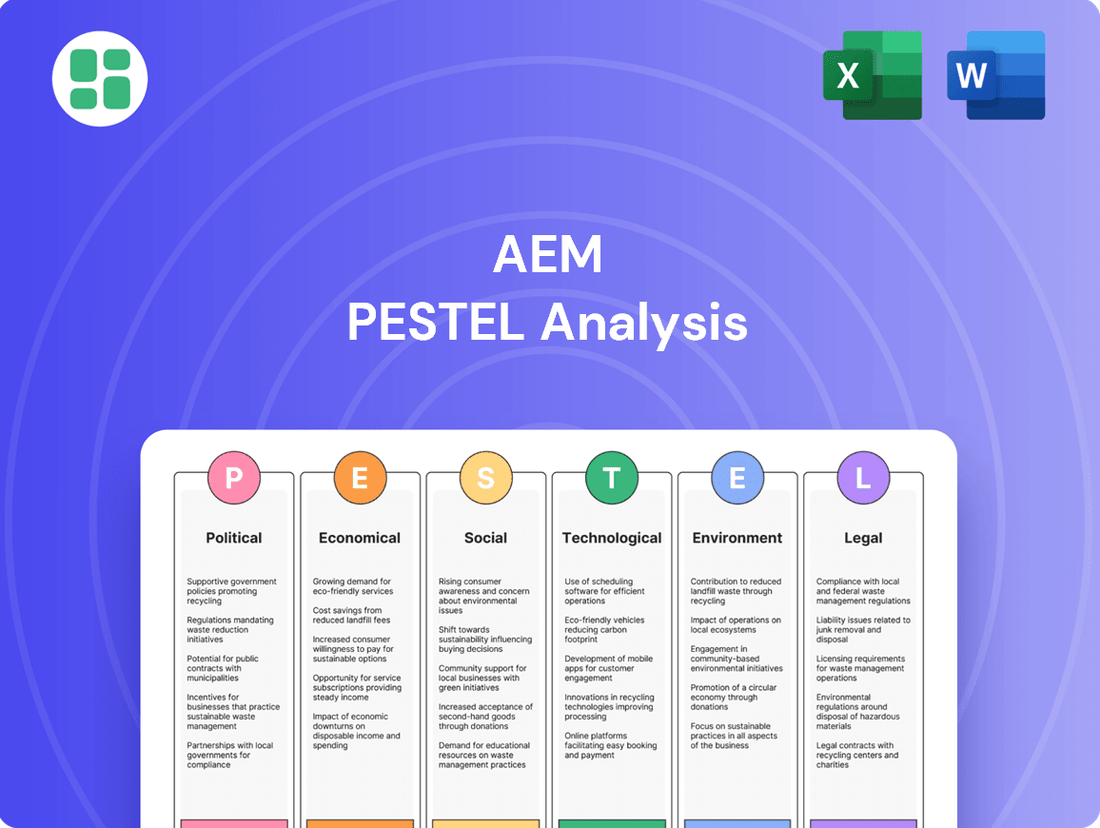

AEM PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEM Bundle

Navigate the complex external forces shaping Adobe Experience Manager (AEM) with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are influencing AEM's market position and future growth. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for in-depth insights.

Political factors

Geopolitical tensions, especially between major economies like the United States and China, cast a long shadow over the global semiconductor industry. For companies like AEM, which supplies crucial testing and handling equipment, these tensions can directly disrupt operations through export controls and tariffs. For example, the US Department of Commerce's Bureau of Industry and Security (BIS) has implemented various export controls on advanced technologies, directly impacting the flow of semiconductor manufacturing equipment and components. These measures can affect AEM's ability to source materials, sell its products in key markets, and navigate the evolving competitive landscape, as seen in the ongoing trade disputes that have seen fluctuating tariff rates applied to various goods, including those related to technology manufacturing.

Governments are actively promoting domestic semiconductor production, with initiatives like the US CHIPS and Science Act of 2022, which allocated $52.7 billion for domestic manufacturing and R&D. Similarly, Europe's European Chips Act aims to mobilize over €43 billion in public and private investments by 2030. These policies are designed to strengthen local supply chains and reduce geopolitical risks.

AEM, a key supplier to the semiconductor industry, stands to gain from this surge in government-backed capital expenditure. Increased investment in new fabrication plants and expansion projects in regions with robust industrial policies will likely translate into higher demand for AEM's testing and handling solutions.

The stability of regulatory frameworks in AEM's primary markets significantly influences its long-term strategic planning and capital allocation. Predictable and transparent regulations governing business operations, foreign investment, and intellectual property are paramount for sustained growth. For instance, in 2024, the semiconductor industry, a key sector for AEM, faced evolving export control regulations from the US and China, impacting supply chains and market access.

