Adecco Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adecco Group Bundle

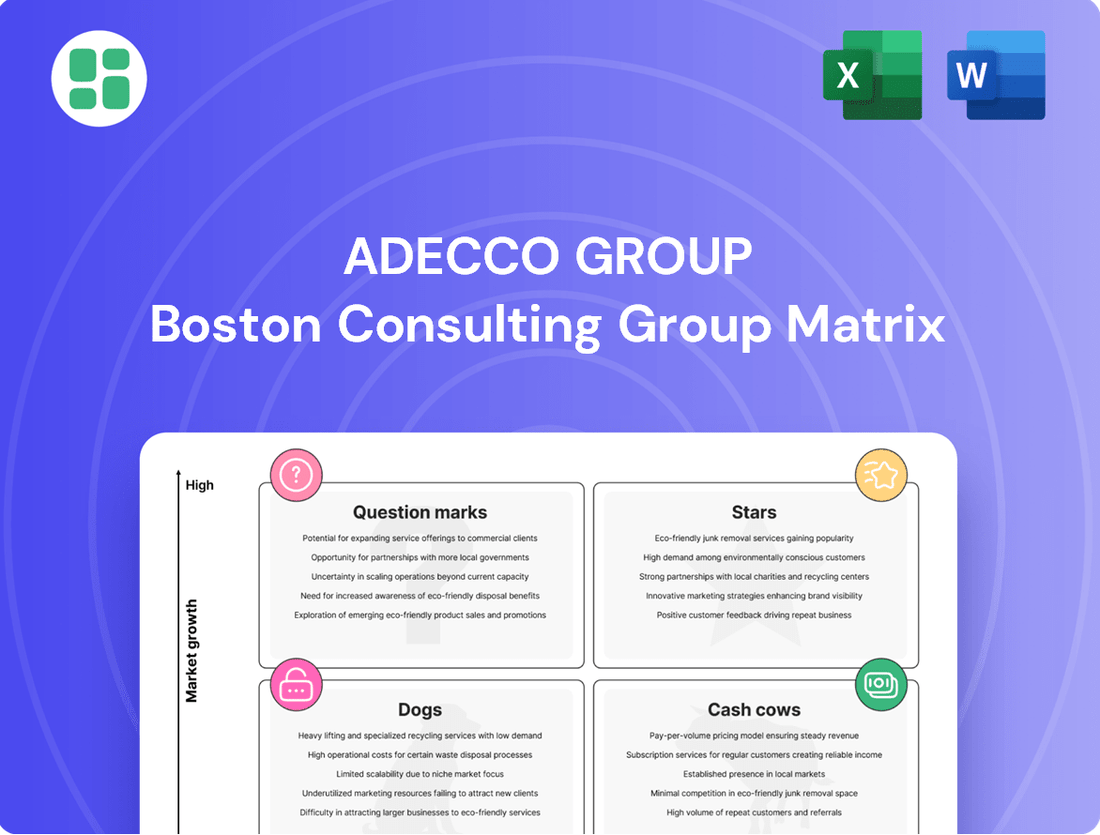

Uncover the strategic positioning of the Adecco Group's diverse business units with our insightful BCG Matrix analysis. See which segments are driving growth, which are generating stable income, and which require careful consideration.

This glimpse into Adecco's portfolio is just the beginning. Purchase the full BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing their business strategy.

Stars

Adecco's operations across the Asia-Pacific (APAC) region, encompassing key markets like Japan and India, are consistently showing robust organic revenue growth. This strong performance signifies a significant market share within a rapidly expanding geographical area for HR solutions, positioning APAC as a crucial growth engine for the Adecco Group.

In 2024, Adecco reported continued strength in its APAC segment, with several markets experiencing double-digit revenue increases, outperforming the global average. For instance, India's IT staffing sector saw a notable surge, contributing significantly to the region's overall expansion, reflecting successful market penetration and a strong competitive stance.

Adecco Group's AI-powered recruitment tools, exemplified by their expanded partnership with Bullhorn for AI Search and Match, firmly place them in the Stars category of the BCG Matrix. This strategic move capitalizes on the accelerating adoption of AI and digital transformation within the HR tech sector, a market experiencing robust growth.

By integrating advanced AI, Adecco aims to significantly boost efficiency and accuracy in talent acquisition, targeting a segment with high potential for market share expansion. This focus on cutting-edge technology positions them for continued success in the evolving recruitment landscape.

Adecco's outsourcing and managed services have experienced robust growth, a testament to their strong market presence in this dynamic sector. Businesses are increasingly offloading non-core operations, and Adecco is effectively capturing a significant portion of this expanding market.

