AerSale SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerSale Bundle

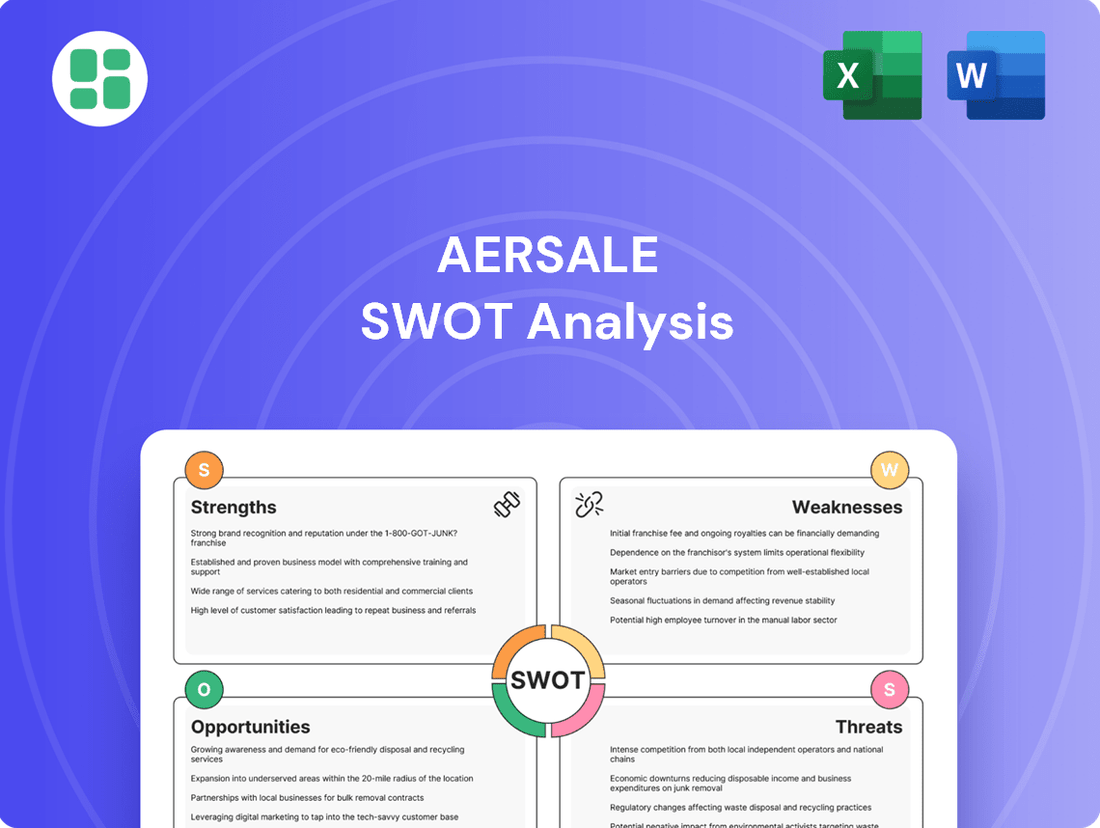

AerSale leverages its strong industry reputation and extensive aftermarket parts inventory as key strengths, but faces potential threats from fluctuating aircraft demand and increasing competition. Understanding these dynamics is crucial for navigating the aviation aftermarket.

Want the full story behind AerSale’s market position, including detailed insights into its opportunities and weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AerSale's integrated aftermarket solutions are a significant strength, combining aircraft and engine sales, leasing, and exchanges with essential MRO, storage, and disassembly services. This holistic approach allows them to manage assets throughout their entire lifecycle, creating a powerful synergy. For instance, in 2023, AerSale reported total revenue of $477.1 million, a substantial portion of which likely stems from these diverse, interconnected service offerings, demonstrating their ability to extract value across multiple touchpoints.

