AGL Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGL Bundle

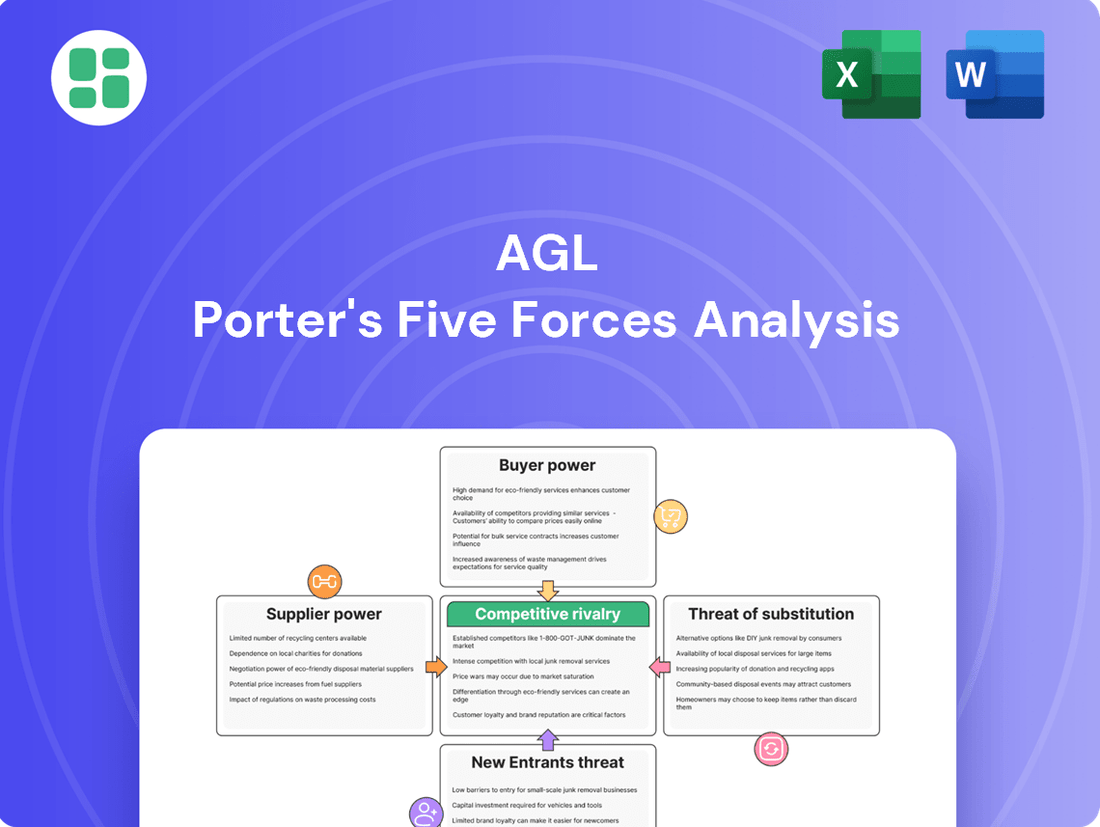

AGL's competitive landscape is shaped by the intense rivalry among existing players and the significant threat of substitute energy sources. Understanding these forces is crucial for navigating the dynamic Australian energy market.

The complete report reveals the real forces shaping AGL’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AGL's reliance on a concentrated supply of fossil fuels, especially coal and gas, for a substantial part of its electricity generation grants these suppliers significant leverage. For instance, in the 2023 financial year, coal and gas still accounted for a considerable portion of AGL's energy mix, underscoring the ongoing dependence.

While the energy transition is underway, the immediate criticality of coal and gas for base-load power and grid stability means suppliers retain considerable bargaining power. This dependence is a key factor in AGL's operational costs and strategic planning, even as renewable sources grow.

Switching away from AGL's established coal and gas supply contracts, or retooling its massive thermal generation plants for different fuels, comes with enormous financial and operational hurdles. These significant switching costs effectively bolster the leverage held by current suppliers of traditional energy resources.