This segment thrives on high demand, further bolstered by Adecco's deep-seated expertise. For instance, the global outsourcing market was valued at approximately $272.4 billion in 2023 and is projected to reach $377.6 billion by 2027, showcasing the significant opportunity Adecco is capitalizing on.

Strategic Client Wins in High-Growth Sectors

Adecco Group's strategic client wins in high-growth sectors, such as electric vehicle (EV) battery manufacturing and global consulting, are a testament to its adaptive strategy. These wins are crucial for solidifying its presence in markets poised for significant expansion.

The company's success in securing partnerships with leading firms in these dynamic industries, particularly in areas like EV battery production, highlights its ability to cater to specialized and rapidly evolving talent needs. Adecco's AI-driven recruiting solutions are a key differentiator, enabling efficient access to specialized skill sets.

- Secured key partnerships in the burgeoning EV battery manufacturing sector, aligning with global shifts towards sustainable energy solutions.

- Expanded its footprint in global consulting by winning mandates from major players, leveraging its expertise in talent acquisition and management.

- In 2024, Adecco's focus on high-growth segments contributed to a notable increase in its market share within these specialized verticals.

- These strategic wins are projected to drive substantial future revenue growth, capitalizing on anticipated demand in these advanced industries.

Overall Market Share Gains

The Adecco Group has demonstrated impressive resilience and strategic execution, notably achieving overall market share gains. This is particularly evident within its core Adecco GBU, a testament to its strong performance even amidst a complex economic landscape. This expansion underscores Adecco's capability to outmaneuver competitors and solidify its leadership across diverse staffing and human resources solutions.

Despite headwinds, Adecco’s strategic focus has enabled it to capture a larger slice of the market. This consistent growth highlights the company's effective operational strategies and its ability to identify and capitalize on emerging opportunities within both mature and developing segments of the staffing industry.

- Market Share Growth: Adecco Group’s consistent market share gains in 2024, especially within the Adecco GBU, indicate a strong competitive advantage.

- Resilience in Challenging Markets: The company’s ability to expand its footprint signifies effective navigation of macroeconomic uncertainties.

- Leadership Position: These gains reinforce Adecco's standing as a leader in the global staffing and HR solutions sector.

- Outperforming Competitors: Adecco is actively outperforming rivals by leveraging its expertise in various staffing segments.

Adecco's AI-powered recruitment tools and strategic partnerships in high-growth sectors like EV battery manufacturing firmly place its technology and specialized staffing services in the Stars category of the BCG Matrix. These areas exhibit high market growth and strong competitive positions for Adecco, indicating significant potential for continued expansion and market share gains.

The company's investment in AI for talent acquisition, as seen with its Bullhorn AI Search and Match integration, is a prime example of a Star. This segment benefits from the rapidly growing HR tech market, projected to see continued double-digit growth through 2025. Adecco's success in securing mandates within the EV battery sector further solidifies its position in a high-growth, high-demand area.

The global AI in recruitment market is expanding rapidly, with estimates suggesting it could reach over $4 billion by 2027. Adecco's proactive adoption of these technologies positions it to capture a substantial portion of this growth, reinforcing its Star status. Similarly, the demand for specialized talent in emerging industries like sustainable energy is a key driver for Adecco's specialized staffing services, which are also performing as Stars.

| Business Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| AI-Powered Recruitment Tools | High | Strong | Star |

| Specialized Staffing (e.g., EV Sector) | High | Strong | Star |

| Outsourcing & Managed Services | High | Strong | Star |

What is included in the product

The Adecco Group BCG Matrix offers strategic insights into its business units, guiding investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, actionable roadmap for resource allocation, alleviating the pain of inefficient investment decisions.

Cash Cows

Adecco Group's Core Flexible Placement Services are the undisputed cash cows, holding a dominant market share in a mature but steady industry. This segment has consistently delivered strong cash flows, underpinning the company's ability to fund innovation and expansion into new ventures.

In 2023, Adecco Group reported revenue of €23.6 billion, with flexible staffing services forming the largest portion. This segment's ability to generate substantial cash flow, even with some organic decline, highlights its resilience and the efficiency of its operations.

The Adecco Global Business Unit (GBU) has firmly re-established its market leadership in the traditional staffing sector, a testament to its enduring global presence and deep client connections. This segment, a consistent cash generator, continues to perform strongly even when the broader market experiences sluggish growth.

In 2024, Adecco GBU's revenue streams from its established operations underscore its "Cash Cow" status within the Adecco Group's BCG Matrix. The company's ability to consistently leverage its extensive network and client loyalty ensures robust cash flow, providing significant financial flexibility for the group.