AerSale's global operational footprint is a significant strength, allowing it to serve a diverse clientele that includes airlines, leasing companies, and original equipment manufacturers (OEMs) across various continents. This broad market penetration, evidenced by its operations in North America, Europe, and Asia, mitigates risks associated with any single geographic region or customer type. For instance, in the first quarter of 2024, AerSale reported that its customers spanned over 50 countries, underscoring this global reach.

AerSale's core strength lies in its profound expertise within the used aviation assets sector. This specialized focus on aircraft, engines, and components places them in a distinct position within the aftermarket. Their adeptness at sourcing, valuing, and remarketing these critical assets allows them to effectively address the growing need for economical aviation solutions, especially for established aircraft models.

Strong Asset Portfolio Management

AerSale excels in managing a diverse portfolio of high-value aviation assets, encompassing aircraft and engines. Their expertise spans the entire asset lifecycle, from initial acquisition through to strategic disassembly, ensuring optimal value extraction at each stage. This capability is underpinned by significant investments in inventory, totaling over $687 million as of the first quarter of 2024, which facilitates efficient parts reclamation and resale.

Their robust asset management strategy focuses on maximizing utilization and mitigating depreciation. By effectively managing their inventory, AerSale can capitalize on the demand for used aircraft parts and engines.

- Optimized Asset Lifecycle: AerSale's management of aircraft and engines from acquisition to disassembly maximizes value.

- Significant Inventory Investment: Over $687 million invested in inventory as of Q1 2024 supports parts reclamation and resale.

- Value Extraction: Expertise in optimizing asset utilization and managing depreciation ensures maximum returns.

Resilience in Aftermarket Demand

The aftermarket aviation sector demonstrates remarkable resilience, as airlines frequently opt to extend the operational life of their current fleets or seek cost-effective alternatives to acquiring new aircraft. This trend is particularly pronounced during economic downturns or when original equipment manufacturers (OEMs) face production delays.

AerSale's business model is strategically positioned to capitalize on this persistent demand for maintenance, repair, and the procurement of used aircraft parts. For instance, in 2023, AerSale reported significant revenue growth driven by its aftermarket services, with a notable increase in demand for engine and airframe MRO services.

- Extended Fleet Life: Airlines are increasingly focused on maximizing the utility of their existing aircraft, driving demand for MRO services.

- Economic Alternatives: Used parts and component solutions offer substantial cost savings compared to new OEM parts, appealing to budget-conscious operators.

- OEM Production Constraints: Ongoing supply chain issues and production backlogs at major OEMs further bolster the attractiveness of the aftermarket sector.

AerSale's integrated aftermarket solutions, combining aircraft and engine sales, leasing, and MRO services, create strong synergies. Their global reach, serving customers in over 50 countries as of Q1 2024, diversifies revenue and mitigates regional risks. The company's deep expertise in used aviation assets allows them to effectively source, value, and remarket critical components, meeting the demand for cost-effective aviation solutions.

What is included in the product

Delivers a strategic overview of AerSale’s internal and external business factors, highlighting its strong market position and growth opportunities while acknowledging potential operational weaknesses and competitive threats.

AerSale's SWOT analysis provides a clear roadmap for navigating industry challenges by highlighting opportunities for growth and mitigating potential threats.

Weaknesses

AerSale's core business is intrinsically tied to the value of used aircraft, engines, and parts. This means that any dips in the market for these assets can directly affect the company's bottom line. For instance, when new, more fuel-efficient aircraft enter the market, the demand for older models, and thus their valuation, can decrease significantly.

The carrying costs for inventory also become a concern when asset values decline. If AerSale holds onto aircraft or parts that are losing value, it ties up capital and incurs expenses without a corresponding increase in potential revenue. This sensitivity was highlighted in their financial reporting, where fluctuations in whole asset sales directly impacted profitability.

