Advantest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantest Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Advantest's operations and future growth. This comprehensive PESTLE analysis provides actionable intelligence to inform your strategic decisions. Download the full report now to gain a competitive edge.

Political factors

Geopolitical tensions, especially between the U.S. and China, directly affect Advantest's market. Tariffs and export controls, like those implemented in late 2023 impacting advanced chip manufacturing equipment, create uncertainty. Advantest, a key player in semiconductor testing, must navigate these shifting trade landscapes, which can influence demand for its sophisticated testing solutions and necessitate adjustments to its global supply chain strategy.

Governments globally are actively promoting domestic semiconductor production through substantial subsidies and incentives. For instance, the U.S. CHIPS and Science Act, enacted in 2022, allocates approximately $52.7 billion to bolster domestic chip manufacturing, research, and development. These programs, while focused on fabrication, indirectly benefit Automatic Test Equipment (ATE) providers like Advantest by driving demand for their advanced testing solutions in new and expanded semiconductor facilities. This trend is already influencing investment decisions, with companies announcing significant fab expansions in regions offering these incentives.

Semiconductors are now seen as critical for national security, prompting governments to bolster domestic chip production. This drive for technological independence, or tech sovereignty, means Advantest might see increased demand for its testing solutions in regions prioritizing local manufacturing. For example, the US CHIPS and Science Act, signed in 2022, allocated over $52 billion to boost domestic semiconductor manufacturing and research, a trend likely to continue and expand through 2024 and 2025.

This geopolitical focus influences Advantest’s strategic decisions regarding partnerships and facility investments. Companies are pressured to align with national objectives, potentially leading Advantest to develop specialized testing equipment that meets specific national security requirements or to invest in R&D centers within key strategic regions. The global semiconductor market, valued at approximately $600 billion in 2023, is expected to see significant government-backed investment in domestic capabilities through 2025.

Regulatory Environment and Compliance

Advantest navigates a complex international regulatory landscape, impacting trade, intellectual property, and product safety. For instance, in 2023, the global semiconductor industry faced increasing scrutiny regarding supply chain transparency and national security concerns, potentially leading to stricter export controls on advanced technologies. Compliance with evolving environmental standards, such as those concerning hazardous materials in electronics, can necessitate significant R&D investment and manufacturing process modifications.

Adherence to diverse legal frameworks is paramount for Advantest's global market access and operational continuity. This includes navigating varying data privacy laws, like the EU's GDPR and similar regulations in other regions, which impact how customer and operational data is handled. The company's 2024 strategic planning likely incorporates increased resources for legal and compliance teams to manage these multifaceted requirements.

Key regulatory considerations for Advantest include:

- Trade Regulations: Navigating export/import controls and tariffs, particularly concerning semiconductor equipment and technology, which saw heightened geopolitical influence in 2023-2024.

- Intellectual Property: Protecting patents and trade secrets in a highly competitive and innovative industry, with ongoing legal battles and licensing agreements being critical.

- Product Safety and Environmental Standards: Ensuring compliance with international standards like RoHS and WEEE directives, which affect the design and disposal of electronic testing equipment.

- Data Privacy and Cybersecurity: Adhering to global data protection laws and implementing robust cybersecurity measures to safeguard sensitive information.

Political Stability in Key Regions

Political stability in regions where Advantest operates, such as Japan, the U.S., Taiwan, and China, is a critical consideration. For instance, geopolitical tensions in East Asia, particularly concerning Taiwan, a major hub for semiconductor manufacturing, could disrupt Advantest's supply chains and customer access. Advantest's reliance on these key markets necessitates continuous monitoring of political landscapes to mitigate potential impacts on its production and sales, which reached ¥572.4 billion in fiscal year 2023.

Trade disputes and protectionist policies between major economies like the U.S. and China can also pose risks. Such disputes can lead to tariffs or export restrictions on advanced semiconductor manufacturing equipment, directly affecting Advantest's global business operations and market access. The company actively manages these risks through diversified sourcing and flexible production planning.

- Geopolitical Risk: Tensions in East Asia, particularly around Taiwan, are a significant political factor impacting semiconductor supply chains.

- Trade Policy Impact: U.S.-China trade relations and potential tariffs on technology goods could affect Advantest's market access and profitability.

- Regulatory Environment: Changes in government regulations related to technology, trade, and foreign investment in key operating regions require constant adaptation.

- Government Support: Conversely, government initiatives to boost domestic semiconductor production, as seen in the U.S. CHIPS Act, could present new opportunities for Advantest.

