AEM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEM Bundle

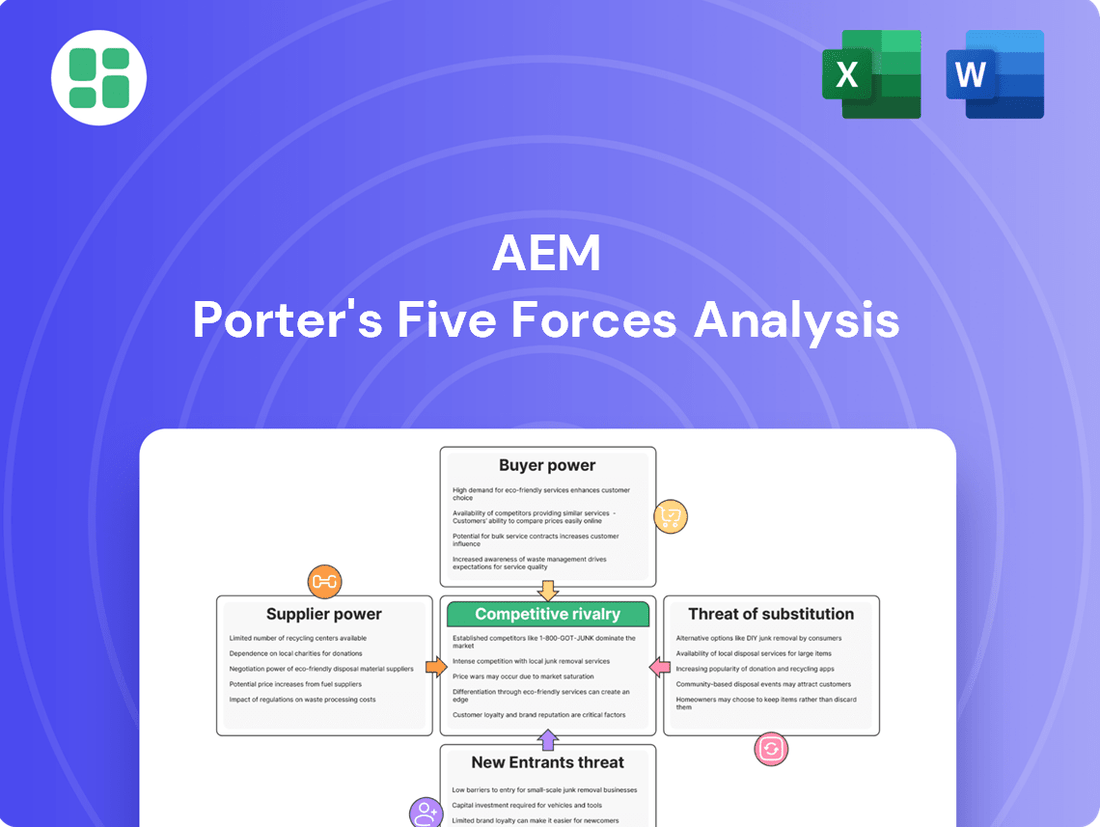

AEM's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any business operating within or looking to enter this market.

The full Porter's Five Forces Analysis dives deep into each of these pressures, providing a comprehensive strategic roadmap for navigating AEM's industry. Unlock actionable insights to drive smarter decision-making and secure your competitive edge.

Suppliers Bargaining Power

AEM's dependence on highly specialized components for its advanced test and handling solutions can significantly empower its suppliers. For instance, in the semiconductor equipment sector, where AEM operates, the reliance on proprietary, high-precision parts can lead to a concentrated supplier base. If AEM requires components with unique specifications or patented technology, and only a limited number of suppliers can provide them, these suppliers gain considerable leverage. This can translate into higher pricing for these critical inputs, directly impacting AEM's cost of goods sold and potentially squeezing profit margins.

Supplier concentration within the semiconductor equipment sector significantly impacts AEM's operational landscape. When a few dominant suppliers control essential raw materials or critical sub-assemblies, their leverage over AEM grows substantially. For instance, in 2024, the market for advanced lithography components saw a notable consolidation, with three key players accounting for over 70% of global supply, giving them considerable pricing power.

