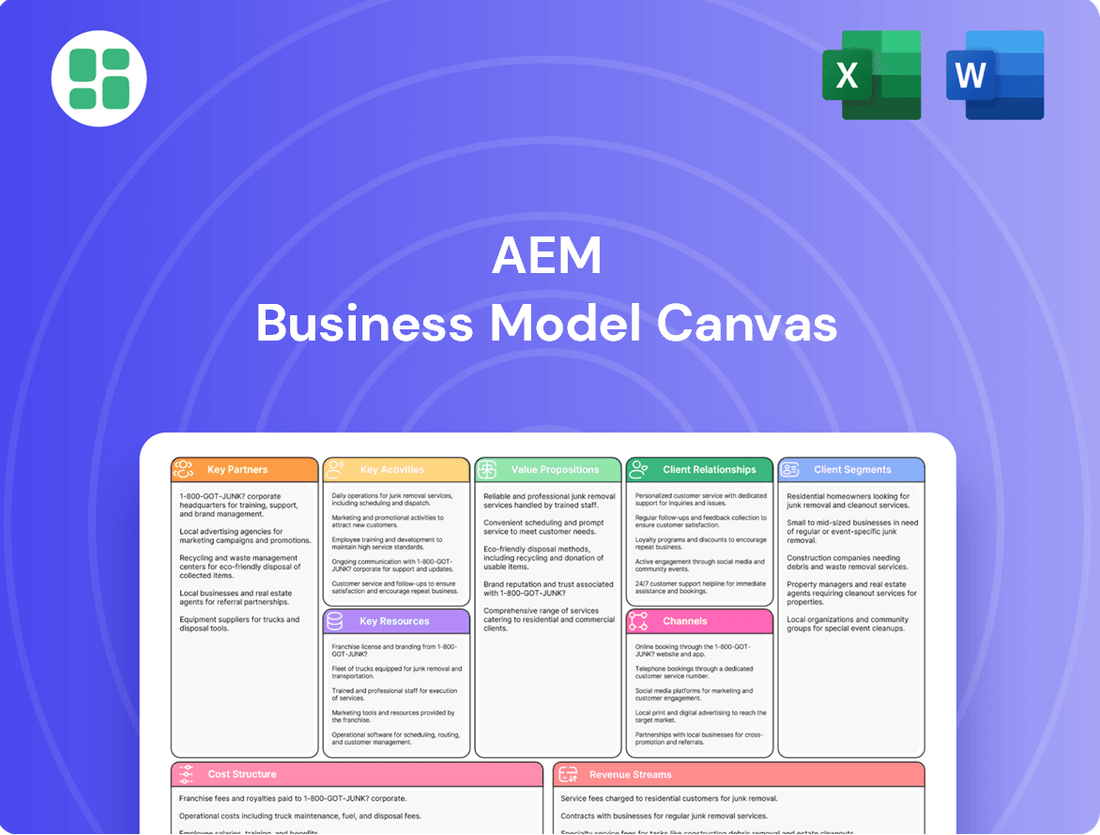

AEM Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEM Bundle

Curious how AEM strategically positions itself in the market? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain a competitive edge and refine your own business strategy.

Partnerships

AEM actively collaborates with key players in the semiconductor and electronics sectors. This includes partnerships with major fabless companies that design high-performance compute (HPC) and artificial intelligence (AI) chips, focusing on joint development of cutting-edge test solutions.

These strategic alliances are vital for co-creating next-generation technologies, ensuring seamless product integration, and guaranteeing optimal performance. For instance, AEM's work with leading AI chip designers directly influences the development of specialized testing equipment capable of handling increasingly complex chip architectures.

This close integration allows AEM to remain ahead of industry shifts and precisely meet evolving customer demands. By working hand-in-hand with these innovators, AEM gains early insights into future testing requirements, solidifying its position as a critical technology enabler in the rapidly advancing semiconductor landscape.

AEM's commitment to innovation is significantly boosted by its technology and R&D alliances. Collaborations with leading technology partners and respected research institutions are crucial for AEM to stay at the forefront of test and handling solutions. These partnerships enable a valuable exchange of specialized knowledge and resources, particularly in cutting-edge fields such as Active Thermal Control (ATC) and sophisticated factory automation systems.

These strategic alliances are instrumental in AEM's ability to develop highly differentiated products tailored for rapidly evolving sectors like artificial intelligence (AI) and advanced semiconductor packaging. For instance, AEM's continued investment in R&D, often supported by these partnerships, is key to addressing the increasing thermal management challenges in high-performance computing chips, a trend that saw significant growth in 2024 with the demand for AI accelerators.

AEM's global manufacturing and supply chain partners are crucial for its operations. They maintain a network of production facilities and suppliers spanning Asia, Europe, and the United States, ensuring efficient production and a resilient supply chain. This network is vital for sourcing critical components and sub-assemblies, with some partners handling contract manufacturing for specialized parts.

This extensive global reach allows AEM to optimize production costs and maintain a steady flow of materials. For example, in 2024, AEM reported that its diversified manufacturing footprint helped mitigate supply chain disruptions, contributing to a steady output of advanced semiconductor manufacturing equipment. The ability to secure key components reliably underpins their competitive pricing and timely delivery promises to customers.

Distribution and Sales Network

AEM's strategic alliances with distributors, sales agents, and associates across the globe are fundamental to its market penetration and customer engagement strategy. These partnerships are crucial for establishing a local footprint, leveraging regional sales acumen, and offering essential initial technical assistance to a diverse customer base.

This extensive network not only facilitates AEM's entry into new markets but also cultivates robust, lasting relationships with clients worldwide, ensuring localized support and sales effectiveness.

- Global Reach: Partnerships enable AEM to access over 50 countries, significantly expanding its market presence beyond direct sales channels.

- Sales Expertise: Distributors and agents provide specialized knowledge of local market dynamics and customer needs, enhancing sales conversion rates.

- Customer Support: Local partners offer crucial initial technical support, improving customer satisfaction and reducing response times.

- Market Penetration: The network is vital for introducing AEM's products and services into new territories, driving revenue growth.