AerSale's business model inherently demands significant capital. Acquiring and maintaining a large inventory of aircraft, engines, and valuable parts requires substantial upfront investment. For instance, the company's inventory levels, a key indicator of this capital intensity, were reported at approximately $1.2 billion as of the end of the first quarter of 2024.

This capital-intensive nature can act as a constraint on rapid growth. It also exposes AerSale to heightened financial risks, especially if market demand softens or the cost of borrowing increases, impacting its ability to finance operations and expansion effectively.

While AerSale's aftermarket focus offers some resilience, the company remains susceptible to the inherent cyclicality of the global aviation industry. Economic downturns, such as those experienced during the COVID-19 pandemic, can significantly curb air travel demand, leading to reduced needs for maintenance, repair, and overhaul (MRO) services, aircraft leasing, and component sales. For instance, in 2020, global air traffic fell by over 60% compared to 2019, directly impacting the demand for services AerSale provides.

Intense Competition and Pricing Pressure

The aftermarket aviation sector is a crowded space, featuring a wide array of competitors from specialized maintenance, repair, and overhaul (MRO) shops to original equipment manufacturers (OEMs) and other independent asset lessors. This intense competition, especially with giants like Boeing and Airbus increasingly offering their own MRO services, inevitably creates significant pricing pressure on AerSale's services and assets. This can directly impact the company's ability to maintain healthy profit margins.

For instance, in the 2024 landscape, the aftermarket services market is projected to reach over $100 billion globally, a segment where AerSale operates. However, the increasing vertical integration by OEMs, who can leverage their scale and brand recognition, poses a direct challenge. This dynamic means AerSale must continuously innovate and optimize its cost structure to remain competitive.

- Competitive Landscape: Includes large OEMs (Boeing, Airbus), independent MROs, and other lessors.

- Pricing Pressure: OEM expansion into MRO services intensifies competition, potentially squeezing AerSale's margins.

- Market Dynamics: The global aftermarket services market is robust but highly competitive, requiring strategic pricing and operational efficiency.

Regulatory and Compliance Burdens

AerSale’s global operations in the aviation sector are subject to a complex web of evolving international regulations, stringent safety standards, and environmental compliance mandates. Navigating these diverse and often changing requirements across different jurisdictions presents a significant challenge.

The cost and time investment necessary for strict adherence to these regulations can be substantial, impacting operational efficiency and potentially creating a financial burden. Furthermore, the risk of non-compliance, even if unintentional, carries the potential for severe penalties and reputational damage.

- Regulatory Complexity: Operating across multiple countries means complying with varying aviation authorities like the FAA, EASA, and others, each with unique rules.

- Cost of Compliance: Investments in certifications, audits, and specialized personnel to meet safety and environmental standards can be considerable. For example, ongoing investments in sustainability initiatives and emissions tracking are becoming increasingly critical.

- Risk of Non-Compliance: Failure to meet evolving standards, such as those related to aircraft emissions or noise pollution, could lead to fines, operational disruptions, or loss of operating licenses.

AerSale's reliance on the used aircraft and parts market makes it vulnerable to asset value depreciation. When newer, more efficient aircraft enter service, the demand and valuation of older models, which form a significant part of AerSale's inventory, can decline sharply. This was evident in the first quarter of 2024, where inventory valuation fluctuations directly impacted profitability.

The company's capital-intensive model, with inventory valued around $1.2 billion in Q1 2024, ties up significant funds. This high capital requirement can hinder rapid expansion and exposes AerSale to financial risks if market demand weakens or borrowing costs rise, impacting its ability to finance operations and growth effectively.

The aviation aftermarket is intensely competitive, with major players like Boeing and Airbus expanding their MRO services. This competition, within a global aftermarket projected to exceed $100 billion in 2024, creates pricing pressure, potentially squeezing AerSale's profit margins and requiring continuous operational optimization.

Preview the Actual Deliverable

AerSale SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of AerSale's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details AerSale's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights into AerSale's market dynamics.