Geopolitical tensions, particularly between the U.S. and China, directly influence Advantest's market by creating uncertainty around tariffs and export controls, impacting advanced chip manufacturing equipment. Governments worldwide are actively promoting domestic semiconductor production through significant subsidies, like the U.S. CHIPS and Science Act, which allocates over $52 billion to bolster chip manufacturing and R&D, indirectly boosting demand for ATE providers like Advantest. Semiconductors are increasingly viewed as critical for national security, driving tech sovereignty initiatives that could increase demand for Advantest's solutions in regions prioritizing local manufacturing.

| Factor | Impact on Advantest | 2023-2025 Relevance |

|---|---|---|

| Geopolitical Tensions (U.S.-China) | Creates trade uncertainty, potential tariffs, and export controls on advanced equipment. | Directly affects market access and supply chain stability. |

| Government Subsidies (e.g., US CHIPS Act) | Stimulates domestic semiconductor manufacturing, increasing demand for testing solutions. | The $52.7 billion allocated by the CHIPS Act is driving fab expansions through 2025. |

| National Security Focus | Promotes tech sovereignty, potentially increasing demand for localized testing capabilities. | Governments are prioritizing domestic production for strategic reasons. |

| Trade Policy & Protectionism | Can lead to tariffs or restrictions on technology goods, impacting global operations. | Advantest manages risks through diversified sourcing and flexible planning. |

What is included in the product

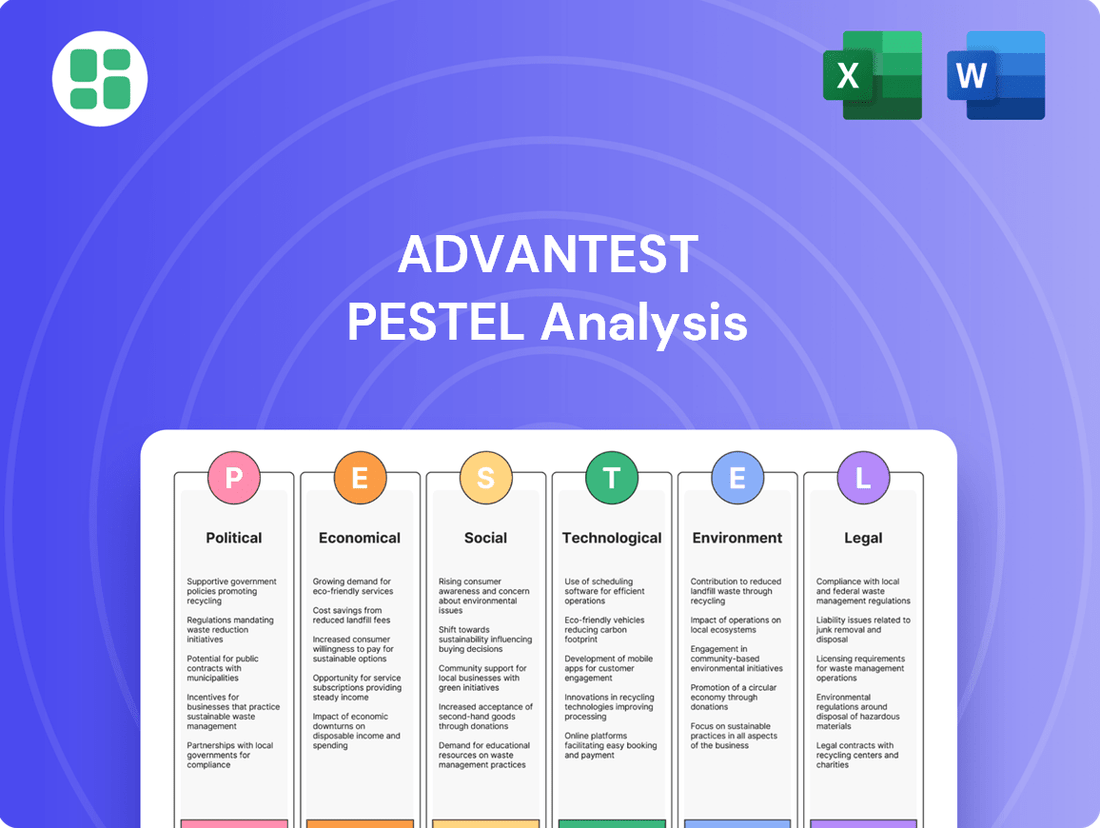

This Advantest PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's strategic landscape.

It provides actionable insights for identifying opportunities and mitigating risks by understanding the dynamic external forces impacting Advantest's operations and future growth.

Provides a concise version of Advantest's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

The global semiconductor market is on a significant upswing, fueled by a surging demand for chips powering artificial intelligence, high-performance computing, and critical sectors like automotive and 5G. This expansion is a direct tailwind for Advantest, as increased chip manufacturing volume translates into a greater need for sophisticated testing solutions.

Industry forecasts point to continued strong performance, with projections anticipating double-digit growth throughout 2024 and 2025, pushing the market to unprecedented sales levels. For instance, the semiconductor market size was estimated to be around $600 billion in 2023 and is expected to grow substantially in the coming years, with some analysts predicting it could reach over $1 trillion by 2030.