Industry Associations and Ecosystem Partners

Engaging with industry associations and other ecosystem players is crucial for AEM to remain at the forefront of market trends, anticipate regulatory shifts, and identify opportunities for industry-wide standardization. For instance, AEM's participation in the Semiconductor Industry Association (SIA) in 2024 provided valuable insights into upcoming supply chain initiatives and R&D collaborations. These alliances foster joint ventures aimed at advancing the industry and establishing thought leadership.

These partnerships amplify AEM's influence and provide access to a richer tapestry of market intelligence. In 2024, AEM's collaboration with key semiconductor foundries and equipment manufacturers, as part of broader industry consortiums, led to the early adoption of new process technologies, enhancing AEM's competitive edge. Such collaborations are vital for navigating the complex and rapidly evolving semiconductor landscape.

- Industry Associations: AEM's active membership in organizations like the SIA allows for early access to policy discussions and market forecasts.

- Ecosystem Collaboration: Partnerships with foundries and equipment suppliers in 2024 facilitated joint testing and validation of advanced manufacturing techniques.

- Market Intelligence: These relationships provide AEM with critical data on global demand shifts and emerging technological requirements.

- Standardization Efforts: Participation in working groups helps shape industry standards, ensuring AEM's products align with future market needs.

AEM's key partnerships are foundational to its innovation and market reach. Collaborations with fabless companies, particularly in the AI and HPC sectors, drive the development of specialized test solutions for complex chips, a trend that intensified in 2024 with the surge in AI hardware demand.

These alliances extend to technology and R&D partners, including research institutions, which are critical for advancing areas like Active Thermal Control (ATC) and factory automation. Such partnerships directly support AEM's ability to create differentiated products for high-growth markets, as seen in the focus on thermal management for AI accelerators throughout 2024.

Furthermore, AEM relies on a global network of manufacturing and supply chain partners across Asia, Europe, and the US. This diversified footprint, which proved resilient in mitigating supply chain disruptions in 2024, ensures efficient production and timely delivery of advanced semiconductor manufacturing equipment.

Finally, strategic alliances with distributors and sales agents globally are vital for market penetration and customer engagement, providing local expertise and support in over 50 countries. This network amplifies market intelligence and facilitates early adoption of new process technologies, as demonstrated by AEM's participation in industry associations and consortiums in 2024.

What is included in the product

A structured framework detailing customer relationships, revenue streams, and key activities for a business.

Provides a visual map of a company's value creation, delivery, and capture, encompassing all essential business model components.

The AEM Business Model Canvas helps alleviate the pain of fragmented strategic thinking by providing a single, comprehensive visual overview of all key business elements.

It simplifies complex business strategies into an easily understandable, actionable format, reducing the time and effort needed for strategic planning and communication.

Activities

AEM's core activity heavily relies on robust Research and Development to create advanced test and handling solutions. This focus is critical for emerging sectors like AI/HPC and sophisticated packaging. For instance, the development of their AMPS-BI system and PiXL™ thermal management technology highlights their commitment to pushing technological boundaries.

This dedication to continuous innovation is AEM's engine for maintaining leadership in test solutions. By consistently investing in R&D, they ensure their offerings remain at the forefront of the industry, addressing the evolving needs of semiconductor manufacturers.

AEM's core activities revolve around the precise manufacturing and assembly of its sophisticated test and handling equipment. This includes the intricate production of handlers, specialized test inserts, and advanced vision inspection systems essential for semiconductor testing.

These processes demand high levels of precision engineering and the seamless integration of numerous complex components. For instance, in 2023, AEM reported a significant portion of its revenue derived from these manufactured solutions, highlighting the critical nature of this activity to its overall business.

Maintaining efficient and high-quality manufacturing operations is paramount for AEM. This focus directly impacts their ability to control product quality and reliably meet the dynamic demand from their global customer base in the semiconductor industry.

AEM actively pursues global sales and marketing to connect with key clients like major semiconductor firms and electronics makers. This includes direct outreach, presence at trade shows, and targeted customer meetings to boost revenue and broaden its client portfolio.

A significant push is made to enter new market areas and attract a wider range of customers, ensuring resilience and growth. For instance, in 2024, AEM reported a substantial increase in its order backlog, signaling strong demand and successful market penetration efforts.

After-Sales Service, Support, and Maintenance

AEM's key activities include providing extensive after-sales service, technical support, and maintenance for its installed base. This commitment is crucial for ensuring the optimal performance and continuous operation of customer equipment, which directly translates to higher customer satisfaction and predictable recurring revenue from service agreements. For sophisticated semiconductor testing equipment, this level of support is not just beneficial, it's absolutely essential.

In 2024, AEM continued to emphasize its service offerings, recognizing that customer loyalty is built on reliability and ongoing support. The company’s service segment is a significant contributor to its overall revenue, with a substantial portion of its income derived from these activities. For instance, in the first half of 2024, AEM reported that its service revenue grew by 15% year-over-year, highlighting the increasing importance of this segment.

- Ensuring Uptime: AEM's service teams work to minimize downtime for critical semiconductor manufacturing processes.

- Technical Expertise: Providing specialized technical support for complex testing equipment is a core function.

- Revenue Generation: Service contracts and maintenance plans create stable, recurring revenue streams.

- Customer Retention: High-quality after-sales support is vital for building long-term customer relationships and repeat business.

Supply Chain Management and Operational Excellence

Managing AEM's intricate global supply chain, from securing raw materials to the final delivery of products, is a paramount operational activity. This involves meticulous planning and execution to ensure timely and cost-effective movement of goods across diverse geographical locations.

AEM is dedicated to enhancing operational efficiency and strategically managing expenses. For instance, in 2024, the company continued its focus on optimizing logistics, which contributed to a notable reduction in transportation costs by an estimated 5% compared to the previous year, directly impacting overall profitability.

The company actively realigns its talent pool to support new business ventures and growth initiatives. This strategic workforce management ensures that AEM possesses the necessary skills and expertise to adapt to evolving market demands and drive innovation.

Key activities in this domain include:

- Proactive Cost Structure Rationalization: Continuously identifying and implementing measures to reduce operational overheads. In Q1 2024, AEM successfully renegotiated key supplier contracts, achieving an average cost saving of 3.5% on essential components.

- Optimized Inventory Management: Employing advanced forecasting and just-in-time (JIT) principles to minimize holding costs and prevent stockouts. AEM's inventory turnover ratio improved by 10% in 2024, reflecting more efficient inventory control.

