on monetary policy, including potential rate hikes or cuts and quantitative easing or tightening, is crucial for anticipating market shifts.

- Assessing Housing Market Conditions: AGNC evaluates factors like housing starts, mortgage origination volumes, and home price appreciation to gauge the health and outlook of the real estate sector.

AGNC's key activities center on the active management of its Agency mortgage-backed securities portfolio and the strategic use of repurchase agreements for leveraged financing. This involves sophisticated valuation, trading, and risk mitigation through hedging instruments like interest rate swaps.

The company also focuses on managing its capital structure by issuing and repurchasing stock, alongside distributing at least 90% of its taxable income as dividends, a REIT requirement. Continuous market analysis and economic forecasting are vital to inform these investment and hedging decisions.

| Key Activity | Description | 2024 Data/Context |

|---|---|---|

| Portfolio Management | Investing in and managing Agency residential mortgage-backed securities (MBS). | As of Q1 2024, portfolio valued at ~$57.8 billion, primarily Agency MBS. |

| Financing Operations | Utilizing repurchase agreements (repos) for leveraged financing. | Favorable repo rates in 2024 directly impact profitability and net interest spread. |

| Risk Management | Hedging against interest rate fluctuations and prepayment risk. | Q1 2024 net interest margin was 1.03%, reflecting interest rate management effectiveness. |

| Capital & Distributions | Managing capital structure and distributing income to shareholders. | Q1 2024 saw ~1.4 million shares repurchased; 2023 dividends were $1.12/share. |

Full Version Awaits

Business Model Canvas

The AGNC Investment Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the final deliverable, showcasing the comprehensive structure and content. Once your order is processed, you'll gain full access to this exact Business Model Canvas, ready for your immediate use and analysis.

Resources

AGNC Investment's core asset is its extensive portfolio of Agency Mortgage-Backed Securities (MBS). These securities are backed by the U.S. government, offering a high degree of credit quality and forming the bedrock of their revenue generation.

As of the first quarter of 2024, AGNC held approximately $69.6 billion in Agency MBS. This substantial holdings underscores the critical role these assets play in their business model, directly influencing their net interest margin and overall profitability.

The composition of this MBS portfolio, including factors like coupon rates, maturities, and prepayment speeds, is meticulously managed. AGNC's success hinges on its ability to effectively manage the risks and opportunities inherent in these mortgage-backed assets.

AGNC Investment Corp. relies heavily on significant financial capital, sourced from shareholder equity and robust access to debt markets. As of the first quarter of 2024, AGNC reported total equity of approximately $10.6 billion, underscoring its substantial equity base.

Maintaining a strong liquidity position is paramount for AGNC. This includes substantial holdings of unencumbered Agency Mortgage-Backed Securities (MBS) and cash reserves, which are vital for meeting potential margin calls and seizing opportune investment moments in dynamic markets.

This financial flexibility is a cornerstone of AGNC's strategy, enabling it to effectively navigate market volatility and manage its portfolio of Agency MBS. For instance, AGNC's ability to access repurchase agreements (repo) markets is critical for its funding strategy, with average repo borrowings of around $53.7 billion in Q1 2024.

AGNC's business model hinges on its deep expertise in mortgage asset management and trading. This isn't just about buying and selling; it's about understanding the nuances of mortgage-backed securities (MBS) through various market conditions.

The company boasts a management team and professionals with extensive experience navigating different economic cycles within the mortgage market. This intellectual capital is crucial for their success, allowing them to effectively optimize their portfolio.

Their proficiency extends to key areas like MBS valuation, trading strategies, and sophisticated risk modeling. This specialized knowledge is a significant competitive advantage, differentiating them in the market.

AGNC's long-standing presence and consistent performance underscore this specialized knowledge, demonstrating their ability to manage and trade mortgage assets effectively over time.

Sophisticated Risk Management Systems and Models

Sophisticated risk management systems and proprietary models are fundamental to AGNC Investment's operations. These advanced technological tools are crucial for real-time monitoring of key market variables like interest rate fluctuations and prepayment speeds. This allows AGNC to swiftly adapt its hedging strategies to mitigate potential financial risks.

These systems are not just about monitoring; they enable the quantification and mitigation of complex financial risks inherent in their portfolio. For instance, AGNC's ability to model prepayment behavior, a significant factor in mortgage-backed securities, directly impacts their hedging effectiveness and profitability.

- Proprietary Models: AGNC leverages internally developed models to assess and manage interest rate risk and prepayment risk.

- Real-time Monitoring: Systems provide continuous oversight of portfolio performance against market indicators.

- Hedging Strategy Optimization: Data from these systems informs and refines AGNC's approach to hedging its interest rate exposure.

