Adecco Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adecco Group Bundle

The Adecco Group, a global leader in workforce solutions, possesses significant strengths in its vast global network and diversified service offerings, yet faces challenges from intense competition and evolving labor market dynamics. Understanding these internal capabilities and external threats is crucial for navigating the future of work.

Want the full story behind Adecco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Adecco Group stands as a titan in the global HR solutions landscape, commanding a significant share of the staffing and recruitment market. This leadership position, evident in their extensive operational footprint, allows them to benefit from substantial economies of scale, which is crucial for maintaining competitive pricing and service offerings.

Their robust global presence, spanning numerous countries, translates into a vast network of both skilled professionals and corporate clients. In 2023, Adecco Group reported revenues of €23.6 billion, underscoring their immense market penetration and the breadth of their service delivery across diverse industries and geographies.

The Adecco Group boasts a diversified service portfolio encompassing temporary staffing, permanent placement, career transition, and talent development. This broad range of HR solutions allows the company to serve a wide spectrum of client needs, from immediate workforce flexibility to long-term strategic talent management.

This comprehensive offering enhances Adecco's resilience by mitigating risks associated with over-reliance on any single service. For instance, in the first quarter of 2024, while the temporary staffing segment experienced market headwinds, the company's other service lines, such as its specialized professional staffing and consulting divisions, demonstrated more stable performance, contributing to overall revenue stability.

Adecco Group's extensive global network, operating in over 60 countries, provides a significant competitive edge. This vast reach allows them to tap into diverse talent pools and serve multinational clients effectively, adapting to varied local market conditions and regulations. In 2023, Adecco Group facilitated placements in numerous sectors across these regions, underscoring their capacity to connect global talent with opportunities.

Strong Brand Recognition and Trust

Adecco Group benefits significantly from its established brand recognition and the trust it has cultivated over years as a global leader in the HR sector. This strong reputation is a cornerstone for attracting both a diverse pool of talent and a broad range of corporate clients. In 2023, Adecco Group continued to leverage this trust, serving millions of candidates and thousands of clients worldwide, reinforcing its position as a reliable partner in workforce solutions.

This strong brand equity translates directly into a competitive advantage, fostering loyalty and encouraging repeat business within the highly competitive staffing landscape. The company's long-standing presence, dating back to its founding, has solidified its image as a dependable and experienced player. For instance, Adecco consistently ranks among the top global staffing firms by revenue, a testament to its enduring brand strength and client confidence.

- Global Employer Scale: Adecco Group is one of the world's largest employers, facilitating millions of job placements annually.

- Industry Longevity: Decades of experience in the human resources sector have built a deep reservoir of trust.

- Client & Candidate Attraction: A recognized and trusted brand is key to consistently drawing both skilled professionals and businesses seeking talent.

- Repeat Business Driver: Brand trust fosters loyalty, leading to sustained relationships and recurring revenue streams.

Strategic Investment in Technology and AI

Adecco Group's strategic investment in technology, particularly AI, is a significant strength. They are actively integrating AI-powered tools for candidate sourcing, matching, and streamlining administrative processes. This not only boosts operational efficiency but also enhances the overall experience for both clients and candidates.

This focus on digital transformation is crucial for staying competitive in the evolving HR landscape. For instance, in 2023, Adecco Group reported that digital channels accounted for a substantial portion of their new client acquisition, demonstrating the tangible impact of these investments. Their ongoing commitment positions them to leverage future technological advancements, ensuring they remain at the forefront of service delivery.

- AI-Driven Efficiency: Adecco is using AI to automate tasks like resume screening and candidate matching, leading to faster placement times and reduced operational costs.

- Enhanced Candidate Experience: AI-powered platforms provide more personalized job recommendations and smoother application processes, improving candidate satisfaction.

- Future-Proofing Operations: Continuous investment in digital delivery engines and AI ensures Adecco remains agile and capable of adapting to emerging trends in the global workforce.

