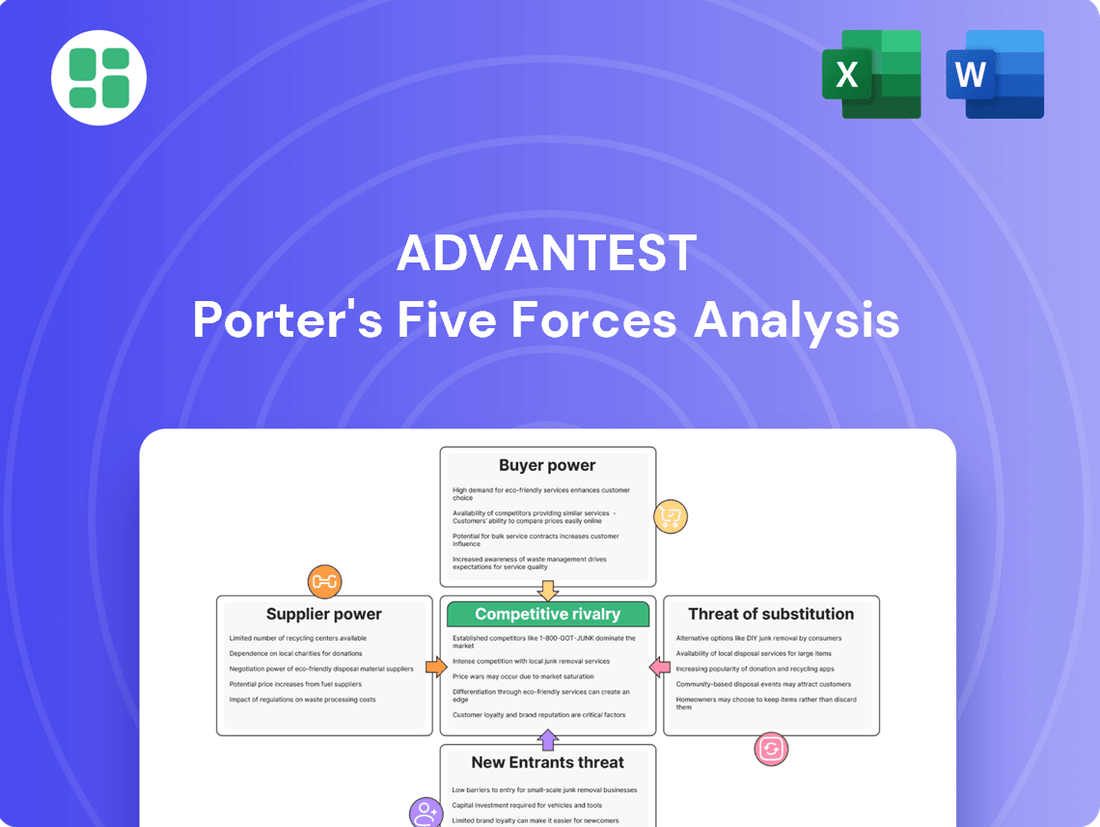

Advantest Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantest Bundle

Advantest operates within a dynamic semiconductor testing landscape, where the bargaining power of buyers and the intensity of rivalry significantly shape its market position. Understanding these forces is crucial for navigating the competitive currents.

The complete report reveals the real forces shaping Advantest’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automatic test equipment (ATE) industry, which Advantest operates within, typically features a moderate level of supplier concentration for its core components. While there are numerous suppliers for standard electronic parts, critical specialized components or advanced software solutions might be sourced from a more limited set of vendors.

If Advantest relies on a few key suppliers for highly specialized or proprietary technologies essential for its ATE systems, these suppliers would possess greater bargaining power. For instance, access to unique semiconductor testing algorithms or advanced sensor technology from a single provider could significantly influence Advantest's costs and product development timelines.

In 2024, the ATE market continues to see innovation driven by specialized technology providers. Companies that offer unique intellectual property or highly integrated solutions for complex testing challenges, such as those in advanced semiconductor packaging or high-frequency applications, can command stronger pricing power due to the limited availability of alternatives.

Advantest faces significant switching costs when changing suppliers, especially for its highly integrated and specialized Automatic Test Equipment (ATE) systems. These costs can include substantial expenses related to re-tooling manufacturing lines, redesigning complex electronic circuits, and the lengthy process of re-qualifying components to meet stringent performance and reliability standards.

