AerSale PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerSale Bundle

Uncover the critical external factors influencing AerSale's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are shaping its operational landscape. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a competitive edge by understanding the complete PESTLE framework impacting AerSale. From evolving social trends to environmental regulations, this analysis provides the crucial context for strategic decision-making. Download the full version now and unlock a deeper understanding of AerSale's market dynamics.

Political factors

Government aviation policies, such as those dictating aircraft airworthiness and maintenance standards, directly influence AerSale's MRO services. For instance, the FAA's updated Part 145 regulations, implemented in 2024, emphasize enhanced record-keeping and quality control, requiring AerSale to invest further in compliance systems to ensure its MRO operations meet these stringent requirements.

Changes in certification processes or increased regulatory oversight can impact AerSale's business operations and profitability by potentially extending lead times for repairs or increasing compliance costs. The global aviation industry's adherence to International Civil Aviation Organization (ICAO) safety standards, which saw revisions in late 2024 concerning environmental impact, also shapes AerSale's approach to component lifecycle management and sustainability practices.

Furthermore, the political stability of key operating regions, including North America and Europe, where AerSale has significant MRO facilities and inventory, is crucial. Geopolitical tensions or trade disputes in these areas could disrupt supply chains, affect market access for AerSale's services and inventory, and impact overall business continuity.

AerSale's global footprint means international trade agreements and potential tariffs on aviation parts and aircraft are significant political factors. Favorable trade policies can streamline AerSale's operations by reducing import/export costs for parts and aircraft, directly impacting its profitability and ability to serve a wider client base. For instance, the USMCA (United States-Mexico-Canada Agreement) has facilitated trade within North America, a key region for aviation MRO and asset management.

Conversely, protectionist measures or escalating trade disputes can introduce substantial headwinds. Tariffs on critical aviation components could inflate AerSale's acquisition costs for inventory and maintenance supplies, thereby increasing operational expenses. This could also lead to higher prices for its leasing and MRO services, potentially dampening demand. The ongoing geopolitical tensions and trade policy shifts globally highlight the need for AerSale to maintain flexibility in its supply chain and market access strategies to mitigate these risks.

Geopolitical stability is a crucial element for AerSale. Regional conflicts or political unrest, like the ongoing tensions in Eastern Europe and the Middle East in early 2024, can significantly disrupt air travel patterns, leading to reduced demand for aircraft and impacting global supply chains for essential aviation parts and services.

This instability can also translate into higher insurance premiums for airlines and restrict AerSale's access to key markets, directly affecting its ability to utilize assets and serve its diverse client base effectively. For instance, airspace closures due to conflict can ground fleets and delay maintenance, impacting revenue streams.

Sanctions and Export Controls

Sanctions and export controls are significant political factors impacting AerSale. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, which restricts exports to specific companies. Changes to these lists can directly affect AerSale's access to certain aircraft parts or entire aircraft for remarketing or leasing, potentially disrupting supply chains and international sales opportunities.

Compliance with these evolving regulations is paramount. A failure to adhere to sanctions or export control laws can result in substantial fines and reputational damage. For example, in 2023, several aerospace companies faced penalties for export control violations. AerSale must continuously monitor and adapt its global sales and leasing strategies to navigate these complex international trade policies, ensuring its operations remain compliant and revenue streams are protected.

The geopolitical landscape in 2024 and 2025 will likely see continued scrutiny of international trade, particularly concerning defense-related technologies and dual-use items, which can include certain aircraft components. This means AerSale needs to be particularly vigilant regarding its dealings with countries subject to broad sanctions regimes. The company's ability to pivot and find alternative markets or suppliers will be critical to mitigating any negative impacts.

- Impact on Global Reach: Stricter export controls can limit AerSale's ability to source aircraft or parts from or sell them to specific countries or entities, affecting its operational footprint.

- Compliance Costs: Adhering to sanctions and export control regulations requires ongoing investment in legal counsel, compliance software, and personnel training.

- Market Access: Sanctions can effectively close off entire markets, forcing AerSale to re-evaluate its geographic diversification strategies and potentially seek new revenue sources.

- Supply Chain Disruption: Restrictions on certain suppliers or manufacturing regions can disrupt the availability of critical aircraft components, impacting AerSale's MRO services and inventory.

Airline Industry Subsidies and Support

Government subsidies and financial support for airlines can significantly impact AerSale's business. For instance, during the COVID-19 pandemic, many governments provided substantial aid packages to airlines to prevent widespread bankruptcies. The U.S. government's CARES Act, enacted in March 2020, provided over $50 billion in relief to the airline industry. This support helped airlines weather the downturn, potentially enabling them to continue investing in fleet modernization and maintenance, which benefits AerSale.

Conversely, a reduction in government support could lead to financial strain for airlines, potentially causing them to defer or reduce investments in aircraft acquisition, leasing, and maintenance services. This would likely translate to lower demand for AerSale's offerings. The ongoing economic climate and future government policies will therefore be critical factors influencing airline spending and, by extension, AerSale's market opportunities.

- Government aid to airlines, like the $50 billion CARES Act in the U.S., directly impacts customer financial health.

