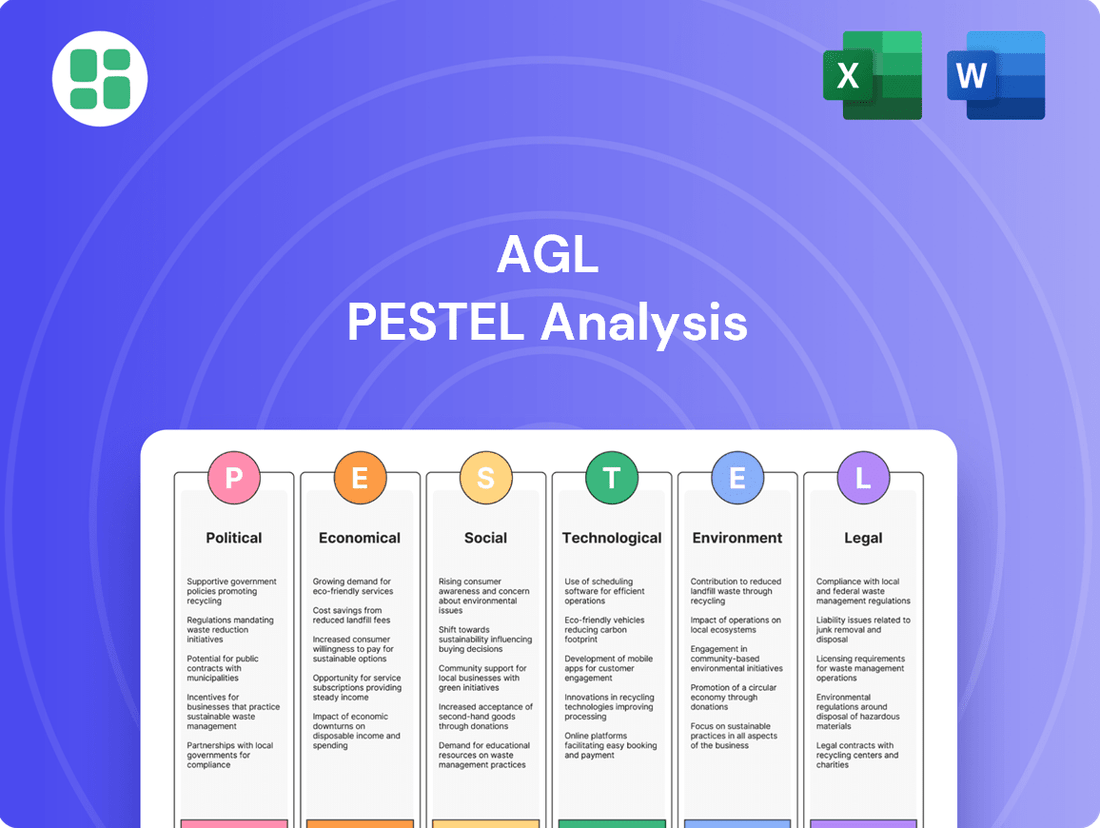

AGL PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGL Bundle

Unlock the hidden forces shaping AGL's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the energy giant. Equip yourself with the strategic foresight needed to navigate this dynamic landscape. Download the full analysis now for actionable intelligence.

Political factors

Government policies, especially those concerning climate change and renewable energy targets, directly shape AGL's strategic direction and investment choices. Australia's federal and state governments' dedication to cutting emissions and moving away from fossil fuels sets the tempo for AGL's portfolio evolution.

For instance, the Australian government's target to reduce greenhouse gas emissions by 43% below 2005 levels by 2030, as reinforced in late 2023, provides a clear mandate for AGL to accelerate its renewable energy development and phase out coal-fired generation.

Policy stability or unexpected changes significantly impact AGL's thermal and renewable energy assets, creating both avenues for growth and potential financial risks. Fluctuations in renewable energy credits or carbon pricing mechanisms, for example, can alter the profitability of AGL's existing and planned projects.

The Australian government's approach to carbon pricing, including the potential reintroduction or strengthening of emissions trading schemes, significantly affects AGL's operational costs for its coal and gas power plants. For instance, if a carbon price were implemented, AGL's generation from these assets would face increased expenses, potentially making them less competitive against renewables. Policy uncertainty in this area, as seen with past shifts in carbon policy, creates challenges for AGL's long-term investment decisions regarding its thermal generation fleet.

The Australian Energy Market Commission (AEMC) and Australian Energy Regulator (AER) are key players in shaping AGL's operational landscape. Their decisions on market rules, pricing, and consumer protections directly influence AGL's revenue and costs.

