Advantest Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantest Bundle

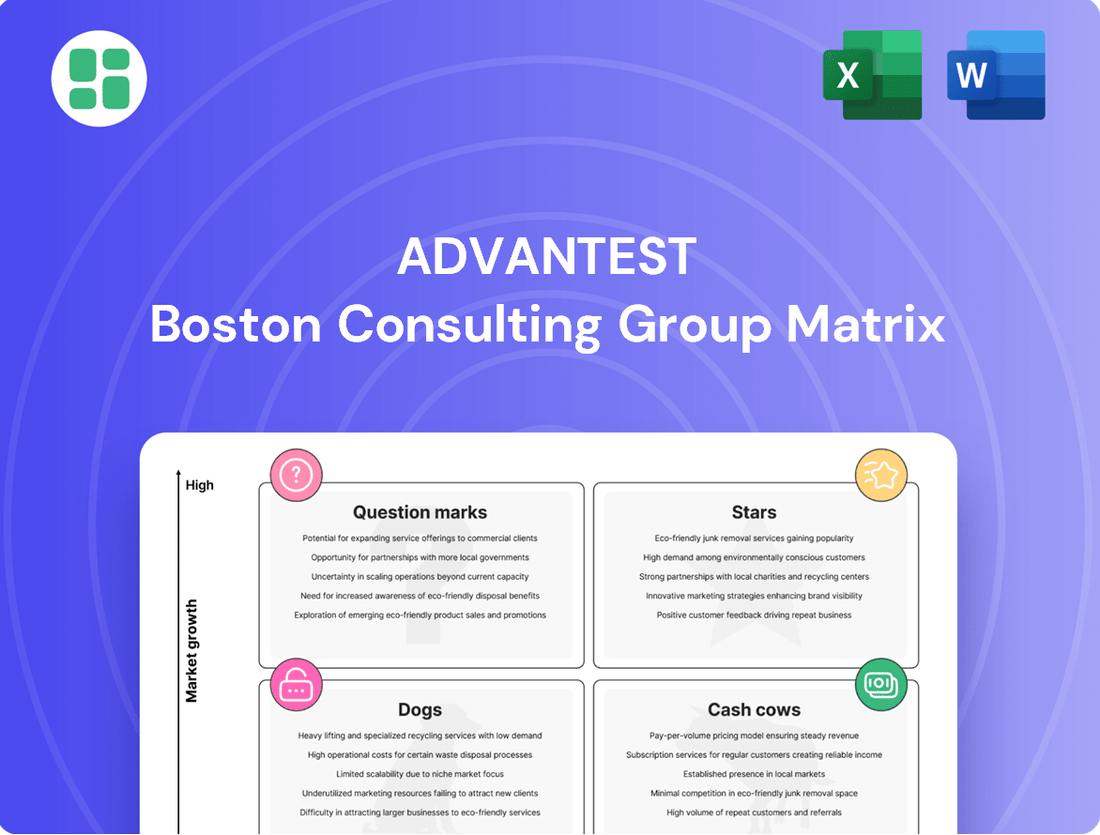

Curious about Advantest's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture that unlocks actionable insights for optimizing your investments and product development strategies. Purchase the full BCG Matrix report to gain a comprehensive understanding and a clear roadmap for future success.

Stars

Advantest's test solutions for AI and HPC semiconductors are considered a strong star within the BCG matrix. The demand for these advanced chips is exploding, fueled by the rapid growth of artificial intelligence and high-performance computing applications.

The semiconductor test equipment market, heavily influenced by AI, HPC, and System-on-Chip (SoC) demand, saw substantial growth in 2024. Projections indicate this upward trend will continue through 2025 and 2026, underscoring the star status of Advantest's offerings in this critical segment.

The Advantest V93000 EXA Scale test platform, especially with its recent advancements like the Wave Scale RF20ex and DC Scale XHC32, is a clear Star in the BCG matrix. This system is indispensable for the rigorous, high-volume testing demanded by sophisticated AI and high-performance computing chips.

Its capacity to manage these complex testing needs positions it as a leader, with its capabilities being further enhanced to support burgeoning fields such as silicon photonics. This strategic focus on next-generation technologies ensures its continued relevance and growth.

