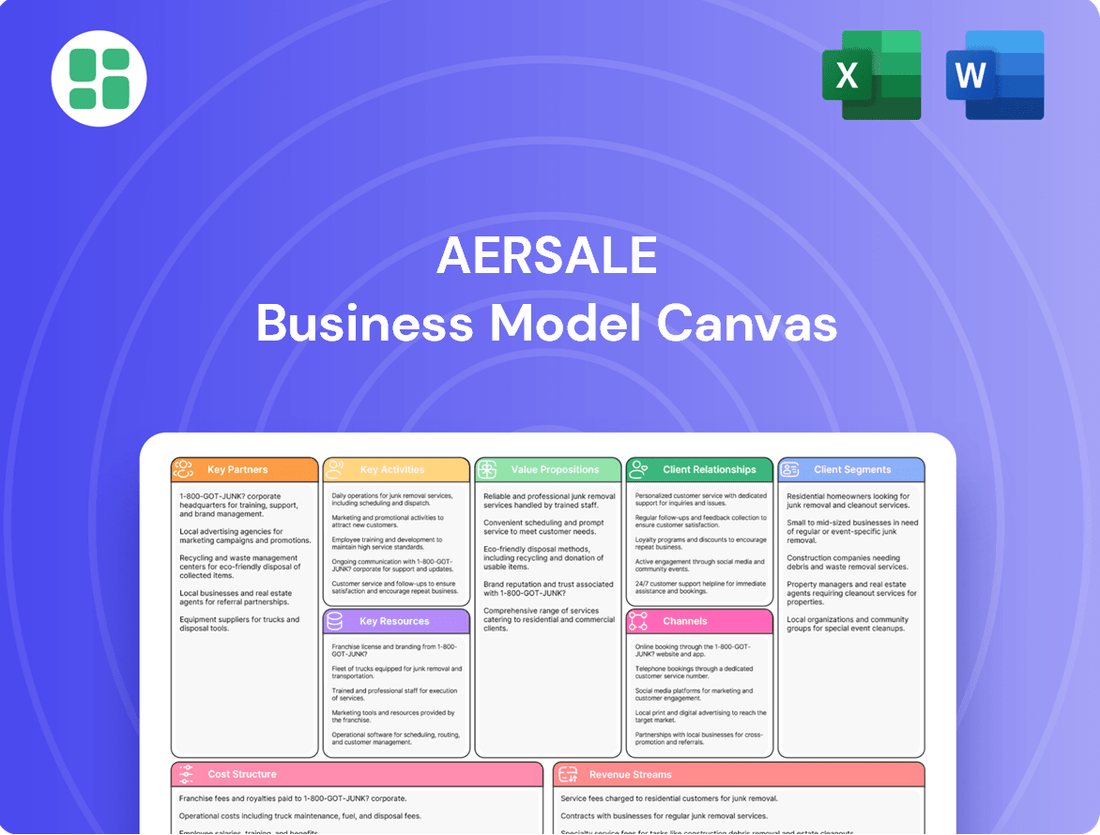

AerSale Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerSale Bundle

Unlock the full strategic blueprint behind AerSale's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

AerSale partners with a worldwide network of MRO service providers, enabling them to offer extensive aircraft and component maintenance, repair, and overhaul services. These collaborations are crucial for extending AerSale's operational reach and technical expertise across various aircraft models.

By leveraging these external MRO capabilities, AerSale can deliver high-quality maintenance, modifications, and overhauls without the need for direct ownership of all specialized facilities. This strategic approach allows for a more flexible and comprehensive service offering to their diverse client base.

AerSale's relationships with financial institutions and lessors are foundational to its operations, particularly in acquiring and financing aircraft and engines. These partnerships provide the necessary capital for large asset transactions, allowing AerSale to build and maintain its extensive inventory.

In 2024, the aviation finance sector continued to see robust activity, with leasing companies playing a pivotal role. For instance, AerSale's ability to secure financing from these entities directly impacts its capacity to purchase used aircraft and engines, which are then refurbished and leased or resold. This financial leverage is critical for their asset-heavy business model.

These collaborations are not just about capital; they also enable AerSale to offer diverse leasing solutions to its clientele. By having strong ties with lessors, AerSale can structure flexible agreements, catering to the varied needs of airlines and other aviation-related businesses, thereby expanding its market reach and revenue streams.

AerSale collaborates with Original Equipment Manufacturers (OEMs) to secure vital technical data, genuine spare parts, and certified repair procedures. These partnerships are crucial for AerSale's aftermarket operations, bolstering the technical expertise and trustworthiness of their Maintenance, Repair, and Overhaul (MRO) services and parts distribution.

By maintaining strong ties with OEMs, AerSale ensures adherence to stringent manufacturer standards and gains access to essential technical bulletins and updates. For instance, in 2024, AerSale's continued OEM engagements facilitated the procurement of over 10,000 genuine OEM parts, supporting their extensive MRO activities for a diverse range of commercial aircraft.

Logistics and Supply Chain Partners

AerSale's ability to serve a global market hinges on its collaborations with specialized logistics and supply chain partners. These alliances are critical for the seamless movement of aircraft, engines, and a vast array of components across continents. For instance, in 2024, the aviation industry continued to grapple with supply chain disruptions, making robust logistics partnerships even more vital for ensuring timely deliveries and maintaining operational continuity for AerSale's customers.

These partnerships are not merely about transportation; they encompass efficient warehousing solutions that are crucial for managing AerSale's extensive inventory of parts and aircraft. By leveraging the expertise of these logistics providers, AerSale can ensure that products reach their destinations promptly, supporting Maintenance, Repair, and Overhaul (MRO) operations worldwide. This efficiency directly translates to reduced downtime for clients and a stronger competitive edge for AerSale.

The strategic integration of these logistics providers allows AerSale to optimize its inventory management, a key factor in cost control and operational efficiency. By streamlining the flow of goods and managing storage across various geographical locations, AerSale can minimize carrying costs and reduce the complexities inherent in international operations. This focus on an optimized supply chain is a cornerstone of AerSale's business model, enabling it to deliver value consistently.