Opportunities

The global aircraft fleet is aging, with many aircraft now exceeding their initial service lives. This reality pushes airlines towards cost-effective maintenance and life extension strategies over immediate new aircraft purchases. This shift directly fuels a robust and expanding market for aftermarket services.

The Maintenance, Repair, and Overhaul (MRO) sector is a prime beneficiary, with projections indicating substantial growth by 2035. This includes demand for spare parts and the leasing of used aircraft, all of which are critical components of AerSale's business model, positioning the company to capitalize on this enduring trend.

Developing economies are witnessing a surge in aviation activity, yet often face capital constraints for acquiring new aircraft. This creates a substantial opening for AerSale, as used aircraft and efficient maintenance, repair, and overhaul (MRO) services become highly sought-after solutions. For instance, the Asia-Pacific region, with India leading the charge in aviation expansion, presents a prime opportunity for AerSale to bolster its market presence and cater to this growing demand.

AerSale can capitalize on technological advancements in Maintenance, Repair, and Overhaul (MRO) by integrating predictive maintenance and additive manufacturing. This shift allows for proactive part replacement and on-demand production, significantly cutting downtime and material costs. For instance, the global MRO market was valued at approximately $95 billion in 2023 and is projected to grow, with technology adoption being a key driver.

Leveraging advanced data analytics, including AI and IoT, presents a substantial opportunity for AerSale. By analyzing vast datasets from aircraft operations, the company can optimize maintenance schedules, identify potential failures before they occur, and even develop new data-driven service offerings. This focus on efficiency and innovation is crucial as the aviation industry increasingly relies on digital solutions to manage complex operations.

Increased Focus on Sustainability and Circular Economy

The aviation sector's drive toward sustainability is significantly boosting the market for responsible aircraft and engine lifecycle management. This trend directly benefits AerSale, whose core competencies in disassembly, recycling, and component reuse are increasingly sought after. The growing adoption of circular economy principles within aviation presents a substantial growth avenue for the company.

AerSale is well-positioned to capitalize on this shift, as evidenced by the increasing demand for certified used parts and the company's expanding inventory of airframes and engines available for teardown. For instance, in 2023, AerSale reported that its Asset Management segment, which includes these services, saw continued strong performance, reflecting the market's embrace of sustainable aviation practices.

- Growing Demand for Sustainable Aviation Solutions

- AerSale's Expertise in Component Reuse and Recycling

- Alignment with Circular Economy Principles in Aviation

Strategic Partnerships and Acquisitions

AerSale's pursuit of strategic partnerships and acquisitions presents a significant avenue for growth. By forming alliances with airlines, other maintenance, repair, and overhaul (MRO) providers, or technology firms, AerSale can broaden its service offerings, capture a larger share of the aviation aftermarket, and integrate cutting-edge technologies. This proactive approach is crucial in a dynamic industry where innovation and expanded capabilities are key differentiators.

The company's recent acquisition of a substantial parts portfolio from Sanad Group, valued at approximately $100 million, exemplifies this strategic direction. This move not only bolsters AerSale's inventory but also enhances its ability to serve a wider range of aircraft types and customer needs, reinforcing its position in the competitive MRO landscape.

- Expanded Service Capabilities: Partnerships can unlock access to specialized MRO services AerSale may not currently offer, creating a more comprehensive solution for clients.

- Market Share Growth: Targeted acquisitions can absorb competitors or complementary businesses, directly increasing AerSale's footprint and customer base.

- Technology Access: Collaborating with or acquiring tech-focused companies allows AerSale to integrate advanced diagnostics, digital MRO solutions, or sustainable aviation technologies.

The increasing global focus on sustainability within aviation presents a significant opportunity for AerSale. As airlines and manufacturers prioritize environmental responsibility, the demand for services like aircraft and engine lifecycle management, including disassembly, recycling, and component reuse, is on the rise. This aligns perfectly with AerSale's core competencies, positioning the company to benefit from the industry's shift towards more circular economy principles.