Adecco Group's extensive global reach, operating in over 60 countries, provides a significant competitive advantage. This vast network allows them to tap into diverse talent pools and serve multinational clients effectively, adapting to varied local market conditions. In 2023, Adecco Group facilitated millions of placements across numerous sectors, underscoring their capacity to connect global talent with opportunities.

The company's diversified service portfolio, including temporary staffing, permanent placement, and talent development, enhances its resilience. This broad range allows Adecco to serve a wide spectrum of client needs, mitigating risks associated with over-reliance on any single service. For example, in Q1 2024, while some segments faced headwinds, specialized divisions showed stable performance, contributing to overall revenue stability.

Adecco Group's established brand recognition and trust cultivated over years as a global leader are significant strengths. This strong reputation attracts both skilled professionals and corporate clients, fostering loyalty and repeat business. In 2023, Adecco continued to leverage this trust, serving millions of candidates and thousands of clients worldwide.

Strategic investment in technology, particularly AI, drives operational efficiency and enhances the experience for clients and candidates. AI-powered tools for sourcing and matching streamline processes, with digital channels accounting for a substantial portion of new client acquisition in 2023.

| Strength | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Global Reach | Extensive operational footprint in over 60 countries. | Facilitated millions of placements globally. |

| Diversified Services | Offers temporary, permanent, and talent development solutions. | Revenue stability in specialized divisions during Q1 2024 headwinds. |

| Brand Recognition & Trust | Long-standing reputation as a global HR leader. | Served millions of candidates and thousands of clients in 2023. |

| Technological Investment | Integration of AI for sourcing, matching, and process automation. | Digital channels contributed significantly to new client acquisition in 2023. |

What is included in the product

Analyzes Adecco Group’s competitive position through key internal and external factors, detailing its strengths in global reach and brand recognition against weaknesses in digital transformation and market saturation.

Identifies key competitive advantages and areas for improvement, enabling targeted strategic adjustments.

Highlights potential market disruptions and internal weaknesses to proactively mitigate risks.

Weaknesses

The staffing industry, and by extension Adecco Group, is quite sensitive to the ups and downs of the global economy. When economies slow down, companies often cut back on hiring, especially for temporary or contract positions, which directly impacts the revenue of staffing agencies.

This vulnerability was evident in Adecco's Q1 2025 performance, where they reported a 2% year-over-year organic revenue decline. This dip underscores the challenging market conditions, particularly noted in certain European regions, highlighting the direct correlation between economic health and the company's financial results.

Adecco Group faces a fiercely competitive environment, with major global rivals like Randstad and ManpowerGroup, alongside many smaller, specialized agencies. This crowded marketplace often results in significant pricing pressures, making it difficult to maintain or grow market share, even with strategic initiatives. The industry's fragmented nature demands constant innovation and a clear differentiation strategy to stand out.

Adecco Group, as a global service provider with an extensive network and a substantial internal workforce, contends with inherently high operational and administrative expenses. These costs, while managed through initiatives like General and Administrative (G&A) savings, can pressure profitability, particularly when revenue experiences a downturn. For instance, in the first quarter of 2024, Adecco reported €2.1 billion in revenue, highlighting the scale of operations that contribute to these costs.

Reliance on Client Relationships

Adecco Group's substantial reliance on established client relationships presents a notable weakness. A significant portion of their revenue is tied to the ongoing needs and loyalty of corporate clients, making them vulnerable to client attrition or shifts in hiring demand. For instance, in the first half of 2024, while Adecco reported revenue growth, the concentration of business with key accounts remains a critical factor to monitor for potential revenue volatility.

This dependency underscores the need for robust client retention strategies and continuous efforts to diversify their client portfolio. The loss of even a few major clients, or a downturn in their hiring activities, could disproportionately affect Adecco's financial performance. This necessitates ongoing investment in account management and business development to secure long-term partnerships and mitigate the impact of any single client's reduced activity.

