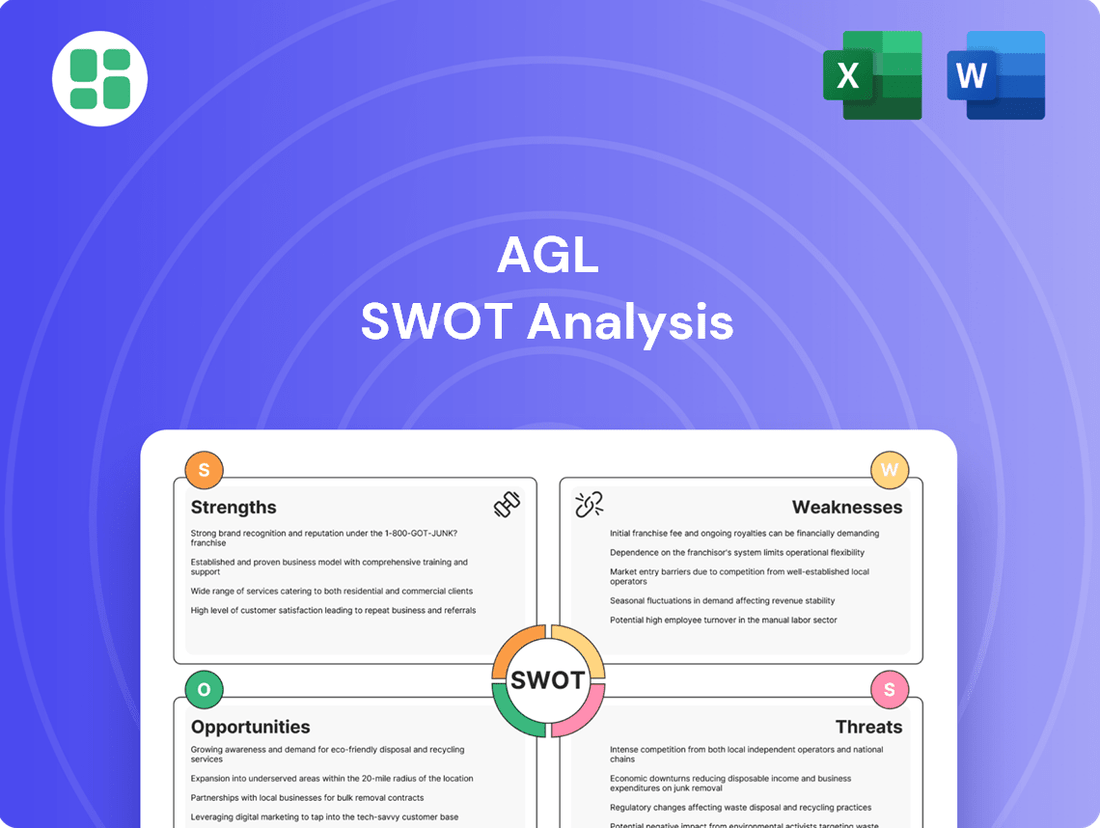

AGL SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGL Bundle

AGL's strengths lie in its established customer base and diverse energy portfolio, while its opportunities include the growing renewable energy market. However, the company faces challenges with aging infrastructure and increasing competition.

Want the full story behind AGL's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AGL Energy boasts a robust and varied energy generation mix, encompassing both traditional thermal power like coal and gas, alongside growing renewable sources such as hydro, wind, and solar. This diversity is crucial for ensuring a reliable and flexible power supply, especially as the energy landscape shifts.

The company's integrated model, spanning from energy generation right through to retail sales, is a significant strength. This allows AGL to effectively manage the volatility of energy prices and serve a wide array of customers across Australia, creating a stable operational base.

AGL's substantial portfolio of privately owned generation assets within the National Electricity Market (NEM) underpins its strong market standing. For instance, as of the fiscal year 2023, AGL operated approximately 7,000 MW of renewable energy capacity, highlighting its commitment to and scale in the clean energy sector.

AGL holds a commanding position as one of Australia's largest integrated energy providers, boasting a substantial customer base of approximately 4.5 million. This extensive reach extends across electricity, gas, and telecommunications, showcasing a diversified service portfolio that fosters strong market penetration.