International Trade Agreements and Alliances

International trade agreements and alliances significantly influence AEM's global reach. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes countries like Japan, Canada, and Australia, can streamline AEM's access to these key markets by reducing tariffs and harmonizing regulations. Conversely, rising protectionist sentiments, such as those seen in trade disputes involving major economies, could impose higher duties on AEM's imports or exports, impacting its cost structure and market competitiveness. Staying abreast of evolving trade policies, like potential updates to the US-Mexico-Canada Agreement (USMCA) or new EU trade deals, is crucial for AEM to adapt its supply chain and market entry strategies effectively.

Key considerations for AEM regarding trade agreements include:

- Tariff Reduction: Agreements can lower import/export duties, directly impacting the cost of goods for AEM. For example, the EU's Generalized Scheme of Preferences (GSP) offers reduced tariffs for developing countries, potentially benefiting AEM's sourcing or sales in those regions.

- Market Access: Favorable terms can open new markets or deepen penetration in existing ones, as seen with bilateral trade agreements that eliminate non-tariff barriers.

- Regulatory Harmonization: Alignment on standards and regulations simplifies compliance and reduces operational friction for companies like AEM operating across multiple jurisdictions.

- Supply Chain Resilience: Understanding trade pacts helps AEM diversify sourcing and distribution, mitigating risks associated with protectionist measures or geopolitical shifts.

Cybersecurity Policies and National Security

AEM's position as a key supplier in the semiconductor industry places it directly under the purview of national security and cybersecurity policies. Governments worldwide are intensifying their focus on safeguarding critical infrastructure and technology companies from escalating cyber threats. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) continues to update its guidance for critical infrastructure sectors, with technology providers often falling under these mandates. Adherence to these evolving regulations is paramount for AEM to ensure its operational resilience and preserve the confidence of its global clientele.

The increasing emphasis on data sovereignty and supply chain security by nations like the United States and the European Union directly impacts companies like AEM. These policies often mandate specific cybersecurity standards and data handling protocols for critical technology components. Failure to comply can result in significant penalties and restricted market access, as seen with various international regulatory actions concerning data privacy and security in recent years. AEM must therefore proactively adapt its cybersecurity framework to meet these stringent, and often diverging, international requirements.

To navigate this complex regulatory landscape, AEM needs to demonstrate robust cybersecurity measures. This includes:

- Implementing advanced threat detection and response systems

- Ensuring secure software development lifecycle practices

- Maintaining strict access controls and data encryption protocols

- Regularly auditing and updating cybersecurity policies to align with emerging threats and governmental directives

Government initiatives like the US CHIPS Act, allocating $52.7 billion, and Europe's €43 billion European Chips Act underscore a global push for domestic semiconductor manufacturing. These policies directly benefit AEM by stimulating demand for its testing and handling solutions as new fabrication plants come online. For instance, in 2024, significant investments were announced for new semiconductor facilities in the US and Europe, creating opportunities for AEM.

Evolving export controls and trade policies, particularly between the US and China, present both challenges and opportunities. While these can disrupt supply chains, they also drive efforts to diversify and strengthen regional semiconductor ecosystems, potentially increasing demand for AEM's equipment in new or expanding markets. The ongoing nature of these trade dialogues means AEM must remain agile in its market access strategies.

Regulatory stability and cybersecurity mandates are critical. Nations are increasingly focused on data sovereignty and supply chain security, leading to stricter compliance requirements for technology providers like AEM. Proactive adaptation to these evolving standards, including robust cybersecurity frameworks, is essential for maintaining market access and client trust.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the AEM across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market and regulatory dynamics.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global demand for semiconductors is a critical driver for AEM, whose solutions are essential for chip production. Factors like projected global GDP growth, which was estimated to be around 2.7% for 2024 by the IMF in their April 2024 report, directly impact consumer electronics and enterprise IT spending, both key semiconductor end-markets.

A healthy semiconductor market, projected to reach over $600 billion in 2024 according to industry analysts, translates into robust demand for AEM's test and handling equipment, thereby supporting its revenue generation.

Rising inflation directly impacts AEM by increasing operational expenses. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 3.4% year-over-year as of April 2024, indicating higher costs for labor and materials. This surge can squeeze AEM's profit margins if not effectively passed on to customers.

Concurrently, fluctuating interest rates present a dual challenge. The Federal Reserve's benchmark interest rate, hovering around 5.25%-5.50% in mid-2024, increases borrowing costs for AEM. This makes financing new equipment or expansion projects more expensive, potentially slowing growth initiatives.

Furthermore, higher interest rates can dampen demand from AEM's customers who rely on financing. This reduced purchasing power, coupled with AEM's own increased borrowing costs, necessitates careful financial planning to maintain stability and competitive pricing.

As a global player, AEM's reliance on international markets means foreign exchange rate volatility is a significant economic factor. Fluctuations in currency values directly influence the cost of its imported components and the repatriated value of its export earnings. For instance, if the US dollar strengthens against the Euro, AEM's European sales revenue would translate into fewer dollars, impacting overall profitability.