- Global Reach: Partnerships with international freight forwarders and specialized aircraft transporters facilitate the movement of assets to and from diverse global markets.

- Inventory Optimization: Collaborations with warehousing and inventory management specialists ensure efficient storage, tracking, and retrieval of aircraft parts, reducing holding costs and lead times.

- MRO Support: Logistics partners are integral to the timely delivery of components and aircraft to MRO facilities, supporting AerSale's service offerings and customer uptime commitments.

- Regulatory Compliance: Working with logistics providers experienced in aviation regulations ensures that all shipments meet international and national compliance standards for hazardous materials and aircraft parts.

Aircraft Disassembly and Recycling Facilities

AerSale collaborates with specialized aircraft disassembly and recycling facilities, crucial for managing end-of-life aircraft. These partnerships are fundamental for acquiring used serviceable material (USM), a key component of AerSale's inventory for resale. For instance, in 2023, AerSale's USM business generated significant revenue, underscoring the importance of these supply chain relationships.

These collaborations ensure responsible asset disposition, aligning with environmental sustainability goals. By working with these facilities, AerSale not only sources valuable parts but also contributes to a circular economy within the aviation industry. This strategic approach enhances their ability to offer a comprehensive range of aviation products and services.

- Sourcing USM: Partnerships with disassembly facilities are the primary channel for acquiring used serviceable material.

- Environmental Stewardship: These collaborations facilitate the responsible recycling and disposal of retired aircraft.

- Inventory Enhancement: The material obtained directly contributes to AerSale's extensive inventory of aircraft parts for sale.

- Strategic Value: These relationships are vital for maintaining a competitive edge in the aviation aftermarket.

AerSale's key partnerships are diverse, encompassing MRO providers, financial institutions, OEMs, logistics specialists, and disassembly facilities. These collaborations are vital for sourcing inventory, providing services, managing assets, and ensuring global operational efficiency.

In 2024, AerSale continued to strengthen its relationships with financial partners, essential for its asset-heavy model. The company also saw significant value from its OEM collaborations, which provided access to genuine parts and technical data, supporting its MRO and parts distribution segments. Furthermore, robust logistics partnerships were critical in navigating ongoing supply chain complexities, ensuring timely deliveries to customers worldwide.

| Partner Type | Role in AerSale's Business Model | 2024 Impact/Focus |

|---|---|---|

| MRO Service Providers | Extend maintenance, repair, and overhaul capabilities globally. | Broadened service offerings and technical expertise across various aircraft. |

| Financial Institutions & Lessors | Provide capital for aircraft and engine acquisition and financing. | Crucial for funding asset purchases and enabling flexible leasing solutions. |

| Original Equipment Manufacturers (OEMs) | Supply technical data, genuine spare parts, and certified repair procedures. | Ensured adherence to standards and facilitated procurement of over 10,000 OEM parts. |

| Logistics & Supply Chain Partners | Facilitate global movement of aircraft, engines, and components; manage warehousing. | Ensured operational continuity amidst supply chain challenges; optimized inventory. |

| Aircraft Disassembly & Recycling Facilities | Source used serviceable material (USM) and manage end-of-life aircraft. | Primary channel for USM acquisition, contributing significantly to inventory and revenue. |

What is included in the product

AerSale's Business Model Canvas offers a detailed blueprint for its aircraft, engine, and component MRO and aftermarket solutions, focusing on diverse customer segments like airlines and leasing companies through efficient channels and a strong value proposition of cost-effective, high-quality services.

AerSale's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex aircraft and engine solutions, simplifying understanding for stakeholders.

It effectively addresses the pain of information overload by condensing AerSale's diverse offerings into a digestible format, facilitating quicker decision-making and strategy alignment.

Activities

AerSale's core activity revolves around strategically acquiring used commercial aircraft, engines, and components. This vital feedstock is sourced from airlines and leasing companies worldwide, forming the backbone of their inventory.

This continuous acquisition process is essential for replenishing AerSale's stock, which directly fuels their sales, leasing, and maintenance, repair, and overhaul (MRO) operations. For instance, in 2024, AerSale continued to actively pursue opportunities to acquire diverse aircraft types to meet market demand.

AerSale provides extensive Maintenance, Repair, and Overhaul (MRO) services for both commercial aircraft and their individual components. These capabilities are housed within their FAA-certified repair stations, ensuring compliance and quality.

The scope of these MRO services is broad, encompassing everything from heavy maintenance checks and complex modifications to detailed component MRO and specialized engineering support. This comprehensive approach allows AerSale to address a wide range of client needs.

In 2024, AerSale's MRO segment continued to be a vital revenue generator, contributing significantly to the company's overall financial performance. For instance, the company reported substantial growth in its MRO segment, with revenues increasing by approximately 15% year-over-year, driven by strong demand for airframe and component services.

AerSale's core business revolves around the commercial transactions of aviation assets, including aircraft, engines, and their components. They facilitate these through direct sales, flexible leasing arrangements, and strategic exchange programs, serving airlines, leasing companies, and original equipment manufacturers (OEMs). This diverse approach caters to a wide range of fleet management needs.

The sale of flight equipment is a significant revenue generator for AerSale. In 2023, the company reported that its aircraft and engine sales segment contributed substantially to its overall financial performance, highlighting the importance of this key activity in driving growth and profitability.

Used Serviceable Material (USM) Sales and Distribution

AerSale's core operation involves harvesting, certifying, and selling Used Serviceable Material (USM) derived from aircraft and engine teardowns. This process offers customers a more economical option compared to purchasing brand-new components, thereby generating substantial revenue and bolstering the aviation aftermarket sector.

The demand for USM has been robust, demonstrating consistent growth. For instance, in 2024, AerSale reported a significant increase in its USM segment, driven by airlines seeking cost-saving solutions amidst ongoing operational pressures. This segment is crucial for maintaining competitive pricing in the aviation parts market.