The company's broad service offering, including the provision of Netflix services, contributes to enhanced customer relationships and loyalty, reflected in a churn rate that outperforms the broader market. This deep customer engagement solidifies AGL's competitive edge within the Australian energy sector.

AGL is making substantial investments to shift towards a cleaner energy future. This includes a strong focus on renewable energy sources and advanced storage technologies.

The company has set an ambitious target to add 12 gigawatts of new renewable generation and firming capacity by 2035. This commitment is backed by an expanded development pipeline for solar and battery storage projects, further bolstered by strategic acquisitions such as Firm Power and Terrain Solar.

This strategic pivot allows AGL to tap into the increasing market demand for clean energy solutions. It also ensures the company's operations are well-aligned with national objectives for reducing carbon emissions.

Improved Financial Performance and Operational Efficiency

AGL has demonstrated a strong financial recovery, with underlying net profit after tax reaching $1,031 million in FY24, a significant jump from the previous year. This improvement is largely attributed to better performance from its power stations and favorable electricity market conditions.

Operational efficiency has also seen a positive trend. AGL reported an improved fleet availability factor, indicating that its generation assets are more reliably online and producing power. This enhanced operational uptime is crucial for meeting demand and maximizing revenue.

The company's strategic investments, particularly in the Retail Transformation Program and Kaluza, are designed to yield further benefits. These initiatives are projected to lower operating expenses and elevate the customer experience, bolstering AGL's long-term financial stability and competitiveness.

- FY24 Underlying Net Profit: $1,031 million.

- Key Drivers: Improved power station performance and higher electricity prices.

- Operational Improvement: Higher fleet availability factor.

- Strategic Investment Focus: Retail Transformation Program and Kaluza for expense reduction and customer experience enhancement.

Strategic Flexibility and Adaptability

AGL demonstrates significant strategic flexibility by adapting its generation fleet to capitalize on higher electricity prices. This includes investments in its expanding battery storage portfolio, a key move in the evolving energy landscape. For instance, AGL's 2024 financial results highlighted a strong performance from its flexible generation assets, contributing to improved earnings.

The company's adaptability is further evidenced by its efforts to enhance the operational flexibility of its coal-fired power stations. This allows them to better manage the intermittency of renewable energy sources, a critical capability in the current market. This strategic maneuver is essential for navigating the inherent volatility and regulatory shifts within the Australian energy sector.

AGL's integrated business model, spanning generation to retail, provides significant operational control and market resilience. This approach, coupled with a substantial customer base of approximately 4.5 million across electricity, gas, and telecommunications, fosters deep market penetration and customer loyalty, as indicated by a churn rate outperforming the broader market.

The company possesses a diverse generation portfolio, including substantial renewable capacity of around 7,000 MW as of FY23, alongside traditional thermal power. This mix ensures energy supply reliability and flexibility, crucial for navigating the evolving energy market. AGL's commitment to a cleaner future is underscored by its target to add 12 GW of new renewable and firming capacity by 2035, supported by strategic acquisitions and an expanded development pipeline.

AGL has shown strong financial performance, with FY24 underlying net profit after tax reaching $1,031 million, driven by improved power station performance and favorable market conditions. Operational efficiencies are also up, with higher fleet availability factors, and strategic investments in the Retail Transformation Program and Kaluza are expected to further reduce costs and enhance customer experience, bolstering long-term competitiveness.

The company's strategic flexibility is evident in its ability to adapt its generation fleet to capitalize on market price movements, including investments in battery storage. AGL's FY24 results demonstrated strong earnings from flexible generation assets, and efforts to enhance the operational flexibility of its coal-fired power stations help manage renewable energy intermittency.

What is included in the product

Delivers a strategic overview of AGL’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies the complex process of analyzing AGL's internal strengths and weaknesses alongside external opportunities and threats, providing a clear roadmap for strategic improvement.

Weaknesses

AGL's significant reliance on coal-fired power generation, despite its transition plans, makes it Australia's largest emitter. This dependency exposes the company to heightened environmental scrutiny and regulatory risks, particularly as the nation pushes for decarbonization.