The explosive growth in generative AI and high-performance computing (HPC) is a major economic force for Advantest. The increasing need for advanced chips in data centers and for edge AI applications directly translates to a higher demand for the sophisticated testing solutions Advantest provides.

These cutting-edge semiconductors, essential for AI's capabilities, necessitate precise and reliable testing, ensuring a robust and ongoing market for Advantest's specialized equipment. The AI chip market alone is anticipated to surpass $150 billion in revenue by 2025, directly benefiting the automatic test equipment (ATE) sector.

Advantest's revenue is deeply connected to the capital expenditure (CapEx) spending patterns of semiconductor companies. When chipmakers invest heavily in new facilities and advanced equipment, Advantest, a key supplier of testing solutions, benefits significantly. For instance, in fiscal year 2023, Advantest reported net sales of ¥275.2 billion, a figure directly influenced by the CapEx decisions of its clients.

While the demand for AI-driven semiconductor production continues to fuel robust CapEx, the recovery in spending for other crucial sectors like automotive, industrial, and consumer electronics may proceed at a more measured pace. This uneven recovery impacts the overall CapEx environment that Advantest operates within.

Sustaining high levels of customer CapEx, particularly for advanced node and AI-related chip manufacturing, is critical for Advantest's financial health. The company's performance hinges on the continued investment by its clients in cutting-edge production capabilities, as seen in the strong demand for its advanced testing equipment in these growth areas.

Exchange Rate Fluctuations

As a Japanese company, Advantest's financial performance is significantly influenced by currency exchange rates, especially the USD/JPY and EUR/JPY. For instance, during fiscal year 2024, a weaker Yen generally boosted Advantest's reported sales and operating profits due to favorable currency translations of overseas earnings.

Conversely, a strengthening Yen can pose a challenge. It makes Advantest's products more expensive for international buyers, potentially dampening demand, and also reduces the Yen-equivalent value of profits earned in foreign currencies.

- FY2024 Impact: A weaker Yen generally benefited Advantest's reported financial results.

- USD/JPY & EUR/JPY: These are key currency pairs affecting Advantest's international earnings.

- Strong Yen Headwinds: Can increase product prices abroad and decrease the value of foreign profits when converted to Yen.

Global Economic Conditions and Inflation

Global economic conditions, particularly inflation and monetary tightening, directly impact consumer spending on electronics, a key driver for semiconductor demand. For instance, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, a slight slowdown from 3.2% in 2023, indicating a cautious economic environment that could temper discretionary spending on advanced electronics.

Advantest's business is indirectly affected by these broader economic trends. Higher inflation can lead central banks to maintain or increase interest rates, making borrowing more expensive for businesses. This can slow down capital expenditure by Advantest's customers in the semiconductor industry, potentially reducing their investment in testing equipment, which is Advantest's core offering.

Despite a projected recovery in the semiconductor market, persistent geopolitical tensions and economic uncertainties remain significant factors. These risks can create volatility in customer investment decisions. For example, ongoing trade disputes or regional conflicts can disrupt supply chains and create an uncertain outlook, prompting customers to delay or scale back their purchases of new testing solutions from Advantest.

- Inflationary Pressures: Elevated inflation rates globally can erode consumer purchasing power for electronics, impacting overall demand for semiconductors.

- Monetary Policy: Tightening monetary policies, such as higher interest rates, increase the cost of capital for semiconductor manufacturers, potentially slowing their investment in new equipment.

- Geopolitical Risks: Ongoing geopolitical uncertainties can create supply chain disruptions and economic instability, influencing customer confidence and investment in advanced testing technologies.

- Economic Growth Projections: The IMF's forecast of 3.1% global growth for 2024 suggests a moderate economic environment that may lead to cautious spending by Advantest's clientele.

The semiconductor industry's robust growth, particularly driven by AI and HPC, is a significant economic tailwind for Advantest. Projections for 2024 and 2025 indicate continued double-digit expansion in the chip market, with AI chip revenues alone expected to exceed $150 billion by 2025.

Advantest's performance is closely tied to semiconductor companies' capital expenditure. While AI-related investments remain strong, recovery in sectors like automotive and consumer electronics may be more gradual, creating an uneven CapEx environment.