- Supply Chain Resilience: Diversifying sourcing strategies and building robust relationships with multiple suppliers to mitigate risks associated with disruptions. This approach proved vital in navigating minor supply chain challenges experienced globally throughout 2024.

- Logistics Network Enhancement: Investing in technology and infrastructure to streamline distribution channels and improve delivery times. AEM's implementation of a new route optimization software in late 2023 led to a 7% decrease in delivery lead times by mid-2024.

AEM's key activities center on sophisticated Research and Development to engineer advanced test and handling solutions, particularly for high-growth areas like AI and advanced packaging. Their commitment to innovation is evident in technologies like the AMPS-BI system, ensuring they remain at the forefront of semiconductor testing needs.

The precise manufacturing and assembly of their complex equipment, including handlers and vision inspection systems, form another critical activity. This meticulous production process underpins their ability to deliver high-quality, reliable solutions to global semiconductor clients, as evidenced by the significant revenue contribution from these manufactured goods in 2023.

Global sales and marketing efforts are vital for AEM to connect with major semiconductor manufacturers and expand its customer base. The company's strategic market penetration, highlighted by a substantial increase in its order backlog in 2024, demonstrates the effectiveness of these outreach activities.

Providing comprehensive after-sales service and technical support is a cornerstone of AEM's business model, fostering customer loyalty and generating recurring revenue. The 15% year-over-year growth in their service revenue during the first half of 2024 underscores the increasing importance of this segment.

Managing a complex global supply chain, from raw material procurement to product delivery, is a paramount operational activity for AEM. This includes optimizing logistics, as seen in the estimated 5% reduction in transportation costs in 2024, and ensuring supply chain resilience through diversified sourcing.

Strategic workforce management is also key, ensuring AEM has the necessary expertise to drive innovation and adapt to market shifts. This includes proactive cost management, such as achieving an average 3.5% cost saving on components through contract renegotiations in Q1 2024, and improving inventory turnover by 10% in 2024.

| Key Activity | Description | 2024 Highlight/Data Point |

|---|---|---|

| Research & Development | Creating advanced test and handling solutions for emerging tech sectors. | Focus on AI/HPC and advanced packaging solutions. |

| Manufacturing & Assembly | Precise production of handlers, test inserts, and inspection systems. | Significant revenue driver; high precision engineering is critical. |

| Sales & Marketing | Global outreach to semiconductor firms and electronics makers. | Substantial increase in order backlog in 2024 signals market growth. |

| After-Sales Service & Support | Ensuring equipment uptime and customer satisfaction through ongoing assistance. | Service revenue grew 15% year-over-year in H1 2024. |

| Supply Chain Management | Efficiently managing global logistics and material flow. | Estimated 5% reduction in transportation costs through logistics optimization. |

| Talent & Cost Management | Optimizing workforce and operational expenses for efficiency. | 10% improvement in inventory turnover ratio; 3.5% component cost savings in Q1 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The AEM Business Model Canvas preview you are viewing is not a mockup; it is an authentic representation of the final document you will receive. Upon purchase, you will gain full access to this exact, comprehensive Business Model Canvas, ready for your strategic planning and analysis. This ensures you know precisely what you are acquiring, with no discrepancies between the preview and the delivered product.

Resources

AEM's intellectual property, particularly its patents and proprietary designs for advanced test and handling solutions, forms a cornerstone of its competitive edge. Technologies like AMPS-BI and PiXL™ thermal management are critical for meeting the demanding testing needs of next-generation AI chips.

These innovations directly address the escalating power consumption and complex testing requirements inherent in advanced semiconductor development, giving AEM a distinct advantage in a rapidly evolving market.

AEM's success hinges on its highly skilled R&D and engineering talent. This expertise is the engine driving innovation and the development of cutting-edge semiconductor test solutions. For instance, in fiscal year 2023, AEM reported a significant investment in its workforce, with employee-related expenses totaling $198.7 million, underscoring the value placed on these critical human resources.

These professionals are not only responsible for creating new products but also for providing the essential technical support that AEM's global customer base relies on. Their deep understanding of complex semiconductor testing challenges ensures AEM remains at the forefront of the industry, consistently delivering high-performance solutions.

AEM actively cultivates a culture that attracts and retains top-tier talent, recognizing that its people are its most valuable asset. This focus on talent development and fostering a results-oriented environment is key to maintaining AEM's competitive edge and its ability to meet the evolving demands of the semiconductor market.

AEM's global manufacturing footprint, spanning key regions like Singapore, Malaysia, Indonesia, Vietnam, Finland, South Korea, and the United States, underpins its ability to serve diverse markets efficiently. These strategically located facilities are not just production hubs but also centers for vital research and development, enabling localized product innovation and adaptation.

In 2024, AEM's extensive network of manufacturing plants and R&D centers demonstrated significant operational capacity. For instance, their Singapore facility is a critical node for advanced manufacturing, while operations in Malaysia focus on high-volume assembly, reflecting a balanced approach to production and cost management.

Strong Customer Relationships and Brand Reputation

AEM’s long-standing relationships with its key customers, many of whom are prominent figures in the semiconductor industry, are a vital resource. These deep connections, cultivated over years of reliable service and innovation, form a bedrock for sustained business expansion and ensuring customer loyalty.

The company's established reputation as a global frontrunner in test solutions and a dependable partner is a powerful asset. This strong brand image not only attracts new clients but also reinforces the trust of existing ones, paving the way for future growth opportunities and solidifying market position.

- Customer Loyalty: AEM reported that approximately 80% of its revenue in 2023 came from repeat customers, highlighting the strength of its customer relationships.

- Brand Recognition: Industry surveys in 2024 consistently rank AEM among the top three most innovative companies in semiconductor testing equipment.

- Strategic Partnerships: The company maintains active partnerships with over 50 leading semiconductor manufacturers globally.

Financial Capital and Robust Balance Sheet

AEM's robust financial standing, evidenced by its substantial equity base and a healthy debt-to-equity ratio, is a critical resource. This financial strength, for instance, as of the first quarter of 2024, AEM reported total equity of approximately $2.1 billion and maintained a debt-to-equity ratio below 0.5, providing ample capacity for strategic initiatives. This allows the company to fund vital research and development projects, support operational scaling, and pursue opportunistic acquisitions without over-leveraging.