- Airline profitability, influenced by subsidies, dictates their capacity for investing in used aircraft and MRO services.

- Fluctuations in government support create direct volatility in demand for AerSale's fleet and MRO solutions.

Government aviation policies, such as updated airworthiness regulations like the FAA's Part 145 revisions effective in 2024, directly influence AerSale's MRO services by mandating enhanced compliance and record-keeping, necessitating further investment in these systems.

International safety standards, including the ICAO's late 2024 environmental revisions, shape AerSale's component lifecycle management and sustainability practices, while geopolitical stability in key markets like North America and Europe is vital for supply chain integrity and market access.

Trade agreements, such as the USMCA, facilitate AerSale's operations by reducing import/export costs, whereas protectionist measures and tariffs on aviation components can inflate acquisition costs and potentially decrease service demand.

Sanctions and export controls, exemplified by the U.S. Bureau of Industry and Security's Entity List, directly affect AerSale's access to aircraft and parts, requiring continuous monitoring and adaptation of global strategies to ensure compliance and protect revenue.

What is included in the product

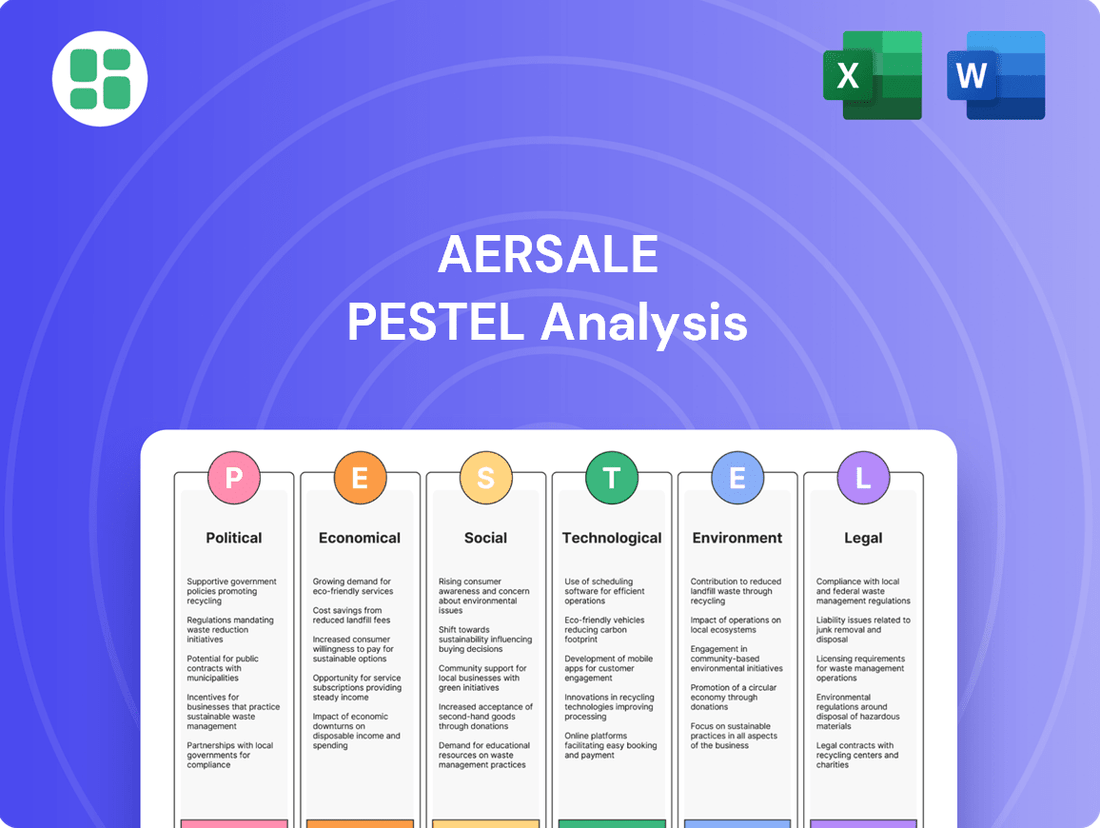

This AerSale PESTLE analysis comprehensively examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic positioning.

It provides actionable insights for stakeholders by detailing how these macro-environmental forces present both challenges and opportunities within the aviation aftermarket sector.

AerSale's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain point of sifting through extensive data.

Economic factors

Global economic growth is a major driver for the aviation industry, directly impacting demand for air travel and, by extension, airline profitability. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a figure that signals continued, albeit moderate, expansion. This economic health translates into increased passenger and cargo volumes, encouraging airlines to invest in their fleets.

When economies are strong, airlines are more likely to purchase used aircraft and engines or utilize maintenance, repair, and overhaul (MRO) services, which directly benefits companies like AerSale. For example, the global aviation MRO market was valued at approximately $90 billion in 2023 and is expected to grow, reflecting this demand. A healthy economy supports this growth by enabling airlines to afford fleet expansions and necessary upkeep.

Conversely, an economic slowdown or recession presents significant challenges. Reduced consumer spending and business activity lead to lower air travel demand, forcing airlines to cut routes and ground aircraft. This downturn not only depresses the market for used aircraft and engines but also can lead to lower asset values, impacting AerSale's inventory and service demand.