This dynamic is especially pertinent for AGL as it navigates the planned retirement of its coal-fired power stations, a process slated to conclude by the mid-2030s. The expense and complexity involved in finding and integrating new energy sources are considerable.

AGL's ongoing transition to renewable energy sources means that for its current thermal generation assets, suppliers of coal and gas face limited direct substitutes from AGL's perspective in the near to medium term. This reliance grants these fuel suppliers significant leverage.

The global energy market's inherent volatility directly impacts the cost and availability of essential fuels like coal and gas. For instance, in early 2024, fluctuations in international gas prices, driven by geopolitical events and supply chain disruptions, directly translated to higher input costs for AGL's thermal power plants, underscoring the suppliers' increased bargaining power.

Threat of Forward Integration by Suppliers

The threat of forward integration by AGL's primary fuel suppliers, such as coal and gas producers, is generally low in Australia. This is due to the substantial capital investment and complex regulatory approvals required to enter large-scale electricity generation or retail operations. For instance, establishing a new power plant involves billions of dollars in upfront costs and navigating extensive environmental and energy market regulations overseen by bodies like the Clean Energy Regulator and the Australian Energy Regulator.

While direct forward integration by fuel suppliers into electricity generation is uncommon, some large, diversified energy companies may hold interests across various parts of the energy value chain. This can create indirect influences on supplier power, as these entities might have existing generation assets that compete with or complement their own fuel supply operations. Such integrated players can leverage their positions to negotiate more favorable terms, impacting the overall supplier landscape.

The Australian energy market, particularly for electricity generation, is characterized by significant barriers to entry. These include the need for substantial infrastructure development, long-term power purchase agreements, and adherence to strict safety and environmental standards. These factors collectively reduce the likelihood of new or existing fuel suppliers easily entering the generation or retail space to compete directly with established players like AGL.

- Low Likelihood of Direct Integration: Coal and gas suppliers face high capital and regulatory barriers to entering Australia's electricity generation and retail markets.

- Indirect Influence: Diversified energy companies with stakes across the supply chain can exert indirect pressure on supplier dynamics.

- Regulatory Oversight: The Clean Energy Regulator and Australian Energy Regulator maintain oversight, influencing market entry and operational compliance.

- Capital Intensity: The substantial financial commitment required for power generation infrastructure deters many fuel suppliers from integrating forward.

Uniqueness of Supplier Offerings

While primary energy sources like coal and natural gas are often seen as commodities, AGL's reliance on specific quality and reliable logistics for its massive power generation facilities grants a degree of leverage to its suppliers. Long-term supply contracts for these essential inputs can solidify supplier power.

Suppliers of specialized equipment for AGL's expanding renewable energy portfolio, such as wind turbines or advanced battery storage systems, possess significant bargaining power. This stems from their proprietary technology, unique manufacturing processes, and the specialized expertise required to maintain and operate these complex assets.

- Commoditized vs. Specialized Inputs: While bulk fuels are largely undifferentiated, the technical specifications and delivery reliability for AGL's power plants create distinct supplier needs.

- Technological Dependence: Suppliers of cutting-edge renewable technology hold sway due to the unique nature of their innovations and the critical role they play in AGL's energy transition.

- Contractual Lock-in: Long-term supply agreements for essential fuels or specialized equipment can reduce AGL's flexibility, thereby strengthening the supplier's position.

AGL's significant reliance on coal and gas for a substantial portion of its electricity generation, even as it transitions, grants its fuel suppliers considerable leverage. For instance, in the 2023 financial year, these fossil fuels remained critical for base-load power, meaning suppliers of these essential commodities held sway over pricing and availability.

The high switching costs associated with AGL's thermal power plants, which are designed for specific fuels and require extensive modifications to adapt, further solidify the bargaining power of existing coal and gas suppliers. This dependence is a key factor in AGL's operational expenses and strategic planning as it navigates its planned retirement of coal-fired stations by the mid-2030s.