The Adecco Group demonstrates exceptional cash generation, a hallmark of its Cash Cow status. In 2024, the company achieved substantial General & Administrative (G&A) savings amounting to €174 million, showcasing a commitment to cost discipline.

This rigorous cost management, combined with robust operating cash flow, means Adecco consistently produces more cash than it needs for its operations. This financial strength is particularly valuable in a mature industry, enabling strategic reinvestment and debt reduction.

Managed Service Provider (MSP) Solutions

Adecco's Managed Service Provider (MSP) solutions are a definite cash cow for the group. They command a significant chunk of the market, which is no surprise given how many large companies rely on Adecco to manage their contingent workforce. This maturity in a high-demand sector translates directly into consistent revenue streams.

The strategic integration of Pontoon MSP into the Adecco Global Business Unit (GBU) only strengthens this position. It means better operational efficiency and a more unified offering, which is great for maintaining those profitable, long-term client relationships. In 2023, Adecco’s staffing and HR solutions segment, which heavily includes MSP, saw robust performance, contributing significantly to the group's overall financial health.

- Market Dominance: Adecco holds a substantial market share in the MSP sector, reflecting strong demand from large enterprises.

- Pontoon Integration: The inclusion of Pontoon MSP enhances operational efficiencies and consolidates Adecco's market standing.

- Revenue Generation: Established client contracts and ongoing demand ensure a steady and reliable cash flow from these services.

- Financial Contribution: Adecco's staffing and HR solutions, encompassing MSP, demonstrated strong financial performance in 2023.

Permanent Placement Services

Permanent Placement Services within Adecco Group, despite facing some market challenges in recent times, continues to be a cornerstone of profitability. This segment operates in a relatively stable market, and its high-margin nature means it generates substantial cash for the company.

While the growth trajectory might not be as steep as some other sectors, the consistent demand and Adecco's strong foothold ensure that permanent placement services act as a reliable cash cow. For instance, in 2023, Adecco reported that its staffing and recruitment solutions, which heavily feature permanent placements, contributed significantly to its operational performance, demonstrating its enduring value.

- High Profitability: Permanent placement services consistently deliver strong profit margins for Adecco.

- Market Stability: This segment benefits from a stable, established demand, providing consistent revenue.

- Cash Flow Generation: It plays a crucial role in Adecco's overall cash flow generation, supporting other business areas.

- Strategic Importance: Despite slower growth, its financial contribution makes it a vital part of Adecco's portfolio.

Adecco's core flexible placement services are the bedrock cash cows, commanding a significant market share in a mature yet stable industry. These operations consistently generate robust cash flows, enabling Adecco to invest in new ventures and innovation.

In 2023, Adecco Group reported revenues of €23.6 billion, with flexible staffing being the largest contributor, highlighting the segment's resilience and operational efficiency.

The Adecco Global Business Unit (GBU) has solidified its leadership in traditional staffing, a testament to its extensive global reach and strong client relationships. This consistent cash generator performs well even during periods of slower market growth.

Adecco's Managed Service Provider (MSP) solutions, including Pontoon, are significant cash cows, serving a large portion of the market due to widespread reliance by major corporations. This maturity in a high-demand sector translates into reliable revenue streams.

| Segment | BCG Category | 2023 Revenue Contribution (Illustrative) | Key Characteristic |

| Flexible Placement Services | Cash Cow | Largest Share | Mature, stable industry, strong market share |

| Managed Service Provider (MSP) | Cash Cow | Significant Share | High demand from large enterprises, consistent revenue |

| Permanent Placement Services | Cash Cow | Substantial Share | High-margin, stable demand, consistent cash generation |

What You See Is What You Get

Adecco Group BCG Matrix

The Adecco Group BCG Matrix you are currently previewing is the identical, fully unlocked document you will receive immediately after your purchase. This comprehensive analysis, featuring all strategic insights and data points, is ready for immediate application without any watermarks or demo limitations. You can confidently use this as your definitive guide for understanding Adecco's portfolio, empowering you to make informed strategic decisions right away.

Dogs

Traditional staffing services in key European markets such as France, Northern Europe, and the DACH region have encountered headwinds, with some experiencing negative organic revenue growth. For instance, Adecco Group reported a 3% organic revenue decline in Northern Europe and a 2% decline in France during 2023, reflecting broader economic challenges.

These mature markets are grappling with economic uncertainties and a softening demand, particularly in sectors like manufacturing and logistics, which are crucial for traditional staffing models. This slowdown points to a low growth outlook for these specific, established segments within Adecco's portfolio.