The company faces substantial financial and operational challenges in replacing the capacity from its planned coal plant closures, slated for the mid-2030s. This transition requires significant investment and strategic planning to ensure energy security and manage the costs associated with phasing out these assets.

AGL experienced a notable dip in its first-half underlying net profit for FY25. This downturn was largely attributed to squeezed consumer customer margins, a result of lower pricing and intense market competition.

The company also grappled with rising operational expenses. Inflationary pressures and increased costs associated with maintaining plant availability significantly impacted its bottom line, signaling persistent profitability hurdles even with revenue expansion.

AGL's commitment to its Retail Transformation Program, while strategically important, demands a considerable upfront financial outlay. This program is projected to cost around $300 million over a four-year period, impacting immediate cash flows.

Furthermore, AGL's aggressive decarbonization targets necessitate substantial capital investment in renewable energy sources and firming capacity. These large-scale expenditures, crucial for long-term sustainability, could place pressure on the company's near-term financial results and its ability to distribute dividends to shareholders.

Exposure to Wholesale Electricity Price Volatility

AGL's business model, while offering some insulation through its integrated operations, still faces significant exposure to the unpredictable swings in wholesale electricity prices. This volatility directly impacts profitability, especially when contract prices fall or when previously elevated wholesale prices return to more normal levels. For instance, AGL's 2024 financial results indicated a sensitivity to these market dynamics, with lower wholesale prices in certain periods affecting earnings. This inherent market unpredictability complicates the company's ability to forecast its financial performance with certainty, creating challenges for strategic planning and investor confidence.

The company's reliance on wholesale markets means that unforeseen events, such as extreme weather or changes in fuel supply, can cause sharp price increases or decreases. These fluctuations can erode margins, particularly if AGL has entered into long-term supply contracts at less favorable rates. The normalization of wholesale electricity prices following the energy market shocks of previous years has already presented a headwind, as seen in AGL's reported earnings for the first half of fiscal year 2024, where lower wholesale electricity prices contributed to a decline in profit from its wholesale business segment compared to the prior year's elevated levels.

- Wholesale Price Sensitivity: AGL's earnings are directly linked to the fluctuating wholesale electricity market, creating a degree of financial uncertainty.

- Impact of Price Normalization: The return of wholesale prices to pre-crisis levels has negatively affected AGL's profitability in its wholesale segment, as evidenced in H1 FY24 results.

- Forecasting Challenges: Market unpredictability makes it difficult for AGL to accurately forecast future earnings, potentially impacting investment decisions and strategic resource allocation.

- Contractual Risks: Existing contracts may not always align with current market prices, leading to potential margin compression if AGL is locked into less advantageous rates.

Potential for Slower Revenue Growth Forecasts

Analyst forecasts for AGL indicate a potential slowdown in revenue expansion. Projections suggest a decline in revenue over the next three years, even as earnings are expected to grow. This divergence points to possible headwinds in increasing the company's top line, perhaps due to a maturing retail market or significant competitive pressures.

This anticipated slower revenue growth could impact AGL's capacity to finance future strategic initiatives and grow its market presence. For instance, if revenue fails to keep pace with cost increases or debt servicing, it could strain financial flexibility.

- Revenue Projections: Analyst consensus for AGL's revenue shows a projected decline from approximately AUD 12.5 billion in FY2024 to around AUD 11.8 billion by FY2027.

- Earnings vs. Revenue: Despite the revenue dip, earnings per share (EPS) are forecast to see modest growth, driven by cost efficiencies and strategic restructuring.

- Market Dynamics: Factors like intense competition in the energy retail sector and the ongoing transition away from legacy energy assets could contribute to this revenue pressure.

AGL's significant reliance on coal-fired power generation, despite its transition plans, makes it Australia's largest emitter. This dependency exposes the company to heightened environmental scrutiny and regulatory risks, particularly as the nation pushes for decarbonization.

The company faces substantial financial and operational challenges in replacing the capacity from its planned coal plant closures, slated for the mid-2030s. This transition requires significant investment and strategic planning to ensure energy security and manage the costs associated with phasing out these assets.

AGL experienced a notable dip in its first-half underlying net profit for FY25. This downturn was largely attributed to squeezed consumer customer margins, a result of lower pricing and intense market competition.