Currency fluctuations, especially the USD/JPY and EUR/JPY, significantly impact Advantest's reported financials, with a weaker Yen generally boosting overseas earnings in Yen terms. Global economic factors like inflation and interest rates also influence customer spending and investment decisions.

| Economic Factor | Impact on Advantest | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Semiconductor Market Growth | Positive Driver | AI chip market projected >$150B by 2025; overall market expected double-digit growth in 2024/2025. |

| Customer Capital Expenditure (CapEx) | Directly Influential | Strong CapEx for AI/HPC chips; more measured recovery in automotive/consumer electronics. |

| Currency Exchange Rates (USD/JPY, EUR/JPY) | Financial Reporting Impact | Weaker Yen generally boosts reported sales and profits from overseas operations. |

| Global Economic Conditions (Inflation, Interest Rates) | Indirect Influence | IMF projects 3.1% global growth for 2024; higher rates can increase customer borrowing costs, potentially slowing CapEx. |

Preview the Actual Deliverable

Advantest PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Advantest PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides actionable insights into the external environment, enabling strategic decision-making for Advantest.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is designed to be a valuable resource for understanding Advantest's strategic landscape.

Sociological factors

The semiconductor sector, including companies like Advantest, is grappling with a significant global deficit of skilled engineers and technicians essential for cutting-edge chip design, manufacturing, and testing. This talent scarcity directly impacts Advantest's ability to innovate and meet production demands, necessitating robust strategies for recruitment and employee development.

To counter this, Advantest is actively investing in internal training programs and fostering partnerships with universities to cultivate a pipeline of future talent, a trend mirrored across the industry as companies recognize the strategic importance of a skilled workforce. For instance, the SIA reported in 2023 that the U.S. semiconductor industry alone needs to fill approximately 70,000 new jobs by 2030, highlighting the urgency of workforce development initiatives.

Consumer appetite for advanced electronics, from AI-infused smartphones to electric vehicles and robust 5G networks, is a powerful sociological driver. This trend directly translates into a heightened need for sophisticated semiconductors, as these devices rely on increasingly complex chip architectures. For instance, the global semiconductor market is projected to reach over $700 billion in 2024, underscoring the scale of this demand.

Advantest's business is inherently linked to this consumer push for innovation. The intricate nature of chips powering these next-generation gadgets necessitates rigorous testing to guarantee their performance and reliability. The increasing integration of artificial intelligence into consumer products, a trend gaining significant momentum in 2024 and beyond, further amplifies this requirement for advanced testing solutions.

Societal expectations for diversity, equity, and inclusion (DE&I) are increasingly influencing how companies like Advantest manage their human capital. A diverse workforce is now recognized as a key driver of innovation and a magnet for top talent, also significantly boosting a company's public image. For instance, in 2024, many tech companies reported that over 60% of new hires were from diverse backgrounds, reflecting this trend.

Advantest, like its peers, is expected to show a tangible commitment to DE&I. This translates into concrete actions such as implementing inclusive hiring practices, developing robust DE&I policies, and cultivating workplace cultures where everyone feels valued and respected. Reports from 2025 indicate that companies with strong DE&I initiatives often see a 15-20% higher employee retention rate compared to those without.

Employee Engagement and Well-being

In the competitive semiconductor testing sector, fostering high employee engagement and well-being is paramount for Advantest to drive productivity, cultivate innovation, and retain its skilled workforce. The company's strategic investments in IT infrastructure and initiatives aimed at enhancing employee engagement underscore a dedication to building a supportive and high-performing workplace culture.

Advantest's commitment extends to actively addressing critical aspects like work-life balance and providing robust career development pathways. This focus is vital for attracting and keeping top talent in an industry that demands continuous learning and adaptability.

- Employee Engagement: Advantest reported a 79% global employee engagement score in their 2024 sustainability report, a slight increase from 77% in 2023.

- Well-being Initiatives: The company has expanded its mental health support programs, offering access to counseling services for 90% of its global employees.

- Learning & Development: In 2024, Advantest invested an average of 45 hours of training per employee, focusing on technical skills and leadership development.

- Work-Life Balance: Survey data from early 2025 indicates that 72% of Advantest employees feel their workload is manageable, up from 68% in the previous year.

Ethical Sourcing and Labor Practices

Societal expectations are increasingly pushing companies like Advantest to demonstrate ethical sourcing and fair labor practices throughout their supply chains. This scrutiny is particularly relevant in the semiconductor industry, where concerns about conflict minerals and human rights can arise. For instance, in 2024, many tech companies reported increased auditing of their suppliers to ensure compliance with ethical standards, a trend Advantest is likely navigating as well.

Maintaining robust ethical standards is crucial for Advantest's brand reputation and the trust it builds with stakeholders, including investors, customers, and employees. Companies that prioritize these practices often see improved brand loyalty and a stronger competitive position. The Responsible Minerals Initiative (RMI), which many electronics manufacturers participate in, aims to provide frameworks for responsible mineral sourcing, impacting companies like Advantest in their procurement processes.

- Supply Chain Scrutiny: Advantest faces growing pressure to ensure its semiconductor manufacturing inputs are ethically sourced and its labor practices are fair, reflecting broader societal demands for corporate responsibility.

- Conflict Minerals and Human Rights: The semiconductor ecosystem is under the microscope for its role in supply chains that may involve conflict minerals or human rights violations, necessitating rigorous due diligence.