AerSale's strategic acquisitions and partnerships are crucial for expanding its market reach and service offerings. For instance, the company's 2023 acquisition of a significant parts portfolio from Sanad Group, valued at approximately $100 million, directly enhanced its inventory and ability to serve a broader customer base. These moves allow AerSale to integrate new technologies and strengthen its competitive position in the aftermarket.

The growing demand for used serviceable parts (USPs) and the leasing of mid-life aircraft are key drivers for AerSale's Asset Management segment. This segment, which saw continued strong performance in 2023, reflects the market's preference for cost-effective and sustainable solutions over new aircraft acquisitions. AerSale's ability to provide these certified parts and aircraft directly addresses this market need.

Developing economies, particularly in regions like Asia-Pacific, offer substantial growth potential due to increasing aviation activity coupled with capital constraints for new fleet purchases. AerSale is well-positioned to serve these markets with its expertise in used aircraft sales and MRO services, making aviation more accessible and affordable. India's rapid aviation expansion exemplifies this trend.

| Opportunity Area | Description | 2024/2025 Relevance |

|---|---|---|

| Sustainable Aviation | Demand for lifecycle management, recycling, and component reuse. | Growing emphasis on ESG initiatives driving preference for AerSale's services. |

| Strategic Partnerships & Acquisitions | Expanding service capabilities and market share through alliances and buyouts. | Acquisitions like Sanad Group ($100M in 2023) bolster inventory and market reach. |

| Used Aircraft & Parts Market | Increasing demand for mid-life aircraft and certified used serviceable parts (USPs). | AerSale's Asset Management segment performance in 2023 highlights strong market adoption. |

| Emerging Markets | Catering to aviation growth in developing economies with capital constraints. | Asia-Pacific, especially India, presents significant opportunities for used aircraft and MRO services. |

Threats

Economic downturns, such as a potential global recession in late 2024 or 2025, pose a significant threat to AerSale. Reduced consumer spending and business activity can drastically cut air travel demand, impacting airline profitability and their need for aircraft and parts. For instance, a sharp decline in passenger traffic, similar to what was seen during the initial COVID-19 pandemic, would directly reduce AerSale's opportunities for aircraft conversions, maintenance services, and parts sales.

Geopolitical instability, including ongoing conflicts or new trade disputes, can further exacerbate economic pressures. These events disrupt global supply chains, increase fuel costs, and create uncertainty for airlines, leading them to defer capital expenditures like fleet expansion or upgrades. This directly translates to lower demand for AerSale's asset management and aftermarket services, potentially affecting their inventory turnover and the valuation of the aircraft and parts they hold.

The constant release of new, fuel-efficient aircraft by manufacturers like Boeing and Airbus poses a significant threat to AerSale. These advancements can hasten the phasing out of older models, potentially flooding the used aircraft market. This oversupply could drive down the value of AerSale's existing inventory of older planes.

Furthermore, as newer, more efficient planes become the norm, the long-term demand for spare parts for aging aircraft is likely to diminish. This trend persists even with current supply chain disruptions affecting new aircraft production, as the focus shifts towards supporting the newer, more dominant fleet types.

Original Equipment Manufacturers (OEMs) are increasingly making their mark in the aftermarket services arena by offering all-encompassing service packages. This strategic shift directly challenges independent providers like AerSale, as OEMs can leverage their established brand loyalty and direct access to aircraft data.

Furthermore, the aviation maintenance, repair, and overhaul (MRO) landscape is seeing significant consolidation among larger players. For instance, the global MRO market was valued at approximately $90 billion in 2023 and is projected to grow, but this growth could be accompanied by increased market concentration, potentially squeezing smaller or more specialized MROs and impacting AerSale's competitive positioning and pricing power.