Advantest's advanced System-on-Chip (SoC) testers are a clear star in their business portfolio, particularly those designed for demanding applications like Graphics Processing Units (GPUs) and custom Application-Specific Integrated Circuits (ASICs). These sophisticated testing solutions are crucial for ensuring the performance and reliability of complex chips powering everything from advanced computing to artificial intelligence.

The significant revenue growth Advantest experienced in 2024 was substantially fueled by its SoC testers. This surge was directly linked to the escalating complexity of semiconductors and a robust demand from customers in the artificial intelligence sector. Advantest anticipates this strong demand for its SoC testing capabilities to persist throughout fiscal year 2025, underscoring its market leadership in this segment.

Ultra-High-Speed DRAM Test Systems (e.g., T5801)

Advantest's T5801 Ultra-High-Speed DRAM test system is a key player in the memory testing market, designed to handle emerging technologies like GDDR7, LPDDR6, and DDR6. This positions Advantest to capitalize on the increasing demand for faster and more efficient memory solutions.

The memory test systems market is experiencing significant expansion. Projections indicate robust growth, fueled by the insatiable appetite for high-performance memory across various sectors. These include consumer electronics, the rapidly evolving automotive industry, and the critical telecommunications infrastructure, all of which are essential for advancements in AI and 5G technologies.

- Market Growth Driver: Demand for high-performance memory in consumer electronics, automotive, and telecommunications.

- Key Technologies Supported: GDDR7, LPDDR6, and DDR6.

- Industry Impact: Crucial for enabling AI and 5G advancements.

- Advantest's Role: Providing advanced testing solutions for next-generation memory.

Real-Time Data Infrastructure (ACS RTDI™) and AI/ML Partnerships

Advantest's Real-Time Data Infrastructure (ACS RTDI™) and its AI/ML partnerships are firmly positioned as a Star within its business portfolio. This strategic focus on AI-driven testing, exemplified by their collaboration with Emerson, is designed to revolutionize semiconductor testing by leveraging real-time data for enhanced analytics.

These advanced solutions are directly addressing critical industry needs, aiming to optimize testing workflows, boost manufacturing yields, and significantly reduce operational costs. By integrating sophisticated AI analytics with their robust hardware capabilities, Advantest is poised to capture a substantial and growing share of the market.

- AI-Driven Optimization: The ACS RTDI™ platform, powered by AI/ML, enables predictive maintenance and anomaly detection in testing, leading to fewer disruptions and higher throughput.

- Yield Improvement: By analyzing vast amounts of real-time data, these systems can identify subtle patterns that impact device yields, allowing for quicker adjustments and better quality control.

- Cost Reduction: Automation and intelligent data analysis reduce the need for manual intervention and minimize costly re-testing, contributing to overall efficiency.

- Market Growth: The increasing complexity of semiconductors and the demand for faster, more reliable chips drive the need for advanced testing solutions, a market Advantest is actively shaping.

Advantest's AI and HPC semiconductor test solutions are Stars due to surging demand. The market for these advanced chips, crucial for AI and high-performance computing, experienced significant growth in 2024, with projections indicating continued expansion through 2025 and 2026. This sustained demand solidifies the star status of Advantest's offerings in this vital segment.

Advantest's V93000 EXA Scale test platform, particularly with its advanced capabilities for AI and HPC chips, is a prime example of a Star. Its ability to handle complex, high-volume testing needs, including support for emerging fields like silicon photonics, ensures its continued market leadership and growth potential.

The T5801 Ultra-High-Speed DRAM test system, supporting next-generation memory like GDDR7, LPDDR6, and DDR6, is another Star. The memory test market is expanding rapidly, driven by consumer electronics, automotive, and telecommunications, all requiring faster memory for AI and 5G advancements.