High switching costs for AEM when changing suppliers can significantly elevate the bargaining power of those suppliers. If migrating to a new supplier requires substantial investment in re-tooling manufacturing equipment, undergoing lengthy re-qualification processes for components, or risks disrupting established production lines, AEM's ability to seek out alternative sources is diminished. This inertia grants existing suppliers greater leverage in price negotiations and contract terms.

Uniqueness of Inputs

The uniqueness of inputs significantly influences the bargaining power of AEM's suppliers. When suppliers offer patented technologies or highly specialized components that are essential for AEM's product performance, their leverage increases. This differentiation can translate into the ability to command higher prices for their offerings.

For instance, if a key supplier provides a proprietary semiconductor fabrication process that is difficult for AEM to replicate or source elsewhere, that supplier gains considerable power. In 2024, the semiconductor industry, particularly for advanced nodes, saw continued supply constraints and high demand, giving leading foundries substantial pricing power. This situation directly impacts AEM if they rely on such specialized manufacturing capabilities.

- Proprietary Technology: Suppliers with patented or unique manufacturing processes hold a stronger negotiating position.

- Customization: Highly customized components, designed specifically for AEM's products, reduce AEM's ability to switch suppliers easily.

- Criticality of Input: If the unique input is vital for AEM's product differentiation or performance, supplier power is amplified.

- Industry Trends: In sectors like advanced electronics, where specialized inputs are scarce and in high demand, supplier bargaining power tends to be elevated.

Threat of Forward Integration by Suppliers

The potential for AEM's suppliers to integrate forward into manufacturing test and handling equipment represents a significant threat. If a supplier has the technical expertise and market reach to become a direct competitor, AEM's reliance on them for critical components gives these suppliers considerable leverage. This leverage can directly impact AEM's negotiation power and the terms of their long-term supply contracts.

For instance, a key supplier to the semiconductor industry, like a specialized materials provider, might develop its own testing solutions to bundle with its products. This would allow them to capture a larger share of the value chain. In 2024, the semiconductor equipment market saw increased consolidation, with some component suppliers actively exploring vertical integration to enhance their offerings and market position.

- Supplier Capability: Suppliers with strong R&D in complementary areas can more easily transition to offering testing and handling solutions.

- Market Access: Suppliers already serving AEM's customer base have an established route to market for their own integrated offerings.

- Leverage: AEM's dependence on specific suppliers for unique or high-quality components strengthens the supplier's position to integrate forward.

- Strategic Impact: Forward integration by suppliers could lead to increased competition, reduced AEM margins, and potential supply chain disruptions if not managed proactively.

Suppliers' bargaining power is amplified when they provide critical, unique, or proprietary components that are difficult for AEM to source elsewhere. High switching costs, due to specialized integration or re-tooling needs, further empower these suppliers. In 2024, the semiconductor industry faced persistent supply chain challenges for advanced materials and specialized chips, granting key suppliers significant leverage in pricing and contract negotiations.

| Factor | Impact on AEM | Example (2024 Trend) |

|---|---|---|

| Supplier Concentration | Increased pricing power for dominant suppliers | Consolidation in lithography components (3 players > 70% market share) |

| Switching Costs | Reduced AEM flexibility, higher supplier leverage | Re-qualification of specialized semiconductor parts can take months |

| Uniqueness of Input | Suppliers can command premium prices | Patented semiconductor fabrication processes are difficult to replicate |

| Forward Integration Threat | Potential for supplier competition and margin pressure | Component suppliers exploring integrated testing solutions in a consolidating market |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to AEM's specific position.

Quickly identify and mitigate competitive threats with a visual breakdown of industry rivalry, supplier power, buyer power, threat of new entrants, and threat of substitutes.

Customers Bargaining Power

AEM's customer concentration is a key factor in its bargaining power. If a few major semiconductor and electronics manufacturers represent a large chunk of AEM's sales, these clients gain significant leverage.

For instance, in 2023, AEM's top 10 customers accounted for approximately 70% of its revenue, indicating a substantial reliance on a limited number of key accounts. This concentration empowers these large customers to negotiate more aggressively on pricing, delivery timelines, and the specific service levels they expect.