- USM Revenue Contribution: In the first quarter of 2024, AerSale's USM segment revenue reached $101.7 million, a notable increase from the previous year, highlighting its importance to the company's financial performance.

- Market Demand: The ongoing need for affordable aircraft parts, especially for older fleets, ensures a sustained demand for certified USM.

- Cost-Effectiveness: USM provides a vital cost-saving alternative, with savings often ranging from 30% to 70% compared to new parts, making it an attractive option for maintenance, repair, and overhaul (MRO) operations.

- Inventory Growth: AerSale actively manages its USM inventory, ensuring a wide selection of certified parts is available to meet diverse customer needs.

Asset Management and Valuation

AerSale's key activity in asset management and valuation centers on maximizing the residual worth of end-of-life aircraft and engine portfolios. This core function encompasses meticulous inventory oversight, comprehensive records auditing, and expert documentation services, all culminating in the strategic disposition of these valuable assets.

Their specialized knowledge in asset valuation and the entire asset lifecycle management process sets them apart. For instance, in 2024, AerSale continued to leverage its deep understanding of market dynamics to identify optimal sale channels and timing for a diverse range of aircraft types, ensuring clients received the best possible returns.

- Expert Inventory Management: Maintaining detailed and accurate records of all managed assets.

- Records Audit and Documentation: Ensuring all historical and technical documentation is complete and compliant.

- Strategic Asset Disposition: Implementing tailored strategies for selling or leasing assets to achieve maximum value.

- Valuation Expertise: Providing accurate and informed valuations based on market conditions and asset specifics.

AerSale's key activities are multifaceted, encompassing the strategic acquisition of used aircraft and engines, providing comprehensive MRO services, and the profitable sale of Used Serviceable Material (USM). They also excel in asset management and valuation, ensuring the maximization of residual asset worth through expert oversight and strategic disposition.

The company's commitment to these activities is reflected in its financial performance. In 2024, AerSale saw continued demand across its service offerings, particularly in MRO and USM, driven by airlines seeking cost-effective solutions. For example, the USM segment alone generated $101.7 million in revenue in the first quarter of 2024, underscoring its significance.

These core functions are supported by robust inventory management and a deep understanding of market dynamics, allowing AerSale to effectively serve a diverse client base. Their ability to offer cost savings, often between 30% to 70% compared to new parts through USM, solidifies their position in the aviation aftermarket.

AerSale's strategic asset disposition and valuation expertise ensure clients receive optimal returns on their aircraft and engine portfolios. This comprehensive approach to the aviation asset lifecycle management is a cornerstone of their business model.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Acquisition of Used Aircraft & Engines | Sourcing feedstock from airlines and leasing companies globally. | Continued active pursuit of diverse aircraft types to meet market demand. |

| MRO Services | Providing extensive repair and overhaul for aircraft and components. | MRO segment revenue increased approximately 15% year-over-year. |

| USM Sales | Harvesting, certifying, and selling used components. | Q1 2024 USM revenue was $101.7 million, with savings of 30-70% compared to new parts. |

| Asset Management & Valuation | Maximizing residual worth of end-of-life assets. | Leveraging market dynamics for optimal sale channels and timing. |

Full Version Awaits

Business Model Canvas

The AerSale Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This means you're seeing the authentic structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business model canvas.

Resources

AerSale's extensive inventory of used commercial aircraft, engines, and components is the bedrock of its asset management and sales operations. This substantial physical asset base allows for rapid fulfillment of customer needs for critical flight equipment and spare parts.

The company's ability to quickly source and deliver these assets is a significant competitive differentiator. For instance, as of the first quarter of 2024, AerSale reported a significant volume of aircraft and engines available for sale or lease, supporting its diverse customer base.

AerSale's MRO facilities are its operational backbone, featuring owned and operated hangars, workshops, and specialized equipment crucial for its maintenance, repair, and overhaul services. These state-of-the-art locations, including key sites in Goodyear, Arizona, Roswell, New Mexico, and Millington, Tennessee, are certified to handle a wide array of aircraft and complex repair tasks.

AerSale's business model hinges on its highly skilled workforce, comprising licensed aircraft mechanics, technicians, and aeronautical engineers. This pool of talent is essential for delivering complex Maintenance, Repair, and Overhaul (MRO) services, accurately valuing aircraft assets, and innovating engineered solutions. Their specialized knowledge is a foundational intellectual asset that guarantees the high quality and regulatory compliance of AerSale's offerings.

In 2024, the aviation MRO market saw continued demand for skilled labor. For instance, the global aviation MRO market was projected to reach over $110 billion by 2024, underscoring the critical need for experienced technical personnel who can handle sophisticated maintenance and repair tasks efficiently and safely.

Certifications and Regulatory Approvals

AerSale's certifications are foundational to its operations, particularly its FAA unlimited repair station ratings for both airframe and component MRO. These aren't just badges; they signify adherence to rigorous aviation safety and quality benchmarks, enabling global operations.

These approvals are critical for AerSale’s credibility and legal standing in the aviation aftermarket. They directly support its ability to perform complex maintenance, repair, and overhaul services, which is a core part of its business model.

- FAA Unlimited Repair Station Ratings: Essential for airframe and component MRO services.

- Global Operational Credibility: Demonstrates compliance with international aviation safety standards.

- Market Access: Enables AerSale to service aircraft and components for a worldwide customer base.

Proprietary Data and Market Intelligence

AerSale's proprietary data and market intelligence are crucial for its business model. They possess unique datasets on aircraft, engine, and component pricing, utilization, and transaction histories. This deep dive into market dynamics allows them to source assets effectively and optimize their pricing strategies.

This market intelligence provides a significant competitive advantage. By understanding granular data points, AerSale can identify emerging market opportunities and navigate the complexities of the aviation aftermarket with precision. For instance, their fleet analytics help them anticipate demand for specific aircraft types or engine models.

- Proprietary Data: AerSale collects and analyzes extensive data on aircraft, engine, and component pricing, utilization, and transaction records.