The company also grappled with rising operational expenses. Inflationary pressures and increased costs associated with maintaining plant availability significantly impacted its bottom line, signaling persistent profitability hurdles even with revenue expansion.

AGL's commitment to its Retail Transformation Program, while strategically important, demands a considerable upfront financial outlay. This program is projected to cost around $300 million over a four-year period, impacting immediate cash flows.

Furthermore, AGL's aggressive decarbonization targets necessitate substantial capital investment in renewable energy sources and firming capacity. These large-scale expenditures, crucial for long-term sustainability, could place pressure on the company's near-term financial results and its ability to distribute dividends to shareholders.

AGL's business model, while offering some insulation through its integrated operations, still faces significant exposure to the unpredictable swings in wholesale electricity prices. This volatility directly impacts profitability, especially when contract prices fall or when previously elevated wholesale prices return to more normal levels. For instance, AGL's 2024 financial results indicated a sensitivity to these market dynamics, with lower wholesale prices in certain periods affecting earnings. This inherent market unpredictability complicates the company's ability to forecast its financial performance with certainty, creating challenges for strategic planning and investor confidence.

The company's reliance on wholesale markets means that unforeseen events, such as extreme weather or changes in fuel supply, can cause sharp price increases or decreases. These fluctuations can erode margins, particularly if AGL has entered into long-term supply contracts at less favorable rates. The normalization of wholesale electricity prices following the energy market shocks of previous years has already presented a headwind, as seen in AGL's reported earnings for the first half of fiscal year 2024, where lower wholesale electricity prices contributed to a decline in profit from its wholesale business segment compared to the prior year's elevated levels.

- Wholesale Price Sensitivity: AGL's earnings are directly linked to the fluctuating wholesale electricity market, creating a degree of financial uncertainty.

- Impact of Price Normalization: The return of wholesale prices to pre-crisis levels has negatively affected AGL's profitability in its wholesale segment, as evidenced in H1 FY24 results.

- Forecasting Challenges: Market unpredictability makes it difficult for AGL to accurately forecast future earnings, potentially impacting investment decisions and strategic resource allocation.

- Contractual Risks: Existing contracts may not always align with current market prices, leading to potential margin compression if AGL is locked into less advantageous rates.

Analyst forecasts for AGL indicate a potential slowdown in revenue expansion. Projections suggest a decline in revenue over the next three years, even as earnings are expected to grow. This divergence points to possible headwinds in increasing the company's top line, perhaps due to a maturing retail market or significant competitive pressures.

This anticipated slower revenue growth could impact AGL's capacity to finance future strategic initiatives and grow its market presence. For instance, if revenue fails to keep pace with cost increases or debt servicing, it could strain financial flexibility.

- Revenue Projections: Analyst consensus for AGL's revenue shows a projected decline from approximately AUD 12.5 billion in FY2024 to around AUD 11.8 billion by FY2027.

- Earnings vs. Revenue: Despite the revenue dip, earnings per share (EPS) are forecast to see modest growth, driven by cost efficiencies and strategic restructuring.

- Market Dynamics: Factors like intense competition in the energy retail sector and the ongoing transition away from legacy energy assets could contribute to this revenue pressure.

AGL faces significant operational risks tied to the aging infrastructure of its thermal power stations. Maintaining the reliability and availability of these assets, particularly as they approach the end of their operational life, requires substantial ongoing investment and can lead to unexpected outages or increased maintenance costs. For example, the company has previously reported unplanned outages impacting generation output.

The company's substantial debt levels, exacerbated by significant capital expenditure requirements for its energy transition, present a financial weakness. High leverage can limit financial flexibility, increase borrowing costs, and make the company more vulnerable to interest rate fluctuations or economic downturns. AGL's net debt stood at approximately $2.9 billion as of December 31, 2023, highlighting this concern.

The ongoing transition to renewable energy sources requires significant capital investment and introduces new operational complexities. Integrating intermittent renewable generation with firming capacity and grid stability solutions is a substantial undertaking that carries execution risk and may not always deliver the expected cost efficiencies or reliability.

AGL's customer base, while large, is subject to increasing competition and evolving consumer preferences. The company must continually invest in customer service and product innovation to retain market share and combat churn, especially in a market where new energy providers and technologies are emerging.