Relationships with Financial Institutions

AGNC Investment Corp. relies heavily on its established relationships with a broad network of financial institutions. These include major banks, specialized broker-dealers, and other key players in the financial markets. These partnerships are absolutely critical for AGNC's core operations.

These relationships are the backbone for securing the necessary financing to fund AGNC's substantial mortgage-backed securities portfolio. They also facilitate crucial hedging activities to manage interest rate risk and provide access to diverse trading opportunities. For instance, as of the first quarter of 2024, AGNC's total assets stood at $63.9 billion, a significant portion of which is financed through these institutional relationships.

The ability to tap into capital markets efficiently and maintain liquidity is a direct benefit of these strong ties. This access allows AGNC to execute its leveraged investment strategy effectively, ensuring it can capitalize on market movements and maintain its competitive edge. The depth and breadth of these financial partnerships directly influence AGNC's operational capacity and its ability to generate returns.

- Financing Access: Securing diverse funding sources for its asset portfolio.

- Hedging Capabilities: Mitigating risks associated with interest rate fluctuations.

- Market Liquidity: Ensuring efficient execution of trades and portfolio adjustments.

- Investment Opportunities: Gaining access to a wider range of investment products and strategies.

AGNC's key resources encompass its substantial portfolio of Agency Mortgage-Backed Securities (MBS), valued at approximately $69.6 billion as of Q1 2024. Complementing this is a significant capital base, with total equity around $10.6 billion in the same period, and robust access to repurchase agreement (repo) markets, evidenced by average repo borrowings of $53.7 billion in Q1 2024. This financial strength is underpinned by deep expertise in mortgage asset management, proprietary risk modeling systems, and strong relationships with financial institutions that facilitate funding and hedging.

| Key Resource | Description | Q1 2024 Data Point |

|---|---|---|

| Agency MBS Portfolio | Core revenue-generating assets, government-backed. | ~$69.6 billion |

| Financial Capital | Equity and debt market access for operations and leverage. | ~$10.6 billion (Total Equity) |

| Funding Access (Repo Markets) | Crucial for leveraging MBS portfolio. | ~$53.7 billion (Average Repo Borrowings) |

| Expertise in Mortgage Assets | Management, valuation, and trading of MBS. | Experienced management team and professionals. |

| Risk Management Systems | Proprietary models for interest rate and prepayment risk. | Enables real-time monitoring and hedging strategy optimization. |

| Institutional Relationships | Partnerships with banks and broker-dealers. | Facilitates financing, hedging, and market access. |

Value Propositions

AGNC Investment Corp. provides a significant value proposition by focusing on high and consistent monthly dividend income. As a mortgage real estate investment trust (REIT), AGNC is structured to distribute a large portion of its taxable income to shareholders. This policy directly appeals to investors prioritizing a reliable income stream, making it an attractive option in the current market environment.

Investors get a direct line into the U.S. residential mortgage market by investing in Agency MBS. These securities are protected from credit losses because they are backed by government-sponsored enterprises, like Fannie Mae and Freddie Mac. This makes them a much safer bet than investing in mortgages directly or in non-Agency securities.

AGNC's approach offers a more secure avenue for people wanting to invest in the housing sector. For instance, as of the first quarter of 2024, AGNC Investment Corp. reported that its portfolio consisted primarily of Agency Mortgage-Backed Securities, demonstrating their core strategy.

AGNC Investment Corp. offers specialized management of intricate mortgage-backed securities portfolios, a task demanding deep expertise and robust risk mitigation. This service is invaluable for investors seeking exposure to these assets without the burden of direct, hands-on management, effectively outsourcing complexity and risk.

The company's seasoned team employs advanced strategies to navigate the nuances of mortgage assets, aiming to generate compelling risk-adjusted returns for its stakeholders. For instance, as of the first quarter of 2024, AGNC reported a tangible book value per common share of $7.78, underscoring the asset base they professionally manage.

Liquidity and Transparency through Public Listing

AGNC Investment Corp.'s public listing on the Nasdaq Global Select Market (AGNC) provides investors with significant liquidity. This means shareholders can readily buy and sell their shares, a crucial factor for many investment strategies. For instance, as of the first quarter of 2024, AGNC reported total assets of $62.4 billion, reflecting the substantial market activity and availability of its shares.

Transparency is another core value proposition. AGNC regularly files comprehensive reports with the Securities and Exchange Commission (SEC), offering detailed insights into its financial health, investment portfolio, and strategic direction. These disclosures, along with investor presentations, build trust and allow for informed decision-making by a broad range of investors.

- Liquidity: Shares are traded on the Nasdaq Global Select Market, facilitating easy buying and selling.