- Fleet Analytics: Unique analytical tools are employed to understand fleet trends and asset performance across the aviation industry.

- Competitive Edge: This intelligence enables superior asset sourcing, pricing optimization, and identification of strategic market opportunities.

- Informed Decisions: AerSale's strategic decisions, from inventory management to investment in new service lines, are heavily informed by this data-driven approach.

AerSale's key resources include its vast inventory of used aircraft, engines, and parts, providing immediate solutions for clients. Its MRO facilities, strategically located and equipped, are central to its service delivery. The company also relies heavily on its highly skilled workforce, possessing specialized aviation expertise.

Furthermore, AerSale leverages proprietary data and market intelligence for informed decision-making and competitive advantage. Crucially, its FAA unlimited repair station ratings grant global operational credibility and market access.

| Key Resource | Description | Impact |

| Inventory | Extensive stock of used commercial aircraft, engines, and components. | Enables rapid fulfillment of customer needs for critical flight equipment. |

| MRO Facilities | Owned and operated hangars, workshops, and specialized equipment. | Core operational backbone for maintenance, repair, and overhaul services. |

| Skilled Workforce | Licensed mechanics, technicians, and aeronautical engineers. | Essential for complex MRO, asset valuation, and innovation. |

| Proprietary Data | Unique datasets on aircraft, engine, and component pricing and history. | Facilitates effective asset sourcing and optimized pricing strategies. |

| Certifications | FAA unlimited repair station ratings for airframe and component MRO. | Signifies adherence to safety benchmarks and enables global operations. |

Value Propositions

AerSale offers substantial cost savings for airlines and MRO providers by supplying used aircraft, engines, and certified used serviceable materials (USM). This approach provides a critical alternative to the high price tags associated with new parts, directly addressing the need to lower operational expenditures.

For instance, in 2024, the demand for cost-effective aftermarket solutions remained robust as airlines navigated ongoing economic pressures. AerSale's ability to provide certified USM can reduce parts acquisition costs by as much as 50-70% compared to new OEM parts, enabling operators to extend fleet viability and manage budgets more effectively.

AerSale's integrated 'one-stop shop' model offers a significant value proposition by consolidating asset acquisition, maintenance, repair, and overhaul (MRO), parts sales, leasing, and asset management into a single provider. This comprehensive approach, often referred to as 'nose-to-tail' support, directly addresses the complexity of the aviation aftermarket for customers.

By centralizing these diverse services, AerSale streamlines operations for its clients, reducing the time and effort typically required to manage multiple vendors and complex supply chains. This efficiency is crucial in an industry where timely aircraft availability and cost control are paramount.

For instance, in 2024, the global aviation MRO market was projected to reach over $100 billion, highlighting the significant demand for specialized services. AerSale's ability to offer a full spectrum of solutions within this expansive market provides a distinct competitive advantage, simplifying procurement and ensuring greater control over aircraft lifecycle management for its customers.

AerSale's business model excels in rapid availability and global reach, a critical value proposition for airlines facing Aircraft On Ground (AOG) situations. With a vast inventory of aircraft, engines, and components, they can swiftly fulfill urgent needs, minimizing costly downtime for operators. In 2023, AerSale reported significant growth in its inventory solutions, supporting hundreds of aircraft globally.

Expertise and Technical Reliability

AerSale's value proposition hinges on its deep industry expertise and robust technical reliability, offering customers peace of mind. This includes specialized in-house engineering capabilities that are crucial for delivering dependable Maintenance, Repair, and Overhaul (MRO) services, as well as custom aircraft modifications. Their proven track record in providing safe and compliant solutions instills significant confidence in their clientele.

Customers benefit directly from AerSale's extensive technical qualifications, which translate into high-quality MRO services and asset valuations. For instance, in 2024, AerSale continued to leverage its engineering talent to support complex aircraft projects, underscoring its commitment to technical excellence. This expertise ensures that all services meet stringent aviation standards.

The company's ability to provide reliable MRO services and custom modifications is a cornerstone of its offering. AerSale's technical teams possess the knowledge to handle a wide range of aircraft types and configurations. Their asset valuation services are also backed by this deep technical understanding, providing accurate and trustworthy assessments.

Key aspects of AerSale's Expertise and Technical Reliability include:

- In-house Engineering: A dedicated team of engineers provides specialized support for MRO and modifications.

- Technical Qualifications: Extensive certifications and experience ensure high standards of service delivery.

- Proven Track Record: A history of successful projects and satisfied customers validates their reliability.

- Safety and Compliance: Adherence to all regulatory requirements guarantees safe and compliant operations.

Sustainability through Lifecycle Management

AerSale champions sustainability in aviation by focusing on the sale, lease, and recycling of used aircraft and components. This approach significantly extends the useful life of valuable assets, thereby reducing the environmental impact associated with new manufacturing. For instance, in 2023, AerSale's inventory management and asset disposition services contributed to diverting a substantial amount of material from landfills, aligning with growing industry demands for circular economy principles.

By extending asset lifecycles and implementing efficient recycling processes, AerSale directly combats waste generation within the aviation sector. This strategy not only minimizes the demand for virgin materials but also appeals to a growing segment of environmentally conscious clients seeking to reduce their own carbon footprints. The company’s commitment to these practices reflects a broader industry trend towards more responsible asset management, a key differentiator in the current market.

AerSale's value proposition in sustainability is underscored by its comprehensive lifecycle management services. These services are designed to maximize asset value while minimizing environmental impact.

- Lifecycle Extension: AerSale’s expertise in maintaining and remarketing used aircraft and components keeps them in service longer, reducing the need for new production.

- Efficient Recycling: The company’s advanced recycling programs ensure that end-of-life aircraft are processed responsibly, recovering valuable materials and minimizing waste.

- Environmental Appeal: This focus on sustainability attracts clients who prioritize environmental responsibility, aligning with global ESG (Environmental, Social, and Governance) initiatives.