Supply Chain Disruptions and Component Scarcity

Global supply chain vulnerabilities, amplified by events like the COVID-19 pandemic and ongoing geopolitical tensions, pose a significant threat to AerSale's operations. These disruptions can hinder the timely acquisition of essential aircraft parts and materials needed for Maintenance, Repair, and Overhaul (MRO) services, potentially leading to project delays and increased operational expenses. For instance, the aerospace industry has faced widespread material shortages, impacting production and MRO timelines throughout 2024 and into 2025.

The scarcity of critical components, such as specialized alloys and electronic parts, directly affects AerSale's ability to service aircraft efficiently. This shortage not only drives up the cost of sourcing parts but also creates a more challenging environment for acquiring used aircraft parts, a core aspect of AerSale's business model. Industry reports from late 2024 indicated that lead times for certain aerospace components had extended by as much as 30% compared to pre-pandemic levels.

- Extended lead times for critical aerospace components are a persistent challenge.

- Geopolitical instability and natural disasters can exacerbate supply chain fragilities.

- Material shortages directly translate to higher operational costs and potential project delays for MRO providers.

- The availability and cost of used aircraft parts are increasingly influenced by broader supply chain dynamics.

Rapid Technological Obsolescence

The aerospace industry is experiencing a significant acceleration in technological advancements, particularly concerning engine efficiency and digital avionics. This rapid evolution poses a threat to AerSale, as it could hasten the obsolescence of its existing inventory and maintenance, repair, and overhaul (MRO) capabilities. For instance, the push towards more fuel-efficient engines and advanced composite materials in new aircraft designs might reduce the demand for older, less technologically advanced components that form a part of AerSale's offerings.

To counter this, AerSale must maintain a proactive strategy of reinvesting in cutting-edge technology and ongoing employee training. This is crucial to ensure its MRO services remain relevant and competitive. The increasing complexity of aircraft systems, from advanced flight management systems to sophisticated engine control units, requires specialized knowledge and equipment, adding to the investment burden.

The financial implications are substantial. A report from Aviation Week in late 2024 highlighted that airlines are increasingly prioritizing fleet modernization, leading to a quicker retirement of older aircraft types. This trend directly impacts the availability of parts for older models and necessitates AerSale's adaptation to support newer generation aircraft, which often feature proprietary technologies and require specialized repair procedures.

- Increased R&D Investment: Continuous investment in research and development to understand and adapt to emerging aerospace technologies is paramount.

- Skills Gap in MRO: The growing complexity of aircraft systems creates a potential skills gap in MRO, requiring significant investment in training and certification for technicians.

- Inventory Management Challenges: Rapid technological shifts can lead to challenges in managing inventory, as older parts may lose value faster than anticipated.

The increasing focus by Original Equipment Manufacturers (OEMs) on providing comprehensive aftermarket service packages presents a direct challenge to independent MRO providers like AerSale. OEMs can leverage their brand recognition and direct access to aircraft data, potentially offering more integrated solutions that could draw business away from third parties. This trend is intensifying as the global MRO market, valued at around $90 billion in 2023, sees greater market concentration.

Consolidation within the aviation MRO sector, with larger players acquiring smaller ones, also poses a competitive threat. This consolidation can lead to increased market power for the larger entities, potentially impacting AerSale's pricing power and market share. The drive for efficiency and scale among these larger MROs could create a more challenging operating environment for independent service providers.

The rapid pace of technological advancement in aviation, particularly in engine efficiency and digital avionics, risks making AerSale's existing inventory and MRO capabilities obsolete faster. Airlines are increasingly prioritizing fleet modernization, leading to quicker retirement of older aircraft. This shift necessitates significant investment in new technologies and training to remain competitive, as evidenced by the growing demand for specialized repair procedures for newer generation aircraft.

SWOT Analysis Data Sources

This AerSale SWOT analysis is built upon a foundation of verified financial filings, comprehensive market intelligence reports, and expert industry evaluations, ensuring a precise and informed strategic assessment.