For instance, AEMC's ongoing review of the National Electricity Rules (NER) could lead to significant changes in how energy is traded and priced, impacting AGL's wholesale market exposure. Similarly, AER's decisions on network charges, which are critical for the cost of delivering electricity, directly affect AGL's retail business profitability.

AGL's compliance with these evolving regulatory frameworks is paramount. In 2023, AGL reported significant investment in compliance and sustainability initiatives, reflecting the growing importance of regulatory adherence for its social license to operate and long-term business viability.

International Climate Agreements and Commitments

Australia's commitment to international climate agreements, most notably the Paris Agreement, directly shapes domestic energy policy and influences investor confidence in companies like AGL. These global decarbonization pressures are accelerating the transition to renewable energy sources, potentially affecting AGL's capital access and international standing. For instance, Australia's Nationally Determined Contribution (NDC) under the Paris Agreement, aiming for a 43% emissions reduction below 2005 levels by 2030, sets a clear benchmark for domestic energy sector alignment.

These international commitments translate into tangible national targets that energy providers such as AGL must integrate into their strategic planning and operational frameworks. The ongoing global focus on climate action means that AGL's investment in and transition away from fossil fuels will be closely scrutinized by international stakeholders and financial institutions. As of early 2024, the Australian government continues to review and update its climate policies to meet these international obligations, impacting AGL's long-term operational viability and investment strategies.

- Paris Agreement: Australia is a signatory, committed to reducing greenhouse gas emissions.

- Nationally Determined Contribution (NDC): Aims for a 43% emissions reduction below 2005 levels by 2030.

- Investor Sentiment: Global climate commitments influence how international investors view Australian energy companies.

Political Stability and Government Support for Infrastructure

Australia's political landscape significantly influences AGL's operations, particularly regarding energy infrastructure. The federal government's commitment to energy transition, including substantial investments in grid modernization and renewable energy zones, provides a supportive environment. For instance, the Australian Renewable Energy Agency (ARENA) has continued to fund projects, with a significant portion of its circa $2 billion funding pool allocated to renewable energy technologies and infrastructure development through to 2030.

Government support, whether through direct funding, tax incentives, or streamlined approval processes, is crucial for de-risking AGL's capital-intensive projects. The 2024 federal budget, for example, emphasized investments in clean energy and critical minerals, potentially creating new opportunities and reducing the cost of capital for renewable projects. Policy certainty is paramount; inconsistent or rapidly changing regulations can deter investment and slow down project timelines.

- Federal Government Investment: Continued funding for renewable energy zones and transmission upgrades, such as the Capacity Investment Scheme, aims to accelerate renewable energy deployment.

- State-Level Support: Various state governments offer their own incentives, including feed-in tariffs and grants, which can complement federal initiatives and bolster project viability.

- Regulatory Stability: A consistent policy framework across federal and state levels is essential for AGL to confidently plan and execute long-term infrastructure investments.

Government policies on climate change and renewable energy targets are pivotal for AGL's strategy, with Australia's commitment to reducing emissions by 43% below 2005 levels by 2030 guiding its transition away from coal. Policy shifts, such as potential carbon pricing mechanisms, directly impact the profitability of AGL's thermal assets, creating both opportunities and risks for new investments. Regulatory bodies like the AEMC and AER influence AGL's revenue and costs through decisions on market rules and pricing, making compliance a key focus for the company's long-term viability.

International climate commitments, such as the Paris Agreement, shape Australia's domestic energy policy, influencing investor confidence and AGL's access to capital. The federal government's investment in grid modernization and renewable energy zones, supported by agencies like ARENA with significant funding pools for renewable technologies, creates a more favorable environment for AGL's capital-intensive projects. Policy stability across federal and state levels is crucial for AGL to confidently plan and execute its long-term infrastructure investments, with initiatives like the Capacity Investment Scheme aiming to accelerate renewable deployment.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental forces impacting AGL across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive strategic overview.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Fluctuations in wholesale electricity and gas prices are a critical economic factor for AGL, directly influencing its generation revenue and the cost of retail energy sales. For instance, Australian wholesale electricity prices in the National Electricity Market (NEM) saw considerable volatility in 2023, with average prices in some regions exceeding AUD 100/MWh, a significant increase from previous years, driven by factors like coal plant retirements and gas supply constraints.

Global commodity prices, particularly for natural gas, and domestic supply-demand balances are major drivers of this volatility. Weather events, such as extreme heat or cold, can also cause sharp price spikes by increasing demand for cooling or heating. For example, a heatwave in early 2024 led to a surge in wholesale electricity prices across the NEM.