Akkodis' tech staffing segment, a part of the Adecco Group, is currently facing significant headwinds. Revenues in this area have seen a consistent decline, notably in key markets such as the United States and Germany. This downturn is directly attributed to the broader challenging conditions within the tech staffing sector.

While Akkodis aims for a wider reach in technology consulting, its tech staffing operations are characterized by a low market share and negative growth. This places it in a challenging position within a market that, while potentially cyclical, is currently experiencing a downturn, suggesting it might be a 'question mark' or even a 'dog' in the BCG matrix depending on future market recovery and Akkodis' strategic response.

LHH Recruitment Solutions, as part of the Adecco Group, currently occupies a position that suggests it's a "Dog" in the BCG Matrix. This is due to persistent market headwinds that have led to notable revenue declines.

The segment exhibits a low market share within the professional talent sector, which is experiencing a contraction. This challenging environment limits its ability to generate significant returns for the Adecco Group.

For instance, Adecco Group's overall revenue saw a decrease in early 2024 compared to previous periods, with recruitment solutions being a contributing factor to this trend. The competitive landscape further intensifies the difficulties for LHH Recruitment Solutions to gain traction and improve its market standing.

LHH Learning & Development (General Assembly, Talent Development)

LHH Learning & Development, encompassing General Assembly and broader talent development services, is experiencing a downturn. These offerings are classified as question marks within the BCG Matrix due to observed organic declines in revenue. This suggests they operate in markets with limited growth potential and may be losing ground to competitors, necessitating a strategic review.

The challenges faced by LHH's learning and development segments are indicative of broader market shifts impacting the education and corporate training sectors. For instance, in 2023, the global corporate e-learning market, a key segment for talent development, saw growth rates moderated compared to previous years, with some sub-sectors facing increased competition and evolving demand for skills. General Assembly, a prominent part of this offering, has also navigated a complex landscape where the demand for specific tech skills can fluctuate rapidly.

The current performance trajectory for these LHH services points towards a need for decisive action. If the observed trends of organic decline and market challenges continue, Adecco Group will need to consider strategies ranging from significant investment to revitalize these offerings to potential divestment if they no longer align with the group's strategic priorities.

- Market Position: LHH Learning & Development (General Assembly, Talent Development) shows signs of a declining market share in its respective sectors.

- Growth Prospects: The end markets for these services are characterized by low growth, impacting revenue generation.

- Strategic Imperative: Persistent organic declines necessitate a thorough re-evaluation of these business units, potentially leading to divestment.

- Financial Health: Organic revenue declines are a key indicator of underperformance, requiring close financial monitoring.

Legacy Undifferentiated Staffing Offerings

Legacy undifferentiated staffing offerings, particularly in mature sectors like general administrative or light industrial temporary roles, often represent Adecco Group's Dogs in the BCG Matrix. These areas typically face limited market growth and significant price pressure from competitors.

For instance, in 2024, sectors characterized by high volume but low margin temporary placements continued to be a challenge. These segments require ongoing investment to maintain market share but offer little potential for expansion or increased profitability, often leading to negative or very low growth rates.

- Low Growth Markets: Mature industries with saturated labor pools and minimal innovation.

- Intense Price Competition: Differentiation is difficult, leading to a race to the bottom on rates.

- Low Profit Margins: High operational costs relative to revenue generated.

- Cash Traps: Require capital for maintenance but yield minimal returns, potentially draining resources from growth areas.

Adecco Group's "Dogs" primarily consist of its legacy, undifferentiated staffing services in mature sectors like general administrative and light industrial temporary roles. These segments are characterized by low market growth and intense price competition, leading to minimal profitability and often requiring capital for maintenance without yielding significant returns.

For example, the traditional staffing segment in mature European markets, including France and Northern Europe, experienced negative organic revenue growth in 2023, with France seeing a 2% decline and Northern Europe a 3% decline. This reflects the low growth prospects of these established areas.

Akkodis' tech staffing operations, particularly in the US and Germany, are also showing signs of being "Dogs" due to consistent revenue declines attributed to challenging conditions in the tech staffing sector. This segment has a low market share and negative growth, indicating a difficult position in a currently downturned market.