- Reputation and Trust: Adherence to ethical sourcing and labor practices is directly linked to Advantest's brand image and the confidence stakeholders place in the company's operations and long-term viability.

Societal demand for advanced technology fuels the semiconductor market, requiring Advantest to deliver sophisticated testing solutions. This trend is evident in the projected growth of the global semiconductor market, expected to exceed $700 billion in 2024, driven by consumer adoption of AI-powered devices and 5G infrastructure. Advantest's role is critical in ensuring the quality of these complex chips, directly responding to consumer desires for innovation and performance.

The industry faces a critical talent shortage, with the U.S. semiconductor sector needing to fill around 70,000 jobs by 2030, according to the SIA. Advantest is addressing this by investing in employee development and university partnerships to build a skilled workforce. Furthermore, a strong emphasis on diversity, equity, and inclusion (DE&I) is shaping Advantest's human capital strategies, with many tech firms reporting over 60% of new hires in 2024 coming from diverse backgrounds, enhancing innovation and retention.

Advantest's commitment to employee well-being and engagement is crucial for sustained productivity and innovation. The company reported a 79% global employee engagement score in 2024 and expanded mental health support to 90% of its workforce. Investing an average of 45 training hours per employee in 2024 highlights a focus on continuous learning and career development, contributing to a manageable workload for 72% of employees as of early 2025.

Ethical sourcing and fair labor practices are increasingly scrutinized, impacting Advantest's supply chain management and brand reputation. The semiconductor industry faces pressure to ensure compliance with standards related to conflict minerals and human rights, prompting increased supplier audits in 2024. Adherence to these ethical principles is vital for maintaining stakeholder trust and a competitive edge.

| Sociological Factor | Trend/Impact on Advantest | Supporting Data (2024-2025) |

|---|---|---|

| Consumer Demand for Advanced Electronics | Drives need for sophisticated chip testing. | Global semiconductor market projected >$700 billion (2024). |

| Skilled Workforce Shortage | Necessitates investment in talent acquisition and development. | ~70,000 U.S. semiconductor jobs to fill by 2030 (SIA). |

| Diversity, Equity, and Inclusion (DE&I) | Influences hiring, culture, and talent retention. | >60% new hires from diverse backgrounds in many tech firms (2024). |

| Employee Engagement and Well-being | Key for productivity, innovation, and retention. | 79% global employee engagement score (Advantest 2024); 45 training hours/employee (2024). |

| Ethical Sourcing and Fair Labor | Impacts supply chain management and brand reputation. | Increased supplier audits for ethical compliance (2024). |

Technological factors

The relentless pursuit of smaller, more powerful, and energy-efficient semiconductors, exemplified by advanced process nodes like 3nm and the emerging 2nm, directly fuels demand for Advantest's sophisticated testing equipment. These intricate chips, coupled with advanced packaging technologies such as chiplets and High Bandwidth Memory (HBM), necessitate highly precise Automated Test Equipment (ATE) to guarantee their functionality and quality.

Advantest is actively integrating AI and machine learning into its testing solutions, a move that's transforming the semiconductor industry. These advanced technologies allow for quicker chip design iterations, on-the-spot identification of manufacturing flaws, and sophisticated predictive analysis to anticipate issues before they arise.

By harnessing AI, Advantest is making its testing processes more efficient. This means better chip yields, less wasted effort on fixing faulty products, and overall improved performance from their test equipment. Their collaboration with Emerson, for instance, highlights this strategic push towards AI-powered optimization in testing workflows.

The burgeoning fields of quantum computing and photonics represent significant technological shifts that will reshape the automated test equipment (ATE) landscape. As these advanced computing and communication technologies mature, they will necessitate entirely new categories of specialized testing solutions. Advantest's strategic foresight in investing in early-stage research and development for these areas is crucial for anticipating and meeting these future market demands.

Automation and Smart Factory Integration

The semiconductor industry's drive towards automation, epitomized by the smart factory concept, directly impacts the requirements for Automated Test Equipment (ATE). This trend means ATE must integrate smoothly into highly automated production environments, minimizing manual touchpoints. Advantest's strategy to automate test processes, particularly through its distributed back-end test flow, directly addresses this by boosting efficiency and reducing the need for human involvement in testing.

This focus on automation is crucial as the global semiconductor manufacturing equipment market was projected to reach approximately $137 billion in 2024, with automation being a key growth driver. Advantest's investments in solutions that support these automated workflows are therefore strategically aligned with market demands.

- Smart Factory Integration: ATE needs to seamlessly connect with automated material handling systems and production scheduling software.

- Efficiency Gains: Automation in testing reduces cycle times and minimizes the potential for human error, critical for high-volume manufacturing.

- Advantest's Approach: The company's distributed back-end test flow aims to decentralize and optimize testing operations within automated lines.