These currency swings can erode profit margins or, conversely, offer unexpected gains. In 2024, major currency pairs like EUR/USD experienced notable volatility, with the Euro trading within a range of approximately 1.05 to 1.12 against the dollar, presenting ongoing challenges for businesses with diverse international transactions.

Consequently, significant movements in exchange rates can alter AEM's competitive standing. A depreciating domestic currency might make its exports cheaper and more attractive globally, while an appreciating currency could make imports more affordable but exports less competitive, directly affecting market share and pricing strategies.

Supply Chain Costs and Logistics

Supply chain costs are a critical factor for AEM, directly influenced by global economic trends. For instance, rising fuel prices in 2024 and projected increases into 2025 can significantly inflate transportation expenses, impacting AEM's overall production costs and delivery schedules. Labor availability and wages within the logistics sector also play a crucial role.

These fluctuating costs can lead to longer lead times and increased operational expenses for AEM. For example, the average cost of shipping a 40-foot container from Asia to Europe saw substantial volatility in late 2023 and early 2024, with rates sometimes doubling due to port congestion and carrier capacity issues, a trend that could persist.

- Rising Fuel Prices: Global oil prices, a key driver of transportation costs, have shown upward momentum, impacting freight rates.

- Logistics Bottlenecks: Continued port congestion and a shortage of truck drivers in various regions can extend delivery times and increase costs.

- Labor Costs: Increased wages for warehouse and transportation workers contribute to higher overall supply chain expenses.

- Supplier Diversification: AEM's strategy to diversify its supplier base helps mitigate the impact of localized disruptions or cost increases from single sources.

R&D Investment Cycles in Semiconductor Industry

The semiconductor industry's R&D investment cycles are critical, fueling constant innovation in chip design and manufacturing processes. For companies like AEM, whose business relies on advanced testing and handling solutions, these cycles directly impact demand. Economic headwinds can significantly curtail R&D budgets, potentially slowing the adoption of AEM's sophisticated equipment.

Global semiconductor R&D spending is projected to reach substantial figures, reflecting the industry's commitment to advancement. For instance, in 2024, total R&D expenditure across the sector is anticipated to grow, with significant portions allocated to next-generation lithography, advanced packaging, and AI-specific chip development. This sustained investment underpins the need for cutting-edge test and handling solutions that AEM provides.

- Projected R&D Growth: Semiconductor R&D spending is expected to see a compound annual growth rate (CAGR) of approximately 8-10% through 2025, driven by intense competition and the pursuit of technological breakthroughs.

- Key Investment Areas: Significant capital is being channeled into areas like chiplet technology, advanced materials, and energy-efficient architectures, all of which necessitate novel testing methodologies.

- Impact of Economic Cycles: A slowdown in global economic growth, as experienced in late 2023 and early 2024, can lead to a 5-15% reduction in R&D budgets for some firms, directly affecting their procurement of new testing equipment.

- AEM's Opportunity: As new chip designs emerge from these R&D efforts, the demand for specialized handling and testing solutions, like those offered by AEM, is expected to increase, creating a direct correlation between R&D intensity and AEM's market opportunities.

Global economic growth directly influences consumer and enterprise spending on electronics, key markets for semiconductors. The IMF's April 2024 forecast projected global GDP growth around 2.7% for 2024, a figure that underpins demand for AEM's specialized equipment.

Inflationary pressures, evidenced by the US CPI at 3.4% year-over-year in April 2024, increase AEM's operational costs for materials and labor, potentially impacting profit margins if not offset by pricing adjustments.

Interest rate hikes, with the Federal Reserve's rate around 5.25%-5.50% in mid-2024, raise AEM's borrowing costs and can dampen customer demand for capital equipment, requiring careful financial management.

Foreign exchange volatility, with the EUR/USD trading between 1.05-1.12 in 2024, directly affects AEM's international revenue and component costs, necessitating strategic hedging or pricing adjustments.

Supply chain costs, exacerbated by rising fuel prices and logistics bottlenecks in 2024, increase AEM's production expenses and delivery times, highlighting the importance of supplier diversification.

Semiconductor R&D spending, projected to grow at an 8-10% CAGR through 2025, fuels demand for AEM's advanced testing solutions as new chip technologies emerge.

| Economic Factor | 2024/2025 Data Point | Impact on AEM |

|---|---|---|

| Global GDP Growth | Projected 2.7% (IMF, April 2024) | Drives demand for electronics, thus semiconductors and AEM's equipment. |

| Inflation (US CPI) | 3.4% YoY (April 2024) | Increases AEM's operational costs (labor, materials). |

| Interest Rates (Fed Funds Rate) | 5.25%-5.50% (mid-2024) | Raises AEM's borrowing costs and can reduce customer investment. |

| EUR/USD Exchange Rate | Volatile, 1.05-1.12 range (2024) | Affects international revenue and component costs. |

| Semiconductor R&D Spending Growth | 8-10% CAGR projected through 2025 | Creates demand for AEM's advanced testing solutions. |

Same Document Delivered

AEM PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AEM PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Adobe Experience Manager. It provides a robust framework for strategic decision-making.