Same Document Delivered

AGL SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, ensuring you get the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights.

Opportunities

AGL is well-positioned to capitalize on the expanding renewable energy and battery storage market. The company's robust development pipeline includes significant wind, solar, and battery energy storage projects, a key opportunity for growth.

Specifically, AGL is targeting 1.4 GW of new battery capacity for final investment decisions in FY25/26. This strategic expansion directly supports national decarbonization targets and addresses the increasing market demand for reliable, clean energy solutions.

By investing in these sustainable alternatives, AGL can effectively replace its aging coal-fired generation assets, enhancing its long-term viability and market competitiveness in the evolving energy landscape.

AGL is well-positioned to capitalize on the growing demand for comprehensive energy solutions. Beyond its traditional electricity and gas offerings, the company can significantly expand into areas like energy storage, electric vehicle charging infrastructure, and advanced energy management services. This diversification aligns with shifting consumer and business needs in the energy sector.

The company's strategic focus on assisting commercial and industrial clients with electrification and decarbonization efforts, including capital commitments to Energy-as-a-Service (EaaS) portfolios, is a key growth driver. For instance, AGL's investment in EaaS projects aims to provide integrated energy solutions, fostering new revenue streams and strengthening customer relationships. This proactive approach to evolving market demands is crucial for sustained growth.

AGL's investment in Kaluza's digital platform, a core component of its Retail Transformation Program, offers a significant opportunity to revamp customer interactions. By digitizing processes and integrating AI, AGL can streamline billing, making it more transparent and user-friendly, which is a key driver of customer satisfaction in the current market.

This technological push is expected to yield substantial operational efficiencies. For instance, the ongoing Retail Transformation Program aims for significant cost reductions through automation, with a target of achieving over $100 million in annual savings by FY2025, directly impacting AGL's bottom line and freeing up resources for further innovation.

Furthermore, the enhanced digital capabilities will enable AGL to more effectively launch and manage innovative energy products and services. This agility in product development and delivery is crucial for retaining customers and attracting new ones in a competitive energy landscape, potentially boosting market share.

Capitalizing on Increased Electricity Demand from Electrification

The electrification trend is set to dramatically reshape the energy landscape, with projections indicating the National Electricity Market (NEM) demand could nearly double by 2050. This surge is primarily fueled by the widespread adoption of electric vehicles, the electrification of household appliances, and the transition of industrial processes to electric power. AGL is strategically positioned to benefit from this significant demand increase.

AGL can capitalize on this by not only supplying the increased electricity but also by actively managing and orchestrating flexible loads. For instance, utilizing the batteries of electric vehicles as distributed energy resources can help balance the grid and optimize AGL's generation portfolio. This approach supports sustainable revenue streams and facilitates the rollout of innovative energy solutions.

- Projected NEM demand doubling by 2050 due to electrification of transport, homes, and industry.

- AGL's strategic advantage in leveraging this increased demand and managing flexible loads like EV batteries.

- Opportunity for long-term revenue growth and the deployment of new energy technologies and services.

Strategic Acquisitions and Partnerships for Portfolio Enhancement

AGL's recent strategic moves, like acquiring Firm Power and Terrain Solar, are a clear signal of its intent to bolster its renewable energy assets. These acquisitions bring a substantial pipeline of solar and battery projects, directly contributing to AGL's transition goals.

By continuing to pursue strategic partnerships and acquisitions, AGL can significantly speed up its energy transition. This approach not only enhances its technological capabilities but also solidifies its leadership in the dynamic energy market.

- Acquisition of Firm Power and Terrain Solar: Significantly expands AGL's renewable project pipeline.

- Accelerated Energy Transition: Strategic growth enhances AGL's ability to meet renewable energy targets.

- Technological Advancement: Partnerships and acquisitions can introduce new technologies and expertise.

- Market Leadership: Proactive portfolio enhancement secures AGL's competitive position.

AGL's commitment to expanding its renewable energy portfolio, including significant battery storage projects, positions it to benefit from Australia's decarbonization efforts. The company's development pipeline, targeting 1.4 GW of new battery capacity for final investment decisions in FY25/26, directly addresses the growing demand for clean energy solutions and supports national climate goals.