Data Analytics and Big Data in Test Operations

The semiconductor industry is awash in data, and Advantest is leveraging this through advanced analytics. Their solutions are designed to process the massive datasets generated during testing. This allows for deeper insights into test processes.

Advantest's strategy involves integrating its real-time data infrastructure with artificial intelligence and machine learning. This synergy aims to unlock valuable information for optimizing testing parameters. The goal is to boost production yields and enhance overall manufacturing efficiency.

- Data Volume Growth: The amount of data generated per semiconductor test is rapidly increasing, with projections suggesting a continued exponential rise in the coming years, driven by more complex chip designs and advanced testing methodologies.

- AI/ML Integration: Advantest's commitment to AI/ML integration in test operations is crucial for extracting actionable insights from this data deluge, enabling predictive maintenance and anomaly detection.

- Yield Improvement Focus: By analyzing vast datasets, Advantest's solutions can identify subtle patterns that lead to improved chip yields, a critical factor in semiconductor manufacturing profitability.

Advantest's technological focus is on enabling the next generation of semiconductors, from advanced nodes like 2nm to novel architectures such as chiplets and HBM. The company is heavily investing in AI and machine learning to enhance test efficiency and predictive capabilities, aiming to improve chip yields and reduce manufacturing costs. Emerging technologies like quantum computing and photonics are also key areas of R&D, anticipating future testing needs.

The semiconductor industry's move towards smart factories necessitates ATE that integrates seamlessly into automated workflows, minimizing manual intervention. Advantest's distributed back-end test flow directly addresses this by boosting operational efficiency. The global semiconductor manufacturing equipment market was expected to reach around $137 billion in 2024, with automation being a significant growth driver.

| Technological Factor | Impact on Advantest | Data/Trend |

|---|---|---|

| Advanced Semiconductor Nodes (e.g., 2nm) | Requires more sophisticated ATE for precision testing. | Demand for advanced testing solutions is growing with shrinking transistor sizes. |

| AI/ML Integration | Enhances test efficiency, predictive maintenance, and yield optimization. | Advantest is actively integrating AI into its solutions, as seen in collaborations. |

| Smart Factory Automation | ATE must integrate into automated production lines. | The semiconductor manufacturing equipment market, projected at $137B in 2024, sees automation as a key growth driver. |

| Emerging Technologies (Quantum, Photonics) | Necessitates development of new, specialized testing solutions. | Advantest invests in early-stage R&D to anticipate future market needs in these areas. |

Legal factors

Advantest's core business is built on its advanced, proprietary technology and a robust portfolio of patents for its automatic test equipment (ATE). These intellectual assets are fundamental to maintaining its market leadership and competitive advantage in the semiconductor testing industry. For instance, in fiscal year 2024, Advantest continued to invest heavily in research and development, a significant portion of which directly contributes to new patent filings aimed at protecting its innovations in areas like AI-driven testing and advanced semiconductor node support.

The company's reliance on these patents means that strong, effective legal frameworks for intellectual property protection are absolutely critical. These legal safeguards are essential to deterring infringement by competitors and ensuring Advantest can exclusively leverage its technological breakthroughs. Without this protection, the significant R&D investments made by Advantest, which reached approximately $500 million in fiscal year 2024, would be vulnerable.

Furthermore, Advantest must actively navigate the complex landscape of international IP laws, as its operations and customer base are global. This involves strategically filing and enforcing patent rights across multiple jurisdictions to prevent unauthorized use of its technologies. The ongoing legal efforts to monitor and address potential infringements are a constant and necessary consideration for the company's long-term success and profitability.

Advantest's operations are significantly shaped by international trade laws and sanctions, especially concerning semiconductor technology. Navigating these regulations, such as U.S. export controls impacting advanced chip manufacturing equipment to countries like China, requires constant vigilance. Failure to comply can lead to substantial legal penalties and restricted market access, directly affecting Advantest's global sales channels and supply chain stability.

As Advantest increasingly leverages data-driven and AI solutions, adherence to global data privacy laws like GDPR and CCPA is paramount. These regulations, which govern how companies collect, process, and store personal data, directly impact Advantest's operations, especially concerning customer information used in advanced testing. Failure to comply can result in significant fines; for instance, GDPR violations can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Labor Laws and Employment Regulations

Advantest, operating across numerous global markets, must navigate a complex web of labor laws and employment regulations. These vary significantly by country, impacting everything from minimum wage requirements and working hours to employee benefits and termination procedures. For instance, in 2024, countries like Germany continued to enforce strong worker protections, including works council consultation rights, while other regions might have more flexible employment contracts.

Compliance with these diverse regulations is not merely a legal necessity but also crucial for fostering positive employee relations and maintaining a stable workforce. In 2025, Advantest's commitment to fair labor practices, including adherence to non-discrimination laws and respecting collective bargaining rights where applicable, will be paramount. The company's ability to adapt to evolving labor standards, such as those related to remote work policies and gig economy regulations, will be a key factor in its operational success.