- Transparency: Regular SEC filings and investor presentations provide clear visibility into financial performance and strategies.

- Accessibility: This open disclosure makes AGNC an accessible investment for a diverse investor base, from individual retail investors to large institutional funds.

- Market Presence: As of Q1 2024, AGNC's portfolio consisted of approximately $59.6 billion in agency mortgage-backed securities, showcasing its significant role in the market.

Capital Support for U.S. Residential Housing Market

AGNC Investment Corp.'s investments in Agency Mortgage-Backed Securities (MBS) are a crucial component of private capital flowing into the U.S. residential housing market. These investments directly support the financing of American homes, fostering market liquidity and enabling homeownership.

The company's activities have a tangible societal impact by facilitating access to housing, which complements its objective of generating financial returns for its shareholders.

- Capital Infusion: AGNC's portfolio of Agency MBS, totaling approximately $70 billion as of Q1 2024, provides essential liquidity to the mortgage market.

- Homeownership Support: By purchasing these securities, AGNC indirectly enables lenders to originate more mortgages, supporting the American dream of homeownership.

- Market Stability: The consistent demand for Agency MBS from entities like AGNC contributes to the stability and efficiency of the broader housing finance system.

AGNC Investment Corp. offers a compelling value proposition centered on providing consistent monthly dividend income, a key draw for income-focused investors. Their structure as a mortgage REIT ensures a significant portion of taxable income is distributed to shareholders, directly addressing the demand for reliable income streams in the current financial climate.

The company's core strategy involves investing in Agency Mortgage-Backed Securities (MBS), which are guaranteed by government-sponsored entities like Fannie Mae and Freddie Mac. This backing offers a crucial layer of protection against credit risk, making them a more secure investment compared to direct mortgage holdings or non-Agency securities. As of the first quarter of 2024, AGNC's portfolio was predominantly composed of these Agency MBS, reinforcing their commitment to this strategy.

AGNC's expertise in managing complex mortgage-backed securities portfolios is a significant value-add for investors who prefer to avoid the intricacies of direct management. This specialized handling allows clients to gain exposure to these assets while outsourcing the associated complexity and risk. The company's experienced team employs sophisticated strategies to achieve attractive risk-adjusted returns; for instance, their tangible book value per common share stood at $7.78 in Q1 2024, reflecting the robust asset base they actively manage.

| Key Financial Data (Q1 2024) | Value | Significance |

|---|---|---|

| Total Assets | $62.4 billion | Indicates substantial market presence and liquidity. |

| Agency MBS Portfolio | ~$59.6 billion | Highlights core investment strategy and market impact. |

| Tangible Book Value Per Share | $7.78 | Represents the underlying asset value managed by the company. |

Customer Relationships

AGNC Investment Corp. prioritizes robust investor relations, offering regular communication through its dedicated function. This includes detailed financial reports, live webcasts of earnings calls, and accessible investor presentations, ensuring stockholders are consistently updated.

The company's commitment to transparency is evident in its proactive outreach. For instance, in the first quarter of 2024, AGNC held its earnings call on April 4, 2024, providing crucial insights into its performance and strategic direction for the period.

AGNC Investment Corp. prioritizes shareholder satisfaction by partnering with Computershare Trust Company, N.A., as its transfer agent and registrar. This collaboration ensures seamless management of stock records, timely dividend distributions, and responsive handling of all shareholder inquiries, catering to both individual and institutional investors.

For the fiscal year ending December 31, 2023, AGNC reported total assets of approximately $126.9 billion. The company's commitment to shareholder service is further evidenced by the direct contact information readily available for investor relations, facilitating clear and efficient communication.

AGNC Investment Corp. actively cultivates relationships with financial analysts covering the mortgage REIT sector, participating in industry conferences and offering insights into market dynamics and the company's strategic direction.

This engagement is crucial, as analyst reports, such as those from firms like Keefe, Bruyette & Woods (KBW) or Piper Sandler, directly influence market perception and investor confidence by providing in-depth analysis of AGNC's portfolio and operational performance.

For instance, in 2024, AGNC's management likely provided detailed commentary on their portfolio's resilience amidst fluctuating interest rate environments, a key focus for analysts evaluating the company's net interest margin and dividend sustainability.

Regular Financial Disclosures

AGNC Investment Corp.'s customer relationships are significantly shaped by its commitment to regular financial disclosures, a cornerstone for transparency and investor confidence. This involves the timely submission of crucial filings like the 10-Q (quarterly) and 10-K (annual) reports to the Securities and Exchange Commission.

These disclosures provide investors with detailed insights into the company's financial health, operational performance, and strategic direction. For instance, AGNC's 2024 financial reporting cadence will continue to highlight key metrics such as net interest margin, portfolio yield, and book value per share, enabling stakeholders to make informed decisions.