Sociological factors

The availability of skilled engineers, technicians, and R&D professionals is paramount for AEM's success in innovation and operations. In 2024, the global demand for AI and machine learning engineers, a key area for AEM, continued to outstrip supply, with estimates suggesting a deficit of over 1 million such professionals. This scarcity directly impacts AEM's capacity to develop cutting-edge products and maintain its competitive edge.

Demographic shifts pose significant challenges. For instance, in many developed economies, an aging workforce means a potential loss of experienced personnel, while in others, a persistent shortage of STEM graduates limits the pipeline of new talent. In the US, for example, while STEM degrees have seen an increase, the number of students graduating with electrical engineering degrees, crucial for AEM, has remained relatively stagnant in recent years, hovering around 65,000 annually.

To counter these trends, AEM's investment in comprehensive training programs and the cultivation of a robust company culture are vital for workforce development. By prioritizing continuous learning and employee engagement, AEM can enhance its ability to attract and retain top talent, mitigating the impact of demographic headwinds and ensuring a skilled workforce for future growth.

Shifting consumer preferences toward digital experiences and smart devices significantly boost demand for semiconductor-powered products. For instance, the global Internet of Things (IoT) market was projected to reach $1.1 trillion in 2024, indicating a strong societal embrace of connected technologies that rely heavily on advanced chips.

The rapid adoption of emerging technologies like artificial intelligence (AI), 5G networks, and electric vehicles (EVs) directly translates into a growing need for more sophisticated and specialized semiconductors. By 2025, the global AI market is expected to surpass $200 billion, underscoring the immense demand for the processing power that semiconductors provide.

AEM's expansion is intrinsically tied to these evolving societal trends, as they continuously create novel applications and markets for its semiconductor testing solutions. The increasing complexity of chips required for AI-driven applications and autonomous driving systems, for example, necessitates advanced testing methodologies that AEM is positioned to deliver.

Societal expectations for corporate social responsibility are increasingly shaping how companies like AEM operate. Consumers and employees alike are looking for businesses that prioritize ethical labor, champion diversity and inclusion, and actively contribute to their communities. For instance, a 2024 report indicated that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions, directly influencing brand perception and loyalty.

Meeting these elevated CSR standards can significantly boost AEM's reputation. Companies demonstrating strong commitment to social good are more likely to attract top talent and appeal to a growing segment of socially conscious investors. In 2025, the ESG (Environmental, Social, and Governance) investment market is projected to exceed $50 trillion globally, highlighting the financial advantage of robust CSR practices.

Education and Skill Development

The quality of education and the emphasis on skill development are crucial for AEM's sustained growth. A highly skilled and adaptable workforce is fundamental for driving innovation and maintaining efficient manufacturing processes, especially in the face of evolving technologies.

Countries with strong educational systems and a focus on vocational training are more likely to produce graduates equipped with the necessary competencies. For instance, in 2024, countries like South Korea and Germany continued to invest heavily in STEM education and apprenticeships, creating a pipeline of talent beneficial for advanced manufacturing sectors.

Strategic collaborations between AEM and educational institutions can effectively address emerging skill shortages. By partnering with universities and technical colleges, AEM can influence curriculum development to align with industry needs, ensuring a steady supply of qualified personnel ready to contribute to its operations.

- Global Education Spending: In 2023, global education spending reached an estimated $5.7 trillion, with a significant portion directed towards higher education and vocational training, indicating a growing recognition of skill development's importance.

- Digital Skills Gap: A 2024 report highlighted that approximately 60% of jobs now require digital skills, underscoring the need for educational systems to prioritize digital literacy and advanced technological training.

- Apprenticeship Programs: The success of apprenticeship models in countries like Switzerland, where over two-thirds of young people participate, demonstrates a proven pathway for bridging the gap between education and industry requirements.

- AI in Education: By 2025, it's projected that AI tools will be integrated into educational platforms to personalize learning and enhance skill acquisition, a trend AEM can leverage through educational partnerships.

Public Perception of the Tech Industry

Public perception significantly shapes the technology and manufacturing sectors, directly impacting policy, consumer trust, and the ability to attract skilled workers. For instance, a 2024 survey indicated that 62% of consumers are more likely to purchase from tech companies demonstrating strong data privacy practices. This sentiment underscores the critical need for AEM to proactively address concerns regarding data security, environmental sustainability, and the ethical deployment of technologies like artificial intelligence.

Negative public sentiment, often fueled by high-profile data breaches or environmental controversies, can create significant headwinds. A 2025 report highlighted that 45% of potential employees would avoid a tech company perceived as having poor environmental stewardship. Therefore, maintaining a positive and responsible image is not merely beneficial but essential for AEM's operational health and long-term growth, influencing everything from regulatory scrutiny to brand loyalty.