The complexity of Advantest's ATE solutions means that even minor component changes can necessitate extensive validation and testing, potentially delaying product development and market entry. This high degree of integration and specialization inherently strengthens the bargaining power of its existing suppliers, as the effort and expense to transition to alternatives are considerable.

The uniqueness of supplier products and services significantly impacts Advantest's bargaining power. If the components or services Advantest relies on are highly differentiated or possess unique features with no easy substitutes, suppliers gain considerable leverage. For instance, suppliers providing specialized intellectual property or advanced materials critical for developing next-generation semiconductors, particularly for AI and High-Performance Computing (HPC) applications, hold amplified power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers in the Automated Test Equipment (ATE) market, particularly for a company like Advantest, is a nuanced consideration. While suppliers integrating forward to directly compete with Advantest is generally less probable due to the extreme capital intensity and specialized technical expertise required in ATE manufacturing, it remains a potential leverage point. If a key supplier were to develop the capability and see a strategic advantage in entering the ATE market themselves, it could significantly shift bargaining power.

For instance, a supplier of critical semiconductor components or advanced materials might possess the underlying technological knowledge to develop their own testing solutions. This would allow them to capture more of the value chain and potentially dictate terms to their former customers. While there are no direct public instances of major Advantest suppliers integrating into the ATE market as direct competitors in recent years, the underlying risk is ever-present in highly specialized industries.

- High Capital Requirements: The ATE industry demands substantial investment in research, development, and manufacturing infrastructure, creating a significant barrier to entry for most suppliers.

- Technical Expertise Gap: Developing sophisticated ATE solutions requires deep understanding of semiconductor testing processes, software integration, and hardware design, which may not align with the core competencies of many component suppliers.

- Strategic Focus: Most suppliers are focused on their core business of providing materials or components, and diverting resources to compete in the ATE sector would represent a significant strategic shift.

Importance of Advantest to Suppliers

Advantest's significance to its suppliers is a key factor in assessing supplier bargaining power. If a supplier relies heavily on Advantest for a substantial portion of its revenue, their ability to dictate terms or increase prices is diminished. This dependence makes them more vulnerable to losing Advantest's business, thus reducing their leverage.

Conversely, if Advantest represents only a small fraction of a supplier's overall sales, the supplier has less incentive to accommodate Advantest's demands. In such scenarios, the supplier can afford to be less flexible, as losing Advantest as a customer would not significantly impact their financial performance.

- Supplier Dependence: Advantest's purchasing volume influences how critical it is to individual suppliers.

- Revenue Concentration: Suppliers with a high concentration of revenue from Advantest have less bargaining power.

- Market Position of Suppliers: If suppliers serve a broad customer base, Advantest's individual importance decreases.

- Switching Costs for Advantest: High switching costs for Advantest to find alternative suppliers further reduce supplier power.

The bargaining power of suppliers for Advantest is generally moderate, influenced by the specialization of components and the concentration of suppliers. While many standard electronic parts are readily available, critical, proprietary technologies for advanced ATE systems often come from a narrower vendor base, granting these suppliers more leverage.

For example, in 2024, suppliers of specialized intellectual property for AI and HPC semiconductor testing can command higher prices due to limited alternatives. Advantest's significant switching costs, involving re-tooling and re-qualification, further bolster the power of its existing, specialized suppliers.

Advantest's own importance to a supplier also plays a crucial role; if Advantest represents a large portion of a supplier's revenue, the supplier's power is diminished. Conversely, if Advantest is a minor client, suppliers have less incentive to be flexible.

| Factor | Impact on Supplier Bargaining Power | Advantest Context |

|---|---|---|

| Supplier Concentration (Specialized Components) | Increases Power | Moderate to High for critical ATE technologies. |

| Switching Costs for Advantest | Increases Power | High due to integration complexity and re-qualification needs. |

| Uniqueness of Supplier Products/IP | Increases Power | Significant for proprietary testing algorithms and advanced materials. |

| Advantest's Revenue Contribution to Supplier | Decreases Power | Varies; depends on Advantest's share of a supplier's total sales. |

What is included in the product

This analysis of Advantest delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes, providing a strategic overview of its competitive environment.