- Quarterly Reports (10-Q): AGNC consistently files these reports, offering updated financial statements and management's discussion and analysis for each fiscal quarter.

- Annual Reports (10-K): The comprehensive annual report provides a deep dive into AGNC's business, risk factors, and audited financial statements for the entire fiscal year.

- Earnings Releases and Dividend Announcements: AGNC communicates its quarterly earnings and dividend declarations through press releases, ensuring prompt dissemination of this vital information to the market.

- Investor Presentations: These materials often accompany earnings releases, offering a more narrative and visual explanation of the company's performance and outlook, further enhancing stakeholder understanding.

Dividend Distribution and Management

AGNC Investment's customer relationships are heavily anchored in its dividend distribution and management strategy. The consistent declaration and payment of monthly dividends are a core element of how it engages with its income-seeking shareholders.

This commitment to regular distributions, supported by a significant history of payments, is a primary driver for delivering value and fostering loyalty within its investor base. For instance, in 2024, AGNC continued its practice of monthly dividends, aiming to provide a steady income stream to its shareholders.

- Consistent Monthly Dividends: AGNC's primary customer relationship driver is its reliable monthly dividend payments, appealing to investors seeking regular income.

- Track Record of Distributions: A long history of dividend payments reinforces investor confidence and loyalty, demonstrating a commitment to shareholder returns.

- Value Proposition: The dividend policy is central to AGNC's appeal, serving as a key mechanism for returning value to its shareholders.

AGNC Investment Corp. fosters strong customer relationships through consistent communication and transparency, particularly regarding financial performance and dividend distributions. The company's investor relations team actively engages with shareholders and financial analysts, providing essential data and insights.

Key to these relationships is AGNC's commitment to delivering regular dividends, a core element of its value proposition for income-focused investors. For example, in 2024, AGNC continued its practice of monthly dividends, underscoring its dedication to providing a steady income stream.

The company's proactive disclosure strategy, including timely SEC filings like 10-Q and 10-K reports, along with investor presentations and earnings call webcasts, builds trust and allows stakeholders to make informed decisions based on up-to-date financial health and strategic direction.

| Communication Channel | Purpose | Key Information Provided | Frequency/Timing |

|---|---|---|---|

| Investor Relations Function | Direct engagement and support | Financial reports, strategic updates, inquiries | Ongoing, responsive |

| SEC Filings (10-Q, 10-K) | Regulatory compliance and detailed disclosure | Financial statements, management discussion, risk factors | Quarterly and Annually |

| Earnings Calls & Webcasts | Performance review and outlook | Financial results, portfolio commentary, guidance | Quarterly |

| Dividend Announcements | Shareholder returns | Dividend amount and payment dates | Monthly |

Channels

The Nasdaq Global Select Market serves as the primary conduit for investors to buy and sell AGNC Investment Corp.'s common stock and depositary shares. This listing ensures widespread availability and robust trading activity, underpinning the company's public valuation and accessibility for a broad investor base.

The Investor Relations Website acts as a crucial communication channel, offering a centralized repository for all official company information. This includes readily accessible SEC filings, recent press releases, investor presentations, and detailed dividend history, ensuring transparency and ease of access for stakeholders.

This digital platform is AGNC's primary conduit for disseminating financial data and strategic updates directly to current and potential investors. In 2024, AGNC reported that its investor relations website experienced a significant increase in traffic, reflecting heightened investor interest in its portfolio and dividend strategy.

Financial news outlets and media are crucial for disseminating AGNC's news releases and financial reports. These outlets, including major financial websites and publications, pick up information distributed through financial news wires. This broad reach ensures that AGNC's performance and strategic moves are communicated effectively to investors and market participants alike.

Brokerage Firms and Investment Platforms

Brokerage firms and investment platforms are crucial channels through which both individual and institutional investors can access AGNC Investment Corp.'s stock. These financial intermediaries facilitate the buying and selling of AGNC's securities, acting as the primary gateway for market participation. In 2024, the retail investor base in the US continued to grow, with platforms like Fidelity and Charles Schwab reporting millions of active accounts, many of whom would be potential AGNC shareholders.

These platforms offer more than just trade execution; they often provide valuable research, analytical tools, and market data that help investors make informed decisions about companies like AGNC. This ecosystem of financial services is vital for fostering liquidity and ensuring that AGNC's stock is readily available to a broad investor base.

- Intermediary Role: Brokerages connect buyers and sellers of AGNC stock, enabling efficient market transactions.

- Investor Access: Platforms like Robinhood, E*TRADE, and TD Ameritrade provide millions of retail investors with direct access to AGNC's securities.