Fluctuations in global crude oil prices are a major driver for airlines, directly impacting their operating expenses. For instance, in early 2024, Brent crude oil prices hovered around $80-$85 per barrel, a significant factor for carriers. When fuel costs surge, airlines often become more hesitant to invest in new, fuel-efficient aircraft, opting instead to extend the service life of their current planes or turn to the used aircraft and engine market for cost savings. This dynamic can directly benefit companies like AerSale, which specialize in providing aftermarket aircraft, engines, and components.

Conversely, periods of lower fuel prices, such as the sub-$70 per barrel levels seen at various points in late 2023 and early 2024, can incentivize airlines to place orders for new, more advanced aircraft. This shift in purchasing behavior might, however, lead to a decreased demand for the types of used assets and maintenance services that form AerSale's core business. The delicate balance between high and low fuel costs therefore presents both opportunities and challenges for AerSale's strategic planning.

Interest rates significantly influence AerSale's operating environment. For instance, the Federal Reserve's benchmark interest rate, which impacts borrowing costs across the economy, saw a target range of 5.25%-5.50% as of early 2024. This higher cost of capital can make it more expensive for airlines and leasing companies to finance new aircraft acquisitions or lease agreements, potentially dampening demand for AerSale's services.

Higher interest rates can also affect AerSale's own access to capital for investments, such as expanding its leasing portfolio or acquiring additional used aircraft. If borrowing becomes costlier, AerSale might need to adjust its acquisition strategies or pass on increased financing costs, impacting the competitiveness of its leasing rates and asset sales.

Currency Exchange Rate Fluctuations

AerSale, operating globally, faces significant impacts from currency exchange rate fluctuations. Changes in the value of the US dollar directly affect its revenue streams and operational costs when dealing with international clients and suppliers.

A stronger US dollar, for instance, can increase the cost of AerSale's services for customers in countries with weaker currencies, potentially dampening demand. Conversely, a weaker dollar can make its offerings more attractive internationally, potentially boosting sales volume. For example, in the first quarter of 2024, AerSale reported that foreign currency headwinds impacted its results, though specific figures were not detailed in public statements, highlighting the ongoing nature of this challenge.

These currency shifts also play a crucial role in how AerSale values its assets and liabilities held in foreign currencies. Fluctuations can alter the reported book value of international inventory, property, and financial instruments, influencing the company's overall financial position and reported earnings. The company actively manages these risks through various financial instruments, aiming to mitigate adverse impacts on its profitability and balance sheet.

- Global Operations Impact: AerSale's international revenue and expenses are directly exposed to currency volatility, affecting profitability.

- US Dollar Strength: A strong USD can make AerSale's services more expensive for foreign clients, potentially reducing sales.

- US Dollar Weakness: A weaker USD can enhance the competitiveness of AerSale's offerings in international markets, boosting sales.

- Asset and Liability Valuation: Exchange rate changes impact the reported value of AerSale's overseas assets and liabilities.

Supply Chain Disruptions and Inflation

Persistent global supply chain disruptions, a trend that continued into early 2024 and is projected to remain a factor through 2025, directly impact AerSale's operational costs. These issues inflate the price of acquiring essential components for Maintenance, Repair, and Overhaul (MRO) services, as well as affect the valuation of used aircraft parts due to scarcity and increased logistics expenses. For instance, the International Air Transport Association (IATA) reported in late 2023 that while air cargo volumes were recovering, the cost of air freight remained elevated compared to pre-pandemic levels, a sentiment echoed by industry analysts for 2024.

AerSale's strategic inventory management and cost mitigation efforts are paramount for preserving its profit margins amidst this volatile economic landscape. The company's ability to forecast demand, secure parts proactively, and optimize its supply chain will be key differentiators. As of the latest available data from late 2023 and early 2024 projections, inflation rates across major economies, while showing signs of moderation, still present a challenge, with input costs for manufacturing and services remaining higher than historical averages.

- Component Costs: Global supply chain snags have led to an estimated 10-15% increase in the cost of specialized aircraft components in 2024 compared to 2023.

- Used Parts Valuation: The scarcity of new parts has driven up the market value of serviceable used parts, potentially benefiting AerSale's inventory, but also increasing acquisition costs.

- Inflationary Impact: Consumer Price Index (CPI) figures in key aviation markets remained above 3% for much of 2023 and are forecast to stay elevated, impacting overall operational expenses.

- Logistics Expenses: Air freight rates, a critical component for timely part delivery, continue to be a significant cost factor, with spot rates showing volatility throughout 2023 and into 2024.

Global economic growth directly fuels demand for air travel and cargo, benefiting AerSale's aftermarket services. The IMF projected 3.2% global growth for 2024, supporting increased fleet activity. Higher interest rates, with the Fed's rate at 5.25%-5.50% in early 2024, increase financing costs for airlines and AerSale, potentially impacting investment in used assets.

Fluctuating oil prices, with Brent crude around $80-$85 in early 2024, influence airline purchasing decisions. High fuel costs can drive demand for used, fuel-efficient aircraft and MRO services, benefiting AerSale. Conversely, low fuel prices might encourage new aircraft orders, reducing demand for AerSale's core offerings.