Advantest's Real-Time Data Infrastructure (ACS RTDI™) and AI/ML partnerships represent a Star in its portfolio, revolutionizing testing through real-time data analytics. This focus on AI-driven optimization enhances yields, reduces costs, and addresses critical industry needs for more sophisticated semiconductor testing.

| Product/Solution | BCG Category | Key Growth Drivers | Market Relevance | Financial Impact (2024 Focus) |

| AI/HPC Test Solutions | Star | Exploding demand for AI/HPC chips | Critical for advanced computing | Substantial revenue contribution |

| V93000 EXA Scale Platform | Star | High-volume testing for complex AI/HPC chips | Indispensable for leading-edge semiconductors | Drives significant market share |

| T5801 Ultra-High-Speed DRAM Tester | Star | Demand for faster memory (GDDR7, LPDDR6, DDR6) | Enables AI and 5G advancements | Capitalizes on memory market expansion |

| ACS RTDI™ & AI/ML Partnerships | Star | AI-driven optimization of testing workflows | Revolutionizes semiconductor testing | Poised for substantial market capture |

What is included in the product

The Advantest BCG Matrix analyzes product portfolios by market share and growth, guiding investment decisions.

The Advantest BCG Matrix provides a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion.

Cash Cows

Advantest's established memory test systems, serving standard DRAM, SRAM, and flash memory in mature markets, are strong cash cows. These systems benefit from a high market share and consistent demand for fundamental memory components. For instance, in fiscal year 2023, Advantest reported that its Memory Test segment remained a significant contributor to revenue, underscoring the stability of this business line even as newer technologies emerge.

Legacy SoC test systems, those not specifically designed for AI or high-performance computing, represent Advantest's cash cows. These older, more general-purpose systems serve a broad and established market for various integrated circuits, providing a consistent and reliable revenue stream.

Advantest's strong market leadership and extensive customer base for these legacy systems mean they continue to generate significant profits with relatively minimal ongoing investment in research and development or marketing efforts. This stability allows Advantest to allocate resources to more dynamic, high-growth segments of the semiconductor testing market.

Advantest's Mechatronics Systems segment, encompassing critical test system peripherals such as handlers, firmly occupies the Cash Cow quadrant of the BCG Matrix. This classification stems from its position in a mature market characterized by stable, albeit low, growth. The segment thrives due to Advantest's substantial installed base of testers, which ensures high attachment rates for these essential peripherals, generating a predictable and consistent revenue stream from existing clientele.

Services, Support, and Other Businesses

Advantest's global services and support, encompassing maintenance, spare parts, and system-level test products, function as a significant cash cow. These recurring revenue streams capitalize on Advantest's substantial customer base and its established reputation for dependability. This segment demands minimal new investment while consistently generating high-margin cash flow from a mature market. For instance, in fiscal year 2023, Advantest reported that its Services segment contributed approximately 20% of its total revenue, demonstrating its stable and profitable nature.

The company’s commitment to providing ongoing support and upgrades for its installed base of testing equipment ensures a steady income stream. This focus on customer retention and lifecycle management is a hallmark of a successful cash cow strategy. Advantest's ability to leverage its existing infrastructure and expertise allows it to efficiently serve its clients, further solidifying its position in this lucrative area.

- Recurring Revenue: Services and support offer predictable income, reducing reliance on new product cycles.

- High Margins: Operational efficiencies and established customer relationships lead to strong profitability.

- Customer Base Leverage: Existing installed base provides a ready market for ongoing service needs.

- Low Investment: Mature market segment requires less capital expenditure compared to R&D for new technologies.

Display Driver IC Test Systems

Advantest's T6391 test system for display driver integrated circuits (ICs) is a prime example of a Cash Cow within their portfolio. While the market for display driver ICs might not experience the explosive growth seen in areas like AI accelerators, Advantest holds a strong, established position. This allows them to generate consistent and predictable revenue streams.

The T6391, by focusing on a specific, mature segment of the semiconductor testing market, likely benefits from high market share due to Advantest's deep expertise and long-standing relationships with display panel manufacturers. This stability translates into reliable cash flow for the company, funding investments in more dynamic growth areas.

For instance, the global display driver IC market, while mature, still represents a significant revenue opportunity. Advantest's continued success in this segment, evidenced by their ongoing product development and customer support, underscores its Cash Cow status. In 2023, the semiconductor test equipment market overall saw significant activity, and Advantest's consistent performance in established segments like display drivers contributed to their financial strength.