- Global Compliance: Advantest must adhere to labor laws in all operating countries, covering wages, working conditions, and non-discrimination.

- Employee Relations: Strict adherence to these laws is vital for maintaining positive employee relations and avoiding legal repercussions.

- Evolving Standards: The company needs to stay abreast of changing labor regulations, including those for remote work and contingent labor, to ensure ongoing compliance in 2024-2025.

Environmental Laws and Regulations

Advantest faces an increasingly stringent environmental regulatory landscape. New mandates concerning manufacturing emissions, waste disposal, and energy efficiency directly influence operational costs and supply chain management. For instance, the European Union's continued push for circular economy principles and stricter controls on hazardous substances, like those outlined in RoHS directives, necessitate ongoing investment in compliance and process adaptation.

Failure to adhere to these evolving environmental laws, including those targeting carbon footprint reduction, can lead to substantial financial penalties and reputational damage. The global semiconductor industry, including Advantest, is under pressure to demonstrate progress in sustainability. For example, by 2025, many regions are expected to have enhanced reporting requirements for greenhouse gas emissions from industrial facilities.

- Stricter Emission Standards: Advantest must manage emissions from its manufacturing facilities, which may include volatile organic compounds (VOCs) and greenhouse gases, aligning with targets set by bodies like the EPA in the US or similar agencies globally.

- Waste Management and Chemical Use: Regulations on the disposal of electronic waste and the handling of chemicals used in semiconductor production, such as those governed by REACH in Europe, require careful management and potential reformulation of processes.

- Energy Consumption Targets: Growing pressure to reduce energy consumption and transition to renewable energy sources will impact Advantest's operational expenses and strategic sourcing decisions.

- Supply Chain Scrutiny: Environmental compliance is increasingly being extended to the entire supply chain, meaning Advantest must ensure its suppliers also meet these rigorous standards.

Advantest's global operations necessitate strict adherence to international trade laws and sanctions, particularly those affecting the semiconductor industry. Navigating regulations like U.S. export controls, which impact the sale of advanced chip manufacturing equipment to certain countries, requires constant vigilance. Non-compliance can result in significant penalties and restricted market access, directly impacting Advantest's sales and supply chain.

The company's increasing reliance on data and AI solutions means compliance with global data privacy laws, such as GDPR and CCPA, is paramount. These laws govern data handling and directly affect how Advantest manages customer information in its advanced testing solutions. Violations can lead to substantial fines, with GDPR penalties potentially reaching up to 4% of annual global turnover.

Advantest must also comply with a diverse array of labor laws across its international operations. These laws cover wages, working conditions, and non-discrimination, and staying updated on evolving standards, such as those for remote work, is crucial for maintaining positive employee relations and avoiding legal issues in 2024-2025.

Environmental factors

The semiconductor industry, including Advantest, faces mounting pressure for supply chain sustainability. This involves responsible sourcing of critical raw materials like rare earth elements and copper, with global demand for copper expected to rise significantly, potentially reaching over 30 million metric tons annually by 2030, driven by electrification. Furthermore, managing water and energy consumption is crucial, as semiconductor manufacturing is notoriously water-intensive, with some fabs consuming millions of gallons per day.

Advantest must actively address its environmental footprint by implementing efficient resource management in its own operations. This includes optimizing energy usage in its testing equipment and facilities, aiming for reductions in greenhouse gas emissions. For instance, many tech companies are setting ambitious targets, with some aiming for 100% renewable energy for their operations by 2030.

Collaboration with suppliers is paramount to ensure ethical and sustainable practices across the entire value chain. This means working with partners to verify responsible mining practices for raw materials and promoting water and energy conservation throughout the manufacturing process. Initiatives like the Responsible Minerals Initiative are gaining traction, with an increasing number of companies committing to its standards.

Semiconductor manufacturing and testing are inherently energy-intensive, contributing significantly to the carbon footprint of the electronics industry. Advantest, like its peers, faces increasing pressure to curb these emissions. For instance, the global semiconductor industry's energy consumption is a growing concern, with projections indicating continued increases as chip complexity and production volumes rise. This necessitates a strategic focus on reducing operational energy use and exploring cleaner power alternatives to meet evolving environmental regulations and corporate sustainability targets.

Semiconductor manufacturing, including the production of test equipment like Advantest's, inherently creates waste, often including hazardous materials. In 2023, the global semiconductor industry faced increasing scrutiny regarding its environmental footprint, with a growing emphasis on sustainable production methods. Advantest is therefore compelled to adopt stringent waste management protocols, focusing on the responsible disposal and reduction of waste generated from its operations and products.