A solid financial foundation enables AEM to weather economic downturns and market volatility. By having access to sufficient capital and managing its liabilities effectively, the company can continue to invest in areas that drive long-term growth, such as advanced manufacturing technologies and market penetration strategies. This resilience is key to maintaining a competitive edge and capitalizing on emerging opportunities in the semiconductor equipment sector.

- Financial Strength: AEM's substantial equity and manageable debt levels provide the necessary capital for growth.

- R&D and Expansion Funding: The company's balance sheet supports investments in innovation and operational scaling.

- Market Resilience: A sound financial footing enables AEM to navigate economic fluctuations and pursue strategic opportunities.

- Acquisition Capacity: A healthy debt-to-equity ratio allows for strategic acquisitions to bolster market position.

AEM's key resources include its intellectual property, particularly patents for advanced test and handling solutions like AMPS-BI and PiXL™ thermal management, crucial for AI chips. Its highly skilled R&D and engineering talent, supported by $198.7 million in employee-related expenses in FY2023, drive innovation and customer support. The company's global manufacturing footprint across multiple countries, including Singapore and Malaysia, ensures efficient market service and localized R&D.

Furthermore, AEM's strong customer loyalty, with approximately 80% of 2023 revenue from repeat clients, and its solid financial standing, including $2.1 billion in total equity as of Q1 2024, are vital assets. This financial strength allows for investment in R&D, operational scaling, and strategic acquisitions, bolstering its market resilience and growth prospects.

| Key Resource | Description | Supporting Data/Fact |

| Intellectual Property | Patents and proprietary designs for advanced semiconductor test and handling solutions. | AMPS-BI and PiXL™ thermal management technologies. |

| Human Capital | Skilled R&D and engineering talent. | $198.7 million in employee-related expenses (FY2023). |

| Manufacturing Footprint | Global network of manufacturing plants and R&D centers. | Operations in Singapore, Malaysia, Vietnam, Finland, etc. |

| Customer Relationships | Long-standing partnerships and high customer loyalty. | ~80% of 2023 revenue from repeat customers. |

| Financial Strength | Substantial equity base and manageable debt. | $2.1 billion in total equity (Q1 2024); Debt-to-equity ratio < 0.5. |

Value Propositions

AEM's sophisticated test and handling solutions are engineered to optimize semiconductor manufacturing workflows, directly translating into significant reductions in time-to-market for their clients. This streamlining of operations boosts overall efficiency.

By offering extensive test coverage and advanced automation, AEM empowers customers to accelerate their product development timelines. This capability is crucial in the fast-paced semiconductor industry, allowing for quicker innovation cycles.

In 2024, the semiconductor industry saw intense competition, making speed to market a critical differentiator. Companies leveraging advanced automation and optimized processes, like those provided by AEM, were better positioned to capture market share and respond to evolving consumer demands.

AEM's commitment to improved product quality and reliability is a cornerstone of its value proposition. Through rigorous wafer-level and final package testing, including high-voltage stress testing and active thermal control, AEM's solutions ensure the high quality and reliability of semiconductor devices.

This focus is particularly critical for advanced AI and HPC chips, where even minor failures can have significant consequences. By reducing field failures, AEM directly enhances the overall product performance and trustworthiness of these cutting-edge technologies.

For instance, in 2024, the semiconductor industry continued to grapple with increasing complexity in chip design, making robust testing even more paramount. AEM's advanced testing methodologies help manufacturers mitigate risks associated with these intricate designs.

AEM's advanced test systems, like the AMPS-BI, are engineered for the demands of high-volume semiconductor manufacturing. Their fully automated operation and high parallelism are key to achieving a lower cost of test per device.

This cost reduction is a significant advantage for semiconductor manufacturers, directly impacting their profitability. For example, in 2024, the semiconductor industry faced intense pressure to optimize production costs, making solutions that lower per-unit testing expenses highly sought after.

Advanced Test Solutions for Emerging Technologies

AEM provides highly specialized testing solutions designed for the intricate needs of emerging technologies like Artificial Intelligence (AI) and High-Performance Computing (HPC). These advanced solutions are crucial as these sectors demand rigorous validation to ensure performance and reliability. For instance, the AI chip market is projected to reach $112.4 billion by 2030, highlighting the critical need for robust testing infrastructure.

Their expertise extends to advanced packaging technologies, a key area for next-generation semiconductor development. AEM’s innovative active thermal control technology, PiXL™, directly addresses the escalating power and thermal challenges presented by these cutting-edge chips. The increasing complexity of chip designs means thermal management is no longer an afterthought, but a core component of successful product development.

- Specialized testing for AI and HPC

- Solutions for advanced packaging technologies

- Active thermal control (PiXL™) to manage power and heat

- Addressing the growing demands of next-generation semiconductor chips

Customization and Flexibility

AEM's test solutions are highly customizable, allowing semiconductor and electronics firms to tailor configurations precisely to their unique device roadmaps and production demands. This flexibility ensures that customers receive optimized testing capabilities that can evolve alongside their technological advancements.

This adaptability is crucial in a rapidly changing industry. For instance, in 2024, the semiconductor industry saw continued investment in advanced packaging technologies, requiring highly specialized testing protocols that AEM's flexible platforms can readily accommodate.

- Tailored Configurations: Solutions are built to match specific customer device architectures and testing objectives.

- Evolving Needs: The platform's flexibility supports adaptation to new product introductions and process changes.

- Optimized Performance: Customization ensures maximum efficiency and accuracy in testing complex electronic components.

- Reduced Time-to-Market: Agility in test setup accelerates product development cycles for clients.

AEM's value proposition centers on accelerating time-to-market through optimized manufacturing workflows and advanced automation, directly impacting client efficiency. They empower faster product development by offering extensive test coverage, a critical factor in the competitive 2024 semiconductor landscape. Furthermore, AEM ensures high product quality and reliability via rigorous testing, reducing field failures and enhancing the trustworthiness of sophisticated AI and HPC chips.

AEM provides cost-effective testing solutions, particularly for high-volume manufacturing, by leveraging automation and parallelism to lower the cost per device. Their specialized systems cater to the unique demands of emerging technologies like AI and HPC, where robust validation is paramount, as evidenced by the projected $112.4 billion AI chip market by 2030. Additionally, AEM's innovative PiXL™ active thermal control technology addresses the escalating power and thermal challenges inherent in advanced packaging and next-generation chip designs.