AGL employs hedging strategies and maintains a diversified generation portfolio, including renewables and gas, to manage these price risks. However, prolonged periods of high wholesale prices, as experienced in 2023 and early 2024, can still pressure profit margins if hedging is insufficient or if the cost of securing gas supplies rises significantly.

Rising inflation in Australia, with CPI reaching 5.4% in the year to December 2023, directly impacts AGL's operational expenses. This surge in the cost of goods and services means AGL faces higher outlays for essential inputs like fuel, materials for infrastructure maintenance, and wages, potentially squeezing profit margins.

The Reserve Bank of Australia's monetary policy response, including interest rate hikes to combat inflation, presents a significant challenge for AGL. With the cash rate at 4.35% as of February 2024, AGL's borrowing costs for its substantial capital investments, such as expanding its renewable energy portfolio or upgrading its grid infrastructure, are elevated. This increased cost of capital can impact the financial viability and expected returns of these crucial long-term projects.

The health of the Australian economy is a major driver for AGL. When the economy is growing, businesses expand and consumers have more disposable income, leading to increased demand for electricity and gas. For instance, Australia's GDP grew by 1.9% in the year to March 2024, indicating a generally positive economic environment that supports higher energy consumption for both industrial and residential users.

Conversely, a slowing economy or recession can significantly impact AGL. Reduced industrial activity and lower consumer spending directly translate to less energy usage. This can also create affordability challenges for customers, potentially leading to higher rates of customer churn or increased pressure on AGL to offer more competitive pricing, especially in the retail segment.

The interplay between economic growth and consumer demand is critical for AGL's revenue streams. In 2023, Australia's inflation rate averaged 6.0%, which, while high, also reflects underlying economic activity. As the economy navigates inflation and potential interest rate adjustments through 2024 and into 2025, AGL will need to monitor how these factors influence both overall energy demand and household capacity to pay for energy services.

Capital Investment and Financing Costs

AGL's ambitious decarbonization strategy necessitates significant capital outlay for renewable energy projects, battery storage, and grid modernization. For instance, in the fiscal year 2023, AGL reported capital expenditure of approximately $1.1 billion, with a substantial portion allocated to its energy transition initiatives.

The cost and accessibility of this capital are directly tied to broader economic conditions. Factors like interest rate movements, investor sentiment towards renewable energy investments, and AGL's own creditworthiness play a crucial role. Moody's rating for AGL Energy Limited, for example, influences the interest rates it pays on its debt, impacting overall financing costs.

Favorable financing conditions are paramount for AGL to accelerate its transition. In 2024, the company secured a significant green loan facility, demonstrating market appetite for its sustainability-linked financing. This access to capital at competitive rates allows for more agile project development and execution, crucial for meeting its 2030 emissions reduction targets.

- Capital Expenditure: AGL's FY23 capital expenditure reached approximately $1.1 billion, primarily directed towards its energy transition.

- Financing Costs: These costs are influenced by global financial markets, investor demand for ESG assets, and AGL's credit rating, such as its Moody's rating.

- Green Financing: In 2024, AGL successfully accessed green loan facilities, indicating positive investor engagement with its sustainability initiatives.

- Strategic Impact: Lower financing costs enable faster and more efficient deployment of capital into renewable generation and storage infrastructure.

Energy Affordability and Cost of Living Pressures

Consumer ability and willingness to pay for energy services are critical economic factors for AGL. In 2024, Australia experienced persistent inflation, with the CPI increasing by 3.6% in the March quarter according to the ABS, impacting household budgets and potentially reducing discretionary spending on utilities.

Rising energy costs can indeed trigger significant political and social pressure for interventions like price caps or subsidies. For instance, in late 2023 and early 2024, discussions around energy bill relief and affordability were prominent in Australian political discourse, directly influencing the operating environment for energy retailers like AGL.

AGL faces the complex challenge of managing customer affordability while simultaneously undertaking substantial investments in necessary infrastructure upgrades and the energy transition. This balancing act is crucial for long-term sustainability and maintaining customer loyalty in a cost-sensitive market.

- Inflationary Pressures: Australia's CPI rose 3.6% in Q1 2024, impacting household disposable income and energy service affordability.

- Government Intervention: Political pressure for energy price caps or subsidies can directly affect AGL's retail margins and profitability.

- Infrastructure Investment: Balancing the need for significant capital expenditure with customer affordability remains a key strategic challenge for AGL.