Embracing circular economy principles is crucial for Advantest to mitigate its environmental impact. This involves actively seeking opportunities to recycle and reuse components from its test equipment, thereby minimizing landfill contributions. For instance, by 2024, many leading electronics manufacturers are setting ambitious targets for e-waste recycling, aiming to recover valuable materials and reduce reliance on virgin resources.

Water Usage and Scarcity

Semiconductor manufacturing, especially at the wafer fabrication stage, is incredibly water-intensive, requiring vast quantities of ultra-pure water. This reliance makes regions experiencing water scarcity a significant risk factor for the entire industry. For instance, by 2025, several key semiconductor manufacturing hubs in Asia are projected to face increased water stress due to climate change and growing demand, potentially impacting production continuity and increasing operational costs.

While Advantest itself does not operate wafer fabs, its role in the semiconductor ecosystem means it must consider its own water footprint. The company can focus on water efficiency within its own facilities, such as optimizing cooling systems and implementing water recycling technologies. Furthermore, Advantest has an opportunity to advocate for and support sustainable water management practices throughout the semiconductor supply chain, recognizing that industry-wide water resilience is crucial for long-term stability.

- Water-intensive processes: Wafer fabrication can use millions of gallons of water per day for cleaning, etching, and cooling.

- Regional water stress: Areas like Taiwan and parts of Arizona, significant semiconductor production zones, are already experiencing water scarcity.

- Advantest's role: Promoting water efficiency in its own operations and encouraging supply chain partners to adopt similar practices.

- Industry-wide impact: Ensuring a stable water supply is vital for the continued growth and output of the global semiconductor market.

Climate Change and Extreme Weather Events

Climate change is increasingly impacting global supply chains, including the semiconductor industry. The rising frequency and intensity of extreme weather events, such as floods, droughts, and typhoons, pose significant risks to Advantest's operations and its extended network. For instance, droughts can affect water-intensive semiconductor manufacturing processes, while floods or typhoons can damage manufacturing facilities and disrupt critical logistics routes. The semiconductor industry relies on a complex global supply chain, with raw material extraction and processing vulnerable to environmental disruptions. Copper, a key material in semiconductors, can see its extraction impacted by water scarcity caused by droughts.

Advantest, like other players in the sector, must prioritize building resilience into its supply chain and operational strategies to navigate these environmental challenges. This involves diversifying sourcing, strengthening logistics partnerships, and investing in climate-resilient infrastructure. The economic impact of these disruptions can be substantial; for example, the 2021 Texas freeze, which affected semiconductor manufacturing, led to an estimated $24 billion in lost revenue for the global auto industry alone due to chip shortages.

- Supply Chain Vulnerability: Extreme weather events can halt production at chip foundries and impact the availability of raw materials.

- Operational Disruptions: Floods, droughts, and storms can damage manufacturing plants and disrupt transportation networks crucial for delivering Advantest's testing equipment.

- Resource Scarcity: Water shortages, exacerbated by drought, can directly affect the water-intensive processes in semiconductor fabrication.

- Mitigation Strategies: Advantest needs to implement robust risk management plans, including supply chain diversification and investments in resilient facilities.

Environmental regulations are tightening globally, pushing companies like Advantest to invest in cleaner technologies and sustainable practices. For instance, the European Union's Green Deal aims for climate neutrality by 2050, influencing manufacturing and product design across sectors. Advantest must ensure its testing equipment meets evolving energy efficiency standards and that its manufacturing processes minimize waste and emissions to comply with these directives.

The semiconductor industry's significant energy and water consumption is under increasing scrutiny. Advantest, as a key enabler of this industry, faces pressure to contribute to a more sustainable ecosystem. By 2024, many leading technology firms are setting ambitious goals for reducing their carbon footprint, with some aiming for carbon neutrality in their operations by 2030. Advantest's own operational efficiency and the energy performance of its test solutions are critical factors in this broader industry effort.

Increasingly, investors and customers are prioritizing environmental, social, and governance (ESG) factors. Advantest's commitment to sustainability, including its approach to resource management and emissions reduction, directly impacts its market perception and access to capital. Companies with strong ESG performance often see improved financial returns and a lower cost of capital, with ESG investments projected to reach trillions of dollars globally in the coming years.

Advantest must manage the environmental impact of its products throughout their lifecycle, from material sourcing to end-of-life disposal. The growing emphasis on circular economy principles encourages the design of durable, repairable, and recyclable equipment. By 2025, many electronics manufacturers are setting targets for increasing the recycled content in their products and improving e-waste management, a trend Advantest needs to align with to maintain its competitive edge.

PESTLE Analysis Data Sources

Our Advantest PESTLE Analysis is grounded in comprehensive data from leading market research firms, financial institutions, and regulatory bodies. We incorporate official government reports, industry-specific publications, and economic forecasts to ensure a robust understanding of the macro-environment.