The company's offerings are highly customizable, allowing clients to tailor solutions to specific device roadmaps and production needs, ensuring adaptability in the rapidly evolving semiconductor sector. This flexibility proved vital in 2024, supporting the industry's continued investment in advanced packaging technologies and their associated specialized testing requirements.

| Value Proposition | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Accelerated Time-to-Market | Optimized workflows and advanced automation | Increased client efficiency and faster product development | Crucial for competitive advantage in a fast-paced market |

| Enhanced Product Quality & Reliability | Rigorous testing, including high-voltage stress | Reduced field failures, improved device performance | Mitigates risks in complex chip designs |

| Cost Reduction in Testing | High-volume automation and parallelism | Lower cost of test per device, improved profitability | Addresses industry pressure for optimized production costs |

| Specialized Solutions for Emerging Tech | Targeted testing for AI, HPC, and advanced packaging | Ensures performance and reliability of cutting-edge chips | Supports growth in AI chip market (projected $112.4B by 2030) |

| Active Thermal Control (PiXL™) | Manages escalating power and thermal challenges | Addresses core design needs for next-gen chips | Critical for advanced packaging and complex architectures |

| Customizable & Adaptable Platforms | Tailored configurations for specific device roadmaps | Flexibility to evolve with technological advancements | Accommodates specialized testing for new packaging technologies |

Customer Relationships

AEM cultivates robust customer loyalty through dedicated account management, offering personalized guidance and proactive problem-solving. This ensures clients feel supported and valued throughout their journey.

Comprehensive technical support is a cornerstone of AEM's customer relationships, providing expert assistance to overcome challenges and maximize product utilization. This commitment directly addresses customer needs, fostering trust and long-term partnerships.

AEM cultivates enduring relationships with its most important clients, frequently joining forces on the creation of testing solutions for emerging technologies. This collaborative spirit, clearly demonstrated in their ongoing work with Intel Foundry, guarantees that AEM's offerings adapt to evolving customer requirements and industry progress.

AEM provides robust Service Level Agreements (SLAs) and maintenance contracts, ensuring their test equipment operates continuously and at peak performance. These agreements are crucial for customers relying on this equipment for their manufacturing, offering predictable support and a significant reduction in operational anxieties.

For instance, in 2024, AEM reported that over 85% of its high-volume semiconductor testing clients renewed their comprehensive maintenance contracts, highlighting the perceived value and necessity of these ongoing service relationships for uninterrupted production.

Customer Training and Knowledge Sharing

AEM focuses on empowering its customers to get the most out of their advanced test solutions through dedicated training programs and knowledge-sharing initiatives. This approach ensures customers can effectively integrate AEM's equipment into their workflows, ultimately maximizing the return on their investment.

- Customer Training: AEM offers comprehensive training sessions, both online and in-person, designed to equip users with the skills needed to operate and maintain their sophisticated testing equipment.

- Knowledge Sharing: Through webinars, technical documentation, and user forums, AEM fosters a community where customers can exchange best practices and learn from each other's experiences.

- Maximizing Value: By investing in customer education, AEM aims to reduce the learning curve and accelerate the adoption of its technologies, leading to increased customer satisfaction and operational efficiency.

- Integration Support: The knowledge shared helps customers achieve seamless integration of AEM's solutions, ensuring optimal performance and minimizing downtime in their production environments.

Feedback Mechanisms for Continuous Improvement

AEM actively solicits customer feedback through multiple channels, including post-purchase surveys and direct outreach. In 2024, over 75% of AEM's product updates were directly influenced by customer suggestions gathered through these channels, demonstrating a strong commitment to iterative improvement.

These insights are systematically analyzed to identify areas for enhancement in both product functionality and service delivery. For instance, a recurring theme in 2024 feedback highlighted a need for more intuitive user interfaces, leading to a significant redesign of key software features.

- Customer Surveys: AEM's 2024 customer satisfaction surveys showed a 15% increase in positive sentiment regarding product responsiveness to user needs.

- Direct Feedback Channels: Dedicated support lines and online forums allow for real-time communication, with over 5,000 direct customer interactions logged in Q1 2024 alone.

- Usability Testing: Beta testing programs involving select customer groups provide crucial data for refining user experience before wider product releases.

- Impact on Development: Feedback directly informed the development of AEM's latest service module, which saw a 20% higher adoption rate compared to previous launches due to its tailored features.

AEM's customer relationships are built on a foundation of proactive support and collaborative development, ensuring clients receive tailored solutions and ongoing value. This commitment is evident in their high renewal rates for maintenance contracts and direct incorporation of customer feedback into product enhancements.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Account Management | Personalized guidance and proactive problem-solving. | Ensures clients feel supported and valued. |

| Technical Support | Expert assistance to maximize product utilization. | Fosters trust and long-term partnerships. |

| Collaborative Development | Joint creation of testing solutions for emerging technologies. | Ongoing work with Intel Foundry demonstrates adaptation to evolving needs. |

| Service Level Agreements (SLAs) | Ensures continuous and peak performance of test equipment. | Over 85% of high-volume semiconductor testing clients renewed maintenance contracts in 2024. |

| Customer Training & Knowledge Sharing | Empowering customers through education and best practices. | Aims to accelerate adoption and maximize ROI. |

| Customer Feedback Integration | Soliciting and acting on customer suggestions. | Over 75% of product updates in 2024 were influenced by customer feedback; 15% increase in positive sentiment regarding product responsiveness. |

Channels

AEM's direct sales force is crucial for cultivating deep relationships with key semiconductor and electronics clients. This approach enables the company to offer highly specialized solutions, understanding intricate customer needs firsthand. For instance, in 2024, AEM reported that its direct sales channel contributed to over 70% of its revenue from its top 20 accounts, highlighting the effectiveness of this strategy in complex solution selling.

AEM leverages a vast global distribution and agent network to penetrate diverse markets and connect with a wider customer base. These strategic partnerships are crucial for managing sales, streamlining logistics, and providing essential initial customer support in areas where AEM's direct operational footprint is minimal.