AerSale's core value lies in providing significant cost savings to airlines and MRO providers by offering used aircraft, engines, and certified used serviceable materials (USM). This strategy directly addresses the need for reduced operational expenditures, with USM potentially cutting parts acquisition costs by 50-70% compared to new OEM parts.

The company's integrated 'one-stop shop' approach consolidates asset acquisition, MRO, parts sales, leasing, and asset management, simplifying complex supply chains for clients. This comprehensive service model streamlines operations and reduces vendor management overhead, which is critical in the aviation industry where timely aircraft availability is paramount.

AerSale's rapid availability and global reach are crucial for mitigating costly aircraft downtime, especially during Aircraft On Ground (AOG) situations. Their extensive inventory allows for swift fulfillment of urgent needs, supporting hundreds of aircraft globally. In 2023, AerSale reported substantial growth in its inventory solutions, demonstrating its capacity to meet urgent demands.

The company's deep industry expertise and technical reliability, including in-house engineering for MRO and custom modifications, provide customers with confidence. AerSale's proven track record in delivering safe and compliant solutions, backed by extensive technical qualifications, ensures high-quality service delivery and accurate asset valuations.

AerSale champions aviation sustainability by extending the lifecycle of used aircraft and components through sale, lease, and recycling. This focus reduces the environmental impact of new manufacturing and appeals to environmentally conscious clients, aligning with global ESG initiatives.

| Value Proposition | Description | Impact | Example Data (2023/2024) |

| Cost Savings | Provides used aircraft, engines, and USM as a cost-effective alternative to new parts. | Reduces operational expenditures for airlines and MROs. | USM can reduce parts costs by 50-70% compared to new OEM parts. |

| Integrated Services | Offers a 'one-stop shop' for asset acquisition, MRO, parts sales, leasing, and asset management. | Streamlines operations, reduces vendor complexity, and improves efficiency. | Simplifies procurement and enhances aircraft lifecycle management for customers. |

| Rapid Availability & Global Reach | Maintains a vast inventory for swift fulfillment of urgent needs, minimizing AOG downtime. | Ensures aircraft availability and reduces costly operational disruptions. | Significant growth in inventory solutions supporting hundreds of aircraft globally in 2023. |

| Expertise & Technical Reliability | Leverages in-house engineering and technical qualifications for dependable MRO and modifications. | Instills customer confidence through high-quality, safe, and compliant solutions. | Continued leverage of engineering talent for complex aircraft projects in 2024. |

| Sustainability | Focuses on lifecycle extension, efficient recycling, and responsible asset disposition. | Minimizes environmental impact and appeals to ESG-conscious clients. | Diverts substantial material from landfills, supporting circular economy principles. |

Customer Relationships

AerSale cultivates lasting client connections via dedicated account management, offering tailored support and diligent follow-up from initial transaction to ongoing service. This commitment ensures client needs are precisely met, driving repeat business and robust collaborations. For instance, in 2023, AerSale reported that its customer retention rate exceeded 85%, a testament to the effectiveness of its relationship-focused approach.

AerSale solidifies customer relationships through multi-year service agreements and long-term contracts, particularly for its MRO services and aircraft leasing. These arrangements offer significant stability and predictable revenue streams for AerSale, while guaranteeing customers consistent support and maintenance for their aviation assets.

AerSale provides robust technical support and consultation, drawing on its deep in-house engineering and Maintenance, Repair, and Overhaul (MRO) capabilities. This expert guidance covers crucial areas like aircraft modifications, proactive maintenance planning, and strategies to maximize asset utilization, fostering strong, trust-based relationships.

Customized Solutions and Flexibility

AerSale understands that no two customers are exactly alike. That’s why they really focus on creating solutions that fit each client perfectly, whether it's for buying, leasing, or maintaining aircraft. This personalized approach is a cornerstone of how they build strong relationships.

Their flexibility is a major draw. For instance, they offer lease agreements that can be short, medium, or long-term. This adaptability allows customers to align their aircraft needs precisely with their operational demands and financial strategies, a key factor in their customer retention.

- Tailored Aircraft Solutions: AerSale crafts specific programs for aircraft sales, leasing, and MRO, acknowledging unique customer requirements.

- Flexible Lease Terms: Offering short, medium, and long-term lease agreements provides clients with crucial operational and financial adaptability.

- Client-Centric Approach: This commitment to customized service fosters strong, lasting relationships with a diverse customer base.

Post-Sale Support and Warranty

AerSale's commitment to post-sale support and warranty is a cornerstone of its customer relationships. This ensures customers have reliable operational continuity for their aircraft, engines, and components, fostering trust and repeat business. For instance, in 2024, AerSale continued to offer comprehensive warranty programs tailored to various product lines, demonstrating their dedication to long-term customer satisfaction and product performance.

This focus on after-sales service is crucial for addressing any potential issues promptly, thereby enhancing overall customer satisfaction and loyalty. It reinforces AerSale's reputation as a dependable partner in the aviation aftermarket.

- Comprehensive Warranty Programs: Offering extended coverage on overhauled engines and airframes.

- Technical Support: Providing access to experienced technicians for troubleshooting and maintenance advice.

- Parts Availability: Ensuring prompt delivery of necessary spare parts to minimize downtime.

- Customer Feedback Integration: Utilizing customer input to refine support services and product offerings.

AerSale builds strong customer relationships through dedicated support and personalized solutions, ensuring client needs are consistently met. Their commitment to after-sales service, including comprehensive warranty programs and prompt parts availability, reinforces trust and drives repeat business. In 2024, AerSale continued to emphasize these customer-centric practices, aiming to maximize client satisfaction and operational continuity.

| Customer Relationship Aspect | Description | 2024 Focus/Example |

|---|---|---|

| Dedicated Support | Personalized assistance and follow-up | Account management for tailored solutions |

| Long-Term Agreements | Service contracts and leasing for stability | Multi-year MRO and aircraft leasing contracts |

| Technical Expertise | In-house engineering and MRO consultation | Guidance on modifications and asset utilization |

| After-Sales Service | Warranty programs and issue resolution | Extended coverage and prompt parts delivery |

Channels

AerSale's direct sales force is a cornerstone of its strategy, engaging directly with airlines, leasing companies, and original equipment manufacturers (OEMs) worldwide. This approach facilitates in-depth discussions about complex integrated aviation product and service offerings.