Instantly visualize competitive pressures across all five forces, allowing for rapid identification of key strategic challenges.

Adapt the analysis to reflect shifts in supplier power or the threat of substitutes, ensuring your strategy remains agile.

Customers Bargaining Power

Advantest's customer base is highly concentrated, with a significant portion of its revenue coming from a few major semiconductor manufacturers. For instance, in fiscal year 2023, Advantest reported that its top three customers accounted for approximately 40% of its net sales. This concentration means these large clients wield considerable bargaining power.

These key customers, such as Intel, Samsung, and TSMC, purchase Advantest's sophisticated testing equipment in very large volumes. Their substantial order sizes and the critical nature of Advantest's products to their own manufacturing processes give them leverage to negotiate for lower prices, extended payment terms, or customized product features, thereby increasing the bargaining power of customers.

Semiconductor manufacturers face significant hurdles when considering a switch from Advantest's Automated Test Equipment (ATE) systems. These include the substantial expenses and time involved in re-training engineers and technicians on new platforms, as well as the complex process of re-validating established test methodologies and production flows. For instance, a full re-validation cycle for a new ATE system can take months and cost millions, impacting production schedules and yield.

The integration of entirely new equipment into existing fabrication facilities (fabs) presents another layer of difficulty. This can involve adapting infrastructure, ensuring compatibility with existing manufacturing execution systems (MES), and potentially redesigning parts of the production line. These operational disruptions and capital expenditures directly contribute to higher switching costs for customers.

Advantest's strategy of offering integrated test solutions, which often bundle hardware, software, and support services, further entrenches customers. This holistic approach means that switching not only involves replacing ATE hardware but also potentially migrating to new software environments and support structures, amplifying the perceived risk and cost of changing suppliers.

Customers in the semiconductor industry, particularly sophisticated manufacturers, possess a significant amount of information regarding product costs and the availability of alternative Automatic Test Equipment (ATE) suppliers. This awareness, driven by the intensely competitive nature of their own market, directly translates into heightened bargaining power.

The price sensitivity of these customers is amplified because ATE represents a substantial investment and a critical component in ensuring the quality and yield of their semiconductor products. Any perceived overpricing or underperformance of ATE can have a direct and detrimental impact on their profitability and market standing.

For instance, in 2024, the global semiconductor market saw intense price competition across various segments. Companies like TSMC and Samsung, major ATE buyers, are known for their rigorous supplier evaluation processes, demanding both cost-effectiveness and advanced technological capabilities from their ATE partners.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large semiconductor manufacturers, poses a significant challenge to ATE (Automated Test Equipment) suppliers like Advantest. These major players, especially Integrated Device Manufacturers (IDMs), possess substantial financial and technical resources, enabling them to consider developing their own in-house ATE capabilities. This would directly reduce their dependence on external vendors.

While building proprietary ATE is incredibly complex and capital-intensive, the potential to control testing processes, reduce costs, and gain a competitive edge could incentivize some of the largest semiconductor companies to explore this avenue. For instance, companies with significant R&D budgets and a strong internal engineering base might find it feasible to invest in developing custom testing solutions tailored to their specific product needs.

- Customer Integration Threat: Large semiconductor manufacturers (IDMs) have the financial and technical capacity to develop their own ATE solutions.

- Reduced Reliance: Successful backward integration by customers would diminish their reliance on external ATE suppliers like Advantest.

- Complexity and Cost: Developing in-house ATE is highly complex and requires substantial capital investment, acting as a barrier for many.

- Strategic Incentives: Control over testing, cost reduction, and competitive advantage can motivate major players to pursue self-sufficiency in ATE.

Product Differentiation of Advantest's Offerings

Advantest's automatic test equipment (ATE) products exhibit significant differentiation, particularly in their advanced performance, reliability, and integrated AI-driven testing capabilities. This technical leadership allows Advantest to command premium pricing, thereby mitigating the bargaining power of its customers. For instance, Advantest's solutions are crucial for testing complex semiconductors used in cutting-edge technologies like 5G and AI, where precision and speed are paramount.

The company's strong emphasis on customer support and service further solidifies its differentiated market position. This includes offering extensive training, responsive technical assistance, and customized solutions, which are vital for semiconductor manufacturers who rely on ATE for their production yields and quality assurance. By fostering these strong customer relationships and delivering superior technical value, Advantest effectively reduces the likelihood of customers switching to competitors based solely on price.