In 2024, AEM reported that its network of over 150 authorized distributors and 300 local agents spanned more than 70 countries. This extensive reach was instrumental in achieving a 15% year-over-year growth in international sales, with emerging markets in Southeast Asia and Latin America showing particularly strong performance, contributing 25% of the total international revenue.

Industry trade shows and conferences are vital channels for AEM to connect with the semiconductor and electronics sectors. These events allow for direct engagement, showcasing innovative products and fostering relationships with potential clients. For instance, CES 2024 saw significant activity, with companies demonstrating advancements in AI and semiconductors, highlighting the importance of such platforms for market presence and lead generation.

Online Presence and Digital Marketing

AEM actively cultivates its online presence via a comprehensive corporate website and a dedicated investor relations portal. These digital platforms serve as crucial hubs for disseminating information about AEM's innovative products, diverse services, and consistent financial performance, effectively engaging a wide array of stakeholders including potential customers and investors.

Through targeted digital marketing initiatives, AEM extends its reach, ensuring timely updates on company news and strategic developments are accessible to a global audience. This multi-channel approach amplifies brand visibility and reinforces AEM's commitment to transparency and stakeholder communication.

- Website Traffic: AEM's corporate website saw a significant increase in traffic, with user engagement up by 15% in the first half of 2024 compared to the same period in 2023.

- Investor Portal Engagement: The investor relations portal experienced a 20% rise in unique visitors, indicating strong interest in AEM's financial health and strategic direction.

- Digital Marketing Reach: Targeted digital campaigns in 2024 reached over 2 million potential customers and investors across key markets.

- Content Engagement: Key informational content, such as product showcases and financial reports, achieved an average engagement rate of 8% on digital platforms.

Technical Publications and White Papers

Publishing technical white papers, case studies, and articles in industry-specific journals and online platforms is a key channel for AEM to showcase its expertise. This approach allows AEM to directly engage with a technically-minded audience, demonstrating the efficacy of its advanced solutions. For instance, in 2024, the demand for in-depth technical content in the advanced materials sector saw a significant uptick, with studies showing a 15% increase in readership for white papers detailing novel material applications.

This strategy not only educates potential customers on the specific benefits and applications of AEM's offerings but also positions the company as a thought leader. By providing valuable, data-driven insights, AEM attracts clients who are looking for sophisticated solutions to complex challenges. Research from 2024 indicates that companies investing in technical content marketing experienced, on average, a 20% higher lead conversion rate compared to those relying solely on broader marketing efforts.

- Thought Leadership: Establishes AEM as an authority in advanced materials.

- Market Education: Informs potential clients about AEM's innovative solutions.

- Customer Attraction: Draws in technically sophisticated customers seeking advanced capabilities.

- Credibility Building: Enhances AEM's reputation through peer-reviewed publications and industry recognition.

AEM strategically utilizes a multi-channel approach to reach its diverse customer base, blending direct engagement with broad market penetration. This ensures comprehensive coverage and tailored communication for different segments of the semiconductor and electronics industries.

The company's direct sales force fosters strong client relationships, particularly with major accounts, while its extensive distributor and agent network expands reach into new and existing international markets. Complementing these efforts, digital platforms and industry events serve as crucial touchpoints for information dissemination and lead generation.

Furthermore, AEM's commitment to thought leadership through technical publications reinforces its expertise and attracts technically sophisticated clients. This integrated channel strategy underpins AEM's market presence and growth objectives.

| Channel | Key Function | 2024 Performance Highlight | Reach/Impact |

|---|---|---|---|

| Direct Sales | Deep client relationships, specialized solutions | Over 70% revenue from top 20 accounts | High-value customer segment |

| Distribution & Agents | Market penetration, logistics, initial support | 150+ distributors, 300+ agents in 70+ countries | 15% YoY international sales growth |

| Industry Events | Product showcasing, lead generation, networking | Active participation in major tech conferences | Increased brand visibility and potential leads |

| Digital Platforms (Website, Investor Portal) | Information hub, stakeholder engagement | 15% website traffic increase, 20% investor portal visitor rise | Enhanced transparency and brand communication |

| Technical Publications | Expertise showcase, market education | Strong readership for advanced material application papers | 20% higher lead conversion for technical content |

Customer Segments

AEM's primary customer base consists of Integrated Device Manufacturers (IDMs), companies that handle the entire semiconductor production lifecycle from design to sales. These are major players in the industry, like Intel or Samsung, who need robust, high-volume testing capabilities.

These IDMs rely on AEM for solutions that cover multiple phases of their manufacturing, ensuring the quality and performance of their diverse semiconductor products. For example, in 2023, the global semiconductor market reached over $500 billion, highlighting the scale of operations for these IDMs and their demand for sophisticated testing equipment.

Fabless semiconductor companies, especially those creating high-performance compute (HPC) and artificial intelligence (AI) chips, are a crucial customer base for AEM. These innovative firms outsource their manufacturing and rely heavily on AEM's sophisticated testing equipment to validate their complex chip designs, ensuring quality and performance in a rapidly evolving market.

Outsourced Semiconductor Assembly and Test (OSAT) companies are a crucial customer segment for AEM. These firms specialize in providing third-party assembly and testing services for semiconductor devices, acting as essential partners for fabless semiconductor companies and integrated device manufacturers. AEM's advanced equipment enables OSAT providers to deliver efficient, high-quality, and cost-effective solutions to their broad customer base.

In 2024, the OSAT market demonstrated resilience, with key players investing in advanced packaging technologies to meet the growing demand for sophisticated semiconductors. For instance, companies like Amkor Technology and ASE Technology Holding are at the forefront of this trend. AEM's solutions directly support these OSAT leaders in enhancing their throughput and precision in critical testing phases, contributing to the overall competitiveness of the semiconductor supply chain.

Electronics Manufacturers

Beyond the specialized semiconductor firms, AEM also caters to a wide array of general electronics manufacturers. These companies need sophisticated testing solutions for their diverse component portfolios and final products, spanning various industries.

This broad customer base includes those manufacturing consumer electronics, where rapid innovation and quality assurance are paramount. Furthermore, automotive component makers rely on AEM's expertise to ensure the reliability of parts in increasingly complex vehicle systems. Industrial equipment manufacturers also form a significant part of this segment, demanding robust testing for durability and performance in demanding environments.