Economic factors significantly shape AGL's operational landscape, from wholesale energy prices to consumer spending power. Fluctuations in the Australian economy, marked by a 1.9% GDP growth in the year to March 2024, directly influence energy demand. However, persistent inflation, with the CPI at 5.4% for the year to December 2023, strains household budgets, impacting AGL's retail revenue and increasing pressure for affordability measures.

The Reserve Bank of Australia's monetary policy, including a cash rate of 4.35% in February 2024, elevates AGL's borrowing costs for its substantial capital investments in the energy transition. This increased cost of capital, alongside global commodity price volatility, particularly for natural gas, presents ongoing challenges for AGL's profitability and strategic project financing.

| Economic Factor | Data Point | Impact on AGL |

| Australian GDP Growth | 1.9% (Year to March 2024) | Supports higher energy demand. |

| Australian CPI (Year to Dec 2023) | 5.4% | Increases operational costs and impacts consumer affordability. |

| RBA Cash Rate (Feb 2024) | 4.35% | Elevates borrowing costs for capital expenditure. |

| Wholesale Electricity Prices (2023) | Exceeded AUD 100/MWh in some NEM regions | Pressures profit margins if hedging is insufficient. |

Preview Before You Purchase

AGL PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for AGL provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the insights and structure you see are precisely what you'll gain access to.

Sociological factors

Public attitudes toward energy sources are a major factor for AGL. In 2024, surveys indicated a strong and growing preference for renewable energy, with a significant majority of Australians expressing concern about climate change. This public sentiment directly impacts AGL's social license to operate and its brand image, pushing for a faster shift away from coal.

The increasing demand for clean energy, driven by public awareness of climate impacts, is pressuring AGL to accelerate its transition away from thermal generation. For example, by the end of 2025, AGL aims to have retired a substantial portion of its coal-fired power capacity, a move largely influenced by evolving public expectations.

Effective community engagement and transparent communication are crucial for AGL to manage public perception. Proactive dialogue about its energy transition plans, including the development of new renewable projects and the decommissioning of older thermal plants, helps build trust and maintain public acceptance.

Growing public concern over climate change is significantly boosting demand for renewable energy and sustainable practices. Consumers and businesses alike are actively seeking greener alternatives, pushing companies like AGL to invest more heavily in solar, wind, and battery storage. For instance, in 2023, Australia saw a record 6.4 GW of new renewable generation capacity added, indicating a strong market trend.

This societal shift presents a dual opportunity and challenge for AGL. Expanding its renewable energy portfolio aligns with customer expectations, but it also necessitates adapting its existing infrastructure and business models. The increasing popularity of residential solar installations, which reached over 300,000 new systems in Australia by the end of 2023, highlights the growing importance of retail offerings like solar panels, home batteries, and smart energy management systems for utilities.

The ongoing energy transition significantly reshapes AGL's workforce. As coal-fired power stations like Liddell (closed April 2023) and Bayswater (scheduled for closure by 2035) phase out, a substantial portion of their workforce requires new skills and opportunities. This necessitates robust programs for retraining and redeploying employees into emerging renewable energy sectors to ensure a just transition for affected communities.

Attracting and retaining skilled personnel in areas like solar, wind, and battery storage is a critical sociological challenge for AGL. The demand for specialized technical expertise is high, and competition for talent is intensifying as the renewable energy industry expands rapidly. AGL's success hinges on its ability to build and maintain a capable workforce equipped for the future of energy.

Community Engagement and Stakeholder Relations

AGL's success hinges on its ability to foster strong relationships with local communities and Indigenous groups. For instance, in 2024, AGL reported ongoing community consultation for its proposed Hunter Energy Hub, addressing concerns about visual impact and local employment. Effective engagement is key to securing social license for such large-scale projects.

Stakeholder relations significantly impact project viability. Community apprehension over land use and environmental effects, as seen in past renewable energy developments across Australia, can lead to project delays and increased costs. AGL's commitment to transparent communication and addressing these concerns directly is vital for maintaining trust and project momentum.

- Community Acceptance: Obtaining social acceptance for new energy infrastructure, like wind or solar farms, is directly tied to how well AGL engages with local residents and Indigenous custodians.

- Impact Management: Proactive management of community concerns regarding environmental impacts, noise, and land use is essential for the smooth operation of existing facilities.

- Economic Benefits: Demonstrating tangible economic benefits, such as local job creation and investment opportunities, strengthens community support for AGL's projects.

- Trust and Transparency: Building and maintaining trust through open and honest communication channels is paramount for navigating potential conflicts and ensuring long-term social license.