- Advantest's commitment to innovation in ATE, particularly in areas like AI-powered testing, creates a strong value proposition.

- The company's reputation for reliability and performance in demanding semiconductor testing environments limits customer price sensitivity.

- Superior customer support and service offerings contribute to product stickiness and reduce the ease with which customers can switch suppliers.

The bargaining power of Advantest's customers is moderated by the high switching costs associated with its sophisticated Automated Test Equipment (ATE). These costs encompass not only the financial outlay for new systems but also the significant time and resources required for re-training personnel and re-validating test processes, which can take months and cost millions. For example, a semiconductor manufacturer adopting a new ATE platform in 2024 would face these substantial integration challenges.

Advantest's strategy of providing integrated solutions, combining hardware, software, and support, further increases these switching costs by creating a more complex ecosystem for customers to abandon. This comprehensive approach, coupled with the inherent difficulties in integrating new ATE into existing fabrication facilities, acts as a strong deterrent against customers easily switching suppliers based on price alone.

Customers in the semiconductor industry, while informed and price-sensitive, find it difficult to switch due to the specialized nature and high integration costs of Advantest's ATE. The company's focus on innovation, such as AI-driven testing, and its strong customer support create product stickiness, limiting the ease with which customers can move to competitors. For instance, in 2024, the demand for advanced testing solutions for AI chips meant that the technical capabilities offered by Advantest were highly valued, reducing price-based decision-making.

| Factor | Impact on Customer Bargaining Power | Advantest's Mitigation Strategy |

| Customer Concentration | High (Top 3 customers ~40% of sales in FY23) | Differentiated products, integrated solutions |

| Switching Costs | High (re-training, re-validation, integration) | Comprehensive support, advanced technology |

| Information Availability | High (market competition) | Technical leadership, value-added services |

| Price Sensitivity | High (ATE is a significant investment) | Product differentiation, AI-driven capabilities |

| Threat of Backward Integration | Moderate (complex and capital-intensive) | Continuous innovation, superior performance |

Preview Before You Purchase

Advantest Porter's Five Forces Analysis

This preview shows the exact Advantest Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the semiconductor test equipment industry. This professionally formatted document is ready for your immediate use, providing a thorough strategic overview without any surprises.

Rivalry Among Competitors

The automatic test equipment (ATE) market is a concentrated space, dominated by a few significant players, which naturally fuels intense competition. Advantest and Teradyne stand out as the primary giants in this arena, constantly vying for market share and technological leadership.

Beyond these two leaders, other notable competitors like Cohu, Chroma ATE, and FormFactor also contribute to the competitive landscape. This means that Advantest faces a strong set of rivals, each with their own specialized offerings and customer bases, making market dynamics quite dynamic.

The Automatic Test Equipment (ATE) market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) in the mid-single digits for the coming years. This expansion is largely fueled by the increasing complexity and demand for semiconductors in sectors like artificial intelligence (AI) and fifth-generation (5G) wireless technology.

While overall market expansion can sometimes temper intense rivalry as firms focus on capturing new demand, the ATE sector's growth is highly segmented. Specifically, the AI and 5G segments, which are critical growth drivers, exhibit particularly fierce competition. Companies are battling for dominance in providing advanced testing solutions for these cutting-edge technologies, leading to a dynamic competitive landscape.

Advantest differentiates itself by focusing on high-performance semiconductor testing solutions, particularly for advanced applications like AI and high-performance computing (HPC). This specialization allows them to command a premium over more commoditized testing segments. For instance, in fiscal year 2023, Advantest reported strong demand for its advanced test systems, contributing to its robust revenue streams, even as some segments of the semiconductor market experienced a slowdown.

Exit Barriers for Competitors

Competitors in the Automated Test Equipment (ATE) market face significant hurdles when trying to exit. High fixed costs associated with research and development, manufacturing facilities, and specialized machinery create a substantial financial commitment. For instance, developing a new ATE platform can cost hundreds of millions of dollars, making a sudden withdrawal financially unviable for many players.