- Data Privacy Concerns: A 2024 Pew Research study found that 79% of Americans are concerned about how companies use their personal data.

- Environmental Impact: Growing public awareness of climate change means 58% of consumers in a recent 2025 Deloitte survey indicated they consider a company's environmental footprint when making purchasing decisions.

- Ethical AI Development: A late 2024 Ipsos poll revealed that 65% of respondents believe AI development needs stronger ethical guidelines and oversight.

Societal expectations for corporate social responsibility (CSR) are increasingly influencing business operations, with consumers and employees prioritizing ethical practices, diversity, and community engagement. A 2024 report found that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions, directly affecting brand perception and loyalty. Meeting these elevated CSR standards can significantly boost AEM's reputation and attract top talent, especially as the ESG investment market is projected to exceed $50 trillion globally by 2025.

The quality of education and the emphasis on skill development are crucial for AEM's sustained growth, as a skilled workforce drives innovation and efficient manufacturing. Countries like South Korea and Germany, which heavily invest in STEM education and apprenticeships, are producing talent beneficial for advanced manufacturing sectors, as seen in 2024. Strategic collaborations between AEM and educational institutions can address skill shortages by aligning curriculum with industry needs, ensuring a steady supply of qualified personnel.

Public perception significantly shapes the technology and manufacturing sectors, impacting policy, consumer trust, and talent acquisition. A 2024 survey indicated that 62% of consumers are more likely to purchase from tech companies demonstrating strong data privacy practices. Addressing concerns about data security, environmental sustainability, and ethical AI deployment is essential for AEM's operational health and long-term growth, as a 2025 report noted that 45% of potential employees would avoid companies with poor environmental stewardship.

| Societal Factor | Impact on AEM | Supporting Data (2024/2025) |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances brand reputation, attracts talent and investment. | 60% of consumers consider social/environmental impact (2024). ESG market projected >$50T (2025). |

| Education & Skill Development | Ensures skilled workforce for innovation and operations. | Strong STEM focus in countries like S. Korea, Germany (2024). Need for digital skills (60% of jobs, 2024). |

| Public Perception & Trust | Influences purchasing decisions, employee attraction, and regulatory scrutiny. | 79% of Americans concerned about data use (2024). 45% avoid companies with poor environmental stewardship (2025). |

Technological factors

Continuous advancements in semiconductor manufacturing, like shrinking node sizes to 2nm and the adoption of new materials, directly influence AEM's product development. These innovations necessitate AEM to constantly update its test and handling solutions to remain competitive.

AEM's ability to adapt to these evolving technologies is critical; for instance, the increasing complexity of chip architectures, such as 3D stacking, requires sophisticated testing equipment that AEM must provide. Failure to innovate risks making its current offerings obsolete in a rapidly advancing market.

The semiconductor industry's embrace of automation and Industry 4.0, including AI, is reshaping manufacturing. For AEM, this means opportunities to enhance testing automation with its solutions, but also a need to integrate these advanced technologies internally to maintain competitiveness. This drive for greater efficiency and precision is a key technological factor.

AEM's commitment to research and development is crucial for maintaining its competitive advantage in the semiconductor testing sector. Significant R&D investment allows the company to innovate and develop new test and handling technologies, ensuring they remain at the forefront of the industry.

In 2023, AEM reported R&D expenses of approximately $89.6 million, representing a notable increase from previous years. This substantial outlay underscores their focus on anticipating future customer needs and developing solutions for increasingly complex chip architectures, such as advanced packaging and next-generation processors.

Intellectual Property and Patent Landscape

The semiconductor test and handling sector is characterized by a fiercely competitive and intricate intellectual property (IP) landscape. AEM's success hinges on its ability to safeguard its own groundbreaking innovations through robust patent and trademark filings, while simultaneously navigating the extensive patent portfolios of its rivals. This proactive IP management is not merely a defensive measure but a critical component for achieving market differentiation and effectively preventing potential infringement issues.

A strong IP strategy is paramount for AEM to maintain its competitive edge. For instance, as of late 2024, the global semiconductor industry saw continued high levels of patent activity, with companies investing billions in R&D to secure new technologies. AEM's approach to IP protection directly influences its ability to license its technologies and deter competitors from using its proprietary designs, thereby securing its market share and profitability.

Key aspects of AEM's IP strategy include:

- Patent Portfolio Development: Continuously filing patents for novel test and handling solutions to build a defensible IP moat.

- Freedom to Operate Analysis: Regularly assessing the patent landscape to ensure AEM's products do not infringe on existing competitor patents.

- Licensing and Collaboration: Exploring opportunities to license its IP or engage in strategic collaborations that leverage its technological strengths.

- Trademark Protection: Safeguarding its brand identity and product names through trademark registration to prevent brand dilution and consumer confusion.