While AGL is expanding its renewable energy portfolio, suppliers of specialized equipment like wind turbines and battery storage systems also wield significant power due to proprietary technology and unique expertise. This is particularly true given the complexity and specialized nature of maintaining these advanced assets, impacting AGL's transition costs.

| Input Type | AGL Dependence (Approx. FY23) | Supplier Bargaining Power Factors | Example Impact |

|---|---|---|---|

| Coal & Gas | Significant portion of generation mix | Critical for base-load power, high switching costs for thermal plants, long-term contracts | Price volatility in early 2024 directly increased input costs due to global market fluctuations. |

| Renewable Technology (e.g., Turbines, Batteries) | Growing reliance for new capacity | Proprietary technology, specialized manufacturing, essential expertise for maintenance | Limited supplier options for cutting-edge tech can lead to higher procurement costs. |

What is included in the product

Analyzes the five competitive forces impacting AGL's industry, revealing the intensity of rivalry, bargaining power of suppliers and buyers, threat of new entrants, and the impact of substitutes.

Identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

AGL's customer base is extensive, encompassing approximately 4.5 million services across residential, small business, and large industrial segments as of December 2024. While individual customers hold minimal sway, the sheer volume and collective demand from this broad group, particularly major industrial clients, can exert significant pressure on AGL's pricing and service offerings.

Customer switching costs for electricity and gas in Australia are notably low for residential and small business segments. Digital platforms and comparison websites have streamlined the process, making it easier for consumers to change providers. This ease of switching is reflected in annual switching rates, which have been observed to be around 15-20% in recent years, demonstrating a significant level of customer mobility.

These low switching costs directly enhance the bargaining power of customers. When it's simple and inexpensive to move to a competitor, customers can more readily demand better pricing, improved service, or more attractive product offerings. This situation puts pressure on companies like AGL to remain competitive and responsive to customer needs to retain their market share.

Australian energy consumers, especially households, are highly sensitive to price changes. This is driven by recent increases in electricity and gas costs, alongside general economic pressures. For instance, in 2023, the Australian Energy Regulator announced the Default Market Offer (DMO) for residential customers in New South Wales, Victoria, and South Australia, setting a benchmark price that directly influences consumer perception of AGL's pricing.

Government interventions like rebates and the DMO further amplify customer price sensitivity. These measures are designed to shield consumers from extreme price hikes, making them more attentive to any deviations from these regulated or subsidized price points. This heightened awareness means AGL must carefully consider its pricing strategies to remain competitive and avoid alienating a price-conscious customer base.

Availability of Substitute Products for Customers

Customers increasingly have access to substitute energy products, significantly impacting AGL's bargaining power. Rooftop solar photovoltaic (PV) systems and home battery storage are becoming more prevalent, allowing consumers to generate and store their own electricity, thereby reducing their dependence on grid-supplied power from AGL.

The proliferation of decentralized energy resources, including solar and battery systems, coupled with the growing adoption of electric vehicles (EVs), further empowers customers. This expansion of choices means consumers are less tied to traditional energy providers like AGL, giving them greater leverage in negotiations and service expectations.

- Growing Solar Adoption: In Australia, residential solar PV capacity reached approximately 18.2 GW by the end of 2023, a substantial increase that directly offers an alternative to grid electricity.

- Battery Storage Integration: Battery storage systems are increasingly being paired with solar PV, enhancing their utility and further reducing reliance on AGL's grid services.

- EV Impact: The increasing uptake of electric vehicles, with sales in Australia exceeding 87,000 in 2023, represents a shift towards electrification that could influence future energy demand patterns and customer choices away from traditional gas and electricity plans.

Customer Information and Transparency

Customer information and transparency significantly bolster their bargaining power in the energy sector. Regulatory bodies like the Australian Energy Regulator (AER) have been instrumental in driving this transparency. For instance, the AER's initiatives aim to make energy pricing and product offerings clearer, enabling consumers to compare options more effectively.

Online comparison tools further amplify this effect, allowing customers to readily identify the most competitive deals. This increased visibility directly challenges energy providers like AGL to offer more attractive terms and competitive pricing to retain their customer base.