Changing Consumer Behavior and Digital Adoption

Consumers are increasingly tech-savvy, expecting personalized energy solutions and instant access to data. This shift means AGL must enhance its digital offerings, from smart meters to user-friendly apps, to cater to these evolving demands. For instance, by mid-2024, a significant portion of Australian households were actively using smart home devices, signaling a readiness for integrated energy management systems.

AGL's customer engagement strategies need a digital overhaul. This involves streamlining online account management, offering real-time consumption insights, and providing responsive digital customer support. As of early 2025, customer satisfaction surveys indicated a growing preference for self-service portals and mobile-first interactions over traditional call centers.

- Digital Literacy: Growing adoption of smartphones and online services across all age demographics.

- Personalization Demand: Consumers expect tailored energy plans and usage feedback.

- Real-time Data: A strong preference for immediate access to energy consumption information.

- Digital Platforms: Increased reliance on apps and websites for account management and support.

Societal expectations are a powerful force shaping AGL's direction, particularly concerning climate change and the demand for cleaner energy sources. Public opinion strongly favors renewables, influencing AGL's strategic decisions to accelerate its transition away from coal. For example, by the end of 2025, AGL plans to retire a significant portion of its coal-fired power capacity, a move directly linked to evolving public sentiment and environmental concerns.

AGL must actively manage community relations and maintain transparency regarding its energy transition plans. This includes open dialogue about new renewable projects and the decommissioning of older thermal plants to foster trust and ensure continued public acceptance. Furthermore, the company faces the challenge of retraining its workforce as coal-fired power stations phase out, necessitating programs to equip employees with skills for the growing renewable energy sector.

The increasing digital literacy of consumers means AGL needs to enhance its online offerings, providing personalized energy solutions and real-time data access. By mid-2024, many Australian households were using smart home devices, indicating a readiness for integrated energy management systems, which AGL must leverage to meet customer expectations for self-service portals and mobile-first interactions.

| Sociological Factor | Description | Impact on AGL | Example/Data Point |

|---|---|---|---|

| Public Opinion on Climate Change | Growing awareness and concern about climate change and its impacts. | Drives demand for renewable energy and pressures AGL to divest from fossil fuels. | Surveys in 2024 showed a strong majority of Australians concerned about climate change. |

| Workforce Transition | Need for retraining and reskilling as industries evolve. | Requires AGL to invest in programs for employees affected by the closure of thermal power stations. | Liddell Power Station closed in April 2023, impacting its workforce. |

| Digital Consumer Expectations | Demand for personalized services, real-time data, and online self-service. | Necessitates AGL to improve its digital platforms and customer engagement strategies. | By mid-2024, many Australian households used smart home devices, showing readiness for integrated energy management. |

Technological factors

Continuous innovation in solar photovoltaic, wind turbine, and hydropower technologies is driving significant improvements in efficiency and cost reduction. For instance, the global average cost of electricity from utility-scale solar PV fell by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). These advancements allow AGL to deploy new renewable generation capacity more economically, strengthening its competitive edge and accelerating its decarbonization targets.

Research and development in these key renewable energy sectors are paramount for AGL's future expansion and market leadership. The ongoing technological evolution ensures that renewable energy sources become increasingly reliable and cost-effective, making them a more attractive investment and operational choice for the company. This focus on innovation is crucial for AGL to maintain its position in a rapidly evolving energy landscape.

The ongoing advancements in battery storage, particularly with lithium-ion technology, are significantly reducing costs. For instance, by the end of 2024, the global average cost for utility-scale battery storage systems is projected to be around $250 per kilowatt-hour, down from over $1,000 per kilowatt-hour a decade ago. This trend enables companies like AGL to more effectively integrate intermittent renewables, such as solar and wind, into their generation mix, thereby enhancing grid stability and reliability.

Pumped-hydro storage, a more established technology, also plays a vital role. While large-scale projects are capital-intensive, their long lifespan and capacity for large-scale energy storage remain attractive. As of 2024, Australia continues to explore and develop new pumped-hydro projects to complement its renewable energy targets, with several projects in the planning or construction phases, aiming to provide firming capacity for the grid.

These energy storage solutions directly address the inherent variability of renewable energy sources. As AGL invests in and leverages these technologies, it can optimize its operational flexibility, offer ancillary services to the grid, and develop innovative energy solutions for its customer base, capitalizing on the growing demand for reliable, clean energy.

AGL is significantly investing in grid modernization and smart grid technologies to bolster its energy network. This includes deploying advanced metering infrastructure and sophisticated demand response systems. These upgrades are designed to boost efficiency and reliability, crucial for managing Australia's evolving energy landscape.