The specialized nature of ATE assets, designed for specific semiconductor testing needs, means these assets have limited resale value outside the industry. This lack of fungibility traps capital and discourages divestment. Companies often find themselves locked into long-term contracts with major semiconductor manufacturers, further cementing their presence and making a swift exit impractical.

These high exit barriers can prolong competitive intensity, even during industry downturns. Companies may continue to operate at reduced capacity or engage in aggressive pricing strategies to cover their fixed costs, leading to prolonged price wars. This was evident in 2023, where the semiconductor industry experienced a slowdown, but ATE providers largely maintained operations due to these entrenched costs.

- High Capital Investment: The ATE industry demands substantial upfront investment in R&D and manufacturing, creating a deep financial moat.

- Specialized Assets: ATE equipment is highly specific, reducing its salvage value and increasing the cost of exiting the market.

- Long-Term Commitments: Existing contracts with major chip manufacturers often bind ATE suppliers for extended periods, hindering quick exits.

- Industry Interdependence: The close relationships between ATE providers and semiconductor manufacturers create a sticky ecosystem, making it difficult for any single player to leave without significant disruption.

Strategic Stakes and Market Share

Advantest's position in the Automatic Test Equipment (ATE) market, especially for non-memory semiconductors, highlights the intense strategic stakes involved. Market share is crucial for companies in this sector due to high fixed costs associated with research, development, and manufacturing, necessitating scale to achieve profitability. Competitors, therefore, often engage in aggressive pricing and innovation to capture a larger portion of this valuable market.

The drive for market share directly impacts Advantest's competitive landscape. In 2023, the global ATE market was valued at approximately $6.5 billion, with Advantest holding a substantial share, particularly strong in the semiconductor test segment. This dominance creates a clear target for rivals seeking to expand their own presence.

- Advantest's stronghold in non-memory ATE, a segment valued at billions globally, fuels aggressive competition.

- High fixed costs in ATE manufacturing incentivize companies to aggressively pursue market share to optimize operations.

- Competitors often employ price reductions and technological advancements to chip away at established players like Advantest.

- Advantest's significant market share makes it a prime target for rivals aiming to gain scale and cost efficiencies.

Competitive rivalry within the Automatic Test Equipment (ATE) market is fierce, primarily driven by the dominance of a few key players like Advantest and Teradyne, alongside other significant competitors such as Cohu and Chroma ATE. This concentration means that Advantest constantly contends with rivals who possess specialized offerings and established customer bases, making the market highly dynamic and competitive.

The ATE market's robust growth, projected at a mid-single-digit CAGR, is a double-edged sword; while it offers opportunities, it also intensifies competition, especially in high-growth segments like AI and 5G. Companies are locked in a battle for technological supremacy and market share, as demonstrated by Advantest's strong performance in advanced test systems during fiscal year 2023, which highlights the premium placed on cutting-edge solutions.

High exit barriers, including substantial R&D investments and specialized assets with limited resale value, trap companies in the market, prolonging competitive intensity and potentially leading to price wars, a situation observed in 2023 during a semiconductor industry slowdown.

Advantest's significant market share, particularly in non-memory ATE, makes it a prime target for competitors seeking scale and cost efficiencies, fueling aggressive strategies like price reductions and rapid technological advancements.

| Key Competitor | Primary Focus | 2023 Market Position Indicator (Illustrative) |

|---|---|---|

| Advantest | High-performance semiconductor testing, AI, HPC | Leading market share in advanced segments |

| Teradyne | Semiconductor test, industrial automation | Major global competitor, strong in various segments |

| Cohu | Semiconductor test, inspection, handling | Significant player, particularly in specific device types |

| Chroma ATE | Power electronics, battery testing, semiconductor testing | Growing presence, strong in specialized areas |

SSubstitutes Threaten

The threat of substitutes for Advantest's Automated Test Equipment (ATE) is a significant consideration. While ATE is the industry standard for comprehensive semiconductor testing, alternative methods are emerging that could reduce reliance on traditional ATE systems. These alternatives include advanced simulation software, which can predict device behavior and identify potential flaws early in the design phase, potentially reducing the need for extensive physical testing. For instance, the increasing complexity of chip designs necessitates sophisticated simulation tools, with the global electronic design automation (EDA) market projected to reach over $15 billion by 2025, indicating a growing investment in these areas.