AGL's own digital engagement strategies also play a crucial role. By providing platforms for customers to voice concerns and share feedback, AGL inadvertently strengthens customer collective bargaining power.

- Increased Transparency: Regulatory efforts and online tools empower customers with detailed information on energy pricing and services.

- Informed Decision-Making: Customers can now easily compare offers, leading to greater pressure on providers for better value.

- Digital Amplification: AGL's digital platforms allow customers to voice opinions, consolidating their influence.

The bargaining power of customers for AGL is substantial, driven by low switching costs and high price sensitivity, particularly among residential and small business segments. As of December 2024, AGL serves about 4.5 million services, and while individual customers have limited power, the collective demand, especially from large industrial clients, can influence pricing. The ease with which customers can switch providers, with annual rates around 15-20%, further empowers them to seek better deals, creating constant pressure on AGL to remain competitive.

| Factor | Impact on AGL | Supporting Data (as of late 2023/early 2024) |

|---|---|---|

| Switching Costs | High (Low for customers) | Annual switching rates around 15-20% indicate ease of movement. |

| Price Sensitivity | High | Government interventions like the Default Market Offer (DMO) set price benchmarks. |

| Availability of Substitutes | Significant | Residential solar PV capacity reached ~18.2 GW by end of 2023. |

| Information Transparency | High | Regulatory bodies and online tools enhance customer understanding of pricing. |

Same Document Delivered

AGL Porter's Five Forces Analysis

This preview showcases the complete AGL Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the energy sector. The document you are viewing is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

The Australian energy sector is a battleground, with AGL facing stiff competition from giants like Origin Energy and EnergyAustralia. These established players, alongside a rising tide of smaller energy retailers and renewable developers, are all vying for market share. This diverse group offers a wide spectrum of energy solutions, from traditional fossil fuel-based generation to a growing emphasis on renewable energy sources.

In 2023, the Australian energy market saw significant activity. For instance, Origin Energy reported a statutory profit after tax of AUD 397 million for the fiscal year ending June 30, 2023, demonstrating the scale of operations for major competitors. AGL itself has been actively managing its portfolio, with its integrated energy business aiming to leverage its diverse generation and retail capabilities in this highly competitive landscape.

The Australian retail energy market is largely mature, characterized by relatively flat retail electricity consumption. This maturity means that intense competition for market share is a constant factor among established players.

While the overall energy sector sees growth driven by the transition to renewables and new energy services, the traditional retail electricity segment faces limited expansion. For instance, in the fiscal year 2023, Australian household electricity consumption remained largely stable, highlighting the competitive pressure on retailers to retain and attract customers.

While the core electricity and gas markets are largely seen as commodities, AGL, like many energy providers, strives to stand out. They achieve this through bundled services, often combining energy with telecommunications or entertainment subscriptions like Netflix. Excellent customer service and a strong push towards renewable energy commitments are also key differentiators. For instance, AGL's renewable energy portfolio is a significant aspect of its brand identity.

However, the effectiveness of these differentiation strategies is often hampered by low customer switching costs. Consumers can readily move between energy providers, making it difficult for companies like AGL to retain customers based solely on these differentiating factors. This dynamic means that even innovative bundled offerings may not create lasting loyalty in the competitive Australian energy market.

Exit Barriers

AGL's exit barriers are substantial, primarily due to the immense capital tied up in its generation assets. Think about the sheer cost of building and maintaining power plants, especially the older, long-life thermal ones. This makes it incredibly difficult and expensive to simply walk away from these investments.

Adding to this challenge is the significant infrastructure required for AGL's retail operations. The networks, customer service systems, and distribution channels all represent considerable investments that are not easily divested. This integrated nature means exiting one part of the business can have ripple effects on others.

Furthermore, the process of decommissioning large power stations presents its own set of costly hurdles. Environmental regulations and safety protocols mean that shutting down and dismantling these facilities involves significant expenditure, further cementing the high exit barriers for companies like AGL.