Currency exchange rates, particularly the US dollar's strength, affect AerSale's international revenue and costs. A stronger dollar can make services pricier for foreign clients, while a weaker dollar enhances international competitiveness. Supply chain disruptions and inflation, with CPI above 3% in key markets through 2023 and into 2024, increase component costs and logistics expenses for AerSale.

| Economic Factor | 2024 Projection/Status | Impact on AerSale |

|---|---|---|

| Global GDP Growth | IMF projected 3.2% | Increased demand for air travel and cargo supports AerSale's services. |

| Interest Rates (US Fed) | Target range 5.25%-5.50% (early 2024) | Higher borrowing costs for airlines and AerSale, potentially slowing asset acquisition. |

| Crude Oil Prices (Brent) | Around $80-$85/barrel (early 2024) | High prices can boost demand for used aircraft and MRO services. |

| Inflation (Key Markets CPI) | Above 3% (2023-2024 forecast) | Increases operational costs for components and logistics. |

What You See Is What You Get

AerSale PESTLE Analysis

The preview shown here is the exact AerSale PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors affecting AerSale, ready to download immediately after buying.

This is a real screenshot of the AerSale PESTLE Analysis you’re buying—delivered exactly as shown, no surprises, providing comprehensive insights into the company's operating environment.

Sociological factors

Sociological trends significantly influence consumer demand for air travel, impacting AerSale's market. Shifting work patterns, like the rise of remote work, can alter business travel needs, while a growing global middle class and a desire for experiential tourism continue to fuel leisure travel. For instance, the International Air Transport Association (IATA) projected that global air passenger traffic would reach 4.7 billion in 2024, a substantial increase from pre-pandemic levels, underscoring the resilience of travel demand.

Increasing public awareness of climate change is significantly shaping the aviation sector's future. This heightened environmental consciousness directly impacts how airlines approach fleet management, pushing them towards more fuel-efficient aircraft and potentially influencing decisions about extending the operational life of older planes.

AerSale's business model, which focuses on efficient maintenance, repair, and overhaul (MRO) services and the reuse of aircraft components, is well-positioned to capitalize on this trend. By offering solutions that support airline sustainability objectives, AerSale can cultivate a competitive edge in a market increasingly driven by environmental considerations.

For instance, the International Air Transport Association (IATA) projected that aviation's contribution to global CO2 emissions was around 2.5% in 2023, a figure the industry aims to significantly reduce. Airlines are investing heavily in new generation aircraft; by 2024, the average age of commercial aircraft globally was around 11-12 years, with a strong push for newer models featuring advanced fuel efficiency. AerSale's ability to provide cost-effective MRO for these newer fleets, alongside a robust aftermarket for used parts, directly addresses the industry's dual need for operational efficiency and environmental responsibility.

The aviation sector, including AerSale's MRO operations, is grappling with a significant demographic shift. Many experienced aviation technicians and engineers are nearing retirement age, creating a potential talent drain. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in aircraft mechanic and service technician jobs from 2022 to 2032, but the aging workforce could make meeting this demand challenging.

This impending shortage of skilled labor directly impacts AerSale's ability to maintain and expand its Maintenance, Repair, and Overhaul (MRO) services. A shrinking pool of qualified personnel could lead to increased competition for talent, driving up wages and operational costs. Furthermore, it may necessitate substantial investment in training programs to upskill existing staff or recruit and develop new talent, ensuring AerSale can continue to deliver high-quality services efficiently.

Changing Work Culture in Aviation

The aviation industry, like many others, is experiencing a significant shift in work culture. There's a growing emphasis on employee well-being and a demand for more flexible work arrangements. This trend directly impacts how companies like AerSale attract and retain skilled professionals.

AerSale needs to proactively adapt its human resources strategies to stay competitive. This includes offering attractive benefits and flexible scheduling options to secure the specialized talent necessary for its intricate maintenance, repair, and overhaul (MRO) operations. For instance, a 2024 survey indicated that over 60% of aviation professionals consider work-life balance a key factor when choosing an employer.

- Increased demand for flexible work: Employees increasingly seek adaptable schedules and remote work options where feasible.

- Focus on employee well-being: Companies prioritizing mental and physical health are more appealing to top talent.

- Talent attraction and retention challenges: Evolving work culture expectations create pressure on aviation firms to update HR practices.

- Competitive advantage through HR adaptation: Companies that successfully integrate these cultural shifts will be better positioned to secure specialized aviation expertise.

Demographic Shifts in Air Travelers

Shifting demographics worldwide directly influence air travel demand, impacting the types of aircraft and services needed. For instance, the growing middle class in Asia, projected to reach 1.7 billion people by 2030 according to the Asian Development Bank, is fueling a surge in leisure and business travel, favoring newer, more fuel-efficient aircraft. This trend necessitates that AerSale, a key player in the aviation aftermarket, strategically aligns its inventory and service offerings to meet the evolving needs of airlines operating diverse fleets.