- Stable Revenue Generation: The T6391 system likely commands a substantial market share in the display driver IC testing segment, ensuring consistent sales.

- Mature Market Focus: Targeting a well-established market allows Advantest to leverage its expertise for predictable cash flow rather than chasing high-risk, high-growth opportunities.

- Funding Growth Areas: Profits generated by the T6391 can be reinvested into Advantest's more innovative product lines, such as those supporting AI and high-performance computing.

- Industry Position: Advantest's long-standing reputation and technological leadership in semiconductor testing provide a competitive advantage in the display driver IC market.

Advantest's established memory test systems are strong cash cows, benefiting from high market share and consistent demand. In fiscal year 2023, the Memory Test segment remained a significant revenue contributor, highlighting its stability.

Legacy SoC test systems, designed for general-purpose integrated circuits, also represent cash cows. These systems provide a reliable revenue stream due to their broad market appeal and Advantest's established market leadership.

The company's global services and support segment, including maintenance and spare parts, functions as a significant cash cow. This segment generated approximately 20% of Advantest's total revenue in fiscal year 2023, demonstrating its stable and profitable nature with minimal new investment.

Delivered as Shown

Advantest BCG Matrix

The Advantest BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for immediate application. You can trust that the insights and formatting you see are precisely what will be delivered, enabling you to seamlessly integrate this powerful tool into your business planning and decision-making processes.

Dogs

Discontinued or phasing-out product lines within Advantest's portfolio, such as older generations of semiconductor test equipment or legacy software, would fall into the Dogs category. These products typically exhibit a low market share and operate within markets experiencing decline or stagnation, reflecting a lack of alignment with current technological advancements and market demands. For instance, test systems designed for older semiconductor nodes might see a significant drop in demand as the industry shifts towards more advanced processes.

These "Dog" products require minimal to no further investment, as their growth potential is negligible. Advantest's strategy for these items would likely involve managing their decline efficiently, potentially through continued support for existing customers for a limited period before phasing them out entirely. In some cases, these product lines might be considered candidates for divestiture if a suitable buyer can be found to take over their management and support.

Niche legacy test solutions, often designed for older semiconductor technologies with dwindling market relevance, are prime examples of Dogs in the Advantest BCG Matrix. These specialized offerings cater to a shrinking customer base, resulting in low market share and minimal revenue growth.

For instance, test equipment primarily supporting 32-bit microcontrollers or older memory interfaces, where demand has significantly decreased due to the industry's shift towards more advanced architectures, would likely be classified here. The market for such solutions is projected to contract further, offering little strategic value.

Underperforming Regional Offerings within Advantest's portfolio might include specific semiconductor testing equipment lines that have struggled to gain significant market share in emerging markets like Southeast Asia. For instance, while Advantest maintained a dominant global position in memory testers, certain advanced logic test solutions might have seen slower adoption in these regions due to pricing sensitivities or a less developed ecosystem for cutting-edge chip manufacturing. This scenario reflects a classic 'dog' in the BCG matrix, characterized by low growth and low relative market share in a particular geographic segment.

Inefficient or Outdated Internal Processes/Tools

Inefficient or outdated internal processes and tools at Advantest, while not products, can be viewed as dogs in the BCG matrix if they don't offer a competitive edge or generate adequate value. These are areas where current spending yields minimal returns, prompting a need for reassessment or discontinuation.

For instance, if Advantest continues to rely on legacy testing software that is significantly slower and less capable than newer market alternatives, it could be considered a dog. This would be especially true if the cost of maintaining this outdated system outweighs the benefits it provides, impacting overall operational efficiency and potentially delaying product development cycles.

- Legacy Test Equipment: Continued reliance on older, less precise test equipment that struggles to keep pace with the evolving demands of semiconductor manufacturing.

- Manual Data Analysis: Internal workflows that require extensive manual data compilation and analysis, leading to increased error rates and longer turnaround times compared to automated solutions.

- Outdated Software Platforms: Using internal software for process management or data handling that lacks modern integration capabilities, hindering seamless data flow and collaboration.