This dynamic can directly impact AEM's profitability and its ability to dictate terms, as meeting the demands of these high-volume buyers often becomes a priority, potentially squeezing profit margins and influencing strategic choices.

Customer switching costs are a significant factor in assessing AEM's bargaining power. If customers can easily switch to a competitor's test and handling solutions without incurring substantial costs, such as re-qualification, integration expenses, or disruption to their operations, their bargaining power increases. For instance, if AEM's solutions are highly integrated into a customer's existing manufacturing process, the cost and effort to switch would be higher, thereby reducing customer power.

The degree to which AEM's advanced test and handling solutions are differentiated significantly impacts customer bargaining power. If AEM offers unique technologies or superior performance that competitors struggle to match, customers have fewer viable alternatives, thereby reducing their leverage.

A strong value proposition, built on specialized solutions, allows AEM to command premium pricing and limits customers’ ability to dictate terms. This differentiation directly translates into a weaker customer bargaining position.

Price Sensitivity of Customers

The price sensitivity of AEM's customers, typically large corporations focused on rigorous cost management, is a notable factor. In the competitive semiconductor industry, these clients actively pursue cost reductions in their production processes, leading to intense price negotiations. This dynamic compels AEM to carefully manage its pricing to maintain both profitability and crucial customer relationships.

- Customer Price Sensitivity: AEM's customers, often large enterprises, exhibit significant price sensitivity due to their emphasis on cost control.

- Market Competition: The semiconductor market's competitiveness drives customers to seek lower manufacturing expenses, impacting AEM's pricing power.

- Negotiation Pressure: Expect aggressive price negotiations from customers aiming to optimize their operational costs.

- Balancing Act: AEM must strike a balance between competitive pricing and maintaining healthy profit margins to retain its key accounts.

Customer's Threat of Backward Integration

The threat of backward integration by AEM's large customers, meaning their potential to develop their own in-house test and handling solutions, is a significant factor. While building such capabilities is costly and complex, the mere possibility can embolden customers in their negotiations with AEM. This leverage allows them to push for more attractive pricing or superior service offerings.

For instance, a major semiconductor manufacturer might explore developing proprietary testing equipment if they perceive AEM's pricing or product roadmap as unfavorable. This strategic consideration, even if not fully executed, can influence AEM's pricing strategies and service level agreements to retain key accounts. In 2024, the semiconductor industry saw significant investment in advanced manufacturing technologies, increasing the feasibility for larger players to consider in-house solutions.

- Customer Capability: Large customers possess the financial resources and technical expertise to explore developing in-house test and handling solutions.

- Negotiation Leverage: The potential for backward integration serves as a powerful bargaining chip for customers, enabling them to negotiate better terms.

- Industry Trend: Increased investment in advanced manufacturing by major industry players in 2024 makes the threat of backward integration more credible.

The bargaining power of customers for AEM is influenced by several factors, including customer concentration, switching costs, product differentiation, price sensitivity, and the threat of backward integration.

AEM's reliance on a few large customers, such as the top 10 accounting for approximately 70% of revenue in 2023, grants these clients significant leverage to negotiate pricing and terms.

High switching costs for customers, stemming from deep integration of AEM's solutions, can mitigate this power, but ease of switching diminishes it.

AEM's ability to differentiate its offerings through unique technologies is crucial in limiting customer demands and maintaining pricing power.

| Factor | Impact on Customer Bargaining Power | 2023/2024 Context |

|---|---|---|

| Customer Concentration | High | Top 10 customers = ~70% of revenue (2023) |

| Switching Costs | Low (if easily replaceable) to High (if deeply integrated) | Depends on integration level |

| Product Differentiation | Low (if commoditized) to High (if unique technology) | AEM's advanced solutions aim for high differentiation |

| Price Sensitivity | High (common in semiconductor industry) | Customers actively seek cost reductions |

| Backward Integration Threat | Moderate to High | Increased investment in advanced manufacturing in 2024 makes this more credible for large players |

Full Version Awaits

AEM Porter's Five Forces Analysis

This preview showcases the complete AEM Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You're looking at the actual deliverable, ready for instant download and use the moment your transaction is complete.