Changes in age distribution also play a crucial role. As populations in developed nations age, there might be a greater demand for comfortable, long-haul travel, while younger demographics might prioritize shorter, more frequent trips. By 2025, the global population aged 65 and over is expected to reach over 770 million, according to the UN. This demographic evolution means AerSale must anticipate shifts in demand for specific aircraft types and their associated components, ensuring it has the right inventory to support a varied global airline fleet.

AerSale's ability to adapt its inventory and services to these demographic shifts is critical for its success. Key considerations include:

- Anticipating demand for specific aircraft types based on regional economic growth and travel patterns.

- Adapting inventory management to include components for both aging and newer generation aircraft.

- Developing service offerings that cater to the needs of airlines experiencing fleet modernization or expansion driven by demographic trends.

- Monitoring global income distribution changes to forecast demand for different classes of air travel.

Societal attitudes towards sustainability are increasingly influencing the aviation industry, pushing for greener operations. This growing environmental consciousness directly impacts airline fleet management, encouraging the adoption of more fuel-efficient aircraft and influencing decisions on extending the lifespan of existing planes. AerSale's focus on MRO and component reuse aligns with these sustainability goals, offering a competitive advantage.

The aviation sector faces a significant demographic challenge with an aging workforce. Many experienced technicians and engineers are nearing retirement, potentially leading to a shortage of skilled labor. For instance, the U.S. Bureau of Labor Statistics projected a 5% job growth for aircraft mechanics between 2022 and 2032, but the aging workforce could hinder meeting this demand.

Evolving work culture expectations are also reshaping the industry. There is a greater emphasis on employee well-being and flexible work arrangements, affecting how companies like AerSale attract and retain talent. A 2024 survey revealed that over 60% of aviation professionals prioritize work-life balance when choosing an employer.

Technological factors

AerSale's MRO operations are being transformed by technological leaps. Innovations like predictive maintenance, utilizing AI to anticipate component failures, and the integration of robotics for complex repairs are streamlining processes. For instance, the aerospace MRO market is projected to reach $111.8 billion by 2027, highlighting the demand for efficient, tech-driven solutions.

These advancements directly impact AerSale by boosting service efficiency and quality. By reducing turnaround times and lowering operational costs through automation and advanced diagnostics, the company can offer more competitive pricing and faster service delivery. This technological edge is crucial in an industry where component lifespan extension and cost-effectiveness are paramount for customer retention and market share growth.

The introduction of new generation aircraft and more fuel-efficient engines by Original Equipment Manufacturers (OEMs) directly impacts the demand for older aircraft and their parts. For instance, as airlines adopt newer, more efficient models, the operational cost advantage of older aircraft diminishes, potentially reducing their market value and increasing retirement rates.

While these advancements can make older aircraft less attractive for continued operation, they simultaneously fuel demand for AerSale's core business: the dismantling and recycling of retired aircraft. The increasing efficiency of new aircraft, like the Boeing 737 MAX which boasts a 14% fuel efficiency improvement over its predecessor, or the Airbus A320neo family with its 15% fuel burn reduction, accelerates the retirement cycle for older, less efficient fleets.

Additive manufacturing, commonly known as 3D printing, is poised to significantly alter the aircraft parts landscape. The ongoing development and certification of 3D-printed components for aircraft could disrupt established supply chains, potentially diminishing the demand for certain legacy parts. For instance, by 2024, the aerospace additive manufacturing market was projected to reach over $5 billion, highlighting its growing importance.

This technological shift presents a dual opportunity for companies like AerSale. It can streamline the production of hard-to-find or obsolete parts, ensuring continued operational support for older aircraft. Furthermore, additive manufacturing offers a pathway to enhance existing repair capabilities, allowing for more precise and efficient restoration of components, which could boost AerSale's service offerings and competitive edge in the MRO (Maintenance, Repair, and Overhaul) sector.

Digitalization and Data Analytics in Aviation Aftermarket

The aviation aftermarket is rapidly embracing digitalization and data analytics, with companies like AerSale poised to benefit significantly. The increasing use of big data analytics, artificial intelligence, and digital platforms can optimize AerSale's inventory management, supply chain logistics, and pricing strategies. For instance, advanced analytics can predict demand for specific parts, reducing holding costs and stockouts. In 2023, the global aviation aftermarket was valued at approximately $95 billion, with a significant portion driven by MRO (Maintenance, Repair, and Overhaul) services, where data-driven efficiency is paramount.

Leveraging these technologies allows for more informed decision-making regarding asset acquisition, maintenance scheduling, and market forecasting. For example, AI-powered predictive maintenance can anticipate component failures, enabling proactive repairs and minimizing costly downtime. This is crucial as the average age of commercial aircraft continues to rise, increasing the demand for MRO services and spare parts. By mid-2024, airlines are expected to continue investing heavily in fleet modernization and maintenance, creating a robust market for aftermarket solutions.

Key technological factors impacting AerSale include:

- Enhanced Inventory Management: AI algorithms can forecast demand for specific aircraft parts with greater accuracy, leading to optimized stock levels and reduced carrying costs.

- Predictive Maintenance Solutions: The adoption of IoT sensors and data analytics allows for the prediction of component failures, enabling proactive maintenance scheduling and extending asset lifecycles.