Data Analytics and Predictive Maintenance

Data analytics and predictive maintenance are transforming manufacturing. By applying these technologies, companies can significantly boost efficiency and minimize unexpected equipment failures. For instance, a 2024 report by McKinsey indicated that companies leveraging predictive maintenance saw a 10-25% reduction in maintenance costs and a 30-40% decrease in downtime. This proactive approach allows for the early detection of potential issues, enabling timely interventions and optimizing overall equipment performance.

AEM can capitalize on these advancements in two key ways. Firstly, by integrating data analytics and predictive maintenance into its own manufacturing processes, AEM can streamline operations and improve its internal efficiency. Secondly, AEM can incorporate these capabilities into its test solutions, offering customers enhanced value. This means AEM's test equipment can not only verify product quality but also provide insights into the operational health of the machinery being tested, leading to better performance and longevity for its clients' assets.

The benefits are substantial:

- Enhanced Operational Efficiency: Predictive maintenance can improve overall equipment effectiveness (OEE) by up to 15-20% according to industry analyses from 2024.

- Reduced Downtime: Proactive issue identification minimizes costly unplanned shutdowns.

- Optimized Resource Allocation: Maintenance efforts can be scheduled more effectively, reducing waste.

- Improved Product Quality: Consistent equipment performance leads to more reliable product output.

Technological advancements, particularly in areas like artificial intelligence and advanced materials, are reshaping the semiconductor industry. AEM must continuously innovate its test and handling solutions to align with these shifts, such as the increasing complexity of chip architectures and the demand for higher precision. For example, the push towards 2nm semiconductor nodes by 2025 necessitates highly sophisticated testing equipment.

AEM's substantial investment in research and development, with R&D expenses reaching approximately $89.6 million in 2023, highlights its commitment to staying ahead. This focus is crucial for developing solutions for emerging technologies like advanced packaging and next-generation processors, ensuring AEM maintains its competitive edge in a rapidly evolving market.

The integration of data analytics and predictive maintenance offers significant opportunities for AEM to enhance both its internal operations and its customer offerings. By embedding these capabilities into its test solutions, AEM can provide clients with greater efficiency and reduced downtime, mirroring industry trends where predictive maintenance can cut costs by 10-25% and decrease downtime by 30-40%.

Legal factors

AEM's global operations mean it must navigate a web of international trade laws and export controls, especially when dealing with advanced technologies. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) oversees export controls, with regulations like the Export Administration Regulations (EAR) impacting sales of dual-use items. Failure to comply can result in significant fines, such as the $300 million penalty imposed on a major tech company in 2023 for export control violations.

Adhering to these intricate rules is paramount for AEM to prevent legal repercussions and maintain smooth operations in its supply chain and with its clientele. These regulations directly influence AEM's ability to conduct business in specific regions or with particular entities, impacting market access and partnership opportunities. The evolving geopolitical landscape in 2024 continues to shape these controls, with increased scrutiny on technology transfers to certain nations.

Protecting its intellectual property (IP) and defending against potential IP infringement claims are significant legal considerations for AEM. The semiconductor industry is highly competitive and prone to patent litigation, making robust IP strategies crucial for market security. For instance, in 2023, the global semiconductor industry saw a significant number of patent disputes, with companies actively seeking to protect their technological advancements.

AEM must maintain strong patent registration processes to safeguard its innovations. Furthermore, developing clear licensing agreements and effective enforcement mechanisms are vital to prevent unauthorized use of its technology and maintain its competitive edge. This proactive approach is essential in an environment where intellectual property is a primary driver of value and market differentiation.

As a provider of equipment for intricate manufacturing, AEM faces significant product liability and safety regulations. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported approximately 2.5 million emergency room visits related to consumer product injuries, highlighting the critical need for robust safety measures in all equipment, including industrial machinery.

AEM must ensure its machinery adheres to rigorous safety standards, such as those set by the Occupational Safety and Health Administration (OSHA) in the United States, which mandates safe working conditions and equipment operation. Failure to meet these standards, like maintaining proper guarding on rotating parts or ensuring emergency stop functionality, can lead to costly lawsuits and damage to AEM's reputation, impacting customer trust and future sales.

Compliance is not merely about avoiding penalties; it's a gateway to market access. For example, in the European Union, products must meet CE marking requirements, a self-declaration that a product meets all essential health and safety requirements of the relevant EU directives. Without this certification, AEM's equipment cannot be legally sold or operated within the EU, a significant market.

Data Privacy and Cybersecurity Regulations

As digitalization accelerates, companies like AEM must navigate a complex web of global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and similar regional laws. These frameworks mandate stringent data protection measures, impacting how customer and operational data are collected, stored, and processed. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. This legal landscape underscores the critical need for robust cybersecurity defenses to safeguard sensitive information and maintain operational integrity.