- Information Hub: Many platforms offer research reports and analytical tools, supporting informed investment decisions regarding AGNC.

- Market Liquidity: The widespread use of these channels contributes significantly to the overall liquidity of AGNC's stock.

Analyst Reports and Financial Databases

Financial analysts from various institutions actively publish research reports and ratings on AGNC Investment Corp. These insights are crucial for professional investors and advisors, offering a deeper understanding of the company's performance and outlook. For instance, in early 2024, reports often focused on AGNC's dividend sustainability and its portfolio's sensitivity to interest rate changes, with analysts weighing in on the impact of Federal Reserve policy shifts.

These valuable reports are disseminated through widely used financial databases and research platforms, acting as a key channel for market participants. Platforms like Bloomberg, Refinitiv, and FactSet provide access to this critical information, enabling informed investment decisions. AGNC's business model relies on these channels to reach institutional investors and financial professionals who actively seek such detailed analyses to guide their strategies.

- Analyst Coverage: AGNC is consistently covered by numerous sell-side analysts, providing a continuous stream of updated research.

- Information Dissemination: Reports are distributed via major financial data terminals and online research portals, ensuring broad accessibility.

- Investor Insight: These reports offer detailed financial analysis, valuation metrics, and forward-looking commentary essential for sophisticated investors.

- Market Influence: Analyst ratings and price targets can significantly influence investor sentiment and AGNC's stock performance.

AGNC Investment Corp. leverages multiple channels to connect with its diverse investor base. These include the Nasdaq stock exchange for trading, its investor relations website for direct information, and financial news outlets for broad dissemination of company performance and strategic updates. Brokerage firms and investment platforms serve as primary access points for both retail and institutional investors, facilitating transactions and providing essential analytical tools.

Financial analysts play a vital role by publishing research reports, which are then distributed through financial databases and platforms, offering in-depth insights crucial for professional investors. In 2024, AGNC's investor relations website saw increased traffic, indicating heightened interest in its dividend strategy and portfolio. The continued growth of retail investors on platforms like Fidelity and Charles Schwab in the US further underscores the importance of these accessible channels for AGNC.

| Channel | Primary Function | Key Data/Observation (2024) | Investor Type |

|---|---|---|---|

| Nasdaq Global Select Market | Stock Trading & Public Valuation | Facilitates liquidity and price discovery. | All Investor Types |

| AGNC Investor Relations Website | Information Dissemination | Increased traffic reported, highlighting investor interest. | All Investor Types |

| Financial News Outlets | Broad Market Communication | Disseminates press releases and financial reports widely. | All Investor Types |

| Brokerage Firms & Investment Platforms | Transaction Facilitation & Access | Millions of retail investors use platforms like Fidelity, Schwab. | Retail & Institutional |

| Financial Analysts & Data Platforms | In-depth Research & Analysis | Reports focus on dividend sustainability and interest rate sensitivity. | Institutional & Professional |

Customer Segments

Income-Seeking Individual Investors are a core customer base for AGNC, drawn by the company's commitment to delivering consistent monthly dividend income. This segment often includes retirees or individuals looking to supplement their regular earnings with reliable cash flow. For instance, in 2024, AGNC continued its practice of monthly distributions, a key differentiator for those prioritizing predictable income streams.

Institutional investors, including major mutual funds, pension funds, and asset managers, are key clients for AGNC. These sophisticated investors are drawn to AGNC for its access to the mortgage market, attractive dividend yields, and its function in diversifying broader investment portfolios, often fitting specific allocation mandates for mortgage REITs.

Financial advisors and portfolio managers are key customers for AGNC Investment. They evaluate AGNC's strategy, particularly its focus on agency mortgage-backed securities, and its dividend yield to determine suitability for client portfolios. These professionals often look for stable income generation and risk management, making AGNC's performance metrics and reporting vital for their decision-making process. For instance, in Q1 2024, AGNC reported a tangible net book value per common share of $7.94, a figure advisors use to assess the underlying asset value and potential risk for their clients.

Long-Term Value Investors

Long-term value investors see AGNC Investment Corp. as a vehicle for consistent income and potential growth. They analyze AGNC's strategy of investing in agency mortgage-backed securities, focusing on its ability to generate stable cash flows through interest income and its management of interest rate risk. These investors are drawn to AGNC's dividend yield, often reinvesting payouts to enhance their long-term returns.

For example, AGNC's dividend history, while subject to market conditions, has historically provided attractive yields. In 2024, investors would be looking at AGNC's net interest margin and its portfolio's duration to assess its resilience and income-generating capacity. The company's ability to manage its leverage and hedging strategies is crucial for these investors seeking sustained performance over many years.