This direct channel is crucial for fostering robust, enduring relationships with major clients, enabling personalized engagement and intricate negotiation processes. In 2024, AerSale reported that its direct sales efforts were instrumental in securing significant multi-year contracts, contributing to a substantial portion of its revenue growth.

AerSale's official website is a crucial online platform. It prominently displays their vast inventory of aircraft, engines, and parts, alongside detailed information about their Maintenance, Repair, and Overhaul (MRO) and asset management services. This digital storefront acts as a central hub for potential customers and investors to learn about the company's offerings and performance.

The company website also functions as a comprehensive information resource, offering detailed company profiles, the latest news updates, and dedicated investor relations sections. This accessibility ensures that stakeholders can easily access critical data and understand AerSale's strategic direction and financial health, supporting informed decision-making.

AerSale actively participates in key aviation industry events like the Paris Air Show and the National Business Aviation Association (NBAA) convention. These platforms are vital for showcasing their comprehensive aircraft and component solutions, directly connecting with a global clientele. In 2024, AerSale highlighted its expanded Part 145 MRO capabilities, a move designed to capture a larger share of the growing maintenance market.

Brokers and Foreign Representation

AerSale leverages contract services and foreign representation to expand its market presence, particularly in regions outside the United States. This strategy is crucial for targeting clients effectively in specific regional markets where local knowledge is advantageous.

These intermediaries act as an extension of AerSale's sales force, enabling the company to tap into new or specialized markets. For instance, in 2024, AerSale reported that approximately 30% of its revenue was generated from international operations, highlighting the importance of such global outreach strategies.

- Foreign Representation: Utilized for client-targeted sales in specific regional markets outside the U.S.

- Contract Services: Employed to enhance local expertise and market penetration.

- Market Reach: Extends AerSale's capabilities into new or niche territories.

- Revenue Impact: International operations contributed significantly to AerSale's 2024 financial performance.

Investor Relations and Public Relations

Investor Relations (IR) and Public Relations (PR) are crucial channels for AerSale, extending beyond just shareholders. These platforms communicate the company's financial health, strategic direction, and unique value proposition to a wide range of financially-literate stakeholders. For instance, in 2024, AerSale's consistent reporting of strong revenue growth, such as their Q1 2024 results showing a significant increase in MRO segment revenue, is highlighted through these channels.

These communications build essential market confidence, which is vital for attracting not only investors but also potential business partners and suppliers. By transparently sharing information about AerSale's operational efficiency and market position, these channels foster trust and encourage deeper engagement. The company's commitment to detailing its fleet management solutions and aftermarket services through press releases and investor presentations directly supports this objective.

- Investor Relations: Communicates financial performance, strategic goals, and growth opportunities to current and potential investors.

- Public Relations: Enhances brand reputation and market perception by disseminating company news, achievements, and industry insights.

- Broader Audience Reach: Extends communication beyond investors to include financial analysts, media, and potential business partners.

- Market Confidence: Fosters trust and credibility, indirectly attracting business opportunities and strengthening market position.

AerSale utilizes a multi-faceted channel strategy, combining direct sales with online presence and industry engagement. This approach ensures broad market reach and effective client interaction. The company's direct sales force is key for building relationships with airlines and OEMs, while its website serves as a digital storefront and information hub.

Participation in industry events and the use of foreign representation and contract services further extend AerSale's market penetration. Investor and public relations channels are vital for communicating financial health and strategic direction, building market confidence and attracting business partners. In 2024, AerSale reported that international operations accounted for approximately 30% of its revenue, underscoring the effectiveness of its global outreach.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Engages directly with airlines, leasing companies, OEMs. | Secured significant multi-year contracts, driving revenue growth. |

| Official Website | Online inventory, MRO services, asset management, company information. | Central hub for learning about offerings and performance. |

| Industry Events | Showcases solutions, connects with global clientele. | Highlighted expanded Part 145 MRO capabilities. |

| Foreign Representation/Contract Services | Expands market presence in specific regions. | Crucial for international operations, contributing to 30% of 2024 revenue. |

| Investor/Public Relations | Communicates financial health, strategy, value proposition. | Builds market confidence and attracts partners; highlighted strong MRO revenue growth in Q1 2024. |

Customer Segments

Commercial airlines, encompassing both passenger and cargo operations worldwide, represent a crucial customer segment. This includes everything from the largest global carriers to smaller regional airlines, all facing similar pressures to optimize their fleets and operations.

These airlines are actively seeking economical solutions for maintaining their aircraft, sourcing replacement parts, and acquiring or leasing new planes. For instance, in 2024, airlines are keenly focused on managing capital expenditures, with many deferring new aircraft orders due to economic uncertainty, making AerSale's offerings for used aircraft and parts particularly attractive.

The primary driver for these customers is the need to reduce operational costs and modernize their fleets efficiently. With global air travel demand showing a strong rebound in 2024, airlines are under pressure to expand capacity while simultaneously controlling expenses, making cost-effective maintenance and acquisition strategies paramount.

Aircraft leasing companies are a crucial customer segment for AerSale, as they consistently need maintenance, repair, and overhaul (MRO) services, as well as parts and asset management for their extensive fleets. These lessors rely on AerSale to preserve the value and operational readiness of their aircraft and engines throughout the leasing cycle.

AerSale's expertise is vital for lessors in managing aircraft that have reached the end of their lease terms or operational life. For instance, in 2024, the global aircraft leasing market continued its robust growth, with major lessors managing portfolios often exceeding hundreds of aircraft, each requiring specialized lifecycle management services that AerSale provides.

AerSale partners with Original Equipment Manufacturers (OEMs) by supplying them with Used Serviceable Material (USM), which can supplement their new production. This also offers a valuable avenue for OEMs to manage their aging fleet components and returns through AerSale's asset management services.