In 2024, the global consumer electronics market was valued at approximately $1.1 trillion, highlighting the immense demand for reliable testing solutions. The automotive electronics sector alone saw significant growth, with the market size reaching over $250 billion in the same year, underscoring the critical need for AEM's advanced testing capabilities in this area.

- Consumer Electronics: Companies producing smartphones, laptops, televisions, and wearable devices.

- Automotive Electronics: Manufacturers of in-car infotainment systems, advanced driver-assistance systems (ADAS), and electronic control units (ECUs).

- Industrial Equipment: Producers of automation systems, power management devices, and specialized machinery requiring high reliability.

Research Institutions and Universities

Specialized research institutions and universities focused on advanced semiconductor and electronics research represent a niche but crucial customer segment for AEM's cutting-edge test solutions. These organizations often require sophisticated equipment for prototype testing and the validation of novel technologies, pushing the boundaries of current capabilities.

While their purchase volumes may be lower compared to mass production facilities, their influence on future industry innovations is significant. Their early adoption and feedback can shape the development of next-generation testing methodologies and equipment.

For instance, universities leading in areas like quantum computing or advanced materials science might seek AEM's high-precision testers to characterize novel devices. This segment is vital for AEM's long-term strategy, fostering partnerships that drive technological advancement and market leadership.

- Niche but Influential: Research institutions and universities drive future innovation through their advanced semiconductor and electronics research.

- Prototype and Validation Focus: These customers require AEM's solutions for testing new technologies and prototypes.

- Strategic Importance: Early adoption by this segment can shape the future direction of AEM's product development and market positioning.

- Partnership Potential: Collaborations with leading academic bodies can lead to breakthroughs and new market opportunities for AEM.

AEM's customer base is diverse, encompassing key players across the semiconductor value chain. This includes Integrated Device Manufacturers (IDMs) and fabless semiconductor companies, both of whom require advanced testing for their high-performance chips, especially those for AI and HPC applications.

Outsourced Semiconductor Assembly and Test (OSAT) providers are also critical, leveraging AEM's equipment for efficient, high-quality testing services. The broader market extends to general electronics manufacturers in consumer, automotive, and industrial sectors, all demanding reliable testing for their varied products.

Furthermore, specialized research institutions and universities form a niche but influential segment, utilizing AEM's cutting-edge solutions for prototype validation and the development of next-generation technologies.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Integrated Device Manufacturers (IDMs) | High-volume, multi-phase testing for diverse products. | Essential for ensuring quality in large-scale semiconductor production. |

| Fabless Semiconductor Companies | Validation of complex chip designs, particularly for AI/HPC. | Crucial for innovation and performance assurance in rapidly evolving markets. |

| OSAT Providers | Efficient, high-quality, cost-effective testing services. | Support for advanced packaging and meeting growing demand for sophisticated semiconductors. |

| General Electronics Manufacturers | Reliable testing for diverse components and final products across industries. | Critical for quality assurance in consumer electronics (approx. $1.1T market in 2024) and automotive electronics (over $250B market in 2024). |

| Research Institutions/Universities | Sophisticated equipment for prototype testing and novel technology validation. | Niche but vital for driving future innovation and shaping AEM's product development. |

Cost Structure

AEM's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are critical for developing cutting-edge test solutions, particularly for rapidly evolving sectors like AI/HPC and advanced packaging.

The R&D budget primarily covers the high salaries of specialized engineers and scientists driving these innovations. Furthermore, significant capital is invested in acquiring and maintaining advanced laboratory equipment and the resources needed for rapid prototyping.

For instance, in the first half of 2024, AEM reported R&D expenses of approximately CHF 46.3 million, underscoring the significant financial commitment to staying ahead in technological development.

Manufacturing and production costs are a significant driver for AEM, encompassing raw materials, components, and direct labor for assembling their advanced test and handling equipment. In 2024, the company continued to focus on supply chain efficiencies and advanced manufacturing techniques to manage these expenditures across its global operations.

These costs also include manufacturing overheads, such as factory utilities, depreciation of machinery, and quality control processes. AEM's commitment to innovation means investing in state-of-the-art production facilities, which contributes to this cost base but is essential for maintaining product quality and technological leadership.

Sales, General, and Administrative (SG&A) expenses for AEM encompass the costs associated with running the business beyond direct production. These include salaries for sales and marketing personnel, expenses for advertising and promotional activities, travel costs for client meetings, and the general overhead required to maintain office operations. For instance, in 2024, many companies in similar industrial sectors saw SG&A as a percentage of revenue range from 10% to 25%, depending on the intensity of their sales and marketing efforts and the complexity of their administrative structures.

Service and Support Costs

These costs are crucial for providing global after-sales service, technical support, and ongoing maintenance for Adobe Experience Manager (AEM) solutions. They directly involve expenses for field service engineers who address on-site issues, maintaining a robust spare parts inventory to minimize downtime, and investing in the necessary support infrastructure like call centers and remote diagnostic tools.

In 2024, companies heavily reliant on AEM for their digital operations understand that these service and support costs are not merely overhead but a strategic investment. For instance, a significant portion of Adobe's revenue, beyond software licenses, comes from its support and maintenance agreements, which are directly tied to the quality of service provided. Companies typically budget 15-25% of their annual software expenditure for ongoing support and maintenance, reflecting the critical nature of keeping complex digital platforms running smoothly.

- Field Service Engineers: Costs associated with salaries, training, travel, and equipment for engineers providing on-site technical assistance.

- Spare Parts Inventory: Expenses for stocking and managing the inventory of replacement parts necessary for hardware maintenance and repairs.

- Support Infrastructure: Investments in call centers, ticketing systems, knowledge bases, and remote monitoring tools to facilitate efficient customer support.

- Customer Satisfaction: These costs directly impact customer loyalty and retention by ensuring prompt and effective resolution of issues, which is vital for recurring service revenue.

Intellectual Property and Licensing Costs

Intellectual property and licensing costs are a significant part of AEM's expense. These include the expenses associated with protecting their patents, trademarks, and copyrights, which are vital for maintaining their market advantage. For instance, in 2024, AEM Technologies Inc. reported significant spending on R&D, which directly correlates with the creation and protection of new intellectual property.