- Client Concentration Risk: A significant portion of Adecco's revenue is derived from a limited number of large corporate clients.

- Vulnerability to Market Shifts: Changes in hiring needs or economic downturns affecting key clients can lead to substantial revenue declines.

- Need for Proactive Relationship Management: Continuous investment in client satisfaction and relationship building is essential to prevent churn.

Challenges in Talent Retention and Shortages

Despite its core business being talent solutions, Adecco Group encounters difficulties in attracting and keeping skilled employees, particularly in fields with significant worker deficits. For instance, the global shortage of IT professionals was estimated to reach 4.3 million by 2023, a trend that continues to impact recruitment efforts across industries.

The escalating need for specialized expertise, especially within technology and healthcare sectors, coupled with intensified competition for these professionals, presents an ongoing hurdle. This makes it challenging for Adecco to consistently fulfill client requirements and sustain a deep reservoir of qualified candidates. In 2024, reports indicated that over 60% of companies struggled to find candidates with the necessary digital skills.

- Talent Shortages: Persistent gaps in specialized skills, particularly in IT and healthcare, strain Adecco's ability to supply clients.

- Increased Competition: Fierce rivalry for in-demand professionals makes it harder to secure and retain top talent.

- Client Demand Pressure: Difficulty in meeting client needs due to talent scarcity can impact service delivery and satisfaction.

Adecco Group's reliance on a concentrated client base poses a significant risk, as a downturn in hiring from a few major accounts can disproportionately impact revenue. This was highlighted in their 2024 performance, where client retention remained a critical focus to mitigate revenue volatility. The company must continuously invest in client relationship management to prevent attrition.

The staffing industry's inherent sensitivity to economic cycles means Adecco is vulnerable to recessions, which can lead to reduced hiring and thus lower demand for their services. This was evident in their Q1 2025 results, which showed a 2% year-over-year organic revenue decline, underscoring the direct link between economic health and their financial performance.

Adecco faces intense competition from global players like Randstad and ManpowerGroup, as well as numerous specialized agencies. This crowded market leads to pricing pressures, hindering market share growth and necessitating constant innovation to differentiate services.

Operational and administrative costs remain a considerable challenge for Adecco, given its extensive global network and workforce. While cost-saving measures are in place, these expenses can pressure profitability, particularly during periods of revenue decline. For instance, in Q1 2024, Adecco reported €2.1 billion in revenue, indicating the scale of operations contributing to these costs.