- Ineffective Training Programs: Internal training methodologies that do not adequately equip employees with the skills needed to operate current or future advanced testing technologies.

Products with High Maintenance Costs and Low Adoption

Products classified as Dogs in the Advantest BCG Matrix are those that demand substantial investment in upkeep and support, yet fail to capture significant market interest or generate comparable revenue. These offerings represent a drain on company resources, offering little in the way of market share expansion or future growth prospects.

Consider a hypothetical scenario for a legacy software product that requires constant patching and customer service, perhaps costing $5 million annually in maintenance. If this product only generates $3 million in annual revenue and has a stagnant market share of 2%, it clearly falls into the Dog category. Such products consume valuable capital and human resources that could be better allocated to more promising ventures.

- High Maintenance Spend vs. Low Revenue: Products with disproportionately high operational and support costs compared to their revenue generation.

- Stagnant or Declining Market Share: Offerings that are not gaining traction or are losing ground in their respective markets.

- Resource Drain: These items consume financial and personnel resources without providing a significant return on investment or contributing to strategic growth objectives.

- Strategic Re-evaluation Necessity: Products in this category warrant careful consideration for divestment, discontinuation, or a significant overhaul to improve their viability.

Dogs in Advantest's portfolio represent products with low market share in slow-growing or declining industries. These are often legacy offerings that no longer align with current technological trends, such as older semiconductor test equipment for obsolete nodes. Advantest's strategy for these products typically involves minimizing investment, managing their decline, and potentially divesting them if a buyer exists.

For example, Advantest's older memory testers, while once dominant, might now be considered dogs as the industry shifts to newer memory technologies. The market for equipment supporting technologies like DDR3 or earlier would be contracting, leading to low growth and market share for those specific product lines.

These "dog" products consume resources without offering significant future potential, making them candidates for discontinuation or sale. Advantest's focus would be on efficiently managing the wind-down of these offerings to free up capital and personnel for more promising areas.

Consider a hypothetical legacy software suite for test data analysis that requires ongoing maintenance. If this software has a declining user base and generates minimal revenue, say $2 million annually with a 1% market share, while costing $3 million in annual support, it clearly fits the dog category. Advantest would likely seek to phase out such offerings.

Question Marks

The KGD Test Cell, featuring the HA1100 die prober for wide-bandgap power semiconductors, is positioned as a Question Mark in the Advantest BCG Matrix. This strategic classification reflects its status as a new product aimed at high-growth, emerging sectors such as electric vehicles and 5G infrastructure.

While these target markets exhibit significant future potential, the HA1100 die prober currently holds a low market share due to its recent introduction. The company's investment in this technology is focused on capturing future market growth, acknowledging the initial stages of market penetration.

Advantest's SiConic™ Automated Silicon Validation Solution is positioned as a Question Mark in the BCG matrix. This innovative product addresses the escalating complexity of advanced System-on-Chips (SoCs), a critical challenge in today's semiconductor industry.

The market for advanced silicon validation is experiencing robust growth, fueled by the imperative for quicker design sign-off and enhanced reliability in cutting-edge chip development. SiConic™ aims to capitalize on this trend, offering a streamlined approach to a demanding process.

However, SiConic™ is still in its early stages of market penetration. While its technological promise is significant, its market share and overall adoption rates are yet to be firmly established, reflecting its nascent status in a competitive landscape.

Advantest's V93000 test system's expansion into silicon photonics and co-packaged optics, facilitated by strategic partnerships, positions these areas as Question Marks within their BCG portfolio. These technologies are experiencing significant growth, driven by demand for faster data transmission in next-generation data centers and telecommunications. For instance, the global silicon photonics market was valued at approximately $1.2 billion in 2023 and is projected to reach over $5 billion by 2028, exhibiting a compound annual growth rate exceeding 25%.

While these segments represent high-potential markets, Advantest's current market share in these specialized testing domains is likely nascent, reflecting the early stage of their investment and development in these areas. The company's ability to capture significant market share will depend on the success of these partnerships and the adoption rate of their solutions by key players in the rapidly evolving photonics industry.