- High Capital Investment: AGL's generation fleet, including thermal plants, represents billions in capital expenditure. For instance, the Liddell Power Station, which AGL is in the process of decommissioning, was a significant asset.

- Infrastructure Costs: The extensive retail network, including customer service centers and IT systems, adds another layer of sunk costs that are difficult to recover.

- Decommissioning Expenses: The costs associated with safely and environmentally responsibly closing down power stations can run into hundreds of millions of dollars, as seen with ongoing decommissioning projects in the energy sector.

Strategic Stakes and Aggressiveness of Competitors

Competitors in the energy sector are engaged in a fierce battle for market share, evidenced by substantial investments in the energy transition. This includes significant outlays on new generation capacity and the development of customer-focused solutions, reflecting a strategic imperative to adapt to decarbonisation goals and changing consumer demands.

This aggressive pursuit of market position intensifies rivalry and spurs innovation across the industry. For instance, in 2024, major energy companies globally announced billions of dollars in investments aimed at expanding renewable energy portfolios and upgrading grid infrastructure to support cleaner energy sources.

- Aggressive Market Share Pursuit: Companies are actively seeking to capture a larger portion of the evolving energy market.

- Investment in Energy Transition: Significant capital is being deployed into renewable energy generation, storage, and grid modernization.

- Customer-Centric Solutions: Focus is shifting towards services and products that cater to individual consumer preferences and energy needs.

- Decarbonisation Drive: Environmental targets are a primary motivator for strategic investments and operational changes, fueling competitive pressures.

The competitive rivalry within Australia's energy sector is intense, with established players like Origin Energy and EnergyAustralia actively competing with AGL. This rivalry is fueled by a mature retail market where customer acquisition and retention are paramount, leading to aggressive strategies. For example, in 2023, Origin Energy reported a statutory profit after tax of AUD 397 million, showcasing the scale of operations and the financial muscle of key competitors in this battle for market share.

The drive for market dominance is evident in the substantial investments companies are making in the energy transition, including billions allocated globally in 2024 towards renewables and grid upgrades. This strategic investment aims to secure future market positions and meet decarbonisation goals, further intensifying the competition for AGL and its rivals.

SSubstitutes Threaten

The threat of substitutes for traditional energy providers, like AGL, is substantial. Rooftop solar photovoltaic (PV) systems have seen a dramatic rise in adoption, surpassing 4 million installations in Australia by 2024 and now contributing over 12% of the nation's electricity generation. This widespread availability of self-generated power directly reduces demand for grid-supplied electricity.

Furthermore, the increasing viability of battery storage solutions empowers consumers to store excess solar energy and reduce their reliance on grid electricity, even during peak demand periods. This dual approach of solar generation and storage significantly diminishes the need for conventional energy sources.

The declining cost of renewable energy technologies, particularly solar and wind, significantly increases the threat of substitutes for traditional grid-supplied electricity. For instance, in 2024, the levelized cost of electricity (LCOE) for utility-scale solar PV continued to fall, with some projects achieving costs below 3 cents per kilowatt-hour, making it highly competitive with conventional power sources, especially when considering the impact of federal tax credits.

While the upfront investment for rooftop solar or battery storage can be substantial, the long-term savings on electricity bills, coupled with growing environmental consciousness and government incentives like the Investment Tax Credit (ITC) which offers up to 30% for solar installations, make these alternatives increasingly attractive. This shift is evident in the growing adoption rates of distributed generation, with residential solar installations in the US seeing robust growth throughout 2024.

Customer propensity to adopt substitutes like rooftop solar and batteries is notably high. This is fueled by growing environmental awareness, a strong desire for energy independence, and the appeal of potential cost savings, especially as electricity prices continue to climb. For instance, in 2023, Australia saw a significant surge in rooftop solar installations, with over 300,000 new systems added, reflecting this strong customer demand for alternatives.