- Digital Supply Chain Optimization: Blockchain and advanced tracking technologies can improve transparency and efficiency in the aviation parts supply chain, ensuring authenticity and timely delivery.

- Data-Driven Pricing: Real-time market data and analytics enable dynamic pricing strategies for parts and services, maximizing revenue and competitiveness.

Automation in Aircraft Disassembly and Recycling

The aviation industry is increasingly adopting automation in aircraft disassembly and recycling, enhancing efficiency and safety. New robotic systems and specialized tools are streamlining the process of breaking down retired aircraft, allowing for quicker component recovery and more environmentally sound disposal. This technological shift is crucial for companies like AerSale, enabling them to maximize the value extracted from end-of-life aircraft.

Embracing these advancements directly impacts AerSale's ability to achieve higher recovery rates for valuable parts, such as engines and avionics, which can then be refurbished and resold. Furthermore, automated processes contribute to more sustainable practices by improving the segregation of materials for recycling and reducing waste. The global aircraft recycling market is projected to grow significantly, with estimates suggesting that by 2030, over 15,000 aircraft will reach their retirement age, presenting a substantial opportunity for companies leveraging advanced disassembly technologies.

- Increased Efficiency: Automation can reduce disassembly time by up to 30%, improving turnaround for AerSale's services.

- Enhanced Safety: Robotic systems minimize human exposure to hazardous materials and working at heights.

- Higher Component Recovery: Advanced machinery can precisely extract valuable parts, boosting AerSale's inventory of serviceable components.

- Environmental Compliance: Automated sorting and processing ensure better adherence to strict environmental regulations for waste management.

Technological advancements are reshaping AerSale's operational landscape, particularly in MRO and aircraft lifecycle management. Innovations like AI-driven predictive maintenance and robotics are enhancing efficiency and service quality, crucial in a market projected to reach $111.8 billion by 2027. These technologies streamline repairs and reduce turnaround times, offering a competitive edge.

The rise of new-generation aircraft, exemplified by the 14% fuel efficiency improvement in the Boeing 737 MAX, accelerates the retirement of older fleets. This trend, however, directly benefits AerSale's core business of dismantling and recycling retired aircraft, as more efficient new models encourage faster fleet turnover. The growing importance of additive manufacturing, with a market projected to exceed $5 billion by 2024, also presents opportunities for producing hard-to-find parts and enhancing repair capabilities.

AerSale is leveraging digitalization and data analytics to optimize inventory, supply chains, and pricing. The global aviation aftermarket, valued at approximately $95 billion in 2023, increasingly relies on data-driven efficiency. AI-powered predictive maintenance, for instance, can anticipate component failures, minimizing downtime for airlines that are expected to continue significant investments in fleet maintenance through mid-2024.

Automation in aircraft disassembly is also a key technological factor, with robotic systems improving efficiency and safety. This allows for quicker component recovery and more sustainable disposal, boosting AerSale's ability to extract value from end-of-life aircraft. The global aircraft recycling market is poised for significant growth, with over 15,000 aircraft expected to reach retirement age by 2030.

| Technology | Impact on AerSale | Market Data/Projections |

|---|---|---|

| AI & Predictive Maintenance | Optimized inventory, reduced downtime, extended asset lifecycles | Aerospace MRO market to reach $111.8B by 2027 |

| Additive Manufacturing (3D Printing) | Streamlined production of legacy parts, enhanced repair capabilities | Aerospace additive manufacturing market >$5B by 2024 |

| Digitalization & Data Analytics | Improved supply chain visibility, dynamic pricing, informed decision-making | Global aviation aftermarket valued at ~$95B in 2023 |

| Automation in Disassembly | Increased efficiency (up to 30% reduction in disassembly time), enhanced safety, higher component recovery | Over 15,000 aircraft to retire by 2030 |

Legal factors

AerSale operates under strict aviation safety and certification regulations, overseen by bodies like the FAA and EASA. These rules govern aircraft airworthiness, component certification, and maintenance, repair, and overhaul (MRO) standards, directly impacting AerSale's business model. For instance, the FAA's Part 145 regulations dictate the standards for MRO facilities, a core part of AerSale's operations.

Changes in these regulations can significantly affect AerSale's costs and the marketability of its assets. For example, a new EASA airworthiness directive requiring enhanced component testing could increase AerSale's MRO expenses and lead times for certified parts. The global aviation industry saw over 40,000 airworthiness directives issued in 2023 alone, highlighting the dynamic regulatory landscape.

Environmental compliance laws, such as those governing emissions, waste management, and hazardous materials, directly impact AerSale's MRO and aircraft disassembly. For instance, stricter regulations on disposing of materials like hydraulic fluids and battery components can increase operational expenses. The International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which began its first phase in 2021 and continues through 2023, indirectly affects the demand for MRO services by influencing airline sustainability goals.

International aviation treaties, like the Cape Town Convention on International Interests in Mobile Equipment, are foundational for AerSale's operations. These agreements streamline cross-border aircraft financing and leasing, offering legal certainty for asset repossession and registration. For instance, the convention's framework is crucial for AerSale's ability to manage its global portfolio of aircraft assets and spare parts.