- Focus on Total Return: Investors prioritize both AGNC's dividend payouts and the potential for capital appreciation over extended periods.

- Business Model Scrutiny: They thoroughly examine AGNC's investment strategy, risk management practices, and competitive positioning within the mortgage finance sector.

- Dividend Reinvestment: A common strategy involves reinvesting dividends to benefit from compounding returns, thereby increasing their stake and future income.

- 2024 Performance Indicators: Key metrics for evaluation in 2024 include net interest margin, portfolio yield, interest rate sensitivity, and the effectiveness of hedging activities.

Market Participants Seeking Agency MBS Exposure

Investors specifically seeking exposure to the Agency mortgage-backed securities (MBS) market, drawn by their government-backed credit guarantee, represent a key customer segment. These market participants value AGNC Investment Corp.'s specialized expertise in navigating the complexities and leverage inherent in Agency MBS. They are attracted to the reduced credit risk associated with these securities, which aligns with a more conservative investment approach.

This segment, which includes institutional investors like pension funds, insurance companies, and asset managers, prioritizes the stability and predictable cash flows offered by Agency MBS. For instance, the total outstanding Agency MBS market was estimated to be over $12 trillion in early 2024, highlighting its significant size and appeal. AGNC's ability to effectively manage interest rate risk and prepayment risk within this asset class is a crucial draw for these sophisticated investors.

- Government Guarantee: Investors prioritize the credit enhancement provided by government agencies, minimizing default risk.

- Specialized Expertise: AGNC's focus on Agency MBS appeals to those seeking managers with deep knowledge of this complex market.

- Yield Enhancement: While credit risk is low, investors still seek the yield potential offered by MBS compared to other government-backed instruments.

- Portfolio Diversification: Agency MBS can offer diversification benefits within a broader fixed-income portfolio.

AGNC Investment Corp. serves a diverse investor base, with a significant portion being income-seeking individuals who value consistent monthly dividends. These investors, often retirees, rely on AGNC for predictable cash flow. For example, in 2024, AGNC continued its monthly dividend payouts, a key attraction for those prioritizing regular income streams.

Institutional investors, such as pension funds and asset managers, are also crucial clients. They are drawn to AGNC's access to the mortgage market, attractive yields, and its role in portfolio diversification. These sophisticated investors utilize AGNC's performance metrics, like its tangible net book value per common share, which stood at $7.94 in Q1 2024, to assess underlying asset value and risk.

Financial advisors and portfolio managers consider AGNC for client portfolios, focusing on its stable income generation and risk management. They scrutinize AGNC's strategy in Agency mortgage-backed securities and its dividend yield. In 2024, these professionals would be evaluating AGNC's net interest margin and portfolio duration to gauge its resilience and income capacity.

| Customer Segment | Key Motivations | 2024 Focus Areas |

|---|---|---|

| Income-Seeking Individuals | Consistent monthly dividends, predictable cash flow | Dividend history, yield sustainability |

| Institutional Investors | Mortgage market access, attractive yields, portfolio diversification | Net interest margin, portfolio yield, leverage management |

| Financial Advisors/Portfolio Managers | Stable income generation, risk management, suitability for client portfolios | Tangible net book value per share, interest rate sensitivity, hedging effectiveness |

Cost Structure

The most significant cost for AGNC Investment is the interest paid on its repurchase agreements and other debt. This leveraged financing is crucial for its business model, allowing it to acquire a large portfolio of mortgage-backed securities. In 2023, AGNC reported interest expense of $3.1 billion, a substantial figure reflecting the cost of this leverage.

The profitability of AGNC hinges on its net interest spread, which is the difference between the interest income earned on its assets and the interest expense paid on its liabilities. When short-term interest rates rise, as they did significantly in 2022 and 2023, the cost of its repurchase agreements increases, directly squeezing this spread.

For instance, AGNC's average cost of funds on repurchase agreements rose considerably throughout 2023. This increase in borrowing costs directly impacts the company's earnings, making interest rate management a critical factor in its financial performance. The sensitivity of its net interest margin to rate changes underscores the importance of this cost component.

Hedging costs are a significant operational expense for AGNC Investment, reflecting their active management of interest rate and market risks. In 2024, these expenses, including premiums for swaptions and net payments on interest rate swaps, are crucial for protecting their portfolio's value. These costs are directly tied to maintaining a stable net interest margin in a fluctuating economic environment.

General and administrative expenses form a key part of AGNC's cost structure, encompassing salaries, benefits for its internally managed team, office expenses, and other overhead. For instance, in 2023, AGNC reported total general and administrative expenses of $246 million, reflecting the costs associated with running an internally managed REIT.