Advanced System-Level Test (SLT) Solutions

Advantest's advanced System-Level Test (SLT) solutions are positioned in a segment with significant future growth potential, particularly as semiconductor complexity escalates in compute and automotive applications. While current overall demand for SLT may be subdued, these specialized offerings are designed to meet the evolving needs of these high-growth sectors.

The key challenge and opportunity lie in the substantial investment and market development required to capture significant market share in this advanced SLT space. This reflects the high barrier to entry and the need for continuous innovation to keep pace with industry advancements.

- High Complexity Demand: Advantest's advanced SLT solutions cater to the increasing complexity of semiconductors in compute and automotive sectors, driving future demand.

- Growth Potential: This segment offers high growth potential due to the relentless rise in semiconductor sophistication.

- Investment Requirement: Significant investment and dedicated market development are crucial for Advantest to achieve substantial market share gains in advanced SLT.

- Market Dynamics: The SLT market, while experiencing a current slowdown overall, presents a strategic area for Advantest to focus on specialized, high-value solutions.

Emerging Technologies in Automotive IC Testing

Advantest's focus on cutting-edge automotive ICs, especially for Advanced Driver-Assistance Systems (ADAS) and infotainment, positions it as a potential Question Mark. The automotive semiconductor market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 10% through 2028, reaching an estimated $150 billion. This expansion is driven by increasing vehicle electrification and automation.

The specialized and evolving testing demands for these advanced automotive ICs represent a strategic investment for Advantest. While the overall automotive market is strong, the specific technologies powering ADAS and next-generation infotainment require sophisticated and often novel test solutions. This creates an opportunity for Advantest to capture significant market share in these niche, high-value segments.

- Market Growth: The automotive semiconductor market is projected to exceed $150 billion by 2028, with a CAGR of over 10%.

- ADAS & Infotainment Focus: Advantest is investing in test solutions for these critical, high-growth automotive segments.

- Specialized Testing Needs: The complexity of ADAS and infotainment ICs requires advanced, tailored testing capabilities.

- Market Share Potential: Advantest aims to build leadership in these specialized, high-value automotive testing areas.

Question Marks in Advantest's portfolio represent areas with high growth potential but currently low market share. These are typically new products or emerging markets where Advantest is investing to build future dominance.

The KGD Test Cell with the HA1100 die prober for wide-bandgap power semiconductors and the SiConic™ Automated Silicon Validation Solution are prime examples. Both target rapidly expanding sectors like EVs, 5G, and advanced SoC development, but are in early stages of market penetration.

Advantest's V93000 system's expansion into silicon photonics and co-packaged optics, alongside advanced System-Level Test (SLT) solutions for compute and automotive, also fall into this category. These areas demand significant investment and market development to achieve substantial market share.

The company's focus on cutting-edge automotive ICs for ADAS and infotainment further solidifies this classification, capitalizing on a market projected to exceed $150 billion by 2028.

| Product/Segment | Market Characteristic | Advantest's Position | Key Drivers | Estimated Market Value (2023/2024) |

| KGD Test Cell (HA1100) | High Growth, Low Share | New Product, Early Stage | EVs, 5G | N/A (Emerging) |

| SiConic™ SLVS | High Growth, Low Share | New Product, Early Stage | Advanced SoC Complexity | N/A (Emerging) |

| V93000 (Silicon Photonics/Co-Packaged Optics) | High Growth, Low Share | Nascent Market Share | Data Centers, Telecom | ~$1.2 Billion (Silicon Photonics, 2023) |

| Advanced SLT Solutions | High Growth Potential, Low Share | Requires Investment & Market Dev. | Compute, Automotive Complexity | N/A (Specialized Segment) |

| Automotive ICs (ADAS/Infotainment) | High Growth, Low Share | Targeted Investment | Vehicle Electrification/Automation | ~$135 Billion (Automotive Semiconductors, 2024 est.) |

BCG Matrix Data Sources

Our Advantest BCG Matrix leverages a robust data foundation, integrating Advantest's financial reports, market share data, and industry growth forecasts to accurately position each business unit.