Furthermore, AGL's strategic focus on providing integrated energy solutions, such as Energy-as-a-Service (EaaS) for commercial and industrial clients, opens up substantial new revenue streams. The company's investment in digital transformation, exemplified by the Kaluza platform, promises to enhance customer experience and drive operational efficiencies, with a target of over $100 million in annual savings by FY2025.

The accelerating trend of electrification, projected to nearly double National Electricity Market demand by 2050, presents a significant opportunity for AGL. By supplying this increased electricity and managing flexible loads like electric vehicle batteries, AGL can solidify its market position and foster sustainable growth.

AGL's recent acquisitions, such as Firm Power and Terrain Solar, are strategically expanding its renewable project pipeline and accelerating its energy transition. These moves enhance its technological capabilities and reinforce its leadership in the evolving energy market.

| Opportunity Area | Key Initiatives/Projects | Projected Impact/Benefit | Relevant Data/Targets |

|---|---|---|---|

| Renewable Energy & Storage Expansion | Development pipeline for wind, solar, and battery projects | Capitalize on growing clean energy demand, replace aging assets | Targeting 1.4 GW new battery capacity for FID in FY25/26 |

| Integrated Energy Solutions | Energy-as-a-Service (EaaS) for C&I clients | New revenue streams, enhanced customer relationships | Capital commitments to EaaS portfolios |

| Digital Transformation | Kaluza platform integration, Retail Transformation Program | Improved customer experience, operational efficiencies, cost savings | Targeting >$100 million annual savings by FY2025 |

| Electrification Trend | Supplying increased electricity demand, managing flexible loads | Benefit from doubling NEM demand by 2050, optimize portfolio | NEM demand projected to nearly double by 2050 |

| Strategic Acquisitions | Acquisition of Firm Power and Terrain Solar | Expand renewable project pipeline, accelerate energy transition | Adds substantial solar and battery project pipeline |

Threats

AGL is navigating an increasingly competitive energy market, which is squeezing customer margins and driving down prices. This intense rivalry means customers have abundant choices, making them highly sensitive to cost, which directly impacts AGL's ability to maintain profitable pricing strategies and market share.

The pressure to offer affordable energy solutions while simultaneously ensuring financial viability presents a persistent challenge for AGL. For instance, in the fiscal year 2023, the Australian energy market saw significant volatility, with wholesale electricity prices fluctuating, forcing retailers like AGL to absorb some of these costs to remain competitive, thereby compressing their own margins.

Changes in Australian government energy policy and evolving regulatory interventions present a significant threat to AGL's financial performance and long-term strategic direction. For instance, ongoing discussions and potential implementation of policies aimed at ensuring utility bill affordability could directly impact AGL's revenue streams.

Furthermore, government initiatives to subsidize new renewable energy supply, while promoting decarbonisation, may exert downward pressure on wholesale electricity prices. This could erode AGL's earnings, particularly in its generation and retail segments. The Australian Energy Regulator (AER) continues to monitor wholesale market dynamics, and any new price caps or interventions would directly affect AGL's profitability.

An unpredictable regulatory landscape creates substantial uncertainty for AGL's investment decisions, especially concerning major capital projects in the energy transition. For example, the timeline and nature of future emissions reduction targets or carbon pricing mechanisms remain subject to policy shifts, impacting the viability of existing and future assets.

AGL faces significant hurdles in phasing out its coal assets, a process accelerated to meet decarbonization targets. Ensuring the grid remains stable during this transition is paramount, as is managing the substantial financial impact of retiring these aging power stations.

Replacing the lost baseload power from coal with renewable sources and reliable firming capacity requires careful, cost-effective planning and execution. For instance, AGL's Loy Yang A power station, a major coal asset, is slated for closure in 2045, but the interim period demands robust solutions to maintain energy security.

Delays or technical setbacks in bringing new renewable projects online could lead to critical energy supply gaps. This risk is amplified by the sheer scale of capacity needing replacement, impacting both AGL's operational continuity and Australia's broader energy market.