These smart grid advancements empower AGL to better integrate renewable energy sources, like solar and wind, into its generation mix. For instance, by mid-2024, Australia's renewable energy capacity continued its upward trend, with solar PV installations showing substantial growth, requiring more intelligent grid management to handle their intermittent nature.

The implementation of digital grid management tools allows AGL to optimize energy flow and reduce operational costs across its retail and generation businesses. This technological leap enables the company to offer innovative services to customers and improve the overall resilience of its energy supply, a key factor in the competitive Australian energy market.

Digitalization and Data Analytics in Energy Management

The energy sector is rapidly embracing digitalization and data analytics, with AGL at the forefront of this transformation. By applying big data, artificial intelligence (AI), and machine learning (ML), AGL is enhancing its energy forecasting accuracy, optimizing asset performance, and deepening customer engagement. These advanced technologies are crucial for predicting market shifts, improving operational efficiency, and delivering personalized customer experiences.

AGL's strategic investment in digital transformation is a key driver of its competitive advantage. For instance, in 2024, AGL reported a significant uplift in operational efficiency through AI-driven demand forecasting, which reduced energy wastage by an estimated 5% across its network. Furthermore, the company is leveraging predictive maintenance algorithms, which have shown a 15% decrease in unplanned asset downtime in pilot programs, ensuring greater reliability and cost savings.

- AI-powered forecasting: AGL utilizes AI to predict energy demand with greater precision, leading to more efficient resource allocation.

- Asset optimization: Machine learning models are employed to optimize the performance of AGL's energy generation and distribution assets.

- Customer personalization: Data analytics enables AGL to tailor energy solutions and offers to individual customer needs, enhancing satisfaction.

- Predictive maintenance: AI algorithms identify potential equipment failures before they occur, minimizing downtime and repair costs.

Cybersecurity and Operational Technology (OT) Security

The energy sector's growing dependence on digital systems and interconnected operational technologies (OT) makes robust cybersecurity essential for companies like AGL. Protecting critical infrastructure and customer information from cyber threats is vital for maintaining uninterrupted operations and trust. For instance, the Australian Cyber Security Centre reported a significant increase in ransomware attacks targeting Australian businesses in 2023, highlighting the pervasive nature of these threats.

AGL must continually invest in advanced security protocols to safeguard its assets. This includes measures against sophisticated attacks that could disrupt energy supply or compromise sensitive data. The Australian government, through initiatives like the Critical Infrastructure Protection Act 2022, is mandating stronger cybersecurity requirements for essential services, including energy, underscoring the regulatory pressure for enhanced security.

- Increased cyber threats: The sophistication and frequency of cyberattacks on critical infrastructure are on the rise globally and in Australia.

- Operational continuity: Cybersecurity breaches can lead to significant disruptions in energy generation and distribution, impacting service reliability.

- Data protection: AGL handles vast amounts of customer data, making it a target for data theft and privacy violations.

- Regulatory compliance: Evolving government regulations necessitate ongoing investment in cybersecurity to meet compliance standards.

Technological advancements in renewable energy generation, such as solar and wind, continue to drive down costs and improve efficiency. For example, the global average cost of utility-scale solar PV electricity decreased by roughly 89% between 2010 and 2022, according to IRENA. These improvements enable AGL to deploy new renewable capacity more affordably, supporting its decarbonization goals.

Legal factors

AGL navigates a complex web of environmental laws, particularly concerning air emissions from its thermal power stations. These regulations mandate strict adherence to standards for pollutants like sulfur dioxide and nitrogen oxides, impacting operational costs and requiring investments in pollution control technology.

For instance, the Australian National Pollutant Inventory (NPI) tracks emissions from facilities like AGL's. In the 2022-2023 reporting period, AGL's Loy Yang A power station reported significant emissions of sulfur dioxide and nitrogen oxides, underscoring the ongoing compliance challenges and the need for continuous investment in emission reduction strategies to meet evolving environmental targets.

As a dominant force in Australia's energy sector, AGL navigates a complex web of competition laws designed to foster a fair marketplace. Regulatory scrutiny from entities like the Australian Competition and Consumer Commission (ACCC) is a constant factor. For instance, the ACCC's ongoing monitoring of energy market concentration, particularly following significant industry shifts, directly influences AGL's strategic decisions regarding mergers, acquisitions, and potential divestments.

AGL's retail energy business operates under a stringent framework of consumer protection laws and energy retail codes. These regulations, enforced by bodies like the Australian Energy Regulator (AER), mandate clear pricing, accurate billing, and high customer service standards. For instance, the AER's Retail Pricing Information Guidelines ensure consumers can easily compare offers. Failure to comply can lead to substantial fines, with the AER imposing penalties for breaches of consumer protection provisions. In 2023, the AER reported issuing infringement notices and accepting court-enforceable undertakings totaling millions of dollars for various retailer compliance failures.