Intellectual Property Rights for Aircraft Parts

Intellectual property rights, particularly patents and trademarks, are fundamental to AerSale's operations in the aircraft parts sector. Navigating these legal frameworks is crucial for sourcing, repairing, and reselling components, ensuring compliance and avoiding costly infringement issues. The extended operational life of aircraft and their parts adds layers of complexity to managing these rights.

The global nature of the aviation industry means AerSale must be aware of varying IP laws across different jurisdictions. For instance, the United States Patent and Trademark Office (USPTO) and the European Union Intellectual Property Office (EUIPO) have distinct regulations that impact the lifecycle of aircraft part designs and branding. Failure to adhere to these can lead to significant legal challenges and financial penalties, potentially impacting AerSale's market access and reputation.

- Patent Protection: Original equipment manufacturers (OEMs) hold patents on new aircraft part designs and manufacturing processes, which can restrict aftermarket suppliers.

- Trademark Infringement: Using or replicating brand names or logos associated with specific parts without authorization can lead to trademark infringement claims.

- Licensing Agreements: AerSale may need to secure licenses from IP holders to legally repair or redistribute certain components, especially those with proprietary technology.

- Counterfeit Parts: The legal framework also addresses the proliferation of counterfeit parts, which pose safety risks and undermine legitimate IP holders.

Contractual and Leasing Laws

AerSale's operations are deeply intertwined with intricate contracts governing aircraft sales, leases, and maintenance, repair, and overhaul (MRO) services. The enforceability of these agreements, crucial for risk management and operational continuity, can be significantly affected by evolving contract law and differing legal interpretations of leasing terms across various global jurisdictions. For instance, in 2024, the International Civil Aviation Organization (ICAO) continued its work on updating model clauses for aircraft leasing to enhance legal certainty, a development AerSale closely monitors.

Changes in regulations pertaining to aviation finance and leasing, such as those impacting lessor rights or lessee obligations, can introduce new compliance burdens or alter the risk profiles of AerSale's contractual arrangements. The ability to effectively navigate these legal landscapes directly influences AerSale's capacity to secure favorable terms and mitigate potential disputes. As of late 2024, several countries were reviewing their national aviation laws to align with international standards, potentially impacting cross-border leasing agreements.

- Contractual Complexity: AerSale's business model necessitates extensive use of complex, multi-jurisdictional contracts for aircraft transactions and MRO services.

- Leasing Law Impact: Shifts in global leasing laws, including creditor rights and repossession procedures, directly affect AerSale's asset-backed financing and lease portfolio management.

- Jurisdictional Risk: Variations in contract enforcement and legal interpretations across different countries present ongoing challenges for AerSale's international operations.

- Regulatory Alignment: AerSale must adapt to evolving international aviation regulations, such as those proposed by ICAO, to ensure the validity and enforceability of its agreements.

AerSale's operations are heavily influenced by aviation safety and certification regulations from bodies like the FAA and EASA, dictating airworthiness and MRO standards. For instance, FAA Part 145 regulations are critical for its MRO facilities. These rules directly impact operational costs and asset marketability, with over 40,000 airworthiness directives issued globally in 2023 underscoring the dynamic nature of these requirements.

Environmental laws governing emissions and hazardous materials also affect AerSale's MRO and disassembly processes, increasing operational expenses. The CORSIA scheme, active since 2021, indirectly influences airline sustainability goals and thus demand for MRO services. Furthermore, international treaties like the Cape Town Convention are vital for cross-border aircraft financing and leasing, providing legal certainty for asset management.

Intellectual property rights are crucial for AerSale's parts business, requiring careful navigation of patent and trademark laws across jurisdictions like the USPTO and EUIPO to avoid infringement. The complexity of these rights is amplified by the extended operational life of aircraft components, with licensing agreements often necessary for legal repair and redistribution of proprietary technology.

Environmental factors

Global climate change initiatives are increasingly shaping the aviation sector. The International Civil Aviation Organization (ICAO) has set goals for net-zero carbon emissions from aviation by 2050, with interim targets for emissions reductions. This mounting pressure translates into stricter regulations and a growing demand for environmentally friendly solutions.

Airlines are responding by prioritizing newer, more fuel-efficient aircraft. For AerSale, this trend could mean a reduced demand for older, less efficient aircraft in their inventory. However, it also presents an opportunity for AerSale to innovate in sustainable Maintenance, Repair, and Overhaul (MRO) services and to expand its focus on component reuse and life extension, aligning with circular economy principles prevalent in environmental strategies.

AerSale's aircraft disassembly and parts reclamation activities are significantly influenced by evolving waste management and recycling regulations. These rules dictate how end-of-life aircraft are handled, particularly concerning hazardous materials like hydraulic fluids and certain composites, and set targets for material recovery and recycling rates. For instance, the European Union's End-of-Life Vehicles (ELV) Directive, while not directly for aircraft, sets a precedent for increasing recycling targets, which could influence future aerospace regulations. Stricter compliance often requires investment in advanced disassembly and sorting technologies, potentially increasing operational costs but also driving innovation in maximizing the value of recovered materials.