Protecting intellectual property and sensitive operational data from cyber threats is paramount and carries significant legal weight. The increasing sophistication of cyberattacks means that breaches are not just technical failures but also potential legal liabilities. For example, the estimated global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the risk. AEM's commitment to cybersecurity is therefore intrinsically linked to its legal compliance and risk management strategy, as data breaches can lead to substantial legal costs, regulatory investigations, and loss of trust.

- GDPR Fines: Up to 4% of annual global turnover or €20 million.

- Global Cybercrime Costs: Projected to reach $10.5 trillion annually by 2025.

- Reputational Damage: Significant loss of customer trust and market standing following a data breach.

- Legal Imperative: Cybersecurity is not merely a technical issue but a core legal requirement for data protection.

Employment Laws and Labor Regulations

AEM navigates a complex web of global employment laws and labor regulations, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, many European Union countries continued to strengthen worker protections, with some nations implementing new legislation around remote work rights and collective bargaining agreements. Failure to comply can lead to significant penalties and operational disruptions.

Key areas of focus for AEM include:

- Wage and Hour Laws: Adherence to minimum wage laws, overtime pay regulations, and rules regarding payment schedules across all operating jurisdictions.

- Anti-Discrimination and Equal Opportunity: Ensuring hiring, promotion, and compensation practices are free from bias based on protected characteristics.

- Workplace Safety and Health: Complying with occupational safety standards to prevent accidents and ensure a healthy working environment for all employees.

- Unionization and Collective Bargaining: Understanding and respecting employee rights to organize and engage in collective bargaining processes where applicable.

AEM's adherence to international trade laws and export controls, such as the U.S. Export Administration Regulations (EAR), is critical. These regulations, which govern the sale of dual-use items, can lead to substantial penalties for non-compliance, with a major tech company fined $300 million in 2023 for violations. The evolving geopolitical landscape in 2024 continues to increase scrutiny on technology transfers, impacting market access and partnerships.

Protecting intellectual property (IP) is a major legal concern, especially in the competitive semiconductor industry rife with patent litigation. In 2023, the sector saw numerous patent disputes as companies fiercely guarded their technological advancements. AEM must maintain robust patent registration and clear licensing agreements to safeguard its innovations and competitive edge.

Product liability and safety regulations are paramount for AEM as a manufacturer of intricate equipment. The U.S. Consumer Product Safety Commission (CPSC) reported approximately 2.5 million product-related injuries in 2024, underscoring the need for rigorous safety standards. Compliance with bodies like OSHA ensures safe operation and prevents costly lawsuits and reputational damage.

Navigating global data privacy laws like GDPR is essential, with fines potentially reaching 4% of annual global turnover or €20 million. The projected global cost of cybercrime reaching $10.5 trillion by 2025 highlights that cybersecurity is a legal imperative for data protection and maintaining customer trust.

| Legal Factor | Key Regulations/Concerns | Impact on AEM | 2023-2025 Data/Examples |

|---|---|---|---|

| Trade & Export Controls | EAR, BIS regulations | Market access, supply chain integrity | $300M fine for tech firm (2023) for export control violations. Increased scrutiny in 2024. |

| Intellectual Property | Patent law, licensing agreements | Competitive edge, market security | High volume of patent disputes in semiconductor industry (2023). |

| Product Liability & Safety | OSHA, CPSC standards | Reputation, legal costs, customer trust | 2.5M ER visits for product injuries (2024). CE marking for EU market access. |

| Data Privacy & Cybersecurity | GDPR, data protection laws | Financial penalties, operational integrity | GDPR fines up to 4% global turnover. Cybercrime costs projected to hit $10.5T by 2025. |

Environmental factors

The global push for sustainability is compelling AEM to integrate eco-friendly manufacturing. This means optimizing energy use, cutting waste, and sourcing sustainable materials, aligning with a growing market demand for environmentally responsible products. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly, indicating a strong consumer preference for sustainable options.

AEM's electronics manufacturing and testing operations inherently involve the use and disposal of diverse materials, including potentially hazardous substances. Strict adherence to waste management and hazardous materials regulations, such as those governing e-waste and chemical disposal, is paramount to avert environmental damage and significant legal repercussions. For instance, the global e-waste generated reached an estimated 53.6 million metric tons in 2019, highlighting the scale of this challenge and the increasing regulatory scrutiny worldwide.

The semiconductor manufacturing process is notoriously energy-hungry, and AEM's operations are no exception, significantly contributing to its overall energy footprint. For instance, the global semiconductor industry consumed an estimated 100 terawatt-hours (TWh) of electricity in 2023, a figure projected to rise.

As governments worldwide, including key markets for AEM, strengthen climate change policies and set ambitious carbon emission reduction targets, the company faces increasing pressure to invest in energy-efficient technologies and renewable energy sources. This proactive approach is crucial not only for mitigating environmental impact but also for ensuring compliance with evolving regulatory landscapes and maintaining a competitive edge.