Similarly, LHH Recruitment Solutions faces persistent market headwinds and a contraction in the professional talent sector, resulting in revenue declines and a low market share. This underperformance contributes to its classification as a "Dog" within the BCG matrix.

| Business Segment | BCG Classification | Key Performance Indicators (2023/Early 2024) | Market Dynamics |

|---|---|---|---|

| Traditional Staffing (France, N. Europe) | Dog | -2% Organic Revenue Decline (France) -3% Organic Revenue Decline (N. Europe) |

Mature markets, softening demand, economic uncertainties |

| Akkodis Tech Staffing (US, Germany) | Dog/Question Mark | Consistent revenue decline | Challenging tech staffing sector, low market share |

| LHH Recruitment Solutions | Dog | Revenue declines, low market share | Contracting professional talent sector, intense competition |

Question Marks

Adecco Group's aggressive digital transformation, particularly with Agentic AI and enhanced AI recruitment platforms like Bullhorn AI Search and Match, positions them in a high-growth segment. These advanced technologies are reshaping HR tech, offering significant potential for market disruption and increased efficiency in talent acquisition.

While these AI-driven solutions represent a significant investment for Adecco, their market share in this rapidly evolving space is still being established. This means the returns, though potentially high, carry a degree of uncertainty as the AI HR tech market matures and competition intensifies.

Adecco Group's ambitious goal to skill and upskill 5 million individuals by 2030, with a strong focus on green economy skills, positions them to capture a significant share of a rapidly expanding market. This initiative directly addresses the global talent deficit and the continuous need for updated competencies, particularly in emerging sectors.

The company's strategic investment in this area is a proactive move to establish leadership in a transformative segment of the workforce solutions industry. By 2024, Adecco has already demonstrated significant progress in its commitment to workforce development, with substantial numbers of individuals participating in their upskilling programs.

Adecco Group is strategically targeting the SME market, recognizing its substantial untapped potential for HR solutions. This segment represents a high-growth opportunity, and Adecco is actively working to increase its penetration by tailoring its offerings to this diverse client base, which has historically been underserved.

Turnaround of Adecco US

Adecco US, previously struggling, is now on a path to recovery, demonstrating growth in the first quarter of 2025. This business unit is positioned as a potential high-growth area, provided the turnaround efforts are sustained and successful.

Currently, Adecco US is categorized as a Question Mark within the Adecco Group's BCG Matrix. This classification stems from its significant market potential juxtaposed with its present market share, indicating a need for ongoing strategic investment to capitalize on its growth prospects.

- Adecco US Turnaround: Following a period of underperformance, Adecco US has initiated a focused turnaround strategy, showing promising signs of returning to growth in Q1 2025.

- Growth Potential: The US market represents a substantial growth opportunity for Adecco if the current turnaround strategy proves effective.

- BCG Matrix Classification: Adecco US is currently a Question Mark due to its high market growth potential but relatively low current market share, necessitating further investment.

- Investment Focus: Continued investment and strategic execution are critical for Adecco US to shift from a Question Mark to a Star in the BCG Matrix.

New Geographic Market Penetration in High-Growth Areas

Adecco Group's strategy includes expanding its presence in high-growth regions where its market share is currently less dominant. This involves targeting emerging geographies or specific sub-regions, such as Latin America, which demonstrated a robust 21% growth in Q2 2025.

These markets present a significant opportunity for Adecco to increase its footprint and capture a larger share of the talent solutions market. The company is likely to allocate substantial resources to these areas to build brand awareness and establish strong operational capabilities.

- Focus on Emerging Geographies: Targeting regions with high economic growth potential.

- Deepening Market Share: Aiming to increase penetration in areas where Adecco's presence is currently smaller.

- Strategic Investment: Allocating significant capital to convert potential into market leadership.

- Leveraging Growth Opportunities: Capitalizing on the dynamism of markets like Latin America, which saw 21% growth in Q2 2025.

Adecco US is currently classified as a Question Mark in Adecco Group's BCG Matrix. This is due to its significant potential for growth in the US market, which is a key focus area, but it currently holds a smaller market share compared to established leaders. The company's ongoing turnaround efforts, showing positive signs of recovery in Q1 2025, aim to boost its market position.

The strategy for Adecco US involves continued investment to capture this market potential and transform it into a stronger performer. Success here could see Adecco US move towards becoming a Star within the portfolio.

Adecco Group's expansion into high-growth regions, like Latin America which experienced 21% growth in Q2 2025, also places these ventures in the Question Mark category. These markets offer substantial opportunity but require strategic investment to build share and solidify presence.

| Business Unit/Region | BCG Classification | Market Growth | Current Market Share | Strategic Focus |

|---|---|---|---|---|

| Adecco US | Question Mark | High | Moderate | Turnaround and investment for growth |

| Latin America | Question Mark | High (21% in Q2 2025) | Lower | Expansion and market penetration |

BCG Matrix Data Sources

Our Adecco Group BCG Matrix is informed by comprehensive market data, including internal financial performance, global employment trend reports, and competitor analysis to provide strategic clarity.