Preview the Actual Deliverable

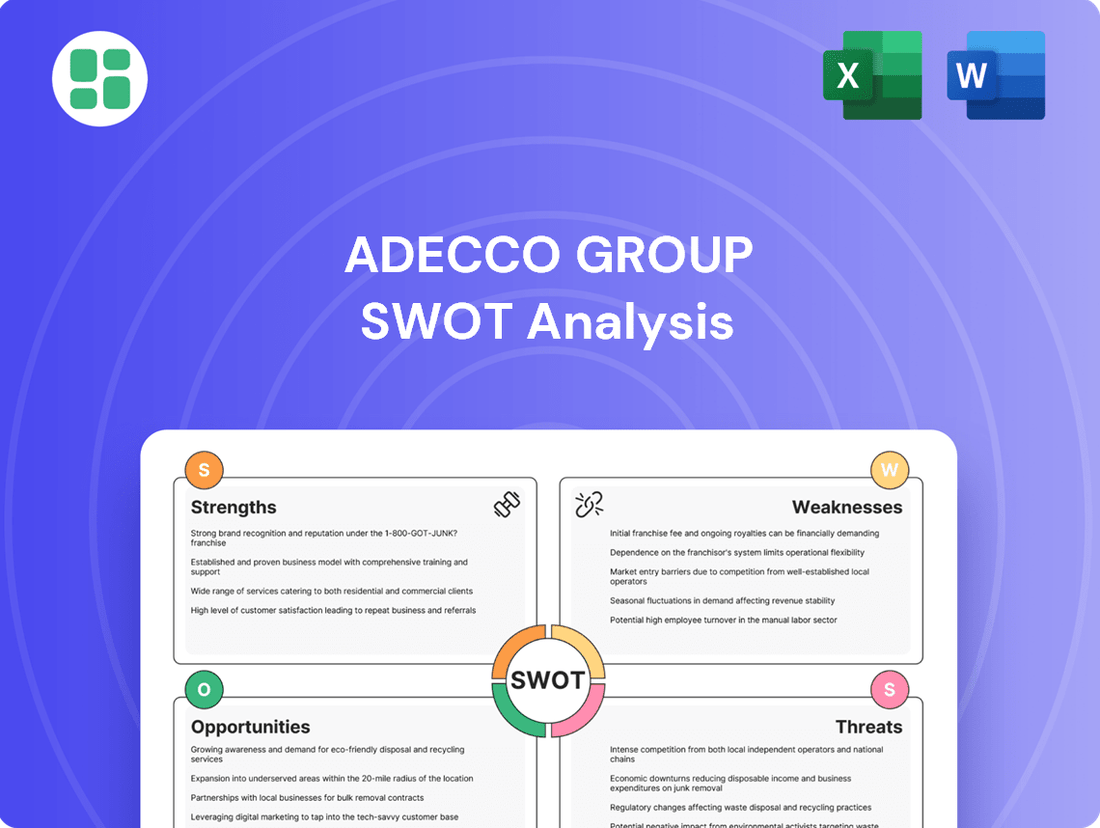

Adecco Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual Adecco Group SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global workforce is embracing flexibility, with remote and hybrid models becoming mainstream. This shift is a major opportunity for Adecco Group, as companies increasingly need agile staffing solutions to adapt to changing work environments.

Adecco's core strength in temporary and contract staffing directly addresses this growing demand for flexible talent. The company is well-positioned to capitalize on this trend, which is projected to fuel further expansion in the temporary staffing sector.

For instance, in 2024, the demand for flexible roles saw a significant uptick. A survey by ManpowerGroup indicated that over 70% of employers were expanding their use of contingent workers to meet fluctuating business needs, a clear indicator of the market's direction.

Adecco Group can capitalize on significant growth opportunities by expanding its footprint in emerging markets, particularly within the APAC region. Countries like Vietnam, the Philippines, India, and China are exhibiting strong economic expansion, directly translating to increased demand for staffing solutions. This strategic move allows Adecco to tap into new customer bases and diversify its revenue streams beyond more mature markets.

Furthermore, focusing on high-growth sectors presents a compelling avenue for Adecco's expansion. Industries such as Information Technology (IT) and Healthcare are experiencing unprecedented demand for skilled professionals globally. By bolstering its service offerings and expertise in these areas, Adecco can meet the evolving needs of businesses and secure a leading position in these lucrative segments. For instance, the global IT staffing market is projected to reach over $38 billion by 2025, indicating substantial potential.

The accelerating digital transformation in HR, coupled with the growing use of AI, presents a significant opportunity for Adecco to innovate and elevate its service offerings. By strategically implementing AI, Adecco can refine candidate matching algorithms, automate routine administrative processes, and leverage predictive analytics, leading to greater efficiency and optimized recruitment outcomes.

This technological integration allows Adecco to provide more sophisticated, value-added solutions to its clients, distinguishing its services in a competitive market. For instance, advancements in AI-powered recruitment platforms are expected to streamline the hiring process, potentially reducing time-to-hire by up to 30% in certain sectors by 2025, according to industry projections.

Focus on Upskilling and Reskilling Initiatives

The dynamic nature of the contemporary job market increasingly demands that individuals and organizations prioritize upskilling and reskilling to bridge widening skills gaps. Adecco Group's established expertise in talent development and career transition services places it in a prime position to leverage this critical need.