Technological Advancements in Substitutes

Technological advancements are significantly enhancing the viability of substitutes for traditional energy sources. Innovations in solar panel efficiency, for example, have seen costs drop dramatically; by early 2024, the global average cost of electricity from utility-scale solar PV had fallen to approximately $35 per megawatt-hour, a substantial decrease from previous years. This makes solar power a more competitive alternative, directly impacting companies reliant on conventional energy generation.

Furthermore, the rapid development in battery storage technology is addressing the intermittency issues often associated with renewables. By mid-2024, battery energy storage system (BESS) costs were projected to continue their decline, making grid-scale storage solutions more economically feasible. This improved storage capability strengthens the threat posed by renewable energy substitutes by ensuring a more reliable and consistent power supply.

- Falling Solar PV Costs: Global average cost of utility-scale solar PV electricity around $35/MWh in early 2024.

- Advancements in Battery Storage: Continued cost reductions in BESS making storage solutions more accessible.

- Smart Home and EV Integration: These technologies enable greater energy independence and reduce reliance on traditional utilities.

- Improved Energy Efficiency: Innovations in building materials and smart grid management further decrease overall energy demand from conventional sources.

Regulatory and Policy Support for Substitutes

Government incentives and policies play a crucial role in amplifying the threat of substitutes, particularly in the energy sector. For instance, the Australian government's commitment to a national energy transition agenda actively encourages investment and adoption of renewable energy sources. This support directly strengthens the viability and attractiveness of substitutes for traditional energy providers.

Specific schemes, such as the Small-scale Technology Certificates (STCs) under the Renewable Energy Target, provide financial incentives that reduce the upfront cost of solar power systems. Similarly, state-based battery programs, like those seen in Victoria and South Australia, further lower the barrier to entry for energy storage solutions, making them more competitive alternatives.

- Government incentives like Small-scale Technology Certificates (STCs) directly reduce the cost of renewable energy adoption.

- State-based battery programs make energy storage solutions more accessible and appealing.

- National energy transition agendas signal a long-term commitment to alternatives, encouraging market shifts.

- These policies collectively enhance the competitiveness and threat posed by substitute energy sources.

The threat of substitutes for traditional energy providers like AGL is significantly amplified by the falling costs and improving efficiency of renewable energy technologies. By early 2024, the global average cost of electricity from utility-scale solar PV had dropped to approximately $35 per megawatt-hour, making it a highly competitive alternative to conventional power sources. This trend is further bolstered by advancements in battery storage, which address the intermittency of renewables and enhance their reliability.

| Substitute Technology | Key Characteristic | Impact on Traditional Energy Providers |

|---|---|---|

| Rooftop Solar PV | Falling LCOE (e.g., < 3 cents/kWh for some projects in 2024) | Reduces demand for grid-supplied electricity. |

| Battery Storage | Declining BESS costs (projected through mid-2024) | Enables energy independence and reduces reliance on grid during peak times. |

| Energy Efficiency | Innovations in building materials and smart grids | Decreases overall energy consumption from conventional sources. |

Entrants Threaten

Entering the Australian energy market, especially for generation and large-scale retail operations, demands immense financial resources. Think about building a new power plant or establishing a significant customer base; these aren't small undertakings. The sheer scale of investment needed for infrastructure and market penetration acts as a formidable hurdle for potential newcomers.

For instance, the cost of constructing a new utility-scale solar farm in Australia can easily run into hundreds of millions of dollars, with some projects exceeding A$1 billion. Similarly, acquiring customers in a competitive retail market requires significant marketing and operational expenditure, further raising the capital barrier to entry.

Established energy giants like AGL leverage substantial economies of scale, particularly in generation and retail operations. This means they can produce and distribute energy more cheaply per unit than a smaller newcomer. For instance, AGL's vast customer base allows for significant cost efficiencies in billing and customer service, a hurdle for any new entrant aiming to match their pricing.

Furthermore, AGL's integrated business model, spanning diverse energy sources from renewables to traditional generation, creates scope economies. This integration allows for better management of energy supply and demand across different customer segments, providing a cost advantage that is difficult for a specialized new entrant to replicate. In 2023, AGL reported a significant portion of its revenue from its integrated energy services, highlighting the strength of this model.