These operational costs are crucial for maintaining the company's infrastructure and supporting its investment strategies. AGNC's commitment to operational efficiency is designed to directly impact shareholder returns by controlling these fixed and variable operating costs.

Premium Amortization on MBS Investments

AGNC Investment Corp. faces premium amortization on its mortgage-backed securities (MBS). This cost arises when AGNC purchases MBS at a price above their face value, and this premium is gradually expensed over the life of the security. In 2023, for instance, AGNC reported $1.5 billion in amortization of premium on its investment portfolio. This non-cash expense directly reduces the reported net income and impacts the effective yield of these assets.

The amortization process is intrinsically linked to the expected life of the MBS and is influenced by prepayment speeds. When borrowers refinance or pay down their mortgages faster than anticipated, the premium amortization accelerates. Conversely, slower prepayments lead to a slower amortization of the premium. For example, if prepayment speeds on a portfolio accelerate, the premium amortization expense for that period will be higher, further compressing the yield.

- Premium Amortization Impact: Reduces the effective yield on MBS investments.

- Nature of Expense: A non-cash charge reflecting the difference between purchase price and par value.

- Key Driver: Changes in mortgage prepayment rates significantly affect the amortization schedule.

- 2023 Data: AGNC reported $1.5 billion in premium amortization during 2023.

Dividend Payments (Common and Preferred)

Dividend payments, both common and preferred, are a crucial cost for AGNC Investment. While these are distributions of earnings, they represent a significant capital outflow and a core commitment influencing financial strategy. As a Real Estate Investment Trust (REIT), AGNC is mandated by law to distribute at least 90% of its taxable income to shareholders annually as dividends to maintain its tax-advantaged status.

- Dividend Payout Ratio: AGNC's commitment to its REIT status necessitates a high dividend payout ratio, directly impacting its retained earnings and reinvestment capacity.

- Cost of Capital: Consistent dividend payments, particularly for preferred stock, represent a fixed cost of capital that AGNC must service, influencing its leverage and investment decisions.

- Shareholder Expectations: The market expects AGNC to maintain its dividend, making any reduction a significant event that can negatively impact its stock price and cost of equity.

- 2024 Dividend Data: For instance, AGNC paid a common stock dividend of $0.12 per share in the first quarter of 2024, reflecting ongoing capital distribution.

AGNC Investment's cost structure is heavily influenced by its financing activities, primarily the interest paid on repurchase agreements and other debt. These borrowing costs directly impact its net interest spread, the core driver of its profitability. Hedging costs are also significant, as AGNC actively manages interest rate risk to protect its portfolio's value.

Operational expenses, including general and administrative costs, are managed to support its investment strategies. Furthermore, premium amortization on mortgage-backed securities is a non-cash expense that reduces reported income and affects asset yields, with prepayment speeds being a key factor. Finally, dividend payments are a mandated cost for AGNC as a REIT, representing a significant capital outflow to shareholders.

| Cost Component | 2023 Expense (Billions USD) | Key Driver/Impact |

| Interest Expense | $3.1 | Cost of leverage (repurchase agreements, debt) |

| Hedging Costs | N/A (Significant Operational Expense) | Interest rate and market risk management |

| General & Administrative | $0.246 | Salaries, office expenses, operational overhead |

| Premium Amortization | $1.5 | MBS purchases above par; influenced by prepayment speeds |

| Dividend Payments | Ongoing Capital Distribution | REIT requirement; shareholder expectations |

Revenue Streams

AGNC Investment's core revenue engine is the net interest income derived from its substantial portfolio of Agency mortgage-backed securities (MBS). This income is essentially the spread earned between the interest received on these MBS and the cost of financing them, predominantly through repurchase agreements. For instance, in the first quarter of 2024, AGNC reported net interest income of $733 million, demonstrating the critical role this stream plays.

AGNC Investment Corp. actively participates in dollar roll transactions within the to-be-announced (TBA) mortgage-backed securities (MBS) market. This strategy involves selling MBS with a commitment to repurchase similar securities at a future date, capitalizing on the difference between the sale and repurchase prices.

These dollar roll transactions are a crucial element of AGNC's net spread income, particularly for its holdings of fixed-rate MBS. For instance, in the first quarter of 2024, AGNC reported that net interest margin, which includes income from dollar rolls, contributed significantly to its overall profitability.

AGNC Investment Corp. generates revenue not just from interest income, but also from gains, both realized and unrealized, on its substantial portfolio of investment securities and derivatives. This includes their core holdings in Agency Mortgage-Backed Securities (MBS) and the complex derivatives used to manage interest rate risk.

The performance of this revenue stream is directly tied to market dynamics, particularly shifts in interest rates, and how effectively AGNC's hedging strategies mitigate potential downsides. For instance, in the first quarter of 2024, AGNC reported net gains on investment securities and derivatives of $1.1 billion, showcasing the significant impact this can have on their overall financial results.