Rivalry Among Competitors

The semiconductor test and handling equipment market is quite crowded, with several well-established companies actively competing. This means AEM isn't the only player in town; there are many others trying to capture the same customers.

Globally and regionally, a significant number of companies are all trying to get a piece of the semiconductor market. This intense competition puts pressure on AEM to consistently develop new and better products to stand out from the crowd and maintain its market position.

The semiconductor industry's growth rate is a critical factor shaping competitive rivalry. When the market expands rapidly, like the projected 15% growth for the global semiconductor market in 2024, companies can often grow by capturing new opportunities rather than directly battling rivals for market share. This dynamic can temper intense competition.

However, during periods of slower growth or potential contraction, the fight for existing customers becomes much fiercer. Companies like Intel, NVIDIA, and AMD may find themselves in a more aggressive competitive stance as they vie for a larger portion of a less expanding market. This intensified rivalry can lead to price wars and increased R&D spending to gain a technological edge.

The intensity of competition for AEM hinges significantly on how distinct its products are from those of its rivals. When products are very similar, like basic commodities, companies often end up competing primarily on price, which can squeeze profit margins for everyone involved.

If AEM can offer truly unique features, cutting-edge technology, or specialized solutions that meet specific customer needs better than competitors, it gains a substantial advantage. This differentiation allows AEM to potentially charge higher prices and face less direct, head-to-head competition, as customers value its unique offerings.

For instance, in the semiconductor equipment sector where AEM operates, companies that invest heavily in R&D to develop advanced metrology or inspection tools that improve yield or reduce defects for chip manufacturers often see stronger market positions. As of early 2024, the demand for advanced semiconductor manufacturing processes, driven by AI and 5G, means that suppliers offering superior technological differentiation are particularly well-positioned to capture market share and command premium pricing.

High Fixed Costs and Exit Barriers

The semiconductor equipment sector is characterized by extremely high fixed costs. Companies pour billions into research and development for next-generation chipmaking technology and into building and maintaining advanced manufacturing facilities. For instance, ASML, a key player, invests heavily in R&D, with its EUV lithography systems alone costing hundreds of millions of dollars each.

These substantial investments, coupled with significant exit barriers, intensify competitive rivalry. These barriers can include highly specialized, proprietary assets that have little resale value outside the industry or long-term supply agreements with major chip manufacturers. Consequently, firms are often compelled to continue operating and competing even when market demand softens, aiming to at least cover their ongoing operational expenses and recoup their massive capital outlays, leading to aggressive price competition and market share battles.

- High R&D Investment: Companies like Applied Materials and Lam Research consistently allocate billions annually to R&D to stay at the forefront of wafer fabrication technology.

- Capital Intensive Manufacturing: Building and equipping a semiconductor equipment manufacturing plant can cost upwards of $1 billion, creating a high barrier to entry and forcing existing players to maintain production.

- Specialized Assets: The unique nature of semiconductor manufacturing equipment means that assets are highly specific and difficult to repurpose if a company exits the market, increasing the cost of leaving.

- Long-Term Contracts: Many equipment suppliers operate under multi-year contracts with major foundries and integrated device manufacturers, making it challenging to exit relationships without significant penalties.

Strategic Stakes and Aggressiveness of Competitors

The semiconductor test market is highly strategic for companies like AEM and its competitors, meaning they are all very keen to win here. This importance drives intense rivalry, as firms see this segment as crucial for their future growth and profitability. In 2024, the global semiconductor test equipment market was valued at approximately $7.6 billion, with significant growth expected, making it a prime battleground.

This high strategic stake leads to aggressive tactics. Companies pour vast sums into research and development to stay ahead technologically. For instance, Advantest, a major competitor, announced significant R&D investments in late 2023 and early 2024, aiming to bolster its next-generation testing solutions. Pricing also becomes a key weapon, with firms willing to offer competitive terms to secure market share.

- Technological Leadership: Competitors are locked in a race to develop the most advanced testing solutions, crucial for the increasingly complex chips being produced.