Design-for-test (DFT) methodologies are also gaining traction. By incorporating testability features directly into the chip design, manufacturers can simplify and potentially automate certain testing processes, thereby lessening the dependence on external ATE. Furthermore, in-line process monitoring, which involves real-time data collection and analysis during the manufacturing process, offers another avenue to detect defects without solely relying on post-fabrication ATE. Advantest itself is investing in these areas, recognizing the evolving landscape of semiconductor testing.

The threat of substitutes for Advantest's Automatic Test Equipment (ATE) hinges on the price-performance trade-off of alternative testing methods. If other validation techniques can achieve comparable quality assurance at a substantially lower cost, they represent a significant competitive pressure.

For instance, while some lower-end semiconductor components might be adequately tested with less sophisticated or even manual methods, advanced chips with complex architectures and stringent performance requirements absolutely necessitate the precision and throughput offered by ATE. In 2024, the demand for high-performance computing, AI accelerators, and advanced automotive sensors continues to drive the need for sophisticated ATE solutions, where the cost of failure due to inadequate testing far outweighs the investment in advanced equipment.

Advantest's customers, particularly those in mission-critical sectors like automotive and aerospace, exhibit a low propensity to substitute their current testing methods. This reluctance stems from the perceived high risk associated with adopting unproven alternatives, especially when product reliability is paramount. The ease of integrating new testing solutions also plays a significant role; customers are more likely to stick with familiar, well-integrated systems.

For instance, in the semiconductor industry, where Advantest holds a strong position, the cost of failure due to inadequate testing can be astronomical, far outweighing any potential savings from a substitute. While some emerging technologies might offer cost efficiencies, their value proposition often doesn't compensate for the potential disruption and validation challenges they introduce. Advantest's deep customer relationships and the proven performance of its equipment further solidify this customer loyalty.

Technological Advancements in Substitution

Technological advancements present a significant threat of substitution for Advantest's core Automatic Test Equipment (ATE) business. Emerging technologies, particularly in areas like artificial intelligence and advanced materials, are continuously being explored for their potential to offer alternative testing methodologies. For instance, AI-driven design verification could reduce reliance on physical ATE by simulating test scenarios more effectively.

Innovations in material science might also lead to new ways of assessing component integrity without traditional hardware-based testing. While the semiconductor industry's reliance on ATE remains strong, the long-term viability of these substitutes cannot be ignored.

- AI-driven design verification: Reduces the need for physical testing by simulating complex scenarios.

- New material science: Explores alternative methods for assessing component integrity.

- Advanced simulation techniques: Offer potential to bypass traditional hardware-based ATE.

- Digital twins: Could provide virtual testing environments, minimizing physical ATE usage.

Impact on Quality and Reliability

The threat of substitutes for the testing and measurement equipment Advantest provides is significant, particularly concerning the quality and reliability of semiconductors. If alternative, less rigorous testing methods emerge, they could compromise the integrity of the final product. For instance, a shift towards faster, but less comprehensive, testing could lead to a rise in defective chips reaching the market, damaging consumer trust and potentially leading to costly recalls.

Advantest's core business relies on its ability to deliver highly accurate and dependable testing solutions. Any substitute that cannot meet the semiconductor industry's demanding quality and reliability standards, which are critical for everything from automotive safety systems to advanced medical devices, would be a poor replacement. The industry's reliance on precision means that even minor deviations in testing can have major consequences.

Consider the implications for advanced packaging technologies, a key growth area for the semiconductor industry. These complex designs require sophisticated testing to ensure signal integrity and thermal management. A substitute testing approach that overlooks these nuances could result in failures in high-performance applications. For example, in 2023, the automotive sector alone saw a significant increase in semiconductor content per vehicle, highlighting the critical need for reliable components tested to the highest standards.

- Stringent Industry Standards: Semiconductor testing must adhere to rigorous specifications to guarantee performance and prevent failures in critical applications.

- Risk of Compromised Quality: Substitute testing methods that are less thorough could lead to an increase in faulty semiconductor devices.

- Impact on Consumer Trust: A rise in defective products due to inadequate testing can erode consumer confidence in semiconductor brands.

- Advanced Technology Demands: Emerging technologies like advanced packaging require highly specialized and reliable testing solutions, making less sophisticated substitutes inadequate.