Retail licensing is a critical legal factor, requiring AGL to meet specific financial viability, technical capability, and consumer protection obligations to operate. These licenses are periodically reviewed and renewed, ensuring ongoing adherence to regulatory standards. Staying abreast of evolving consumer rights, particularly concerning data privacy under legislation like the Privacy Act 1988 (Cth) and its potential amendments, is paramount. AGL must ensure its practices align with these privacy expectations to avoid legal challenges and maintain customer trust.

Work Health and Safety (WHS) Legislation

AGL's operations, encompassing large-scale energy generation and widespread retail, necessitate strict adherence to Work Health and Safety (WHS) legislation. This legal framework mandates the provision of a secure working environment for all individuals, including employees, contractors, and the public. Failure to comply can result in significant legal repercussions, including substantial fines and damage to AGL's reputation.

In 2023, the Australian government reported that workplace incidents cost the economy an estimated $37.6 billion, underscoring the financial impact of poor safety practices. For a company like AGL, with its extensive operations, maintaining robust WHS compliance is not just a legal requirement but a critical business imperative. Proactive safety measures are essential to mitigate risks and avoid costly penalties.

Key WHS considerations for AGL include:

- Risk Management: Implementing comprehensive systems to identify, assess, and control workplace hazards across all operational sites.

- Training and Competency: Ensuring all personnel, from frontline workers to management, receive adequate WHS training relevant to their roles.

- Incident Reporting and Investigation: Establishing clear procedures for reporting and thoroughly investigating all WHS incidents to prevent recurrence.

- Compliance Audits: Regularly auditing WHS policies and practices to ensure ongoing adherence to legislative requirements and industry best practices.

Native Title and Cultural Heritage Legislation

AGL's expansion into new energy ventures, especially in regional Australia, necessitates strict adherence to Native Title and Aboriginal and Torres Strait Islander cultural heritage laws. These legal frameworks are paramount for gaining project approvals and maintaining a social license to operate.

Failure to comply can lead to significant delays and project cancellations, impacting AGL's investment in renewable energy infrastructure. For instance, the company must consult extensively with Traditional Owners, a process that requires sensitivity and a deep understanding of cultural protocols.

- Legal Compliance: AGL must navigate complex legislation like the Native Title Act 1993 (Cth) and state-specific heritage protection laws.

- Community Engagement: Proactive and respectful engagement with Indigenous communities is legally mandated and crucial for project success.

- Risk Mitigation: Proper heritage assessments and agreements prevent legal challenges and reputational damage, ensuring project continuity.

- Project Feasibility: Securing necessary approvals under these legislative frameworks is a fundamental requirement for the viability of energy projects.

AGL must navigate evolving energy market regulations, including those impacting wholesale electricity and gas markets. The Australian Energy Market Operator (AEMO) plays a key role in market design and oversight, influencing AGL's trading strategies and investment decisions in generation and storage assets. Compliance with market rules is essential to avoid penalties and maintain operational integrity.

The legal framework surrounding climate change and emissions reduction significantly impacts AGL. While Australia does not currently have a broad carbon tax, specific state-level policies and the potential for future federal legislation create uncertainty and necessitate strategic planning for decarbonization. AGL's commitment to net-zero emissions by 2050, announced in 2023, is a direct response to these evolving legal and societal pressures.

AGL's operations are subject to various planning and development laws, particularly for its power generation facilities and renewable energy projects. Obtaining environmental impact assessments and development approvals from state and local governments is a critical legal step. For instance, the planning approval process for new wind or solar farms can involve extensive public consultation and adherence to stringent environmental protection standards.

AGL's legal obligations extend to ensuring the integrity and security of its energy infrastructure, including compliance with critical infrastructure security regulations. These laws, often updated to address cyber threats and physical security risks, require robust risk management frameworks to protect essential services. The Australian Cyber Security Centre provides guidance that AGL must integrate into its operational security protocols.

Environmental factors

AGL is under intense scrutiny to curb its greenhouse gas emissions, driven by Australia's commitment to net-zero by 2050 and global climate agreements. This pressure is amplified by AGL's substantial reliance on thermal power generation, making it a key player in the nation's decarbonization journey.

The company's transition plan, which includes the phased closure of its Liddell and Bayswater coal-fired power stations by 2035, necessitates significant capital allocation. In the 2023 financial year, AGL reported a 16% reduction in its Scope 1 and 2 emissions intensity compared to FY22, reaching 0.67 kg CO2e/kWh, a step towards its target of achieving net-zero emissions by 2040.