New entrants in the energy sector grapple with securing access to existing electricity and gas distribution networks, which are predominantly managed by incumbent utility companies. This control by established players creates a substantial barrier, as new companies must either build their own infrastructure, a capital-intensive endeavor, or negotiate access agreements with these incumbents, which can be difficult to obtain on favorable terms.

Regulatory and Policy Barriers

The Australian energy sector is a prime example of high regulatory barriers to entry. Key bodies such as the Australian Energy Regulator (AER), the Australian Energy Market Commission (AEMC), and the Clean Energy Regulator (CER) impose stringent rules. Navigating these complex licensing, environmental, and market regulations requires substantial investment and expertise, acting as a significant deterrent for potential new competitors.

For instance, in 2024, the AER continued to oversee wholesale and retail energy markets, ensuring compliance with the National Electricity Rules and National Gas Rules. These rules dictate everything from pricing mechanisms to network reliability standards, making it challenging for new players to establish themselves without significant upfront capital and a deep understanding of the regulatory landscape. Environmental regulations, particularly those related to emissions and renewable energy integration, further add to the complexity and cost of entry.

- AER's Oversight: The Australian Energy Regulator actively enforces market rules and consumer protection measures in 2024, adding layers of compliance for new entrants.

- AEMC's Rulemaking: The Australian Energy Market Commission's continuous development of energy market rules necessitates ongoing adaptation and investment from all participants, including those seeking to enter.

- CER's Environmental Mandates: Compliance with clean energy targets and emissions reduction schemes managed by the Clean Energy Regulator presents a significant hurdle for new energy companies.

Brand Loyalty and Customer Switching Costs

While the ease of switching providers in the energy market has increased, established brand loyalty and customer recognition for incumbent retailers like AGL remain a significant hurdle for new entrants. Customers often stick with familiar brands due to perceived reliability or past positive experiences.

New companies entering the market must therefore allocate substantial resources to marketing campaigns and develop highly competitive pricing or service packages to persuade customers to switch from established providers. This investment is crucial to overcome the inertia of brand preference.

For instance, in the Australian energy market, customer acquisition costs can be substantial. In 2024, average customer acquisition costs for energy retailers were estimated to be between $200 and $400 per customer, reflecting the marketing and promotional efforts needed to gain market share.

- Brand Loyalty: Customers often prioritize familiarity and trust, making it difficult for new entrants to dislodge incumbents like AGL.

- Customer Switching Costs: While direct financial switching costs may be low, the effort and perceived risk of changing providers can act as a deterrent.

- Marketing Investment: New entrants need significant marketing spend to build brand awareness and offer compelling incentives to attract customers.

- Competitive Offers: Differentiated pricing, bundled services, or superior customer service are essential to overcome customer inertia.

The threat of new entrants into Australia's energy sector is significantly mitigated by the substantial capital requirements for infrastructure and market penetration. Building new power generation facilities or establishing a wide retail customer base necessitates enormous upfront investment, effectively creating a high barrier to entry. For example, constructing a utility-scale renewable energy project in Australia can easily cost hundreds of millions of dollars, with larger projects exceeding A$1 billion in 2024.

Economies of scale enjoyed by incumbents like AGL further deter new players. AGL's large operational footprint allows for lower per-unit costs in generation and customer service, making it challenging for smaller, newer companies to compete on price. In 2023, AGL's integrated operations provided significant cost efficiencies, a benefit difficult for new entrants to match immediately.

Access to established distribution networks and stringent regulatory compliance also pose major challenges. New entrants must either build their own infrastructure or negotiate access with incumbents, a process often fraught with difficulty and cost. Navigating complex regulations from bodies like the AER and AEMC in 2024 requires substantial expertise and financial resources, acting as a significant deterrent.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AGL draws from a comprehensive set of data sources including AGL's annual reports, ASX filings, and industry-specific energy market research reports. We also incorporate data from regulatory bodies like the AER and macroeconomic indicators to provide a robust assessment of the competitive landscape.