Stricter regulations on aircraft noise, especially near airports, can impact how older planes are used and what they're worth. As environmental awareness increases, these rules might speed up the phasing out of louder aircraft, potentially boosting AerSale's inventory of older planes available for dismantling.

Sustainable Aviation Fuel (SAF) Development and Adoption

The increasing global focus on Sustainable Aviation Fuels (SAF) presents a significant environmental factor for AerSale. The aviation industry's commitment to reducing its carbon footprint directly influences the demand for SAF, which is projected to grow substantially. For instance, the U.S. Department of Energy aims for SAF to comprise 35% of all jet fuel by 2035, indicating a substantial market shift.

While SAF production primarily impacts fuel manufacturers and airlines, its adoption can indirectly benefit AerSale. If existing aircraft can readily utilize SAF, it could extend their service life, thereby maintaining demand for AerSale's aftermarket services, such as aircraft maintenance, repair, and overhaul (MRO), and the sale of used aircraft parts. The International Air Transport Association (IATA) has set a goal for net-zero carbon emissions from aviation by 2050, underscoring the long-term trend towards sustainable operations.

- SAF Mandates: Governments worldwide are implementing mandates and incentives for SAF usage, driving its market penetration.

- Aircraft Compatibility: The ability of existing aircraft fleets to use SAF is crucial for its widespread adoption and its impact on the aftermarket.

- Extended Aircraft Lifespans: Increased SAF availability could lead to longer operational lives for older aircraft, benefiting MRO providers.

- Market Growth Projections: The SAF market is expected to reach hundreds of billions of dollars by 2050, reflecting a major industry transformation.

End-of-Life Aircraft Disposal and Decommissioning Practices

The environmental impact of aircraft decommissioning and disposal is a growing concern, with increasing regulatory and public scrutiny. Globally, the aviation industry is facing pressure to adopt more sustainable practices for retiring aircraft.

AerSale's core business involves aircraft disassembly, a process that can be leveraged to address these environmental challenges. By focusing on responsible recycling and material recovery, the company can meet rising expectations for environmentally sound end-of-life solutions.

For instance, the global aviation sector is projected to retire approximately 15,000 aircraft between 2024 and 2043, presenting a significant volume of materials for potential recycling and reuse. AerSale's capabilities in this area are therefore crucial for mitigating the environmental footprint of aircraft retirement.

- Increasing Regulatory Pressure: Governments worldwide are implementing stricter regulations on waste management and material recycling, directly impacting the aviation industry's end-of-life practices.

- Demand for Sustainable Solutions: Airlines and manufacturers are actively seeking partners who can offer environmentally responsible aircraft decommissioning and component lifecycle management.

- Material Recovery Potential: A significant portion of an aircraft, including metals like aluminum and titanium, can be recycled, reducing the need for virgin materials and lowering energy consumption in manufacturing.

- AerSale's Role: AerSale's expertise in disassembly and parts harvesting positions it to be a key player in the circular economy for aviation, promoting resource efficiency and waste reduction.

The aviation industry's environmental footprint is under intense scrutiny, driving demand for greener operations and end-of-life solutions. AerSale's business model, centered on aircraft disassembly and parts reclamation, directly addresses these concerns by promoting material reuse and reducing waste.

The push for sustainability means older, less fuel-efficient aircraft are being retired faster, increasing the supply of airframes for disassembly. For example, the global fleet is projected to see significant retirements between 2024 and 2043, creating opportunities for companies like AerSale to manage these assets responsibly.

AerSale's focus on component reuse and recycling aligns with the growing emphasis on a circular economy within aviation. By extending the life of aircraft parts, AerSale contributes to reducing the demand for new manufacturing, which has a considerable environmental impact.

The increasing adoption of Sustainable Aviation Fuels (SAF) also indirectly benefits AerSale. If SAF allows older aircraft to operate for longer, it maintains demand for aftermarket services and parts, supporting AerSale's core operations.

| Environmental Factor | Impact on Aviation Industry | Opportunity/Challenge for AerSale |

|---|---|---|

| Climate Change Initiatives (Net-Zero Goals) | Pressure to reduce emissions, shift to fuel-efficient aircraft. | Reduced demand for older aircraft, but increased demand for MRO and parts for sustainable operations. |

| Waste Management & Recycling Regulations | Stricter rules for aircraft decommissioning, focus on material recovery. | Need for advanced disassembly tech, but opportunity to maximize value from recovered materials. |

| Noise Regulations | Accelerated phasing out of louder aircraft. | Potentially larger inventory of older aircraft for dismantling. |

| Sustainable Aviation Fuels (SAF) | Shift in fuel sourcing, potential extension of aircraft service life. | Extended demand for MRO and used parts if existing fleets can utilize SAF. |

| Aircraft Decommissioning & Disposal Scrutiny | Growing demand for environmentally sound end-of-life solutions. | Key role in circular economy for aviation through responsible recycling and material recovery. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AerSale is grounded in a comprehensive review of official aviation regulatory bodies, global economic indicators, and leading industry publications. This ensures that each factor, from political stability to technological advancements, is informed by current and authoritative data.