Government and Defense Contractors

Government and defense contractors represent a crucial customer segment for AerSale, seeking specialized aftermarket aviation products and services to maintain their fleets. These entities often require components and solutions that adhere to stringent military specifications and operational demands.

AerSale has a proven track record of supporting government programs, including the provision of parts and services for military transport aircraft. This capability highlights their understanding of the unique needs within the defense sector.

- Specialized Needs: Defense clients require parts and services that meet rigorous military standards and operational requirements, often for aging aircraft fleets.

- Program Support: AerSale's history includes supplying components and services for military transport aircraft, demonstrating their ability to integrate into government procurement processes.

- Fleet Modernization: Many government and defense entities are looking to extend the life of their existing aircraft through cost-effective aftermarket solutions, a niche AerSale effectively fills.

- Regulatory Compliance: Adherence to strict defense industry regulations and certifications is paramount for this customer segment, an area where AerSale's expertise is vital.

Independent MRO Providers

AerSale supports other independent Maintenance, Repair, and Overhaul (MRO) providers by supplying them with Used Serviceable Materials (USM) and components. This crucial B2B relationship allows these independent MROs to access reliable, cost-effective parts, thereby enhancing their own operational efficiency and reducing project turnaround times.

For instance, in 2024, the global aviation MRO market was valued at approximately $100 billion, with independent MROs playing a significant role. By providing USM, AerSale directly contributes to the competitiveness of these smaller players, enabling them to offer more attractive pricing and faster service to their own clientele.

- Cost Reduction: Independent MROs can significantly lower their material acquisition costs by sourcing USM from AerSale, compared to purchasing new parts.

- Improved Turnaround Times: Access to readily available USM helps independent MROs expedite repairs and maintenance, leading to quicker aircraft availability for their customers.

- Expanded Service Offerings: By having a reliable source for components, independent MROs can broaden the range of services they offer.

- Market Competitiveness: AerSale's support helps independent MROs compete more effectively against larger, vertically integrated maintenance providers.

AerSale's customer base is diverse, primarily serving commercial airlines, aircraft leasing companies, and government entities. These clients seek cost-effective solutions for aircraft maintenance, parts, and fleet management.

In 2024, commercial airlines are prioritizing cost control and fleet optimization, making AerSale's offerings for used aircraft and parts particularly valuable. Aircraft leasing companies also rely on AerSale for lifecycle management of their extensive portfolios.

Government and defense contractors represent another key segment, requiring specialized aftermarket aviation products that meet stringent military specifications. Independent MRO providers also benefit from AerSale's supply of Used Serviceable Material (USM), enhancing their competitiveness.

| Customer Segment | Key Needs | 2024 Relevance |

| Commercial Airlines | Cost-effective maintenance, parts, fleet optimization | High demand for used aircraft and parts due to capital expenditure management |

| Aircraft Leasing Companies | MRO services, parts, asset management, lifecycle management | Continued growth in leasing market necessitates specialized fleet management |

| Government & Defense | Specialized aftermarket products, military-spec components | Need for cost-effective solutions to maintain aging military fleets |

| Independent MROs | Used Serviceable Material (USM), components | Access to reliable, cost-effective parts to improve efficiency and competitiveness |

Cost Structure

AerSale's cost structure heavily relies on the significant capital outlay for acquiring used aircraft, engines, and substantial component inventories. These purchases are foundational, ensuring a robust supply for their sales and leasing divisions, and providing the necessary materials for their maintenance, repair, and overhaul (MRO) and used serviceable material (USM) businesses.

For instance, in 2024, the market for used aircraft and engines saw continued demand, with prices fluctuating based on aircraft type, age, and condition. AerSale's strategic procurement in this area directly impacts its ability to fulfill customer orders and maintain competitive inventory levels, a key driver of their operational expenses.

AerSale's Maintenance, Repair, and Overhaul (MRO) operations incur substantial costs. These include the wages for highly skilled technicians and engineers, essential for complex aircraft maintenance. In 2024, the demand for these specialized roles continued to drive up labor expenses significantly within the aviation MRO sector.

Furthermore, the acquisition and upkeep of specialized tooling and equipment, along with facility maintenance, represent considerable outlays. The procurement of repair materials, often including expensive parts and consumables, also adds to the overall operational expenditure for AerSale's MRO segment.

AerSale's extensive physical inventory of aircraft, engines, and parts necessitates significant expenses for storage, insurance, and security. In 2024, effective inventory management is paramount to controlling these substantial carrying costs.

Personnel and Administrative Expenses

AerSale's cost structure heavily relies on personnel and administrative expenses, reflecting the significant investment in its diverse workforce. This includes compensation and benefits for sales, technical, administrative, and management staff, crucial for supporting its aircraft and parts lifecycle management operations.

These costs are substantial, encompassing salaries, comprehensive benefits packages, and ongoing training to maintain a high level of expertise across the organization. For instance, in 2023, AerSale reported selling, general, and administrative expenses of $178.3 million, underscoring the scale of these operational outlays.

- Salaries and Wages: Direct compensation for all employees, from technical specialists to sales representatives.

- Employee Benefits: Health insurance, retirement plans, and other benefits provided to the workforce.

- Training and Development: Investment in upskilling technical staff and professional development for management.

- General and Administrative Costs: Includes corporate overhead, rent, utilities, and professional services like legal and accounting.

Logistics and Transportation Costs

AerSale's global operations mean significant investment in moving aircraft, engines, and parts worldwide. These logistics are essential for transporting specialized aviation assets to and from their facilities and clients.

In 2024, the aviation industry continued to grapple with elevated fuel prices and supply chain complexities, directly impacting AerSale's transportation expenses. For instance, the average cost of jet fuel saw fluctuations throughout the year, influencing the overall expenditure on shipping large aviation components across international borders.

- Global Shipping Expenses: Costs associated with the international movement of aircraft, engines, and spare parts.