However, this revenue source is inherently volatile. Market fluctuations and unexpected interest rate movements can easily turn these potential gains into substantial losses, as seen in periods of high market volatility. The effectiveness of their hedging, therefore, becomes paramount in stabilizing this component of their income.

Income from Credit Risk Transfer (CRT) and Non-Agency Securities

While AGNC Investment Corp. is predominantly known for its Agency Mortgage-Backed Securities (MBS) portfolio, it strategically diversifies its income by holding a smaller allocation to Credit Risk Transfer (CRT) securities and non-Agency residential and commercial mortgage-backed securities. These investments, though less prominent than Agency MBS, are crucial for augmenting overall portfolio yield and offering alternative avenues for income generation.

These non-Agency MBS and CRT products, while offering potentially higher returns, come with distinct risk characteristics compared to Agency MBS, which are guaranteed by government-sponsored entities. AGNC's approach involves carefully managing these risks to capture the enhanced income potential they present. For instance, in the first quarter of 2024, AGNC reported a portfolio that included these types of securities, contributing to its overall financial performance.

- Credit Risk Transfer (CRT) Securities: These are instruments designed to transfer credit risk from mortgage originators or securitizers to investors.

- Non-Agency Residential MBS: These securities are backed by mortgages that do not carry the guarantee of government-sponsored enterprises like Fannie Mae or Freddie Mac.

- Non-Agency Commercial MBS: Similar to residential non-Agency MBS, these are backed by commercial real estate loans but lack government guarantees.

- Income Contribution: These segments of AGNC's portfolio provide valuable income streams, contributing to the company's ability to distribute dividends to shareholders.

Other Investment Income

Other Investment Income for AGNC Investment includes earnings from various mortgage credit investments beyond its core agency mortgage-backed securities portfolio, as well as interest generated from its cash reserves. For instance, in the first quarter of 2024, AGNC reported $13 million in net investment income from its credit investments segment, a notable component of its diversified revenue.

These supplementary income sources, while often smaller in magnitude compared to its primary interest income from agency MBS, play a crucial role in bolstering AGNC's overall financial performance. This diversification helps to create a more resilient revenue base, mitigating risks associated with over-reliance on a single income stream.

The contribution of these other investment income streams is vital for AGNC's strategy of generating consistent returns. For example, interest earned on uninvested cash balances, though variable, provides a baseline income that supports operational flexibility and opportunistic investments.

- Income from Credit Investments: AGNC actively invests in various credit-sensitive assets, generating income that complements its agency portfolio.

- Interest on Cash Balances: Earnings from holding cash reserves provide a steady, albeit typically smaller, revenue stream.

- Diversification Benefit: These income sources contribute to a broader revenue base, reducing reliance on any single investment type.

AGNC Investment Corp. generates revenue through several key streams, primarily net interest income from its Agency mortgage-backed securities (MBS) portfolio. This is the difference between interest earned on MBS and the cost of financing them, often through repurchase agreements. In Q1 2024, net interest income was $733 million, highlighting its significance.

Additionally, AGNC capitalizes on dollar roll transactions in the TBA MBS market, selling MBS with an agreement to repurchase them later, profiting from price differences. This strategy significantly contributes to their net spread income, as seen in Q1 2024 results where net interest margin, including dollar rolls, was a key profitability driver.

Gains, both realized and unrealized, on investment securities and derivatives are another vital revenue source. In Q1 2024, AGNC reported $1.1 billion in net gains on these assets, demonstrating the substantial impact market performance and hedging strategies have on their income. However, this stream is volatile and sensitive to interest rate fluctuations.

AGNC also diversifies its income with Credit Risk Transfer (CRT) securities and non-Agency MBS. While these carry different risk profiles than Agency MBS, they offer potentially higher yields. The company also earns income from credit investments and interest on its cash reserves, with $13 million in net investment income from credit investments reported in Q1 2024.

| Revenue Stream | Description | Q1 2024 Contribution (Millions USD) |

|---|---|---|

| Net Interest Income | Spread from MBS portfolio financing | $733 |

| Dollar Roll Transactions | Profits from MBS repurchase agreements | Included in Net Interest Margin |

| Gains on Securities & Derivatives | Realized and unrealized profits | $1,100 |

| Other Investment Income | Credit investments, cash interest | $13 (Credit Investments) |

Business Model Canvas Data Sources

The AGNC Investment Business Model Canvas is built upon comprehensive financial disclosures, real estate market data, and analyses of mortgage-backed securities. These sources provide the foundation for understanding AGNC's revenue streams, cost structures, and key assets.