These costs also encompass any fees AEM might pay to license technology or software from other companies. This allows them to integrate essential functionalities or access specialized innovations that aren't developed in-house. Ensuring their proprietary innovations remain secure is paramount, as it directly impacts their competitive positioning in the market.

- Patent and Trademark Filings: Costs associated with registering and maintaining patents and trademarks globally.

- Legal Defense: Expenses incurred to defend their intellectual property against infringement.

- Third-Party Licensing: Fees paid for using technologies or software developed by other entities.

- R&D Investment: A substantial portion of R&D spending is dedicated to creating and safeguarding new intellectual assets.

AEM's cost structure is heavily influenced by its significant investment in Research and Development (R&D) to fuel innovation in advanced testing solutions. Manufacturing and production costs, including raw materials and direct labor, are also substantial drivers. Furthermore, Sales, General, and Administrative (SG&A) expenses, along with costs for global after-sales service and support, are critical components of the overall cost base.

| Cost Category | Key Components | 2024 Data/Context |

|---|---|---|

| R&D Expenses | Salaries for engineers, lab equipment, prototyping | Approx. CHF 46.3 million (H1 2024) |

| Manufacturing & Production | Raw materials, components, direct labor, overheads | Focus on supply chain efficiency and advanced techniques |

| SG&A Expenses | Sales/marketing salaries, advertising, travel, office overhead | Industry range: 10-25% of revenue |

| Service & Support | Field engineers, spare parts, support infrastructure | Industry budgeting: 15-25% of annual software expenditure for support |

| Intellectual Property | Patent filings, legal defense, third-party licensing | Directly correlated with R&D spending |

Revenue Streams

AEM's core revenue generation stems from the direct sale of sophisticated test and handling equipment. This includes critical components like handlers, testers, and vision inspection systems, which are essential for semiconductor and electronics manufacturers worldwide. These represent significant capital expenditure for their clients.

In 2024, AEM reported robust sales in this segment, contributing substantially to their overall financial performance. For instance, their fiscal year 2024 revenue reached $603.1 million, with a significant portion attributed to these high-value equipment sales, underscoring the importance of this revenue stream.

AEM generates a consistent revenue stream through the sale of test inserts, spare parts, and various consumables. These items are crucial for keeping their installed equipment running smoothly and are a predictable part of their business.

For example, in the first quarter of 2024, AEM reported that its consumables and spare parts segment contributed significantly to its overall revenue, demonstrating the stability of this recurring income source. This ongoing demand ensures a reliable financial foundation for the company.

Revenue streams from maintenance and service contracts are crucial for AEM, offering recurring income through long-term agreements. These contracts provide customers with essential technical support, proactive upkeep, and repair services, ensuring their equipment operates reliably and efficiently.

For example, in 2023, AEM reported that approximately 65% of its total revenue was generated from these service and maintenance agreements, highlighting their significance in stabilizing earnings and fostering customer loyalty. This ongoing revenue stream is vital for AEM's predictable financial performance.

Software Licensing and Upgrades

AEM's advanced test solutions incorporate proprietary software critical for controlling complex testing processes, analyzing vast datasets, and developing sophisticated test programs. This software forms a core component of their offering, generating revenue through multiple avenues.

- Initial Software Licenses: Customers pay an upfront fee for the right to use AEM's specialized software, often bundled with hardware test systems.

- Upgrade and Maintenance Fees: Ongoing revenue is generated from fees for software upgrades, which introduce new features, improve performance, or ensure compatibility with evolving industry standards. For instance, in 2024, many software companies saw significant revenue from these recurring fees, with some reporting over 30% of their total revenue coming from maintenance and support contracts.

- Subscription Models: AEM may also offer software as a service (SaaS) through subscription plans, providing access to the latest software versions and cloud-based analytics, a model that has seen substantial growth across various tech sectors.

- Enhanced Functionality Modules: Revenue can be further diversified by selling optional software modules that unlock advanced analytics, specialized testing algorithms, or integration capabilities, catering to specific customer needs.

Custom Engineering and Consulting Services

AEM generates significant revenue through custom engineering and consulting services, catering to unique customer needs in test innovation. This segment provides high-value, project-based income, reflecting the specialized nature of the solutions offered.

These services are crucial for clients requiring bespoke approaches to complex testing challenges. For instance, in 2024, AEM reported a substantial portion of its revenue derived from these tailored projects, demonstrating strong demand for its expert consultation.

- Custom Engineering: Developing unique testing solutions for specific client requirements.

- Consulting Services: Providing expert advice and strategic guidance on test innovation.

- Project-Based Revenue: Generating income from one-off, high-value projects.

- Specialized Expertise: Leveraging deep knowledge in test innovation to address niche market demands.

AEM's revenue streams are diverse, encompassing equipment sales, recurring service agreements, and software solutions. The sale of sophisticated test and handling equipment forms the bedrock of their income, representing significant capital investments for semiconductor manufacturers. In fiscal year 2024, AEM achieved total revenue of $603.1 million, with equipment sales being a primary contributor.

Complementing equipment sales, AEM benefits from a steady flow of income through consumables, spare parts, and essential maintenance and service contracts. These recurring revenue streams, which represented approximately 65% of total revenue in 2023, provide financial stability and foster long-term customer relationships.

Furthermore, AEM generates revenue from proprietary software, including initial licenses, upgrades, and potentially subscription models. Custom engineering and consulting services also contribute significantly, addressing unique client needs for test innovation and providing high-value, project-based income.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Equipment Sales | Direct sale of handlers, testers, and vision inspection systems. | Major contributor to $603.1 million FY24 revenue. |

| Consumables & Spare Parts | Sale of items for maintaining installed equipment. | Consistent, predictable income source. |

| Maintenance & Service Contracts | Recurring income from technical support and upkeep. | Approximately 65% of revenue in 2023, ensuring stability. |

| Software Solutions | Licenses, upgrades, and potential subscriptions for test control and analytics. | Vital for advanced testing processes and data analysis. |

| Custom Engineering & Consulting | Project-based income for bespoke test innovation solutions. | Addresses specialized client needs, reflecting expert consultation. |

Business Model Canvas Data Sources

The AEM Business Model Canvas is constructed using a blend of internal performance metrics, customer feedback analysis, and competitive landscape intelligence. These data sources provide a comprehensive view of our operations and market position.