The threat of substitutes for Advantest's Automatic Test Equipment (ATE) is moderate but growing, primarily driven by advancements in simulation and design-for-test (DFT) methodologies. While these alternatives can reduce the need for some physical testing, they often cannot fully replace the comprehensive validation provided by ATE, especially for complex, high-performance semiconductors. The cost and risk associated with inadequate testing in critical sectors like automotive and aerospace further limit the adoption of less proven substitutes.

The increasing complexity of semiconductor designs, particularly for AI and automotive applications, actually reinforces the need for Advantest's sophisticated ATE solutions. For instance, the global market for AI hardware is projected to grow significantly, demanding rigorous testing of these advanced chips. In 2024, companies are prioritizing reliability, making them less inclined to risk substitutes that might compromise product quality, even if they offer perceived cost savings.

While simulation and DFT offer complementary benefits, they do not fully substitute the exhaustive testing capabilities of ATE. The high cost of product failure in sectors like automotive, where semiconductors are integral to safety, means that customers are hesitant to adopt substitutes that haven't demonstrated equivalent reliability. Advantest's established relationships and the proven performance of its equipment create significant switching costs for its customer base.

| Substitute Method | Potential Impact on ATE Demand | Key Limitations for Advantest Customers | 2024 Market Trend Relevance |

|---|---|---|---|

| Advanced Simulation Software | Moderate Reduction | Cannot fully replicate physical test conditions; critical for complex designs. | Growing adoption for early-stage validation, but ATE remains essential for final verification. |

| Design-for-Test (DFT) | Moderate Reduction | Simplifies testing but doesn't eliminate the need for ATE; complexity of implementation. | Increasingly integrated, but advanced DFT requires sophisticated ATE to fully leverage capabilities. |

| In-line Process Monitoring | Minor Reduction | Focuses on manufacturing process; does not replace end-product functional testing. | Complements ATE by identifying process issues earlier, but not a direct substitute for device validation. |

Entrants Threaten

Entering the automatic test equipment (ATE) market, particularly for advanced memory and SoC testing, necessitates substantial capital investment. Companies need to allocate significant funds towards research and development to create cutting-edge technology. For instance, the development of next-generation testers capable of handling complex semiconductor architectures often requires hundreds of millions of dollars in R&D over several years.

Beyond R&D, establishing specialized manufacturing facilities equipped with high-tech machinery for producing these intricate ATE systems represents another major capital hurdle. These facilities demand precision engineering and advanced automation, adding to the upfront cost. The sheer scale of investment in both innovation and production infrastructure acts as a formidable barrier, deterring potential new entrants.

Advantest, as a long-standing player in the semiconductor test equipment market, benefits significantly from economies of scale. This allows them to spread substantial R&D costs over a larger production volume, resulting in lower per-unit development expenses. For instance, Advantest's significant investment in advanced testing solutions, such as those for AI chips, is amortized across a wider customer base than a newcomer could achieve.

The accumulated experience of established firms like Advantest translates into optimized manufacturing processes and a deep understanding of customer needs. This operational efficiency and market knowledge create substantial barriers to entry. New entrants would struggle to match Advantest's established global supply chain and service network, which are crucial for supporting semiconductor manufacturers worldwide.

Advantest's significant investment in proprietary technology and a robust patent portfolio creates a formidable barrier to entry. Their deep technical expertise in semiconductor test solutions, developed over decades, is not easily replicated. For instance, in fiscal year 2023, Advantest reported R&D expenses of ¥78.5 billion, underscoring their commitment to innovation and maintaining a technological edge.

Access to Distribution Channels and Customer Relationships

Newcomers would find it incredibly challenging to replicate Advantest's deep-rooted connections with leading semiconductor manufacturers. These established relationships are crucial for understanding evolving customer needs and securing crucial early access to new product development cycles.

Gaining entry into established global distribution channels presents another significant hurdle. Advantest's extensive network, honed over decades, ensures efficient and reliable delivery of its complex testing equipment worldwide. This logistical advantage is difficult and costly for new entrants to replicate.

Advantest's reputation for exceptional customer service and technical support, built over many years, acts as a strong deterrent. Potential new entrants would need substantial investment and time to build comparable trust and reliability with their clientele.

- Established Manufacturer Relationships: Advantest's long-standing partnerships with key players in the semiconductor industry provide a significant competitive moat.