- Market Share Dominance: Securing a larger slice of the $7.6 billion semiconductor test market in 2024 is a primary objective for all players.

- Investment in R&D: Companies are channeling substantial capital into innovation, as seen with major players announcing increased R&D budgets for 2024 and beyond.

- Aggressive Pricing: Competitive pricing strategies are frequently employed to attract and retain customers in this high-stakes environment.

Competitive rivalry in the semiconductor test and handling equipment market is fierce, driven by a crowded field of established players and the industry's rapid technological evolution. The significant R&D investments and capital-intensive nature of this sector create high barriers to entry, compelling existing firms to compete aggressively for market share.

The strategic importance of the semiconductor test market, valued at approximately $7.6 billion in 2024, fuels intense competition. Companies are heavily investing in innovation and employing aggressive pricing to secure dominance, as demonstrated by competitors like Advantest's increased R&D spending in late 2023 and early 2024.

| Key Competitor Focus | 2024 Market Value (Semiconductor Test Equipment) | Strategic Driver | Competitive Tactic |

| Technological Advancement | ~$7.6 Billion | Securing future growth | High R&D Investment |

| Market Share | Profitability | Aggressive Pricing | |

| Innovation | Customer acquisition | Product Differentiation |

SSubstitutes Threaten

The threat of substitutes for AEM's testing and handling solutions is significant, primarily stemming from alternative testing methodologies. Innovations like software-defined testing and virtual testing environments are emerging as viable replacements. These advancements can potentially bypass the need for specialized physical handlers and test inserts, offering customers more cost-effective pathways to achieve their testing goals.

Large semiconductor manufacturers, with their substantial R&D budgets, could develop their own in-house customer solutions for testing and handling. For instance, Intel has historically invested heavily in vertical integration, including its own manufacturing and testing processes, showcasing the feasibility of such an approach. This represents a significant threat as it bypasses the need for external equipment providers like AEM.

The availability of more general-purpose test equipment presents a significant substitute threat to AEM's specialized solutions. While these general-purpose tools might not offer the same level of optimization or specific functionality, they can often perform a sufficient range of tasks for certain customers. For instance, in the semiconductor testing industry, a broad spectrum of electronic manufacturers might find that versatile, off-the-shelf test equipment can meet their basic validation needs without the higher cost associated with highly specialized AEM products.

Technological Advancements in Design & Simulation

Technological advancements, particularly in design and simulation software, present a growing threat of substitutes for AEM's traditional testing equipment. Sophisticated simulation tools are increasingly capable of replicating physical testing scenarios with high fidelity. This can lead to a reduced need for physical prototypes and, consequently, less demand for the handling and test equipment AEM provides. For instance, in 2024, the semiconductor industry saw continued investment in advanced simulation platforms, with companies reporting significant reductions in physical test cycles, sometimes by as much as 30% for certain design validation stages.

These digital alternatives can directly substitute for certain aspects of AEM's offerings. By accurately predicting device performance and identifying potential flaws through simulation, manufacturers can bypass some of the physical testing phases that historically relied on specialized equipment. This trend is expected to accelerate as simulation accuracy improves, potentially impacting AEM's market share in areas where digital solutions become a more cost-effective and efficient alternative.

The threat is amplified by the rapid pace of innovation in AI-driven simulation and virtual prototyping.

- Simulation software advancements are reducing the need for physical testing in semiconductor manufacturing.

- Improved accuracy and predictive analytics in simulations mean fewer physical test cycles are required.

- Digital alternatives can directly substitute for certain handling and test equipment functions.

- AI-driven virtual prototyping is accelerating this substitution trend in 2024 and beyond.

Emergence of New Materials or Architectures

The semiconductor industry is constantly evolving, and the emergence of novel materials or chip architectures poses a significant threat of substitution for AEM. For instance, advancements in quantum computing or photonic integrated circuits could necessitate entirely new testing and handling methodologies, potentially bypassing the need for current AEM solutions. This could lead to the development of alternative testing equipment or processes that serve as direct substitutes, impacting AEM's market share.