By offering targeted training programs, Adecco can significantly enhance workforce employability and proactively address future talent acquisition challenges for its clients. This strategic focus not only benefits individual career trajectories but also contributes to building a more adaptable and resilient talent ecosystem overall.

- Skills Gap Growth: Reports from organizations like the World Economic Forum consistently highlight growing skills gaps, with projections indicating millions of jobs will require new skills by 2025-2030.

- Adecco's Investment: Adecco Group has been actively investing in digital learning platforms and partnerships to expand its reskilling offerings. For instance, in 2024, they announced expanded collaborations with several educational technology providers to offer a wider range of specialized courses.

- Market Demand: The demand for digital skills, AI proficiency, and green economy expertise is surging, creating a significant opportunity for Adecco to provide relevant training solutions.

- Client Benefits: Businesses partnering with Adecco for reskilling initiatives can expect improved employee retention and a more agile workforce capable of adapting to technological advancements and market shifts.

Strategic Acquisitions and Partnerships

The Adecco Group can strategically acquire specialized staffing firms or HR tech companies to broaden its service portfolio, capture market share in particular segments, and bolster its technological prowess. For instance, in 2024, the HR tech market saw significant investment, with deals like Workday's acquisition of Hired, valued at over $100 million, highlighting the trend of integrating advanced technology into HR solutions. This move would allow Adecco to offer more comprehensive solutions and tap into emerging talent pools.

Forming alliances with technology providers and educational institutions presents another avenue for growth. These collaborations can fortify Adecco's competitive standing and enlarge its network of integrated solutions. Partnerships can facilitate access to new markets and specialized skill sets. For example, in early 2025, Randstad announced a strategic partnership with Coursera to upskill its workforce, demonstrating the value of educational alliances in the staffing industry.

- Acquire niche HR tech startups to integrate advanced AI-driven recruitment tools.

- Partner with online learning platforms to offer reskilling and upskilling programs to clients' employees.

- Explore joint ventures with cybersecurity firms to provide specialized staffing for the growing cybersecurity sector.

The increasing demand for flexible work arrangements presents a significant opportunity for Adecco Group, as companies globally seek agile staffing solutions. This trend is projected to drive further growth in the temporary and contract staffing sectors, with over 70% of employers expanding their use of contingent workers in 2024. Adecco is well-positioned to capitalize on this by expanding into high-growth sectors like IT and Healthcare, and by leveraging AI to enhance its recruitment efficiency.

The company can also tap into emerging markets, particularly in the APAC region, to diversify revenue streams and reach new customer bases. By focusing on talent development and reskilling, Adecco can address growing skills gaps, with millions of jobs expected to require new skills by 2025-2030. Strategic acquisitions of HR tech firms and partnerships with online learning platforms will further bolster Adecco's service offerings and competitive edge.

| Opportunity Area | Key Trend/Driver | Adecco's Advantage | Market Data/Projection |

|---|---|---|---|

| Flexible Workforce | Rise of remote/hybrid work | Core strength in temporary/contract staffing | 70%+ employers expanding contingent workforce (2024) |

| Emerging Markets | Economic expansion in APAC | Diversification of revenue streams | Strong growth in Vietnam, India, China |

| High-Growth Sectors | Demand for IT & Healthcare talent | Bolstering specialized service offerings | Global IT staffing market >$38B by 2025 |

| Digital Transformation & AI | HR tech innovation | Enhanced efficiency, predictive analytics | AI recruitment reducing time-to-hire by up to 30% (projected by 2025) |

| Upskilling & Reskilling | Growing skills gaps | Expertise in talent development | Millions of jobs needing new skills by 2025-2030 |

| Strategic Acquisitions/Alliances | HR tech market consolidation | Broadening service portfolio, tech prowess | HR tech market saw significant investment in 2024 |

Threats

A significant global economic downturn is a major threat to Adecco Group, directly reducing hiring volumes and the demand for its staffing solutions. This sensitivity to economic health means that prolonged uncertainty or recessions can lead to substantial revenue declines and margin pressure.