- Fuel Price Impact: Fluctuations in global fuel prices directly affect the cost of transporting heavy aviation assets.

- Supply Chain Management: Investments in managing and optimizing the complex supply chain for aviation components.

AerSale's cost structure is dominated by the acquisition of used aircraft and engines, as well as the significant expenses associated with their MRO operations, including skilled labor and specialized equipment. These core activities are supported by substantial personnel and administrative costs, alongside considerable global logistics and transportation expenditures, all of which are sensitive to market conditions like fuel prices.

| Cost Category | Key Components | 2023 Data (USD Millions) | 2024 Relevance |

|---|---|---|---|

| Asset Acquisition | Used Aircraft & Engines | Not Separately Disclosed | High capital outlay, market price sensitive |

| MRO Operations | Labor, Tooling, Materials | Not Separately Disclosed | Demand for skilled technicians, material costs |

| Personnel & Admin | Salaries, Benefits, Overhead | 178.3 (SG&A) | Significant workforce investment |

| Logistics & Transport | Shipping, Fuel, Supply Chain | Not Separately Disclosed | Impacted by fuel prices and supply chain complexity |

Revenue Streams

AerSale generates substantial revenue by directly selling pre-owned commercial aircraft and their engines. This core business caters to airlines, leasing firms, and various other aviation entities looking for cost-effective fleet solutions.

These significant transactions are a major driver of AerSale's overall income. For instance, in 2023, the company reported total revenues of $451.7 million, with aircraft and engine sales forming a critical component of this figure.

AerSale generates consistent income by leasing its aircraft and engines. These leasing arrangements, often structured as dry leases or leaseback agreements, create a reliable and predictable revenue stream. This recurring income is a key component of their financial stability.

The company's lease pool is a steadily expanding asset, contributing to the predictability of its earnings. For instance, in 2023, AerSale reported that its aircraft and engine leasing segment continued to be a significant driver of its financial performance, underscoring the value of this recurring revenue model.

AerSale generates significant revenue by selling certified Used Serviceable Material (USM) sourced from aircraft and engine teardowns. This segment provides customers with cost-effective alternatives to new parts, catering to a growing demand for affordable aftermarket components.

This USM sales channel represents a high-margin business for AerSale. For instance, in the first quarter of 2024, AerSale reported that its USM segment contributed substantially to its overall performance, with strong demand continuing from the previous year.

Maintenance, Repair, and Overhaul (MRO) Service Fees

AerSale generates significant income by offering a wide array of Maintenance, Repair, and Overhaul (MRO) services for commercial aircraft and their components. This includes everything from extensive heavy maintenance checks and complex modifications to specialized component MRO. This focus on MRO represents a strategic move by the company to bolster its higher-margin, recurring service revenue.

This strategic emphasis on MRO services is proving to be a robust revenue driver for AerSale. For instance, in the first quarter of 2024, AerSale reported that its MRO segment contributed significantly to its overall performance, highlighting the growing importance of these services. This trend is expected to continue as airlines increasingly outsource these critical functions.

The MRO service fees contribute to AerSale's business model in several key ways:

- Diversified Income: Provides a steady stream of revenue beyond aircraft sales.

- Higher Margins: MRO services typically command better profit margins compared to aircraft sales.

- Customer Retention: Offering comprehensive MRO fosters stronger, long-term relationships with clients.

- Strategic Growth: Positions AerSale as a full-service provider in the aviation lifecycle.

Aircraft Storage and Disassembly Fees

AerSale generates income by offering secure storage solutions for aircraft, a crucial step before their eventual disassembly. These storage services are often the initial phase for aircraft destined for the Used Serviceable Material (USM) market, forming a key part of their comprehensive asset lifecycle management.

Beyond storage, AerSale also collects fees for the de-commissioning and disassembly of aging aircraft. This process is vital for extracting valuable components and managing the end-of-life cycle of aviation assets. In 2024, the company continued to see robust demand for these services, driven by fleet modernization efforts worldwide.

- Aircraft Storage: Providing secure and compliant facilities for aircraft awaiting disposition or repurposing.

- Disassembly Fees: Charging for the meticulous process of dismantling aircraft to salvage usable parts.

- Asset Lifecycle Management: Completing the value chain from storage to disassembly, preparing components for the USM market.

AerSale's revenue streams are diverse, encompassing the sale of pre-owned aircraft and engines, leasing of these assets, and the sale of Used Serviceable Material (USM). Additionally, the company profits from Maintenance, Repair, and Overhaul (MRO) services and aircraft storage and disassembly. This multi-faceted approach ensures multiple avenues for income generation within the aviation aftermarket.

In 2023, AerSale reported total revenues of $451.7 million, with aircraft and engine sales, leasing, and USM sales being significant contributors. The company's strategic focus on MRO services in early 2024 also showed strong performance, indicating a growing reliance on higher-margin service revenue.

| Revenue Stream | Description | 2023 Contribution (Illustrative) | 2024 Outlook |

|---|---|---|---|

| Aircraft & Engine Sales | Direct sale of pre-owned commercial aircraft and engines. | Major component of $451.7M total revenue. | Continued strong demand expected. |

| Aircraft & Engine Leasing | Leasing aircraft and engines to airlines and leasing firms. | Significant recurring revenue driver. | Lease pool expansion supports predictable earnings. |

| Used Serviceable Material (USM) | Sale of certified parts from aircraft teardowns. | High-margin business with substantial contribution. | Robust demand continues from previous year. |

| MRO Services | Maintenance, Repair, and Overhaul services. | Growing importance, contributing significantly in Q1 2024. | Expected to be a key growth area. |

| Storage & Disassembly | Aircraft storage, de-commissioning, and disassembly fees. | Key part of asset lifecycle management. | Strong demand driven by fleet modernization. |

Business Model Canvas Data Sources

The AerSale Business Model Canvas is constructed using a blend of internal financial statements, customer feedback, and operational performance metrics. These data sources provide a comprehensive view of AerSale's current business and inform strategic decisions.