Consider the rapid development in areas like advanced packaging, such as chiplets, which are changing how semiconductors are designed and interconnected. If these new architectures require different electrical or physical testing parameters, existing AEM equipment might become less efficient or even obsolete. The global semiconductor market, valued at approximately $600 billion in 2024, is a dynamic landscape where such material and architectural shifts can rapidly redefine competitive advantages.

- New Materials: The exploration of wide-bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) already demands different testing protocols compared to traditional silicon.

- Novel Architectures: The rise of 3D chip stacking and heterogeneous integration presents unique challenges for electrical testing and physical handling.

- Testing Methodologies: If future chip designs rely on optical interconnects or entirely new forms of data processing, current electrical probing and testing methods could become substitutes.

- R&D Investment: Companies heavily investing in fundamental research into new semiconductor physics and engineering could develop disruptive technologies that render existing test infrastructure less relevant.

The threat of substitutes for AEM's testing and handling solutions is a dynamic challenge, driven by evolving technological landscapes and customer demands for cost-efficiency. Innovations in simulation and virtual testing are increasingly capable of replicating physical test scenarios, potentially reducing the need for specialized equipment. Furthermore, the semiconductor industry's inherent drive for vertical integration means large manufacturers could develop in-house solutions, bypassing external providers.

The increasing sophistication of simulation software, particularly with AI integration, is a key substitute. For instance, in 2024, many semiconductor firms reported significant reductions in physical test cycles due to advanced simulation platforms, some achieving up to a 30% decrease in certain design validation stages. This trend directly impacts the demand for physical testing and handling equipment.

Emerging semiconductor materials and architectures also present substitution threats. The shift towards wide-bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) already necessitates different testing protocols compared to traditional silicon. Similarly, novel architectures such as 3D chip stacking and heterogeneous integration create unique challenges that could render current testing and handling methods less relevant, potentially leading to the adoption of entirely new equipment or processes.

| Substitute Type | Impact on AEM | Example/Data Point |

|---|---|---|

| Simulation Software | Reduces demand for physical testing | Up to 30% reduction in physical test cycles reported by some firms in 2024 due to advanced simulation. |

| In-house Solutions | Bypasses external equipment providers | Historically, large manufacturers like Intel have invested in vertical integration, including their own testing processes. |

| General-Purpose Test Equipment | Offers a lower-cost alternative for basic needs | Broad spectrum of electronic manufacturers may use versatile, off-the-shelf equipment for basic validation. |

| New Materials/Architectures | Necessitates new testing methodologies | GaN and SiC semiconductors require different testing protocols; 3D chip stacking presents unique challenges. |

Entrants Threaten

The semiconductor test and handling equipment sector presents a formidable barrier to entry due to exceptionally high capital investment requirements. Companies looking to establish a foothold must allocate significant funds towards cutting-edge research and development, acquire or build specialized, high-precision manufacturing facilities, and create robust global distribution and support networks. For instance, the cost of setting up a new semiconductor fabrication plant alone can run into billions of dollars, and while test and handling equipment is a segment of this, the R&D and specialized machinery still demand hundreds of millions. This immense financial outlay effectively deters most aspiring new players, safeguarding existing market participants like AEM.

The development of sophisticated test and handling solutions demands significant technological know-how and ongoing, intensive research and development. New companies entering this space would face substantial upfront costs to acquire or develop proprietary technologies and recruit specialized engineering talent. For instance, in 2024, the semiconductor testing equipment market saw significant R&D spending, with major players investing billions to stay ahead, creating a high barrier for newcomers.

Established customer relationships and trust represent a formidable barrier for new entrants in the semiconductor equipment (AEM) market. Companies like AEM have spent years cultivating deep partnerships with major semiconductor and electronics manufacturers, fostering loyalty built on consistent performance, reliable support, and proven technology. For instance, a new entrant would need to overcome the inertia of existing supply chains and the inherent risk aversion of large corporations that rely on predictable uptime and quality for their own production lines.

Economies of Scale and Experience Curve Effects

Existing players like AEM leverage significant economies of scale in their operations, from bulk purchasing of raw materials to efficient manufacturing processes. For instance, AEM's extensive production capacity in 2023 allowed for a lower cost per unit compared to a smaller, new entrant. This scale advantage translates directly into competitive pricing power.