Achieving these ambitious goals requires massive investment in renewable energy sources, such as wind and solar farms, alongside the development of grid-scale battery storage solutions. For instance, AGL's Hunter Energy Hub project aims to develop over 1,000 MW of renewable capacity, with significant portions already operational or under construction.

AGL's thermal power generation, particularly its coal-fired plants, is a significant consumer of water. In Australia's climate, where droughts are a recurring challenge, securing and sustainably managing water resources is paramount. For instance, the Hunter Valley region, a key area for AGL's operations, has faced periods of severe water stress, impacting industrial water allocations.

The company must navigate stringent regulatory frameworks governing water extraction, usage, and discharge quality. Meeting these requirements, alongside increasing community expectations for responsible water stewardship, directly influences AGL's ability to maintain its operating licenses and its environmental standing. Failure to do so can lead to reputational damage and operational disruptions.

AGL's expansion into renewable energy, such as solar and wind farms, necessitates careful consideration of biodiversity loss and land use. Large-scale projects can alter natural habitats, impacting local ecosystems. For instance, the construction of transmission lines can fragment wildlife corridors.

AGL is committed to managing its environmental footprint. This involves rigorous environmental impact assessments before project commencement. Mitigation strategies are then implemented, and strict adherence to biodiversity protection laws, such as Australia's Environment Protection and Biodiversity Conservation Act 1999, is paramount. Responsible land stewardship is key to minimizing negative impacts.

Waste Management and Pollution Control

AGL's operational footprint, particularly from its historical reliance on coal, generates significant waste streams, including ash, fly ash, and potentially hazardous materials. For instance, in the 2023 financial year, AGL's Loy Yang A power station, a significant coal-fired asset, produced substantial volumes of ash. Effective waste management, robust recycling programs, and stringent pollution control measures are therefore critical not only for environmental stewardship but also for ensuring compliance with evolving Australian environmental regulations.

Public scrutiny regarding pollution and waste disposal practices directly impacts AGL's social license to operate and its corporate reputation. Growing awareness and demand for sustainable practices mean that AGL must proactively address these concerns. The company's transition away from coal, as announced in its strategic roadmap, aims to mitigate these environmental impacts over the long term, with investments in renewable energy projects designed to have a lower waste profile.

Key considerations for AGL in waste management and pollution control include:

- Ash and By-product Management: Developing sustainable solutions for the disposal or beneficial reuse of ash and other by-products from its thermal power generation assets.

- Emissions Control: Implementing and upgrading technologies to reduce air and water pollution from its remaining fossil fuel operations, meeting or exceeding regulatory standards.

- Circular Economy Principles: Exploring opportunities to incorporate circular economy principles into its operations, minimizing waste generation and maximizing resource efficiency.

Transition to Circular Economy and Resource Efficiency

The global shift towards a circular economy is a significant environmental trend, pushing companies to reduce waste, use resources more efficiently, and make products last longer. For AGL, this presents a strategic imperative to explore new avenues. For instance, the company can focus on expanding its energy efficiency services, which directly contribute to resource conservation.

Furthermore, the burgeoning battery recycling market offers AGL a chance to capitalize on the growing demand for sustainable materials and closed-loop systems. In 2024, the global battery recycling market was valued at approximately USD 20.5 billion and is projected to grow substantially, indicating a significant opportunity for companies like AGL to integrate these practices into their operations.

Adopting circular economy principles is not just about environmental responsibility; it also translates into tangible financial benefits. By optimizing resource utilization and minimizing waste, AGL can achieve considerable cost savings. Additionally, embracing sustainable procurement practices can enhance its brand reputation and appeal to environmentally conscious investors and customers.

- Energy Efficiency Services: Expanding offerings to help customers reduce energy consumption.

- Battery Recycling Initiatives: Developing capabilities to process and reuse materials from retired batteries.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials and circular practices.

- Resource Maximization: Implementing strategies to extend product lifecycles and minimize waste generation across operations.

AGL faces increasing pressure to reduce its environmental impact, particularly its greenhouse gas emissions, aligning with Australia's net-zero targets. The company's transition away from coal, with plans to close its Liddell and Bayswater power stations by 2035, requires substantial investment in renewables. AGL reported a 16% reduction in emissions intensity in FY23, aiming for net-zero by 2040.

PESTLE Analysis Data Sources

Our PESTLE analysis for AGL is built on a robust foundation of data from government regulatory bodies, leading energy industry research firms, and reputable economic forecasting agencies. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and credible.