For instance, the lingering effects of inflation and the potential for interest rate hikes in key markets throughout 2024 and into 2025 could dampen business investment and, consequently, the need for temporary and permanent staffing.

The rapid advancement of agentic AI and automation poses a significant threat by potentially decreasing the need for human workers in various sectors, including those Adecco Group typically serves with temporary staff. This technological shift could directly impact Adecco's core business model, especially if it leads to a reduced demand for roles that can be easily automated.

For instance, reports from 2024 suggest that AI is increasingly capable of handling administrative, data entry, and even some customer service tasks, areas where temporary staffing has historically been strong. Adecco needs to proactively adapt by emphasizing placements in roles demanding uniquely human skills like critical thinking, emotional intelligence, and creative problem-solving to mitigate this threat.

Adecco Group operates globally, facing a constantly shifting environment of labor laws and data privacy rules such as GDPR. For instance, in 2024, the European Union continued to refine its digital services and data protection frameworks, potentially increasing compliance burdens for Adecco’s cross-border operations.

Evolving regulations, especially those impacting flexible work arrangements or the use of artificial intelligence in talent acquisition, could raise operational costs and limit strategic agility. Failure to adhere to these diverse legal requirements can result in substantial fines, impacting profitability and reputation.

Intensified Competition from Digital Platforms and Niche Players

The staffing industry is facing a significant threat from digital platforms and niche players. Online staffing marketplaces, for instance, are rapidly gaining traction by connecting employers with talent more directly and efficiently. These platforms often operate with lower overheads, allowing them to offer competitive pricing and attract both job seekers and companies seeking specialized skills. For example, in 2024, the global online recruitment market was valued at over $30 billion, demonstrating the scale of this digital shift.

Niche recruitment agencies, focusing on specific industries or skill sets like AI development or renewable energy, are also intensifying competition. These specialized firms can offer deeper expertise and more tailored solutions than generalist staffing providers. This trend forces established players like Adecco to constantly innovate and adapt their service offerings to remain relevant. Adecco’s own digital transformation efforts, including investments in AI-powered matching and data analytics, are a direct response to this evolving competitive landscape.

- Digital platforms offer lower cost-per-hire, potentially impacting Adecco's traditional fee structures.

- Niche players provide specialized expertise that can attract clients seeking highly specific talent pools.

- The agility of online platforms allows for faster response times and more flexible engagement models.

Talent Poaching and Wage Inflation

The Adecco Group operates in a highly competitive labor market, facing the persistent threat of talent poaching. As demand for skilled professionals outstrips supply, clients and rival staffing firms actively seek to lure away Adecco's placed candidates, increasing the challenge of talent retention. This dynamic is particularly acute in specialized sectors where shortages are most pronounced.

Wage inflation further exacerbates this threat. In 2024 and projected into 2025, the high demand for in-demand skills, such as those in technology and healthcare, is driving up salary expectations. Adecco must absorb these increased labor costs, which can compress profit margins if the company cannot effectively pass these higher wages onto its clients through service fees. For instance, reports from early 2024 indicated that wage growth in key European markets, where Adecco has a significant presence, was accelerating due to these supply-demand imbalances.

- Talent Poaching: Increased client and competitor efforts to recruit Adecco's temporary and permanent staff.

- Wage Inflation: Rising labor costs due to high demand for specialized skills, impacting Adecco's cost structure.

- Retention Challenges: Difficulty in retaining skilled professionals amidst competitive offers, leading to higher recruitment and onboarding expenses.

The increasing sophistication of AI and automation presents a significant threat by potentially reducing the demand for human labor in roles Adecco typically fills. For instance, by mid-2024, AI tools were demonstrating enhanced capabilities in administrative and customer service tasks, areas that have historically relied on temporary staffing. This trend necessitates a strategic shift towards roles requiring uniquely human skills like complex problem-solving and emotional intelligence to counter the impact on Adecco's core business.

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, including Adecco Group's official financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded strategic view.