The experience curve effect further solidifies AEM's position. Years of refining design, optimizing production, and building robust customer support networks mean they operate with greater efficiency and fewer errors. A new competitor would face substantial upfront investment and a prolonged learning period, making it challenging to match AEM's established cost structure and operational expertise.

- Economies of Scale: AEM's large-scale manufacturing in 2023 resulted in lower per-unit production costs, a barrier for new entrants.

- Experience Curve: Accumulated knowledge in design and production provides AEM with efficiency advantages that new companies lack.

- Cost Disadvantage for New Entrants: Start-up companies would incur higher initial costs for R&D, production setup, and market entry.

- Competitive Pricing: AEM's cost efficiencies enable more aggressive pricing strategies, pressuring new entrants to compete on price.

Intellectual Property and Regulatory Hurdles

The semiconductor equipment industry presents a formidable barrier to new entrants due to extensive patent protection and intellectual property rights. Companies like ASML, a dominant player, hold crucial patents for technologies such as extreme ultraviolet (EUV) lithography, making it exceedingly difficult for newcomers to develop comparable products without significant legal challenges or licensing agreements. For instance, ASML's market share in EUV lithography systems was nearly 100% in 2023, underscoring the strength of its IP portfolio.

Navigating complex industry standards and obtaining necessary regulatory certifications further escalates the threat of new entrants. Compliance with stringent quality control, safety regulations, and interoperability standards requires substantial investment in research, development, and testing. This lengthy and resource-intensive process can deter potential competitors, especially smaller firms lacking the capital and expertise to meet these demanding requirements.

- Intellectual Property Protection: The semiconductor equipment sector is characterized by a dense web of patents, particularly in areas like lithography, deposition, and etching. For example, in 2023, leading companies continued to file hundreds of new patents, reinforcing their technological moats.

- Regulatory Compliance: Meeting international standards for manufacturing, environmental impact, and product safety adds significant costs and time to market entry. This includes certifications required for global supply chains, which can take years to secure.

- R&D Investment: The capital required for cutting-edge research and development in semiconductor equipment is immense. Companies like Applied Materials and Lam Research consistently invest billions of dollars annually in R&D to maintain their competitive edge, a level of expenditure difficult for new entrants to match.

The threat of new entrants in the semiconductor test and handling equipment sector is significantly mitigated by the substantial capital investment required. Establishing operations necessitates massive outlays for advanced R&D, specialized manufacturing facilities, and global support infrastructure, effectively deterring most newcomers.

Technological complexity and the need for continuous, intensive R&D create a high barrier. New entrants must overcome significant upfront costs for proprietary technology development and specialized talent acquisition, a challenge underscored by the billions invested annually by established players in 2024.

Established customer relationships and trust are critical deterrents, as companies like AEM have cultivated deep, long-standing partnerships with major semiconductor manufacturers. Overcoming the inertia of existing supply chains and the risk aversion of large corporations is a formidable hurdle for any new player.

| Barrier | Description | Example/Data Point (2023-2024) |

|---|---|---|

| Capital Requirements | Extremely high initial investment for R&D, manufacturing, and distribution. | Semiconductor fabrication plant costs can reach billions; test/handling equipment R&D and machinery still in hundreds of millions. |

| Technological Expertise & R&D | Need for advanced know-how and continuous innovation. | Major players invested billions in R&D in 2024 to maintain a competitive edge. |

| Customer Relationships | Loyalty built on performance, support, and proven technology. | New entrants must overcome inertia and risk aversion of large corporations reliant on predictable uptime. |

| Economies of Scale | Cost advantages from large-scale production and purchasing. | AEM's 2023 production capacity led to lower per-unit costs than potential smaller entrants. |

| Intellectual Property | Extensive patent protection limits new product development. | Companies like ASML held nearly 100% market share in EUV lithography in 2023 due to strong IP. |

| Regulatory Compliance | Meeting stringent industry standards and certifications. | Securing global supply chain certifications can take years and significant investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive blend of data, including publicly available company financial statements, industry-specific market research reports, and insights from reputable trade publications. This approach ensures a robust understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.