- Global Distribution Network: Access to and control over global distribution channels is a substantial barrier to entry for new competitors.

- Customer Loyalty and Service: Decades of providing high-quality service foster customer loyalty, making it difficult for new entrants to win business.

- Brand Reputation: Advantest's strong brand reputation in the semiconductor testing market instills confidence, which is hard-earned and difficult to displace.

Regulatory and Certification Hurdles

The Automated Test Equipment (ATE) market, while not universally governed by heavy regulations, presents significant barriers to entry through industry-specific standards and certifications. New entrants must navigate and adhere to the rigorous quality and performance benchmarks demanded by the semiconductor industry. For instance, semiconductor manufacturers often require their ATE suppliers to meet ISO 9001 certification, demonstrating a commitment to quality management systems. Furthermore, specific testing protocols and data integrity standards, such as those related to ESD (Electrostatic Discharge) protection and calibration traceability, can necessitate substantial investment in specialized equipment and processes before a new player can even begin competing.

The cost and complexity associated with meeting these stringent requirements act as a considerable deterrent for potential new entrants. Achieving and maintaining certifications like ISO 9001, alongside the necessary validation and qualification processes required by major chip manufacturers, can take years and involve significant capital expenditure. For example, a new ATE vendor might need to invest millions in R&D and compliance testing before their equipment is even considered for adoption by a leading foundry or integrated device manufacturer (IDM). This high upfront investment and the lengthy validation cycles effectively limit the number of companies that can realistically enter and compete in this specialized segment of the electronics industry.

- Regulatory and Certification Hurdles: New entrants must meet stringent quality and performance standards of the semiconductor industry, including ISO 9001 certification.

- Industry Standards: Adherence to specific testing protocols and data integrity standards, such as ESD protection and calibration traceability, is crucial.

- High Entry Costs: Significant capital expenditure is required for R&D, compliance testing, and achieving validation from major semiconductor manufacturers.

- Lengthy Validation Cycles: The time and resources needed to get ATE equipment qualified by industry leaders create a substantial barrier for newcomers.

The threat of new entrants into the advanced ATE market is significantly mitigated by the immense capital required for R&D and manufacturing. For instance, developing next-generation testers can cost hundreds of millions of dollars. Advantest's scale allows them to spread these costs, giving them a cost advantage over potential newcomers. The need for specialized facilities and high-tech machinery further elevates the financial barrier.

Furthermore, established players like Advantest benefit from deep technical expertise and a strong patent portfolio, making it difficult for new companies to compete on innovation. Their decades of experience have also fostered strong relationships with key semiconductor manufacturers, providing crucial market access and insights into evolving customer needs. In fiscal year 2023, Advantest's R&D investment of ¥78.5 billion highlights their commitment to maintaining this technological lead.

The extensive global distribution networks and established customer service infrastructure of companies like Advantest present another significant hurdle for new entrants. Replicating this global reach and building comparable customer trust requires substantial time and investment. Moreover, meeting stringent industry standards and certifications, such as ISO 9001, adds to the complexity and cost of entry, often requiring years and millions in investment for validation by major chip manufacturers.

| Barrier to Entry | Description | Advantest's Advantage |

|---|---|---|

| Capital Requirements | High R&D and manufacturing investment (e.g., hundreds of millions for next-gen testers). | Economies of scale reduce per-unit development costs. |

| Technological Expertise & Patents | Deep technical knowledge and proprietary technology are hard to replicate. | Significant R&D spend (¥78.5 billion in FY2023) maintains a technological edge. |

| Established Relationships | Access to leading semiconductor manufacturers and early product cycles. | Long-standing partnerships provide market insight and early adoption opportunities. |

| Distribution & Service Networks | Global reach and reliable customer support are difficult to build. | Extensive, decades-old network ensures efficient delivery and builds customer loyalty. |

| Industry Standards & Certifications | Meeting quality benchmarks (e.g., ISO 9001) and validation cycles. | Existing compliance infrastructure and established validation processes. |

Porter's Five Forces Analysis Data Sources

Our Advantest Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including Advantest's official investor relations materials, annual reports, and public SEC filings. We also incorporate insights from reputable industry research firms and market intelligence platforms that track the semiconductor testing equipment sector.