Inflationary Pressures and Rising Operating Costs

AGL is feeling the pinch from rising inflation, which is driving up its operating costs. This is particularly evident in the expenses needed to keep its thermal power plants running smoothly. For instance, in the fiscal year ending June 30, 2024, AGL reported that its underlying operating costs saw a notable increase, partly attributed to these inflationary pressures and the necessary maintenance of its thermal fleet.

A significant factor contributing to these higher expenses is the escalating cost of fuel, especially coal and natural gas. These price hikes directly impact AGL's operational expenditure. Looking at the 2024 financial results, the company highlighted that volatile energy markets and increased commodity prices, including fuels, put pressure on its cost base.

These increased costs pose a direct threat to AGL's profit margins. If the company cannot offset these rising expenses through improved efficiency or by passing costs onto consumers via price adjustments, its profitability could be negatively affected. For example, in early 2025, analysts noted that the lag in passing on higher fuel costs could temporarily squeeze margins for energy providers like AGL.

- Increased Maintenance Costs: Higher inflation directly inflates the cost of spare parts, labor, and specialized services required for thermal generation asset upkeep.

- Fuel Price Volatility: Fluctuations in global coal and gas markets, exacerbated by geopolitical events in 2024 and early 2025, have led to unpredictable and often higher fuel procurement expenses for AGL.

- Margin Erosion: Without commensurate price increases or significant operational efficiencies, the gap between revenue and escalating operating costs can shrink profit margins, impacting financial performance.

Environmental, Social, and Governance (ESG) Scrutiny

AGL, as Australia's largest carbon emitter, faces significant Environmental, Social, and Governance (ESG) scrutiny. Investors and the public are pressuring the company to speed up its transition away from fossil fuels. For instance, in the 2023 financial year, AGL's Scope 1 emissions were reported at 14.5 million tonnes of CO2 equivalent, highlighting the scale of the challenge.

Failure to meet its decarbonization goals, such as achieving net zero by 2040, or experiencing major environmental issues could severely damage AGL's reputation. This could also result in harsher regulatory penalties and lead ESG-focused investors, who represent a growing portion of the market, to divest their holdings. The company's social license to operate and its ability to secure future capital are directly impacted by this ongoing scrutiny.

- Reputational Risk: Negative perception due to emissions output and transition pace.

- Investor Divestment: Loss of capital from ESG-focused funds if targets are missed.

- Regulatory Penalties: Increased fines for non-compliance with environmental standards.

- Social License: Erosion of public trust and community support for operations.

Intensifying competition in the Australian energy market, characterized by customer price sensitivity and abundant choices, continues to pressure AGL's margins and pricing strategies.

The Australian energy market saw significant volatility in FY23, with wholesale price fluctuations forcing retailers like AGL to absorb costs, compressing their own margins.

Navigating evolving government energy policies and potential interventions aimed at ensuring bill affordability poses a direct threat to AGL's revenue streams and strategic direction.

The ongoing transition away from coal-fired power generation presents significant operational and financial challenges, including the need for stable grid replacement capacity and the management of asset retirement costs.

| Threat Category | Specific Factor | Impact on AGL | Supporting Data/Context |

| Market Competition | Price Sensitivity & Choice | Margin compression, difficulty in maintaining profitable pricing. | Australian energy market volatility in FY23 impacted retailer margins. |

| Regulatory & Policy | Policy Changes & Interventions | Uncertainty in investment, potential revenue impact from affordability measures. | Ongoing discussions on utility bill affordability could affect revenue streams. |

| Operational Transition | Coal Asset Retirement | Need for stable baseload replacement, financial impact of closures. | Loy Yang A closure by 2045 requires robust interim solutions. |

| Cost Pressures | Inflation & Fuel Costs | Increased operating expenses, potential margin erosion. | FY24 underlying operating costs increased due to inflation and thermal fleet maintenance. Fuel price volatility in 2024-2025 directly impacts procurement expenses. |

| ESG Scrutiny | Decarbonization Pressure | Reputational risk, potential investor divestment, regulatory penalties. | AGL's Scope 1 emissions were 14.5 million tonnes CO2e in FY23; net zero by 2040 target faces ongoing scrutiny. |

SWOT Analysis Data Sources

This analysis is built on a robust foundation of AGL's official financial statements, comprehensive market research reports, and insights from industry experts to provide a thorough and accurate SWOT assessment.