Supply Chain Environmental Compliance

AEM faces growing pressure to ensure its entire supply chain adheres to environmental regulations. This means meticulously checking suppliers, from those providing raw materials to those manufacturing components, to verify their environmental stewardship. For instance, in 2024, the global electronics industry saw a significant increase in supply chain audits focused on carbon emissions and waste management, with many companies implementing stricter supplier codes of conduct.

Promoting sustainable sourcing and conducting regular audits are crucial steps in this process. AEM's commitment to these practices directly impacts its reputation and ability to attract investment. By 2025, it's projected that over 70% of large corporations will have publicly disclosed their supply chain environmental performance metrics, driven by investor demand for ESG (Environmental, Social, and Governance) accountability.

Stakeholders, including investors, customers, and regulators, increasingly expect a transparent and environmentally conscious supply chain. This expectation translates into tangible business benefits, such as improved brand loyalty and reduced regulatory risks. Reports from 2024 indicated that companies with robust environmental supply chain management often experienced fewer disruptions and better long-term financial performance compared to their less compliant peers.

Key aspects of AEM's supply chain environmental compliance include:

- Supplier Audits: Regularly assessing suppliers' environmental practices, such as waste disposal, water usage, and emissions control.

- Sustainable Sourcing: Prioritizing suppliers who utilize renewable energy, recycled materials, and eco-friendly production methods.

- Regulatory Adherence: Ensuring all supply chain partners comply with local and international environmental laws and standards.

- Transparency: Providing clear information to stakeholders about the environmental impact of the supply chain and efforts to mitigate it.

Water Usage and Wastewater Treatment

Semiconductor manufacturing, a core activity for companies like AEM, is inherently water-intensive. Processes such as wafer cleaning, etching, and cooling can consume vast quantities of this vital resource. For instance, the semiconductor industry globally is estimated to use billions of gallons of water annually, with specific fab operations potentially requiring millions of gallons per day.

AEM must therefore prioritize efficient water management and robust wastewater treatment. This involves not only minimizing consumption through recycling and reuse technologies but also ensuring that discharged water meets stringent environmental standards. Failure to do so can lead to significant regulatory penalties and reputational damage, especially in regions facing water scarcity.

- Water Consumption: Global semiconductor manufacturing can consume upwards of 50 billion gallons of water annually, highlighting the scale of this resource requirement.

- Wastewater Treatment Costs: Investing in advanced wastewater treatment can represent a significant capital expenditure for semiconductor facilities, potentially running into tens or hundreds of millions of dollars for new fabs.

- Regulatory Compliance: Environmental agencies worldwide are increasingly tightening regulations on industrial water discharge, requiring sophisticated treatment processes to remove contaminants like heavy metals and chemicals.

- Water Scarcity Impact: In water-stressed regions, semiconductor companies may face operational disruptions or increased costs if water availability is limited, underscoring the need for water stewardship.

Environmental regulations are increasingly shaping AEM's operational landscape, pushing for greener practices and stricter compliance. This includes managing waste, particularly e-waste, and reducing the significant energy consumption inherent in semiconductor manufacturing. For instance, the global semiconductor industry's electricity consumption was projected to exceed 100 terawatt-hours in 2023.

AEM's commitment to sustainability extends to its entire supply chain, with a growing emphasis on supplier audits and transparent reporting of environmental performance metrics. By 2025, over 70% of large corporations are expected to disclose their supply chain environmental data, driven by investor demand for ESG accountability.

Water usage in semiconductor fabrication is substantial, with global consumption by the industry estimated in the billions of gallons annually. AEM must focus on efficient water management and advanced wastewater treatment to meet tightening regulations and mitigate risks in water-scarce regions.

| Environmental Factor | Impact on AEM | Key Data/Trends (2023-2025) |

|---|---|---|

| Climate Change Policies | Pressure to invest in energy efficiency and renewables; compliance with carbon reduction targets. | Global push for net-zero emissions; increasing carbon taxes in key markets. |

| Waste Management (E-waste) | Strict adherence to disposal regulations; potential legal repercussions for non-compliance. | Global e-waste generation reached 53.6 million metric tons in 2019, with ongoing increases and stricter regulations. |

| Energy Consumption | High electricity usage in semiconductor manufacturing; need for optimization. | Semiconductor industry consumed ~100 TWh electricity in 2023; projected to rise. |

| Water Usage | Significant water consumption in fabrication; need for efficient management and treatment. | Industry uses billions of gallons of water annually; tightening regulations on discharge. |

| Supply Chain Sustainability | Increased audits and demand for transparent environmental performance from suppliers. | By 2025, >70% of large corporations expected to disclose supply chain ESG metrics. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data sourced from reputable economic indicators, official government publications, and leading market research firms. We meticulously gather information on regulatory changes, technological advancements, and socio-cultural trends to ensure comprehensive and actionable insights.